Beruflich Dokumente

Kultur Dokumente

Negotiable Instruments Law

Hochgeladen von

Yanhicoh CySaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Negotiable Instruments Law

Hochgeladen von

Yanhicoh CySaCopyright:

Verfügbare Formate

Negotiable Instruments Law

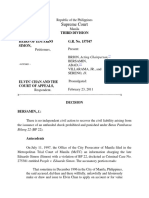

NEGOTIABLE INSTRUMENT - HISTORY -Written contract for the payment of money, by its form intended as substitute for money and intended to pass from hand to hand to give the holder in due course the right to hold the same and collect the sum due - FORMAL RE !"REME#$% PROMISSORY NOTE *Republic Planters Bank vs. CA GR 93073, 21 Dece ber 1992 *Astr! "lectr!nics C!rp. vs. P#ilippine "$p!rt an% &!rei'n (!an Guarantee C!rp!rati!n )GR 13*729, 23 +epte ber 2003, BILL OF EXCHANGE TYPES OF BILL OF EXCHANGE: &' (raft ) *Cit- .rust Bankin' /s. CA G.R. 92091 April 30 1991 *P#ilippine Bank !1 C! erce vs. Arue'! GR (2 2033*2*+, *& ,anuary &-.& 2. $rade Acceptance 3. /an0er1s Acceptance' 4. $rust Receipt 5. $reasury Warrants *Abubakar v. Au%it!r General G.R. (41500 6ul31, 1953 *7etr!p!litan Bank 8 .rust C! pan- vs. C!urt !1 Appeals )GR 333**, 13 &ebruar- 1991, 6. Money Order *P#ilippine "%ucati!n C!. vs. +!rian! GR (222500, 30 6une 1971 7. 2lean and (ocumentary /ills of E3change 8. (4A and (45 /ills of E3change 9. 6%ight bills7 10. 6$ime or usance bills7 ) are bills 8hich are payable at a fi3ed future time or at a determinable future time' When bill ma be !"ea!e# a$ %"&mi$$&" n&!e' &' Where the dra8er and the dra8ee are the person such as, in a draft dra8n by an agent on his principal by authority of the principal' 9' Where the dra8ee is a fictitious person' *' Where the dra8ee has no capacity to contract' Re(e"ee in )a$e &( nee# BEARER 5erson in possession of a bill4note payable to bearer HOL*ER 5ayee or indorsee of a bill or note 8ho is in possession of it, or the bearer thereof' THE LIFE OF A NEGOTIABLE INSTRUMENT: +INPA*-P*-N-P*, &' issue 9' negotiation *' presentment for acceptance in certain bills :' acceptance ;' dishonor by on acceptance <' presentment for payment +' dishonor by nonpayment .' notice of dishonor -' protest in certain cases &=' discharge NEGOTIABILITY

RE-UISITES +SU*OC, .' in /"i!in0 an# $i0ne# b ma1e" &" #"a/e" 2' 3n)&n#i!i&nal %"&mi$e &" &"#e" !& %a a' 8ith e3change, 8hether at a fi3ed rate or at the current rate, *P!nce vs. C!urt !1 Appeals, 90 +CRA 033 *9alal! vs. (u:, 35 +CRA 337 b' 8ith costs of collection or an attorney1s fee, in case payment not made at maturity 4' %a able &n #eman#5 &" a! a (i6e# &" #e!e"minable (3!3"e !ime 7' %a able !& &"#e" &" bea"e"5 5. 8here addressed to dra8ee> such #"a/ee name#8 in#i)a!e# !he"ein /i!h "ea$&nable )e"!ain! 2O#%"(ERA$"O# ?$an $iong $ic0 vs' 5hil Manufacturing 2orp' &= %2RA :&< C;<.=<>A.=;< ;& <"G;.=AB(" C?ARAC."R !ntil> &' restrictively indorsed 9' discharged by payment or other8ise EFFECT OF A**ITIONAL PRO9ISIONS +Se)':, Gen' R3le: order4promise to do any act in addition to the payment of money renders instrument non-negotiable' E6)e%!i&n: negotiability not affected by provisions O!he" In$!an)e$ /hen ne0&!iabili! n&! a((e)!e# +Se)' ;, Se)' .<' C&n$!"3)!i&n /he"e in$!"3men! i$ ambi03&3$' *"van'elista vs. 7ercat!r &inance C!rp. )GR 1533*5, 21 Au'ust 2003, *ELI9ERY +Se)' .;, I$$3an)e-the first delivery of the instrument complete in form to a person 8ho ta0es it as a holder' +teps@ &' Mechanical Act of 8riting, complying 8ith re@uirements of %ec' & 9' (elivery 8ith intention to give effect thereto' *Dela /ict!ria vs. Bur'!s G.R. 111190 6une 21 1990 *(i vs. CA G.R. 107393 Dece ber 19, 199* *(i vs. R!%ri'! G.R. 7*975 <!ve ber 13, 1933 *Pe!ple vs. Gr!spe GR (275003205, 20 6anuar- 1933 *Devel!p ent Bank !1 Ri:al vs. +i a Aei )GR 30519, 9 7arc# 1993, PRESUMPTION OF *ELI9ERY Where the instrument is no longer in the possession of a party 8hose signature appears thereon, a valid and intentional delivery by him is presumed until the contrary is proved A?if in the hands of a B(2, presumption conclusiveC NEGOTIATION *+esbren! vs. C!urt !1 Appeals )GR 39202, 25 7a- 1993, vs assi'n ent *Calte$ P#il. /s CA 212 +CRA IN*ORSEMENT =IN*S OF IN*ORSEMENT A' A$ !& manne" &( (3!3"e me!h&# &( ne0&!ia!i&n B' A$ !& 1in# &( !i!le !"an$(e""e#

Negotiable Instruments Law

*Republic Bank vs. "bra%a GR (25079*, 31 6ul- 1970 C' A$ !& 1in# &( liabili! a$$3me# b in#&"$e" *Pe!ple vs. 7anie'! GR (230910, 27 &ebruar- 1937 *' A$ !& %"e$en)e8ab$en)e &( e6%"e$$ limi!a!i&n$ %3! b in#&"$e" 3%&n %"ima" &bli0&">$ %"i?ile0e$ &( %a in0 !he h&l#e" HOL*ER IN *UE COURSE RE-UISITIES &' )&m%le!e an# "e03la" 3%&n i!$ (a)e 9' h&l#e" be)ame $3)h be(&"e i! /a$ &?e"#3e5 /i!h&3! n&!i)e &( an %"e?i&3$ #i$h&n&" *' !a1en in 0&&# (ai!h an# (&" ?al3e :' a! !ime ne0&!ia!e# !& him5 he ha# n& n&!i)e &( -a'in(i"mi! in in$!"3men! b'#e(e)! in !i!le &( %e"$&n ne0&!ia!in0: *Bataan Ci'ar an% Ci'arette &act!r- vs. CA G.R. 93053 7arc# 1995B *De ;ca p! vs. Gatc#alian )GR (21012*, 30 <!ve ber 19*1, *+telc! 7arketin' C!rp. vs. C!urt !1 Appeals )GR 9*1*0, 17 6une 1992, *Can' vs. C!urt !1 Appeals )GR 133075, 10 Au'ust 2003, *+tate =nvest ent ?!use vs =AC 6ul- 13, 1939 RIGHTS OF HOL*ER IN *UE COURSE RIGHTS OF PURCHASER FROM HOL*ER IN *UE COURSE *EFENSES .' INCAPACITY: REAL> indorsement4assignment by corporation4infant passes property but corp4infant no liability 2' FORGERY: Real: (efinition> the counterfeit-making or fraudulent alteration of any writing, and may consist in the signing of anothers name or the alteration of an instrument in the name, amount, description of the person and the like, with intent thereby to defraud. Ba% &!r'er-Dforgery which is apparent or naked to the eye G!!% &!r'er-requires examination of signature if it was forged "11ect E#en +i'nature is 1!r'e% !r a%e Eit#!ut aut#!rit!1 pers!n E#!se si'nature it purp!rts t! be. Gene"al R3le> a' 8holly inoperative b' no right to retain instrument, or give discharge, or enforce payment vs' any party, can be ac@uired through or under such signature Aunless forged signature unnecessary to holder1s titleC E6)e%!i&n: unless the party against 8hom it is sought to enforce such right is precluded from setting up forgery48ant of authority P"e)l3#e#: a' parties 8ho ma0e certain 8arranties, li0e a general indorser or acceptor b' estopped4negligent parties *Ass!ciate% Bank vs. CA G.R. 107332 6anuar- 31, 199* *Ge pesaE vs. CA G.R. 92255 &ebruar- 9, 1993 *7A++ vs. CA G.R. (2*2953 6ul- 15, 193* *P#ilippine C! ercial =nternati!nal Bank vs. CA GR 121513, 29 6anuar- 2001 *Republic Bank vs. CA GR 52720, 22 April 1991

4' MATERIAL ALTERATION @ Where #" materially altered 84o assent of all parties liable thereon, avoided, e3cept as against &' party 8ho has himself made, authoriDed or assented to alteration 9' and subse@uent indorsers E /ut 8hen an instrument has been materially altered and is in the hands of a B(2 not a party to the alteration, B(2 may enforce payment thereof according to orig' tenor ?material alteration a %e"$&nal #e(en$e 8hen used to deny liability according to org' tenor of instrument, but "eal #e(en$e 8hen relied on to deny liability according to altered terms' *?!n'k!n' an% +#an'#ai Bank vs. Pe!pleFs Bank an% .rust G.R. 2322* +epte ber 30 1970 *P#ilippine <ati!nal Bank vs. C!urt !1 Appeals )GR 107003, 20 April 199*, 7' FRAU* a' ("a3# in e6e)3!i&n: real defense Adidn1t 0no8 it 8as a #egotiable "nstrumentC b' ("a3# in in#3)emen!: personal defense A0no8s it1s #egotiable "nstrument but deceived as to value4termsC :' COMPLETE5 UN*ELI9ERE* INSTRUMENT E 5ersonal defense Asec' &<C E "f instrument not in possession of party 8ho signed, delivery prima facie presumed E "f holder is B(2, delivery conclusively presumed ;' INCOMPLETE5 UN*ELI9ERE* INSTRUMENT @ Real defense Asec' &;C @ "nstrument 8ill not, if completed and negotiated 8ithout authority, be a valid contract in the hands of any holder, as against any person 8hose signature 8as placed thereon before delivery <' INCOMPLETE5 *ELI9ERE* @ 5ersonal defense Asec' &:C @ 2 =in#$ &( W"i!in0$: &' Where instrument is 8anting in any material particular> person in possession has prima facie authority to complete it by filing up blan0s therein 9' %ignature on blan0 paper delivered by person ma0ing the signature in order that the paper may be converted into a #"> prima facie authority to fill up as such for any amount @ "n order that any such instrument, 8hen completed, may be enforced against any person 8ho became a party thereto prior to its completion> &' must be filled up strictly in accordance 84 authority given 9' 8ithin a reasonable time E but if any such instrument after completion is negotiated to B(2, itFs valid for all purposes in his hands, he may enforce it as if it had been filled up properly Real *e(en$e$ &' Material Alteration 9' Want of delivery of incomplete instrument *' (uress amounting to forgery :' Fraud in factum or Fraud in esse contractus ;' Minority Aavailable to the minor onlyC <' Marriage in the case of Pe"$&nal *e(en$e$ &' Absence or failure of consideration 8hether partial or total 9' Want of delivery of complete instrument *' "nsertion of 8rong date in an instrument :' Filling up of blan0 contrary to authority given or not 84in reasonable time

Negotiable Instruments Law

a 8ife "nsanity 8here the insane person has a guardian appointed by the court .' !ltra Gires acts of corporation -' Want of authority of agent &=' E3ecution of instrument b48 public enemies &&' "llegalityHif declared void for any purpose &9' Forgery +' ;' Fraud in inducement <' Ac@uisition of instrument by force, duress or fear +' Ac@uisition of instrument by unla8ful means .' Ac@uisition of the instrument for an illegal consideration -' #egotiation in breach of faith &=' #egotiation under circumstances that amount to fraud &&' Mista0e &9' "nto3ication &*' !ltra Gires Acts of corporations 8here the corporation has the po8er to issue negotiable paper but the issuance 8as not authoriDed for the particular purpose for 8hich it 8as issued

- "n a promissory note, #i$h&n&" b n&n-%a men! ta0es place 8hen it is duly presented for payment and payment is refused or cannot be obtainedJ or if presentment is e3cused, the instrument is overdue and unpaid' E((e)!: $here is an immediate right of recourse by the holder against persons secondarily liable, 8hich re@uires notice of dishonor A%ec' .:C ). In *I++$ ", (-./0&1( - "n bills of e3change, 8here the bill is presented for acceptance and is returned dishonored, or 8ithin t8enty four hours from presentment, is not returned accepted or unaccepted, or 8hen presentment for acceptance is e3cused and the bill is not accepted there is a #i$h&n&" b n&n-a))e%!an)e' -$here is a #i$h&n&" b n&n-%a men! if the bill, after it has been accepted is not paid 8hen presented for payment, or presentment being e3cused, is not paid on the date of maturity' E((e)! &( *i$h&n&" b N&n-a))e%!an)e: An immediate right of recourse against the dra8er and indorsers accrues to the holder and #O 5RE%E#$ME#$ for payment is necessary' A%ec' &;&C &ote2 $ame effect in 3ishonor by &on-payment is romissory &ote NOTICE OF *ISHONOR --bringing either verbally or by 8riting, to the 0no8ledge of the dra8er or indorser of an instrument, the fact that a specified negotiable instrument, upon proper proceedings ta0en, has not been accepted or has not been paid and that the party notified is e3pected to pay it' RE-UISITES: *"lvira Cu ;# vs. C!urt !1 Appeals G.R. n!. 120297 6une *, 2003. *(i (a! vs. C.A. G.R. 119173 6une 20, 1997 TO WHOM GI9EN Can)ella!i&n: it includes the act of tearing, erasing, obliterating or burning. It is not limited by writing the word 4cancelled5 or 4paid5 or drawing criss-cross lines across the instrument. It may be made by any other means by w6c the intention to cancel the instrument may be e7ident. Ren3n)ia!i&n +Se)' .22, PROTEST

LIABILITIES OF PARTIES Liabili! &( A))&m&#a!i&n Pa"! E *e(ini!i&n: one 8ho signed instrument as ma0er4dra8er4acceptor4 indorser 84o receiving value thereof, for the purpose of lending his name to some other person E Accomodation 5arty liable on the instrument to holder for value even if holder, at time of ta0ing instrument, 0ne8 he 8as only an Accomodation 5arty *An' .i!n' vs. .in' G.R. (22*7*7 &ebruar- 22, 19*3 *Cris!l!'!26!se vs. C!urt !1 Appeals )GR 30099, 10 +epte ber 1939, *Garcia vs. (la as )GR 105127, 3 Dece ber 2003, *.ravel2!n vs CA 210 +CRA 301 PR"+"<.7"<. RE-UISITES OF ACTUAL ACCEPTANCE: EFFECT OF ACCEPTANCE: C&n$!"3)!i?e A))e%!an)e P"e$en!men! (&" A))e%!an)e *e(ini!i&n: "t is the production or e3hibition of a bill of e3change to the dra8ee for his acceptance' GENERAL RULE: 5resentment for acceptance is #O$ #E2E%%ARI to render any party to the bill liable' P"e$en!men! F&" Pa men! O( A))e%!e# Bill P3"%&$e: $he purpose of presentment for payment of an accepted bill is to collect from the acceptorJ and if refused, to collect from the secondary parties' *&ar "ast Realt- =nvest ent =nc. vs. C!urt !1 Appeals )GR (23*059, 0 ;ct!ber 1933, *A!n' vs. C!urt !1 Appeals )GR 117307, 2 &ebruar- 2001, *.#e =nternati!nal C!rp!rate Bank Gn!E >ni!n Bank !1 t#e P#ilippinesB vs. +p!uses Guec! )GR1519*3, 12 &ebruar2001, *ISHONOR 1 .In !"#I$$"!% &"'(

ACCEPTANCE FOR HONOR Acceptance of a bill made by a stranger to it before maturity, 8here the dra8ee of the bill refused to accept it, and the bill has been protested for non-acceptance or 8here the bill has been protested for better security' P3"%&$e (&" a))e%!an)e (&" h&n&": An acceptance for honor is done 4to sa7e the credit of the parties to the instrument or some party to it, as the drawer, drawee, or indorser, or somebody else.5 PAYMENT FOR HONOR BILLS IN SET

Ri0h! &( h&l#e"$ /he"e #i((e"en! %a"!$ a"e ne0&!ia!e#: Where t8o or more parts are negotiated to different BOL(ER% "# (!E 2O!R%E ) the BOL(ER 8hose title

Negotiable Instruments Law

F"R%$ A22R!E% ) A% /E$WEE# %!2B BOL(ER% ) is the $R!E OW#ER of the bill' PROMISSORY NOTES AN* CHEC=S

5. 7e !ran%u

Pr! iss!r- <!te ) is an unconditional promise in 8riting made by one person to another, signed by the ma0er, engaging to pay on demand, or at a fi3ed or determinable future time, a sum certain in money to order or bearer' S%e)ial ! %e$ &( %"&mi$$&" n&!e$: .' Ce"!i(i)a!e &( #e%&$i! is a 8ritten ac0no8ledgment by a ban0 of the receipt of money on deposit 8hich the ban0 promises to pay to the depositor, bearer, or to some other person or order' "t is #O$ ipso facto negotiable 8 it must first comply with the requirements pro7ided under $ection 1, &I+. *Calte$ P#il vs CA Au' 10, 1992 2' B&n#$ - A promise, under seal, to pay money' - $he bond certifies that the issuing company is indebted to the bondholder for the amount specified on the face of the bond, and contains an agreement of the company to pay the sum at a specified time in the future, and mean8hile to pay a specified interest on the principal amount at regular intervals, generally si3 months apart' $hey are negotiable if it the re@uisites in %ection &, #"L are complied 8ith'

C#ecks ) a chec0 on 8hich is 8ritten the 8ord 6memorandum7, 6memo7, and 6mem7, signifying that the dra8er engages to pay the bona fide holder absolutely and not upon a condition to pay upon presentment and non-payment' "f it bounces ) the dra8er can be charged for violation of /5 99' 6. Certi1ie% C#ecks ) a chec0 on 8hich the dra8ee ban0 has 8ritten an agreement 8hereby it underta0es to pay the chec0 at any future time 8hen presented for payment, such as, by stamping on the chec0 the 8ord 6certified7 or 6Kood For 5ayment7 and underneath it is 8ritten the signature of the cashier' 7. .raveler1s C#eck8. Cr!sse% c#eck )One 8hich has t8o parallel lines, usually on the upper left hand corner' H&/ i$ )"&$$in0 &( )he)1 #&ne: it is usually done by dra8ing t8o parallel lines transversally on the face of the chec0' A chec0 may be crossed A&C specially or A9C generally' *Ass!ciate% Bank vs. CA G.R. 39302 7a- 7, 1992 Cr!ssin' speciall- ) a chec0 is crossed specially 8hen the name of a particular ban0er or a company is 8ritten bet8een the parallel lines dra8n transversally on the face of the chec0' Bere, the dra8er is instructing the dra8ee ban0 not to honor the chec0 unless the payee is identified by another ban0 Cr!ssin' 'enerall- ) a chec0 is crossed generally 8hen only the 8ords 4and company5 are 8ritten bet8een the parallel lines, or 8hen nothing is 8ritten at all bet8een the parallel lines' Bere, the dra8er is instructing the dra8ee ban0 not to honor the chec0 unless the payee is identified by the particular ban0 named in bet8een the t8o parallel lines' Fea!3"e$ &( !he Che)1 Che)1 A /hen $h&3l# i! be %"e$en!e# (&" %a men!: A chec0 M!%$ be presented for payment 8ithin a reasonable time after its issue or the dra8er 8ill be discharged from liability thereon to the e3tent of the loss caused by the delay' must be presented 8ithin si3 A<C months ) other8ise it 8ill become stale' - a chec0 under /5 99 must be presented for payment to the ban0 8ithin -= days from date so that the holder 8ill enLoy the benefit of the prima facie presumption that the ma0er, dra8er, or issuer 0no8s at the time of issue that he does not have sufficient funds in or credit 8ith the dra8ee ban0 for payment of such chec0' A chec0 is a bill of e3change payable on demand ) is intended for immediate use and not to circulate as a promissory note' E((e)! i( !he )he)1 /a$ all&/e# !& be)&me $!aleB A%tale 8hen not encashed 84in < monthsC - the dra8er is discharged but only to the e3tent of the loss caused by the delay' Bence, if no loss or inLury is sho8n, the dra8er is not discharged' Certi1icati!n !1 c#eck ) is an agreement 8hereby the ban0 against 8hom a chec0 is dra8n, underta0es to pay it at any future time 8hen presented for payment' A ban1 i$ n&! &bli0e# !& !he #e%&$i!&" !& )e"!i( )he)1$' $he certification of a chec0 is E !"GALE#$ to an A22E5$A#2E'

CHEC= ) is a bill of e3change dra8n on a ban0 payable on demand' "t is a 8ritten order on a ban0, purporting to be dra8n against a deposit of funds for the payment of all events, of a sum of money to a certain person therein named or to his order or to cash and payable on demand' NOTE: - Acceptance is #O$ re@uired for chec0s for the same are 5AIA/LE O# (EMA#(' C#eck is n!t (e'al .en%er, but produces the effect of payment when2 a. 'he check was encashed. 9(ncashment is not limited to physical encashment o7er the counter of the drawee bank. 0 check can be considered encashed through the clearing house, or when the check had been credited to the account of the creditor: b. ;hen through the fault of the creditor the check is impaired c. In case of redemption *.ibaHia vs. CA GR 100290, 5 6une 1993 *P#ilippine Airlines vs. C!urt !1 Appeals )GR 59133, 30 6anuar- 1990, =in#$ &( )he)1$: 1. ;r%inar- C#eckH$he most common chec0 issued by a ban0 to a client 8ho opens a chec0ing account 2. Cas#ierFs c#eck ) it is a chec0 dra8n by the cashier of a ban0 in the name of the ban0 against the ban0 itself payable to a third person or order' *.an vs. CA GR 103000, 20 Dece ber 1995

3. 7ana'erFs C#eck ) a dra8n by the manager of a ban0

in the name of the ban0 against the ban0 itself payable to a third person' "t is similar to the cashier1s chec0 as to effect and use' *C! vs. P<B G.R. (2017*7 6une 29, 1932 *=ntl C!rp Bank vs Guec! &eb 12, 2001 5. Gi1t C#eck

S!&% Pa men! O"#e"Can instruction by the dra8er addressed to the dra8ee ban0 directing the latter not to honor

Negotiable Instruments Law

or pay the chec0' A dra8er may stop payment of the chec0 before the same is accepted, certified or paid by the dra8ee ban0' ReIuisites 1!r +t!p Pa- ent ;r%er 1. It must describe the check with reasonable accuracy ). It must be gi7en to an authori<ed officer or employee of the drawee bank =. It must be positi7e and unqualified >. It must gi7e the bank sufficient time prior to acceptance, certification or payment to enable the bank, in the exercise of reasonable diligence to stop payment. =r!n2Cla% Rule@ rohibits the countermanding of payment of certified checks. Ca$e$ /hen Ban1 Ma Re(3$e Pa men! &' $he ban0 is insolvent 9' $he dra8er1s deposit is insufficient or he has no account 8ith the ban0 or said account had been closed or garnished *' $he dra8er is insolvent and proper notice is received by the ban0 :' $he dra8er dies and proper notice is received by the ban0 ;' $he dra8er has countermanded payment <' $he holder refuses to identify himself +' $he ban0 has reason to believe that the chec0 is forgery' /'5' 99 cases> Cara Res!urces vs. C!ntreras A7 7.6 0330359 ;ct!ber 2*, 1995 Cru: vs. CA G.R. 103733 6une 17 1995 (i vs. Pe!ple G.R. 130033 +epte ber 13, 2000 (la a%! vs. CA G.R. 99032 arc# 2*, 1997 7!ran vs. CA G.Rn!. 10033* 7arc# 7, 1995 +tate =nvest ent ?!use vs. CA GR 1011*3, 11 6anuar- 1993

Das könnte Ihnen auch gefallen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- Lecture Notes-Real Property II-Mortgages 2020-21Dokument13 SeitenLecture Notes-Real Property II-Mortgages 2020-21Lecture WizzNoch keine Bewertungen

- Example Response To Health Dept PDFDokument7 SeitenExample Response To Health Dept PDFslavenumerounoNoch keine Bewertungen

- Negotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Dokument14 SeitenNegotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Gennelyn Grace PenaredondoNoch keine Bewertungen

- Does A Tangible Lien Survive BankruptcyDokument2 SeitenDoes A Tangible Lien Survive BankruptcyA. CampbellNoch keine Bewertungen

- 2-1-2021 Response To LandlordDokument2 Seiten2-1-2021 Response To LandlordJessica SwarnerNoch keine Bewertungen

- 1951 DDokument8 Seiten1951 Datp5eNoch keine Bewertungen

- Applicability of NilDokument14 SeitenApplicability of NilIan Ray PaglinawanNoch keine Bewertungen

- By Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Dokument11 SeitenBy Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Real TrekstarNoch keine Bewertungen

- Clogging the Equity of Redemption: An Outmoded ConceptDokument18 SeitenClogging the Equity of Redemption: An Outmoded Conceptadvopreethi100% (1)

- Foreclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority RequiredDokument20 SeitenForeclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority Required83jjmackNoch keine Bewertungen

- Letter # 2 9.12.16 Short VisionDokument3 SeitenLetter # 2 9.12.16 Short Visionboytoy 9774Noch keine Bewertungen

- Negotiable Instrument: Sesbreno Vs CADokument19 SeitenNegotiable Instrument: Sesbreno Vs CAChris InocencioNoch keine Bewertungen

- Nguyen Chase Motions Rule 60 (B) and 55 Re Default JudgmentDokument57 SeitenNguyen Chase Motions Rule 60 (B) and 55 Re Default JudgmentjohngaultNoch keine Bewertungen

- United States Court of Appeals, First CircuitDokument8 SeitenUnited States Court of Appeals, First CircuitScribd Government DocsNoch keine Bewertungen

- Affidavit of Debt Small ClaimDokument2 SeitenAffidavit of Debt Small ClaimEduardo NegapatanNoch keine Bewertungen

- Bank Guarantee Text d1Dokument4 SeitenBank Guarantee Text d1Fenny Kusien0% (1)

- Cash AssignmentsDokument21 SeitenCash AssignmentsSushil RiyarNoch keine Bewertungen

- N:Fal: : Nam-E - Ro (J:L :: PDokument5 SeitenN:Fal: : Nam-E - Ro (J:L :: PChapter 11 DocketsNoch keine Bewertungen

- 15 US Code 1692e Restricts Misleading Debt Collection PracticesDokument4 Seiten15 US Code 1692e Restricts Misleading Debt Collection PracticesJunius EdwardNoch keine Bewertungen

- Rule 7 and 15 AM 19-10-20-SCDokument7 SeitenRule 7 and 15 AM 19-10-20-SCMaria Leonora TheresaNoch keine Bewertungen

- 2017 Florida Mugshot Removal Bill: CHAPTER 130Dokument2 Seiten2017 Florida Mugshot Removal Bill: CHAPTER 130Remove ArrestsNoch keine Bewertungen

- Breach of Covenant Against Lender and ServicerDokument31 SeitenBreach of Covenant Against Lender and Servicerdsnetwork100% (1)

- Commonly Confused Words GuideDokument4 SeitenCommonly Confused Words GuideKoay Kian YewNoch keine Bewertungen

- Promissory Estoppel ExplainedDokument53 SeitenPromissory Estoppel ExplainedLuis Colin RiveroNoch keine Bewertungen

- Securities and Exchange Commission (SEC) - Formadv-NrDokument2 SeitenSecurities and Exchange Commission (SEC) - Formadv-NrhighfinanceNoch keine Bewertungen

- Disqualification of Justice, Judge, or Magistrate JudgeDokument4 SeitenDisqualification of Justice, Judge, or Magistrate JudgeMarquise JenkinsNoch keine Bewertungen

- Constructing A Counter ClaimDokument8 SeitenConstructing A Counter ClaimSteve CuttlerNoch keine Bewertungen

- Oklahoma Durable Financial Power of Attorney FormDokument6 SeitenOklahoma Durable Financial Power of Attorney FormCarlos VaqueroNoch keine Bewertungen

- Power of Attorney In-FactDokument4 SeitenPower of Attorney In-FactJoshua Sygnal GutierrezNoch keine Bewertungen

- Frank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Dokument5 SeitenFrank Miskovsky v. United States, 414 F.2d 954, 3rd Cir. (1969)Scribd Government DocsNoch keine Bewertungen

- Complainant AffidavitDokument5 SeitenComplainant AffidavitMia Steyn100% (1)

- A Bail Bond Template Made With Adobe PhotoshopDokument1 SeiteA Bail Bond Template Made With Adobe PhotoshopHamidah BelloNoch keine Bewertungen

- Chancery, Court of EquityDokument3 SeitenChancery, Court of EquityNuwaha Ozius100% (1)

- Red Light Camera Refund Claim FormDokument4 SeitenRed Light Camera Refund Claim FormLindsay TolerNoch keine Bewertungen

- Court upholds postal money order dispute rulingDokument12 SeitenCourt upholds postal money order dispute rulingMunchie MichieNoch keine Bewertungen

- What Is LawDokument2 SeitenWhat Is LawXagonNoch keine Bewertungen

- Relocation SettlementDokument5 SeitenRelocation Settlementrich chastNoch keine Bewertungen

- Rules 57-61 Provisional Remedies GuideDokument5 SeitenRules 57-61 Provisional Remedies GuideArmand Patiño AlforqueNoch keine Bewertungen

- Revised Instructions To TenderersDokument22 SeitenRevised Instructions To TenderersAbir MohammadNoch keine Bewertungen

- Purchase Agreement TemplateDokument9 SeitenPurchase Agreement TemplateCarol MarieNoch keine Bewertungen

- Authority to Enforce Promissory Note Indorsed in BlankDokument22 SeitenAuthority to Enforce Promissory Note Indorsed in BlankBeth Stoops Jacobson0% (1)

- Sample Qualified Written Request Under Re SpaDokument3 SeitenSample Qualified Written Request Under Re SpaPamGrave100% (1)

- Quasi-Contractual ObligationsDokument22 SeitenQuasi-Contractual ObligationsUzma SheikhNoch keine Bewertungen

- Acknowledgement of DebtDokument3 SeitenAcknowledgement of DebtJeffrey AranzansoNoch keine Bewertungen

- Specific Relief ActDokument7 SeitenSpecific Relief Actankit rocksNoch keine Bewertungen

- 1 What Is TortDokument8 Seiten1 What Is TortDonasco Casinoo ChrisNoch keine Bewertungen

- 537 QuestionsDokument95 Seiten537 QuestionsJohnnyLarsonNoch keine Bewertungen

- Do This First A2Dokument18 SeitenDo This First A2manuelllNoch keine Bewertungen

- Objecting To Debtor's DischargeDokument5 SeitenObjecting To Debtor's DischargeMMA PayoutNoch keine Bewertungen

- Unpaid Wages Demand LetterDokument1 SeiteUnpaid Wages Demand LetterFREDDIERICK FERNANDO100% (1)

- Will Trust MidtermDokument33 SeitenWill Trust MidtermAnonymous lS5yLN0CrNoch keine Bewertungen

- Fiduciary Breaching DutyDokument1 SeiteFiduciary Breaching DutyOCEANA_HOANoch keine Bewertungen

- Methods and Modes of Terminating ContractsDokument83 SeitenMethods and Modes of Terminating ContractsNusrat ShatyNoch keine Bewertungen

- QuitDokument4 SeitenQuitcaleb ebongNoch keine Bewertungen

- Credit Transactions PDFDokument4 SeitenCredit Transactions PDFJehannahBaratNoch keine Bewertungen

- ELEMENTS OF LAW OF CONTRACTSDokument38 SeitenELEMENTS OF LAW OF CONTRACTSAzmansah Bangsa Dadung GigurNoch keine Bewertungen

- Constitution of the State of Minnesota — 1974 VersionVon EverandConstitution of the State of Minnesota — 1974 VersionNoch keine Bewertungen

- Civil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithVon EverandCivil Government of Virginia: A Text-book for Schools Based Upon the Constitution of 1902 and Conforming to the Laws Enacted in Accordance TherewithNoch keine Bewertungen

- Supreme CourtDokument6 SeitenSupreme CourtYanhicoh CySaNoch keine Bewertungen

- Republic V GrijaldoDokument7 SeitenRepublic V Grijaldocookbooks&lawbooks0% (1)

- Republic V GrijaldoDokument7 SeitenRepublic V Grijaldocookbooks&lawbooks0% (1)

- 10Dokument11 Seiten10Yanhicoh CySaNoch keine Bewertungen

- Tolentino V GonzalesDokument12 SeitenTolentino V GonzalesKenneth BuriNoch keine Bewertungen

- Phcpi vs. CirDokument10 SeitenPhcpi vs. CirYanhicoh CySaNoch keine Bewertungen

- 02 People V ConcepcionDokument6 Seiten02 People V Concepcionamazing_pinoyNoch keine Bewertungen

- BPI Investment V CA - GR 133632Dokument6 SeitenBPI Investment V CA - GR 133632Jeremiah ReynaldoNoch keine Bewertungen

- SC upholds municipality's power to levy production taxDokument8 SeitenSC upholds municipality's power to levy production taxKristineSherikaChyNoch keine Bewertungen

- 8Dokument146 Seiten8Yanhicoh CySaNoch keine Bewertungen

- Supreme Court upholds Ormoc City lumber tax ordinanceDokument3 SeitenSupreme Court upholds Ormoc City lumber tax ordinanceYanhicoh CySaNoch keine Bewertungen

- MMDADokument6 SeitenMMDAYanhicoh CySaNoch keine Bewertungen

- 1-Lorenzo Vs PosadasDokument9 Seiten1-Lorenzo Vs PosadasNimpa PichayNoch keine Bewertungen

- 12 Philippine Airlines V Edu (1988)Dokument8 Seiten12 Philippine Airlines V Edu (1988)KristineSherikaChyNoch keine Bewertungen

- Coc v. Hypermix FeedsDokument9 SeitenCoc v. Hypermix FeedsHaniyyah FtmNoch keine Bewertungen

- Phil Petroleum Corp Vs Municipality of Pililia, RizalDokument6 SeitenPhil Petroleum Corp Vs Municipality of Pililia, RizalrrrhesariezenNoch keine Bewertungen

- Universal Declaration of Human RightsDokument6 SeitenUniversal Declaration of Human RightsYanhicoh CySaNoch keine Bewertungen

- Cir Vs Pineda 21 Scra 105Dokument4 SeitenCir Vs Pineda 21 Scra 105Atty JV AbuelNoch keine Bewertungen

- Caltex vs. CoaDokument16 SeitenCaltex vs. CoaYanhicoh CySaNoch keine Bewertungen

- Gaston Vs Republic Planters BankDokument5 SeitenGaston Vs Republic Planters BankRyan SuaverdezNoch keine Bewertungen

- City of Manila vs. Coca ColaDokument10 SeitenCity of Manila vs. Coca ColaYanhicoh CySaNoch keine Bewertungen

- UN Convention against Torture key obligationsDokument9 SeitenUN Convention against Torture key obligationsYanhicoh CySaNoch keine Bewertungen

- Human Rights EducationDokument13 SeitenHuman Rights EducationYanhicoh CySaNoch keine Bewertungen

- Leido, Andrada, Perez and Associates For Petitioners. Office of The Solicitor General For RespondentsDokument6 SeitenLeido, Andrada, Perez and Associates For Petitioners. Office of The Solicitor General For RespondentsYanhicoh CySaNoch keine Bewertungen

- G.R. No. L-7859 - Lutz Vs Araneta (22 Dec 55)Dokument3 SeitenG.R. No. L-7859 - Lutz Vs Araneta (22 Dec 55)jdz1988Noch keine Bewertungen

- Convention For Ozone Layer PDFDokument81 SeitenConvention For Ozone Layer PDFYanhicoh CySaNoch keine Bewertungen

- Intro To LawDokument12 SeitenIntro To LawRea Jane B. MalcampoNoch keine Bewertungen

- Forum On Environmental JusticeDokument4 SeitenForum On Environmental JusticeYanhicoh CySaNoch keine Bewertungen

- Rules Implementing Code of Conduct for Public OfficialsDokument18 SeitenRules Implementing Code of Conduct for Public OfficialsicebaguilatNoch keine Bewertungen

- Developments in PhilippineDokument6 SeitenDevelopments in PhilippineYanhicoh CySaNoch keine Bewertungen

- Corporate LawDokument14 SeitenCorporate LawnupurNoch keine Bewertungen

- Question Answer Negotiable Instrument LawDokument4 SeitenQuestion Answer Negotiable Instrument LawEuxine Albis0% (2)

- Private Limited: Memorandum of Association OFDokument5 SeitenPrivate Limited: Memorandum of Association OFAnonymous 2g24pum1cNoch keine Bewertungen

- Cpar Nego Law On Negotiable InstrumentsDokument21 SeitenCpar Nego Law On Negotiable InstrumentsMarl Dela ROsaNoch keine Bewertungen

- Negotiable Instruments ActsDokument25 SeitenNegotiable Instruments ActsShikhar Saxena100% (1)

- Whaley Chap 3 HIDC PDFDokument76 SeitenWhaley Chap 3 HIDC PDFRaffyLaguesmaNoch keine Bewertungen

- How to correctly complete a bill of exchangeDokument2 SeitenHow to correctly complete a bill of exchangeVũ Nguyễn100% (1)

- Philippine Court Rules Postal Money Orders Not Negotiable InstrumentsDokument36 SeitenPhilippine Court Rules Postal Money Orders Not Negotiable InstrumentsSpidermanNoch keine Bewertungen

- Presentation On Indian Stamp Act 1899Dokument26 SeitenPresentation On Indian Stamp Act 1899Annuj SrivastavaNoch keine Bewertungen

- BLTDokument30 SeitenBLTJemson Yandug0% (1)

- Osmena Vs CitiBankDokument6 SeitenOsmena Vs CitiBankGian Reynold C. ParinaNoch keine Bewertungen

- JNTUH MBA R17 I Semester SyllabusDokument10 SeitenJNTUH MBA R17 I Semester SyllabusPhani Kumar SurampuudiNoch keine Bewertungen

- Civil liability arising from BP 22 violationDokument8 SeitenCivil liability arising from BP 22 violationHannah MedesNoch keine Bewertungen

- Bognot V RRI Lending Corp., G.R. No. 180144, September 24, 2014Dokument5 SeitenBognot V RRI Lending Corp., G.R. No. 180144, September 24, 2014Lyle BucolNoch keine Bewertungen

- Negotiable Instruments LawDokument2 SeitenNegotiable Instruments LawTacoy DolinaNoch keine Bewertungen

- 04-02-12 OUR Style Money Order For WebDokument1 Seite04-02-12 OUR Style Money Order For WebSaleem Alhakim84% (19)

- BIR Revenue Regulation 13-04Dokument9 SeitenBIR Revenue Regulation 13-04kyroe104Noch keine Bewertungen

- Samsung Const Co Phils Vs FEBTC - 129015 - August 13, 2004 - JDokument12 SeitenSamsung Const Co Phils Vs FEBTC - 129015 - August 13, 2004 - JYasha Min HNoch keine Bewertungen

- FybafDokument4 SeitenFybafsglory dharmarajNoch keine Bewertungen

- Promotion Material 2023-2024-1-10Dokument10 SeitenPromotion Material 2023-2024-1-10CREDIT BHARATPURNoch keine Bewertungen

- KanchanDokument84 SeitenKanchanJyoti KumariNoch keine Bewertungen

- For UploadDokument6 SeitenFor UploadDino AbieraNoch keine Bewertungen

- Great Eastern vs. Hongkong & Shanghai Banking CorporationDokument3 SeitenGreat Eastern vs. Hongkong & Shanghai Banking CorporationMichelle Montenegro - AraujoNoch keine Bewertungen

- C9 Receivable Financing Discounting of Notes ReceivableDokument24 SeitenC9 Receivable Financing Discounting of Notes ReceivableAngelie LaxaNoch keine Bewertungen

- 016 DBP v. Sima Wei (Bolinao)Dokument2 Seiten016 DBP v. Sima Wei (Bolinao)Malcolm CruzNoch keine Bewertungen

- Sample Memorandum PDFDokument16 SeitenSample Memorandum PDFsuresh6265Noch keine Bewertungen

- A Negotiable Instrument Is DischargedDokument1 SeiteA Negotiable Instrument Is Dischargednigel alinsugNoch keine Bewertungen

- Banking DukkiDokument356 SeitenBanking DukkiDeepesh SinghNoch keine Bewertungen

- Bill of Exchange Act 34 of 1964Dokument31 SeitenBill of Exchange Act 34 of 1964lifeisgrand100% (7)

- LETTER OF ADVICE OrigninalDokument2 SeitenLETTER OF ADVICE OrigninalSebastian Wienbreyer80% (5)