Beruflich Dokumente

Kultur Dokumente

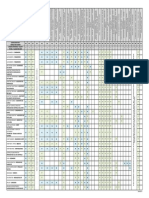

General Environment

Hochgeladen von

Ahmad ChreitehOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

General Environment

Hochgeladen von

Ahmad ChreitehCopyright:

Verfügbare Formate

General Environment

Demographic

Carrefour Company undertakes its operations in more than 29 nations globally. The world populace is increasing, geographic distribution of different populations is changing, world population is also aging, and ethnic constituents in developed nations are shifting rapidly, while the average household disposable incomes are rising significantly (Gehlen & Lasserre, 2005). The demographic climate provides both threats and opportunities for Carrefour. The rising population in the world and increasing household disposable incomes assist to expand the Asian market where the company has ventured. Nevertheless, changes in the geographic distribution of populace, because of technological advancements in communications, might lead to challenges for Carrefour in ascertaining and establishing productive and profitable regions for new storefronts in Asia.

Economic

In 2004, there was a considerable economic growth because of near-record low interest rates in the U.S., leading to considerable growth in worldwide trade. This growth was affected by sky-scraping oil prices in major oil-producing nations. The economic climate offers both opportunities and threats for Carrefour. Growth in international businesses provides opportunities for Carrefour in appreciating and venturing new products and services to provide to its clients. Increasing oil prices, nevertheless, pose threats to Carrefours productivity by raising the costs of transportation for goods intended for Carrefours storefronts and warehouses new markets such as Asia (Hoskisson, 2008).

Political/ legal

Later on, it worked with industrial and financial partners only when state regulations made it essential, in nations such as China, Thailand, Indonesia, and Malaysia. Overseas ownership regulations and laws in Thailand permitted overseas firms, except U.S. firms, to maintain not more than 49 % of the total shares. Carrefour claimed that these regulations will promote its rival, Wal-Mart (Gehlen & Lasserre, 2005). When the Central Retail Corp sold its 40% shareholding in 1998, this regulation made it impracticable for Carrefour to buy the shares. All the firms products within its stores were halhal in conformity with current food requirements within the industry. Since 1992, the companys foreign operations have been authorized through joint ventures with Chinese firms. In 1999, Chinas government stated that overseas firms will not posses more than 65% of any retailing business in China .Consequently, State Economic and Trade Commission (SETC), threatened to close all the stores if Carrefour did not conform to the central government provisions (Hoskisson, 2008). In the year 2004, China pronounced that it would respect its pledge by opening the booming retail sectors to overseas players, which include Carrefour and Wal-Mart, eliminating joint venture needs before the end of the year. Beijing also promised to stop checks on the number of overseas-owned chain stores and their locations. The company focuses to undertake its business activities in 70 hypermarkets in some years to come; however, Chinas political environment poses many threats. Rather, domestic distributors established court cases against Carrefour as the firm opted to buy directly instead of abiding to the long-established distribution outlets. Therefore, the legal/political environment provides a threat for Carrefour (Gehlen & Lasserre, 2005). The dissimilarities in the legal/political environments across different regions make it complex, and in most instances costly, for Carrefour to abide with governments rules. Political uncertainties in some nations remain considerably high as well as the threat of court cases from rivals, consumers, and distributors.

Social-Cultural

The new markets has seen spectacular shifts in cli ent markets purchasing behaviors, combined with soaring increase in per capita GNP, greater involvement of women in the labor force, large rise in the ownership of refrigerators and automobiles, and suburbanization. Asian clients are still inclined to sho pping on daily basis at wet markets or mom and pop chain stores. The rise in the growth of suburban societies overseas has become another outstanding socio-cultural trend in Asian markets (Nina, 2008).

Furthermore, impulse purchasing was on the increase and substituting a must buying, where a shopping as an aspect of leisure has become an increasing phenomenon. The socio-cultural climate represents opportunities for Carrefour Company. Growth of suburban societies, increase in impulse purchasing ,increases leisure shopping as well as other key changes in buying behaviors bond effectively with Carrefours capability to take advantage of these changes when penetrating new markets (Hoskisson, 2008).

Technological

The technological changes in information systems, data storage, the internet, as well as other types of communication, continue at a fast rate. The centralization of information technology systems and administrative processes realize further savings for the company. Nonetheless, technological environment offers threats and opportunities for Carrefour Company. Advancements in technology will allow Carrefour undertake better analysis if data is linked to future and the current customer bases. The technological advancements will enable the company to upgrade continuously its supply chain that is essential in enabling the firm to offer low prices. These technological advancements, nevertheless, might also be readily accessible by top rivals, where, if the rivals can easily imitate companys processes via improvements in technology, the company will suffer drawbacks (Gehlen & Lasserre, 2005).

Industry Analysis

Carrefour is one of the leading members in the retails industry, whereby the company was ranked the second-largest mass retailer globally. Though principally known as a hypermarket, Carrefour also had supermarkets, convenience stores, and hard discounts. In China and Europe, the company is the leading retailer in terms of size. The firm established its reputation in the retail industry through freshness, variety, as well, as low prices. Barriers to entry into particular market are raised by the aspect of Carrefours differentiation storefronts and stores, its reputation, and the degree of its community interaction. It will be complex for new entrants to penetrate, which Carrefour has not already performed or is not presently performing (Gehlen & Lasserre, 2005). Carrefours business operations are global and colossal in scope. Barriers to entry for new entrants are raised by economies of large scale. Discounts, promotions, partnerships, credit programs, free parking, joint ventures, refunds, and partnerships function to increase switching costs for suppliers, consumers, and partners alike. Nevertheless, switching the cost for clients in this industry is neither low nor high. On the other hand, barriers to entry distribution channels are very high. In this industry, the power of suppliers is low because the concentration of suppliers are less concentrated and not predominated by a few big firms. The power of buyers is neither low nor high. Threat of product substitutes might be low or high on the country or region where the business is located (Hoskisson, 2008).

Industry Competition

The company has continued to face competition from other companies offering similar products in the retail market. The company, for instance in 2003, was facing immense competition from powerful foreign and local retailers, which include Tesco. Nevertheless, local rivalry in the retail industry remained sturdy and professional (NTUC). Local suppliers repelled Carrefours methods in the market, where in 1999; the company was facing substantial competition and had to change its operations. Supermarkets and convenience stores were predominated by local chains, which included Lianhua, and hypermarkets were in strong hands of large international players in the retail industry (Gehlen & Lasserre, 2005). China has acquired WTO membership and at the same time, it owned a huge market in the world. Carrefour was advantageous while penetrating the Asian market since there was less competitors in the market. The growth of the retail industry functions to reduce competition among the rival companies. However, this is not the situation in Japan, where the saturated market functions to increase competition in the industry amongst the rival firms (Nina, 2008). Consequently, the competition in the industry is high. There are incredible numbers of big and medium-sized companies that are competing on regional, local, international, and national markets in a view of increasing their market shares. This has increased competition in this retail industry thus making Carrefour lower its prices (Gehlen & Lasserre, 2005).

The company has well-established reputation in the retail industry, with which the firm can offer the utmost freshness and variety at relatively low prices in the market. The company can pledge low prices and at the same undying providing approximately 50,000 products. Consequently, high fixed costs for huge storefronts, which comprise of facilities and land, integrated with high storage expenses for perishable commodities, functions to increase competition in the retail industry (Hoskisson, 2008). Despite the Asian crisis that compelled the local retailers to retreat on their expansion plans, while some of the retail companies became bankrupt, the competition in the industry continues to increase as well as remaining strong. Where the degree of operations of various companies match, and they undertake their businesses in the same environment, the strategic stakes remain high,-this may result to increased rivalry in the industry.

Carrefour's business and international strategies

The company has strong formal reporting structures, controlling, planning, and coordinating systems that will enable the company to integrate effectively its operation in the eight markets. The company, before venturing and entering into international market, conducts researches and analyses the local and regional conditions against a system of established socio-economic criteria. After the company has undertaken feasibility research conclusively, Carrefour aims at selecting the structure that will best suit its particular market and embrace this format to suit the regional condition resulting to an effective translational strategy (Hoskisson, 2008). The company attempts to establish those stores in urban setting to attain economies of scale. The use of centralized IT ensures that the company meets local, regional, and international market strategies. Furthermore, the company when launching a new market ensures that it operates a dual system for hiring local executives and expatriates (Gehlen & Lasserre, 2005). The company also has strategic location of its equipments and plants both regional and internationally. The firm has 10,378 stores in 29 nations and has 410,000 employees globally. This will enable the company meet both local and international industry needs as well as making it easy for the firm to undertake its translational strategy, which focuses on the regional strategies. Through technological resources, such as trademarks, patents, trade secrets, and copyrights Carrefour had to fulfill local and regional conditions before penetrating the international markets against the socio-economic parameters. In addition, through the technological resources, they had to use regional stores in launching new product in the market. The company promoted cost management approach of sourcing strategy by using translational strategy. This will allow the company to become the leader in the retail industry, which will increase its reputation as well as its productivity and profitability (Gehlen & Lasserre, 2005). In addition, the company has excellent remuneration plan. The company has reputation for paying its workers well, for instance, heads of departments earn approximately 20% more than what is offered in other supermarkets, and might earn a bonus depending on the outcomes of the department. This raises the morale of the employees promoting the translational strategies.

International Corporate Level Strategy

Translational Strategies

In Asian markets, Carrefour wanted to realize both local and global efficiency receptiveness. They had to seize costs down because of the increasing number of international competitors they faced; however, they also had to encounter the needs of an extremely different set of cultures, tastes, preferences, and buying habits. Its strategy of cross-training experts with local managers assisted to raise local receptiveness (Nina, 2008). In addition, several Asian business operations needed more independence than local operations. As a result, with Carrefour, there seems to be a blend of the global and multidomestic strategies. Carrefour has embraced and implemented the utilization of strategic alliances, initially, in penetrating new unknown markets. Once Carrefour emerges to be well conversant with the market, it then quickly expands its markets and business via the development of new entirely owned departmental stores. This strategy appears to balance the risk concerned with

Green Fields ventures and the lesser returns linked with strategic alliances. Since this strategy has confirmed its costefficiency in the past, Carrefour must continue undertaking it in the future (Gehlen & Lasserre, 2005).

Recommendations

The company needs to create online supply platform, which will have Sears and Oracle. This will allow the companys retailers and suppliers exchange innovative information through the internet system and maximize the flow of products, hence minimizing their administrative costs. Carrefour also needs to embrace technological advances, which will allow the company venture into new markets where it can increase its customer base. The marketing strategies, which the company can embrace, include online, viral marketing, and sourcing strategies (Nina, 2008). The company needs to streamline its legal aspects to allow its expanding in Asian markets without any hurdles. The legal restructuring must be undertaken by the company with the partnership of Chinese authorities, which will enable the firm to expand easily and in a cost-effective manner. Carrefour must look into the benefits of RFID, as well as other up-and-coming technologies, to minimize the quantity of labor needed to stock, package, track, and deliver its products. Gains of the utilization of emerging technologies can also come in the form of lowered tear and wear on equipment and facilities, which will decrease the maintenance needed for equipment and facilities (Gehlen & Lasserre, 2005). Carrefour has to show an exceptional capacity to adapt its concept to local business environment across the globe. By internalizing the achievement or failure of definite initiatives in one business design, Carrefour is capable to transmit the knowledge of this failure or success transversely in all business departments at little cost to the firm. The company is competent to spread the expertise, which its human capital has gained by sending experts to work side-by-side with local managerial team. This structure enables the spreading of understanding within the firm both downstream and upstream, therefore, creating value for the whole company (Hoskisson, 2008).

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Issue15 - Chirag JiyaniDokument6 SeitenIssue15 - Chirag JiyaniDipankar SâháNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Chapter 10 Translation ExposureDokument14 SeitenChapter 10 Translation ExposurehazelNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- WFM 5101 Watershed Hydrology: Shammi HaqueDokument18 SeitenWFM 5101 Watershed Hydrology: Shammi HaquejahirNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Offshore Training Matriz Matriz de Treinamentos OffshoreDokument2 SeitenOffshore Training Matriz Matriz de Treinamentos OffshorecamiladiasmanoelNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Paper 4 Material Management Question BankDokument3 SeitenPaper 4 Material Management Question BankDr. Rakshit Solanki100% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Products ListDokument11 SeitenProducts ListPorag AhmedNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Note Hand-Soldering eDokument8 SeitenNote Hand-Soldering emicpreampNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Retail Operations ManualDokument44 SeitenRetail Operations ManualKamran Siddiqui100% (2)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Volvo Catalog Part2Dokument360 SeitenVolvo Catalog Part2Denis Konovalov71% (7)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Gics-In-India Getting Ready For The Digital WaveDokument81 SeitenGics-In-India Getting Ready For The Digital Wavevasu.gaurav75% (4)

- Context in TranslationDokument23 SeitenContext in TranslationRaluca FloreaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- PMDG 737NGX Tutorial 2 PDFDokument148 SeitenPMDG 737NGX Tutorial 2 PDFMatt HenryNoch keine Bewertungen

- Genie PDFDokument277 SeitenGenie PDFOscar ItzolNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Department of Education: Republic of The PhilippinesDokument1 SeiteDepartment of Education: Republic of The PhilippinesKlaribelle VillaceranNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Altos Easystore Users ManualDokument169 SeitenAltos Easystore Users ManualSebNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Chemistry II EM Basic Learning MaterialDokument40 SeitenChemistry II EM Basic Learning MaterialMAHINDRA BALLANoch keine Bewertungen

- Portfolio Final AssignmentDokument2 SeitenPortfolio Final Assignmentkaz7878Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- MotorsDokument116 SeitenMotorsAmália EirezNoch keine Bewertungen

- Model DPR & Application Form For Integrated RAS PDFDokument17 SeitenModel DPR & Application Form For Integrated RAS PDFAnbu BalaNoch keine Bewertungen

- IEEE 802 StandardsDokument14 SeitenIEEE 802 StandardsHoney RamosNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Most Probable Number (MPN) Test: Principle, Procedure, ResultsDokument4 SeitenMost Probable Number (MPN) Test: Principle, Procedure, ResultsHammad KingNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Quiz 2 I - Prefix and Suffix TestDokument10 SeitenQuiz 2 I - Prefix and Suffix Testguait9Noch keine Bewertungen

- 04 Membrane Structure NotesDokument22 Seiten04 Membrane Structure NotesWesley ChinNoch keine Bewertungen

- Report On Monitoring and Evaluation-Ilagan CityDokument5 SeitenReport On Monitoring and Evaluation-Ilagan CityRonnie Francisco TejanoNoch keine Bewertungen

- Preblending of Raw Materia1Dokument26 SeitenPreblending of Raw Materia1Mohammed Abdo100% (1)

- Mongodb TutorialDokument106 SeitenMongodb TutorialRahul VashishthaNoch keine Bewertungen

- Measures For FloodsDokument4 SeitenMeasures For FloodsMutsitsikoNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Teambinder Product BrochureDokument7 SeitenTeambinder Product BrochurePrinceNoch keine Bewertungen

- Dash8 200 300 Electrical PDFDokument35 SeitenDash8 200 300 Electrical PDFCarina Ramo LakaNoch keine Bewertungen

- How To Make An Effective PowerPoint PresentationDokument12 SeitenHow To Make An Effective PowerPoint PresentationZach Hansen100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)