Beruflich Dokumente

Kultur Dokumente

Corporate Finance

Hochgeladen von

mrlogicalmanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corporate Finance

Hochgeladen von

mrlogicalmanCopyright:

Verfügbare Formate

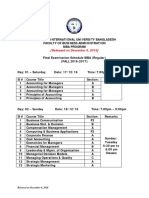

Investments & Portfolio Management

Quiz 4 [Final Term] Time: 30 minutes Total Marks: 20

Name _____________________________ ID ________________ Sec:_______

1. The annual interest paid on a bond relative to its prevailing market price is called its _____________. a) Promised yield b) Yield to maturity c) Coupon rate d) Effective yield e) Current yield 2. The term structure of interest rates is a static function that relates the a) Term to call and the yield to maturity. c) Term to call and the yield to call. b) Term to maturity and the yield to maturity. d) Term to maturity and the coupon rate.

3. Consider a 15%, 20 year bond that pays interest annually, and its current price is $850. What is the promised yield to maturity? a) 10.23% b) 18.45% c) 2.31% d) 17.77% e) 9.26% 4. Consider a bond with a 9% coupon and a current yield of 8 1/2%. What is this bonds price? a) $1058.82 b) $1009.00 c) $1085.00 d) $1062.44 e) $1077.96 5. Suppose you have a 12%, 20 year bond traded at $850. If it is callable in 5 years at $1,100, what is the bonds yield to call? Interest is paid semiannually. a) 8% b) 9.0% c) 18.0% d) 9.4% e) 16.5% 6. Calculate the duration of a 6 percent, $1,000 par bond maturing in three years if the yield to maturity is 10 percent and interest is paid semiannually. a) 1.35 years b) 1.78 years c) 2.50 years d) 2.78 years e) 2.95 years 7. A 12-year, 8 percent bond with YTM of 12 percent has Macaulay duration of 9.5 years. If interest rates decline by 50 basis points, what will be the percent change in price for this bond? a) +4.48% b) +4.61% c) +8.48% d) +8.96% e) +17.92% 8. Consider a bond with a duration of 7 years having a yield to maturity of 7% and interest rates are expected to rise by 50 basis points. What is the percentage change in the price of the bond? a) 3.62% b) 3.45% c) -3.38% d) 3.38% e) -3.62% 9. If the price before yields changed was $925, what is the resulting price? b) $918.66 c) $889.11 d) $1000.00 e) $1012.45

a) $865.22

10. Assume that you purchase a 10-year $1,000 par value bond, with a 12% coupon, and a yield of 9%. Immediately after you purchase the bond, yields fall to 8% and remain at that level to maturity. Calculate the realized horizon yield, if you hold the bond for 5 years and then sell. Interest is paid annually. a) 16.25% b) 12.15% c) 7.75% d) 10.05% d) 9.34%

Problem: A $1000 par value bond with 5 years to maturity and a 6% coupon has a yield to maturity of 8%. Interest is paid semiannually. a. b. c. d. Calculate the current price of the bond. Calculate the Macaulay duration for the bond Calculate the modified duration for the bond Estimate the percentage price change for this 5-year $1,000 par value bond, with a 6% coupon, if the yield rises from 8% to 8.5%. Interest is paid semiannually.

Answer: 1. E 2. B 3. D 4. A 5. C 6. D 7. a 8. c 9. c 10. e

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Profit From The PanicDokument202 SeitenProfit From The PanicLau Wai KentNoch keine Bewertungen

- Probable Cause Document - Chantail WilliamsDokument2 SeitenProbable Cause Document - Chantail WilliamsKGW NewsNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Graphs, Linear Equations, and FunctionsDokument42 SeitenGraphs, Linear Equations, and FunctionsmrlogicalmanNoch keine Bewertungen

- Emerging Cyber Threats in BangladeshDokument13 SeitenEmerging Cyber Threats in Bangladeshmrlogicalman100% (1)

- SOIC-Financial Literacy 2 1 Lyst9826Dokument62 SeitenSOIC-Financial Literacy 2 1 Lyst9826bradburywillsNoch keine Bewertungen

- Learn About Return and Risk from Historical DataDokument6 SeitenLearn About Return and Risk from Historical Dataminibod100% (1)

- M1B Insider Trading and Securities Law QuestionsDokument14 SeitenM1B Insider Trading and Securities Law QuestionsMegan PangNoch keine Bewertungen

- Canadian Banking PDFDokument41 SeitenCanadian Banking PDFFuria_hetalNoch keine Bewertungen

- Business Feasibility Study OutlineDokument14 SeitenBusiness Feasibility Study OutlineMohamed AbbasNoch keine Bewertungen

- Factors Behind PRANDokument14 SeitenFactors Behind PRANmrlogicalmanNoch keine Bewertungen

- Pest Analysis of Pran RFLDokument6 SeitenPest Analysis of Pran RFLmrlogicalman100% (1)

- Cancel PayorderDokument1 SeiteCancel PayordermrlogicalmanNoch keine Bewertungen

- Released On December 6, 2016Dokument3 SeitenReleased On December 6, 2016mrlogicalmanNoch keine Bewertungen

- To LetDokument2 SeitenTo LetmrlogicalmanNoch keine Bewertungen

- Mba5103 Buslaw Assignment1Dokument15 SeitenMba5103 Buslaw Assignment1mrlogicalmanNoch keine Bewertungen

- The One Minute ManagerDokument22 SeitenThe One Minute Managernithin_joseph_2Noch keine Bewertungen

- Not ImpDokument1 SeiteNot ImpmrlogicalmanNoch keine Bewertungen

- Mba5103 Buslaw Assignment1Dokument15 SeitenMba5103 Buslaw Assignment1mrlogicalmanNoch keine Bewertungen

- 10th Week Lecture Company Act Full 28.09.14Dokument34 Seiten10th Week Lecture Company Act Full 28.09.14mrlogicalmanNoch keine Bewertungen

- Luxury Hotel Health Check USD 330 / RM 1199: Prime Time Screening by Specialist 2D/1N Combo PackageDokument2 SeitenLuxury Hotel Health Check USD 330 / RM 1199: Prime Time Screening by Specialist 2D/1N Combo PackagemrlogicalmanNoch keine Bewertungen

- LSMDokument3 SeitenLSMmrlogicalmanNoch keine Bewertungen

- Tuition FeesDokument5 SeitenTuition FeesmrlogicalmanNoch keine Bewertungen

- Grameen BankDokument10 SeitenGrameen BankmrlogicalmanNoch keine Bewertungen

- Leave of AbsenceDokument1 SeiteLeave of AbsencemrlogicalmanNoch keine Bewertungen

- Total Assets AvgDokument1 SeiteTotal Assets AvgmrlogicalmanNoch keine Bewertungen

- Personal StatementDokument1 SeitePersonal StatementmrlogicalmanNoch keine Bewertungen

- JobsDokument2 SeitenJobsmrlogicalmanNoch keine Bewertungen

- Variety Spices, Inc.: Vari Ety Spic Es, Inc. BusiDokument56 SeitenVariety Spices, Inc.: Vari Ety Spic Es, Inc. BusimrlogicalmanNoch keine Bewertungen

- Open and Distance Learning To Empower Rural Women: BangladeshDokument13 SeitenOpen and Distance Learning To Empower Rural Women: BangladeshmrlogicalmanNoch keine Bewertungen

- Table of ContentsDokument3 SeitenTable of ContentsmrlogicalmanNoch keine Bewertungen

- Subject: Submission of Internship Report & Consideration of Pocket MoneyDokument4 SeitenSubject: Submission of Internship Report & Consideration of Pocket MoneymrlogicalmanNoch keine Bewertungen

- Corporate FinanceDokument2 SeitenCorporate FinancemrlogicalmanNoch keine Bewertungen

- BanglaDokument1 SeiteBanglamrlogicalmanNoch keine Bewertungen

- 4598Dokument19 Seiten4598kavitachordiya86Noch keine Bewertungen

- Radhuni - 1Dokument13 SeitenRadhuni - 1api-26027438100% (1)

- Directorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Dokument76 SeitenDirectorate of Treasuries and Accounts, Department of Finance, Punjab Manual (XVII)Pankaj kumarNoch keine Bewertungen

- Aktham Abuhouran v. Christopher Melloney, 3rd Cir. (2010)Dokument9 SeitenAktham Abuhouran v. Christopher Melloney, 3rd Cir. (2010)Scribd Government DocsNoch keine Bewertungen

- Test Bank For College Accounting Chapters 1-24-14th EditionDokument24 SeitenTest Bank For College Accounting Chapters 1-24-14th EditionLuisWallacecqjm100% (42)

- Biaya Pembayaran Pest Control Periode Agustus-September 2023Dokument2 SeitenBiaya Pembayaran Pest Control Periode Agustus-September 2023Mahesta JinggaNoch keine Bewertungen

- Invoice 2Dokument1 SeiteInvoice 2Dd GargNoch keine Bewertungen

- CARLYLE GROUP IN Shareholder MTG Call 2021223 DN000000002951272157Dokument66 SeitenCARLYLE GROUP IN Shareholder MTG Call 2021223 DN000000002951272157Phill NamaraNoch keine Bewertungen

- Depreciation and Error Analysis A Depreciation Schedule For Semi PDFDokument1 SeiteDepreciation and Error Analysis A Depreciation Schedule For Semi PDFAnbu jaromiaNoch keine Bewertungen

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDokument4 Seiten(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalakurilNoch keine Bewertungen

- Gitman 4e Ch. 2 SPR - SolDokument8 SeitenGitman 4e Ch. 2 SPR - SolDaniel Joseph SitoyNoch keine Bewertungen

- Financial and Managerial Accounting PDFDokument1 SeiteFinancial and Managerial Accounting PDFcons theNoch keine Bewertungen

- Security Analysis and Portfolio ManagementDokument3 SeitenSecurity Analysis and Portfolio Managementharsh dhuwaliNoch keine Bewertungen

- WCH977263735 Auth LetterDokument3 SeitenWCH977263735 Auth LetterJaripati RajeshNoch keine Bewertungen

- Inflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoDokument31 SeitenInflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoRizki Praba NugrahaNoch keine Bewertungen

- Financial Markets and Institutions Test Bank (021 030)Dokument10 SeitenFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmNoch keine Bewertungen

- Investment Appraisal Camb AL New (1) RIKZY EESADokument14 SeitenInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabNoch keine Bewertungen

- Periodic Method-Joseph MerchandiseDokument8 SeitenPeriodic Method-Joseph MerchandiseRACHEL DAMALERIONoch keine Bewertungen

- Yen To Trade Full Curriculum UnitDokument148 SeitenYen To Trade Full Curriculum UnitAlbert Kirby TardeoNoch keine Bewertungen

- Ifamr2019 0030Dokument22 SeitenIfamr2019 0030RizkiMartoba SitanggangNoch keine Bewertungen

- BH Ffm13 TB Ch02Dokument14 SeitenBH Ffm13 TB Ch02Umer Ali KhanNoch keine Bewertungen

- 3B Binani GlassfibreDokument2 Seiten3B Binani GlassfibreData CentrumNoch keine Bewertungen

- LD Case Study - Auditing Leases (PARTICIPANT)Dokument26 SeitenLD Case Study - Auditing Leases (PARTICIPANT)Jefri SNoch keine Bewertungen

- Tutorial Week 2 SolutionDokument13 SeitenTutorial Week 2 SolutionXiaohan LuNoch keine Bewertungen

- Mekidelawit Tamrat MBAO9550.14BDokument4 SeitenMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherNoch keine Bewertungen

- Citadel EFT, Inc. (CDFT) Congratulates Director Joseph Raid - News and Press Release Service TransWorldNewsDokument10 SeitenCitadel EFT, Inc. (CDFT) Congratulates Director Joseph Raid - News and Press Release Service TransWorldNewsjaniceshellNoch keine Bewertungen