Beruflich Dokumente

Kultur Dokumente

EDUCO101129C Understanding GST

Hochgeladen von

Azian Mohd HanipOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

EDUCO101129C Understanding GST

Hochgeladen von

Azian Mohd HanipCopyright:

Verfügbare Formate

T A X A T I O N

S E R i E s

Understanding Goods & Services Tax (GST) in Malaysia

Are You Ready?

GST is a fiscal policy featured in over 140 countries worldwide. It is a broad based consumption tax, replacing the current sales and service tax in Malaysia. It is therefore important for businesses to have a better understanding of GST system and be GST ready.

T A X A T I O N

S E R i E s

Making Sense of GST

Understanding Goods & Services Tax (GST) in Malaysia Are You Ready?

The International Monetary Fund (IMF) has long recommended the introduction of GST as a way of raising the efciency of the Malaysian tax system. Malaysia plans to introduce a four per cent goods and services tax in 2011, replacing current sales and services tax (SST) in a bid to diversify national revenues. The aim of the seminar is to introduce the participants to this new tax system which is proposed to be introduced in 2011 so that companies can be prepared for its introduction without any delay and to maximise costs.

Objectives

Participants will learn: Key elements of GST and its mechanism. Implications of GST on businesses. To identify and review business activities in line with GST. To effectively overcome implementation, compliance and enforcement issues. Treatment of transitional issues upon implementation of GST.

Facilitator

P. NaDaraJa P. Nadaraja was formerly with the Royal Malaysian Customs as a Senior Customs Ofcer. He served in various units and specialised in customs administration, import and export procedures, classication, valuation, licensing and compliance matters. He possesses indepth knowledge in various customs legislations including Customs Act, Sales Tax Act, Service Tax Act, Excise Act and other subsidiary legislations. His vast experience in the eld of Customs has made him a popular guest lecturer at the Royal Malaysia Customs Academy in Malacca. He left the Customs Department in 1997 on optional retirement for a private practice as an Advocate and Solicitor. He is now involved in legal practice and at the same a time is actively conducting seminars and workshops on Customs related topics. He has also conducted in-house training for various companies including statutory bodies and has advised and consulted companies on the issues of customs and sales tax valuation, classication, service tax matters, drawback, refunds, exemptions and others. He was ofcially appointed by the Customs Department to conduct Basic Customs Course for forwarding agents for a duration of 2 years in 2005. Nadaraja is an Associate of the Malaysia Institute of Chartered Secretaries and Administrators.

Methodology

Lectures, supported with PowerPoint, discussions and a Q&A session.

Who Should Attend

Finance Managers, Accountants and Auditors General Managers Management Corporations Manufacturers & Traders Purchasing / Procurement Managers Operations Managers IT Personnel Management / Business Consultants Tax Advisors

T A X A T I O N

S E R i E s

Making Sense of GST

Understanding Goods & Services Tax (GST) in Malaysia Are You Ready?

Course Outline

1 Introduction 2 Comparing SST vs. GST 3 Objective 4 Rationale for Implementing GST 5 Scope and Charge to tax 6 Types of Supply Standard Rated Supply Zero Rated Supply Exempt Supply Out of Scope Supply 7 Tests for GST What is a supply Taxable Supply Taxable Person Concept of Business 8 Input & Output Tax, and Credit Mechanism 9 Concept of Supply Place of Supply Time of Supply Value of Supply 10 Reliefs, Exemption, Refund & Remission 11 Computation of Taxable Turnover 12 Registration Liability to Register Voluntary Registration Group Registration Branch Registration Exemption from Registration Partnership Deregistration 13 Accounting for GST Taxable Period Accounting Basis Bad Debt Provision Tax Invoice & Simplied Tax Invoice GST Returns Input Tax Credit (ITC) Input Tax Apportionment Deminis Principle Input Tax Adjustments 14 Special Cases Non application to Government Treatment of Agents Supplies spanning changes in rate or description Transfers as Going Concern (TOGC) Joint Ventures Warehousing Scheme Approved Trader Scheme Toll Manufacturer Scheme Approved Jeweller Scheme Flat Rate Scheme Designated Areas 15 Review and Appeals 16 Goods & Service Tax Rulings 17 Transitional Issues Payments & Invoicing before GST Effect on GST Irreviewable Contracts Progressive & Periodic Supply Rights granted for life Refund of sales tax on goods held on hand Special Refunds Construction Agreements Retention Payments 18 Offences & Penalties 19 Questions and Answer

REgIstratIon Form | MPDC programmE

Online Registration: www.mia.org.my

paRticipants dEtails 1. FULL NAME AS PER I/C (Dato / Datin / Dr / Mr / Mrs / Ms): VEgEtaRian mEal

programmE rEgIstErED for: UnDErstanDIng GooDs & SErVIcEs TaX (GST) In MaLaysIaArE You REaDy? 22 & 23 September 2010, Wednesday & Thursday Melia, Kuala Lumpur 29 & 30 November 2010, Monday & Tuesday Mutiara, Johor Bahru

FEE

DESIGNATION:

MEMBERSHIP NO.1 : VEgEtaRian mEal

2. FULL NAME AS PER I/C (Dato / Datin / Dr / Mr / Mrs / Ms):

Member | RM 900 Member Firms Staff or Sponsored Staff 1 | RM 1,000 Non-member | RM 1,100 rEgIstratIon / EnQuIry KLANG VALLEY CaLL : Vera TEL : 03.2279 9358 FaX : 03.2273 5167 EmaIL : mpdc@mia.org.my ADD : Malaysian Institute of Accountants Dewan Akauntan, No. 2, Jalan Tun Sambanthan 3 Brickelds, 50470 Kuala Lumpur JOHOR BAHRU CaLL : Faizura / Hanem TEL : 07.227 0369 FaX : 07.222 0391 EmaIL : miajbu@mia.org.my ADD : Malaysian Institute of Accountants 5.03A, 5th Floor Menara TJB No. 9. Jalan Syed Mohd Mufti, 80000 Johor Bahru

tErms & conDItIons coursE fEE Fee is payable to: 1. MIA-MPDC for programmes in the Klang Valley and other locations (other than item 2); 2. MALAYSIAN INSTITUTE OF ACCOUNTANTS for programmes in Perlis, Penang, Perak, Kedah, Johor, Sabah and Sarawak. Fee includes course materials, lunch and 2 tea breaks per day. Admittance will only be permitted upon receipt of full payment. Registration made by fax must be followed immediately by payment. CANCELLATION / TRANSFER Upon registering, participant(s) are considered successfully enrolled in the event. Should participant(s) decide to cancel/transfer their enrollment; a cancellation/transfer fee will be levied. Written cancellations/transfer notice received: Within (5) working days before the event, a refund (less an administrative charge of 20%) will be made. For no-show on the day of the event, no refund will be entertained. You can substitute an alternate participant(s) if you wish to avoid cancellation/transfer charges. Any difference in fee charges will be charged accordingly. Cancelled/transferred unpaid registrations will also be liable for full payment of the registration fee. sponsorED staff 1 Sponsoring member is required to indicate his/her name, designation and membership number in the registration form. The sponsored staff must report directly to him/her in his/her rm or company, but for the latter, not in a subsidiary or related company. In the absence of written information on sponsoring, no refunds will be applicable after conrmation of acceptance of registration. Terms and conditions apply. CPE HOURS All participants will be presented with a Certicate of Attendance upon successful completion of the programme. For MIA members, the CPE hours will be credited into the Membership System within 2 weeks of the programme. DISCLAIMER Malaysian Institute of Accountants (MIA) reserves the right to change the speaker(s), date(s) and to cancel the programme should circumstances beyond its control arises. MIA also reserves the right to make alternative arrangements without prior notice should it be necessary to do so. Upon signing the registration form, you are deemed to have read and accepted the terms and conditions.

DESIGNATION:

MEMBERSHIP NO.1 : VEgEtaRian mEal

3. FULL NAME AS PER I/C (Dato / Datin / Dr / Mr / Mrs / Ms):

DESIGNATION:

MEMBERSHIP NO.1 :

ORGANISATIONs dEtails ORGANISATION: INDUSTRY: CONTACT PERSON:

ADDRESS: E-MAIL: TEL: FAX:

signatuRE & Company stamp

paymEnt dEtails

PAYMENT BY chEquE Bank & ChEquE No.: Amount (RM):

PAYMENT BY CREDIT CARD VISA MASTER (tick whichever applicable) CARD EXPIRY DATE:

CaRdholdER NamE: CaRd No.: I authoRisE paymEnt of RM:

DatE:

SignatuRE:

Das könnte Ihnen auch gefallen

- GST in MalaysiaDokument6 SeitenGST in MalaysiaAlbert TanNoch keine Bewertungen

- Y5 Living Thing Set 1 Section ADokument8 SeitenY5 Living Thing Set 1 Section ARuby LaiNoch keine Bewertungen

- Goods and Services Tax in MalaysiaDokument6 SeitenGoods and Services Tax in MalaysiaAzian Mohd HanipNoch keine Bewertungen

- GST in Malaysia Seminar Brochure KL PNGDokument9 SeitenGST in Malaysia Seminar Brochure KL PNGAzian Mohd HanipNoch keine Bewertungen

- Sains BP Set 1 2010Dokument19 SeitenSains BP Set 1 2010Zul IbrahimNoch keine Bewertungen

- SmithDokument17 SeitenSmithAzian Mohd HanipNoch keine Bewertungen

- Trial MT K2 Kelantan 2010Dokument4 SeitenTrial MT K2 Kelantan 2010Azian Mohd HanipNoch keine Bewertungen

- SHN Resource Manual June 2012 4th DraftDokument137 SeitenSHN Resource Manual June 2012 4th DraftAzian Mohd HanipNoch keine Bewertungen

- Monitoring and Evaluation Report 2006Dokument97 SeitenMonitoring and Evaluation Report 2006Azian Mohd HanipNoch keine Bewertungen

- Nero6QuickStart EnuDokument0 SeitenNero6QuickStart EnuAzian Mohd HanipNoch keine Bewertungen

- Perak 2010 k1Dokument28 SeitenPerak 2010 k1Joe TurkoeNoch keine Bewertungen

- Science BHG ADokument27 SeitenScience BHG AKURT_FANSURINoch keine Bewertungen

- Trial MT k1 Kelantan 2010Dokument6 SeitenTrial MT k1 Kelantan 2010Syed Abdul Halim Al-attasNoch keine Bewertungen

- (Cvnvuon .Orvo) : Rnu RNDokument3 Seiten(Cvnvuon .Orvo) : Rnu RNAzian Mohd HanipNoch keine Bewertungen

- Communication Is KeyDokument2 SeitenCommunication Is KeyAzian Mohd HanipNoch keine Bewertungen

- Md. Kher B. KamisDokument126 SeitenMd. Kher B. KamisAzian Mohd HanipNoch keine Bewertungen

- Y6 Topic 1 Whole NumbersDokument43 SeitenY6 Topic 1 Whole NumbersAzian Mohd HanipNoch keine Bewertungen

- Year 4 Science FinalDokument19 SeitenYear 4 Science FinalIB IsmadyNoch keine Bewertungen

- (2.5") Laptop Hard Disk: PC DepotDokument2 Seiten(2.5") Laptop Hard Disk: PC DepotAzian Mohd HanipNoch keine Bewertungen

- Dean'S List: It Is Hereby Certified ThatDokument1 SeiteDean'S List: It Is Hereby Certified ThatAzian Mohd HanipNoch keine Bewertungen

- Laptop&Full SystemDokument2 SeitenLaptop&Full SystemAzian Mohd HanipNoch keine Bewertungen

- Jadual Pemindahan Gaji SBPADokument6 SeitenJadual Pemindahan Gaji SBPAHuang ZcNoch keine Bewertungen

- Dean'S List: It Is Hereby Certified ThatDokument1 SeiteDean'S List: It Is Hereby Certified ThatAzian Mohd HanipNoch keine Bewertungen

- General Info of Air Pollutant Index PDFDokument10 SeitenGeneral Info of Air Pollutant Index PDFFuad SamsudinNoch keine Bewertungen

- Perlaksanaan Dasar KokurikulumDokument11 SeitenPerlaksanaan Dasar KokurikulumAzian Mohd HanipNoch keine Bewertungen

- RPT MT THN5Dokument19 SeitenRPT MT THN5Azian Mohd HanipNoch keine Bewertungen

- Senarai Blog Seni: Lifeasaartstudentlilizala - Blogspot.c OmDokument1 SeiteSenarai Blog Seni: Lifeasaartstudentlilizala - Blogspot.c OmAzian Mohd HanipNoch keine Bewertungen

- RPT MT THN5Dokument19 SeitenRPT MT THN5Azian Mohd HanipNoch keine Bewertungen

- Basic Guidelines in Style and Format For Academic WritingDokument4 SeitenBasic Guidelines in Style and Format For Academic WritingPatrickNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Symbiosis International (Deemed University) Pune Symbiosis Law Scool, PuneDokument17 SeitenSymbiosis International (Deemed University) Pune Symbiosis Law Scool, PuneSanskriti GrewalNoch keine Bewertungen

- On GLPDokument80 SeitenOn GLPManoj Kumar Sharma100% (2)

- Ms 1042 Part 1 2007-Safety in Laboratories - Code of Practice - Part 1 General (First Revision) - 840594Dokument52 SeitenMs 1042 Part 1 2007-Safety in Laboratories - Code of Practice - Part 1 General (First Revision) - 840594MARVINNoch keine Bewertungen

- Supplier AgreementDokument4 SeitenSupplier AgreementRocketLawyer50% (2)

- Lakeport City Council Meeting Agenda PacketDokument377 SeitenLakeport City Council Meeting Agenda PacketLakeCoNewsNoch keine Bewertungen

- Payment of Fees Regulations: Ravensbourne College of Design and CommunicationDokument9 SeitenPayment of Fees Regulations: Ravensbourne College of Design and CommunicationlisaconnollyNoch keine Bewertungen

- Citi Regulatory Mindmap Hedge Funds NorthAmerica Nov 2012Dokument1 SeiteCiti Regulatory Mindmap Hedge Funds NorthAmerica Nov 2012adee_adityaNoch keine Bewertungen

- Internship 1 ReviewerDokument7 SeitenInternship 1 ReviewerJake BalladaNoch keine Bewertungen

- End User License Agreement For HID OMNIKEY 5x2x Driver V1.2.26.140Dokument5 SeitenEnd User License Agreement For HID OMNIKEY 5x2x Driver V1.2.26.140Văn Phúc NguyễnNoch keine Bewertungen

- BS en 1869 Fire Blankets VersionDokument12 SeitenBS en 1869 Fire Blankets VersionCameronNoch keine Bewertungen

- UNDP - Procurement User Guide Jan 2006 PDFDokument86 SeitenUNDP - Procurement User Guide Jan 2006 PDFPres Asociatie3k100% (1)

- Act 74 Final (U)Dokument298 SeitenAct 74 Final (U)Sagheer AhmedNoch keine Bewertungen

- Pablico v. Master PabDokument10 SeitenPablico v. Master PabRaeNoch keine Bewertungen

- CorpDokument3 SeitenCorpMuskan KhatriNoch keine Bewertungen

- Sample Copy AUSTWHEATBILL PDFDokument2 SeitenSample Copy AUSTWHEATBILL PDFJason Pablo CardenasNoch keine Bewertungen

- Pledge and Mortgage Contract RequirementsDokument9 SeitenPledge and Mortgage Contract RequirementsBreAmberNoch keine Bewertungen

- Safety Inspection Report by WillPoolDokument5 SeitenSafety Inspection Report by WillPoolRana Muhammad ZeeshanNoch keine Bewertungen

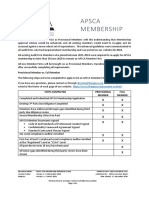

- APSCA Firm Membership Definitions D 028Dokument1 SeiteAPSCA Firm Membership Definitions D 028VANoch keine Bewertungen

- IAS 23 Borrowing CostsDokument11 SeitenIAS 23 Borrowing Costsksmuthupandian2098Noch keine Bewertungen

- Clearfield Doctrine: Exhibit 8aDokument2 SeitenClearfield Doctrine: Exhibit 8aRamon MartinezNoch keine Bewertungen

- 1492ADokument3 Seiten1492ADenzo RyugaNoch keine Bewertungen

- Article 1723Dokument3 SeitenArticle 1723Brian Ernest RegaladoNoch keine Bewertungen

- Observership ApplicationDokument5 SeitenObservership ApplicationPratiksha KapartiwarNoch keine Bewertungen

- Defective ContractsDokument2 SeitenDefective ContractsaceamulongNoch keine Bewertungen

- RLOC Equipment Integrity PolicyDokument10 SeitenRLOC Equipment Integrity PolicyMohammed ZubairNoch keine Bewertungen

- FBDC Vs FongDokument2 SeitenFBDC Vs FongDahl Abella TalosigNoch keine Bewertungen

- RCBCDokument2 SeitenRCBCLisa BautistaNoch keine Bewertungen

- Lecture 2Dokument42 SeitenLecture 2maria fernNoch keine Bewertungen

- AP Gov-Ch. 17 Economic Policy Making WorksheetDokument3 SeitenAP Gov-Ch. 17 Economic Policy Making WorksheetLillian JinNoch keine Bewertungen

- Foreign Bank Account Certification Capital OneDokument4 SeitenForeign Bank Account Certification Capital OneMohammed RagehNoch keine Bewertungen