Beruflich Dokumente

Kultur Dokumente

14mar2012181326 - Holding & Investment Companies - Deeply in Discount

Hochgeladen von

didwaniasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

14mar2012181326 - Holding & Investment Companies - Deeply in Discount

Hochgeladen von

didwaniasCopyright:

Verfügbare Formate

ANALYST:

PriteshBumb|+912240935008

pritesh.bumb@sushilfinance.com

SALES:

DevangShah|+912240936060/61

devang.shah@sushilfinance.com

p

Sushil Financial Services

Private Limited

hilfi www.sushilfinance.com

For Private Circulation Only

Please refer to important disclosures at the end of the report

Holding&InvestmentCompanies

DeeplyinDiscount

We have covered Holding & Investment companies in this report, which are trading at very high discount to their NAVs.

Selection of stocks are based on qualitative and quantitative factors as explained below:

QualitativeFactors

Promotershistoryandbackground&theirstakeinthecompany

Qualityofinvestments

Possibilityofvalueunlocking

Majorshareholdersotherthanpromoters

Quantitative Factors QuantitativeFactors

Sizeofthecompany&averagevolumes

CurrentdiscounttoNAV

HistoricaldiscounttoNAVinvariousmarketsituations

Otherliabilitiesinthebalancesheet

Al i h di di id d i h l i i id d di id d i ld l i i i Also,inshorttomediumterm,dividendistheonlyincomeinvestorgenerates,weconsidereddividendyieldasaselectioncriteria.

OURVIEW

We believe holding company discount arises due to few factors which includes lack of controlling stake, long term nature of

investment, liquidation cost etc. Over a period of time the discount varies based on market & economic conditions and due to some

fundamental changes like group restructuring, promoter increasing stake, large investor getting interest etc. In this report, we have

selected a list of 12 companies which we believe are trading at a discount much higher than historical average. We expect the

discount to decrease as investors would flock towards buying these undervalued companies, keeping in mind the sharp recovery in

the stock market and improved sentiments.

Return for investors in these companies can be two fold driven by appreciation of its investments and decrease in discount. Hence,

We expect that most of these companies will turn out to be the safest bets in the current environment & would provide extremely

d t th i t

2 March14,2012

good returns over the coming two years.

Holding&InvestmentCompanies

DeeplyinDiscount

Why holding company trades at discount?

Strategicstake:Sincemostoftheholdingcompanyinvestmentsarestrategicinnature,unlockingofvalueofinvestment

couldnotbeforeseeninnearfuture.Sotheunrealizedgainsareonlyinthebooksbutseldomrealized.Thus,whatan

investorofholdingcompanyearnsisnottheappreciationinthesharepriceoftheunderlyinginvestmentsbutthedividend

d f th i t t earnedfromtheseinvestments.

Lack of majority : If a holding company does not have a majority stake in its investments, then the financials of the

investments thus held, do not reflect in the holding companys financial statements. Hence, valuing financials of the holding

company may not give a fair picture of the value of overall investment held by it.

Liquidation Cost: High liquidation cost of the investment i.e. if it sells a large block of shares in open market, it might have to

do so at a price below the market price and the price may correct drastically unless the investments are highly liquid stocks. do so at a price below the market price and the price may correct drastically unless the investments are highly liquid stocks.

Triggers that can result in decrease in holding company discount:

1. Fundamental Change

Group /Business Restructuring: Generally group restructuring results in unlocking of value of investments and reduction in

discount.

Promoter trying to increase its stake: Sometime promoter wants to increase their stake in its group So the cheapest & Promoter trying to increase its stake: Sometime promoter wants to increase their stake in its group. So the cheapest &

easiest way for them is to increase their stake in holding company at a steeply discounted valuation (rather than that of

individual companies at market related prices). This results in reduction of discount for holding company.

Launch of holding company funds: Since large number of mutual funds/PE Funds are trying to focus in niche area of

operation, we may see holding company funds to get launched in India in next few years which would result in decrease in

the discount due to fresh buying interest.

2. Technical Behavior/ Market sentiments

Our historical analysis points out that when markets are at top, holding company discount is lowest and when market

bottoms, it is at highest. We have observed a trend (within the universe we covered in this report) which shows that the

discount was least, when the market peaked in Jan08 and it was maximum when market bottomed in Mar09. Despite of a

sharp revival in the market recently, the discount currently are still at high. Hence, we expect discount to decrease

3 March14,2012

substantially over the coming two years as the market condition remains upbeat and expect the investors to flock towards

buying these undervalued holding companies.

Holding&InvestmentCompanies

DeeplyinDiscount

NAV Calculation Methodology

A holding company typically does not have ongoing operations other than the management of investments and cash. The valuation

of these companies usually relies significantly upon the value of the underlying asset as normal valuation techniques dont apply to

these companies as there is no consistency in revenue generation i.e. Net profit will be extremely volatile based on liquidation of p y g p y q

shares. If the company sells its part of holding and book profit in a particular year, its Income and Net Profit for that year will look

extraordinarily high. Hence, we estimate business value based upon the market value of the underlying assets rather than income

producing capacity or peer valuation. We used Net Asset Value (NAV) based valuation methodology, which is market value of

company assets less liabilities and apply appropriate discount to it. Discount generally depends on nature of its assets and general

market condition market condition.

Disclaimer: For analysis, we have considered investments breakup based on last annual report. Since some of the investments may

have been sold, since then, at much lower price, our conclusion may be inappropriate to the extent of price rise after the sale of

shares.

4 March14,2012

Holding&InvestmentCompanies

DeeplyinDiscount

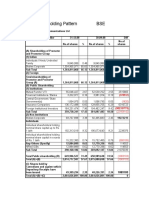

COMPANIESCOVERED CMP(RS.) MCAP(MN) NAV(RS.) DISCOUNT(%) PAGENO.

BajajHoldings&InvestmentLtd. 805 89355 2230 64 6 j j g

TataInvestmentCorporationLtd. 459 22032 790 42 8

BombayBurmah &TradingCorporation 549 7686 1793 69 10

l S I L d 68 3840 322 6 12 Nalwa SonsInvestmentsLtd. 768 3840 3225 76 12

MaharashtraScootersLtd. 307 3377 1688 82 14

Balmer Lawrie InvestmentsLtd. 150 3300 265 43 16

Bengal&AssamLtd. 204 1836 691 71 18

SILInvestmentsLtd. 73 803 354 80 20

UniphosEnterprisesLtd. 26 650 106 75 22

MajesticAutoLtd. 59 614 194 70 24

WilliamsonMagor&CoLtd 46 506 212 78 26

Williamson Financial Services Ltd. 27 227 138 81 28

5 March14,2012

WilliamsonFinancialServicesLtd. 27 227 138 81 28

March 14,2012 CMP:Rs.805 NAV:Rs.2230 Discount :64%

BajajHoldings&InvestmentLtd.

Pursuant to Bajaj Autos scheme of demerger, Bajaj Holdings & Investment Ltd (BHIL) was formed

on 30th April 2007, whereby its manufacturing undertaking was transferred to the Bajaj Auto and

its strategic business undertaking consisting of wind farm business and financial services business

has been vested with Bajaj Finserv. All other investments and liabilities remained with BHIL.

BHIL is essentially a Holding & Investment company and currently holds strategic stake in

B j j A t (31 49% t k ) i I di d l t t h l ith 19% k t

STOCKDATA

ReutersCode

BloombergCode

BJAT.BO

BJHI.IN

BSECode

NSE Symbol

500490

BAJAJHLDNG

Bajaj Auto (31.49% stake) is Indias second largest twowheeler company with 19% market

share and is among the leader in three wheeler segment with +40% market share.

Bajaj Finserv (39.15% stake) which is one of the leading financial services company in India, is

engaged in life insurance, general insurance and consumer finance

Maharashtra Scooters (24% stake) has a scooter manufacturing facility but has ceased

production since April 2006. It holds huge investments in its balance sheet, which is valued at

b R 18 b k i f li d i i

NSESymbol BAJAJHLDNG

Mkt.Cap. 89355mn

SharesOutstanding 111mn

52WeeksH/L Rs.831/625

about Rs.18+ bn at current market price for listed entities.

MultiCommodity Exchange (3.06% stake) is the largest commodity trading exchange in India

with 84% market share and is 5

th

largest in the world in terms of turnover.

BSE and Other unlisted investments: It holds 3 mn shares in BSE India with book value of +2.1

bn. It also holds Investments in other securities which includes Gsec worth Rs.0.8 bn,

Debentures worth Rs.10 bn & MF units worth Rs.0.4 bn.

Avg.DailyVol.(6m) 9,047Shares

PricePerformance(%)

1M 3M 6M

4 17 9

200 Days EMA Rs.736

Strong, Reputed Management: The Bajaj Group is amongst the top 10 business houses in India. Its

footprint stretches over a wide range of industries, spanning automobiles (2wheelers and 3

wheelers), home appliances, lighting, iron and steel, insurance, travel and finance. The group's

flagship company, Bajaj Auto, is ranked as the world's fourth largest two and three wheeler

manufacturer and the Bajaj brand is wellknown across several countries in Latin America, Africa,

Middle East and Asia.

200DaysEMARs.736

SHAREHOLDING(%)

Promoters 40.1

FII 11.8

FI/MF 12.7

At the CMP, the stock is available at +64% discount to its NAV, which seems to be very attractive.

BHIL holds considerable stake in other unlisted exchanges like BSE & NMCE and a ratings company

CARE which could trigger price if compared to listed peers in the market.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 12.0

Public&Others 23.4

6 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

8134.8 7713.3

293.5 72.7 19.9 11.1 2.2 1.2

FY11

10764.5 10000.9

29.7 89.9 21.7 9.0 2.0 1.1

BajajHolding&InvestmentsLtd.

NAVCalculation NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

BajajAuto 91.1 31.5 1,789 2,862 82,149

BajajFinserv 56.0 39.2 615 3,461 35,137

ICICIBank 12.2 1.1 930 4,460 16,061

BajajElectricals 16.7 2.0 190 1,118 1,854

OtherQuotedShares 5,987 6,654

ValueofQuotedEquity 17,888 218,585

Otherinvestmentincl.stake inBSE (cost) 27,847 27,847

ValueOfInvestment 45,735 246,432

Less:NetDebt (DebtCash) (1775) ( ) ( )

NAV 248,207

No. ofshares 111

NAVPerShare(Rs.) 2,230

CMP(Rs.) 805

Discount(%) 64

PriceHistory

ValuationGapChart

7

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

March 14,2012 CMP:Rs.459 NAV:Rs.790 Discount :42%

TataInvestmentCorporationLtd.

Tata Investment Corporation (TIC), formerly known as Investment Corporation of India, is a NBFC

located in Mumbai. TIC is primarily involved in investing in longterm investments such as equity

shares. TIC was promoted by Tata Sons in 1937 and went public in 1959.

TIC currently holds strategic stake in all major Tata companies like Tata Chemicals, Tata Steel,

Tata Motors Voltas Tata Tea Titan Industries TCS & other Tata companies which together

STOCKDATA

ReutersCode

BloombergCode

TINV.BO

TICL.IN

BSECode

NSE Symbol

501301

TATAINVEST

Tata Motors, Voltas, Tata Tea, Titan Industries, TCS & other Tata companies, which together

constitute about +60% of its total value of investments. It also holds investments in other listed

companies like HDFC, Ambuja Cements, Sun Pharma among others. Also, it holds investment in

certain unlisted entities like Tata AMC, Tata Capital, TATA Tele, NSE etc.

Strong Management: TIC is a part of Tata group which holds about 73% stake. The Tata Group is

amongst the top 10 business houses in India. Group is respected in India for +140 years for its

NSESymbol TATAINVEST

Mkt.Cap. 22032mn

SharesOutstanding 48mn

52WeeksH/L Rs.570/396

g p p p y

adherence to strong values and business ethics. Its footprint stretches over a wide range of

industries, spanning automobiles, retail, iron and steel, insurance, IT & communications, power &

chemicals, etc. It also has significant international operations. The total revenue of Tata

companies taken together was $83.3 bn in FY11 with 57% coming from international operations

and it employs around 424,365 people worldwide.

i l b h i h l l k i h ld f i i d

Avg.DailyVol.(6m) 3,715Shares

PricePerformance(%)

1M 3M 6M

(5) 6 (13)

200 Days EMA Rs.471

Group Companies: Tata Steel became the sixth largest steel maker in the world after it acquired

Corus. Tata Motors is among the top five commercial vehicle manufacturers in the world and has

major brands like Jaguar and Land Rover. TCS is a leading global software company with delivery

centres in the US, UK, Hungary, Brazil, Uruguay and China, besides India. Tata Global Beverages is

the second largest branded tea company in the world. Tata Chemicals is the worlds second

largest manufacturer of soda ash.

200DaysEMARs.471

SHAREHOLDING(%)

Promoters 65.8

FII 2.5

FI/MF 7.0 g

TIC has high dividend yield of +3% given dividend per share of Rs 16. At the CMP, the stock is

available at 42% discount to its NAV, which seems to be attractive.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

/

BodyCorporates 3.4

Public&Others 21.3

8 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

2326.2 1939.1

4.1 38.0 15.7 12.1 1.4 2.8

FY11

2481 1985.9

2.4 38.5 12.5 11.9 1.4 3.5

TataInvestmentCorporationLtd.

NAVCalculation

NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

TataChemicals 15.8 6.2 353 455 5,560

TitanIndustries 17.2 1.9 246 171 4,236

TataMotors 14.8 0.4 284 858 4,183

Tata Global Beverages 27.5 4.5 117 74 3,215 TataGlobal Beverages 27.5 4.5 117 74 3,215

Tata Steel 3.4 0.4 456 615 1,544

Voltas 9.5 2.9 127 36 1,198

IndianHotels 9.9 1.3 68 581 670

OtherQuotedShares 5,269 10,546

ValueofQuotedEquity 8,059 31,151

OtherInvestment(cost) 4,850 4,850

ValueOfInvestment 12,909 36,002

Less:NetDebt(DebtCash) (2,095)

Less:NetCurrentLiabilities

NAV 38,097

No. ofshares(inMn) 48

NAVPerShare 790

CMP 459

PriceHistory ValuationGapChart

CMP 459

Discount(%) 42

9

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

March 14,2012 CMP:Rs.549 NAV:Rs.1793 Discount :69%

BombayBurmah TradingCorpLtd.

The Bombay Burmah Trading Corporation Ltd (BBTCL), a 142 years old company, is a leading

concern of the Wadia Group. BBTCL has a number of diverse businesses viz. Tea and Coffee Estates

under Plantations, Dental Products under Health Care and Weighing Products under Electronics.

While plantations continue to be its core business, the other divisions, although profitable, are

relatively small in size.

BBTCLs tea & coffee plantations business is in Southern India with eight estates under tea, totaling

STOCKDATA

ReutersCode

BloombergCode

BBRM.BO

BBTC.IN

BSECode

NSE Symbol

501425

BBTC

2822 hectares and has seven factories producing about 8 mn kg of tea annually. Its has 8 Estates,

totaling 927 hectares of planted coffee and produces about 1000 tons of clean coffee per year, out

of which 50 tons is organically cultivated coffee, which is in highest demand for export.

BBTCL major holdings consist of:

Bombay Dyeing (14.6% stake) is engaged into Real Estate and textiles business with products

ranging from stylish linens, towels, home furnishings, leisure clothing, kids wear and range of

th d t

NSESymbol BBTC

Mkt.Cap. 7686mn

SharesOutstanding 14mn

52WeeksH/L Rs.577/338

other products.

Britannia Industries engaged in the manufacture and sale of biscuits, bread, rusk, cakes and

dairy products with ~38% market share. BBTCL indirectly holds (50.96% stake) in Britannia

Industries through its 100% subsidiary Leila Lands Limited, which strategically holds majority

stake through its 100% subsidiary Associated Biscuits International Ltd holding 45.13% stake

and 5.83% through other five 100% subsidiaries.

At the CMP the stock is available at +69% discount to its NAV which seems to be very

Avg.DailyVol.(6m) 14,285Shares

PricePerformance(%)

1M 3M 6M

27 48 27

200 Days EMA Rs.425

At the CMP, the stock is available at +69% discount to its NAV, which seems to be very

attractive. As indicated in FY11 annual report, BBTC has strong inclination to move up the value

chain by shifting the focus from commodity to branded offerings. A number of actions have

been initiated to achieve this objective and some positive developments are expected to take

place in years ahead. As a part of restructuring exercise in last 2 quarters, BBTC has sold its two

business segments namely Sunmica Division for Rs.1003 mn and an autoancillary division for

Rs.1805 mn. We believe this is the beginning of the restructuring process with next in line

200DaysEMARs.425

SHAREHOLDING(%)

Promoters 66.0

FII 0.2

FI/MF 1.3

g g g p

would be real estate. BBTCL holds land at KanjurmargMumbai, AkurdiPune and Coimbatore.

BBTC intends to sell Pune land, where as other land parcels have been converted to stock in

trade and necessary permission has also been taken for development of these properties.

.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 3.6

Public&Others 28.9

10 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

44298.7 528.3

1809.7 21.8 6.6 25.9 1.0 0.6

FY11

53265.5 578.3

9.5 78.5 6.8 7.2 0.9 1.2

BombayBurmah TradingCorpLtd.

NAVCalculation NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

Bombay Dyeing 5.9 14.6 463 987 2,744

ValueofQuotedEquity 987 2,744

BritanniaIndustries* 60.9 51.0 570 34,719

Otherinvestment(cost) 81

ValueOfInvestment 37,544

Less:NetDebt (DebtCash) 12,419

Less:NetDeferred TaxLiability 89

NAV 25,035

No. ofshares(inMn) 14 ( )

NAVPerShare(Rs.) 1,793

CMP(Rs.) 549

Discount(%) 69

*BombayBurmah holdsindirectstakeinBritanniaInds.viaLeilaLandsSenderian Berhad,a100%Subsidiary.

PriceHistory

ValuationGapChart

11

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

NalwaSonsInvestmentsLtd.

March 14,2012 CMP:Rs.768 NAV:Rs3225 Discount :76%

Nalwa Sons Investments Ltd (NSIL), formerly known as Jindal Strips Ltd, is an O.P. Jindal Group

company. NSIL was incorporated in the year 1970 and converted to public limited company in the

year 1975.

NSIL is an investment company and continues to hold significant investments in

i d l S ( 9 % S k ) i f h ' l d f S i hi h i

STOCKDATA

ReutersCode

BloombergCode

NALS.BO

NINV.IN

BSECode

NSE Symbol

532256

NSIL

Jindal Saw (19.4 % Stake) is one of the country's largest producers of Saw pipes, which is

widely used in the energy sector for the transportation of oil and gas.

JSW Holdings (10.24% stake) is an Investment Company of the JSW Promoters Group with its

investments mainly in Jindal Group of Companies.

JSW Steel (2% direct stake and 1.5% indirect holding via Jindal holdings, which is a subsidiary

i h 87% k ) i I di d l l k i h 10 MT i hi h i f

NSESymbol NSIL

Mkt.Cap. 3840mn

SharesOutstanding 5mn

52WeeksH/L Rs.950/510

with 87% stake) is Indias second largest steelmaker with 10 MT capacity, which consists of

the most modern, ecofriendly steel plants with the latest technologies for both upstream &

downstream processes.

NSIL also hold investments in Stainless investment, Brahmaputra Capital as its majority

holdings. The company has four unlisted subsidiaries namely Jindal Holdings Ltd, Jindal

Stainless (Mauritius) Ltd Jindal Steel & Alloys Ltd and Massillon Stainless Inc USA

Avg.DailyVol.(6m) 447Shares

PricePerformance(%)

1M 3M 6M

(8) 33 20

200 Days EMA Rs.700

Stainless (Mauritius) Ltd, Jindal Steel & Alloys Ltd and Massillon Stainless Inc., USA.

Strong Background: Nalwa Sons is a part of O.P. Jindal Group which is amongst the Indias largest

corporate groups having business collaborations around the world. Group is involved in

Infrastructure, Hightech realms of deepocean oil drilling, Prospecting for oil, gas and petroleum

products and Exports

At the CMP the stock is available at 76% discount to its NAV which seems to be very attractive

200DaysEMARs.700

SHAREHOLDING(%)

Promoters 55.6

FII 4.2

FI/MF 0.6

At the CMP, the stock is available at 76% discount to its NAV, which seems to be very attractive.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

/

BodyCorporates 2.1

Public&Others 37.5

12 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

237.0 158.1

(84.6) 30.8 3.2 24.4 1.2

FY11

311.9 259.1

63.9 50.4 7.5 14.9 1.1

NalwaSonsInvestmentsLtd.

NAVCalculation

NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

JindalSaw 53.5 19.4 169 35 9,069

JSWSteel 4.6 2.0 764 199 3,477

JSWHoldings 1.1 2.5 769 118 875

O h Q d Sh 9 OtherQuotedShares 14 169

ValueofQuotedEquity 366 13,589

JindalHolding(87%Stake) 3.1 87.0 764 610 2,424

OtherInvestment(cost) 775 775

ValueOfInvestment 1,751 16,789

Less:NetDebt(DebtCash) 215

Less: Net Current Liabilities Less:NetCurrentLiabilities

NAV 16,574

No. ofshares(inMn) 5

NAVPerShare 3,225

CMP 768

Discount(%) 76

PriceHistory

ValuationGapChart

13

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

MaharashtraScootersLtd.

March 14,2012 CMP:Rs.307 NAV:Rs.1688 Discount :82%

Maharashtra Scooters Ltd (MSL) is primarily a scooter manufacturer. It is a joint enterprise

promoted by Western Maharashtra Development Corporation (27%) and Bajaj Auto (24%). The

company was incorporated in 1975. MSLs main business is to assemble geared scooters, but due

to nonavailability of CKD packs from Bajaj Auto, MSL ceased production of geared scooters in

April 2006. MSL has managerial and technical agreement with Bajaj Auto for production of

STOCKDATA

ReutersCode

BloombergCode

MHSC.BO

MHSC.IN

BSECode

NSE Symbol

500266

MAHSCOOTER

p g g j j p

scooters in which scooter brands included are Chetak, Super and Priya. The company has its

plants in Waluj and Akurdi.

MSLs major investment holdings consist of

Bajaj Auto (2.34% stake) is Indias second largest twowheeler company with 19% market

share and is among the leader in 3wheeler segment with +40% market share.

NSESymbol MAHSCOOTER

Mkt.Cap. 3377mn

SharesOutstanding 11mn

52WeeksH/L Rs.389/275

g g

Bajaj Finance (4.48% stake) primarily dealing in financing consumer durables, personal and

small business loans, loan against property, loan against shares.

Bajaj Finserv (2.34% stake) which is one of the leading financial services company in India, is

engaged in life insurance, general insurance and consumer finance

Bajaj Holdings (3 04% stake) is essentially an Holding & Investment company for Bajaj group

Avg.DailyVol.(6m) 1,020Shares

PricePerformance(%)

1M 3M 6M

6 (52)

200 Days EMA Rs.322

Bajaj Holdings (3.04% stake) is essentially an Holding & Investment company for Bajaj group.

Its investments also include Debentures and MFs worth Rs.1000 mn.

Strong Background MSL is the part of the Bajaj Group, which is amongst the top 10 business

houses in India. Bajajs footprint stretches over a wide range of industries, spanning automobiles,

home appliances, lighting, insurance, etc. Bajaj Auto is ranked as the world's fourth largest two

and three wheeler manufacturer and the Bajaj brand has presence in several countries in Latin

200DaysEMARs.322

SHAREHOLDING(%)

Promoters 51.0

FII 3.7

FI/MF 3.1

and three wheeler manufacturer and the Bajaj brand has presence in several countries in Latin

America, Africa, Middle East, South and South East Asia.

At the CMP, the stock is available at +82% discount to its NAV, which seems to be very attractive.

MSL has dividend yield of 1.7%.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 10.0

Public&Others 32.2

14 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

241.5 81.8

(3.8) 6.4 4.2 47.7 1.7 1.8

FY11

410.4 212.3

159.5 17.6 10.6 17.5 1.7 2.9

MaharashtraScootersLtd.

NAVCalculation NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

BajajAuto 6.8 2.3 1,789 183 12,119

BajajHoldings 3.4 3.0 806 467 2,728

BajajFinserv 3.4 2.3 615 177 2,083

BajajFinance 1.6 4.5 801 216 1,312

OtherQuotedShares 4 43

ValueofQuotedEquity 1,046 18,285

OtherInvestment(cost) 1094 1094

ValueOfInvestment 2,140 19,379

Less:NetDebt(DebtCash) (35)

b l Less:NetCurrentLiabilities 118

NAV 19,296

No. ofshares(inMn) 11

NAVPerShare 1,688

CMP 307

Discount(%) 82

PriceHistory ValuationGapChart

15

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

BalmerLawrieInvestmentsLtd.

March 14,2012 CMP:Rs.150 NAV:Rs.265 Discount :43%

Balmer Lawrie Investments Ltd (BLIL), incorporated in 2001, as a public Ltd company under

the administrative control of the Ministry of Petroleum & Natural Gas.

BLIL was formed under the scheme of demerger of IBP, where investment in Balmer Lawrie

was transferred to BLIL and other business was kept with IBP. Government of India currently

STOCKDATA

ReutersCode

BloombergCode

BLMI.BO

BALM.IN

BSECode 532485

p y

holds about 60% stake in the company.

The Company does not carry any business except its investments in Balmer Lawrie. Hence

BLILs source of income is only dividend income.

Strong Background: BLIL is the holding company of Balmer Lawrie Co Ltd with 61.8% stake.

Balmer groups principal activity is engaged in diversified businesses like Industrial Packaging

Mkt.Cap. 3300mn

SharesOutstanding 22mn

52WeeksH/L Rs.192/134

A D il V l (6 ) 4 548 Sh

Balmer group s principal activity is engaged in diversified businesses like Industrial Packaging,

Logistics Management, Greases & Lubricants, Travels and Tours. Its Infrastructure business

includes three Container Freight Stations (CFSs) in Mumbai, Chennai and Kolkata. Balmer is

Indias largest manufacturer of MS drums used in packaging of lubricants, chemicals, paints,

etc and it holds the largest market share in India. It delivers BALMEROL brand of Industrial,

Automotive & Speciality range of lubricants.

Avg.DailyVol.(6m) 4,548Shares

PricePerformance(%)

1M 3M 6M

(5) 5 (7)

200 Days EMA Rs.153

p y g

BLIL has been rewarding investors with good dividend consistently. It paid final dividend of Rs

8.5 per share during FY11 resulting in yield of 5.6%.

At the CMP, the stock is available at +43% discount to its NAV, which seems to be attractive.

200DaysEMARs.153

SHAREHOLDING(%)

Promoters 59.7

FII 3.2

FI/MF 2.1

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 16.1

Public&Others 18.9

16 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

221.6 211.1

17.5 9.51 45.0 15.8 6.8 5.0

FY11

253.0 242.2

14.7 10.91 46.9 13.8 6.1 5.6

BalmerLawrieInvestmentsLtd.

NAVCalculation

NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

Balmer Lawrie 10.1 61.8 544 327 5,473

OtherQuotedShares

Value of Quoted Equity 327 5 473 ValueofQuotedEquity 327 5,473

OtherInvestment(cost)

ValueOfInvestment 327 5,473

Less:NetDebt(DebtCash) (405)

Less:NetCurrentLiabilities

NAV 5 878 NAV 5,878

No. ofshares(inMn) 22

NAVPerShare 265

CMP 150

Discount(%) 43

PriceHistory ValuationGapChart

17

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

March 14,2012 CMP:Rs.204 NAV:Rs.691 Discount :71%

Bengal&AssamLtd

Bengal & Assam Ltd is essentially a Finance & Investment company. It has four subsidiaries with

interest in engineering products, polymers, cotton yarn, dairy products and investment. The

Groups turnover was at Rs.82 bn with Fenner India contributing more than 50% in FY11.

Fenner India commenced operations in India in 1929 and put up their first manufacturing unit at

Madurai in Tamilnadu in the year 1956. Currently it has 7 manufacturing units over 5 locations. It

offers a total solution to Mechanical Power Transmission and Sealing requirements on a single

STOCKDATA

ReutersCode

BloombergCode

BAAC.BO

BENG.IN

BSECode

NSE Symbol

533095

window basis and is a market leader. The product lines covers VBelts, Oil seals, Moulded Rubber

Components and Engineering Products for applications in both Industrial and Automotive

mechanical power transmissions. It also exports to more than 50 countries globally. As of FY11, it

had revenue of Rs.4198.7 mn and PAT of Rs.472.7 mn.

Bengal and Assam currently holds strategic stake in

J.K Lakshmi Cement (22.3% stake) has a capacity of 5 mn tons p.a. with clinkerisation unit

l t d t Si hi i R j th d i di iti i Si hi d K l l Ah d b d

NSESymbol

Mkt.Cap. 1836mn

SharesOutstanding 9mn

52WeeksH/L Rs.305/170

located at Sirohi in Rajasthan and grinding capacities in Sirohi and Kalol near Ahmedabad.

J.K Paper (20.7% stake) is Indias largest producer of branded papers and a leading player in the

Fine Papers and Packaging Board segments. With combined capacity of 2,40,000 tons its

products are marketed under various popular brand names such as JK Copier, JK Bond, etc.

J.K Tyres (20.9% stake) is one of leading player in radial tyre market with capacity of more than

16 mn tyres p.a. It is known for manufacturing Indias leading tyre brands JK Tyre, Vikrant and

Tornel in Mexico for all categories of fourwheelers

Avg.DailyVol.(6m) 63,940Shares

PricePerformance(%)

1M 3M 6M

(6) 6 (16)

200 Days EMA Rs.1001

Tornel in Mexico, for all categories of fourwheelers.

J.K Agri Genetics (38.5% Stake) is a leading Hybrid Seed company engaged in Research &

Development, Production, Processing and Marketing of Hybrid Seeds of wide range of crops.

Strong background: The Singhania Group JK Organization is amongst the eminent business houses

in India. Its footprint stretches over a wide range of industries, like Automotive Tyres, Paper & Pulp,

Cement, Power Transmission Systems, Woolen Textiles, Sugar, Food & Dairy Products, etc.

At the CMP, the stock is available at +71% discount to its NAV (Valuing Fenner India at Book Value),

200DaysEMARs.1001

SHAREHOLDING(%)

Promoters 69.7

FII 0.2

FI/MF 4.6

At the CMP, the stock is available at +71% discount to its NAV (Valuing Fenner India at Book Value),

which seems to be very attractive. Considering potential of value unlocking in its other companies

like Fenner India (87.9% stake) and Clinirx Research as these companies are on a excellent growth

path and already have good revenues.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 6.2

Public&Others 19.3

18 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

304.9 240.4

86.6 27.7 10.8 7.3 0.8 1.2

FY11

342.8 292.1

21.5 33.7 11.9 6.0 0.7 2.0

Bengal&AssamLtd.

NAVCalculation NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

JKLakshmiCement 27.2 22.3 60 534 1,646

JK Paper 28.3 20.7 37 255 1,039

JK Tyres 8.4 20.9 74 494 628

JKAgriGenetics 1.4 38.6 333 131 450

Umang Dairies 10.0 45.1 41 5 404

Otherquoted Shares 97 166

ValueofQuotedEquity 1,558 4,332

Otherinvestment(cost) 1,514 3,903

Value Of Investment 3 072 8 235 ValueOfInvestment 3,072 8,235

Less:NetDebt (DebtCash) 2,151

NAV 5,994

No. ofshares(inMn) 9

NAVPerShare(Rs.) 691

CMP(Rs.) 204

( )

PriceHistory ValuationGapChart

Discount(%) 71

19

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

SILInvestmentsLtd.

March 14,2012 CMP:Rs.73 NAV:Rs.354 Discount :80%

SIL investments (SIL), originally incorporated as Sutlej Cotton Mills Ltd is promoted by late Shri

G.D. Birla in 1934. It is engaged in investments and financial activities. The company demerged its

textile business in 1995 and became purely an investment company. SILs core investments are

mainly in group companies besides investments in Shares & Securities and Real Estate. SIL also

holds investments in immovable properties in Maharashtra, UP and Punjab. SIL earns its income

STOCKDATA

ReutersCode

BloombergCode

SILI.BO

SIIN.IN

BSECode

NSESymbol

521194

SILINV

holds investments in immovable properties in Maharashtra, UP and Punjab. SIL earns its income

in form of rent income, dividend income and profit on sale of investments & fixed assets.

SILs major investment holdings consist of Chambal Fertilizers and Zuari Industries which covers

about 88% of its total value of investment.

Chambal Fertilisers (7.7% stake) is one of the largest private sector fertiliser producers in

India. Chambal Fertilisers has three divisions : agriinputs, shipping and textiles. It has

Mkt.Cap. 803mn

SharesOutstanding 11mn

52WeeksH/L Rs.118/61

Avg Daily Vol (6m) 943 Shares

India. Chambal Fertilisers has three divisions : agri inputs, shipping and textiles. It has

diversified into other sectors through its subsidiaries in the software and in the infrastructure

sector. It also has a joint venture in Morocco for manufacturing phosphoric acid.

Zuari Industries (10.9% stake) has operations that spans the entire range of agriinputs

manufacturing and delivery. The company has diversified into a number of related and non

related industries, from oil tanking to furniture.

Avg.DailyVol.(6m) 943Shares

PricePerformance(%)

1M 3M 6M

(21) 2 (21)

200DaysEMARs.85

Strong Background: SIL is part of K.K. Birla group companies who has diversified interest in

Fertilizers, Engineering, Textiles, Sugar, Tea, Media, Shipping Food Products, Media, Information

Technology, Biotechnology, Shipping and others.

At the CMP, the stock is available at 80% discount to its NAV, which seems to be very attractive.

SIL has dividend yield of 1.3%.

SHAREHOLDING(%)

Promoters 62.7

FII

FI/MF 0.1

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 19.6

Public&Others 17.6

20 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

195.4 76.7

2.1 7.1 6.0 11.2 0.6 1.3

FY11

208.2 93.1

22.2 8.7 6.9 9.1 0.6 1.3

SILInvestmentsLtd.

NAVCalculation NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

ChambalFertiliser 32.2

7.7

82 526 2,638

ZuariInds. 3.2

10.9

517 80 1,659

Other Quoted Shares 210 69 OtherQuotedShares 210 69

ValueofQuotedEquity 815 4,367

OtherInvestment(cost) 418 418

ValueOfInvestment 1,234 4,785

Less:NetDebt(DebtCash) 1,020

Less:NetCurrentLiabilities

NAV 3,761

No. ofshares(inMn) 11

NAVPerShare 354

CMP 73

Discount(%) 80

PriceHistory ValuationGapChart

21

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

UniphosEnterprisesLtd.

March 14,2012 CMP:Rs.26 NAV:Rs.106 Discount :75%

Uniphos Enterprises Ltd. (UEL) was incorporated in 1969 as a private company and went

public in the year 1986. UEL located at Gujarat was demerged from United Phosphorus Ltd

leaving it mainly with the business of trading.

UELs main business comprise into trading of chemicals, import & export of engineering

d i lt l d t d i th it It di t ib t h bi id d f i id

STOCKDATA

ReutersCode

BloombergCode

UNPH.BO

UPE@IN

BSECode

NSE Symbol

500429

UNIENTER

goods, agricultural products and various other items. It distributes herbicides and fungicides

for agricultural applications and it offers other products like additives for the paper industries,

adhesive tape, cotton yarn, dyes intermediates, mosquito mats, and many more products.

Strong Background: UEL is an associate of United Phosphorus group and UEL holds strategic

stake of 5.4% in United Phosphorous. United Phosphorus Ltd (UPL) is the largest

manufacturer of agrochemicals in India and is a leading global producer of crop protection

NSESymbol UNIENTER

Mkt.Cap. 650mn

SharesOutstanding 25mn

52WeeksH/L Rs.36/21

manufacturer of agrochemicals in India and is a leading global producer of crop protection

products, intermediates, specialty chemicals and other industrial chemicals. UPL has its

presence across value added agriinputs ranging from seeds to crop protection and post

harvest activity. UPL holds 50% stake in Advanta India, its subsidiary engaged in producing

seed products. Through group activities, the company has 28 branches in India, also has

presence in the UK, USA, Denmark, Sri Lanka, Australia, Mexico, Vietnam, Zambia, Mauritius

Avg.DailyVol.(6m) 11,152Shares

PricePerformance(%)

1M 3M 6M

(4) 2 (12)

200 Days EMA Rs.27 presence in the UK, USA, Denmark, Sri Lanka, Australia, Mexico, Vietnam, Zambia, Mauritius

among other countries.

At the CMP, the stock is available at 75% discount to its NAV valuation, which seems to be

very attractive.

200DaysEMARs.27

SHAREHOLDING(%)

Promoters 50.4

FII 18.9

FI/MF 3.8

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 4.1

Public&Others 22.8

22 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

313.2 (75.2)

(2.5) (16.1) 1.2

FY11

51.5 (18.3)

75.7 (1.4) 1.2

UniphosEnterprisesLtd.

NAVCalculation

NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

UnitedPhosp. 25 5.4 136 761 3,395

ValueofQuotedEquity 761 3,395

OtherInvestment(cost) 14 14

ValueOfInvestment 775 3,409

Less:NetDebt(DebtCash) 720

Less:NetCurrentLiabilities

NAV 2,689 NAV 2,689

No.ofshares(inMn) 25

NAVPerShare 106

CMP 26

Discount(%) 75

PriceHistory ValuationGapChart

23

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

MajesticAutoLtd.

March 14,2012 CMP:Rs.59 NAV: Rs.194 Discount :70%

Majestic Auto Ltd (MAL), established in 1973, is a part of Indias wellknown Hero Group of

Companies comprising 20 companies, each one having established its own respective production

line in India and in International Market.

MAL diversified in 1999 in the field of Fine Blanked Components by doing technical collaboration

with Feintool of Switzerland The company is supplying components to the major automobile

STOCKDATA

ReutersCode

BloombergCode

MJST.BO

MATOIN

BSECode

NSESymbol

500267

MAJESAUTO

with Feintool of Switzerland. The company is supplying components to the major automobile

companies of India like Maruti, Tata Motors, Mahindra & Mahindra, Ford, Toyota, General Motors,

Bosch India, Hero Motocorp, Fiat and Force Motors.

MAL has further established a modern unit to manufacture various types of silencers for Hero

Motocorp, Stator & Rotor assembly for LG Electronics and Tecumseh.

MAL essentially is a Holding & Investment company which currently holds strategic stake in Hero

Mkt.Cap. 614mn

SharesOutstanding 10.4mn

52WeeksH/L Rs.100/53

Avg Daily Vol (6m) 4 875 Shares

MAL essentially is a Holding & Investment company which currently holds strategic stake in Hero

Motocorp Ltd (0.81% stake) which is a world's largest twowheeler manufacturing company. Hero

bikes currently spin out from its three globally benchmarked manufacturing units sited at in

Haryana and Uttarkhand. These plants collectively are proficient of producing out 6.1 million units

per year.

Strong Management: MAL is a part of Hero Group which is amongst the Top 10 Indian Business

Avg.DailyVol.(6m) 4,875Shares

PricePerformance(%)

1M 3M 6M

(8) (9) (25)

200DaysEMARs.72

Houses of India. It is a multiunit, multiproduct, geographically diversified Group with myriad

interests. Hero, known for its twowheelers business in India and the Group's other ventures

include product designing, IT enabled services, finance and insurance etc. The Group today

comprises of 20 companies, 300 ancillary suppliers, over 5,000 outlets, and has employee strength

of more than 23,000.

At the CMP the stock is available at 70% discount to its NAV valuation which seems to be very

SHAREHOLDING(%)

Promoters 75.0

FII 1.4

FI/MF 0.8

Body Corporates 4 4 At the CMP, the stock is available at 70% discount to its NAV valuation, which seems to be very

attractive.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 4.4

Public&Others 18.4

24 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

1479 208.3

356.1 20.0 48.3 3.0 1.2

FY11

1611 66.2

(68.2) 6.8 11.6 8.8 1.0

MajesticAutoLtd.

NAVCalculation

NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

HeroHondaMotor 1.6 0.8 1,928 1 3,133

ValueofQuotedEquity 1 3,133

OtherInvestment(cost) 38 38

ValueOfInvestment 39 3,171

Less:NetDebt(DebtCash) 1,120

Less:NetDeferredTax Liability 38

NAV 2,013 ,0 3

No. ofshares(in Mn) 10.4

NAVPerShare 194

CMP 59

Discount(%) 70

PriceHistory ValuationGapChart

25

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

WilliamsonMagor&CompanyLtd.

March 14,2012 CMP:Rs.46 NAV:Rs.212 Discount :78%

Williamson Magor & Company Ltd (WM&C) established in the year 1949, is primarily engaged in

the business of investing and lending funds and it operates in real estate through its subsidiaries

Woodside Park and Majerhat Estates & Developers.

WM&C Ltd holds major investments in associate companies

Mcleod Russel Ltd. (10.6% stake) is the worlds largest tea producer with over 80 mn kgs of

STOCKDATA

ReutersCode

BloombergCode

WILM.BO

WMC.IN

BSECode

NSESymbol

519224

WILLAMAGOR

Mcleod Russel Ltd. (10.6% stake) is the world s largest tea producer with over 80 mn kgs of

high quality tea p.a. from tea estates in Assam, West Bengal and Vietnam.

Eveready Industries Ltd. (23% stake) formerly known as Union Carbide India Ltd, has a

portfolio comprising of dry cell batteries, flashlights, CFLs and packet tea.

Mcnally Bharat Engg Ltd. (10.2% stake) is engaged in providing turnkey solutions in the areas

of Power, Steel, Aluminium, Material Handling, Mineral Beneficiation, Pyroprocessing, coal

Mkt.Cap. 506mn

SharesOutstanding 11mn

52WeeksH/L Rs.79/32

Avg Daily Vol (6m) 3 312 Shares

washing, port cranes, civic and industrial water supply etc.

Williamson Financial Services Ltd. (6.9% stake) is into fundbased activities like leasing, hire

purchase and corporate financing. It also holds strategic stake in Mcleod Russel & Eveready

Industries.

Kilburn Engineering Ltd. (32.6% stake) is the worlds only company manufacturing all types of

d d ff i l t d i l ti f di li ti

Avg.DailyVol.(6m) 3,312Shares

PricePerformance(%)

1M 3M 6M

5 17 (15)

200DaysEMARs.46

dryers and offering complete drying solution for diverse applications.

Strong Background & Management: WM&C Ltd is a part of Williamson Magor group, which has

grown to become the world`s largest producer of tea having 28 tea estates. The group has

successfully launched three brands of packet tea Tez, Premium Gold and Jaago. The company has

experienced and renowned names on its board like BM Kaitan (Chairman), Deepak Kaitan (Vice

Chairman) and Bharat Bajoria (Director) among others.

SHAREHOLDING(%)

Promoters 61.9

FII 1.0

FI/MF 2.5

Chairman) and Bharat Bajoria (Director) among others.

Stock is currently available at 78% discount to its NAV, which seems to be very attractive.

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 5.0

Public&Others 29.6

26 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

273.1 (6.9)

80.7 (0.4) 0.4

FY11

254.3 1.2

117.4 0.1 0.1 405.0 0.4

WilliamsonMagor&CompanyLtd.

NAVCalculation NoofShare

(mn)

Stake (%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

Mcleod Russel 11.6 10.6 236 672 2,753

EvereadyInds. 16.8 23.0 26 936 432

McNallyBharat 1.9 10.2 101 170 190

KilburnEngg. 4.3 32.6 26 107 114

OtherQuotedShares 81 49

ValueofQuotedEquity 1,966 3,598

OtherInvestment(cost) 93 93

ValueOfInvestment 2,059 3,539

Less:NetDebt(DebtCash) 1,309

Less:NetCurrentLiabilities

NAV 2,323

No. ofshares(inMn) 11

NAVPerShare 212

CMP 46

Discount(%) 78

PriceHistory ValuationGapChart

27

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

WilliamsonFinancialServicesLtd.

March 14,2012 CMP:Rs.27 NAV:Rs.138 Discount :81%

Williamson Financial Services Ltd. (WFSL), earlier known as Makum Tea Company (India), was

renamed in Dec'94. WFSLs principal area of business is fundbased activities like leasing, hire

purchase and corporate financing.

It plans to play an advisory role in foreign exchange dealing and corporate restructuring including

b id h b ki d l h b ki Th i i d NBFC

STOCKDATA

ReutersCode

BloombergCode

WILF.BO

MAKM.IN

BSECode 519214

mergers, besides merchant banking and also share broking. The company is registered as a NBFC

with RBI.

WFSL holds strategic investments in

Mcleod Russel (5.4% stake) is the worlds largest tea producer with over 80 mn kgs of high

quality tea a year from tea estates in Assam, West Bengal and Vietnam.

d d ( k ) f l k b d d d h f l

Mkt.Cap. 227mn

SharesOutstanding 8.4mn

52WeeksH/L Rs.41/18

Avg Daily Vol (6m) 1 281 Shares

Eveready industries (7.1% stake) formerly known as Union Carbide India Ltd, has a portfolio

comprising of dry cell batteries, flashlights, CFLs and packet tea.

Strong Background & Management: WM&C Ltd is a part of Williamson Magor group, which has

grown to become the world`s largest producer of tea having 28 tea estates. The group is on

course added value to its products and has successfully launched three brands of packet tea

Tez Premium Gold and Jaago The company has experienced and renowned names on its board

Avg.DailyVol.(6m) 1,281Shares

PricePerformance(%)

1M 3M 6M

10 23 (51)

200DaysEMARs.28

Tez, Premium Gold and Jaago. The company has experienced and renowned names on its board

like BM Kaitan (Chairman), Deepak Kaitan (Vice Chairman) and Bharat Bajoria (Director) among

others.

At the CMP, the stock is available at 81% discount to its NAV, which seems to be very attractive.

SHAREHOLDING(%)

Promoters 65.2

FII

FI/MF 1.2

Y/EMar.

Revenues

(Rs.mn)

PAT

(Rs.mn)

PATGrowth

(%Ch.)

EPS

(Rs.)

ROE

(%)

PER

(x)

Price/BV

(x)

Dividend

Yield(%)

BodyCorporates 4.1

Public&Others 29.5

28 ThisreportbasedonTechnoFundaResearchandourView/TargetPricehasbeenderivedaccordingly.Pleaserefertothedisclaimeronthelastpage.

FY10

39.3 14.6

1223.1 1.8 2.0 14.8 0.3

FY11

41.7 7.0

(52.1) 0.9 1.0 27.6 0.3

WilliamsonFinancialServicesLtd.

NAVCalculation

NoofShare

(mn)

Stake(%)

CMP (Rs.)

(12Mar12)

Cost

(RsMn)

Value

(Rsmn)

Mcleod Russel 5.9 5.4 236 589 1,394

EvereadyInds. 5.2 7.1 26 516 133

Other Quoted Shares 1 OtherQuotedShares 1

ValueofQuotedEquity 1,107 1,529

OtherInvestment(cost) 55 55

ValueOfInvestment 1,162 1,584

Less:NetDebt(DebtCash) 97

Less:NetCurrentLiabilities 330

NAV 1,157

No. ofshares(inMn) 8.4

NAVPerShare 138

CMP 27

Discount(%) 81

PriceHistory ValuationGapChart

29

Source: Company,SushilFinancialServicesEstimates

March14,2012 Holding&InvestmentCompanies

Holding&InvestmentCompanies

DeeplyinDiscount

Out of the discussed 12 holding & investment companies, we have further refined to 6 companies on the basis of following criteria:

(1) Number of Investments by the company should not be less than two. Imposing this criteria will remove names where investment is

highly concentrated and chances of value unlocking or business restructuring are remote, thereby eliminating companies Balmer

Lawrie Investments, Uniphos Enterprises and Majestic Auto.

(2) Investment Holding Discount should be above 50%, thereby eliminating Tata Investment Corporation, where discount is less than

50%, i.e 42%.

O h b i f b i i l f i h 8 i Of h 8 i h f h fi d 6 i On the basis of above two criteria, we are now left with 8 companies. Of these 8 companies, we have further refined to 6 companies

on the basis of (a) size of investments and (b) Nature of Investments i.e Cross Holding. The Whole idea behind applying these two

more filters is to see opportunities of value unlocking or business restructuring in the long run. Thereby, 2 more companies SIL

Investments and Williamson Financial Services get eliminated from the selection amidst their smaller size of investments and lack of

cross holding.

On the basis of all the above criteria we have arrived at the final list of 6 companies in which we could see higher probability of

triggers. The name of companies are Bajaj Holdings & Investments, Bombay Burmah & Trading Corporation, Bengal & Assam, Nalwa

Sons & Investments, Maharashtra Scooters, Williamson Magor & Company.

30 March14,2012

This is a guide to the rating system used by our Institutional Research Team. Our rating system comprises of six rating categories, with a corresponding risk

rating.

RatingScale

rating.

RiskRating

RiskDescription PredictabilityofEarnings/Dividends;PriceVolatility

LowRisk Highpredictability/Lowvolatility

MediumRisk Moderatepredictability/volatility

HighRisk Lowpredictability/Highvolatility

TotalExpectedReturnMatrix

Rating LowRisk MediumRisk HighRisk

Buy Over15% Over20% Over25%

Accumulate 10%to15% 15%to20% 20%to25%

Hold 0%to10% 0%to15% 0%to20%

Sell NegativeReturns NegativeReturns NegativeReturns

Neutral NotApplicable NotApplicable NotApplicable

NotRated NotApplicable NotApplicable NotApplicable

Please Note

Recommendations with Neutral Rating imply reversal of our earlier opinion (i.e. Book Profits / Losses).

**Indicates that the stock is illiquid With a view to combat the higher acquisition cost for illiquid stocks, we have enhanced our return criteria for such stocks by five percentage

points.

Stock Review Reports: These are Soft coverages on companies where Management access is difficult or Market capitalization is below Rs. 2000 mn. Views and

recommendation on such companies may not necessarily be based on management meeting but may be based on the publicly available information and/or attending Company

AGMs. Hence Stock Reviews may be just one-time coverages with an occasional Update, wherever possible.

Additional information with respect to any securities referred to herein will be available upon request. Additional information with respect to any securities referred to herein will be available upon request.

This report is prepared for the exclusive use of Sushil Group clients only and should not be reproduced, re-circulated, published in any media, website or otherwise, in any form

or manner, in part or as a whole, without the express consent in writing of Sushil Financial Services Private Limited. Any unauthorized use, disclosure or public dissemination of

information contained herein is prohibited. This report is to be used only by the original recipient to whomit is sent.

This is for private circulation only and the said document does not constitute an offer to buy or sell any securities mentioned herein. While utmost care has been taken in preparing

the above, we claimno responsibility for its accuracy. We shall not be liable for any direct or indirect losses arising fromthe use thereof and the investors are requested to use the

information contained herein at their own risk.

This report has been prepared for information purposes only and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the

securities, markets or developments referred to in the material. The information, on which the report is based, has been obtained fromsources, which we believe to be reliable, but

31

secu tes, a ets o de eop e ts e e ed to t e ate a e o ato , o c t e epo t s based, as bee obta ed o sou ces, c e be e e to be e abe, but

we have not independently verified such information and we do not guarantee that it is accurate or complete. All expressions of opinion are subject to change without notice.

Sushil Financial Services Private Limited and its connected companies, and their respective directors, officers and employees (to be collectively known as SFSPL), may, fromtime

to time, have a long or short position in the securities mentioned and may sell or buy such securities. SFSPL may act upon or make use of information contained herein prior to the

publication thereof.

Member:BSEL,SEBIRegn.No.INB/F010982338|NSEIL,SEBIRegn.No.INB/F230607435

12,HomjiStreet,Fort,Mumbai400001.Phone:+912240936000Fax:+912222665758

Das könnte Ihnen auch gefallen

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDokument10 SeitenRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasNoch keine Bewertungen

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDokument8 SeitenRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNoch keine Bewertungen

- Industry Report Card April 2018Dokument16 SeitenIndustry Report Card April 2018didwaniasNoch keine Bewertungen

- IDEA One PagerDokument6 SeitenIDEA One PagerdidwaniasNoch keine Bewertungen

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDokument2 SeitenMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasNoch keine Bewertungen

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDokument8 SeitenInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasNoch keine Bewertungen

- Shareholding Pattern BSEDokument3 SeitenShareholding Pattern BSEdidwaniasNoch keine Bewertungen

- CKP PresentationDokument39 SeitenCKP PresentationdidwaniasNoch keine Bewertungen

- BHEL One PagerDokument1 SeiteBHEL One PagerdidwaniasNoch keine Bewertungen

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDokument7 SeitenThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasNoch keine Bewertungen

- Nurturing A Distinct Corporate Identity,: DifferentlyDokument10 SeitenNurturing A Distinct Corporate Identity,: DifferentlydidwaniasNoch keine Bewertungen

- 'A' Grade Turnaround: Associated Cement CompaniesDokument3 Seiten'A' Grade Turnaround: Associated Cement CompaniesdidwaniasNoch keine Bewertungen

- Ready Reckoner, November 2015Dokument92 SeitenReady Reckoner, November 2015didwaniasNoch keine Bewertungen

- Competitors' Product Knowledge and Marketing in Changing ScenarioDokument62 SeitenCompetitors' Product Knowledge and Marketing in Changing ScenariodidwaniasNoch keine Bewertungen

- IndiaEconomicsOverheating090207 MF PDFDokument4 SeitenIndiaEconomicsOverheating090207 MF PDFdidwaniasNoch keine Bewertungen

- Strategy, Knowledge and Success: Presented byDokument55 SeitenStrategy, Knowledge and Success: Presented bydidwaniasNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Global Framework For Export MarketingDokument13 SeitenGlobal Framework For Export Marketingapi-291598576Noch keine Bewertungen

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesDokument29 Seiten15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitNoch keine Bewertungen

- Industrial Trip Report CIPLA PDFDokument36 SeitenIndustrial Trip Report CIPLA PDFAbhishek JhaNoch keine Bewertungen

- Amsterdam Brewery Group 4Dokument18 SeitenAmsterdam Brewery Group 4Jimmy Zhuang100% (2)

- SM 12 Economics English 201617Dokument196 SeitenSM 12 Economics English 201617GAMENoch keine Bewertungen

- Finance Applications and Theory 3rd Edition Cornett Solutions ManualDokument18 SeitenFinance Applications and Theory 3rd Edition Cornett Solutions Manualamyrosemqconaxgzd100% (19)

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDokument10 SeitenCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247Noch keine Bewertungen

- 1 - Basic Economic ConceptsDokument4 Seiten1 - Basic Economic ConceptsEric NgNoch keine Bewertungen

- Formula Sheet QT1Dokument2 SeitenFormula Sheet QT1Cheeseong LimNoch keine Bewertungen

- Tutorial 4 QDokument4 SeitenTutorial 4 QlaurenyapNoch keine Bewertungen

- 12 Bduk3103 Topic 8Dokument50 Seiten12 Bduk3103 Topic 8frizal100% (1)

- Crescent PureDokument6 SeitenCrescent PureSHIVAM CHUGH100% (3)

- Отговори на матурата по английски езикDokument17 SeitenОтговори на матурата по английски езикNovanews100% (1)

- Report Nova VarosDokument75 SeitenReport Nova VarosSrbislav GenicNoch keine Bewertungen

- ICSE 2017 Mathematics Class 10Dokument7 SeitenICSE 2017 Mathematics Class 10machinelabnitaNoch keine Bewertungen

- The Basics of Capital BudgetingDokument26 SeitenThe Basics of Capital BudgetingAmbrien MaherNoch keine Bewertungen

- Interview Guidelines For Research Thesis-PractitionerDokument5 SeitenInterview Guidelines For Research Thesis-PractitionerNoor Rahman SahakNoch keine Bewertungen

- Homestyle Renovation June 2008Dokument34 SeitenHomestyle Renovation June 2008Abu HanifahNoch keine Bewertungen

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDokument12 SeitenMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNoch keine Bewertungen

- Cost Quizlet 2Dokument7 SeitenCost Quizlet 2agm25Noch keine Bewertungen

- Lesson 2Dokument40 SeitenLesson 2Sarah JaneNoch keine Bewertungen

- NIDLP Delivery PlanDokument258 SeitenNIDLP Delivery Planace187Noch keine Bewertungen

- 1 - Business Model - FundamentalDokument33 Seiten1 - Business Model - FundamentalVED CHIRAG ANILNoch keine Bewertungen

- A Study On The Problems Faced by The FMCG Distribution Channels in Rural Area of Bhopal Hoshangabad Districts of M.P.Dokument9 SeitenA Study On The Problems Faced by The FMCG Distribution Channels in Rural Area of Bhopal Hoshangabad Districts of M.P.IjbemrJournalNoch keine Bewertungen

- Generation and Screening of Project IdeasDokument17 SeitenGeneration and Screening of Project IdeasAnkit BarjatiyaNoch keine Bewertungen

- Economics AssignmentDokument6 SeitenEconomics Assignmenturoosa vayaniNoch keine Bewertungen

- Groupon Inc (NASDAQ:GRPN) MemoDokument6 SeitenGroupon Inc (NASDAQ:GRPN) MemoTung NgoNoch keine Bewertungen

- Marketing Management: Submitted To Ms - Ayesha LatifDokument5 SeitenMarketing Management: Submitted To Ms - Ayesha LatifSadia FahadNoch keine Bewertungen

- Dwnload Full Macroeconomics Policy and Practice 2nd Edition Mishkin Test Bank PDFDokument26 SeitenDwnload Full Macroeconomics Policy and Practice 2nd Edition Mishkin Test Bank PDFAlexisSmithpomtx100% (8)

- Cash Flow ActivityDokument1 SeiteCash Flow Activitycarl fuerzasNoch keine Bewertungen