Beruflich Dokumente

Kultur Dokumente

CTA Requires Donors to Prove Donee Compliance for Deduction of Donations

Hochgeladen von

Ardy Falejo FajutagOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CTA Requires Donors to Prove Donee Compliance for Deduction of Donations

Hochgeladen von

Ardy Falejo FajutagCopyright:

Verfügbare Formate

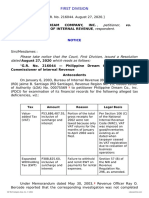

MARIPOSA PROPERTIES VS. CIR (CTA Case No.

6402, 02/13/2007) (Note: Guys I could not find a full text copy of the case in the internet as this is not one decided by the SC but merely by the CTA. The only available copy is not actually a copy! but a discussion of the rulin" of the court. No facts at all. So I #ust copied it and reproduce it here. Any$ay yun" rulin" naman an" impt. I hope this $ill suffice. %y source is the $ebsite of &unon"bayan and Araullo.' Ded !"#$#%#"& o' do(a"#o(s) In deciding on the BIRs disallowance of deduction for donations made to a private foundation, the CTA required the donor to prove compliance of both the donor and the donee with the requirements for deductibility of donations !ence, for failure of the donor to present proof that the foundations income ta" return #ITR$ and audited financial statements #A%&$ 'as well as the annual information report of the foundation( were submitted to the BIR as required in the regulations, the deductions for donation was disallowed A donor must not only comply with the substantiation requirements for donors but also prove that the donee complied with the )*+A(prescribed +onee Reporting Requirements under BIR()*+A Regulation )o ,(-, as a precedent to the full deductibility of a donation pursuant to &ec ./ #!$ #c$ #ii$ of the )IRC In deciding on the BIRs disallowance of deduction for donation to a private foundation, the CTA required the donor to present evidence to establish that the foundation has been complying with the substantiation requirements for the donees as prescribed under &ec ,, #B$ of BIR()*+A Reg )o ,(-, !owever, neither the ITR and A%& nor the annual information report duly certified by the authori0ed official of the foundation containing the annual information report required by &ec ,, of BIR()*+A Reg )o ,(-, was presented by the donor Thus, on account of its failure to establish that the foundation has been complying with the substantiation requirements for donees, the donors claim for deduction of its donations was disallowed The CTA further held that the BIR()*+A Reg )o ,(-, was a valid administrative issuance since it does not go beyond the confines of what has been provided in the )IRC The regulation only supplies the details necessary for carrying out the law by enumerating the procedures and requirements necessary for claiming donations as ta" deductions Considering that the provision of BIR( )*+A Reg )o ,(-, is within the delegated authority of the administrative agency, donors must adhere to the requirements under the said regulation in order to be entitled to a ta" deduction

Das könnte Ihnen auch gefallen

- Cir V ManningDokument12 SeitenCir V Manningnia_artemis3414Noch keine Bewertungen

- MicromillDokument15 SeitenMicromillFerdinand ZamoraNoch keine Bewertungen

- SEC upholds ban on similar corporate namesDokument3 SeitenSEC upholds ban on similar corporate namesRubyNoch keine Bewertungen

- Commissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Dokument9 SeitenCommissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Mariel ManingasNoch keine Bewertungen

- CIR vs. BenipayoDokument5 SeitenCIR vs. BenipayoHannah BarrantesNoch keine Bewertungen

- 4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006Dokument10 Seiten4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006FredamoraNoch keine Bewertungen

- McBurnie v. GanzonDokument22 SeitenMcBurnie v. GanzonMaria AndresNoch keine Bewertungen

- National Exchange Co Vs DexterDokument2 SeitenNational Exchange Co Vs DexterQueenie SabladaNoch keine Bewertungen

- 4 Razon, Jr. v. TagitisDokument94 Seiten4 Razon, Jr. v. TagitisVianice BaroroNoch keine Bewertungen

- Human Rights Assignement 3Dokument9 SeitenHuman Rights Assignement 3ADNoch keine Bewertungen

- Aoi Walang ForeverDokument6 SeitenAoi Walang ForeverJuris PoetNoch keine Bewertungen

- Velasco vs. PoizatDokument2 SeitenVelasco vs. Poizatdura lex sed lexNoch keine Bewertungen

- CIR Vs ReyesDokument16 SeitenCIR Vs Reyes123456789Noch keine Bewertungen

- TaxationBarQ26A TaxRemediesDokument32 SeitenTaxationBarQ26A TaxRemediesjuneson agustinNoch keine Bewertungen

- NEGO - Associated Bank v. CADokument22 SeitenNEGO - Associated Bank v. CAmarlonNoch keine Bewertungen

- BBC Dividends from Unrealized Asset AppreciationDokument1 SeiteBBC Dividends from Unrealized Asset Appreciationvmanalo16Noch keine Bewertungen

- Case Digest Atty CabaneiroDokument11 SeitenCase Digest Atty CabaneiroChriselle Marie DabaoNoch keine Bewertungen

- Contex Corporation vs. CIR Persons LiableDokument16 SeitenContex Corporation vs. CIR Persons LiableEvan NervezaNoch keine Bewertungen

- Cadalin Vs POEA G.R. No. L-104776 December 5, 1994Dokument10 SeitenCadalin Vs POEA G.R. No. L-104776 December 5, 1994Emrico CabahugNoch keine Bewertungen

- 242-Castro v. CIR G.R. No. L-12174 April 26, 1962Dokument11 Seiten242-Castro v. CIR G.R. No. L-12174 April 26, 1962Jopan SJNoch keine Bewertungen

- Garcia-Quiazon V BelenDokument14 SeitenGarcia-Quiazon V BelenMoniqueLeeNoch keine Bewertungen

- 12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFDokument8 Seiten12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFEmelie Marie DiezNoch keine Bewertungen

- TaxDokument38 SeitenTaxCL DelabahanNoch keine Bewertungen

- 04 Pardo vs. Hercules Lumber PDFDokument2 Seiten04 Pardo vs. Hercules Lumber PDFStacy WheelerNoch keine Bewertungen

- Topacio Vs Banco FilipinoDokument2 SeitenTopacio Vs Banco FilipinoPearl AmwaoNoch keine Bewertungen

- Supreme Court Upholds Labor Ruling in Madrigal & Co. CaseDokument8 SeitenSupreme Court Upholds Labor Ruling in Madrigal & Co. CasewewNoch keine Bewertungen

- Cases Wala Sa Soriano Notes - ObliconDokument6 SeitenCases Wala Sa Soriano Notes - ObliconLauriz Esquivel100% (1)

- 15 Republic Vs AblazaDokument5 Seiten15 Republic Vs AblazaYaz CarlomanNoch keine Bewertungen

- Cta CaseDokument10 SeitenCta Caselucial_68Noch keine Bewertungen

- (People v. Macasling, GM, No. 90342, May 27,1993Dokument7 Seiten(People v. Macasling, GM, No. 90342, May 27,1993TrexPutiNoch keine Bewertungen

- 5) Dulay V CADokument11 Seiten5) Dulay V CAresjudicataNoch keine Bewertungen

- Manila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Dokument17 SeitenManila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Kaye Miranda LaurenteNoch keine Bewertungen

- Dimaguila Vs MonteiroDokument9 SeitenDimaguila Vs MonteiroAnonymous DsZxyFgRJNoch keine Bewertungen

- Part I: Concept of Tax AdministrationDokument22 SeitenPart I: Concept of Tax AdministrationShiela Marie Sta AnaNoch keine Bewertungen

- LegCoun InterviewDokument4 SeitenLegCoun InterviewJohansen FerrerNoch keine Bewertungen

- Lumanlan Vs CuraDokument3 SeitenLumanlan Vs CuraaceamulongNoch keine Bewertungen

- Commercial Law Case Digest: List of CasesDokument57 SeitenCommercial Law Case Digest: List of CasesJean Mary AutoNoch keine Bewertungen

- Taxation Law Mock BarDokument4 SeitenTaxation Law Mock BarKrizzy GayleNoch keine Bewertungen

- Engtek v. CIR PDFDokument16 SeitenEngtek v. CIR PDFArnold Rosario ManzanoNoch keine Bewertungen

- Chapter 6.0 Taxation Under Local GovtDokument7 SeitenChapter 6.0 Taxation Under Local GovtDerick Ocampo FulgencioNoch keine Bewertungen

- Pomoly Bar Reviewer Day 2 PM RemDokument84 SeitenPomoly Bar Reviewer Day 2 PM RemRomeo RemotinNoch keine Bewertungen

- TAXATION LAW TITLEDokument10 SeitenTAXATION LAW TITLEJc GalamgamNoch keine Bewertungen

- Lakas Atenista Notes JurisdictionDokument8 SeitenLakas Atenista Notes JurisdictionPaul PsyNoch keine Bewertungen

- BAR E&AMINATION 2004 TAXATIONDokument8 SeitenBAR E&AMINATION 2004 TAXATIONbubblingbrookNoch keine Bewertungen

- Remedial Law PrinciplesDokument271 SeitenRemedial Law PrinciplesAhmed-Adhiem Bahjin KamlianNoch keine Bewertungen

- 02.BM - Taxing Off-Line Carriers. (07!12!07) .ICNDokument3 Seiten02.BM - Taxing Off-Line Carriers. (07!12!07) .ICNNotario PrivadoNoch keine Bewertungen

- Rohm Apollo vs. CIRDokument6 SeitenRohm Apollo vs. CIRnikkisalsNoch keine Bewertungen

- Coral Bay Vs CIR Cross Border DoctrineDokument7 SeitenCoral Bay Vs CIR Cross Border DoctrineAira Mae P. LayloNoch keine Bewertungen

- Conflicts Missing2Dokument102 SeitenConflicts Missing2lex libertadoreNoch keine Bewertungen

- Supreme Court upholds non-binding nature of cement dealership agreementDokument10 SeitenSupreme Court upholds non-binding nature of cement dealership agreementEnan IntonNoch keine Bewertungen

- Steinberg V VelascoDokument6 SeitenSteinberg V VelascoJan Jason Guerrero LumanagNoch keine Bewertungen

- Cir v. Nidec Copal Phil CorpDokument24 SeitenCir v. Nidec Copal Phil CorpKris CalabiaNoch keine Bewertungen

- 2019 Bar Review: Taxation Law Chair'S CasesDokument19 Seiten2019 Bar Review: Taxation Law Chair'S CasesClarisse-joan Bumanglag GarmaNoch keine Bewertungen

- Tax AmnestyDokument25 SeitenTax AmnestyCali Shandy H.Noch keine Bewertungen

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDokument11 Seiten35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNoch keine Bewertungen

- Cases in Remedial LawDokument187 SeitenCases in Remedial LawMary Pretty Catherine ConsolacionNoch keine Bewertungen

- Greorg Grotjahn V Isnani FullDokument5 SeitenGreorg Grotjahn V Isnani FullRejane MarasiganNoch keine Bewertungen

- Corporation Law Digest CompilationDokument16 SeitenCorporation Law Digest CompilationEs-EsNoch keine Bewertungen

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowDokument6 SeitenYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JoseNoch keine Bewertungen

- Sample Motions Forms DefensesDokument42 SeitenSample Motions Forms DefensesKNOWLEDGE SOURCE33% (3)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokument20 SeitenBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJaan-cNoch keine Bewertungen

- Sandoval Poli Rev Lecture NotesDokument126 SeitenSandoval Poli Rev Lecture NotesPeetsa100% (1)

- Ncip Ao No 3 S 2018 Ipmr PDFDokument19 SeitenNcip Ao No 3 S 2018 Ipmr PDF0506sheltonNoch keine Bewertungen

- Ao 3 The Revised Guidelines On Fpic and Related Processes of 2012Dokument27 SeitenAo 3 The Revised Guidelines On Fpic and Related Processes of 2012RobieHalip100% (1)

- Maquiling Full CaseDokument18 SeitenMaquiling Full CaseJennilyn TugelidaNoch keine Bewertungen

- 2019 Ust Pre Week Civil Law PDFDokument85 Seiten2019 Ust Pre Week Civil Law PDFNiles Adam C. RevillaNoch keine Bewertungen

- 2019 Ust Ethics PWDokument50 Seiten2019 Ust Ethics PWjohn joseph100% (2)

- 2019 Preweek Labor PDFDokument60 Seiten2019 Preweek Labor PDFペラルタ ヴィンセントスティーブ100% (3)

- PDFDokument79 SeitenPDFmichellouise17100% (1)

- REMEDIAL LAW Pre Week 2019 RevisedDokument89 SeitenREMEDIAL LAW Pre Week 2019 RevisedArdy Falejo FajutagNoch keine Bewertungen

- 2019 Ust Pre Week Taxation LawDokument36 Seiten2019 Ust Pre Week Taxation Lawdublin80% (20)

- Salva Lecture Notes Criminal Law 2Dokument17 SeitenSalva Lecture Notes Criminal Law 2Ardy Falejo FajutagNoch keine Bewertungen

- Ust Law Pre-Week Notes 2019: Kinds of Bank Role LiabilityDokument83 SeitenUst Law Pre-Week Notes 2019: Kinds of Bank Role LiabilityFarasha uzmaNoch keine Bewertungen

- 2019 Ust Pre Week Criminal LawDokument50 Seiten2019 Ust Pre Week Criminal LawNormilah Lindao75% (4)

- Special Lecture of Dean Nilo DivinaDokument22 SeitenSpecial Lecture of Dean Nilo DivinaArdy Falejo FajutagNoch keine Bewertungen

- Criminal Law - Justice Velasco's CasesDokument117 SeitenCriminal Law - Justice Velasco's CasesNikki MendozaNoch keine Bewertungen

- Gotardo V BulingDokument1 SeiteGotardo V BulingLotsee Elauria100% (1)

- Labor Velasco CasesDokument49 SeitenLabor Velasco Caseskath mags100% (9)

- Leoveras v. ValdezDokument2 SeitenLeoveras v. ValdezPaui RodriguezNoch keine Bewertungen

- Marcos Vs Heirs of NavarroDokument2 SeitenMarcos Vs Heirs of NavarroRal Tibs100% (2)

- Chavez Vs CA DigestedDokument4 SeitenChavez Vs CA DigestedDave A ValcarcelNoch keine Bewertungen

- Loon vs. Power MasterDokument2 SeitenLoon vs. Power MasterEloisa Katrina MadambaNoch keine Bewertungen

- June DigestsDokument15 SeitenJune DigestsClaire RoxasNoch keine Bewertungen

- 1 Provisional Remedies BarredoDokument18 Seiten1 Provisional Remedies BarredoArdy Falejo Fajutag100% (1)

- Criminal Law UPRevised Ortega Lecture Notes IIDokument189 SeitenCriminal Law UPRevised Ortega Lecture Notes IItwocubes88% (24)

- OrteganotesDokument102 SeitenOrteganotesEia PaladNoch keine Bewertungen

- Tax Notes Domondon 2010Dokument81 SeitenTax Notes Domondon 2010Ardy Falejo FajutagNoch keine Bewertungen

- Philippine Institute of ArbitratorsDokument58 SeitenPhilippine Institute of ArbitratorsArdy Falejo FajutagNoch keine Bewertungen

- SBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkDokument76 SeitenSBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkArdy Falejo Fajutag100% (2)

- Comprehending Party Autonomy in Private Dispute ResolutionDokument60 SeitenComprehending Party Autonomy in Private Dispute ResolutionAnonymous 5k7iGyNoch keine Bewertungen

- Joint Venture Agreement LPG TerminalDokument5 SeitenJoint Venture Agreement LPG TerminalMunir HussainNoch keine Bewertungen

- Martin v. Wrigley First Amended ComplaintDokument27 SeitenMartin v. Wrigley First Amended ComplaintWashington Free BeaconNoch keine Bewertungen

- Republic Act No. 75Dokument3 SeitenRepublic Act No. 75Tippy OracionNoch keine Bewertungen

- Catungal Vs RodriguezDokument2 SeitenCatungal Vs Rodriguezwesleybooks100% (2)

- A1 MV2809627Dokument2 SeitenA1 MV2809627Muhd SyahidNoch keine Bewertungen

- Service ContractDokument4 SeitenService Contractliberace cabreraNoch keine Bewertungen

- Donald Ray Bass v. David Graham, Assistant Warden H.H. Hardy, Laundry Supervisor J. Lafoon, R.N. Doctor Thompson, 14 F.3d 593, 4th Cir. (1994)Dokument2 SeitenDonald Ray Bass v. David Graham, Assistant Warden H.H. Hardy, Laundry Supervisor J. Lafoon, R.N. Doctor Thompson, 14 F.3d 593, 4th Cir. (1994)Scribd Government DocsNoch keine Bewertungen

- Philippine Airlines vs. LiganDokument8 SeitenPhilippine Airlines vs. Liganaudrey100% (1)

- CP approval processDokument3 SeitenCP approval processGerard GovinNoch keine Bewertungen

- Appellant's Brief Cyber LibelDokument15 SeitenAppellant's Brief Cyber LibelRonie A100% (1)

- People v. PanisDokument5 SeitenPeople v. PanisMRNoch keine Bewertungen

- Delta Motor Sales Corporation vs. Niu Kim DuanDokument7 SeitenDelta Motor Sales Corporation vs. Niu Kim DuanFD BalitaNoch keine Bewertungen

- Daraga Press v. Coa RevisedDokument5 SeitenDaraga Press v. Coa RevisedReynier Molintas ClemensNoch keine Bewertungen

- PSBRC POLICE OPERATIONAL PROCEDURE Dr. de VillaDokument2 SeitenPSBRC POLICE OPERATIONAL PROCEDURE Dr. de Villaᜐᜌ᜔ᜎᜓ ᜐᜌ᜔ᜎᜓNoch keine Bewertungen

- Land Bank of The Phils. v. Spouses Orilla, G.R. No. 194168, (February 13, 2013) )Dokument8 SeitenLand Bank of The Phils. v. Spouses Orilla, G.R. No. 194168, (February 13, 2013) )PreciousGan100% (1)

- Manila Water vs. DalumpinesDokument8 SeitenManila Water vs. DalumpinesaudreyNoch keine Bewertungen

- Code of Professional ConductDokument37 SeitenCode of Professional ConductChris AbhilashNoch keine Bewertungen

- Katarungang PambarangayDokument105 SeitenKatarungang PambarangayJay-r Malazarte Bergamo100% (7)

- Ty v. Banco Filipino Savings and Mortgage Bank (422 SCRA 649)Dokument8 SeitenTy v. Banco Filipino Savings and Mortgage Bank (422 SCRA 649)Jomarc MalicdemNoch keine Bewertungen

- FCB ACT EXAM REVIEWDokument8 SeitenFCB ACT EXAM REVIEWRizza OmalinNoch keine Bewertungen

- Minerva Industries, Inc. v. Motorola, Inc. Et Al - Document No. 212Dokument2 SeitenMinerva Industries, Inc. v. Motorola, Inc. Et Al - Document No. 212Justia.comNoch keine Bewertungen

- Echegaray Vs Sec of JusticeDokument8 SeitenEchegaray Vs Sec of JusticedesereeravagoNoch keine Bewertungen

- Shops and Commercial EstablishmentsDokument19 SeitenShops and Commercial Establishmentsapi-3698486100% (2)

- Professor Minda's Antitrust Law OutlineDokument17 SeitenProfessor Minda's Antitrust Law OutlinesupersafdieNoch keine Bewertungen

- CIR v. CTA and Petron CorporationDokument13 SeitenCIR v. CTA and Petron CorporationBeltran KathNoch keine Bewertungen

- Plan de Pago John CarneyDokument27 SeitenPlan de Pago John CarneyArmandoInfoNoch keine Bewertungen

- Duque v. Spouses YuDokument2 SeitenDuque v. Spouses YuRienaNoch keine Bewertungen

- LAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsDokument12 SeitenLAND BANK OF THE PHILIPPINES (LBP), Petitioner, vs. Domingo and Mamerto Soriano, RespondentsanneNoch keine Bewertungen

- Ombudsman vs. Barangay CaptainDokument7 SeitenOmbudsman vs. Barangay CaptainCk Bongalos AdolfoNoch keine Bewertungen

- A Luxury in High Quality House Is On Sale Now!!! - Seoul HomesDokument1 SeiteA Luxury in High Quality House Is On Sale Now!!! - Seoul HomesAnna OnyszczukNoch keine Bewertungen