Beruflich Dokumente

Kultur Dokumente

1 s2.0 S0304407607001741 Main

Hochgeladen von

Aziz AdamOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1 s2.0 S0304407607001741 Main

Hochgeladen von

Aziz AdamCopyright:

Verfügbare Formate

Journal of Econometrics 142 (2008) 539552

Fixed effects instrumental variables estimation in correlated

random coefcient panel data models

Irina Murtazashvili

a

, Jeffrey M. Wooldridge

b,

a

Department of Economics, University of Pittsburgh, Pittsburgh, PA 15260, USA

b

Department of Economics, Michigan State University, East Lansing, MI 48824-1038, USA

Available online 6 September 2007

Abstract

We provide a set of conditions sufcient for consistency of a general class of xed effects instrumental variables (FE-IV)

estimators in the context of a correlated random coefcient panel data model, where one ignores the presence of individual-

specic slopes. We discuss cases where the assumptions are met and violated. Monte Carlo simulations verify that the

FE-IV estimator of the population averaged effect performs notably better than other standard estimators, provided a full

set of period dummies is included. We also propose a simple test of selection bias in unbalanced panels when we suspect the

slopes may vary by individual.

r 2007 Elsevier B.V. All rights reserved.

JEL classication: C23; C33

Keywords: Correlated random coefcient model; Population averaged effect; Average treatment effect; Fixed effects; Instrumental

variables

1. Introduction

In both cross-section and panel data settings, there is substantial interest in estimating population averaged

effects (PAEs), including average treatment effects (ATEs), in the correlated random coefcient (CRC) model.

Models with both exogenous explanatory variables and endogenous regressors have been investigated in

recent years. Angrist (1991) discusses the conditions for consistency of ATE estimates in models with binary

endogenous variables and no exogenous covariates. A set of sufcient assumptions required for consistent

ATE estimates with continuous endogenous regressors in a CRC model can be found in Wooldridge (2003).

Both papers study estimation with random sampling from a cross-section.

The possibility that treatment effects might depend on individual-specic heterogeneity motivated Imbens

and Angrist (1994). to introduce the local ATE (LATE) as an evaluation parameter, which provides a useful

interpretation of the instrumental variables estimator when the effect of a binary treatment varies across units.

That emphasis on LATE led to a reinterpretation of IV estimates in many empirical applications, and spurred

ARTICLE IN PRESS

www.elsevier.com/locate/jeconom

0304-4076/$ - see front matter r 2007 Elsevier B.V. All rights reserved.

doi:10.1016/j.jeconom.2007.09.001

Corresponding author. Tel.: +1 517 353 5972; fax: +1 517 432 1068.

E-mail address: wooldri1@msu.edu (J.M. Wooldridge).

a great deal of research on interpreting IV estimators in a variety of contexts. Heckman and Vytlacil (2005) provide

a recent unication, including a discussion of whether we should be interested in parameters such as LATE.

The understanding that IV generally consistently estimates LATE in simple settings is useful, but often we

are interested in estimating the expected effect for a randomly drawn unit from the underlying population.

Plus, strict interpretation of LATE as the ATE among units induced into treatment by the switching of an

instrumental variablesuch as program eligibilityis limited to special cases. Here we study estimation of

population average effects, or ATEs, in a general panel data model with heterogeneous slopes. By estimating

population average effects we can easily estimate the aggregate effects of various policies, such as increasing

the amount of job training among the population of manufacturing workers.

Wooldridge (2005a) studied general xed effects estimators with strictly exogenous regressors in the CRC

model with panel data, and derived conditions under which generalized xed effects estimatorsgeneralized

in the sense that they sweep away unit-specic trendsare consistent for the PAE. In this paper, we study the

model in Wooldridge (2005a) but, in addition to allowing correlation between the instruments and the

unobserved heterogeneity, we allow some explanatory variables to be correlated with the idiosyncratic error.

The main result is a set of sufcient conditions under which xed effects instrumental variables (FE-IV)

estimators consistently estimate the PAE, even when the individual-specic slopes are ignored. The results

include the commonly used FE two stage least squares estimator (FE-2SLS) as a special case, but also more

general FE-IV estimators that sweep away individual-specic time trends. The conditions are most likely to

apply when the endogenous explanatory variables are continuous, as in Wooldridge (2003) for the cross-

sectional case.

The remainder of the paper is organized as follows. In Section 2 we introduce the model and briey review

existing results. Section 3 contains the main consistency result, and Section 4 covers examples where the

conditions willand will nothold. Section 5 contains a Monte Carlo study that shows how the FE-IV

estimator, with a full set of time period dummies, outperforms its obvious competitors. The simulation results

support the results in Sections 3 and 4.

In Section 6, we expand on earlier work by allowing the random trend part of the structural equation to be

misspecied. Interestingly, it is still possible to estimate the averaged slopes under reasonable assumptions.

Section 7 considers unbalanced panels, characterizes the nature of any sample selection problem, and proposes

simple variable addition tests that can be used when the slopes are thought to be individual-specic. Section 8

contains a brief conclusion.

2. Model specication and previous results

The model of interest is a CRC model studied in Wooldridge (2005a). For a random draw i from the

population, the model is

y

it

= w

t

a

i

x

it

b

i

u

it

; t = 1; . . . ; T, (2.1)

where y

it

is a dependent variable, w

t

is a 1 J vector of aggregate time variables, which we treat as

nonrandom, a

i

is a J 1 vector of individual-specic slopes on the aggregate variables, x

it

is a 1 K vector of

endogenous covariates that change across time, b

i

is a K 1 vector of individual-specic slopes, and u

it

is an

idiosyncratic error. As discussed in Wooldridge (2005a), we require JoT. So, if we have two time periods, we

can only allow a scalar individual-specic intercept, a

i

. If T = 3, we can allow individual-specic linear trends,

too. Higher order trend terms are allowed as T increases.

Eq. (2.1) is a CRC model when the individual specic slopes, b

i

(as well as the elements in a

i

), are allowed to

be correlated with x

it

. For example, a simple CRC wage equation might look like

log(wage

it

) = a

i1

a

i2

t b

i1

training

it

b

i2

union

it

b

i3

married

it

u

it

, (2.2)

where, in addition to the standard level effect a

i1

, each individual is allowed to have his or her own unobserved

growth in wages, a

i2

. In addition, the time-varying explanatory variables have individual-specic returns. The

variable training might be hours spent in job training, and the CRC model allows the return to training to be

individual-specic and correlated with the amount of trainingas a standard model of human capital

accumulation would suggest.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 540

Wooldridge (2005a) studied the consistency of xed effects estimators of (2.1) that sweep out the a

i

but act

as if b

i

= b for all i. To describe Wooldridges main result, and the extension here, write b

i

= b d

i

, and

substitute into (2.1):

y

it

= w

t

a

i

x

it

b (x

it

d

i

u

it

) w

t

a

i

x

it

b v

it

, (2.3)

where v

it

x

it

d

i

u

it

: We eliminate a

i

by regressing, for each i, y

it

on w

t

; t = 1; . . . ; T and x

it

on w

t

;

t = 1; . . . ; T, and keeping the residuals, y

it

and x

it

, respectively. This gives the equations

y

it

= x

it

b

i

u

it

= x

it

b ( x

it

d

i

u

it

) = x

it

b v

it

; t = 1; . . . ; T. (2.4)

The xed effects estimator studied by Wooldridge (2005a) is just the pooled OLS estimator from (2.4). We

control the amount of individual-specic detrending by choosing w

t

appropriately.

An assumption used by Wooldridge (2005a) is the standard strict exogeneity assumption conditional on

(a

i

; b

i

):

E(u

it

[x

i1

; . . . ; x

iT

; a

i

; b

i

) = 0; t = 1; . . . ; T. (2.5)

Using a simple iterated expectations argument, Wooldridge shows that, under the additional assumption

E(b

i

[ x

it

) = E(b

i

); t = 1; . . . ; T, (2.6)

the xed effects estimator is consistent for the PAE, b.

Consistency of the usual FE estimator relies heavily on assumption (2.5), which rules out traditional

simultaneity, time-varying measurement error, correlation between time-varying omitted factors (in u

it

) and

the elements of x

it

, and models with lagged dependent variables or other kinds of regressors where changes in

u

it

may feed back into changes in x

i;th

for hX1. In the case where b

i

= b, methods that rst eliminate a

i

and

then apply instrumental variablesusually, 2SLShave become a standard tool for the applied economist.

Here, we study such estimators but allow for individual-specic slopes, b

i

.

Let z

it

be a 1 L vector of instrumental variables, with LXK. Let z

it

be the detrended instruments from

the individual-specic regressions of z

it

on w

t

; t = 1; . . . ; T. Then we can estimate (2.4) using instruments z

it

for

unit i in time period t. Whether we just use pooled 2SLSthe estimator we focus on hereor a more

sophisticated generalized method of moments (GMM) estimator, the moment conditions we use are

E( z

/

it

v

it

) = 0; t = 1; . . . ; T. (2.7)

In the next section, we study consistency of the FE-2SLS estimator under conditions that relax those in

Wooldridge (2005a).

3. Conditions for consistent FE-IV estimation

In order to ensure that (2.7) holds, we place conditions separately on the relationship between the

instruments and idiosyncratic errors and the instruments and the unobserved effects. Plus, of course, there is

always a standard rank condition.

Assumption 3.1. With the denitions in Section 2,

E(u

it

[z

i1

; z

i2

; . . . ; z

iT

) = 0; t = 1; . . . ; T. (3.1)

Assumption 3.1 is stronger than we needas will be clear, E( z

/

it

u

it

) = 0; t = 1; . . . ; T would sufcebut (3.1)

is a natural strict exogeneity assumption on the instruments. Assumption 3.1 is common in simultaneous

equations models with panel data, as well as models with other kinds of endogeneity that induces correlation

between x

it

and u

it

, such as omitted variables and measurement error. Assumption 3.1 rules out lagged

dependent variables among the instrumentsas well as other nonstrictly exogenous instrumentsand so its

application to dynamic models is limited unless sufcient strictly exogenous instruments are available. When

z

it

= x

it

, so that the covariates are strictly exogenous, Wooldridge (2005a) included a

i

and b

i

in the

conditioning set, as in (2.5). When the unit-specic trend function is correctly specied, this stronger form of

the assumption is essentially harmless. But in Section 6 we will investigate the behavior of the FE-IV estimator

when the unit-specic trends have been misspecied.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 541

The second component of the error term in (2.4) is x

it

d

i

, and we need assumptions such that z

it

is

uncorrelated with x

it

d

i

. This requires some care because x

it

contains endogenous elements. (That is, we allow

components of x

it

to be endogenous even after removing unit-specic intercepts and trends.) The rst

assumption mimics the key assumption from Wooldridge (2005a), except that we replace the covariates with

the instruments:

Assumption 3.2. b

i

is mean independent of all the unit-specic detrended z

it

, that is,

E(b

i

[ z

it

) = E(b

i

) = b; t = 1; . . . ; T. (3.2)

Because the z

it

are net either of a time average or, more generally, level and trend effects, Assumption 3.2

maintains mean independence of the heterogeneous slopes and deviations of the instruments from long-run

levels or trends. Of course, in the case where the instruments are assumed, in each time period, to be

independent of all heterogeneity, Assumption 3.2 automatically holds. Assumption 3.2 is practically much

weaker than full independence because it allows b

i

to be arbitrarily correlated with systematic components of

z

it

; we cover some examples in Section 4. (Wooldridge (2005a) contains a discussion for the case of strictly

exogenous x

it

.)

Generally, the richer is w

t

, the more likely (3.2) is to hold. For example, the usual FE-IV estimator takes out

time averages from the instruments, and this might not be enough to ensure (3.2) if the instruments are

trending differently across units i. On the other hand, adding more aggregate factors to w

t

reduces the

variation in z

it

, generally leading to less efcient IV estimators. Not surprisingly, in deciding what to include in

w

t

we confront the usual tradeoff between efciency and consistency.

Unfortunately, Assumptions 3.13.2 are not enough to conclude that the IV estimator is consistent. Instead,

we employ a constant conditional covariance assumption.

Assumption 3.3. For j = 1; . . . ; K;

Cov( x

itj

; b

ij

[ z

it

) = Cov( x

itj

; b

ij

); t = 1; . . . ; T. (3.3)

Importantly, (3.3) allows the detrended covariates and the random coefcient to be correlated, and the

covariance may change over time; in fact, there is no restriction on the temporal pattern of Cov( x

itj

; b

ij

). But

the covariance conditional on the detrended IVs is assumed not to depend on z

it

. (In any case, the covariances

Cov( x

itj

; b

ij

) do not depend on i because of random sampling in the cross-sectional dimension. As we are

conditioning only on z

it

, the restriction is that the covariance condition on z

it

does not depend on z

it

; we have

no need to place restrictions on other conditional covariances.)

Assumption 3.3 extends to the panel data case a condition used by Wooldridge (2003) for the pure cross-

sectional case. An important difference is that Assumption 3.3 applies to the detrended covariates and

instruments. Importantly, we allow the unconditional covariances to change arbitrarily over time. Of course, if

b

ij

= b

j

for all i, then (3.3) is trivially true because both sides are zero.

Assumptions 3.33.3 imply that the key orthogonality conditions (2.7) hold, and these conditions can be

used in a GMM framework. For simplicity, we focus here on the xed effects two stage least squares

estimator, FE-2SLS (interpreted in the general sense of eliminating a

i

from (2.1)). To ensure consistency of

FE-2SLS estimator we add a standard rank condition.

Assumption 3.4. (i) rank(

P

T

t=1

E( z

/

it

x

it

)) = K.

(ii) rank(

P

T

t=1

E( z

/

it

z

it

)) = L.

Practically speaking, the rst part of Assumption 3.4 is most important; it means that, after netting out

individual-specic trends, there is still sufcient correlation between the instruments and regressors. Part (ii)

requires sufcient variation in the detrended instruments. It would be violated if, say, we specify w

t

= (1; t)

and z

it

contains an element that is constant across t for all i (such as gender) or changes by the same value in

each time period (such as a persons age when the length of the sampling period is constant).

Proposition 3.1. Under Assumptions 3.13.4assumption4, the FE-IV estimator is consistent for b, provided a

full set of time period dummies is included in (2.4).

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 542

Proof. Under Assumption 3.2, E(d

ij

[ z

it

) = 0, j = 1; . . . ; K for all t, and so

E( x

itj

d

ij

[ z

it

) = Cov( x

itj

; d

ij

[ z

it

) = Cov( x

itj

; b

ij

[ z

it

).

But by Assumption 3.3, the conditional covariances equal the corresponding unconditional covariances, say

g

tj

, and so E( x

itj

d

ij

[ z

it

) = g

tj

, j = 1; . . . ; J, t = 1; . . . ; T. Since x

it

d

i

= x

it1

d

i1

x

it2

d

i2

x

itK

d

iK

, we have

shown that E( x

it

d

i

[ z

it

) = g

t1

g

tK

y

t

. Therefore, we can write x

it

d

i

= y

t

r

it

where E(r

it

[ z

it

) = 0,

t = 1; . . . ; T. Now we plug this expression for x

it

d

i

into Eq. (2.4):

y

it

= y

t

x

it

b (r

it

u

it

); t = 1; . . . ; T. (3.4)

As we have just shown, Assumptions 3.3.2 and 3.3 imply that E(r

it

[ z

it

) = 0. Assumption 3.1 implies that

E( u

it

[ z

it

) = 0. Thus, the composite error in (3.4) satises E(r

it

u

it

[ z

it

) = 0, t = 1; . . . ; T, and so any IV method

that uses instruments z

it

at time t consistently estimates b. In particular, under the rank condition in

Assumption 3.4, and standard nite moment conditions, the FE-2SLS estimator is consistent and

N

_

-

asymptotically normal. This completes the proof. &

Proposition 3.1 contains an important empirical lesson: unless there are very good reasons to the contrary,

one should include a full set of time effects in a xed effects IV analysis. Even if the model does not originally

contain separate time period interceptsitself a questionable premisethe estimating equation generally

should if one wants to allow correlated random slope coefcients.

Because the error term in (3.4), r

it

u

it

, is generally heteroskedastic and serially correlatedat a minimum

due to the presence of x

it

d

i

inference should be carried out using a fully robust variance matrix for

^

b.

Typically this is straightforward for pooled 2SLS where all instruments have been detrended prior to

estimation.

4. Examples

To see how Proposition 3.1 applies, suppose x

it

is linearly related to z

it

with heterogeneous linear trends for

each element of x

it

:

x

it

= g

i

C t h

i

W z

it

P q

it

; t = 1; . . . ; T. (4.1)

Initially, take w

t

= (1; t), so the regressors and instruments are linearly detrended before applying pooled

2SLS. Assume the instruments also have heterogeneous linear trends, which are removed by individual-specic

detrending. Then Assumption 3.2 simply requires that the idiosyncratic movements in z

it

are uncorrelated with

b

i

, a weak requirement on instrumental variables. For Assumption 3.3 , write x

it

= z

it

P q

it

, t = 1; . . . ; T, so

that Cov( x

it

; b

i

[ z

it

) = Cov[( z

it

P q

it

); b

i

[ z

it

] = Cov( q

it

; b

i

[ z

it

), t = 1; . . . ; T under Assumption 3.2. Thus,

provided

Cov( q

it

; b

i

[ z

it

) = Cov( q

it

; b

i

); t = 1; . . . ; T, (4.2)

we can use z

it

as IVs for x

it

to obtain a consistent estimate of the PAE, b, in Eq. (3.4). One might even assume

that (q

i1

; . . . ; q

iT

; b

i

) is independent of (z

i1

; . . . ; z

iT

), which is sufcient for (4.2) (as well as for Assumption 3.2).

It is possible that the FE-IV estimator is consistent even if we only demean the regressors and instruments,

provided the instruments satisfy a stronger exogeneity assumption. In other words, even though x

it

contains

individual-specic linear trends, we ignore that in our estimation procedure. To see why we can still get

consistency, demean x

it

to get

x

it

x

i

= [t (T 1)=2] h

i

W (z

it

z

i

)P (q

it

q

i

); t = 1; . . . ; T. (4.3)

Now, if [(q

it

q

i

); b

i

] is independent of (z

it

z

i

) for each t, and (3.2) holds for z

it

= (z

it

z

i

) and (4.2) also

holds. Therefore,

Cov(x

it

x

i

; b

i

[z

it

z

i

) = [t (T 1)=2]W

/

Cov(h

i

; b

i

) = Cov(x

it

x

i

; b

i

)

for each t, which means that Assumption 3.3 holds: while the conditional covariances are not generally zero,

or even constant over time, they do not depend on z

it

z

i

. So, the FE-IV estimator will be consistent provided

we include a full set of year dummies in estimation.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 543

What happens if we have a binary endogenous variable, x

it

? Assumption 3.3 is unlikely to hold. To see why,

take the case w

t

1; t = 1; . . . ; T, which corresponds to the usual unobserved effects model with CRC. Then,

x

it

= x

it

x

i

; t = 1; . . . ; T, and we need E( x

it

d

i

[ z

it

) not to depend on z

it

. Now, by iterated expectations,

E( x

it

d

i

[ z

it

) = E[E( x

it

d

i

[d

i

; z

i

)[ z

it

] = E[d

i

E( x

it

[d

i

; z

i

)[ z

it

]. (4.4)

Standard models for binary responses, with z

it

strictly exogenous conditional on d

i

, would have P(x

it

= 1[d

i

; z

i

)

depending on d

i

and z

it

, in a nonlinear way. For concreteness, suppose P(x

it

= 1[d

i

; z

i

) follows a probit model,

P(x

it

= 1[d

i

; z

i

) = P(x

it

= 1[d

i

; z

it

) = F(a

0

a

1

d

i

z

it

a

2

). (4.5)

Then

E( x

it

[d

i

; z

i

) = F(a

0

a

1

d

i

z

it

a

2

) T

1

X

T

r=1

F(a

0

a

1

d

i

z

ir

a

2

) g

t

(d

i

; z

i

) (4.6)

and so, by (4.4),

E( x

it

d

i

[ z

it

) = E[d

i

g

t

(d

i

; z

i

)[ z

it

]. (4.7)

Even if d

i

is independent of z

it

a sensible strengthening of Assumption 3.3.2(4.7) generally depends on z

it

.

Thus, assuming E( x

it

d

i

[ z

it

) does not depend on z

it

is rather strong for a binary endogenous explanatory variable

x

it

. (Heckman (1997) contains a detailed discussion of the behavioral implications of this assumption in

different empirical studies.) In a cross-sectional context, Wooldridge (1997) proposes a modied set of

assumptions that are sufcient for consistent estimation of the ATE, b, with a binary endogenous variable, but,

applied to the current setup, P(x

it

= 1[d

i

; z

it

) would have to follow a linear probability model.

In a cross-sectional setting, Card (2001) shows that the analogue of Assumption 3.3 can also be violated in

the case of continuous explanatory variables due to heteroskedasticity in the variance matrix of (x

i

; b

i

) given z

i

.

(With a pure cross-section, there are no time subscripts and, of course, no unit-specic demeaning or

detrending.) In an earnings equation where x

i

includes schooling, Card rejects Cov(x

i

; b

i

[z

i

) = Cov(x

i

; b

i

) using

IQ score as a proxy for unobserved ability (an element of b

i

) and a binary indicator for college proximity as an

instrument for education. In our panel data setup, Assumption 3.1 allows Cov(x

it

; b

i

[z

it

) to depend on z

it

, as it

generally would if x

it

and z

it

contain persistent heterogeneity correlated with b

i

. Using a generalized xed

effects approach, we need only assume Cov( x

it

; b

i

[ z

it

) does not depend on z

it

, and this is much more plausible

when we think the unit-specic detrending successfully eliminates the time-constant heterogeneity in x

it

and z

it

.

More recently, in a cross-sectional setting, Wooldridge (2005b) proposes conditions that allow Cov(x

i

; b

i

[z

i

)

to depend on z

i

, but these do not apply directly to the panel data case with time-constant heterogeneity that

can be correlated with the covariates and instruments.

5. Finite sample behavior of the FE-IV estimator

In this section we provide evidence on the nite sample properties of FE-IV estimator of the PAE in a CRC

panel data model. Because one of the most commonly used applications of CRC panel data models is the

usual unobserved effects model with a random coefcient, we rst assume w

t

1, t = 1; . . . ; T in (2.1), as in

the second part of the rst example from Section 4. Also, for scalar processes x

it

and z

it

, we assume a linear

relationship between x

it

and z

it

, with a linear trend for x

it

. We use Monte Carlo simulations to draw the data

and check the properties of the estimator. The number of replications is 500, and the results of the experiment

are presented for cross-sectional sample sizes of 100, 400, and 800 for two time horizons, T = 5 and T = 10.

The population average values are b = 2 and a = 3. For t = 1; . . . ; T, the endogenous explanatory variable is

generated as

x

it

l

xz

z

it

l

xu

u

it

l

xa

a

i

xb

i

xtd

i

1 l

2

xz

l

2

xu

l

2

xa

x

2

(1 t)

2

q

e

it

, (5.1)

where u

it

, e

it

Normal(0; 1), a

i

Normal(a; 1), b

i

= b d

i

, d

i

Normal(0; s

2

b

), and l

xz

; l

xu

; l

xa

, and x are

constants. Further, the instrument is generated as z

it

= l

za

a

i

1 l

2

za

q

m

it

where a

i

is dened above

m

it

Normal(t; 1), and l

za

is the population correlation coefcient between z

it

and a

i

, t = 1; . . . ; T.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 544

In our reported simulations we use s

2

b

= 1. When l

za

= 0, the coefcients l

xz

, l

xu

, and l

xa

from (5.1) are the

population correlation coefcients between x

it

and z

it

, x

it

and u

it

, and x

it

and a

i

, t = 1; . . . ; T, respectively. The

population correlation between x

it

and b

i

when l

za

= 0 is x(1 t), t = 1; . . . ; T. We use the coefcient on the

error term in (5.1) to ensure that x

it

has unit variance when l

za

= 0. When l

za

a0, Var(x

it

) = 1 2l

xz

l

za

l

xa

,

which is only slightly greater than one for our choices of the l parameters. The relevant covariances are

Cov(x

it

; u

it

) = l

xu

, Cov(x

it

; a

i

) = l

xz

l

za

l

xa

, and Cov(x

it

; z

it

) = l

xz

l

xa

l

za

. For the endogenous explanatory

variable dened in (5.1), Assumption 3.3 is met: Cov( x

it

; b

i

[ z

it

) = Cov( x

it

; b

i

) = x(1 t); t = 1; . . . ; T.

The dependent variable y

it

is generated as

y

it

= a

i

x

it

b

i

u

it

; t = 1; . . . ; T, (5.2)

where a

i

, b

i

, u

it

, and x

it

are dened above. Among other estimators, we obtain the FE-IV estimator in (5.2)

acting as if b

i

= b. Based on the rst example from Section 4, we know this FE-IV estimator is consistent for

x

it

generated as in (5.1) provided we include a full set of time dummies, even though we only demean the

regressor and the instrument while ignoring the individual-specic linear trend in the regressor.

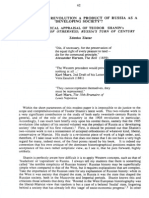

Table 1 presents simulation results for the CRC model for l

xu

= 0:40, l

xa

= 0:20, l

xz

= 0:20, and l

za

= 0:25.

The implied correlation between x

it

and z

it

is about 0:245, which seems to be a reasonable value for panel data.

For comparison, we used a data set provided with Wooldridge (2002) on domestic route air fares for 1,149

routes in the United States for 19972000. (The data set is called AIRFARE.) The correlation between the

log of air fare (an endogenous explanatory variable in a passenger demand equation) and the instrumental

variable candidate, the concentration ratio on the route, is about 20:22, which has a magnitude in the range

of 0:245.

Panel A of Table 1 reports the simulation outcomes for T = 5, where x = 0:12, while Panel B covers the case

T = 10, where x = 0:06. When x = 0:12, the correlation between x

i1

and b

i

is slightly less than 0:24; when

x = 0:06, the correlation is just below 0:12. Columns 16 contain the mean, standard deviation (SD), root

mean squared error (RMSE), lower quartile (LQ), median, and upper quartile (UQ) of the PAE estimates

from 500 replications. Rows of the table report statistics for usual pooled ordinary least squares (POLS)

estimates on the original data, the usual xed effects estimates (FE-OLS), which is just pooled OLS on the

time-demeaned data, pooled instrumental variables (IV) estimates using the original data, the FE-IV estimates

without period dummy variables (FE-IV without dummies), and FE-IV estimates when a full set of period

dummy variables is included (FE-IV with dummies).

From the table we see that the POLS estimates are roughly 1.5 times larger than the true value of b in the

100, 400, and 800 observation samples. One source of bias of the POLS estimates is the correlation between

the unobserved heterogeneity a

i

and the regressor x

it

. A second source of bias in the POLS estimates is the

endogeneity of the regressor x

it

, with correlation coefcient r

xu

very close to 0:4. A third source of bias (and

inconsistency) is the correlation between x

it

and b

i

.

The within transformation eliminates a

i

, and so the correlation between x

it

and a

i

is not a source of bias for

the usual FE-OLS estimator. But FE-OLS still produces a biased estimator of b for the last two reasons

mentioned above. The bias in the FE-OLS estimator is much lower than for POLS, but the bias is still on the

order of 30%.

The pooled IV estimatorthat is, without removing time averages and without time period dummies

actually has a larger bias than the FE-OLS estimator, a nding that is not too surprising because the

instruments are correlated with a

i

. Using the FE transformation combined with IV eliminates the dependence

between z

it

and a

i

because z

it

= l

za

a

i

1 l

2

za

q

m

it

. Therefore, the FE-IV estimator (without time dummies)

has a smaller bias and considerably smaller RMSE than the pooled IV estimator. More importantly, the

FE-IV estimator with period dummies has the lowest RMSE among all estimators for all the sample sizes and

both time horizons. Plus, the RMSE of the FE-IV estimator with time dummies falls quickly as the sample

size, N, grows. Without period dummies, the FE-IV estimates of b are biased by at least 20%, and the bias

does not disappear as No. As T increases, the RMSE of the FE-IV estimator without dummies estimates

decreases but it is still higher than the one for the FE-IV estimates when the period dummy variables are

included. Thus, even though the structural model (5.2) does not contain a time trend, inclusion of a full set of

period dummies ensures the consistency of the FE-IV estimation.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 545

Not surprisingly, the FE-OLS estimator has a smaller SD than the FE-IV estimator (both without time

dummies). Typically, methods that treat regressors as exogenous have substantially less sampling variation

than their IV counterparts because the correlation between the instrument and regressor is typically well below

one, as in the current simulation.

The difference between the FE-IV estimates with and without time dummies illustrates the trade-off

between bias and variance. The FE-IV estimates without time period dummy variables are always less variable

than the FE-IV with time dummies. This is hardly surprising, as including more explanatory variablesthe

time dummies in this casethat are correlated with the instrument induces multicollinearity into the IV

estimates. The instrument, z

it

, is constructed to be correlated with time dummies, and so the FE-IV estimator

with time dummies is less precise than that without. But, of course, the estimator without time dummies

suffers from substantial bias even though the structural model does not contain separate period intercepts. The

ARTICLE IN PRESS

Table 1

Estimator Time dummies? (1) (2) (3) (4) (5) (6)

Mean SD RMSE LQ Median UQ

A: Usual unobserved effects CRC model for b = 2 and T = 5

N = 100

POLS No 3.363 0.189 1.377 3.238 3.356 3.486

FE-OLS No 2.616 0.138 0.642 2.527 2.621 2.711

IV No 2.752 0.225 0.781 2.612 2.761 2.901

FE-IV No 2.423 0.214 0.484 2.288 2.429 2.558

FE-IV Yes 1.945 0.407 0.407 1.711 1.980 2.208

N = 400

POLS No 3.369 0.091 1.372 3.299 3.366 3.434

FE-OLS No 2.623 0.067 0.635 2.575 2.626 2.667

IV No 2.745 0.110 0.760 2.666 2.740 2.818

FE-IV No 2.428 0.096 0.455 2.362 2.423 2.498

FE-IV Yes 1.988 0.177 0.213 1.887 1.997 2.101

N = 800

POLS No 3.373 0.063 1.375 3.330 3.366 3.412

FE-OLS No 2.625 0.046 0.637 2.596 2.624 2.655

IV No 2.753 0.076 0.764 2.700 2.750 2.801

FE-IV No 2.436 0.068 0.458 2.389 2.437 2.480

FE-IV Yes 2.004 0.131 0.182 1.919 2.009 2.091

B: Usual unobserved effects CRC model for b = 2 and T = 10

N = 100

POLS No 3.204 0.157 1.223 3.097 3.195 3.314

FE-OLS No 2.534 0.106 0.562 2.469 2.531 2.603

IV No 2.397 0.123 0.440 2.324 2.395 2.475

FE-IV No 2.277 0.115 0.331 2.208 2.276 2.351

FE-IV Yes 2.013 0.283 0.313 1.841 2.020 2.210

N = 400

POLS No 3.196 0.077 1.202 3.146 3.193 3.247

FE-OLS No 2.528 0.056 0.545 2.490 2.527 2.565

IV No 2.392 0.061 0.417 2.450 2.393 2.431

FE-IV No 2.270 0.060 0.305 2.231 2.274 2.308

FE-IV Yes 1.995 0.138 0.186 1.901 2.002 2.092

N = 800

POLS No 3.194 0.054 1.200 3.155 3.194 3.224

FE-OLS No 2.525 0.040 0.541 2.498 2.523 2.551

IV No 2.388 0.042 0.410 2.357 2.387 2.416

FE-IV No 2.268 0.041 0.299 2.241 2.267 2.294

FE-IV Yes 1.992 0.100 0.160 1.926 1.993 2.062

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 546

RMSE for the FE-IV estimator that includes a full set of dummies is much lower than the estimator that

does not.

We also conducted simulations with more variability in the random coefcient, namely, s

2

b

= 4, so that the

SD of b

i

is double that in Table 1. The results of these simulations are not included here but are available on

request. With more variability in b

i

, the bias induced by failing to include time dummies in the FE-IV

estimation is more pronounced (even though, remember, the structural model does not include time effects).

For example, with T = 5, and N = 800, the RMSE of the FE-IV estimator without dummies is about 1:36,

compared with about 0:22 for the estimator that does include the dummies.

For the next set of simulations, we take w

t

(1; t); t = 1; . . . ; T, in (2.1), so that each cross-sectional unit has

its own linear trend. In particular, we generate y

it

as

y

it

= a

i0

a

i1

t x

it

b

i

u

it

; t = 1; . . . ; T, (5.3)

where a

i0

and a

i1

are independent Normal(a; 1) random variables and b

i

, and u

it

are dened above. The

endogenous explanatory variable x

it

is generated as

x

it

l

xz

z

it

l

xu

u

it

l

xa

(a

i0

a

i1

) xb

i

xtd

i

1 l

2

xz

l

2

xu

2l

2

xa

x

2

(1 t)

2

q

e

it

, (5.4)

and the instrument is generated as z

it

= l

za

a

i0

1 l

2

za

q

m

it

. Again, the coefcient on e

it

is chosen so that

Var(x

it

) = 1 if l

za

= 0. We use the same values for the l parameters as in Table 1, and we take s

b

= 1.

(Simulation ndings for the case s

b

= 2 are available on request). Because the structural model (5.3) contains a

time trend, the default is to include a full set of time period dummies in the various estimation methods. For

comparison, we include the FE-IV estimator without time period dummies.

The rows of Table 2 report statistics for POLS with time dummies, xed effects with time dummies, pooled

instrumental variables with time dummies, FE-IV estimates with time dummies, and FE-IV estimates without

time dummies. As in Table 1, the simulation ndings are unambiguous: xed effects IV with a full set of time

dummies is superior, by far, to the other estimation methods, for all combinations of N and T. Perhaps not

surprisingly, when y

it

is itself trending, the consequences of omitting aggregate time effects is much more

detrimental than in the previous case.

The simulation ndings are perhaps not too surprising: the only estimator that is essentially unbiased for the

PAE removes the unobserved effect (or, more generally, the individual-specic trends), includes a full set of

aggregate time effects, and instruments for the endogenous explanatory variable. Nevertheless, it is useful to

see that the theoretical ndings in Section 3 have practically important implications: the FE-IV estimator with

time dummies is robust to correlation between the random coefcients and the explanatory variable, at least

for assumptions that can be met by continuous endogenous explanatory variables.

6. Estimation with misspecied random trends

The consistency result in Proposition 3.1 assumes that the random trend in model (2.1) is actually w

t

a

i

, so

that unit-specic detrending in Eq. (2.1) eliminates the unobserved heterogeneity, a

i

. But what if we have the

individual-specic trends incorrect in the structural model?

It turns out that we can extend Proposition 3.1 to allow for misspecication in the random trends. We now

take the structural model to be

y

it

= g

i

(t) x

it

b

i

u

it

; t = 1; . . . ; T, (6.1)

where g

i

(t) is the unknown trend function for unit i. In estimation, we act as if g

i

(t) = w

t

a

i

, and we still apply

the FE-IV estimator that ignores variation in the slopes, b

i

. In other words, the estimator is exactly the same

one studied in Section 3 but under possible misspecication of the unit-specic trend function.

When we detrend (6.1), we no longer necessarily eliminate the random trend component. Instead,

y

it

= g

i

(t) x

it

b

i

u

it

= g

i

(t) x

it

b ( x

it

d

i

u

it

); t = 1; . . . ; T, (6.2)

where the double-dot notation indicates residuals from regressing on w

t

, t = 1; . . . ; T. Because we apply

instrumental variables estimation to (6.2), we adopt the same conditions in Proposition 3.1, but we now add

an assumption to handle the extra, unknown trend term, g

i

(t).

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 547

Assumption 6.1. The unit-specic trends are uncorrelated with the detrended instruments, that is,

Cov[ z

it

; g

i

(t)] = 0; t = 1; . . . ; T, (6.3)

where { z

it

: t = 1; . . . ; T] are the residuals from the regression z

it

on w

t

, t = 1; . . . ; T.

Proposition 6.1. In addition to Assumptions 3.13.4, assume Assumption 6.1 holds. Then the FE-IV estimator

is consistent for b, again provided a full set of time period dummies is included.

Proof. The proof is a simple modication of the proof of Proposition 3.1. With a full set of time period

dummies, we can assume that E[g

i

(t)] = 0 (because the time period dummies effectively demean g

i

(t) for each

t). The error term now contains g

i

(t), and so we need, in addition to the steps in Proposition 3.1,

E[

P

T

t=1

z

/

it

g

i

(t)] = 0. But

P

T

t=1

z

/

it

g

i

(t) =

P

T

t=1

z

/

it

g

i

(t), and so (6.3), along with the earlier assumptions,

ARTICLE IN PRESS

Table 2

Estimator Time dummies? (1) (2) (3) (4) (5) (6)

Mean SD RMSE LQ Median UQ

A: Random trend CRC model for b = 2 and T = 5

N = 100

POLS Yes 4.293 0.300 2.303 4.096 4.284 4.475

FE-OLS Yes 2.673 0.182 0.697 2.555 2.671 2.782

IV Yes 2.929 0.850 1.247 2.444 2.941 3.496

FE-IV Yes 2.000 0.626 0.642 1.635 2.057 2.383

FE-IV No 13.414 1.411 11.422 12.464 13.221 14.225

N = 400

POLS Yes 4.308 0.144 2.312 4.201 4.307 4.411

FE-OLS Yes 2.663 0.085 0.679 2.607 2.666 2.721

IV Yes 3.004 0.411 1.073 2.704 3.023 3.292

FE-IV Yes 2.013 0.269 0.301 1.835 2.019 2.204

FE-IV No 13.406 0.665 11.406 12.915 13.340 13.878

N = 800

POLS Yes 4.296 0.097 2.294 4.225 4.295 4.363

FE-OLS Yes 2.660 0.060 0.671 2.617 2.658 2.700

IV Yes 2.996 0.278 1.038 2.809 2.993 3.171

FE-IV Yes 1.996 0.187 0.223 1.874 2.005 2.130

FE-IV No 13.351 0.478 11.328 13.049 13.318 13.654

B: Random trend CRC model for b = 2 and T = 10

N = 100

POLS Yes 4.789 0.407 2.820 4.522 4.814 5.051

FE-OLS Yes 2.651 0.178 0.687 2.539 2.656 2.761

IV Yes 2.916 1.042 1.401 2.357 2.976 2.615

FE-IV Yes 1.968 0.619 0.641 1.603 2.001 2.384

FE-IV No 15.933 0.771 13.919 15.367 15.902 16.479

N = 400

POLS Yes 4.808 0.190 2.815 4.678 4.808 4.943

FE-OLS Yes 2.662 0.089 0.678 2.600 2.662 2.718

IV Yes 3.000 0.504 1.137 2.659 2.993 3.361

FE-IV Yes 1.981 0.311 0.338 1.767 1.978 2.203

FE-IV No 15.900 0.406 13.875 15.633 15.890 16.177

N = 800

POLS Yes 4.788 0.144 2.784 4.682 4.779 4.885

FE-OLS Yes 2.663 0.062 0.674 2.618 2.660 2.703

IV Yes 3.000 0.360 1.061 2.759 3.026 3.243

FE-IV Yes 1.997 0.201 0.234 1.855 1.998 2.132

FE-IV No 15.904 0.289 13.888 15.693 15.895 16.098

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 548

impliesE(

P

T

t=1

z

/

it

v

it

) = 0, where v

it

= g

i

(t) x

it

d

i

u

it

. This orthogonality condition implies consistency of

FE-2SLS under the rank condition Assumption 3.4. &

Proposition 6.1 is a rather straightforward extension of Proposition 3.1, but its implications are practically

important. If our choice of w

t

effectively removes the unit-specic heterogeneity in the instruments, then the

fact that the individual-specic trends in the structural model might be misspecied does not affect our ability

to consistently estimate b. In most applications our interest is in b, and Proposition 6.1 implies some

additional robustness of the FE-IV estimator. Our ability to determine the trends in z

it

, without confounding

factors, is likely to be easier than specifying the trend in (6.1), where we must deduce the random trends

affecting y

it

that are not due to trends in x

it

.

As a general example of where Assumption 6.1 is reasonable, assume that

z

it

= w

t

H

i

q

it

; t = 1; . . . ; T, (6.4)

where {q

it

; t = 1; . . . ; T] is a general time series process and H

i

is a J L matrix of unobserved heterogeneity.

Then z

it

= q

it

so, provided the idiosyncratic movements {q

it

; t = 1; . . . ; T] are uncorrelated with g

i

(t)a

reasonable assumptionAssumption 6.1 holds. Note that H

i

is allowed to be arbitrarily correlated with the

unknown trend functions g

i

(t). This example makes the point that if w

t

adequately captures the trends in the

exogenous variables then we need not have g

i

(t) correctly modeled.

We can also apply Proposition 6.1 to a class of models with only one source of heterogeneity but where the

effect of the heterogeneity on y

it

changes over time in an unrestricted manner. Specically, the model is

y

it

= Z

t

c

i

x

it

b

i

u

it

; t = 1; . . . ; T, (6.5)

so that g

i

(t) = Z

t

c

i

for unknown constants Z

t

(sometimes called the factor loads). This model applies to wage

equations when the return to unobserved ability, c

i

, varies over time, or to a production function when

unobserved managerial skill has time-varying effects on rm output. Ahn et al. (2001) (ALS) study (6.5) with

b

i

= b and with strictly exogenous regressors (z

it

= x

it

). With strictly exogenous covariates, we can draw

conclusions for estimating b when b

i

varies across i and the trend function used in estimation differs from Z

t

c

i

.

Condition (6.3) becomes

Cov( x

it

; c

i

) = 0; t = 1; 2; . . . ; T, (6.6)

which is a pretty weak assumption concerning the relationship between the detrended regressors and the time-

constant heterogeneity in the equation of interest, (6.5). In other words, consistency of the (generalized) FE

estimator for b = E(b

i

) is ensured when the explanatory variables are strictly exogenous (with respect to

{u

it

: t = 1; . . . ; T]), E(b

i

[ x

it

) = E(b

i

) for all t, (6.6) holds, and we include a full set of time period dummies.

Importantly, these assumptions do not restrict the second moment matrix of u

i

, either conditionally or

unconditionally. Proposition 6.1 allows us to conclude the FE-IV estimator is consistent in some applications

where some elements of x

it

are correlated with u

it

.

In some cases, interest lies in estimating the Z

t

in model (6.5) (where a normalization, such as Z

1

= 1, is

needed for identication). For the case of strictly exogenous covariates, ALS study estimators of b and the Z

t

when b

i

= b. They propose conditional least squares, which is consistent only when u

i

has a scalar variance

matrix, as well as GMM procedures that allow the second moments of u

i

to be unspecied. Our analysis here

shows that an initial consistent estimator of b is available under the extra assumption (6.6). (The usual FE

estimator is neither more nor less robust than ALSs conditional least squares estimator: Assumption (6.6) is

very different from second moment assumptions on u

i

). If one then imposes E(u

i

[x

i

; c

i

) = 0 and

Var(u

i

[x

i

; c

i

) = s

2

u

I

T

, the residuals ^ v

it

= y

it

x

it

^

b can be used to estimate s

2

c

; s

2

u

, and the Z

t

by nding the

variance matrix of v

i

, where v

it

= Z

t

c

i

u

it

, as a function of (s

2

c

; s

2

u

; Z

2

; . . . ; Z

T

). Alternatively, we can drop the

second moment assumption and use two-step GMM estimators to simplify estimation of the Z

t

after

preliminary estimation of b. As our goal here is not in estimating theunit-specic trend function, we do not

pursue these possibilities in detail.

Sometimes, one wants to estimate the heterogeneity in the trend functions g

i

(t). While we have nothing

specic to say about this problemit would require a large T as well as large N frameworkProposition

6.1 might be helpful in future work. In particular, again take the case where b

i

= b for all i. Then we can rst

obtain a consistent estimator of b using FE-IV (or just FE when the x

it

are strictly exogenous), and again

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 549

obtain the residuals, y

it

x

it

^

b. We can use time series of residuals to estimate g

i

(t) for each unit i. Any

discussion of consistency requires T o. In conducting inference on the g

i

(t) we might be able to ignore the

estimation error in

^

b if we allow N to grow fast enough relative to T.

7. Unbalanced panels and a test for selection bias

Unbalanced panel data sets are common, and it is useful to know when applying FE-IV to an unbalanced

panel nevertheless results in consistent estimation of b = E(b

i

). We extend the framework in Semykina and

Wooldridge(2005) to allow for general random trends as well as random slope coefcients in the context of

model (2.1). In particular, unlike in the previous section, we assume that we have the individual-specic trends

correctly specied. (Allowing for a misspecied trend means we would have to assume selection does not

depend on unobserved heterogeneity). Unlike in Semykina and Wooldridge(2005), we do not consider testing

or correcting for selection that depends on idiosyncratic factors.

For each random draw i from the cross-section, let s

i

= (s

i1

; . . . ; s

iT

) be the vector of selection indicators

such that s

it

= 1 if we use time period t for unit i. Now, the individual-specic detrending can be done only

using the time periods with s

it

= 1. Let T

i

=

P

T

t=1

s

it

be the number of observed time periods for unit i. Then,

assuming that T

i

4J, we obtain y

it

as

y

it

= y

it

X

T

r=1

s

ir

w

/

r

w

r

!

1

X

T

r=1

s

ir

w

/

r

y

ir

!

. (7.1)

Of course, we observe y

it

only when s

it

= 1. With similar denitions for x

it

and z

it

, we can write the FE-2SLS

estimator on the unbalanced panel as in Semykina and Wooldridge(2005):

^

b = N

1

X

N

i=1

X

T

t=1

s

it

x

/

it

z

it

!

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

z

it

!

1

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

x

it

!

2

4

3

5

1

N

1

X

N

i=1

X

T

t=1

s

it

x

/

it

z

it

!

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

z

it

!

1

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

y

it

!

= b N

1

X

N

i=1

X

T

t=1

s

it

x

/

it

z

it

!

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

z

it

!

1

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

x

it

!

2

4

3

5

1

N

1

X

N

i=1

X

T

t=1

s

it

x

/

it

z

it

!

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

z

it

!

1

N

1

X

N

i=1

X

T

t=1

s

it

z

/

it

v

it

!

, (7:2)

where v

it

= x

it

d

i

u

it

. From Semykina and Wooldridge(2005), it sufces that E(s

it

z

/

it

v

it

) = 0 for all t, along

with a rank condition on the selected sample. The rst assumption we impose is strict exogeneity of selection

conditional on (Z

i

; a

i

; b

i

).

Assumption 7.1. With the previous denitions,

E(u

it

[z

i

; s

i

) = 0; t = 1; . . . ; T. (7.3)

Assumption 7.1 formalizes the notion that selection is not correlated with the idiosyncratic part of the error

term. Eq. (7.3) allows unrestricted correlation between s

i

and (a

i

; b

i

), as well as with the instruments, z

i

.

However, the next assumption rules out systematic correlation between the random slopes and selection:

Assumption 7.2. b

i

is mean independent of all the detrended z

it

and the selection indicators, that is,

E(b

i

[ z

it

; s

it

) = E(b

i

) = b; t = 1; . . . ; T. (7.4)

Similarly, we add the selection indicator to Assumption 3.3 as well as to the rank condition,

Assumption 3.4:

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 550

Assumption 7.3. For j = 1; . . . ; K,

Cov( x

itj

; b

ij

[ z

it

; s

it

) = Cov( x

itj

; b

ij

); t = 1; . . . ; T. (7.5)

Assumption 7.4. (i) rank(

P

T

t=1

E(s

it

z

/

it

x

it

)) = K.

(ii) rank(

P

T

t=1

E(s

it

z

/

it

z

it

)) = L.

Proposition 7.1. Under Assumption 7.17.4, the FE-IV estimator applied to the selected sample is consistent

for b, provided a full set of time period dummies is included.

The proof of Proposition 7.1 is a straightforward modication of Proposition 3.1, once we add selection

indicators, as in Eq. (7.2). With individual-specic slopes, the conditions for consistent estimation by xed

effects methods under sample selection are not as straightforward as the case b

i

= b. With common slopes we

can get away with Assumptions 6.1.1 and 7.4 while allowing selection to depend in an unrestricted way on a

i

.

Consequently, it is useful to have a simple method of testing for selection bias in unbalanced panels when we

think the coefcients might vary by individual.

We focus on an alternative to Assumption 7.2. Because z

it

depends on (z

i1

; . . . ; z

iT

) and (s

i1

; . . . ; s

iT

),

sufcient for (7.4) is

E(b

i

[z

i1

; . . . ; z

iT

; s

i1

; . . . ; s

iT

) = E(b

i

) = b; t = 1; . . . ; T, (7.6)

and, as a practical matter, there may not be much difference between (7.6) and (7.4). Eq. (7.6) suggests an

alternative to the null of no selection:

E(b

i

[z

i1

; . . . ; z

iT

; s

i1

; . . . ; s

iT

) = E(b

i

[s

i1

; . . . ; s

iT

) = E(b

i

[T

i

), (7.7)

where the rst equality implies that we are looking specically for correlation between b

i

and selection and

the second equality means that b

i

(which does not vary over time) is correlated only with the total number

of time periods available for unit ian assumption very similar to the Mundlak-type assumption

E(b

i

[z

i1

; . . . ; z

iT

) = E(b

i

[ z

i

).

The alternative (7.7) is convenient for obtaining a specication test because E(b

i

[T

i

) takes on at most T

different values. With dim(w

t

) = J, we can only use the cross-section observations with T

i

XJ 1. Therefore,

let d

i;J1

= 1[T

i

= J 1]; . . . ; d

i;T1

= 1[T

i

= T 1] be dummy variables for the possible values taken on by

T

i

, with T

i

= T taken as the base group. Then we augment the original equation by including interactions

between these dummy variables and the explanatory variables:

y

it

w

t

a

i

x

it

b d

i;J1

x

it

d

1

d

i;J2

x

it

d

2

d

i;T1

x

it

d

TJ1

v

it

. (7.8)

We remove a

i

by regressing y

it

and each element of x

it

on w

t

using the selected sample (for each i). The

detrended equation is

y

it

x

it

b d

i;J1

x

it

d

1

d

i;J2

x

it

d

2

d

i;T1

x

it

d

TJ1

v

it

(7.9)

and we estimate this equation by FE-2SLS using instruments ( z

it

; d

i;J1

z

it

; d

i;J2

z

it

; . . . ; d

i;T1

z

it

). The null

hypothesis of no selection bias is H

0

: d

1

= d

2

= = d

TJ1

= 0. A fully robust Wald statistic is appropriate.

Naturally, one may be selective about which elements of x

it

are thought to have time-varying coefcients, and

only those (detrended) elements would be used in constructing the interactions in (7.9).

This simple test is attractive because it tests the most pertinent issue: Do the estimated slope coefcients

differ signicantly over the subpanels that use different numbers of time periods? If they do, then not only is

there evidence that the slopes vary across individual, but that selection is correlated with those slopes and

therefore causes inconsistency in the FE-2SLS estimator on the unbalanced panel.

8. Conclusion

This paper suggests a set of conditions sufcient for applying the standard IV approach to the estimation of

PAEs in a CRC panel data model with continuous endogenous explanatory variables. Assumptions 3.13.4

ensure consistent FE-IV estimation of the population averaged slopes, b, even ignoring individual-specic

slopes. Monte Carlo simulations suggest the proposed FE-IV estimator of the PAEs performs better than

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 551

other estimators in nite samples for the case of continuous endogenous explanatory variables, provided a full

set of time period dummies is included in the model.

A natural direction for future work is to relax homoskedasticity of E( x

it

d

i

[ z

it

); Card (2001) showed how the

analogous assumption can fail in a cross-sectional environment. Recently, Murtazashvili (2006) shows how

this assumption can be relaxed using a control function approach by putting restrictions on the reduced forms

of the endogeneous elements of x

it

restrictions that can be met for continuous variablesand by modeling

the conditional covariances.

Acknowledgment

Three anonymous referees provided very helpful comments, as did participants at the Michigan State

University econometrics workshop.

References

Angrist, J.D., 1991. Instrumental variables estimation of average treatment effects in econometrics and epidemiology. National Bureau of

Economics Research Technical Working Paper Number 115.

Ahn, S.C., Lee, Y.H., Schmidt, P., 2001. GMM estimation of linear panel data models with time-varying individual effects. Journal of

Econometrics 101, 219255.

Card, D., 2001. Estimating the return to schooling: progress on some persistent econometric problems. Econometrica 52, 11991218.

Heckman, J.J., 1997. Instrumental variables: a study of implicit behavioral assumptions used in making program evaluations. Journal of

Human Resources 32, 441462.

Heckman, J.J., Vytlacil, E., 2005. Structural equations, treatment effects, and econometric policy evaluation. Econometrica 73, 669738.

Imbens, G., Angrist, J.D., 1994. Identication and estimation of local average treatment effects. Econometrica 62, 467476.

Murtazashvili, I., 2006. A control function approach to estimation of correlated random coefcient panel data models. Mimeo, Michigan

State University Department of Economics.

Semykina, A., Wooldridge, J.M., 2005. Estimating panel data models in the presence of endogeneity and selection: theory and application.

Mimeo, Michigan State University Department of Economics.

Wooldridge, J.M., 1997. On two stage least squares estimation of the average treatment effect in a random coefcient model. Economics

Letters 56, 129133.

Wooldridge, J.M., 2002. Econometric Analysis of Cross Section and Panel Data. MIT Press, Cambridge, MA.

Wooldridge, J.M., 2003. Further results on instrumental variables estimation of the average treatment effect in the correlated random

coefcient model. Econometric Theory 79, 185191.

Wooldridge, J.M., 2005a. Fixed effects and related estimators in correlated random coefcient and treatment effect panel data models.

Review of Economics and Statistics 87, 385390.

Wooldridge, J.M., 2005b. Unobserved heterogeneity and estimation of average partial effects. In: Andrews, D.W.K., Stock, J.H. (Eds.),

Identication and Inference for Econometric Models: A Festschrift in Honor of Thomas J. Rothenberg. Cambridge University Press,

Cambridge, pp. 2755.

ARTICLE IN PRESS

I. Murtazashvili, J.M. Wooldridge / Journal of Econometrics 142 (2008) 539552 552

Das könnte Ihnen auch gefallen

- Theoretical Criminology 2010 Hirschfield 155 82Dokument28 SeitenTheoretical Criminology 2010 Hirschfield 155 82Aziz AdamNoch keine Bewertungen

- Citizenship in GermanyDokument15 SeitenCitizenship in GermanyAziz AdamNoch keine Bewertungen

- Guidelines For A Successful Marriage Based On The Life and Teachings of Prophet MuhammadDokument53 SeitenGuidelines For A Successful Marriage Based On The Life and Teachings of Prophet MuhammadMeaad Al-AwwadNoch keine Bewertungen

- Public Discourse of Labor Migration To Russia - A Potential Threat To Russia - S Soft SecurityDokument21 SeitenPublic Discourse of Labor Migration To Russia - A Potential Threat To Russia - S Soft SecurityAziz AdamNoch keine Bewertungen

- First To Read - Prejudice in The Former Soviet UnionDokument17 SeitenFirst To Read - Prejudice in The Former Soviet UnionAziz AdamNoch keine Bewertungen

- Critisizm of Shanin's WorkDokument15 SeitenCritisizm of Shanin's WorkAziz AdamNoch keine Bewertungen

- Citizenship ArticleDokument32 SeitenCitizenship ArticleAziz AdamNoch keine Bewertungen

- American Sociological AssociationDokument27 SeitenAmerican Sociological AssociationAziz AdamNoch keine Bewertungen

- State-Propagated Narratives About A National Defender in Central Asian StatesDokument17 SeitenState-Propagated Narratives About A National Defender in Central Asian StatesAziz AdamNoch keine Bewertungen

- Identity Theory and Social Identity Theory: Peter J. Burke Jan E. Stets Washington State UniversityDokument41 SeitenIdentity Theory and Social Identity Theory: Peter J. Burke Jan E. Stets Washington State UniversityAbieber Tanvir100% (1)

- Russian NationalismDokument2 SeitenRussian NationalismAziz AdamNoch keine Bewertungen

- Prejudice As Group PositionDokument28 SeitenPrejudice As Group PositionAziz AdamNoch keine Bewertungen

- Social Perspective of Identity FormationDokument12 SeitenSocial Perspective of Identity FormationAziz AdamNoch keine Bewertungen

- 2782464Dokument46 Seiten2782464Aziz AdamNoch keine Bewertungen

- Maximum Likelihood Estimation of Heckman's Sample Selection ModelDokument16 SeitenMaximum Likelihood Estimation of Heckman's Sample Selection ModelAziz AdamNoch keine Bewertungen

- Prejudice As Group PositionDokument28 SeitenPrejudice As Group PositionAziz AdamNoch keine Bewertungen

- Docile BodiesDokument8 SeitenDocile BodiesAziz Adam0% (1)

- Governmentality and Human RightsDokument24 SeitenGovernmentality and Human RightsAziz AdamNoch keine Bewertungen

- Paper EngineeringDokument24 SeitenPaper EngineeringCesar Augusto Hilarióɳ Colmeɳares84% (19)

- RussiaDokument16 SeitenRussiaAziz AdamNoch keine Bewertungen

- Nick Haslam On DehumanizationDokument13 SeitenNick Haslam On Dehumanizationijuswantthatpaper100% (2)

- Social Connection Enables Dehumanization - ImportantDokument7 SeitenSocial Connection Enables Dehumanization - ImportantAziz AdamNoch keine Bewertungen

- Migration, Cultural Bereavement and Cultural IdentityDokument7 SeitenMigration, Cultural Bereavement and Cultural IdentityAziz AdamNoch keine Bewertungen

- A Mid-Level Representation For Capturing Dominant Tempo and Pulse Information in Music RecordingsDokument6 SeitenA Mid-Level Representation For Capturing Dominant Tempo and Pulse Information in Music RecordingsAziz AdamNoch keine Bewertungen

- Balibar P. 37-68 Racism and NationalismDokument16 SeitenBalibar P. 37-68 Racism and NationalismAziz AdamNoch keine Bewertungen

- Enforcement PillarsDokument0 SeitenEnforcement PillarsAziz AdamNoch keine Bewertungen

- Migrant and Ethnic Minority Youths in Europe Challenges For IntegrationDokument27 SeitenMigrant and Ethnic Minority Youths in Europe Challenges For Integrationapi-26075761Noch keine Bewertungen

- MigrationguidestudentDokument5 SeitenMigrationguidestudentapi-214727071Noch keine Bewertungen

- World Migration Report 2013Dokument220 SeitenWorld Migration Report 2013sergiu.ssNoch keine Bewertungen

- 26 People On The Move Reducing The Impacts of Human Migration On BiodiversityDokument104 Seiten26 People On The Move Reducing The Impacts of Human Migration On BiodiversityAziz AdamNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Gat 1-Communication SystemsDokument110 SeitenGat 1-Communication SystemssauravNoch keine Bewertungen

- 04 Evolution StrategiesDokument30 Seiten04 Evolution StrategiesAditya Gururaja Rao KarnamNoch keine Bewertungen

- Risk and ReturnDokument6 SeitenRisk and ReturnMira EdoraNoch keine Bewertungen

- Introduction To Longitudinal Analysis Using SPSS - 2012Dokument66 SeitenIntroduction To Longitudinal Analysis Using SPSS - 2012EcaterinaGanencoNoch keine Bewertungen

- Econometrics - Lecture 1 Review of Basic Probability and StatisticsDokument33 SeitenEconometrics - Lecture 1 Review of Basic Probability and StatisticsMaksim NelepaNoch keine Bewertungen