Beruflich Dokumente

Kultur Dokumente

BSE Company Research Report - Saurashtra Cement LTD

Hochgeladen von

didwaniasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BSE Company Research Report - Saurashtra Cement LTD

Hochgeladen von

didwaniasCopyright:

Verfügbare Formate

Saurashtra Cement Limited| BSE Scrip Code: 502175

Cement & Cement Products September 17, 2012

Equity Statistics Current Market Price Rs. 20.0 52 Week High / Low Rs. 23.55/8.4 Market Capitalisation Rs. crores 102.4 Free Float Rs. crores 40.0 Dividend Yield % 5.0 0.4 One Year Regression Beta Times BSE Volumes Trend - Average = 76.16 Thousand

600 400 200 0

in '000s

Business Summary Saurashtra Cement Limited (SCL) is into manufacturing of cement and cement products like portland pozzolana cement (PPC), ordinary portland cement (OPC) and sulphate resisting portland cement (SRPC) at its manufacturing facilities located at Ranavav in Porbandar (Gujarat). The range of application for cement products is primarily in real estate, infrastructure and Industrial construction. SCL is ISO 9001:2008, EMS ISO 14001:2004 and OHSAS 18001:2007 certified. SCL is exporting its products in Sri Lankan and African markets as the products have already been approved by Sri Lankan standard, South African Business Standards besides Bureau of Indian Standard. In FY12, SCL reported net sales of Rs. 438.5 crore and incurred a net loss of Rs.20.5 crore. The Indian market continues to be the key market contributing to around 82% of net sales in FY12. The company is looking forward to market its products in new markets like Tanzania, Sudan and other East African countries etc, by offering competitive prices and better quality of goods and services. SCL sells its product under the brand name "Hathi Cement". SCL has upgraded its technology by installing a Medium Voltage VFD for power saving, replacement of old DC motors with AC motors and control desk of crusher with SCADA. SCL is currently trading at a trailing EV/EBITDA multiple of 5 times and 0.23 times FY12 net sales.

Relative Returns

150 125 100 75 50

Sensex

SCL

Returns (%) Absolute Relative to Sensex

100%

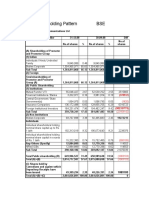

1M 3M 6M 1Yr 1% 21% 27% 30% 2% 8% 4% 17% Shareholding Pattern

50% 0% Sep '11 Dec '11 Promoter DII Mar '12 FII Jun '12 Others

Board of Directors Person Role M.N. Mehta NED & Chairman Jay M. Mehta ED & Vice Chairman Mr. M. S. Gilotra MD Hemang D. Mehta NED M. N. Rao NED S. V. S. Raghavan NED B. P. Deshmukh NED K. N. Bhandari NED Jayant N. Godbole NED Hemnabh Khatau NED Bimal Thakkar NED V. R. Mohnot Director (Finance) & CS Source: AR and CARE Research Note: MD: Managing Director, ED: Executive Director, NED: Non Executive Director, CS: Company Secretary

Source: BSE, Capitaline and CARE Research

Initiative of the BSE Investors Protection Fund

Background Saurashtra Cement Limited (SCL) is the flagship company of the Mehta Group, incorporated in 1956. SCL is engaged into manufacturing of cement and cement products like portland pozzolana cement (PPC), ordinary portland cement (OPC) and sulphate resisting portland cement (SRPC). SCL sells its product under the brand name "Hathi Cement". SCL has fully owned six subsidiary companies named Agrima Consultants International Limited, Pranay Holdings Limited, Prachit Holdings Limited, Ria Holdings Limited, Reeti Investments Limited and Concorde Cement Private Limited. SCL has plants at Ranavav in Porbandar (Gujarat), employing 482 people. Business overview SCL derives its revenue from one segment i.e. manufacturing of cement. Geographically, the Indian market continues to be the key market contributing around 82% of net sales in FY12. Sales from the Indian market grew by around 1% in FY12 y-oy, while the sales from overseas market exhibited a growth of around 87% y-o-y, albeit on a smaller base. Power & fuel is the major cost of cement production (formed around 40% of the total cost of sales in FY12) for SCL in the manufacturing of cement. Strengths and growth drivers Rich experience of the promoters supported by the Mehta group coupled with established brand image. Locational advantages as its presence in proximity to the Porbandar and Veraval/Okha ports, rail network and is close to highways. Thus, SCL has competitive access to the domestic markets as well as export markets in the Africa, Middle East countries, Sri Lanka etc. by the economical sea route. SCL has upgraded its technology by installing a Medium Voltage VFD for power saving, replacement of old DC motors with AC motors and control desk of crusher with SCADA. SCL has technical collaboration with many companies located in US, Europe and Austria. Risk and concerns Overcapacity of cement versus the demand coupled with the continued fragmentation of the industry results in the cyclical fluctuation in the profitability of cement business. Exposure to volatility in prices of power & fuel, freight cost and high rates of taxation can have negative effect on the profitability of SCL. A draft scheme of rehabilitation of the sick company has been circulated for comments and suggestions in Q4FY12. The scheme provides for restructuring of debts and reliefs and concessions from the Government of Gujarat in respect of waiver of interests and penal interests. Till the sanction of the rehabilitation scheme, the short tenure of a large part of debt and SCLs operations in these conditions expose the company to a default in servicing of its debts. Future strategy and expansion plans SCL has upgraded its existing mechanical packer, fly ash storage, handling & dosing system and cement mills SCADA system. The company plans to take action in R&D by using VFD in fan applications, improvement in efficiency of fans by reengineering and upgradation of PLC control system of main plant. The company is looking forward to market its products in new markets like Tanzania, Sudan and other East African countries etc, by offering competitive prices and better quality of goods and services. Industry outlook The Indian cement industry recorded a dismal growth of 6.5% in FY12 on account of slowdown in the real estate sector and delay in takeoff of the various infrastructural projects which owing to the spiralling cost of capital hit the cement industry. Long-term cement demand in the country is expected to remain stable driven by increased focus of the government on promotion of low-cost affordable housing and infrastructure development. The industry has been grappling with cost pressure due to rise in raw material cost and freight charges. CARE Research has estimated that the domestic Cement demand is expected to grow at a CAGR of 8.3% during the period FY 12-15. Cement demand would largely be driven by the low-cost housing segment in rural & semi-urban regions and governments focus on infrastructure development in the country. The countrys per-capita consumption of cement is abysmally low as compared to the levels in other countries which indicate that the long-term growth potential for the industry is intact. Also, cement as such does not have any direct substitute. Almost 55-60% of the domestic cement demand is derived from the real estate sector. So, further rise in the interest rates and slowdown in the economy can hamper the offtake of cement. Some of essential inputs for cement manufacturing are controlled by government like royalty on limestone, power tariffs, allocation of coal etc. Cement is an essential input for the infrastructure development in the country consequently; government provides enough support to the cement industry during the economic down-cycles like providing excise duty reduction, measures to boost housing demand etc. Government does not directly control cement prices. However, it can put an anchor on rising cement prices by tinkering the duty structure. SCL is well-placed in the industry by virtue of its long track record and established brand.

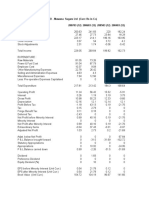

Initiative of the BSE Investors Protection Fund

Peer comparison Year ended March 31, 2012 Income statement (Rs. crore) SCL JLCL MCL GSCL Total income 442.7 1,780.9 618.5 444.2 Net sales 438.5 1,718.1 630.8 439.0 EBITDA 39.5 288.7 103.5 15.7 Ordinary PAT (20.5) 108.8 56.0 5.5 Adjusted PAT (20.7) 108.8 56.5 5.6 Per share data (Rs.) Adjusted BVPS NM 99.9 160.1 7.3 Diluted EPS 8.6 20.0 0.4 Growth (Y-o-Y) (%) Growth in total income 8.3 28.1 19.6 21.5 Growth in net sales 12.1 29.9 27.1 25.3 Growth in EBITDA 117.6 51.3 63.2 NM Growth in adjusted PAT NM 84.0 49.6 NM Growth in EPS* NM 85.3 49.7 NM Profitability ratio (%) EBITDA margin 9.0 16.8 16.4 3.6 Adjusted PAT margin NM 6.1 9.1 1.3 Valuation ratios (Times) Price/EPS (P/E) NM 11.5 6.9 22.3 Price/Book value (P/BV) NM 1.0 0.9 1.2 Enterprise value (EV)/EBITDA 5.0 6.9 3.4 6.0 Source: BSE, Capitaline and CARE Research Note: JLCL: JK Lakshmi Cement Ltd.,; MCL: Mangalam Cement Limited; GSCL: Gujarat Sidhee Cement Limited NM: Non Meaningful Quarterly financials Income statement (Rs. crore) Total income Net sales EBITDA Ordinary PAT Adjusted PAT Growth (Q-o-Q) (%) Growth in net sales Profitability ratio (%) EBITDA margin Adjusted PAT margin Q1FY13 303.1 141.6 54.4 148.4 16.6 12.6 38.4 5.5 Quarter ended June 30, 2012 Q4FY12 Q3FY12 Q2FY12 128.6 96.6 96.5 125.8 95.5 96.5 43.3 11.7 15.5 17.3 (15.3) (22.0) 17.3 (15.3) (22.0) 31.8 34.4 13.4 (1.1) 12.3 NM (20.4) 16.0 NM 32.5 0.8 Q1FY12 122.1 121.3 39.4 1.0 1.0

Initiative of the BSE Investors Protection Fund

Financial analysis In FY12, SCL reported net sales of Rs.438.5 crore up 12.1% y-o-y. Total income witnessed a growth of 8.3% during the same period. SCL reported EBITDA margins of 9% in FY12. However SCL incurred a net loss of 4.7% on account of high interest and depreciation cost in the same year. SCL reported a negative networth of Rs.38.4 crore as on March 31, 2012 owing to accumulated losses for the last five years. Interest coverage ratio also remained low at 0.4 times in FY12. The overall liquidity position of SCL remained stressed marked by current ratio of 0.3 times in the last two years. The company has not paid any dividend for the last five years. Annual financial statistics Income statement (Rs. crore) Total income Net sales EBITDA Depreciation and amortisation EBIT Interest PBT Ordinary PAT Adjusted PAT Balance sheet (Rs. crore) Adjusted networth Total debt Cash and bank Investments Net fixed assets (incl. CWIP) Net current assets (excl. cash, cash equivalents) Per share data (Rs.) Adjusted BVPS Diluted EPS* DPS Growth (Y-o-Y) (%) Growth in total income Growth in net sales Growth in EBITDA Growth in adjusted PAT Growth in EPS* Key financial ratio EBITDA margin (%) Adjusted PAT margin (%) RoCE (%) RoE (%) Gross debt - equity (times) Net debt - equity (times) Interest coverage (times) Current ratio (times) Inventory days Receivable days Source: BSE, Capitaline and CARE Research Financial Year (FY) refers to period from April, 1 to March, 31 NM: Non Meaningful FY07 12m 448.1 410.3 33.3 18.1 15.2 26.5 24.6 22.2 31.6 19.7 369.2 138.8 15.8 266.6 (81.4) 6.1 5.4 8.1 7.1 18.8 11.7 0.6 1.3 FY08 18m 748.0 712.7 5.1 27.3 (22.2) 59.0 (53.7) (47.7) (20.8) 6.8 337.3 17.1 8.0 350.4 (87.2) 2.1 66.9 73.7 (84.6) NM NM 0.7 NM NM NM 49.4 46.9 NM 0.6 27.5 10.7 FY10 15m 591.8 574.4 87.4 29.9 57.5 55.8 32.0 23.2 18.0 38.9 258.5 17.6 15.0 337.8 (120.4) 12.0 4.3 (20.9) (19.4) 1,611.0 NM NM 15.2 3.0 18.1 101.4 6.6 6.2 1.0 0.5 37.7 10.8 FY11 12m 408.8 391.1 18.1 24.0 (5.8) 42.8 (42.1) (57.1) (57.0) (17.9) 121.3 8.1 15.0 311.4 (268.2) NM (30.9) (31.9) (79.3) NM NM 4.6 NM NM NM NM NM NM 0.3 56.2 20.3 FY12 12m 442.7 438.5 39.5 22.0 17.4 44.7 (20.5) (20.5) (20.7) (38.4) 102.7 5.9 15.0 293.1 (285.9) NM 8.3 12.1 117.6 NM NM 9.0 NM 27.0 NM NM NM 0.4 0.3 62.1 18.0

Initiative of the BSE Investors Protection Fund

DISCLOSURES Each member of the team involved in the preparation of this grading report, hereby affirms that there exists no conflict of interest that can bias the grading recommendation of the company. This report has been sponsored by the BSE Investors Protection Fund.

DISCLAIMER CARE Research, a division of Credit Analysis & REsearch Limited [CARE] has taken utmost care to ensure accuracy and objectivity while developing this report based on information available in public domain or from sources considered reliable. However, neither the accuracy nor completeness of information contained in this report is guaranteed. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report can be construed as either investment or any other advice or any solicitation, whatsoever. The subscriber / user assumes the entire risk of any use made of this report or data herein. CARE specifically states that it or any of its divisions or employees do not have any financial liabilities whatsoever to the subscribers / users of this report. This report is for personal information only of the authorised recipient in India only. This report or part of it should not be reproduced or redistributed or communicated directly or indirectly in any form to any other person or published or copied for any purpose.

PUBLISHED BY CARE Research is an independent research division of CARE Ratings, a full-service rating company. CARE Research is involved in preparing detailed industry research reports with 5-year demand and 2-year profitability outlook on the industry besides providing comprehensive trend analysis and the current state of the industry. CARE Research also offers research that is customized to client requirements. Credit Analysis & REsearch Ltd. (CARE) is a full service rating company that offers a wide range of rating and grading services across sectors. CARE has an unparallel depth of expertise. CARE Ratings methodologies are in l ine with the best international practices. Head Office: 4th Floor Godrej Coliseum, Off Eastern Express Highway, Somaiya Hospital Road, Sion East, Mumbai 400 022.|Tel: +91-22-67543456|Fax: +91-22-67543457|www.careratings.com| Regional Offices: New Delhi| Kolkata| Ahmedabad| Bangalore| Hyderabad| Chennai| Pune|

Published on behalf of The Stock Exchange Investors' Protection Fund First Floor, P J Towers, Dalal Street, Mumbai. Tel: 22721233/34| www.bseindia.com

www.careratings.com

Das könnte Ihnen auch gefallen

- Fluidomat BSE CAREDokument5 SeitenFluidomat BSE CAREayushidgr8Noch keine Bewertungen

- Fauji Cement Company Limited Annual-Report-2012Dokument63 SeitenFauji Cement Company Limited Annual-Report-2012Saleem Khan0% (1)

- Group1 - Balkrishna Industries TyresDokument6 SeitenGroup1 - Balkrishna Industries TyresparthkosadaNoch keine Bewertungen

- Grasim Q1FY05 Results PresentationDokument46 SeitenGrasim Q1FY05 Results PresentationDebalina BanerjeeNoch keine Bewertungen

- Graphite India Ltd2 110512 RSTDokument13 SeitenGraphite India Ltd2 110512 RSTVarun JainNoch keine Bewertungen

- Performance Highlights: Company Update - AutomobileDokument13 SeitenPerformance Highlights: Company Update - AutomobileZacharia VincentNoch keine Bewertungen

- Bajaj Auto: Uncertainty Priced In, Upgrade To BUYDokument8 SeitenBajaj Auto: Uncertainty Priced In, Upgrade To BUYvipin51Noch keine Bewertungen

- Madras Cements Result UpdatedDokument11 SeitenMadras Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Madras Cements: Performance HighlightsDokument12 SeitenMadras Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hindustan Construction Company Financial Analysis 2010-2014Dokument21 SeitenHindustan Construction Company Financial Analysis 2010-2014Harsh MohapatraNoch keine Bewertungen

- Market Outlook 11th August 2011Dokument4 SeitenMarket Outlook 11th August 2011Angel BrokingNoch keine Bewertungen

- Fie M Industries LimitedDokument4 SeitenFie M Industries LimitedDavuluri OmprakashNoch keine Bewertungen

- Market Outlook 18th January 2012Dokument7 SeitenMarket Outlook 18th January 2012Angel BrokingNoch keine Bewertungen

- Aditya Birla Nuvo: Consolidating Growth BusinessesDokument6 SeitenAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikNoch keine Bewertungen

- Top Picks Sep 2012Dokument15 SeitenTop Picks Sep 2012kulvir singNoch keine Bewertungen

- Ultratech: Performance HighlightsDokument10 SeitenUltratech: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Market Outlook 8th February 2012Dokument9 SeitenMarket Outlook 8th February 2012Angel BrokingNoch keine Bewertungen

- India Cements Result UpdatedDokument10 SeitenIndia Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Market Outlook 21st July 2011Dokument6 SeitenMarket Outlook 21st July 2011Angel BrokingNoch keine Bewertungen

- NCL Industries (NCLIND: Poised For GrowthDokument5 SeitenNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyNoch keine Bewertungen

- Market Outlook 10th August 2011Dokument5 SeitenMarket Outlook 10th August 2011Angel BrokingNoch keine Bewertungen

- India Cements: Performance HighlightsDokument12 SeitenIndia Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ProfitabilityDokument3 SeitenProfitabilityNaheed AdeelNoch keine Bewertungen

- Exide Industries: Performance HighlightsDokument12 SeitenExide Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Directors Report 12 ACC CementsDokument13 SeitenDirectors Report 12 ACC Cements9987303726Noch keine Bewertungen

- Siyaram Silk Mills Result UpdatedDokument9 SeitenSiyaram Silk Mills Result UpdatedAngel BrokingNoch keine Bewertungen

- ProfitabilityDokument9 SeitenProfitabilityNaheed AdeelNoch keine Bewertungen

- Balkrishna Industries: Growth On Track, Not RatedDokument4 SeitenBalkrishna Industries: Growth On Track, Not Ratedarunvenk89Noch keine Bewertungen

- Sadbhav Engineering: Performance HighlightsDokument13 SeitenSadbhav Engineering: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Amara Raja Batteries: Performance HighlightsDokument11 SeitenAmara Raja Batteries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sintex Industries: Topline Beats, Margins in Line - BuyDokument6 SeitenSintex Industries: Topline Beats, Margins in Line - Buyred cornerNoch keine Bewertungen

- Ceat Result UpdatedDokument11 SeitenCeat Result UpdatedAngel BrokingNoch keine Bewertungen

- India Cements: Performance HighlightsDokument10 SeitenIndia Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Vesuvius India: Performance HighlightsDokument12 SeitenVesuvius India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements: Performance HighlightsDokument10 SeitenMadras Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Tech Mahindra: Performance HighlightsDokument11 SeitenTech Mahindra: Performance HighlightsAngel BrokingNoch keine Bewertungen

- TVS Srichakra Result UpdatedDokument16 SeitenTVS Srichakra Result UpdatedAngel Broking0% (1)

- Sadbhav Engineering Result UpdatedDokument13 SeitenSadbhav Engineering Result UpdatedAngel BrokingNoch keine Bewertungen

- Subros Result UpdatedDokument10 SeitenSubros Result UpdatedAngel BrokingNoch keine Bewertungen

- India Cements Result UpdatedDokument12 SeitenIndia Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Dokument5 SeitenOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerNoch keine Bewertungen

- Rallis India: Performance HighlightsDokument10 SeitenRallis India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements Result UpdatedDokument11 SeitenMadras Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- ACC Result UpdatedDokument10 SeitenACC Result UpdatedAngel BrokingNoch keine Bewertungen

- Jyoti Structures: Performance HighlightsDokument12 SeitenJyoti Structures: Performance HighlightsAngel BrokingNoch keine Bewertungen

- FAG Bearings Result UpdatedDokument10 SeitenFAG Bearings Result UpdatedAngel BrokingNoch keine Bewertungen

- Sharekhan Top Picks: October 01, 2011Dokument7 SeitenSharekhan Top Picks: October 01, 2011harsha_iitmNoch keine Bewertungen

- IVRCL Infrastructure: Performance HighlightsDokument12 SeitenIVRCL Infrastructure: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Market Outlook 250912Dokument3 SeitenMarket Outlook 250912Angel BrokingNoch keine Bewertungen

- Edelweiss 5 Stocks 2016Dokument14 SeitenEdelweiss 5 Stocks 2016Anonymous W7lVR9qs25Noch keine Bewertungen

- Equity Note - Padma Oil Company LTDDokument2 SeitenEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNoch keine Bewertungen

- Tech Mahindra: Performance HighlightsDokument11 SeitenTech Mahindra: Performance HighlightsAngel BrokingNoch keine Bewertungen

- IL&FS Transportation Networks: Performance HighlightsDokument14 SeitenIL&FS Transportation Networks: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Jyoti Structures 4Q FY 2013Dokument10 SeitenJyoti Structures 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Shree Cement: Performance HighlightsDokument10 SeitenShree Cement: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Automotive Axles Result UpdatedDokument10 SeitenAutomotive Axles Result UpdatedAngel BrokingNoch keine Bewertungen

- Astra Microwave Products LTD: Exponential Growth On The Way!Dokument5 SeitenAstra Microwave Products LTD: Exponential Growth On The Way!api-234474152Noch keine Bewertungen

- Standalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaDokument126 SeitenStandalone Accounts: Ratan N Tata Ravi Kant J J Irani R Gopalakrishnan N N WadiaGourav VermaNoch keine Bewertungen

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportVon EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNoch keine Bewertungen

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDokument8 SeitenRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNoch keine Bewertungen

- Weekly Technical PicksDokument4 SeitenWeekly Technical PicksMaruthee SharmaNoch keine Bewertungen

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentDokument10 SeitenRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasNoch keine Bewertungen

- Industry Report Card April 2018Dokument16 SeitenIndustry Report Card April 2018didwaniasNoch keine Bewertungen

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsDokument8 SeitenInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasNoch keine Bewertungen

- BandhanBank 15 3 18 PLDokument1 SeiteBandhanBank 15 3 18 PLdidwaniasNoch keine Bewertungen

- 0hsie F PDFDokument416 Seiten0hsie F PDFchemkumar16Noch keine Bewertungen

- APL Apollo Antique Stock Broking Coverage Aprl 17Dokument17 SeitenAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasNoch keine Bewertungen

- Financials 7-11-08Dokument6 SeitenFinancials 7-11-08didwaniasNoch keine Bewertungen

- Idfc QTR FinancialsDokument2 SeitenIdfc QTR FinancialsdidwaniasNoch keine Bewertungen

- Sensex AnalysisDokument2 SeitenSensex AnalysisdidwaniasNoch keine Bewertungen

- BandhanBank 15 3 18 PL PDFDokument13 SeitenBandhanBank 15 3 18 PL PDFdidwaniasNoch keine Bewertungen

- IDEA One PagerDokument6 SeitenIDEA One PagerdidwaniasNoch keine Bewertungen

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayDokument2 SeitenMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasNoch keine Bewertungen

- BHEL One PagerDokument1 SeiteBHEL One PagerdidwaniasNoch keine Bewertungen

- 24 Jun 08 - BHELDokument4 Seiten24 Jun 08 - BHELdidwaniasNoch keine Bewertungen

- Sponge Iron Industry B K Oct 06 PDFDokument30 SeitenSponge Iron Industry B K Oct 06 PDFdidwaniasNoch keine Bewertungen

- Shareholding Pattern BSEDokument3 SeitenShareholding Pattern BSEdidwaniasNoch keine Bewertungen

- Mawana FinancialsDokument8 SeitenMawana FinancialsdidwaniasNoch keine Bewertungen

- IFLEX One PagerDokument1 SeiteIFLEX One PagerdidwaniasNoch keine Bewertungen

- HSBC Private Bank Strategy MattersDokument4 SeitenHSBC Private Bank Strategy MattersdidwaniasNoch keine Bewertungen

- 'A' Grade Turnaround: Associated Cement CompaniesDokument3 Seiten'A' Grade Turnaround: Associated Cement CompaniesdidwaniasNoch keine Bewertungen

- The Subprime Meltdown: Understanding Accounting-Related AllegationsDokument7 SeitenThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasNoch keine Bewertungen

- IAG+ +India+Strategy+ (June+08)Dokument17 SeitenIAG+ +India+Strategy+ (June+08)api-3862995Noch keine Bewertungen

- CKP PresentationDokument39 SeitenCKP PresentationdidwaniasNoch keine Bewertungen

- IAG+ +India+Strategy+ (June+08)Dokument17 SeitenIAG+ +India+Strategy+ (June+08)api-3862995Noch keine Bewertungen

- Citizens Guide 2008Dokument12 SeitenCitizens Guide 2008DeliajrsNoch keine Bewertungen

- Income & Growth One Pager 06302008Dokument2 SeitenIncome & Growth One Pager 06302008didwaniasNoch keine Bewertungen

- Kpo VsbpoDokument3 SeitenKpo VsbposdNoch keine Bewertungen

- Sanjiv KaulDokument18 SeitenSanjiv KaulsdNoch keine Bewertungen

- Critical Minimum Effort TheoryDokument3 SeitenCritical Minimum Effort TheorycarolsaviapetersNoch keine Bewertungen

- P12. & P.13 Faculty List With Designation, Qualification, Joining Date, Publication, Citation, R&D, Interaction DetailsDokument11 SeitenP12. & P.13 Faculty List With Designation, Qualification, Joining Date, Publication, Citation, R&D, Interaction DetailsNeelamani SamalNoch keine Bewertungen

- Hyperformance Plasma: Manual GasDokument272 SeitenHyperformance Plasma: Manual GasSinan Aslan100% (1)

- Scope: Manufacture of High Precision and CloseDokument1 SeiteScope: Manufacture of High Precision and CloseAnuranjanNoch keine Bewertungen

- Price List Ciaz AccessoriesDokument4 SeitenPrice List Ciaz AccessoriesAsif RazviNoch keine Bewertungen

- Economics: PAPER 1 Multiple ChoiceDokument12 SeitenEconomics: PAPER 1 Multiple ChoiceigcsepapersNoch keine Bewertungen

- Appointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentDokument7 SeitenAppointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentZiiee BudionganNoch keine Bewertungen

- 2019 Specimen Paper 3 Mark SchemeDokument6 Seiten2019 Specimen Paper 3 Mark SchemeProjeck HendraNoch keine Bewertungen

- Community Support For IYCF As of 22 SeptDokument57 SeitenCommunity Support For IYCF As of 22 SeptMJ ArcillaNoch keine Bewertungen

- 75 December Month Current Affairs Questions 35Dokument34 Seiten75 December Month Current Affairs Questions 35Sailo AimolNoch keine Bewertungen

- Summer 2019 - OSD Exam Paper MS - FINALDokument13 SeitenSummer 2019 - OSD Exam Paper MS - FINALAsifHossainNoch keine Bewertungen

- Variance of A SinusoidDokument22 SeitenVariance of A SinusoidrzalshNoch keine Bewertungen

- Mystique-1 Shark Bay Block Diagram: Project Code: 91.4LY01.001 PCB (Raw Card) : 12298-2Dokument80 SeitenMystique-1 Shark Bay Block Diagram: Project Code: 91.4LY01.001 PCB (Raw Card) : 12298-2Ion PetruscaNoch keine Bewertungen

- Solution: Wireshark Lab: HTTPDokument7 SeitenSolution: Wireshark Lab: HTTPHaoTian YangNoch keine Bewertungen

- Safety Manual For DumperDokument9 SeitenSafety Manual For DumperHimanshu Bhushan100% (1)

- Manual de Serviços QQ PDFDokument635 SeitenManual de Serviços QQ PDFLéo Nunes100% (1)

- Introduction To MAX InternationalDokument48 SeitenIntroduction To MAX InternationalDanieldoeNoch keine Bewertungen

- Tender - RCB NIT 08 20 21 IBDC - 1597146134Dokument124 SeitenTender - RCB NIT 08 20 21 IBDC - 1597146134Guy HydNoch keine Bewertungen

- New Micra BrochureDokument14 SeitenNew Micra BrochureGlobalGroupOfDealersNoch keine Bewertungen

- Synchronization Checklist PDFDokument8 SeitenSynchronization Checklist PDFAdhyartha KerafNoch keine Bewertungen

- Text-Book P3Dokument147 SeitenText-Book P3Nat SuphattrachaiphisitNoch keine Bewertungen

- Warman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q PDokument2 SeitenWarman Slurry Correction Factors HR and ER Pump Power: MPC H S S L Q Pyoel cueva arquinigoNoch keine Bewertungen

- Aquamimicry: A Revolutionary Concept For Shrimp FarmingDokument5 SeitenAquamimicry: A Revolutionary Concept For Shrimp FarmingMarhaendra UtamaNoch keine Bewertungen

- Lapid V CADokument11 SeitenLapid V CAChami YashaNoch keine Bewertungen

- Operations Management: Green Facility Location: Case StudyDokument23 SeitenOperations Management: Green Facility Location: Case StudyBhavya KhattarNoch keine Bewertungen

- ZIOIEXCELDokument4 SeitenZIOIEXCELSunil GNoch keine Bewertungen

- Civil Procedure Flash CardsDokument48 SeitenCivil Procedure Flash CardsNick Ashjian100% (1)

- 100 Free Fonts PDFDokument61 Seiten100 Free Fonts PDFzackiNoch keine Bewertungen

- Environmental Life Cycle AssessmentDokument1 SeiteEnvironmental Life Cycle Assessmentkayyappan1957Noch keine Bewertungen

- Queue Using Linked ListDokument2 SeitenQueue Using Linked ListHassan ZiaNoch keine Bewertungen