Beruflich Dokumente

Kultur Dokumente

13 - Diez Vda. de Gabriel vs. Cir Digest

Hochgeladen von

Ardy Falejo FajutagOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

13 - Diez Vda. de Gabriel vs. Cir Digest

Hochgeladen von

Ardy Falejo FajutagCopyright:

Verfügbare Formate

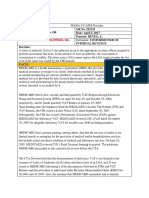

CASE DIGEST ESTATE OF THE LATE JULIANA DIEZ VDA. DE GABRIEL vs.

COMMISSIONER OF INTERNAL REVENUE 421 SCRA 266 (2004) FACTS During the lifetime of the decedent, Juliana Vda. De Gabriel, her business affairs were managed by the Philippine Trust Company (Philtrust . The decedent died on !pril ", #$%$. Two days after her death, Philtrust, through its Trust &fficer, !tty. !ntonio '. (uyles, filed her )ncome Ta* +eturn for #$%,. The return did not indicate that the decedent had died. &n 'ay --, #$%$, Philtrust also filed a .erified petition for appointment as /pecial !dministrator with the +egional Trial Court of 'anila, 0ranch 111V))), doc2eted as /p. Proc. (o. +3,-34$$5. The court a 6uo appointed one of the heirs as /pecial !dministrator. Philtrusts motion for reconsideration was denied by the probate court. )n the meantime, the 0ureau of )nternal +e.enue conducted an administrati.e in.estigation on the decedent s ta* liability and found a deficiency income ta* for the year #$%% in the amount of P"#,,-"".$". Thus, on (o.ember #,, #$,-, the 0)+ sent by registered mail a demand letter and !ssessment (otice (o. (!+D3%,3,-37787# addressed to the decedent 9c:o Philippine Trust Company, /ta. Cru;, 'anila9 which was the address stated in her #$%, )ncome Ta* +eturn. (o response was made by Philtrust. The 0)+ was not informed that the decedent had actually passed away. &n June #,, #$,5, respondent Commissioner of )nternal +e.enue issued warrants of distraint and le.y to enforce collection of the decedent s deficiency income ta* liability, which were ser.ed upon her heir, <rancisco Gabriel. &n (o.ember --, #$,5, respondent filed a 9'otion for !llowance of Claim and for an &rder of Payment of Ta*es9 with the court a 6uo. &n January %, #$,8, 'r. !mbrosio filed a letter of protest with the =itigation Di.ision of the 0)+, which was not acted upon because the assessment notice had allegedly become final, e*ecutory and incontestable. ISSUES >hether or not the Court of !ppeals erred in holding that the ser.ice of deficiency ta* assessment against Juliana Die; Vda. de Gabriel through the Philippine Trust Company was a .alid ser.ice in order to bind the ?state@ and >hether or not the Court of !ppeals erred in holding that the deficiency ta* assessment and final demand was already final, e*ecutory and incontestable. HELD

The first point to be considered is that the relationship between the decedent and Philtrust was one of agency, which is a personal relationship between agent and principal. Ander !rticle #$#$ (" of the Ci.il Code, death of the agent or principal automatically terminates the agency. )n this instance, the death of the decedent on !pril ", #$%$ automatically se.ered the legal relationship between her and Philtrust, and such could not be re.i.ed by the mere fact that Philtrust continued to act as her agent when, on !pril 8, #$%$, it filed her )ncome Ta* +eturn for the year #$%,. /ince the relationship between Philtrust and the decedent was automatically se.ered at the moment of the Ta*payer s death, none of Philtrusts acts or omissions could bind the estate of the Ta*payer. /er.ice on Philtrust of the demand letter and !ssessment (otice (o. (!+D3%,3,-37787# was improperly done. )t must be noted that Philtrust was ne.er appointed as the administrator of the ?state of the decedent, and, indeed, that the court a 6uo twice reBected Philtrusts motion to be thus appointed. !s of (o.ember #,, #$,-, the date of the demand letter and !ssessment (otice, the legal relationship between the decedent and Philtrust had already been non3e*istent for three years. /ince there was ne.er any .alid notice of this assessment, it could not ha.e become final, e*ecutory and incontestable, and, for failure to ma2e the assessment within the fi.e3year period pro.ided in /ection "#, of the (ational )nternal +e.enue Code of #$%%, respondents claim against the petitioner ?state is barred. /aid /ection "#, readsC /?C. "#,. Period of limitation upon assessment and collection. ?*cept as pro.ided in the succeeding section, internal re.enue ta*es shall be assessed within fi.e years after the return was filed, and no proceeding in court without assessment for the collection of such ta*es shall be begun after the e*piration of such period. <or the purpose of this section, a return filed before the last day prescribed by law for the filing thereof shall be considered as filed on such last dayC Pro.ided, That this limitation shall not apply to cases already in.estigated prior to the appro.al of this Code.

Das könnte Ihnen auch gefallen

- SolutionsManual NewDokument123 SeitenSolutionsManual NewManoj SinghNoch keine Bewertungen

- Criminal Law UPRevised Ortega Lecture Notes IIDokument189 SeitenCriminal Law UPRevised Ortega Lecture Notes IItwocubes88% (24)

- Foundstone Hacme Bank User and Solution Guide v2.0Dokument60 SeitenFoundstone Hacme Bank User and Solution Guide v2.0Yeison MorenoNoch keine Bewertungen

- Subordination, Non - Disturbance and Attornment AgreementDokument7 SeitenSubordination, Non - Disturbance and Attornment AgreementDavid CromwellNoch keine Bewertungen

- Estate of The Late Juliana Diez Vda. de Gabriel vs. CirDokument1 SeiteEstate of The Late Juliana Diez Vda. de Gabriel vs. CirRaquel Doquenia100% (1)

- Tax 2 Case Digest 5Dokument1 SeiteTax 2 Case Digest 5Leo NekkoNoch keine Bewertungen

- Case No. 49 G.R. No. L-13325 April 20, 1961 Santiago Gancayco, Petitioner, vs. The Collector of INTERNAL REVENUE, RespondentDokument5 SeitenCase No. 49 G.R. No. L-13325 April 20, 1961 Santiago Gancayco, Petitioner, vs. The Collector of INTERNAL REVENUE, RespondentLeeNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncDokument1 SeiteCommissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncMary AnneNoch keine Bewertungen

- The Estate of Ruiz Vs CADokument1 SeiteThe Estate of Ruiz Vs CAMyra BarandaNoch keine Bewertungen

- CIR Vs ST Luke S Medical CenterDokument6 SeitenCIR Vs ST Luke S Medical CenterOlan Dave LachicaNoch keine Bewertungen

- 07 - Visayan Cebu Terminal V CIRDokument2 Seiten07 - Visayan Cebu Terminal V CIRKristine De LeonNoch keine Bewertungen

- Estate of The Late Juliana Diez Vda de Gabriel V CIRDokument3 SeitenEstate of The Late Juliana Diez Vda de Gabriel V CIRKenneth BuriNoch keine Bewertungen

- 49 Cabling vs. DangcalanDokument12 Seiten49 Cabling vs. DangcalangabbieseguiranNoch keine Bewertungen

- Birth Application FormDokument2 SeitenBirth Application FormKim-Ezra Agdaca50% (2)

- AZNAR Vs CTADokument2 SeitenAZNAR Vs CTAMCNoch keine Bewertungen

- Buenaflor Car Services Vs DavidDokument1 SeiteBuenaflor Car Services Vs DavidHiroshi CarlosNoch keine Bewertungen

- Cir vs. Meralco G.R. No. 181459, June 9, 2014Dokument1 SeiteCir vs. Meralco G.R. No. 181459, June 9, 2014Rusty NomadNoch keine Bewertungen

- Tantuico Vs RepublicDokument3 SeitenTantuico Vs RepublicManuel Joseph FrancoNoch keine Bewertungen

- Pagcor Vs BirDokument2 SeitenPagcor Vs BirTonifranz SarenoNoch keine Bewertungen

- Lascona Land Vs CIRDokument2 SeitenLascona Land Vs CIRJesstonieCastañaresDamayo100% (1)

- CIR vs. Filinvest Dev't Corp.Dokument2 SeitenCIR vs. Filinvest Dev't Corp.Direct LukeNoch keine Bewertungen

- Income Tax Syllabus. Rev. Jan. 2021Dokument13 SeitenIncome Tax Syllabus. Rev. Jan. 2021Macapado HamidahNoch keine Bewertungen

- CIR Vs General Foods DigestDokument3 SeitenCIR Vs General Foods DigestGil Aldrick FernandezNoch keine Bewertungen

- Lopez vs. City of ManilaDokument2 SeitenLopez vs. City of ManilaDeniel Salvador B. MorilloNoch keine Bewertungen

- CIR v. Juliane Baier-Nickel - SUBADokument2 SeitenCIR v. Juliane Baier-Nickel - SUBAPaul Joshua Torda SubaNoch keine Bewertungen

- Saavedra vs. EstradaDokument2 SeitenSaavedra vs. EstradaJayson Lloyd P. MaquilanNoch keine Bewertungen

- CIR vs. CA, CTA and Josefina P. PajonarDokument1 SeiteCIR vs. CA, CTA and Josefina P. PajonarMarie ChieloNoch keine Bewertungen

- Caltex Vs CoaDokument1 SeiteCaltex Vs CoaAnonymous 5MiN6I78I0Noch keine Bewertungen

- CIR V BurmeisterDokument3 SeitenCIR V BurmeisterGenevieve Kristine Manalac100% (1)

- Separate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellDokument1 SeiteSeparate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellMACNoch keine Bewertungen

- DIAZ and TIMBOL Vs Sec of Finance and CIRDokument2 SeitenDIAZ and TIMBOL Vs Sec of Finance and CIRBrylle Deeiah TumarongNoch keine Bewertungen

- Exxonmobil Petroleum and Chemical Holdings, Inc. - Phil. Branch vs. Commissioner of Internal RevenueDokument2 SeitenExxonmobil Petroleum and Chemical Holdings, Inc. - Phil. Branch vs. Commissioner of Internal Revenueiwamawi100% (1)

- Pepsi Cola vs. City of ButuanDokument1 SeitePepsi Cola vs. City of ButuanArdy Falejo FajutagNoch keine Bewertungen

- Meralco vs. CIR (December 6 2010)Dokument60 SeitenMeralco vs. CIR (December 6 2010)Jasreel DomasingNoch keine Bewertungen

- Chevron Vs CIRDokument2 SeitenChevron Vs CIRKim Lorenzo CalatravaNoch keine Bewertungen

- CIR v. General Foods / G.R. No. 143672 / April 24, 2003Dokument1 SeiteCIR v. General Foods / G.R. No. 143672 / April 24, 2003Mini U. Soriano100% (1)

- 46 in The Matter of Estate of Telesforo de Dios - Case DIgestDokument3 Seiten46 in The Matter of Estate of Telesforo de Dios - Case DIgestGoodyNoch keine Bewertungen

- Republic V JabsonDokument2 SeitenRepublic V JabsonJoyceNoch keine Bewertungen

- June 7, 2017 G.R. No. 198795 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee vs. Merceditas Matheus Delos Reyes, Accused-Appellant Decision Tijam, J.Dokument17 SeitenJune 7, 2017 G.R. No. 198795 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee vs. Merceditas Matheus Delos Reyes, Accused-Appellant Decision Tijam, J.Mark Anthony Ruiz DelmoNoch keine Bewertungen

- Cantoja v. LimDokument2 SeitenCantoja v. LimAsunaYuukiNoch keine Bewertungen

- CIR v. Asalus CorpDokument9 SeitenCIR v. Asalus CorpMeg ReyesNoch keine Bewertungen

- 119 Soriano v. SOF (Capistrano) - Converted (With Watermark) B2021Dokument5 Seiten119 Soriano v. SOF (Capistrano) - Converted (With Watermark) B2021james lebronNoch keine Bewertungen

- Tax Cases Page 6Dokument5 SeitenTax Cases Page 6MikhailFAbzNoch keine Bewertungen

- YUIJUICO v. UNITED RESOURCES ASSET MANAGEMENTDokument2 SeitenYUIJUICO v. UNITED RESOURCES ASSET MANAGEMENTkennethpenusNoch keine Bewertungen

- PhilAm LIFE vs. Secretary of Finance Case DigestDokument2 SeitenPhilAm LIFE vs. Secretary of Finance Case DigestDenn Reed Tuvera Jr.Noch keine Bewertungen

- Medicard Philippines, Inc. v. CIRDokument3 SeitenMedicard Philippines, Inc. v. CIRFlorence Rosete100% (1)

- Gutierrez Vs CollectorDokument2 SeitenGutierrez Vs CollectorBenedict AlvarezNoch keine Bewertungen

- Tax SparingDokument5 SeitenTax Sparingfrancis_asd2003Noch keine Bewertungen

- Cir vs. BenguetDokument2 SeitenCir vs. BenguetCaroline A. LegaspinoNoch keine Bewertungen

- CIR V SONY Case DigestDokument2 SeitenCIR V SONY Case DigestAndrea TiuNoch keine Bewertungen

- Case Digest For GR 184823Dokument1 SeiteCase Digest For GR 184823Ren Piñon100% (1)

- Cir vs. Next MobileDokument2 SeitenCir vs. Next MobileAnalou Agustin VillezaNoch keine Bewertungen

- Cases Family RelationsDokument4 SeitenCases Family RelationsRussel SirotNoch keine Bewertungen

- CBK Power Company Limited Vs CirDokument6 SeitenCBK Power Company Limited Vs CirAnonymous VtsflLix1Noch keine Bewertungen

- CIR v. American Express PHIL. BranchDokument2 SeitenCIR v. American Express PHIL. BranchJaypoll DiazNoch keine Bewertungen

- Javier Vs CADokument1 SeiteJavier Vs CAAmee Bagtang-dapingNoch keine Bewertungen

- Nippon Express vs. CIR 185666Dokument1 SeiteNippon Express vs. CIR 185666magenNoch keine Bewertungen

- PNB v. VillaDokument3 SeitenPNB v. VillaYodh Jamin OngNoch keine Bewertungen

- Cir V CA ComasercoDokument2 SeitenCir V CA ComasercoJoel G. AyonNoch keine Bewertungen

- Diez Vs CIRDokument2 SeitenDiez Vs CIRArdy Falejo FajutagNoch keine Bewertungen

- Credit Transactions - DigestsDokument8 SeitenCredit Transactions - DigestsJoan NarvaezNoch keine Bewertungen

- Estate of Vda de Gabriel vs. CIRDokument1 SeiteEstate of Vda de Gabriel vs. CIRMichelleNoch keine Bewertungen

- H05.Mandatory CasesDokument96 SeitenH05.Mandatory CasesRatani UnfriendlyNoch keine Bewertungen

- GR 197849 Brodeth & Onal V People of The Philippines & VillegasDokument9 SeitenGR 197849 Brodeth & Onal V People of The Philippines & VillegasXyriel RaeNoch keine Bewertungen

- REMEDIAL LAW Pre Week 2019 RevisedDokument89 SeitenREMEDIAL LAW Pre Week 2019 RevisedArdy Falejo FajutagNoch keine Bewertungen

- Sandoval Poli Rev Lecture NotesDokument126 SeitenSandoval Poli Rev Lecture NotesPeetsa100% (1)

- Special Lecture of Dean Nilo DivinaDokument22 SeitenSpecial Lecture of Dean Nilo DivinaArdy Falejo FajutagNoch keine Bewertungen

- Salva Lecture Notes Criminal Law 2Dokument17 SeitenSalva Lecture Notes Criminal Law 2Ardy Falejo FajutagNoch keine Bewertungen

- 1 Provisional Remedies BarredoDokument18 Seiten1 Provisional Remedies BarredoArdy Falejo Fajutag100% (1)

- Tax Notes Domondon 2010Dokument81 SeitenTax Notes Domondon 2010Ardy Falejo FajutagNoch keine Bewertungen

- Adr 1Dokument60 SeitenAdr 1Anonymous 5k7iGyNoch keine Bewertungen

- Philippine Institute of ArbitratorsDokument58 SeitenPhilippine Institute of ArbitratorsArdy Falejo FajutagNoch keine Bewertungen

- SBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkDokument76 SeitenSBCA 2011 Acads Lumbera Tax Notes - Washout WatermarkArdy Falejo Fajutag100% (2)

- Ambil JR Vs SandiganbayanDokument8 SeitenAmbil JR Vs SandiganbayanArdy Falejo FajutagNoch keine Bewertungen

- Hannah Serrana Vs SandiganbayanDokument10 SeitenHannah Serrana Vs SandiganbayanArdy Falejo FajutagNoch keine Bewertungen

- Asia's Emerging Dragon Vs DOTCDokument23 SeitenAsia's Emerging Dragon Vs DOTCArdy Falejo FajutagNoch keine Bewertungen

- Frequently Asked Questions - Maybank Visa DebitDokument4 SeitenFrequently Asked Questions - Maybank Visa DebitholaNoch keine Bewertungen

- BagbagtoDokument3 SeitenBagbagtoJayson Valentin EscobarNoch keine Bewertungen

- 10 Day Penniman Chart - Literacy NarrativesDokument5 Seiten10 Day Penniman Chart - Literacy Narrativesapi-502300054Noch keine Bewertungen

- Operaton Q. PDokument47 SeitenOperaton Q. PPravin KeskarNoch keine Bewertungen

- ToobaKhawar 6733 VPL Lab Sat 12 3 All TasksDokument38 SeitenToobaKhawar 6733 VPL Lab Sat 12 3 All TasksTooba KhawarNoch keine Bewertungen

- AVR On Load Tap ChangerDokument39 SeitenAVR On Load Tap ChangerInsan Aziz100% (1)

- EIC 3 Practice Exercises Unit 4Dokument3 SeitenEIC 3 Practice Exercises Unit 4Trần ChâuNoch keine Bewertungen

- Culture-Partners M&A EbookDokument12 SeitenCulture-Partners M&A EbookapachemonoNoch keine Bewertungen

- Partnership For Sustainable Textiles - FactsheetDokument2 SeitenPartnership For Sustainable Textiles - FactsheetMasum SharifNoch keine Bewertungen

- Republic V Mangotara DigestDokument3 SeitenRepublic V Mangotara DigestMickey Ortega100% (1)

- Issues in Corporate GovernanceDokument15 SeitenIssues in Corporate GovernanceVandana ŘwţNoch keine Bewertungen

- 2020 ESIA Guideline Edited AaDokument102 Seiten2020 ESIA Guideline Edited AaAbeje Zewdie100% (1)

- BVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFDokument3 SeitenBVP651 Led530-4s 830 Psu DX10 Alu SRG10 PDFRiska Putri AmirNoch keine Bewertungen

- 30 This Is The Tower That Frank BuiltDokument26 Seiten30 This Is The Tower That Frank BuiltAlex BearishNoch keine Bewertungen

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADDokument29 SeitenPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephNoch keine Bewertungen

- LGDokument36 SeitenLGNanchavisNoch keine Bewertungen

- Modal Verbs EjercicioDokument2 SeitenModal Verbs EjercicioAngel sosaNoch keine Bewertungen

- Prelims Reviewer Biochem LabDokument4 SeitenPrelims Reviewer Biochem LabRiah Mae MertoNoch keine Bewertungen

- Acid Bases and Salts Previous Year Questiosn Class 10 ScienceDokument5 SeitenAcid Bases and Salts Previous Year Questiosn Class 10 Scienceclashhunting123123Noch keine Bewertungen

- Ism Practical File NothingDokument84 SeitenIsm Practical File NothingADITYA GUPTANoch keine Bewertungen

- Explicit Lesson PlanDokument10 SeitenExplicit Lesson PlanBanjo De Los SantosNoch keine Bewertungen

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersDokument41 SeitenNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediNoch keine Bewertungen

- RHEL 9.0 - Configuring Device Mapper MultipathDokument59 SeitenRHEL 9.0 - Configuring Device Mapper MultipathITTeamNoch keine Bewertungen

- Vững vàng nền tảng, Khai sáng tương lai: Trang - 1Dokument11 SeitenVững vàng nền tảng, Khai sáng tương lai: Trang - 1An AnNoch keine Bewertungen

- Paper Cutting 6Dokument71 SeitenPaper Cutting 6Vidya AdsuleNoch keine Bewertungen

- Lesson PlansDokument12 SeitenLesson Plansapi-282722668Noch keine Bewertungen

- Character AnalysisDokument3 SeitenCharacter AnalysisjefncomoraNoch keine Bewertungen