Beruflich Dokumente

Kultur Dokumente

Module 3 Fundamental Analysis 1

Hochgeladen von

wijayaarieOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Module 3 Fundamental Analysis 1

Hochgeladen von

wijayaarieCopyright:

Verfügbare Formate

Paritechs suite of multimedia training programs cover the following:Module 1 Module 2 Module 3 Module 4 Technical Analysis 1 Technical Analysis

2 Fundamental Analysis Strategies for Successful Investing

Module 3 Fundamental Analysis 1 Hello and welcome to Paritech training. This is the third in a series of interactive training modules designed to give you the knowledge, skills and attitude necessary to be successful in todays markets. Module 3 is made up of 6 lessons, each approximately twenty-five minutes in duration. The lessons are designed for you to work through at your own pace and come with practical examples and self help exercises. It is important to make sure you complete all the self help exercises, even if some of the answers at times appear obvious. The self help exercises are like stepping stones to higher levels of understanding and we want to make sure that your knowledge of the basics is sound before moving on to more advanced topics later in the curriculum. In this one hour session we will cover: Introduction to Fundamental Analysis Profit and Loss Statements Balance Sheets Utilising Financial Ratios Market Performance Ratios Investment Methods and Resources

Lesson 1 helps investors develop a basic understanding of what we mean by the term Fundnamental Analysis and how we can use financial statements and ratio analysis to gain insights into the operating performance of a company. We commence our education of how to analyse the performance of companies by looking at two important financial reports in Lesson 2 we look at the Profit and Loss Statement and in Lesson 3 the Balance Sheet. We will work through a series of exercises which are designed to help us understand how they are constructed and how we interpret them. Lesson 4 looks at five accounting based ratios - these being the Current ratio, the Debt to Equity ratio, Profit Margin ratio, Cashflow ratio, and Return on Equity, and how these are generally accepted in the marketplace as being vital when determining a company's financial strength. In Lesson 5 we look at a group of market performance ratios that will enable you to compare the performance of an individual stock to that of its industry peers. The ratios that we will focus on are the Earnings Per Share Ratio, Price Earnings ratio, Price to Sales ratio, Sales Growth ratio, Earnings Growth rate, Price Earnings Growth ratio, and the Dividend Yield/Dividend Cover ratio. These ratios will assist us in our buy and sell decision making once we have found likely stocks.

And finally in Lesson 6 having worked through the process of analysing financial accounts and identifying better performing companies we look at the importance of developing a balanced approach to investing to improve our prospects for success. In addition, we look at some tools that can assist investors in the analysis process, including media and on-line news and information sources.

Module 3 Fundamental Analysis

Lesson 1 Defining Fundamental Analysis Q. - What is fundamental analysis? Fundamental analysis is concerned with the historical performance of the economy, the industry, and companies for the insights they offer into the future performance of companies. Financial analysts not only explore the financial relationships that exist for a given company at a moment in time, but more importantly trends in those relationships over time. The composition of company assets, its capital structure and leverage, its competitive position and company earnings are all studied for clues as to future performance. Fundamental analysis enables us to screen and classify companies in terms of their investment quality and expected return. Estimates of expected return and perceived risk serve as a basis for appraising the relative attractiveness of stocks for investment. According to International Accounting Standards, most publically listed companies are required to make available to the investing public their financial results (or accounts) once and in some instances twice a year. Most companies typically have an annual balance date of June or December, however these are not hard and fast rules. For example most retail companies prefer to close their books as at the end of June as this allows them to focus resources on the December peak trading period. Companies will generally publish with their home exchanges several pages of information relating to their performance. This usually includes the Company Secretary making a media release at the same time. The primary documents which the Company Secretary refers to are the Profit and Loss Statement and Balance Sheet and we will look at the first of these, the Profit and Loss Statement in our next lesson.

Fundamental Analysis

Progressive Questions

Q1. Which of these three statements best describes Fundamental Analysis:a. Fundamental analysis is concerned with the historical performance of the economy, the industry, and companies for the insights they offer into the future performance of companies; b. Fundamental analysis is concerned with the historical performance of the industry, and companies for the insights they offer into the future performance of companies; c. Fundamental analysis is concerned with the retrospective performance of a company for the insights they offer into the future performance of the company;

Answer A Fundamental analysis is concerned with the historical performance of the economy, the industry, and companies for the insights they offer into the future performance of companies.

Lesson 2 Profit and Loss Statements So what is a Profit and Loss Statement ?

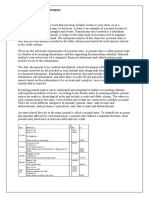

A Profit & Loss Statement is a financial summary of the activity of a company over a period of time, usually reported on an Interim (6 monthly) and Annual basis. Included in the summary are sales, cost of goods sold, general operating expenses and finally the net profit figure. In practice, income and expenditure is usually divided into two sections, the trading account, which includes sales revenue and the costs directly associated with bringing goods and services to market, and the profit and loss account, which includes other (non-sales) income and operating expenses. Lets take a look at an example of a Profit and Loss Statement and see how they are put together.

Exhibit A

Structure of a typical Profit and Loss Statement XYZ LTD Year Ended 30 June XX $

COMPANY:PROFIT & LOSS ACCOUTNT

INCOME Sales Commissions Earned 4,779,423 35,451

NET SALES

4,814,874

COST OF SALES Opening Stock Purchases Less: Closing Stock 174,725 4,166,665 (181,339) 4,160,051

GROSS PROFIT LESS: EXPENSES Salaries, Wages, & Superannuation Delivery Contracts Motor Expenses Repairs & Maintenance Insurance Electricity & Rates Travel Expenses Office Expenses Depreciation Expense Interest Expense TOTAL OPERATING EXPENSES Profit on Sale of Asset OPERATING PROFIT BEFORE TAX & ABNORMAL ITEMS Provision for income Tax

654,823

128,522 74,331 21,669 24,331 19,004 34,482 19,855 34,869 48,319 81,503 486,885 1,773 169,711 (19,833)

OPERATING PROFIT AFTER TAX & ABNORMALS

149,878

RETAINED PROFIT Opening Balance RETAINED PROFIT Closing Balance

206,869 356,747

The account begins with a recording of the companys revenue from its business operations. The focus here is not on all revenue, but rather on the sales revenue that the company generates from normal trading operations. Sometimes companies will generate revenue from the sale of assets and /or generate additional revenue from consultancy fees which are not part of its normal operations. In such instances, these are not included with the revenue streams in the trading section of the profit and loss account. Keep in mind that the revenue is recorded by application of accrual accounting principles. That is, revenue is recorded when a sales transaction takes place, not when the actual cash associated with that sale is collected in cash. Following revenue, the profit and loss account next focuses on the direct costs of producing the goods for sale the cost of sales or cost of goods sold. The direct costs are recorded in accordance with the revenue that they generate and become expense items in the profit and loss account. A number of costs may be involved in arriving at the cost of goods sold, from the cost of materials to production wages, direct factory overhead and depreciation of machinery used in the production process. Sometimes there are no direct production costs, only those involved in the administration of the business. The difference between a companys revenue and cost of goods sold is called its Gross Profit, which is often referred to as Gross Profit Margin. The term Gross Profit is used as it recognises that there are additional expenses and revenues to consider, such as office expenses and sundry revenue, before we arrive at an Operating Profit figure. Next in the flow of the account is the array of expenses normally incurred in the course of business which represent selling costs as well as general administrative costs. We call these Operating Expenses. The largest single expense in this group is usually salaries and wages, superannuation, commissions, and so forth. Many profit and loss accounts will provide even greater detail under sub-headings of selling expenses, administrative expenses and financial expenses. Some however do not and merely list the expenses alphabetically or otherwise. Note in particular that interest expense and depreciation are also recorded in this block of expenses. This is often the point at which we look to draw comparisons between the performance of companies, but more on this a little later. We next encounter any miscellaneous revenue that is apart from the normal stream of revenue for the business. For example, sometimes we find there is a profit on the sale of a fixed asset, an event which effects the profit and loss account but does not represent a major element of trading operations. Once we have worked our way through all the operating expenses, we come to another sub-total, usually designated as Operating Profit Before Income Tax (or sometimes referred to as Net Profit Before Tax in abbreviated form NPBT). At this point weve accounted for all the revenues and expenses including those that fall outside the mainstream so that we now arrive at the provision for income tax, an item which is representative of our best estimate of how much tax we need to pay in relation to the financial year just ended. Note however that there are two additional expense items after the provision for income tax. These fall under the abnormal category (sometimes called extraordinary) items category.

So why not show the abnormal items amongst operating expenses, i.e. above the income tax provision? The reason is simple. An abnormal item by definition is a one-off event. To consider it at any other point in the profit and loss account would distort the totals and subtotals for normal business operations and would certainly change the operating profit before tax calculation. Consequently, if we wished to compare the operating results from year to year, abnormal items must be placed in a category of their own at a point after normal operating revenue and expenses. The next item in the Profit and Loss account is the net result of all the companys activity for the year, Operating Profit After Income Tax (or Net Profit After Income Tax NPAT). This figure, which may occasionally be negative, would be bracketed, representing a loss. The line following after tax adds retained profits from the previous period (representing undistributed profits from previous years) to the profit or loss for this period. The total of these two figures is the amount available for distribution to shareholders, which represents the amount which the company may distribute by way of dividend. The maximum dividend fund consists of:1. 2. 3. Current year profits; Accumulated past year profit (retained profit); (and in some countries) Reserves.

The amount declared as a dividend is at the discretion of the directors and would rarely exceed the profit made in any year, as directors would prudently leave a certain portion of the profit in the company to provide additional working capital. The final dividend, once declared, represents debt owed by the company to the shareholders. This debt may be enforced by each shareholder as any other contract debt. This means the dividend cannot be rescinded after declaration but before it is actually paid. The final line on the profit and loss account is the retained profits at the end of the financial year. This figure is carried onto the balance sheet in the shareholders equity section. If this amount is negative, it would be referred to as accumulated loss. Ok, so we now have a good understanding of what a Profit and Loss Statement is and how it is constructed. An equally important statement is the companys Balance Sheet, and we will look at this in our next lesson. Ok, so we can now see how the Profit and Loss statements are constructed and what the various ledger items represent. This is an important milestone in our learning that we can look to build on, by seeking out company reports from different industries and seeing how they vary in asset and liability composition, and equity mix. Next we will explore the process of defining performance trends as it is through this form of analysis that we look to establish a framework from which we can form views as to the future prospects of a company. Specifically, we will look at a summary Profit and Loss statement for ABC Company covering the 2000 and 2001 financial years. As you work through each ledger item select an up arrow when the year on year trend is up and select a down arrow when the year on year trend is down:-

Profit & Loss Statement - ABC Company FYE 2000 Sales Revenue Operating Expenses (excl. Interest & Abnormals) Operating Profit Before Interest, Abnormals & Tax 409,140 361,053 48,087 FYE 2001 546,187 463,059 83,128

Interest Revenue/(Expense) Operating Profit Before Abnormals & Tax Abnormal Items Operating Profit/(Loss) Before Tax Less Tax Operating Profit After Tax Key Points So how might we sum up the performance of ABC company?

(700) 47,387 1, 882 45,505 17,289 28,216

1,019 84,147 5,814 78,333 26,595 51,738

Well in trend (or percentage change) terms we can see significant movements in the following areas:Sales Revenue has increased by 33.5% Operating expenses have increased by 28% This will lead to an improved gross margin.

Operating Profit before abnormal items and tax increased by 78% Operating Profit after tax and abnormals has increased by 83% In summary, the company has managed to increase sales whilst at the same time contain, or more accurately reduce costs, which underpinned an improved profit performance in the current year. Do we therefore view this as a positive and the company worthy of investment ? Well based on the information currently before us we would see its performance as encouraging, but insufficient to be satisfied as to the financial strength of the company.

Fundamental Analysis

Progressive Questions

Q2. Which of these three statements best describes A Profit and Loss Statement:A. A Profit & Loss Statement is a financial summary of the activity of a company over a period of time. Included in the summary are sales, cost of goods sold, general operating expenses and an itemised list of assets and liabilities. B. A Profit & Loss Statement is a financial summary of the activity of a company over a period of time, usually reported on an Interim (6 monthly) and Annual basis. This itemised report highlights the performance of individual product lines and the profit contribution of each asset owned by the company. C. A Profit & Loss Statement is a financial summary of the activity of a company over a period of time, usually reported on an Interim (6 monthly) and Annual basis. Included in the summary are sales, cost of goods sold, general operating expenses and finally the net profit figure.

Answer C

A Profit & Loss Statement is a financial summary of the activity of a company over a period of time, usually reported on an Interim (6 monthly) and Annual basis. Included in the summary are sales, cost of goods sold, general operating expenses and finally the net profit figure.

Lesson 3 Balance Sheets The assets, liabilities and shareholders interests in a company are listed on a document called a Balance Sheet. Balance sheet items are usually arranged according to their liquidity, where we define liquidity as ease of conversion to cash. That conversion can take place in the business operations themselves, when stock is converted to sales and then cash, or by the actual sale of the assets to other parties. Now lets look at a balance sheet.

Exhibit A COMPANY:-

Structure of a typical Balance Sheet Statement XYZ LTD Year Ended 30 June XX $

CURRENT ASSETS Cash Debtors Stock Prepaid Expenses Loans to Employees TOTAL CURRENT ASSETS FIXED ASSETS Motor Vehicles Plant & Equipment Land & Buildings 65,352 27,300 381,519 35,332 129,782 181,339 20,351 4,429 371,233

TOTAL FIXED ASSETS INTANGIBLE ASSETS Product Patents Goodwill TOTAL INTANGIBLE ASSETS

474,171

42,000 125,000 167,000

TOTAL ASSETS

1,012,404

CURRENT LIABILITIES Creditors Lease Creditors Current Term Loan Current 168,946 4,124 98,066

Accrued Expenses Income Tax Payable TOTAL CURRENT LIABILITIES NON-CURRENT LIABILITIES Lease Creditors Non Current Term Loan Non Current TOTAL NON-CURRENT LIABILITIES

5,880 19,833 296,849

10,121 224,725 234,846

TOTAL LIABILITIES NET ASSETS

531,695 480,709

SHAREHOLDERS FUNDS Issued Share Capital Retained Profits TOTAL SHAREHOLDERS FUNDS 122,459 358,250 480,709

As we go down the asset side of the balance sheet, we start with the most liquid of all assets, cash, and continue to the least liquid, non-current (fixed assets). Note too that assets are grouped into various blocks. All the current assets are placed together because they will be converted to cash or used up in the next operating period. The non-current assets that follow refer to the fact that they will not be used or turned into cash in the next operating period. The non-current group, in turn, is usually dominated by the companys fixed assets, which can be designated capital assets or property, plant, and equipment. Within the group of assets themselves, liquidity or ease of conversion to cash, normally dictates which accounts come first and which ones follow. For example, we have noted that cash is the most liquid of all assets and obviously the most liquid of the current assets. Its followed by trade debtors and then stock. That makes sense. Trade debtors should be more liquid than stock since trade debtors represent stock that has already been sold. Therefore, it is one step closer to the cash stage in the conversion process. Furthermore, a company can usually sell its trade debtors to a third party more easily than it can sell stock. The value of trade debtors is normally clear. The market value of stock is often less clear. Next we come to prepaid expenses which represent intangible assets to be used up in the next period, and finally, we get to the least liquid of all the current assets, at least in the companys opinion, which is loans to employees. The same process (though not quite so categorically) may be applied to the non-current asset grouping. The fixed assets are the most illiquid of the assets, albeit they do contribute to the production process. It just takes several years to use them up completely. Further, the company can normally find some type of market for those assets if forced to do so. It can sell its delivery trucks, for example. Now lets focus on the other side of the balance sheet. The liabilities side has the same account listing and rationale as on the asset side. Liquidity dictates the account listing again, but from a different perspective. In this instance, the accounts are listed generally in priority of liquidation or payment by the company. The company does not convert the accounts to cash for its use. Rather the opposite, it pays out cash to satisfy a claim, or, put another way, to eliminate a commitment.

The current liabilities section lists the short term debts of a company. These are the liability items that the company expects to pay during the current operating period, usually within the coming year. Note the relationship of these payment requirements to a companys general liquidity or availability of cash to meet all operating expenses. As a company goes through its operating period, it uses up cash paying salaries, purchasing stock, paying operating expenses etc and it generates cash by converting stock to sales and the resulting trade debtors to cash. A company is liquid if the cash generated over the period exceeds the cash paid out, including cash paid out for interest and dividends. The first grouping in the current liabilities category reflects those commitments that are scheduled to be paid in the next operating period. Creditors come first as the company must pay its suppliers within a reasonable period of time if it wants to assure continued access to supplies without having to pay cash at the time of purchase. After commitments to suppliers, the company lists its internal commitments in the form of accrued expenses. Generally accruals are listed after all other current liabilities, but the order is interesting since we may read into it that the company must first assure its source of supply, then worry about satisfying its own employees to whom it owes salaries, commissions, travel expenses and so on. Following accrued expenses, is income tax payable. The order of accounts in the non-current section of liabilities follows the logic we reviewed in the current section. It begins by listing the companys contractual commitments to financial institutions. The group of accounts ends with term loans. All the assets and liabilities recorded reflect the application of the conservatism principle and the going concern assumption. However, the conservatism principle has a particular twist when we focus on liabilities. That is, we want to be assured that the maximum amount owed is recorded, not the minimum amount. Normally, the amount recorded and the (market) value of the liability will be identical. But differences could arise in special circumstances. In relation to the going concern concept, if we assume the company is about to close its doors, the general impact would be to increase the claims against the company rather than to decrease them. If anything, it serves to increase liability values; any party with even a remote claim against the company will present that claim together with additional legal costs, if it believes the company may be terminating operations. The total amount of a companys assets must always equal the sum of its liabilities and shareholders equity. So far we have made numerous observations about the sequence of asset and liability accounts with specific emphasis on the liquidity implications. We can make somewhat similar observations about the accounts in the shareholders equity group. However, that would really miss the point. Liabilities plus shareholders equity must equal total assets, and net assets must equal shareholders equity which is the same formula merely stated differently. We can conclude that all the assets a company owns are financed by a combination of liabilities and shareholders equity. In the (unlikely) event that there were no liabilities on the balance sheet, then all the companys assets would be financed by the amount of capital contributed to the company by its shareholders. As investors our intuition tells us that we would prefer to invest in companies that have more rather than less shareholders equity relative to non-shareholder funding, which we designate as liabilities. There are a couple of reasons for this, both of which raise the issue of solvency the companys ability to meet all obligations from the cash value of its assets. Firstly, if a company has to sell its assets to pay off its creditors, it must by law discharge its liabilities before it can pay out the shareholders. Secondly, more shareholder funds relative to non-shareholder funds means that there is a larger block of assets available to convert to cash if a liquidity crisis occurs. This is an important consideration, since we can never be sure how much the company can get for its assets, paritculary if the sale takes place in distressed circumstances. Lets look at the various accounts within the shareholders funds group - issued share capital and retained profits.

Issued share capital is the amount of the shareholders direct contribution. Do not confuse book value of shares with market value. If shares are publicly traded, there is usually no relationship between the amounts we see on the balance sheet and the price of shares on the open market. The company records its receipts of cash from the initial issue of its shares. What the shareholders do with the shares subsequently is between them and the new buyers. If the shares are sold on the open market for more than the original price, it has no bearing on the company nor the amount it records for issued share capital. The final item in the shareholders equity group is retained profits. Retained profits simply shows the amount of profits left in the business over the years, which, in turn, helps support the finances of the companys assets. In this case, the retained profits balance is roughly three times the amount of issued share capital. Issued share capital may have several categories. It may consist totally of ordinary shares, or the ordinary shares may be supplemented by preference shares. For example, it is common to see a preference shares account for many publicly traded companies. Preference shares have liquidity implications. It means that the holder of those shares are in a preferred position with respect to dividends the company pays (preferred to the holders of ordinary shares). They are also in a preferred position to the holder of ordinary shares if liquidation occurs. That is, they get paid, assuming any cash is available, before the holders of ordinary shares. Redeemable preference shares have even more significant liquidity implications, in that the shareholders capital, represented by redeemable shares, has to be repaid (redeemed) to the shareholders at any given date. The repayment of capital can have a significant effect on the companys liquidity at any time in its business cycle. Next we need to take a closer look at the companys assets and we will do that in our next exercise. Here are the companys balance sheet assets:-

Balance Sheet Assets of ABC Company FYE 2000 CURRENT ASSETS Cash Debtors Stock TOTAL CURRENT ASSETS NON-CURRENT ASSETS Debt ors Property, Plant & Equipment Stock Intangibles Other TOTAL NON-CURRENT ASSETS TOTAL ASSETS Key Points 4,218 44,350 4,940 8,817 1,308 63,633 223,363 5,563 64,369 4,902 7,264 7,258 89,356 273,825 40.4% 22.6% 4,503 85,855 69,372 159,730 16,418 92,390 75,661 184,469 15.5% FYE 2001 Percentage Change %

10

Ok, so we can now see how the Profit and Loss and Balance Sheet statements are constructed and what the various ledger items represent. This is an important milestone in our learning that we can look to build on, by seeking out company reports from different industries and seeing how they vary in asset and liability composition, and equity mix. Next we will explore the process of defining performance trends as it is through this form of analysis that we look to establish a framework from which we can form views as to the future prospects of a company. Specifically, we will look at a summary Balance sheet statement for ABC Company covering the 2000 and 2001 financial years. As you work through each ledger item select an up arrow when the year on year trend is up and select a down arrow when the year on year trend is down:-

Balance Sheet Assets of ABC Company FYE 2000 CURRENT ASSETS Cash Debtors Stock TOTAL CURRENT ASSETS NON-CURRENT ASSETS Debt ors Property, Plant & Equipment Stock Intangibles Other TOTAL NON-CURRENT ASSETS TOTAL ASSETS Key Points As outlined earlier, the Balance Sheet is a company's financial record reporting the current value of all assets, liabilities and shareholders equity as at a specific date. As outlined earlier, the Balance Sheet is a company's financial record reporting the current value of all assets, liabilities and shareholders equity as at a specific date. Put simply, Assets are things that we own/possess. So what conclusions can we draw from this year on year comparison ? Well you will note that we have introduced a third column, which draws our attention to movements in asset classes for the year on year period. In summary we can see that the company ABC's Assets have increased by 23% - suggesting that it has expanded or acquired another business. Is this a positive? Well it certainly appears to be in the short term as evidenced by the increase in revenues and bottom line profit. Having said this, it is important to keep in mind the image of a simple balance sheet and recognise that any increase in assets needs to be funded either through increased debt (or in other words an increase in liabilities), equity or a combination of both. 4,218 44,350 4,940 8,817 1,308 63,633 223,363 5,563 64,369 4,902 7,264 7,258 89,356 273,825 40.4% 22.6% 4,503 85,855 69,372 159,730 16,418 92,390 75,661 184,469 15.5% FYE 2001 Percentage Change %

11

Lets take a closer look at the Liabilities and Equity side of ABCs balance sheet:Balance Sheet Liabilities of ABC Company FYE 2000 CURRENT LIABILITIES Creditors Term Loan Current Accruals TOTAL CURRENT LIABILITIES NON-CURRENT LIABILITIES Term Loan Non-Current Provisions Other TOTAL NON-CURRENT LIABILITIES TOTAL LIABILITIES NET ASSETS EQUITY Capital Reserves Retained Profits TOTAL EQUITY Balance Sheet Liabilities Liabilities are anything we owe. Equity is the balance of our Assets less what we owe - our true net worth. So we can now conclude that Total Liabilities have increased by 40%, significantly more than the increase in Assets. In the short term this will result in a decline in the financial structure of the company, but given its increased capacity to generate profits this may not be a major concern. Now we need to see how productively the company is in utilising its resources and with this in mind we need to supplement our analysis with an approach which allows us to measure the use of the assets, liabilities and also equity of the company. With this purpose in mind we will look to assess the company via a series of important ratios each specifically selected to isolate key performance measures of the business. 20,867 48,077 50,975 119,919 68,370 300 60,496 129,166 8% 3,225 4,938 1,159 9,322 103,444 119,919 5,957 5,750 745 12,452 144,659 129,166 34% 40% 52,287 13,970 27,865 94,122 66,409 6,005 59,793 132,207 40.5% FYE 2001 Percentage Change %

Fundamental Analysis

Progressive Questions

Q3. Which of these three statements best describes a Balance Sheet:A. The assets and liabilities of a company are listed on a document called a Balance Sheet. Balance sheet items are usually arranged according to their size or dollar value, from the lowest dollar value item to the largest;

12

B. The assets, liabilities and shareholders interests in a company are listed on a document called a Balance Sheet. Balance sheet items are usually arranged according to their liquidity, where we define liquidity as ease of conversion to cash; C. The assets, direct and contingent liabilities of a company are listed on a document called a Balance Sheet. Balance sheet items are usually arranged according to their size or dollar value, from the lowest dollar value item to the largest;

Answer B

The assets, liabilities and shareholders interests in a company are listed on a document called a Balance Sheet. Balance sheet items are usually arranged according to their liquidity, where we define liquidity as ease of conversion to cash. Lesson 4 Utilising Financial Ratios The key benefit of ratio analysis is that it promotes the use of a uniform methodology by which we can compare changes in a companys operations over time. Ratio analysis allows us to evaluate:1. 2. 3. The business performance of a company; Its liquidity (both short and long term); and Its operating efficiency

In addition, ratio analysis allows us to measure changes in one internal performance measure against another, or indeed the performance of one company to another, or compare the performance of a company to an industry benchmark. There are approximately 50 popular accounting ratios used to analyse financial statements. If we used each one of theses ratios we would find conflicting outcomes and would certainly find it time consuming calculating and assessing each ratio. For our purposes, we will look at just five accounting based ratios that are generally accepted in the marketplace as vital when determining a company's financial strength. But before we do its important to note that we should never judge a companys ratio performance by simply viewing one ratio in isolation. We should always endeavour to compare the results with prior periods to establish trends and always compare companies in the same industry sector. Ratio analysis is not intended to be the sole process by which we judge companies. Rather, it is used to supplement our analysis firstly of a companys business (i.e. what it is and what it does) and then its performance. Now lets start to work through some practical exercises, which will help us consolidate our understanding of how we use Balance sheets, Profit and Loss Statements and ratio analysis to form views as to the financial strength of a company. First of all lets have a look at the Current Ratio. Current Ratio What is the current ratio ? Its the companys current assets divided by its current liabilities.

Current Assets to Current Liabilities =

Current Assets Current Liabilities

13

ABC Company $m Current Assets Current Liabilities CACL Ratio

1999/ 00 159,730 94,122 1. 7

2000/01 184,469 132,207 1.4

The current ratio measures the companys capacity to cover current liabilities from the liquidation of current assets. A high score implies that there is a high degree of coverage of short term assets over short term liabilities. A rule of thumb for the current ratio is 1.2 or higher. However, a score of 1.15 does not necessarily indicate an unsatisfactory ratio. Many companies operate successfully over long periods with ratios of 1. The type of business may require only nominal investments in current assets. For example if management are efficient they may have a quick turnover period of debtors and stock resulting in low dollar values on the balance sheet. This highlights the previous point that ratios are relative measures and should therefore be put in context by comparing to prior periods and other companies. The current ratio has fallen, however it still remains acceptable. Therefore on our financial strength checklist we will give the company a tick. There is a related ratio to the current ratio and this is called the quick ratio or 'acid test'. It is a slightly more stringent method of measuring liquidity in that it only includes those assets that may be converted to cash in the next month or two, to help meet the liabilities due over the same period. In short it is the same calculation as Current Ratio except that stock is deducted from Current Assets and Overdraft is deducted from Current Liabilities. [Insert checklist and a green tick] Lets have a look at the debt to equity ratio:Debt to Equity Ratio What is the Debt to Equity ratio ? Debt to Equity Ratio = Total liabilities Total Equity

Well it is the total liabilities of a company divided by the total equity of a company. It is used as an indication of the leverage used to finance the business activities of the company. Here are the calculations:ABC Company $m Total Liabilities Total Equity TLTE Ratio 1999/ 00 103,444 119,919 0.86:1 2000/01 144,659 129,166 1.12:1

14

There are no hard and fast rules regarding acceptable levels of gearing, however most businesses have a rule of thumb and wish to stay below a ratio of 1 to 1. As investors we need to watch out when the debt portion of a company rises over time, especially when profit margins remain static or decline and interest rates are rising. The ratio is an important indication of financial stability on a long-term basis. If a companys external liabilities continue to increase out of proportion to shareholders equity, then it may find itself severely strained by the level of interest repayments. So we need to recognise the importance of companies not being too heavily reliant on debt as a form of funding. On the other hand a very lowly geared company (where liabilities are less than 50% of Equity) may indicate that management have failed to utilise relatively cheap borrowed funds. (A low-geared company is seen by financiers as a low credit risk and therefore can usually borrow at cheaper rates). In this instance, the debt to equity ratio has increased and is modestly above preferred levels, however given the companys ability to generate strong profits debt levels at this point do not appear to be a concern. [Insert checklist and a green tick] Next we will have a look at the Profit Margin ratio.

Profit Margin Ratio

Operating Profit Before Interest, Abnormals & Tax divided by Sales Revenue = OPBIAT Sales Revenue 1999/ 00 48,087 409,140 11.8% 2000/01 83,128 546,187 15.2%

ABC Company $m OPBIAT Sales Revenue Profit Margin

We must be able to distinguish between profit and profitability - the Profit Margin or Gross Margin ratio allows us to do that. A higher margin indicates improved earnings potential. Some businesses can operate on small margins largely due to massive turnovers. For example retailers and wholesalers will generally have margins of less than 5%. Conversely some businesses earn extremely high gross profit margins and are not dependent on volume of sales. Such firms earn margins of greater than 20%. Businesses that have high margins and low turnover include Luxury items distributors, Professional Services (Accountants, Lawyers etc). A reasonable target will depend on the type of business and therefore the ratio should generally be only compared to like companies. In this instance the gross margin has improved even though the company has grown this is a very positive sign. This means that on our financial strength checklist we can give the Profit Margin Ratio a tick.

15

[Insert progressive checklist and a green tick] Next is the Cashflow Ratio Cashflow Ratio Cashflow Ratio = ABC Company $m OPBIAT Current Liabilities Cashflow ratio OPBIAT Current Liabilities 1999/ 00 48,087 94,122 51% X 100 1

2000/01 83,128 132,207 63%

The Cashflow ratio provides further evidence of a companys ability to meet its short-term commitments. A high Operating Profit /Current Liabilities ratio indicates a sound, financially viable company. Companies that have a lower coverage of Current Liabilities are said to have poor profitability. Businesses with a low cashflow ratio will struggle to meet their commitments and will generally resort to borrowing's to fund liabilities, resulting in downward spirals. Companies that have a 20% or better cover of current liabilities, as in this instance, are seen to be solid. [Insert progressive checklist and a green tick] Return on Equity ROE = OPAT Total Equity 1999/00 28,216 119,919 23.5% 2000/01 51,738 129,166 40%

ABC Company $m Operating Profit After Tax Total Equity Return on Equity

Return on equity is a basic profitability test. The ability of a company to earn a satisfactory ROE will determine its ability to attract investment and survive financially in the long term. ROE is a measure of management's ability to extract a profit from the equity employed within the business. During times of growth it is important for management to maintain profitability and therefore ROE. Therefore we should not necessarily look for an improving ROE but rather a stable ROE at sustainable rates. A healthy target for ROE of >10% ROE is widely used as a profitability measure in the financial press. In our current example the Return on Equity is exceptional and on an improving trend. [Insert progressive checklist and a green tick]

16

So based on our analysis thus far it would appear that changes in the companys business activities have resulted in immediate benefits, and this can be seen through improved operating efficiencies (i.e. increased sales, lower operating costs) and higher profits. Does our analysis therefore lead us to the conclusion that we should invest in ABC company ? Well, not yet. Whilst it is not unreasonable to conclude that the company is in a sound financial position, this alone does not mean that it represents a good investment. We now need to take a slightly different perspective and look at some key market performance ratios to evaluate how attractive the company is to us as investors. And that is what we will do in our next lesson.

Fundamental Analysis

Progressive Questions

Q4. Which of these three statements best describes the use of Financial Ratios:A. The key benefit of ratio analysis is that it allows us to compare the size of one company to another;

B. The key benefit of ratio analysis is that it obviates the need for us to analyse all other aspects of a companies activities; C. The key benefit of ratio analysis is that it promotes the use of a uniform methodology by which we can compare changes in a companys operations over time. Ratio analysis allows us to evaluate: The business performance of a company; Its liquidity (both short and long term); and Its operating efficiency

In addition, ratio analysis allows us to measure changes in one internal performance measure against another, or indeed the performance of one company to another, or compare the performance of a company to an industry benchmark.

Answer C

The key benefit of ratio analysis is that it promotes the use of a uniform methodology by which we can compare changes in a companys operations over time. Ratio analysis allows us to evaluate:A. The business performance of a company; B. Its liquidity (both short and long term); and C. Its operating efficiency In addition, ratio analysis allows us to measure changes in one internal performance measure against another, or indeed the performance of one company to another, or compare the performance of a company to an industry benchmark.

Lesson 5 Market Performance Ratios With our financial statements in hand, the fundamental analysts goal is to determine quality undervalued stocks, and then buy them in anticipation of the appreciation that should occur when this value comes to light.

17

We have already discussed how to determine the financial strength of a company - we now need a means of assessing wether the company is attractive from an investment perspective. To do this we need to apply a range of Market Performance Ratios that are will assist to identify value. As usual the ratios will in most cases need to be compared to prior periods and importantly with other companies to identify trends. For calculation purposes we will assume a current share price of $15.00 and $7.00 for last year. The Market Performance Ratios we will look at are: Earnings Per Share Ratio Price to Earnings Ratio Price to Sales Ratio Sales Growth Ratio Earnings Per Share Growth Rate Price Earnings Growth Ratio DPS Yield & Cover

Just as we kept a scorecard when we assessed the financial strength of XYZ Ltd, we will do the same here as ultimately we want to form a view as to the attractiveness of the company from an investment perspective. Lets look at the first of these, the Earnings Per Share ratio. Earnings Per ShareRatio.

EPS = Operating Profit After Tax attributable to shareholders (OPAT) / average number of ordinary shares outstanding during the period EPS = OPAT Av No. Shares

1999/00 - $28,216 / 104,337 = 0.27 cents per share 2000/01 - $51,738 / 104,337 = 0.50 cents per share This gives us a means by which we can determine the amount of profit earned for every ordinary share on issue. EPS is the most common method of expressing a company's profit or earnings. We will see shortly how EPS is compared to share price for a meaningful comparison ratio. P/E Ratio

The formula for calculating the Price Earnings Ratio is the current share price divided by earnings per share:-

PER =

Current Share Price Earnings per Share 1999/ 00 $7.00 0.27 c 26 times 2000/01 $15.00 0.50 c 30 times

ABC Company $m Share Price EPS PER

18

The Price to Earnings Ratio describes the number of times the market price exceeds the earnings per share. . It is an indicator of the markets anticipation of future earnings and the quality of past earnings. . The ratio should always be included when you are assessing a company's potential value as it is an excellent measure of converting profits and share prices to a comparable base. This in turn allows us to measure a company's potential value in comparison with other company's and the market as a whole. The Price Earnings ratio will vary between industries, however a rough guide would be: Low P/E Average P/E Above average P/E = < 15 = 15-20 = > 20

In a bull market we generally see P/E's rise whilst in a bear market we generally see lower P/E's. In this example the Price Earnings ratio has increased as the share price has accelerated at a quicker rate due to shareholder expectations and may be seen by some investors as being expensive. This is a detracting feature and we need to recognise this in our analysis. [Insert progressive checklist and a red tick]

Price to Sales Ratio The price sales ratio is calculated by dividing the current share price by the sales per share:Price Sales Ratio = Current Share Price Sales per Share

First of all, to calculate this ratio, we will work out the second part of the equation first, and that is the calculation of how many sales dollars we are generating per share. The equation is: Sales Revenue Shares on Issue Therefore:ABC Company $m Sales Revenue Shares on Issue Sales Per Share 1999/ 00 409,140 104,337 $3.92 2000/01 546,187 104,337 $5.23 X 100 1

Next we calculate Sales Per Share Ratio Share Price Sales Per Share $7.00 $3.92 $15.00 $5.23

Price Sales Ratio

1.79 times

2.87 times

The Price to Sales ratio is calculated by dividing the current share price to it's sales for a particular period. It is an early indicator of the markets anticipation of future performance (if margins are maintained) and describes the number of times the market price exceeds the Sales Revenue per share.

19

We often see a company increasing sales at a rapid rate only to find costs also increasing quickly. If the business has a sound history it is likely that costs in future periods will be controlled with greater effect. Therefore a lower Price Sales Ratio may be an early indicator of improving profits. In our example the Price Sales Ratio has increased - this indicates that the market expectations are exceeding the actual sales growth of the company. Share price may stabilise or fall in the future as a result. [Insert progressive checklist and a red tick]

Sales (Revenue) Growth Ratio Sales Growth Ratio = ABC Company $m Current Sales Previous Sales Sales Growth Rate 1999/ 00 409,140 327,851 24.8% Current Sales Revenue Previous Sales Revenue 2000/01 546,187 409,140 33.5% X 100 1

The sales growth ratio is an early indicator of dynamic growth stocks as it measures the rate that a company is growing their sales revenue. . The study of the sales growth rate will enable us to ensure that growth is at a stable rate - if sales were to increase too rapidly it may lead to falling margins and therefore see costs spiralling at a greater rate. Growth stocks need to be improving sales however it is more desirable to see consistent growth over a period of time. This will ensure that management has the financials under control and that growth is sustainable over the long term. In our example the Sales Growth Rate is increasing at what appears to be at a steady rate rather than out of control and this is a very good sign of the performance of management. [Insert progressive checklist and a green tick]

Earnings Per Share Growth Rate Earnings Growth Rate = ABC Company $m Current EPS Previous EPS EPSGR 1999/ 00 0.27 c 0.16c 69% Current EPS Previous EPS X 100 1

2000/01 0.50 c 0.27 c 85%

Consistent growth should lead to share price appreciation. Growth in Earning per Share is globally accepted as a primary indicator of share price performance. In other words if we see Earnings Per Share increasing over a number of periods and is forecast to increase in future periods we should expect share price to perform similarly. The Earnings Per Share

20

ratio measures the rate that a company is growing their earnings base and importantly dynamic growth stocks will have a high Earnings Growth Rate. In order to attract investment, it is imperative for a company to maintain a stable growth in earnings over the long term. [Insert progressive checklist and a green tick]

Price Earnings Growth Ratio Price Earnings Growth = ABC Company $m PER EGR Price Earnings Growth Ratio Price Earnings Ratio Earnings Growth Ratio 1999/00 26 times 69 percent 0.4 2000/01 30 times 85 percent 0.35

The Price Earnings Growth ratio is calculated by dividing the Price Earnings Ratio by the Earnings Growth Rate. We are looking for the Earnings Growth Rate to exceed the Price Earnings Ratio - in other words a rating of less than 1 (ideally a rating of 0.8 or less is desirable). It is perhaps the most underrated ratio - extremely useful for identifying those dynamic growth stocks that have high P/E's. Typically a company with a P/E of greater than 20 to 25 would have been viewed with a certain amount of scepticism. However if the high P/E is justified and the company can exceed market expectations then we need to be alert to them. It is an excellent measure for growth stocks with high P/Es (i.e. >25 times). Indicates if there is still value in the companys share price. We should where possible apply this calculation to the forecast EGR to further highlight potential value. When we are using forecast data we do not need to be as stringent with our rating - a score of less than 1 is exceptional. [Insert progressive checklist and a green tick]

Dividends Per Share

DPS = Total of dividends provided for (or paid) / average number of ordinary shares outstanding during the period

1999/00 - $8,682/104,337 = 8 cents per share - (Annual div.) 2000/01 - $12,767/104,337 = 12 cents per share - (Annual div.) Similar to that of EPS in that it gives us a meaningful measure to express a company's dividend payout per share. However, in the case of DPS it is the actual amount a shareholder will receive in payment for every share that they hold. This method of investing allows a shareholder to receive regular income on their investment rather than waiting for a capital gain when shares are sold. Typically growth stocks will have a low dividend as they are utilising funds to grow the company - in this case you would typically see a superior gain in the company's share price.

21

We will be familiar with the Balance Sheet and Profit & Loss Statements - we should not think ourselves accounting experts but rather arming ourselves with the knowledge required to understand these financial statements. We will breakdown the Earning per Share and Dividend per share and explain what this means to an investor.

Dividend Per Share Yield & Cover

Dividend Per Share Yield & Cover = ABC Company $m Annual DPS Share Price Dividend Yield 1999/ 00 0.08 c $7.00 1. 14%

Annual Dividend per Share Current Share Price 2000/01 0.12 c $15.00 0.8%

x 100

The Dividend Per Share Yield is the latest annual dividend per share divided by the latest closing stock price. Dividend cover on the other hand is the number of times Dividends Per Share is covered by latest Earnings Per Share. . Dividend Per Share Yield is the return (based on previous dividends) to be expected on an investment if the shares are bought at current prices. Example - Growth stock with relatively low Yield. Average yield 4-5% Solid yield > 8%

Dividend Cover =

Earnings per Share Dividends per Share 1999/ 00 0.27 c 0.08 c 3.38 times 2000/01 0.50 c 0.12 c 4.16 times

ABC Company $m Current EPS Annual DPS Dividend Cover

If the DPS exceeds the EPS it is obviously unsustainable Dividend cover is an indicator of the ability to pay future dividends. If current DPS exceeds the current EPS, future DPS will have to fall unless EPS can be improved. But this is not the case in the current example. [Insert progressive checklist and a green tick] Ok, so lets review our quantitative analysis of ABC Ltd. Before we look at our Market Indicator checklist. Lets quickly revisit our Financial Strength Checklist:-

22

Financial Strength Ratio Analysis Current Ratio Debt to Equity Ratio Profit Margin Ratio Cashflow Ratio Return on Equity Tick Tick Tick Tick Tick

Ok, as can be seen from our checklist, the company appears to be in a sound financial position as evidenced by increasing sales levels, lower operating costs, improving profits and modest debt. This said, we should now look at how attractive the company is from an investment perspective:Market Indicator checklist Here is how we rated the company:-

Price to Earnings Ratio Price to Sales Ratio Sales Growth Ratio Earnings Growth Rate Price Earnings Growth Ratio DPS Yield & Cover

X X Tick Tick Tick Tick

Here we can see that the market has to a certain extent recognised the improving prospects for the business and this has led to a significant increase in share price over the last twelve months. Nevertheless, our Price Earnings Growth Ratio suggests that there is still value in the company, even at these prices, and as such it would not be unreasonable to elevate the company to our list of buy prospects. Congratulations on working through our step by step process of analysing the financial accounts of companies ! Ultimately the decision to invest rests in the selection of stocks that meet our investment criteria, which inturn brings into play many other facets including risk appetite, portfolio diversification objectives and indeed asset mix. These bigger picture considerations are key components of our investment plan, and represent a higher level of prospect screening as we move towards the selection and maintenance of a portfolio of stocks which supports the achievement of our investment goals over the long term.

Q5. The primary use of Market Performance ratios is:A. To help us form a view as to the relative attractiveness of the company from an investment perspective; B. To see which company has generatd the greatest profits; C. To see which company has the lowest price to earnings ratio;

Answer A

To help us form a view as to the relative attractiveness of the company from an investment perspective.

23

Lesson 6 Investment Methods & Resources

Many investors tend to have a haphazard approach to investing in the stockmarket. If we were to develop a structured approach and a consistent investment methodology (in other words an investment plan), then it stands to reason that our chances of success will be improved. We have already covered a screening process that will assist us in identifying sound financial companies. We then discussed a means of identifying stocks that are potentially undervalued, and a methodology to recognise those stocks that offer the greatest upside as far as share price appreciation is concerned. We now need to determine what type of investor we want to be and identify tools to assist with our desired approach. Lets look at our options:Balanced Approach Here are the elements of three different investment approaches:Value Portfolio Large Cap stocks, Banks etc. High Dividend Stocks Trading - Short term Need to pay closer attention to market trends We need to identify our risk profile and to decide if we are comfortable with a conservative approach, where traditionally risk is low and returns moderate, or whether we are prepared to be a little more adventurous, commit more time to actively managing our portfolio and therefore increase our potential for greater gains. A well-balanced portfolio will usually have a combination of both approaches (i.e. Conservative and Growth) and therefore greater stability over the longer term. If short-term gains are your desired approach then the use of technical analysis is necessary as it will put you more in tune with short term trends in the market. Structure Spread over Industry Sectors Have a defined exit strategy We also need to work out how much we are prepared to invest or risk for each stock. A well-structured portfolio should also have a spread over different industry sectors. Eg: If the building industry suffers a downturn we do not want to be over-weighted with stocks in this sector. We should also have clear stop loss points in mind - sometimes the hardest decision is when to sell. This is often an approach that is overlooked by long-term investors however we should always be mindful of a stock not meeting our expectations. After all, we will not be right all the time.

Timing When to Buy When to Sell

24

When to hold Economic factors Rightly or wrongly the most often asked question is not what to buy but when to buy. Throughout this Module we have identified a process that helps us to select stocks to buy and with the use of market performance ratios we should now have a better idea of when to buy. That leaves the questions of should I sell or should I hold. This is really where experience is invaluable - we will make a few errors of judgement along the way, but dont be discouraged however as a sound approach will pay dividends over the long term. Ultimately the decision as to which investment methodology is best (i.e. value or trading) is a personal one and directly tied to your risk appetite, available time and resources and investment goals. There is no magical answer to this question and each investor needs to thoughtfully consider the options available to them and arrive at a decision that suits their personal circumstances. Once you are clear as to which investment strategy you wish to pursue, the next important step in the process is the development of an investment plan.

Putting Our Plan Into Action Financial Press Investment Publications On-line Brokers On-line services & tools Throughout this module you have learnt how to assess a company's fundamentals using accounting ratios, how to apply market performance ratios to assess value and the importance of having a well balanced approach to investing with a soundly structured portfolio. We now need to know how to apply this information and most importantly where we can access the necessary data. Financial Media Daily Newspapers Investment Magazines On-line Brokers Utilising free on-line services If we are serious about investing we always need to be mindful of what is happening in the marketplace, we need to keep abreast of any factors that may affect the price of our investments. We therefore need to be regularly monitoring financial markets and what analysts and journalists are saying about the economy both in the country we wish to invest and worldwide.

Financial Media Daily Newspapers/Investment Magazines News announcements and editorial comment can have an influence on share prices. Often we can get early notification of changing economic sentiment through this medium and we can take action to recognise this through our investment plan.

25

In addition, a positive news announcement and favourable review by the press can result in a significant increase in the price of shares, often led by buying activity at an institutional level. Being aware of opinions of influential people can be important to an investor, and account for movements in price activity, and as such a subscription to one of the major daily broadsheets/monthly magazines can be an important investment. On-line Brokers and Information Services We can generally obtain a list of On-Line Brokers from the equities exchange of the country we are looking to invest. We should also consider establishing an account with one of these brokers for easy and discounted access to buy and sell shares. On-line broking is fiercely competitive with most brokers offering a wealth of data if you hold your shares with them. Ask for trial periods where available. Most services will offer some form of incentive to try their service. It is also wise to subscribe to the many free information services over the internet. Most send daily or weekly emails with a market-wrap and include access to regular editorials along with delayed share prices and company announcements. So there we have it. In modules one and two we learnt the basics of technical analysis, including chart pattern recognition and grouping of indicators. In this module we have learned the principals of security analysis and developed skills that will help us interpret financial accounts. We also touched on the need for each investor to sit down and ask themselves some serious questions, such as what type of investor am I (conservative or trader) and how willing am I to commit the necessary time and resources to prudently manage my investments. Once we have decided what type of investor we want to be, we need to move to the next step in the process, and that is developing an investment plan. This is the theme of our next module, Strategies for Investing Successful Investing, in which we work through the process of developing a customised checklist for various profiles of investors.

Q6. It is generally accepted that our prospects for success in the markets will be improved by:A. Developing a structured investment approach and a consistent investment methodology; B. Having a defined exit strategy; C. Keeping abreast of factors that may affect the performance of our investments; D. All of the above;

Answer D

26

All of the above

27

Das könnte Ihnen auch gefallen

- Understanding Financial Statements (Review and Analysis of Straub's Book)Von EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Bewertung: 5 von 5 Sternen5/5 (5)

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDokument36 SeitenLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNoch keine Bewertungen

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookVon EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNoch keine Bewertungen

- Financial Health in Terms of Profitabilty and LiquidityDokument49 SeitenFinancial Health in Terms of Profitabilty and Liquiditymilind_iiseNoch keine Bewertungen

- Equity Valuation.Dokument70 SeitenEquity Valuation.prashant1889Noch keine Bewertungen

- Financial Accounting & AnalysisDokument5 SeitenFinancial Accounting & AnalysisSourav SaraswatNoch keine Bewertungen

- Tools For Fundamental AnalysisDokument20 SeitenTools For Fundamental AnalysisvkathorNoch keine Bewertungen

- Financial TrainingDokument15 SeitenFinancial TrainingGismon PereiraNoch keine Bewertungen

- Understanding The Income StatementDokument4 SeitenUnderstanding The Income Statementluvujaya100% (1)

- Evaluating A Firms Financial Performance by Keown3Dokument36 SeitenEvaluating A Firms Financial Performance by Keown3talupurum100% (1)

- Fabm2 Week 4Dokument28 SeitenFabm2 Week 4Jeremy SolomonNoch keine Bewertungen

- Income StatementDokument3 SeitenIncome StatementMamta LallNoch keine Bewertungen

- CH 04Dokument51 SeitenCH 04Pham Khanh Duy (K16HL)Noch keine Bewertungen

- Chapter 03 IM 10th EdDokument32 SeitenChapter 03 IM 10th EdahelmyNoch keine Bewertungen

- Analyzing Financial Statements: Before You Go On Questions and AnswersDokument52 SeitenAnalyzing Financial Statements: Before You Go On Questions and AnswersNguyen Ngoc Minh Chau (K15 HL)Noch keine Bewertungen

- Financial Management Chapter 03 IM 10th EdDokument38 SeitenFinancial Management Chapter 03 IM 10th EdDr Rushen SinghNoch keine Bewertungen

- Financial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIDokument3 SeitenFinancial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIMeyannaNoch keine Bewertungen

- The Full Business Plan: Strategy and StructureDokument4 SeitenThe Full Business Plan: Strategy and StructureIya MendozaNoch keine Bewertungen

- CFI Jeff Schmidt - Analysis of Financial StatementsDokument7 SeitenCFI Jeff Schmidt - Analysis of Financial StatementsDR WONDERS PIBOWEINoch keine Bewertungen

- Financial Analysis: Learning ObjectivesDokument39 SeitenFinancial Analysis: Learning ObjectivesKeith ChandlerNoch keine Bewertungen

- Trading Smart With Fundamental AnalysisDokument53 SeitenTrading Smart With Fundamental AnalysisChor KiongNoch keine Bewertungen

- Q1. Explain The Basic Elements of Income Statement? Income StatementDokument5 SeitenQ1. Explain The Basic Elements of Income Statement? Income StatementMina TahirNoch keine Bewertungen

- Net Block DefinitionsDokument16 SeitenNet Block DefinitionsSabyasachi MohapatraNoch keine Bewertungen

- How To Write A Traditional Business Plan: Step 1Dokument5 SeitenHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNoch keine Bewertungen

- Investment & Security AnalysisDokument50 SeitenInvestment & Security AnalysisAamir RazaNoch keine Bewertungen

- Ankita Pusu Kuleti Assignment Advance Management AccountingDokument15 SeitenAnkita Pusu Kuleti Assignment Advance Management AccountingAvishad RaipureNoch keine Bewertungen

- Financial StatementsDokument12 SeitenFinancial StatementsNitesh KumarNoch keine Bewertungen

- Business 7 Habits EffectsDokument6 SeitenBusiness 7 Habits Effectssaba4533Noch keine Bewertungen

- Example Thesis On Financial Ratio AnalysisDokument8 SeitenExample Thesis On Financial Ratio Analysisejqdkoaeg100% (1)

- Current Assets Current LiabilitiesDokument7 SeitenCurrent Assets Current LiabilitiesShubham GuptaNoch keine Bewertungen

- Finance AnalysisDokument11 SeitenFinance Analysissham_codeNoch keine Bewertungen

- Business PlanDokument27 SeitenBusiness PlanCJ Paz-ArevaloNoch keine Bewertungen

- Introduction To Accounting: Student's Name: Student's ID: Course Code: Course TitleDokument15 SeitenIntroduction To Accounting: Student's Name: Student's ID: Course Code: Course TitleMica BaylonNoch keine Bewertungen

- Meaning of Financial StatementsDokument44 SeitenMeaning of Financial Statementsparth100% (1)

- 21.understanding Retail ViabilityDokument23 Seiten21.understanding Retail ViabilitySai Abhishek TataNoch keine Bewertungen

- Beginners' Guide To Financial StatementsDokument7 SeitenBeginners' Guide To Financial StatementsIbrahim El-nagarNoch keine Bewertungen

- Lecture 3 - Applying For FinanceDokument22 SeitenLecture 3 - Applying For FinanceJad ZoghaibNoch keine Bewertungen

- Understanding Financial Statements - Making More Authoritative BCDokument6 SeitenUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNoch keine Bewertungen

- Examples of Non-Operating Revenues and ExpensesDokument7 SeitenExamples of Non-Operating Revenues and ExpensesVj Ram Asriya RaoNoch keine Bewertungen

- Applied Nusiness Finance AssignmentDokument13 SeitenApplied Nusiness Finance AssignmentHajra HaroonNoch keine Bewertungen

- Proforma Fin Statement AssignmentDokument11 SeitenProforma Fin Statement Assignmentashoo khoslaNoch keine Bewertungen

- Financial Statement Analysis (Nov-20)Dokument51 SeitenFinancial Statement Analysis (Nov-20)Aminul Islam AmuNoch keine Bewertungen

- Nitin BhaiDokument9 SeitenNitin BhaiKapil RathiNoch keine Bewertungen

- Corporate Financial Accounting AssignmentsDokument7 SeitenCorporate Financial Accounting AssignmentsPooja MauryaNoch keine Bewertungen

- Ratio Analysis Note Acc 321-2Dokument20 SeitenRatio Analysis Note Acc 321-2Adedeji MichaelNoch keine Bewertungen

- A Primer On Financial StatementsDokument11 SeitenA Primer On Financial StatementsPranay NarayaniNoch keine Bewertungen

- A Study On Profitability Analysis atDokument13 SeitenA Study On Profitability Analysis atAsishNoch keine Bewertungen

- Chapter-8 Assessing A New Venture's Financial Strength and ViabilityDokument53 SeitenChapter-8 Assessing A New Venture's Financial Strength and ViabilityHtet Pyae ZawNoch keine Bewertungen

- Profitability Ratios: What Is It?Dokument4 SeitenProfitability Ratios: What Is It?Lanpe100% (1)

- Lyka ScriptDokument4 SeitenLyka ScriptLysa Karylle VillanuevaNoch keine Bewertungen

- Financial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureDokument11 SeitenFinancial Leverage Ratios, Sometimes Called Equity or Debt Ratios, MeasureBonDocEldRicNoch keine Bewertungen

- Financial Statement Analysis A Look at The Income SheetDokument4 SeitenFinancial Statement Analysis A Look at The Income SheetNajmalinda ZenithaNoch keine Bewertungen

- Interpretation of AccountDokument36 SeitenInterpretation of AccountRomeo OOhlalaNoch keine Bewertungen

- Chapter 3 - Financial AnalysisDokument39 SeitenChapter 3 - Financial AnalysisHeatstroke0% (1)

- Top 50 QuestionsDokument11 SeitenTop 50 Questionsmax financeNoch keine Bewertungen

- Seven Habits FSADokument6 SeitenSeven Habits FSAWaseem AkhtarNoch keine Bewertungen

- Financial Modelling: Types of Financial ModelsDokument7 SeitenFinancial Modelling: Types of Financial ModelsNavyaRaoNoch keine Bewertungen

- Stock Analysis Week 4: Quantitative Analysis: Balance SheetDokument7 SeitenStock Analysis Week 4: Quantitative Analysis: Balance SheetSushil1998Noch keine Bewertungen

- Ch.13 Managing Small Business FinanceDokument5 SeitenCh.13 Managing Small Business FinanceBaesick MoviesNoch keine Bewertungen

- Jurnal AJISDokument16 SeitenJurnal AJISElsa AugusttenNoch keine Bewertungen

- Chapter 11: Re-Situating ConstructionismDokument2 SeitenChapter 11: Re-Situating ConstructionismEmilio GuerreroNoch keine Bewertungen

- Section 7 4 Part IVDokument10 SeitenSection 7 4 Part IVapi-196193978Noch keine Bewertungen

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketDokument13 SeitenBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaNoch keine Bewertungen

- TRB - HSK NC IiiDokument7 SeitenTRB - HSK NC IiiBlessy AlinaNoch keine Bewertungen

- FRA - Project - NHPC - Group2 - R05Dokument29 SeitenFRA - Project - NHPC - Group2 - R05DHANEESH KNoch keine Bewertungen

- Introduction To Anglo-Saxon LiteratureDokument20 SeitenIntroduction To Anglo-Saxon LiteratureMariel EstrellaNoch keine Bewertungen

- GR - 211015 - 2016 Cepalco Vs Cepalco UnionDokument14 SeitenGR - 211015 - 2016 Cepalco Vs Cepalco UnionHenteLAWcoNoch keine Bewertungen

- TO 1C-130H-2-33GS-00-1: Lighting SystemDokument430 SeitenTO 1C-130H-2-33GS-00-1: Lighting SystemLuis Francisco Montenegro Garcia100% (1)

- Who Is He? Where Is He? What Does He Do?Dokument3 SeitenWho Is He? Where Is He? What Does He Do?David Alexander Pacheco Morales100% (1)

- Consolidation Physical Fitness Test FormDokument5 SeitenConsolidation Physical Fitness Test Formvenus velonza100% (1)

- 5 15 19 Figaro V Our Revolution ComplaintDokument12 Seiten5 15 19 Figaro V Our Revolution ComplaintBeth BaumannNoch keine Bewertungen

- Testamentary Succession CasesDokument69 SeitenTestamentary Succession CasesGjenerrick Carlo MateoNoch keine Bewertungen

- Report WritingDokument3 SeitenReport WritingSeema SinghNoch keine Bewertungen

- Correctional Case StudyDokument36 SeitenCorrectional Case StudyRaachel Anne CastroNoch keine Bewertungen

- How Beauty Standards Came To BeDokument3 SeitenHow Beauty Standards Came To Beapi-537797933Noch keine Bewertungen

- Tail Lamp Left PDFDokument1 SeiteTail Lamp Left PDFFrancis RodrigueNoch keine Bewertungen

- BCLTE Points To ReviewDokument4 SeitenBCLTE Points To Review•Kat Kat's Lifeu•Noch keine Bewertungen

- AJWS Response To July 17 NoticeDokument3 SeitenAJWS Response To July 17 NoticeInterActionNoch keine Bewertungen

- Is 2750 Specifiction For Steel Scaffoldings R0.183134252Dokument29 SeitenIs 2750 Specifiction For Steel Scaffoldings R0.183134252Suhas Karar0% (1)

- Covid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialDokument3 SeitenCovid-19: Researcher Blows The Whistle On Data Integrity Issues in Pfizer's Vaccine TrialLuxNoch keine Bewertungen

- Organization and ManagementDokument65 SeitenOrganization and ManagementIvan Kirby EncarnacionNoch keine Bewertungen

- E-Conclave Spon BrochureDokument17 SeitenE-Conclave Spon BrochureNimish KadamNoch keine Bewertungen

- Juegos 360 RGHDokument20 SeitenJuegos 360 RGHAndres ParedesNoch keine Bewertungen

- The Key To The Magic of The Psalms by Pater Amadeus 2.0Dokument16 SeitenThe Key To The Magic of The Psalms by Pater Amadeus 2.0evitaveigasNoch keine Bewertungen

- Lean Supply Chains: Chapter FourteenDokument29 SeitenLean Supply Chains: Chapter FourteenKshitij SharmaNoch keine Bewertungen

- Upcoming Book of Hotel LeelaDokument295 SeitenUpcoming Book of Hotel LeelaAshok Kr MurmuNoch keine Bewertungen

- NZAA ChartsDokument69 SeitenNZAA ChartsA340_600100% (5)

- Brunon BradDokument2 SeitenBrunon BradAdamNoch keine Bewertungen

- Spica 3.2 PDFDokument55 SeitenSpica 3.2 PDFKavi k83% (6)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthVon EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthBewertung: 4 von 5 Sternen4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Mind over Money: The Psychology of Money and How to Use It BetterVon EverandMind over Money: The Psychology of Money and How to Use It BetterBewertung: 4 von 5 Sternen4/5 (24)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNoch keine Bewertungen

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsVon EverandCreating Shareholder Value: A Guide For Managers And InvestorsBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamVon EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNoch keine Bewertungen

- Ready, Set, Growth hack:: A beginners guide to growth hacking successVon EverandReady, Set, Growth hack:: A beginners guide to growth hacking successBewertung: 4.5 von 5 Sternen4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyVon EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyBewertung: 3 von 5 Sternen3/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsVon EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsBewertung: 4.5 von 5 Sternen4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfVon EverandProduct-Led Growth: How to Build a Product That Sells ItselfBewertung: 5 von 5 Sternen5/5 (1)

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorVon EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNoch keine Bewertungen

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsVon EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsBewertung: 5 von 5 Sternen5/5 (1)

- Value: The Four Cornerstones of Corporate FinanceVon EverandValue: The Four Cornerstones of Corporate FinanceBewertung: 5 von 5 Sternen5/5 (2)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistVon EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistBewertung: 4 von 5 Sternen4/5 (32)