Beruflich Dokumente

Kultur Dokumente

Vendor Registration Form

Hochgeladen von

Vivek GosaviCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Vendor Registration Form

Hochgeladen von

Vivek GosaviCopyright:

Verfügbare Formate

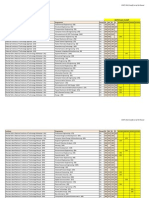

Application for Vendor Registration

Date : To, Account Officer, FAR Section, C.A. ( Finance ) Deptt. , MCGM Room No.300, 3rd floor, Municipal Head Office Mahapalika Marg, Fort, Mumbai- 400001 I/We the undersigned hereby request MCGM to register myself/our establishment as Vendor with MCGM. Required information is submitted as below. Sr.No. 1 DETAILS Name of the Vendor (Copy of the registration certificate of Company/ Society/Firm/Institution/Organization/ Trust etc. to be registered be furnished ) Type of Organization

1-A

(Pl. tick mark whichever is applicable)

a) Sole Trading Co. b) Partnership Firm c) Private Limited Company d) Public Limited Company e) Government Undertaking f) Individual Consultant g) Joint Venture h) MCGM Employee i) Registered Society j) Charitable Trust k) Bank l) Others. m) Individual n) Foreign Company.

Address :-

House number and street

Street 2

Street 3

Postal Code

CITY 1

TEL. NUMBER

Email ID

(Compulsory)

VAT Registration No. *Copy of certificate be submitted BANK ACCOUNT DETAILS :

Type of Bank : (Pl. tick mark whichever is applicable)

Type of Account with code: (Pl. tick mark whichever is applicable)

a) State Bank & Associates b) Nationalized Bank c) Scheduled Bank d) Private Bank e) Co-op. Bank a) Saving Bank A/c. -Code no. 10 b) Current Bank A/c. -Code no.11 c) Cash Credit A/c. -Code no. 13

Bank Account Number

Name of the Bank

Name of the Branch

Address / Telephone No

MICR NUMBER (9 digit Code No. of the Bank & Branch appearing on the MICR cheque issued by the bank) IFSC CODE (Blank, cancelled cheque be submitted)

Additional information For CO-OP BANK :-

a) Name of the Agent Bank

b) MICR & IFSC code of the Agent Bank

c) Beneficiarys A/c. no. with Agent Bank (Blank, cancelled cheque of agent bank be submitted) PAYMENT METHODS (Pl. tick mark whichever is applicable) I.T. EXEMPTION - CERTIFICATE NUMBER

a) E.C.S. c) R.T.G.S.

b) Cheque d) N.E.F.T.

*Copy of certificate be submitted

EXEMPTION RATE (Reason for Exemption)

DATE ON WHICH EXEMPTION BEGINS

DATE ON WHICH EXEMPTION ENDS

Order Currency

Terms of Payment for P.O.

Incoterms (PART 1) Applicable for Import Vendors

(Abbreviation) For eg. F.O.B.

10

11

Incoterms (PART 2) Applicable for Import Vendors (Abbreviation) for eg. Free on Board CST No. *Copy of certificate be submitted

12

LST No. *Copy of certificate be submitted

13

14

PAN CARD NO. (Pan card must be in the name of Vendor to be registered) *Copy of certificate be submitted Tax Rate & TDS Section

15

Works Contract Tax rate ( Tick mark appropriate )

1) 1%,

2) 2%

3) 4%

16

Service Tax Registration No. *Copy of certificate be submitted

I hereby declare that the information submitted by me/us is correct and complete to the best of knowledge & belief. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I would not hold MCGM responsible for the same. I will indemnify the MCGM in all matters in case information furnished by me/us found incorrect in future. I understand that Vendor Code will be blocked for all purposes till mandatory information like PAN details, VAT/CST/LST details etc. along with documentary evidence is not furnished at the time of submission of this registration form. I agree to pay Rs.100/- in cash as Charges towards Vendor Registration.

Name & Signature of the Vendor/authorized person along with Rubber Stamp/Seal of organization For Office Use Only

SAP System name

SAP Client

SAP Vendor Code

Created in SAP by

Created in SAP on

*Timing : 11.00 a.m. to 3.00 p.m. on all working days except 2nd & 4th Saturday, Sunday & Govt. Holidays for accepting cash at MCGM Collection Counter (C.F.C.). In case of any enquiry pertaining to e-tendering process (including User ID, Password etc.), please contact IT Cell at Ground Floor, Worli Data Centre, 1 Z Store Building, Dr.E.Mozes Road, Worli Naka, Mumbai-400 018. Tel.No.(022) 24811275.

Das könnte Ihnen auch gefallen

- 03 Concrete WorksDokument49 Seiten03 Concrete WorksVivek GosaviNoch keine Bewertungen

- Sales Management Strategies for Achieving Goals EffectivelyDokument17 SeitenSales Management Strategies for Achieving Goals EffectivelyShoaibNoch keine Bewertungen

- Policy of RetailDokument7 SeitenPolicy of Retailkyunjae JetomoNoch keine Bewertungen

- Retail Shop ManagementDokument18 SeitenRetail Shop Managementkowsalya18Noch keine Bewertungen

- Non Destructive Concrete TestingDokument11 SeitenNon Destructive Concrete TestingVivek GosaviNoch keine Bewertungen

- Non Destructive Concrete TestingDokument11 SeitenNon Destructive Concrete TestingVivek GosaviNoch keine Bewertungen

- Assignment of Brand ManagementDokument9 SeitenAssignment of Brand ManagementMuhammad Taqi AdnanNoch keine Bewertungen

- Marketing PlanDokument16 SeitenMarketing Planerrol SksoanaNoch keine Bewertungen

- Retail and Franchise AssignmentDokument8 SeitenRetail and Franchise AssignmentAkshay Raturi100% (1)

- KRT ProposalDokument13 SeitenKRT ProposalShafiq SsekittoNoch keine Bewertungen

- Marketing Segmentation Targeting and PositioningDokument100 SeitenMarketing Segmentation Targeting and Positioningchandana thimmayaNoch keine Bewertungen

- Travel Order FormDokument1 SeiteTravel Order FormJack SprwNoch keine Bewertungen

- Product and Brand Management - SynopsisDokument8 SeitenProduct and Brand Management - SynopsisdevakarreddyNoch keine Bewertungen

- Mall@Home: Business ProposalDokument16 SeitenMall@Home: Business ProposalTusharNoch keine Bewertungen

- Business Feasibility ChecklistDokument5 SeitenBusiness Feasibility ChecklistAlvaro J. RiveroNoch keine Bewertungen

- Final Assignment CRMDokument24 SeitenFinal Assignment CRMDumidu Chathurange Dassanayake0% (1)

- P&P HC - 14 Billing ProceduresDokument6 SeitenP&P HC - 14 Billing ProceduresabokoraaNoch keine Bewertungen

- Fynd PresentationDokument7 SeitenFynd PresentationRahul Pillai0% (1)

- Sales Plan NescafeDokument10 SeitenSales Plan Nescafealden ricardoNoch keine Bewertungen

- Titan Company Limited 37th Annual Report 2020-21Dokument304 SeitenTitan Company Limited 37th Annual Report 2020-21Aman SrivastavaNoch keine Bewertungen

- Business ConsultingDokument6 SeitenBusiness ConsultingAneesh BansalNoch keine Bewertungen

- Reliance FreshDokument57 SeitenReliance FreshBimal Kumar DashNoch keine Bewertungen

- Sales Mid Term ReportDokument10 SeitenSales Mid Term ReportAnjali PaneruNoch keine Bewertungen

- Brand P&L ExplainedDokument1 SeiteBrand P&L ExplainedabdulhaquecmaNoch keine Bewertungen

- Business Plan For Clothing BrandDokument1 SeiteBusiness Plan For Clothing BrandNewzayn PacomoNoch keine Bewertungen

- Lifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Dokument23 SeitenLifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Kshatriy'as ThigalaNoch keine Bewertungen

- Sponsorship Tariff SampleDokument2 SeitenSponsorship Tariff SamplePredueElleNoch keine Bewertungen

- Market Share. Marketing.Dokument15 SeitenMarket Share. Marketing.khizrakaramatNoch keine Bewertungen

- AMEDIA Annualreport2019 30092019 31012020Dokument167 SeitenAMEDIA Annualreport2019 30092019 31012020Vanan MuthuNoch keine Bewertungen

- Code of Conduct Scandic Hotels Group Ab Publ 2017Dokument3 SeitenCode of Conduct Scandic Hotels Group Ab Publ 2017Instant ITServicengNoch keine Bewertungen

- Retail ManagementDokument31 SeitenRetail ManagementSushmita BarlaNoch keine Bewertungen

- Hotel Sarina BangladeshDokument16 SeitenHotel Sarina BangladeshtomatoluluNoch keine Bewertungen

- Retail MGTDokument29 SeitenRetail MGTKasiraman RamanujamNoch keine Bewertungen

- WING Investor Presentation IR Website 2018 WingstopDokument37 SeitenWING Investor Presentation IR Website 2018 WingstopAla BasterNoch keine Bewertungen

- Experienced Zonal Manager Seeks New OpportunityDokument3 SeitenExperienced Zonal Manager Seeks New OpportunityMarufNoch keine Bewertungen

- Marketing Plan OF: Pratibha Prabin Stores Butwal-20 Rupandehi, NepalDokument7 SeitenMarketing Plan OF: Pratibha Prabin Stores Butwal-20 Rupandehi, NepalAman GhimireNoch keine Bewertungen

- Business Plan: Presented By: Greeshma VDokument10 SeitenBusiness Plan: Presented By: Greeshma VGreeshmaNoch keine Bewertungen

- Proposal NSDCDokument2 SeitenProposal NSDCDheeraj SaxenaNoch keine Bewertungen

- Call Centre Manual 04052007Dokument27 SeitenCall Centre Manual 04052007shaharhr1Noch keine Bewertungen

- Restaurant service blueprint analysisDokument4 SeitenRestaurant service blueprint analysisRebecca CalhounNoch keine Bewertungen

- Proj ReportDokument52 SeitenProj ReportAli AhmedNoch keine Bewertungen

- Customer Journey Mapping and Franchise OperationsDokument12 SeitenCustomer Journey Mapping and Franchise OperationsPiyush SharmaNoch keine Bewertungen

- Assistant Gaming Manager KRADokument6 SeitenAssistant Gaming Manager KRAsinghankit75Noch keine Bewertungen

- UE Internship Report for Management DepartmentDokument8 SeitenUE Internship Report for Management DepartmentHamid Asghar0% (2)

- Travel Trade Account Executive JDDokument4 SeitenTravel Trade Account Executive JDAnonymous N5Noo7wQFNoch keine Bewertungen

- How to welcome hotel guestsDokument2 SeitenHow to welcome hotel guestszaw khaingNoch keine Bewertungen

- Compiled By:: Shivangi Priya 45 Rahul Verma 33 FddiDokument25 SeitenCompiled By:: Shivangi Priya 45 Rahul Verma 33 FddiRAHUL_90_VERMANoch keine Bewertungen

- Customer Service: Meeting Needs Through Prompt, Polite and Professional AssistanceDokument15 SeitenCustomer Service: Meeting Needs Through Prompt, Polite and Professional AssistanceAl-juffrey Luis AmilhamjaNoch keine Bewertungen

- TT - Unit Franchise Proposal Updated 5-Apr22 CompDokument35 SeitenTT - Unit Franchise Proposal Updated 5-Apr22 CompHari S SubramanianNoch keine Bewertungen

- Organization Structure of A Retail OutletDokument19 SeitenOrganization Structure of A Retail OutletRitika GaubaNoch keine Bewertungen

- Session 6 7 CRM in B2C Markets PDFDokument23 SeitenSession 6 7 CRM in B2C Markets PDFmanmeet kaurNoch keine Bewertungen

- Why Location Is The New Currency of MarketingDokument9 SeitenWhy Location Is The New Currency of MarketingGlenPalmerNoch keine Bewertungen

- Restaurant Sales ReportDokument9 SeitenRestaurant Sales ReportPramod VasudevNoch keine Bewertungen

- Expense Claim: Personal Information Contact Number PIN Cost CentreDokument3 SeitenExpense Claim: Personal Information Contact Number PIN Cost CentreMansiAroraNoch keine Bewertungen

- Sales TerritoriesDokument16 SeitenSales TerritoriesDrRavi JainNoch keine Bewertungen

- Hotel IndustryDokument25 SeitenHotel Industryvivekm0reNoch keine Bewertungen

- Synopsis Axis BankDokument6 SeitenSynopsis Axis BankAbhinav NaikNoch keine Bewertungen

- Eamon Chiffey Marketing CVDokument2 SeitenEamon Chiffey Marketing CVDavid HawkinsNoch keine Bewertungen

- Flow Chart CommercialDokument19 SeitenFlow Chart CommercialAndi ChristianNoch keine Bewertungen

- Commercial management Complete Self-Assessment GuideVon EverandCommercial management Complete Self-Assessment GuideNoch keine Bewertungen

- The Robert Donato Approach to Enhancing Customer Service and Cultivating RelationshipsVon EverandThe Robert Donato Approach to Enhancing Customer Service and Cultivating RelationshipsNoch keine Bewertungen

- Torsion BeamDokument15 SeitenTorsion BeamVivek GosaviNoch keine Bewertungen

- Gate Ce 2004Dokument10 SeitenGate Ce 2004mitulkingNoch keine Bewertungen

- Tailor MadeDokument1 SeiteTailor MadeVivek GosaviNoch keine Bewertungen

- 16 PDFDokument12 Seiten16 PDFVivek GosaviNoch keine Bewertungen

- Vierendeel GirdersDokument29 SeitenVierendeel GirdersSaadallah Oueida100% (2)

- Tailor MadeDokument1 SeiteTailor MadeVivek GosaviNoch keine Bewertungen

- AnethatsDokument1 SeiteAnethatsVivek GosaviNoch keine Bewertungen

- Reaction of Matr1Dokument17 SeitenReaction of Matr1Vivek GosaviNoch keine Bewertungen

- Vendor Registration FormDokument2 SeitenVendor Registration FormVivek GosaviNoch keine Bewertungen

- GATE 2013 BrochureDokument93 SeitenGATE 2013 BrochureSurbhi KumariNoch keine Bewertungen

- 6 ExamplesDokument77 Seiten6 ExamplesVivek GosaviNoch keine Bewertungen

- 4.52 ME Civil StructruralDokument40 Seiten4.52 ME Civil StructruralAshish DumbreNoch keine Bewertungen

- Able of Contents: Section A: Installation GuideDokument28 SeitenAble of Contents: Section A: Installation GuideHawraz MuhammedNoch keine Bewertungen

- M.Tech in Ocean EngineeringDokument5 SeitenM.Tech in Ocean EngineeringVivek GosaviNoch keine Bewertungen

- How To InstallDokument1 SeiteHow To InstallVivek GosaviNoch keine Bewertungen

- Round 4Dokument12 SeitenRound 4Vivek GosaviNoch keine Bewertungen

- CCMT2012 Cutoff List-Round3Dokument13 SeitenCCMT2012 Cutoff List-Round3Chockalingam ChidambaramNoch keine Bewertungen

- E TN CFD Eurocode2 1992 007Dokument1 SeiteE TN CFD Eurocode2 1992 007Vivek GosaviNoch keine Bewertungen

- CCMT2012 Cutoff List-Round2Dokument15 SeitenCCMT2012 Cutoff List-Round2Shivam MangalNoch keine Bewertungen

- E TN CFD BS 8110 97 005Dokument1 SeiteE TN CFD BS 8110 97 005Vivek GosaviNoch keine Bewertungen

- Round 4Dokument12 SeitenRound 4Vivek GosaviNoch keine Bewertungen

- E TN SFD Aisc Lrfd93 012Dokument3 SeitenE TN SFD Aisc Lrfd93 012Vivek GosaviNoch keine Bewertungen

- E TN SFD BS5950 90 005Dokument4 SeitenE TN SFD BS5950 90 005Vivek GosaviNoch keine Bewertungen

- E TN SWD Ubc97 003Dokument4 SeitenE TN SWD Ubc97 003Vivek GosaviNoch keine Bewertungen

- E TN SWD Ubc97 005Dokument5 SeitenE TN SWD Ubc97 005Vivek GosaviNoch keine Bewertungen

- Welcome To ETABSDokument52 SeitenWelcome To ETABSjhakepascuaNoch keine Bewertungen