Beruflich Dokumente

Kultur Dokumente

Comprative Study or Equity Scheme in The Mutual Fund

Hochgeladen von

Mohd ShahidOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Comprative Study or Equity Scheme in The Mutual Fund

Hochgeladen von

Mohd ShahidCopyright:

Verfügbare Formate

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

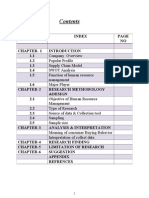

CONTENTS

PART I

1. Industry overview 2. Company profile 3. Comparison study 1 15 21

PART II 1. Research methodology

Pro lem definition ! "ectives #ample profile #ample si$e #ampling techni%ue &ata collection procedure &ata analysis techni%ue 'imitations of the survey #cope of the pro"ect

27

2. (indings

3.

32 3*

)nalysis

Respondents in general Respondents whose income is more than Rs 3+,,+,,, Respondents who -nows a out .nit 'in-ed Policy

/. #uggestions 5. Conclusions 0. 1i liography 7. )ppendi2

57 0, 02 0/

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 1

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

EXECUTIVE SUMMARY

)fter privati$ation and li erali$ation in 1**1+private sector is growing very fast across wide spectrum of Indian economy. ) ma"or part of such li erali$ation process is finance sector. 3hat is also applica le to Insurance Industry. 'arge num er of multinational companies in colla oration with the Indian companies is competing with the strong 'IC. )t the same time an- rates are going down. #o investors are going for

alternatives. 3hey are investing in mar-et for good returns. 3his report titled Comparison study of unit lin-ed policies and its mar-et research contains detail study of unit4lin-ed policies and comparison unit lin-ed schemes of different companies and also their mar-et potential in 1angalore city. 3he main o "ect unit lin-ed policies. )t the same time we are interested to -now 1. 5hether people are aware a out unit lin-ed policies or not6 2. 5hat factor they are consider while purchasing unit lin-ed policy6 3. 5hat is their e2pectation from unit lin-ed policy6 /. 7ow much they want to invest in 'ife Insurance6 5. In which type of fund they prefer to invest.6 1ased on this an appropriate %uestionnaire was prepared. &ata was collected through mar-et survey . 3he data is analy$ed using code sheet+ percentages+ averages+ sums and weightages . BABASAB PATIL PROJECT REPORT ON MARKETING Page 2 ehind ta-ing this pro"ect is to find outstanding terms and

conditions of different companies who issue unit lin-ed policies and mar-et potential for

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Findings

1. *08 of the people -now a out life insurance and 198 -now a out unit lin-ed policy 2. Responded people ran-ed 'IC as first+ ICICI as second and )llian$ 1a"a" as third 3. :ost people want to invest in 'ife insurance in the range of Rs 3,,,,, to Rs 5,,,,, /. 3he Responded people mostly want to invest in alanced fund. ) ove study shows that awareness of )llian$ 1a"a" is very low. 1ut there is a potential mar-et for unit4lin-ed policies. #o )'1; should come up with some salient features to tap the mar-et. 3hey should come up with some special offers li-e giving onus or fi2ing some minimum guarantee amount.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 3

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

BACKGROUND

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

AN INTRODUCTION:

3he insurance industry in India is evolving and assuming different proportions since it was privati$ed. 3here was a time when only traditional insurance products used to dominate the arena+ ut with innovation coming into play+ unit4 lin-ed<mar-et4lin-ed products have also found a place.

It is worth mentioning here that world over unit4lin-ed products constitute %uite a su stantial chun- of the total portfolio of insurance companies.

3he emergence of unit4lin-ed insurance policies com ines the characteristics of oth endowment insurance policies and mutual funds. 5ith falling interest rates %uestioning the economics of traditional products+ most insurers are launching unit4lin-ed policies.

In the developed mar-et+ products more in common with mutual funds have overta-en traditional life insurance products. Customers too are loo-ing for products that give sta ility of returns in the long run and total protection.

In India+ 1irla #un 'ife+ ICICI Prudential+ )llian$ 1a"a"+ 'IC are the some life insurance companies dealing in unit4lin-ed insurance products.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 5

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

HOW THE UNIT LINKED PLAN WORKS?

.nit lin-ed plans com ines the protection of life insurance and enefits of mutual fund .3he main reason for increasing interest towards unit lin-ed plans is that they allow you to earn more return on your investment in this declining interest scenario+ and at the same time offer financial protection to your family in unfortunate event of your death. 3hey also allow you the fle2i ility of withdrawing or surrendering your unit wholly or partially to meet any contingency li-e your children=s education marriage+ etc. .nit lin-ed plans come in the form of units where the premium paid y you is used to uy units and an investment fund is allotted to you. :ost of the companies offer two or more options to you with regard to the fund. 3he choice of the fund allows you to determine as to how much premium paid y you should e invested and in which financial instrument. 3he performance of the fund depends upon the current value of units in the mar-et.

(or e.g. if current value of unit is Rs 1,<4 and you pay annual premium of Rs 1,,,,<4+ than the num er of units you uy with this premium is 1,,, units. If the mar-et is ullish and the value of a unit ecome Rs 13 <4 then you can surrender the units for a profit.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 0

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

)ccording to the IR&)+ a company offering unit lin-ed plans must give the investor an option to choose among de t+ alanced and e%uity funds. If you opt for a unit4lin-ed endowment policy+ you can choose to invest your premiums in de t+ alanced or e%uity funds. If you choose a de t fund+ the ma"ority of your premiums will get invested in de t securities li-e gilts and onds. If you choose e%uity+ then a ma"or portion of your premiums will e invested in the e%uity mar-et. 3he type of fund you choose would depend on your risprofile and your investment need. In case of death during the premium paying term or the term of the policy+ the sum assured+ or value of policy fund+ whichever is higher+ is paid to the eneficiaries. In case of survival up to maturity+ the value of the fund is paid out. 3herefore+ the ris- here is transferred to the policyholder and nothing is guaranteed. #o+ if the fund value falls elow the amount invested+ the policyholder will receive a lower amount. 3a-ing a closer loo- at charges and feesone comes to -nows that+ there is an initial administrative charge deducted every month from units. 3his could e very high+ around 158 per annum in the first year+ around 78 p a in the second and around 2438 p a thereafter. #uppose you uy a policy wherein the annual premium wor-s out to Rs 1,+,,,+ in the first year+ Rs 1+5,, would e deducted towards administrative charges+ Rs 7,, in the second year and around Rs 3,, from the third year. 3hese rates vary from company to company ut are more or less in this range.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 7

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

3here is an investment management charge too+ which would vary according to the fund selected> for instance+ an e%uity fund would attract a higher investment management fee of around 18 p a compared with a de t fund that might attract a fee of ,.258. #o continuing with the same e2ample+ a sum of Rs 1,, would e deducted from the annual premium if an e%uity fund is opted for. ?e2t+ companies charge an annual administration charge. In case of some companies this charge is a flat rate+ say+ Rs 2, per month. In the case of others+ this charge is again a percentage of net assets for each fund. (inally+ there is a deduction for ris- cover. 3his goes towards contri ution to the sum assured or the life insurance cover. It is ased on mortality rates as calculated y actuaries. (or comprehensively summarising our e2ample+ we will assume the age of the male policyholder to e 3, years and sum assured Rs 1+,,+,,,. !f a total premium of Rs 1,+,,, paid in the first year+ Rs 1+5,, is deducted towards initial administration fees+ Rs 1,, towards investment management fees @assuming the fund opted for is e%uityA and Rs 2/, towards annual administration fees. 3hat leaves a alance of Rs 9+10, in the first year. !ut of this+ Rs 10* would e deducted towards ris- cover. 7ence+ finally Rs 7+**1 would e invested in the fund. In the second year+ the figure would stand at Rs 9+7*1 and third year onwards+ around Rs *+1*1 for the term of the policy. #o+ every time you ma-e your premium payment+ only a part of it is actually invested in the fund of your choice.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 9

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Com in!"ion o# m$"$!% #$nd !nd ins$&!n'( 'o)(&:

.nit4lin-ed plans are a com ination of an investment fund and an insurance policy. ) ma"or part of the premium amount received on such policies is invested in the stoc- mar-et y the insurer in select funds depending on the ris- level chosen y the customer. :ind you+ this is after deducting administration charges and management e2penses that may vary from one fund to the other.

C*oi'( o# F$nds:

3he customer has the option of choosing from de t+ alance and e%uity funds. If the individual chooses a de t fund+ a ma"or part of his premia is invested in de t securities li-e gilts and onds. 1ut if it is e%uity+ a ma"or portion goes towards investments in the stoc- mar-et. #o depending on the ris- profile the individual may choose his investment option.

S$&)i)!% +(n(#i"s:

)s regards survival enefits the fund value as on that date is paid to the individual.

D(!"* +(n(#i"s:

In case of death the individual is paid higher of the sum assured or the fund value standing to his account.

F$nd V!%$(:

3he fund value is the value of your investment as on a given date. 3his is influenced y the ups and downs in the sense2. #o (und Balue C .nit Price 2 ?um er of .nits BABASAB PATIL PROJECT REPORT ON MARKETING Page *

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

S,i"'*ing (",((n F$nds:

3he advantage one gets in case of a unit lin-ed fund is that the wor-ing is similar to a mutual fund. !ne can ship out of a fund if he feels its performance is not up to the mar-. Companies allow certain num er of free switches in a year. (or any more switches one may have to pay.

Ris- E%(m(n":

!n the face of it investment in unit4lin-ed plans are not entirely safe. )n element of ris- is definitely in the hands of the individual. )n individual choosing to parhis funds in e%uities stands to gain or lose depending on the ull run in the stoc- mar-et. 5hen the mar-et is uoyant he stands to gain handsomely ut on the other hand he may lose heavily when it tan-s out. .nit4lin-ed insurance plans are all of a sudden much tal-ed a out+ pu lici$ed and sold. 5hile these are not a recent phenomenon+ since a num er of insurance companies already had these products as a part of their portfolio+ of late these plans have It is perhaps the insurance companies have products outselling others. seen sudden fren$y.

ull phase or the lure of mar-et4lin-ed returns that

een shouting hoarse a out that is responsi le for these

5hile this is not to dissuade from purchasing unit lin-ed covers it would e once own interest to ta-e a pee- at the Dmar-et lin-ed returns= you can e2pect. )nd if you thin- that the entire premium you pay is invested in avenues chosen y you to ma2imi$e returns you could e wrong. Page 1,

BABASAB PATIL PROJECT REPORT ON MARKETING

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

E./(ns(s d$&ing "*( #i&s" 0(!&:

3he insurance company towards various charges reducing the investa le amount considera ly deducts a su stantial amount from your premium income. In the first year )llian$ 1a"a" through its .nit Eain #P Plus claims to allocate 1,, percent of the single premium you invest ut cancels units on a monthly asis towards various charges from your fund.

)ccordingly Fota- #afe Investment Plan allocates 90 percent and 'ife3ime of ICICI Pru 'ife allocates 9, percent for amounts less than Rs 5,+,,, and 92 percent for those a ove Rs 5,+,,, towards investments.

Adminis"&!"ion (./(ns(s:

3he fund e2pense is the highest in the first year. ICICI Pru 'ife charges administration e2penses of 2, percent of the premium for amounts elow Rs 5,+,,, and 19 percent for amounts over Rs 5,+,,, in the first year while it is 7 percent for amounts upto Rs 2,+,,, in case of Fota#afe Investment plan.

)gain there are annual administrative charges that are as high as 1.25 percent per annum of net assets on 'ife 'in- of ICICI Pru 'ife and on .nit Eain #P Plus of )llian$ 1a"a" 'ife Insurance.

Mo&"!%i"0 '*!&g(sG

5hile the annual administrative charges stand at 1.25 percent of net assets for ICICI Pru 'ife and )llian$ 1a"a" 'ife Insurance the differences in mortality charges is %uite a it. ICICI Pru 'ife charges 1./9 per thousand of sum assured at age 3, while )llian$ 1a"a" charges 1.2* at age 31.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 11

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

S,i"'*ing:

?ow what if you plan to switch from one fund to the other. ICICI Pru 'ife offers only one free switch every year and charges a switching fee of 1 percent for e2tra switches. In contrast )llian$ 1a"a" offers three switches free with su se%uent switches charged at the rate of 18 of switch amount or Rs 1,, which ever is higher while with !: Fota-=s #afe Investment plan you can switch any num er of times at no e2tra cost. 1esides there are fund management charges that varies depending on the type of fund you choose to par- your funds. !: Fota- charges ,.0 percent if you choose to invest in money mar-et funds+ on gilt funds it is 1 percent+ on alanced funds it is 1.3 percent and on growth funds it is 1.5 percent.

T&!ns!'"ion 'os"s:

)lso )llian$ 1a"a" charges transaction costs at ,.5 percent ut not

e2ceeding ,.7 percent of the e%uity investment while it is ,.1 percent not e2ceeding ,.2 percent of the de t investments. :oreover+ there e2ist underwriting charges on the asis of the age of the individual.

Fnow that when you uy unit4lin-ed insurance products+ a ma"or part of the ris- is transferred to you from the insurance company. .nit lin-ed ris- products may not e a good investment option when ta-en into account the high costs and the risassociated with volatile mar-ets.

3hese products will entail regular monitoring since they are mar-et lin-ed and may perhaps e a good et when the mar-et is at a pea- ut if the mar-et ottoms out you may lose heavily. #o -now that you are playing with your ris- cover.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 12

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Uni"1%in-(d )s2 "&!di"ion!% ins$&!n'( /&od$'"s2

5hile in a unit4lin-ed insurance product part of the premium paid y the policyholder goes towards administrative and mortality charges @that provides life coverA and the alance into an investment account+ in a traditional policy @with or without profit policyA+ the premiums are put in a common fund+ part of which is invested and part goes into paying for the ris- cover. 7owever+ the entire profit from investment is not declared as onus in a traditional policy. #ome is held ac- y the insurance company to uild reserves to pay end onus and other returns. )lso+ there is a chance of using the money to cross4su sidise other products i.e. paying more returns towards single premium products. 3he performance of the investi le portion of premium in a unit4lin-ed scheme is monitored in the form of mutual fund units.

.nit4lin-ed insurance products allow policyholders to define their underlying investment with choices varying from a conservative to an aggressive option. In effect+ a customer can create his<her own personal investment plan ac-ed y an insurance policy with at least a minimum guaranteed return+ in some cases. !n the contrary+ a traditional policyholder has to rely on the investment manager.

1esides+ unit4lin-ed products offer

enefits li-e transparency+

li%uidity and fle2i ility. 3he insured has the fle2i ility of changing the investment option BABASAB PATIL PROJECT REPORT ON MARKETING Page 13

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

after completing one policy year ta-ing advantage of mar-et movements to plan investments and earn returns+ giving him complete control of his funds. 3hus+ in a scenario when the e%uity mar-et is not performing well+ a policyholder with high e2posure to e%uities can switch to the option+ which has a high proportion of fi2ed income instruments.

) ove all+ as in the case of other insurance products+ the premiums are ta2ing deducti le and the enefits i.e. the maturity enefit+ withdrawal+ surrender and death enefits are all ta24free.

Mod( o# /&(mi$m /!0m(n":

Paying single premium or regular premium in the form of yearly <half yearly+ %uarterly and monthly installment and premium paid y you is used to uy units.

7ence unit lin-ed policies multiply your profits and rings you the return and li%uidity of the stoc- mar-et and the safety of the insurance at the same time.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 1/

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

A%%i!n3 +!4!4 Li#( Ins$&!n'( Com/!n0 Limi"(d

)llian$ 1a"a" 'ife Insurance Co. 'td. is a "oint venture etween two leading conglomerates4 )llian$ )E+ one of the worldHs largest insurance companies+ and 1a"a" )uto+ one of the iggest 2 and 3 wheeler manufacturers in the world.

)llian$ )E with over 11, years of e2perience in over 7, countries and 1a"a" )uto+ trusted for over 55 years in the Indian mar-et+ together are committed to offering you financial solutions that provide all the security needed for once family and oneself

)llian$ 1a"a" 'ife Insurance

Is the fastest growing private life Insurance company in India Currently has over Rs 3+,,+,,, p.a. satisfied customers Is ac-ed y a networ- of 09 Customer Care Centers spanning 55 locations across the country

!ne of IndiaHs leading private life insurance companies

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 15

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

COMPANY PROFILE A%%i!n3 5&o$/

A%%i!n3 5&o$/ is on( o# "*( ,o&%d6s %(!ding ins$&(&s !nd #in!n'i!% s(&)i'(s /&o)id(&s2

(ounded in 19*, in 1erlin+ )llian$ is now present in over 7, countries with almost 17/+,,, employees. )t the top of the international group is the holding company+ )llian$ )E+ with its head office in :unich. )llian$ Eroup provides its more than 0, million customers worldwide with a comprehensive range of services in the areas of

Property and Casualty Insurance+ 'ife and 7ealth Insurance+ )sset :anagement and 1an-ing.

ALLIAN7 A51 A 5LO+AL FINANCIAL POWERHOUSE

5orldwide 2nd y Eross 5ritten Premiums 4 Rs./+ /0+05/ cr. 3rd largest )ssets .nder :anagement @).:A I largest amongst Insurance cos. 4 ).: of Rs.51+ *0+*5* cr.

12th largest corporation in the world /*.9 8 of glo al usiness from 'ife Insurance Jsta lished in 19*,+ 11, yrs of Insurance e2pertise 7, countries+ 173+75, employees worldwide

+!4!4 5&o$/

BABASAB PATIL PROJECT REPORT ON MARKETING Page 10

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

+!4!4 A$"o L"d8 "*( #%!gs*i/ 'om/!n0 o# "*( Rs2 9::: '&o&( +!4!4 g&o$/ is "*( %!&g(s" m!n$#!'"$&(& o# ",o1,*((%(&s !nd "*&((1,*((%(&s in Indi! !nd on( o# "*( %!&g(s" in "*( ,o&%d2

) household name in India+ 1a"a" )uto has a strong rand image I rand loyalty synonymous with %uality I customer focus.

A STRON5 INDIAN +RAND1 HAMARA +A;A;

!ne of the largest 2 I 3 wheeler manufacturer in the world 21 millionK vehicles on the roads across the glo e :anaging funds of over Rs /,,, cr. 1a"a" )uto finance one of the largest auto finance cos. in India Rs. /+7// Cr. 3urnover I Profits of 539 Cr. in 2,,24,3 It has "oined hands with )llian$ to provide the Indian consumers with a distinct. !ption in terms of life insurance products

)s a promoter of )llian$ 1a"a" 'ife Insurance Co. 'td.+ 1a"a" )uto has the following to offer 4 (inancial strength and sta ility to support the Insurance 1usiness

) strong rand4e%uity. ) good mar-et reputation as a world4class organi$ation. )n e2tensive distri ution networ-.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 17

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

)de%uate e2perience of running a large organi$ation.

S*!&(d Vision

A *o$s(*o%d n!m( in Indi! "(!ms $/ ,i"* ! g%o !% 'ong%om(&!"(222

1a"a" )uto 'td+ the flagship company of the Rs. 9,,, crore 1a"a" group is the largest manufacturer of two4wheelers and three4wheelers in India and one of the largest in the world.

) household name in India+ 1a"a" )uto has a strong rand image I rand loyalty synonymous with %uality I customer focus. 5ith over 15+,,, employees+ the company is a Rs. /,,, crore auto giant+ is the largest 2<34wheeler manufacturer in India and the /th largest in the world. ))) rated y Crisil+ 1a"a" )uto has een in operation for over 55 years. It has "oined hands with )llian$ to provide the Indian consumers with a distinct option in terms of life insurance products.

)s a promoter of )llian$ 1a"a" 'ife Insurance Co. 'td.+ 1a"a" )uto has the following to offer

(inancial strength and sta ility to support the Insurance 1usiness. ) strong rand4e%uity. ) good mar-et reputation as a world class organi$ation. )n e2tensive distri ution networ-. )de%uate e2perience of running a large organi$ation. ) 1, million strong ase of retail customers using 1a"a" products. )dvanced Information 3echnology in e2tensive use.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 19

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

J2perience in the financial services industry through 1a"a" )uto (inance 'td

+OARD OF DIRECTORS OF ALLIAN7 +A;A; ARE

1. Rahul 1a"a" 2. ?ira" 1a"a" 3. #an"ivnayan 1a"a" /. Ran"it Eupta 5. Eovind Prasad 'addha 0. ;.#hridhar 7. 1a"a" )uto 'imited 9. &r 5emer Ledelius *. 7ein$ &oll erg 1,. &on ?guyen 11. )lan 5ilson

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 1*

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

)llian$ 1a"a" rings several innovative products+ the details of which as followes

ALLIAN7 +A;A;<S PRODUCTS

Indi)id$!% P%!ns

UNITGAIN

A Unit Linked Plan

UNITGAIN

A Single Premium Unit Linked Plan

SP

INVESTGAIN

An Endowment Plan

CHILDGAIN

Children's Policy

CASHGAIN

Money Back Plan

SWARNA

Retirement Plan

VISHRANTI CARE CARE CARE CARE ECONOMY SP PROTECTOR

RISK

Pure Term Plan

TERM

Term Plan with Return o! Premium

LIFETIME

"hole Li!e Plan

SAVE LOAN

Single Premium Endowment Plan

A Mortgage Reducing Term #nsurance Plan

KEYMAN

A Promising Business $%%ortunity

INSURANCE

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 2,

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

5&o$/ P%!ns

5ROUP

)vaila le for and ?on Jmployer4Jmployee Eroups

CREDIT

Jmployer 4 Jmployee

CARE

Eroups

5ROUP

)vaila le for Jmployer and ?on Jmployer4Jmployee Eroups

TERM

4 Jmployee

LIFE

Eroups

5ROUP

TERM

InsuranceA

LIFE

SCHEME

in lieu of J&'I @Jmployees &eposit 'in-ed

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 21

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

COMPARISON STATEMENT

P!&"i'$%!&s A%%i!n3 +!4!4 1A 3ypes of aA .nit Eain policy Issued A .nit Eain #P +i&%! s$n %i#( ICICI aA (le2i #ave Plus aA 'ifetime Jndowment Plan A (le2i cash flow money ac- Plan cA (le2i 'ife 'ine Plan 2A Jligi ility 3A:inimum premium amount @ in RsA /A 3erm of &eath or low alance )s per policy term the Plan whichever is first 5+1,+15+2,+25or3, or as per maturity age 15+2,+25+3,or 35years for minor I 0,+05+7,+9, for 5A Premium Mearly+ 7alf yearly+ payment fre%uency premium deduction scheme.Q adult Mearly+ Nuarterly O:onthly salary scheme.Q 7alf Mearly+ yearly+ and :onthly Pwith 7alf Mearly+ and yearly+ Nuarterly and #ingle premium 7alf (rom 1year to 0, (rom 3, days to (rom ,year to (rom 12 years to years Rs 1,+,,, regular Rs 25+,,, single premium 05 years 5,+,,, for minor 75+,,, for adults 0, years 19+,,, p.a. or yearly and 1+5,, for monthly. )t the age of 1, years 1,, 55 years 5+,,,regular A 'ife linLIC aA 'ife 3ime A 'ife 3ime #P

*+,,, for half 2,+,,, single

Nuarterly and #ingle yearly+ O:onthly Pwith salary #ingle premium deduction

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 22

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

0A :aturity 3otal value of that 3otal value of that 3otal value of 1id value of the enefit you <funds hold in fund you hold in fund that you hold in fund along with <funds fund <funds maturity onus at 58 7A &eath #um assured chosen (ace amount K or value of units 5hichever is higher Policy fund #um of units 5hichever higher of sum 1st

assured. assured 4&eath in #.)Kfund value

enefit

chosen or value 0months P3,8 of is 4&eath in 2nd half of 1st year P0,8 of #.) value 41st year I a ove #.) Balue 4!n 1,th year 58 onus of #) K id value of fundRRR K fund K fund

9A

(ree 3hree free switches !ne free switch !ne free switch 3wice during the every year. every year. every year. term plan. of

switches

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 23

*A:inimum and ma2imum #um )ssured

(or #ingle Premium :inC1.,1 time the #P :a2CM time the #P

) g e M ,4 3, /5 314 35 /, 304 /, 25

)mount chosen y the customer

(or

#ingle Prem ium CRs CRs

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

5here M as per following ta le

/14 /5 15 /04 0, 5

:in 2,+,,, :a2

1,+,,+,,, (or Regular Prem ium :in 5,+,,, :a2 CRs 1,+,,+,,, CRs

(or Regular Premium :inC5 time )P :a2CM time the )P 5here M as per following ta le

) g e M ,4 3 , 1 2 5 31 4 35 1, 5 304 /, 75 /14 /5 55 /04 55 3, 50 0, 2,

1,A option

Cash Mou may withdraw money any Mou time after D3= full years withdraw money time

may Mou withdraw

may )fter

D3= years the polic y hold er can

withdrawal

any money any time after after years D3= full

D/=full years

withdraw ma2 of 11AInvestm ent option J%uity (und 1alanced fund &e t fund Protector 1uilder Jnhancer :a2imiser Protector 1alancer 5,8. #ecured fund 1alance

Cash fund BABASAB PATIL PROJECT REPORT ON MARKETING

d fund Page 2/ Risfund

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

The fund value is always depend upon the market condition. On the total premium the deductions are

)llocation charges !ther charges

ALLOCATION RATES

A%%i!n3 +!4!4 Mearly Cumulati )lloca tion @8A Mear 1 Mear 2 Mear 3 Mear / Mear 5 Mear 0 Mear 7 Mear 9 Mear * Mear 1, Mear 11 Mear 12 Mear 13 Mear 1/ Mear 15 Mear 10 Mear 17 Mear 19 Mear 1* Mear 2, )verage allocati on year per 3, *9 ** 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, 1,, ve )llocatio n @8A 3, 129 227 327 /27 527 027 727 927 *27 1,27 1127 1227 1327 1/27 1527 1027 1727 1927 1*27 1*27<2, C *0.358 /, 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 Comm ission @8A +i&%! S$n%i#( Mearly Cumul )lloca tion @8A 35 *0.5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 *5 ative )lloca tion @8A 35 127.5 222.5 317.5 /12.5 5,7.5 0,2.5 0*7.5 7*2.5 997.5 *92.5 1,77.5 1172.5 1207.5 1302.5 1/57.5 1552.5 10/7.5 17/2.5 1937.5 1937.5 <2, C*28 35 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 Comm ission @8A ICICI Mearly )lloca tion @8A 9, *2.5 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 *0 Cumul ative )lloca tion @8A 9, 172.5 209.5 30/.5 /0,.5 550.5 052.5 7/9.5 9//.5 */,.5 1,30.5 1132.5 1229.5 132/.5 1/2,.5 1510.5 1012.5 17,9.5 19,/.5 1*,,.5 1*,,.5 <2, C*58 Co mm issi on @8A 9 5 3 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 Om Ko"!Mearly Cumulati )lloca tion @8A 90 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 90.5 ve )llocatio n@8A 90 192.5 27* 375.5 /72 509.5 005 701.5 959 *5/.5 1,51 11/7.5 12// 13/,.5 1/37 1533.5 103, 1720.5 1923 1*1*.5 1*1*.5<2 , C*08 1, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, 3.5, Commiss ion @8A

Non allocated amount

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 25

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

P!&"i'$%!&s A%%!n3 +!4!4 Mear 1 7,8 Mear 2 28 Mear3 18 Mear/ Mear5 Mear0 Mear7 Mear9 Mear* Mear1, ?on allocation charge@cumulativeA 738

+i&%! S$n%i#( 058 7.58 58 58 58 58 58 58 58 58 112.58

ICICI 2,8 7.58 /8 /8 /8 /8 /8 /8 /8 /8 5*.5

Om Ko"!108 3.58 3.58 3.58 3.58 3.58 3.58 3.58 3.58 3.58 /7.5

In "*( %ong &$n s!0 =: 0(!&s8 "*( non !%%o'!"ion ,i%% (

3he main determinant of how policy operates is allocation of fund and growth rate of the company. 3he growth rates are availa le in the P!&"i'$%!&s A%%!n3 +!4!4 ?on allocation Charges@cumulativeA )verage will e newspaper. BABASAB PATIL PROJECT REPORT ON MARKETING Page 20 non 9.1258 58 /.1258 738 102.58 **.58 92.58 +i&%! S$n%i#( ICICI Om Ko"!-

allocation per year 3.058

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

7owever+ some insurers do guarantee a part of the return. 1irla+ for instance+ guarantees a minimum return of 08 in case of Protector option+ /.58 in 1uilder and 38 in Jnhancer. 1irla+ as of ?ovem er 2,,3 has declared+ since inception+ a return of 13.55 8 on Protector+ 19.238 on 1uilder and 25.018 on Jnhancer.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 27

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

RESEARCH METHODOLOGY

RESEARCH METHODOLO5Y PRO+LEM DEFINITION

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 29

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

In the mar-et+ an- interest rates are coming down and peoples

prefer other investment avenues li-e mutual funds. 3he main focus of this pro"ect is to -now a out unit4lin-ed policy @ com ination of mutual fund and life coverageA+ how this plan wor-s in the mar-et and how people consider its attri utes and factors.

O+;ECTIVE

3he main o "ective of the research is to find potential mar-et for the unit lin-ed plans in 1angalore city.

SU+ O+;ECTIVES

1. 3o -now potential mar-et for life insurance. 2. 3o -now awareness of different insurance companies. 3. 3o -now which attri utes people consider most important. /. 3o -now what factor people consider while purchasing unit lin-ed policy. 5. 3o -now the investment criteria 0. 3o -now in which range people want to invest. Feeping a ove o "ective in mind a %uestionnaire was designed and field survey conducted in 1angalore city.

SAMPLE PROFILE

1usinessmen+ Jmployees and other are population for this pro"ect. Jfforts were made to get the respondents with income of Rs 3+,,+,,, I more. #ampling units are ta-en from the 1angalore city. BABASAB PATIL PROJECT REPORT ON MARKETING Page 2*

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

SAMPLE SI7E

#ample si$e was 1,, in 1angalore city

SAMPLIN5 TECHNIQUE

#amples were chosen from different areas of 1angalore i.e. ;ayanagar+ : E Road+ Corporation area+ Jlectronics city and tried to maintain 1G1G1 ratio of usinessman+ employees and other among the respondents

DATACOLLECTIONPROCEDURE

&ata collection for unit lin-ed policy #econdary data collected from following source 1. 'iterature from )llian$ 1a"a" office 2. )rticles from Jconomictimes 3. )rticle from Insurance Cover Primary data was collected through field survey %uestionnaire y framing the

DATA ANALYSIS TECHNIQUE

3he data collected was consolidated+ the sum average was calculated. Barious charts were prepared which helped to analy$e the data etter .&ata analysis involved converting of recorded o servation in to descriptive statement. BABASAB PATIL PROJECT REPORT ON MARKETING Page 3,

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

LIMITATION OF THE STUDY

1. 3he findings are relevant only to 1angalore city + however a generali$ed view can e applica le to cities with similar characteristics. 2. #ince the sampling techni%ue was random+ the finding might not give an accurate picture. 3. #ince the time and cost were the a constraints+ result may not e accurate+ as surveyor could not survey the entire customer and potential investors. /. #ome of the customers could not give an accurate response to some of the %uestions

SCOPE OF THE STUDY

T*( /&o4('" in'%$d(s

1. #tudy of unit lin-ed policy. BABASAB PATIL PROJECT REPORT ON MARKETING Page 31

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

2. 3he eligi ility criteria of the applicant 3. 1rief idea a out the company called )llian$ 1a"a" life insurance company limited. /. Comparison study of different unit in-ed policies of different companies 5. 3erms and conditions of different companies unit lin-ed policies 0. &ifferent types of policies issued y )llian$ 1a"a"

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 32

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

FINDINGS

Findings:

1A 7ave you ought any Insurance policy< -now a out unit lin-ed policy6

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 33

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Awareness of life insurance

4%

know insurance policy 96% dont know insurance policy

Awareness of unitlinked policy

18% know unit linked policy 82% dont know unit linked policy

2A Ran- the Insurance companies you are aware of6

Respondents ran-ed life insurance companies as elow BABASAB PATIL PROJECT REPORT ON MARKETING Page 3/

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Ranking of Insurance Co panies !ased on co posite score

35 30 co posite score 25 20 15 10 5 0

I "a #a # $a ta &u nl i'e IC (i (a LI C I% IC

llia n!

"a e of co panies

3he ran-ing is 1. 'ife Insurance Corporation 2. ICICI 3. )llian$ 1a"a" 'ife Insurance Company 'imited /. 3ata )IE 'ife Insurance Company 'imited 5. )viva 'ife Insurance Company 'imited

3A 7ave you ought any unit lin-ed policy6

BABASAB PATIL PROJECT REPORT ON MARKETING

"i rla

Page 35

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

!ut of 1,, samples only 2 people ought unit lin-ed policy.

#ercentage of respondents w$o $a%e !oug$t unit linked policy

120 100 80 60 40 20 0 "ou)*t unit linked policy +oesnt ,ou)*t unitlinked policy

/A )re you interested in uying unit lin-ed policy6

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 30

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

#ercentage of respondents w$o are intereste to !uy unit linked policy

100 90 80 -0 60 50 40 30 20 10 0 Interested to ,uy unit linked policy .ot interested to ,uy unit linked policy

5ARan- the elow attri utes do you consider while purchasing6

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 37

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Consideration of attri!utes

C*ar)es le(ied 9% &a(in) co0ponent 15% Li'e co(era)e 16% /aturity ,ene'its 15% /ode o' payin) pre0iu0 14% Creation o' estate 16%

1it*draw al ,ene'its 15%

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 39

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

0A Ran- the factors do you consider while purchasing 'ife Insurance<.nit 'in-ed policy6

Consideration of factors w$ile !uying &ife Insurance

/arket condition 18% "rand i0a)e 14%

2elati(es3'rien ds 12%

2isk 'actor 19%

)e 18%

Inco0e 19%

7A 7ow much do you want to invest6

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 3*

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Respondent's interest of in%est ent in percentage(In Rs p)a*

,o(e 5 Lak*s 14%

,o(e 1Lak* 20%

3 Lak*s 4 5Lak*s 28%

2 Lak*s43 Lak*s 16%

1Lak*42 Lak*s 22%

9A In which fund do you prefer to invest@ran- them accordinglyA

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /,

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Co posite ranking of %arious fund

300 250 200 150 100 50 0 56uity 'und +e,t 'und Cas* 'und "alance 'und 232 222 246 280

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /1

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

ANALYSIS

ANALYSISHASBEENMADEIN THREEPARTS

Respondents in general Respondents whose income is more than Rs Rs 3,00,000 p.a. Respondents who knows about Unit Linked Policy

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /2

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

RESPONDENTS IN GENERAL

INCOME OF THE RESPONDENTS

Inco e of respondents

22%

In Rs 28%

"elow 150000 1500004300000 3000004500000 ,o(e500000

30%

20%

(our types of income group has een responded+ accordingly respective percentage has een given. 1. 1elow Rs 1+5,+,,, 2. Rs 1+5,+,,,4Rs 3+,,+,,, p.a. 3. Rs Rs 3+,,+,,, p.a.45+,,+,,, /. ) ove Rs 5+,,+,,, 298 2,8 3,8 228

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /3

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

AWARENESS OF LIFE INSURANCE

Awareness of &ife Insurance

120 100 80 60 40 20 0 7now insurance policy +ont know insurance policy

)wareness of the life insurance is out of the 1,, samples 2 peoples don=t -now a out the life insurance.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page //

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

AWARENESS OF UNITLINKED POLICY Awareness of unitlinked policy

22%

know unit linked policy dont know unit linked policy

-8%

!ut of *9 people 228 -now a out the unit lin-ed policy.

RANKIN5 OF LIFE INSURANCE COMPANIES

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /5

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Respondents ran-ed life insurance companies as elow

35 30 co posite score 25 20 15 10 5 0

Ranking of Insurance Co panies !ased on co posite score

I%

"a

IC

n!

$a

"a e of co panies

3he ran-ing is 1. 'ife Insurance Corporation 2. ICICI 3. )llian$ 1a"a" 'ife Insurance Company 'imited /. 3ata )IE 'ife Insurance Company 'imited 5. )viva 'ife Insurance Company 'imited Respondents ran-ed )llian$ 1a"a" as 3rd among 0 life insurance companies.3hat means awareness is less a out the company. 3herefore company should ta-e some measure to create awareness.

BABASAB PATIL PROJECT REPORT ON MARKETING

"i rla

llia

&u n

ta

(i (a

LI

li' e

IC

#a #

Page /0

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

5hile purchasing unit lin-ed policy+ people consider the attri utes li-e Creation o' estate8 Li'e co(era)e8 /ode o' payin) pre0iu08 1it*drawal ,ene'its8 &a(in)

co0ponent ec*o 0uc* i0portance t*ey )i(e to eac* attri,ute is )i(en ,elow

Consideration of attri!utes

C*ar)es le(ied 9% &a(in) co0ponent 15% Creation o' estate 16%

Li'e co(era)e 16%

/aturity ,ene'its 15% /ode o' payin) pre0iu0 14%

1it*draw al ,ene'its 15%

5hile purchasing life insurance people considered most important is %i#( 'o)(&!g( than C&(!"ion o# (s"!"( than s!)ing 'om/on(n" than other attri utes li-e m!"$&i"0 (n(#i"s8 ,i"*d&!,!% (n(#i"s !nd mod( o# /!0ing /&(mi$m 2the least important attri ute is '*!&g(s %()i(d. )s people consider most important as life coverage+ in the policy of .nit gain they should concentrate on &eath enefits and life coverage period.

)fter consideration of attri utes the ne2t step towards the purchase of life insurance y the prospective uyer are following factors BABASAB PATIL PROJECT REPORT ON MARKETING Page /7

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

1. 1rand Image 2. Ris- (actor 3. Income /. )ge factor 5. Influence of relatives and friends 0. :ar-et condition

Consideration of factors w$ile !uying &ife Insurance

/arket condition 18% "rand i0a)e 14%

2elati(es3'riend s 12%

2isk 'actor 19%

)e 18%

Inco0e 19%

Respondents considered very important as Ris- #!'"o& than the factors li-e In'om(8 Ag(8 !nd M!&-(" 'ondi"ions2 +&!nd im!g( as less important and In#%$(n'( o# &(%!"i)(s !nd #&i(nds as very least important. )s people are tend to avoid ris- and give more importance to risfactor it shows that people are willing to ta-e ris-.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /9

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

PEOPLE<S INTEREST OF INVESTIN5 IN LIFE INSURANCE

Respondent's interest of in%est ent in percentage (in Rs p)a *

,o(e 5 Lak*s 14% 3 Lak*s 4 5Lak*s 28% ,o(e 1Lak* 20%

2 Lak*s43 Lak*s 16%

1Lak*42 Lak*s 22%

Respondents got a option of five categories as shown a ove. 3he response was 1elow Rs 1+,,+,,, Rs 1+,,+,,, P2+,,+,,, Rs 2+,,+,,, P Rs 3+,,+,,, p.a. Rs Rs 3+,,+,,, p.a.4 5+,,+,,, ) ove Rs 5+,,+,,, 138 198 278 2*8 138

:ost peoples are interested in ta-ing the policy of Rs 3+,,+,,, p.a. to 5+,,+,,,.?e2t to it is the policy of Rs2+,,+,,, to Rs 3+,,+,,, p.a..

BABASAB PATIL PROJECT REPORT ON MARKETING

Page /*

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

PEOPLE >S PREFERENCE OF INVESTIN5 PREMIUM AMOUNT Customer got several option to invest their premium .3he preference respondents are given elow according to

+rap$ s$owing Co posite ranking of %arious fund

300 250 200 150 100 50 0 56uity 'und +e,t 'und Cas* 'und "alance 'und 232 222 280 246

Ran-ings are given elow 1. 1alanced fund 2. J%uity fund 3. Cash fund /. &e t fund 298 258 2/8 238

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 5,

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

RESPONDENTS WHOSE INCOME IS MORE THAN RS Rs 3, , !"a"

Ranking of &ife Insurance co panies !ased on t$eir co posite score

35 30 25 20 15 10 5 0 Lic "irla &unli'e ICICI llian! "a#a# (i(a $ata I%

Ran-ing according to respondents whose income is more than Rs 3+,,+,,, p.a. 1. 'IC 2. ICICI 3. 1irla #unlife /. )llian$ 1a"a" 5. 3ata )IE 0. )viva

R(s/ond(n"s ,*os( in'om( is mo&( "*!n Rs ?8::8::: /2!2 'onsid(&(d !""&i $"(s !s (%o,

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 51

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Consideration of Attri!utes

C*ar)es la(ied 8% &a(in) co0ponent 16% Creation o' estate 16%

Li'e co(era)e 16% /aturity ,ene'its 14%

1it*draw al ,ene'its 15%

/ode o' payin) pre0iu0 15%

Respondents considered very important attri ute as C&(!"ion o# (s"!"(8 S!)ing 'om/on(n"s !nd %i#( 'o)(&!g(2 ?e2t important as Mod( o# /!0ing /&(mi$m and ne2t is Wi"*d&!,!% (n(#i"s ne2t is M!"$&i"0 (n(#i"s and the least important is C*!&g(s %()i(d2 Respondents even consider #aving component and creation of estate as very important.

R(s/ond(n"s ,*os( in'om( is mo&( "*!n Rs ?8::8::: /2!2 'onsid(&(d #!'"o&s !##('"ing "o $0 %i#( ins$&!n'( !s (%o,

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 52

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

,actors considered w$ile !uying &ife Insurance

/arket condition 19% 2elati(es3'riends 11% "rand i0a)e 14% 2isk 'actor 18%

)e 19%

Inco0e 19%

Respondent considered all the a ove4mentioned attri utes as most important In percentage most important is Ag(8 In'om(8 M!&-(" 'ondi"ions8 RisF!'"o& and least important is +&!nd im!g( !nd in#%$(n'( o# &(%!"i)(s !nd #&i(nds2

R(s/ond(n"s ,*os( in'om( is mo&( "*!n Rs ?8::8::: /2!2 'onsid(&(d "*( in)(s"m(n" '&i"(&i! !s #o%%o,s

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 53

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

Respondents interest of in%est ent in percentage (in Rs p)a*

,o(e 500000 19% "elow 100000 4% 1000004 200000 23%

3500004 500000 31%

2000004 350000 23%

Respondent interested to invest money more etween Rs?8@:8:::1@8::8::: /2!2 ?e2t is Rs=8::8:::1?8@:8::: /2!2 and same percentage of people wants to invest in RsA8::8:::1=8::8::: /2!2 and 1*8 want to invest in ! o)( Rs @8::8::: /2!2 and least people want to invest in (%o, Rs A8::8::: /2!2

R(s/ond(n"s ,*os( in'om( is mo&( "*!n Rs ?8::8::: /2!2 'onsid(&(d in)(s"ing "*(i& mon(0 in #o%%o,ing #$nds

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 5/

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

#reference of respondents interest of in%esting #re iu in %arious funds

56uity 'und 22% "alance 'und 31%

+e,t 'und 22%

Cas* 'und 25%

Ran-ings are given elow 1. 1alanced fund 2. Cash fund 3. J%uity fund /. &e t fund 318 258 228 228

OPINION O# THE RESPONDENTSWHO $NOW A%O&T THE &NITLIN$ED POLIC'"

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 55

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

ATTRI-UTES C."SI/ERE/ -Y RES#."/E"TS 01I&E #URC1SI"+ U"IT &I"2E/ #.&ICY

&a(in) co0ponen t 15% /aturity ,ene'its 14% C*ar)es la(ied 10% Creation o' estate 15%

Li'e co(era)e 1-%

1it*drawa l ,ene'its 16%

/ode o' payin) pre0iu0 13%

Respondents considered very important attri ute as Li#( 'o)(&!g( ne2t important as Wi"*d&!,!% (n(#i"s ne2t is S!)ing 'om/on(n"s !nd C&(!"ion o# (s"!"( ne2t important as M!"$&i"0 (n(#i"s ne2t important attri ute is Mod( o# /!0ing /&(mi$m and the least important is C*!&g(s %()i(d2 H(&( mos" im/o&"!n" "o no"( is ()(&0 !""&i $"( is 'onsid(&(d im/o&"!n" ('!$s( !%% "*( /(&'(n"!g( is mo&( "*!n A:B2

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 50

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

C."SI/ERATI." ., T1E ,ACT.RS 01I&E -UYI"+ U"IT &I"2E/ #.&ICY

/arket condition 1-% 2elati(es3'riends 10%

"rand i0a)e 15%

2isk 'actor 20% )e 19%

Inco0e 19%

Bery important 'ess important Important ?ot important 'east important

Ris- factor Income+ age :ar-et conditions 1rand image Influence of relatives Ifriends

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 57

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

+RA#1 S1.0I"+ #ERCE"TA+E ., #E.#&E 3 T1EIR I"TEREST ., I"VESTME"T (I" RS #)A)*

60 50 40 30 20 10 0 "elow 100004 500004 1000004 ,o(e 10000 50000 100000 200000 200000

Respondents got an option of five categories as shown a ove. 3he response was 1elow Rs 1+,,+,,, Rs 1+,,+,,, P2+,,+,,, Rs 2+,,+,,, P Rs 3+,,+,,, p.a. Rs Rs 3+,,+,,, p.a.4 5+,,+,,, ) ove Rs 5+,,+,,, ,*8 ,,8 ,*8 558 278

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 59

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

#E.#&E'S CRETERIA T. I"VEST I" VARI.US ,U"/S

"alance 'und 32% 56uity 'und 25%

+e,t 'und 20% Cas* 'und 23%

Ran-ings are given elow 1. 1alanced fund 2. J%uity fund 3. Cash fund /. &e t fund 328 258 238 2,8

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 5*

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

SUGGESTIONS:

1. 3he a ove study showed that the awareness a out )llian$ 1a"a" is less . People ran-ed it 3rd in the life insurance companies .#o companies should ta-e some measure to create awareness in the minds of customer .(or that it may go for aggressive advertising campaign or sponsor for some events+ go for anners or hoardings

2. 3he competitor companies of )'1; is very strong in unit lin-ed policies 1irla #unlife and 'IC are going e2tremely well in the mar-et.their growth rates are very high .#o )'1; should highlight their strong points li-e Choosing the sum assured 'ow allocation charges in the long run Eood service 'ow switching charges 3erm of policy is unlimited #alary deduction schemes

3. 3he unit4lin-ed policies are suita le to those who are active investors and at the same time they want to cover their life.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 0,

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

/. 3here are various categories of people who can e differentiated li-e :en and 5omen :en usually ta-e the ris-+ where as women hesitate to ta-e ris-. #o this policy is more suita le to men )ge factor Moung people are more willing to ta-e the ris-+ where old people are not. #o it is suita le to young income people Income group If income of the person is high than he can ta-e ris- ut low4income group cant ta-e the ris-. #o this policy is suita le to high4income group people.

5. 'ife insurance is the classical e2ample of unsought goods. 3he nature of that is the consumer does -now a out or does not normally thin- of uying. It re%uires personal selling support. #o agents should e fully informative and they should e a le to tell the entire information customer needed. 0. )s awareness is less + )llian$ 1a"a" should open some more ranches so that acccess ecomes easy. #o that people can approach the company and ta-e service. 7. )s people consider ris- factor as very important company should give minimum guarantee of money so that people may consider this policy as most secured and also giving good profit. 9. Company should come up with group unit lin-ed plans so that people may have option to go for unit4lin-ed policy.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 01

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

CONCLUSION

In new economy things are moving at a nanosecond pace> that our mar-ets are characterised y hyper competition> that disruptive technologies are changing every usiness must adapt to the empowered consumer. In such an

usiness and every

environment )'1; is performing on a consistence asis. It is not a result of luc-+ tricplays or misfortune of the competitors+ ut service and attractive schemes of )'1;. )llian$ 1a"a" sustained efforts are yielding superior long4term result.

3he a ove study showed that unit lin-ed policy has attractive mar-et. 1ut main pro lem is awareness. #o )llian$ 1a"a" should create awareness among the people. 3hey should e2plain the advantages they are getting out of unit4lin-ed policy. 3hey should come up with some salient features li-e different investment criteria+ group investment plans etc.In India people are not willing to invest their money in mar-et ut they ma-e idle investment. #o it is the wor- of middlemen win the willingness of people to invest in mar-et. )lso company should concentrate on death enefit and term of policy.

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 02

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

BIBLIOGRAPHY

1. Donald .#.3ull I 7aw-ins P :ar-eting research measurement and method+ Prentice 7all of India Private 'imited+?ew &elhi42,,1 . 'iterature availa le at )llian$ 1a"a" 1ranch office+ 1angalore. !. www.)llian$1a"a".com ". www.economictimes.com

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 03

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

APPENDIX

BABASAB PATIL PROJECT REPORT ON MARKETING Page 0/

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

MARKETSURVEYON UNITLINKEDPOLICIES

Sir/Madam,

I am MBA student studying in. I am doing survey on unit linked plans . Please co-operate and spare a few minutes of your time to fill up the following questionnaire. The information provided by you will be kept confidential since this project is for academic purpose.

Name Add&(ss P* 2No

: : :

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 05

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

5(nd(&

Ag( :

P&o#(ssionCO''$/!"ion: Ann$!% in'om(: !D (%o, A@:::: DA@::::1?::::: dD ! o)( @:::::

'D ?:::::1@:::::

1. 7ave you ought any Insurance policy < -now a out unit lin-ed policy6

Mes ?o

2. Ran- the insurance companies you are aware off 'IC 1irla #unlife I CI C I 3. Have you bought any unit linked policy? Yes If Yes Company name : If No 4. Are you interested in buying unit linked policies Yes If yes From which company And why No No )llian$ 1a"a" )viva 3ata )IE

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 00

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

5 . Rank the below attributes do you consider while purchasing Life Insurance/ Unit

Linked policies (For very important 5 to least important 1) )ttri utes Creation of estate 'ife coverage :ode of paying premium 5ithdrawal enefits :aturity enefits #aving component Charges levied 5 / 3 2 1

0. Ran- the elow factors are you consider while purchasing 'ife Insurance< .nit 'in-ed policies @(or very important 5 to least important 1A (actors 1rand image Ris- factor Income )ge Relatives and friends :ar-et conditions 5 / 3 2 1

7. 7ow much do you want to invest6 Below -10000 10000-50000 50000-100000

100000-200000 Above 200000

8. In which fund do you prefer to invest (rank them accordingly) Equity fund Debt fund Cash fund Balance fund

3han- you

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 07

COMPARITIVE STUDY OR EQUITY SCHEMES IN THE MUTUAL FUND INDUSTRY

BABASAB PATIL PROJECT REPORT ON MARKETING

Page 09

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Certificate of Physical Fitness by A Single Medical OfficerDokument1 SeiteCertificate of Physical Fitness by A Single Medical OfficerBalu Ramachandran69% (29)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Economic Growth ProblemsDokument12 SeitenEconomic Growth ProblemsAdnan Jawed100% (1)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Spray-Foam-Genie-2023 FDDDokument204 SeitenSpray-Foam-Genie-2023 FDDdK100% (1)

- Virginia Henry BillieBMO Harris Bank StatementDokument4 SeitenVirginia Henry BillieBMO Harris Bank StatementQuân NguyễnNoch keine Bewertungen

- L G Projectreport 2Dokument79 SeitenL G Projectreport 2Mohd ShahidNoch keine Bewertungen

- Physical Fitness Certificate for Study in IndiaDokument5 SeitenPhysical Fitness Certificate for Study in IndiaMohd ShahidNoch keine Bewertungen

- Airline Reservation System Visual BasicDokument29 SeitenAirline Reservation System Visual BasicMohd ShahidNoch keine Bewertungen

- Project Report On Advertising EffectivenessDokument74 SeitenProject Report On Advertising EffectivenessMohd ShahidNoch keine Bewertungen

- DJDokument115 SeitenDJMohd ShahidNoch keine Bewertungen

- Marketing Strategies of LG Electronics in IndiaDokument114 SeitenMarketing Strategies of LG Electronics in IndiaMohd ShahidNoch keine Bewertungen

- Tata MotorsDokument80 SeitenTata MotorsMohd ShahidNoch keine Bewertungen

- Videocon ProjectDokument64 SeitenVideocon ProjectMohd ShahidNoch keine Bewertungen

- DJDokument115 SeitenDJMohd ShahidNoch keine Bewertungen

- What Is A Control FileDokument18 SeitenWhat Is A Control FileMohd ShahidNoch keine Bewertungen

- Medical Certificate Fitness Check SEODokument1 SeiteMedical Certificate Fitness Check SEOtacharya1Noch keine Bewertungen

- Report FinalDokument59 SeitenReport FinalMohd ShahidNoch keine Bewertungen

- HyperCITY Retail India LTDDokument126 SeitenHyperCITY Retail India LTDMohd Shahid100% (1)

- 634137560747743750Dokument22 Seiten634137560747743750Mathew JoseNoch keine Bewertungen

- Mr. Rahul Parihar Kratika PandeyDokument49 SeitenMr. Rahul Parihar Kratika PandeyMohd ShahidNoch keine Bewertungen

- Ado Visual BasicDokument22 SeitenAdo Visual BasicMohd ShahidNoch keine Bewertungen

- Medical Certificate Fitness Check SEODokument1 SeiteMedical Certificate Fitness Check SEOtacharya1Noch keine Bewertungen

- Compiler DesignDokument40 SeitenCompiler DesignMohd ShahidNoch keine Bewertungen

- Physical Fitness Certificate for Study in IndiaDokument5 SeitenPhysical Fitness Certificate for Study in IndiaMohd ShahidNoch keine Bewertungen

- Name of The Option Chosen: 1) A Winning Business Name Has To Be Memorable - But Easy To SpellDokument11 SeitenName of The Option Chosen: 1) A Winning Business Name Has To Be Memorable - But Easy To SpellMohd ShahidNoch keine Bewertungen

- 4340 292337 Hms - FinalDokument44 Seiten4340 292337 Hms - FinaluserPLNoch keine Bewertungen

- SynopsisDokument20 SeitenSynopsisMohd ShahidNoch keine Bewertungen

- History of MathDokument13 SeitenHistory of MathMohd ShahidNoch keine Bewertungen

- BSNL Land LineDokument117 SeitenBSNL Land Linenits231Noch keine Bewertungen

- Questionnaire: 1. Overall, How Satisfied Are You Working For The Company?Dokument2 SeitenQuestionnaire: 1. Overall, How Satisfied Are You Working For The Company?Mohd Shahid100% (1)

- role-of-hr-IN-HR in Corporation BankDokument51 Seitenrole-of-hr-IN-HR in Corporation BankMohd ShahidNoch keine Bewertungen

- Online Crime ReportDokument43 SeitenOnline Crime ReportMohd ShahidNoch keine Bewertungen

- (040420) Developing Business Case PPT GroupDokument22 Seiten(040420) Developing Business Case PPT GroupAndi Yusuf MasalanNoch keine Bewertungen

- Debate SpeechDokument4 SeitenDebate SpeechTevin PinnockNoch keine Bewertungen

- Soneri Bank Ltd. Company Profile: Key PeoplesDokument4 SeitenSoneri Bank Ltd. Company Profile: Key PeoplesAhmed ShazadNoch keine Bewertungen

- SociologyDokument153 SeitenSociologyuocstudentsappNoch keine Bewertungen

- Industrial+Conflict 2Dokument10 SeitenIndustrial+Conflict 2angelsaraswatNoch keine Bewertungen

- Comparative Economic SystemsDokument8 SeitenComparative Economic SystemsDan GregoriousNoch keine Bewertungen

- The Definitive Guide To A New Demand Planning Process PDFDokument11 SeitenThe Definitive Guide To A New Demand Planning Process PDFmichelNoch keine Bewertungen

- RELATIONSHIP MARKETING USING DIGITAL PLATFORMSDokument32 SeitenRELATIONSHIP MARKETING USING DIGITAL PLATFORMSAwien MazlannNoch keine Bewertungen

- Managerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankDokument140 SeitenManagerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankLauraLittlebesmp100% (16)

- Wpp2022 Gen f01 Demographic Indicators Compact Rev1Dokument6.833 SeitenWpp2022 Gen f01 Demographic Indicators Compact Rev1Claudio Andre Jiménez TovarNoch keine Bewertungen

- GRA Strategic Plan Vers 2.0 06.12.11 PDFDokument36 SeitenGRA Strategic Plan Vers 2.0 06.12.11 PDFRichard Addo100% (3)

- ICM-HRM Exam Preparation Class Answer For December 2017, Question No: 6Dokument1 SeiteICM-HRM Exam Preparation Class Answer For December 2017, Question No: 6Zaw Ye MinNoch keine Bewertungen

- Entrepreneurship Business Plan DR John ProductDokument11 SeitenEntrepreneurship Business Plan DR John ProductsuccessseakerNoch keine Bewertungen

- MAGNI AnnualReport2013Dokument105 SeitenMAGNI AnnualReport2013chinkcNoch keine Bewertungen

- What Is Double Diagonal Spread - FidelityDokument8 SeitenWhat Is Double Diagonal Spread - FidelityanalystbankNoch keine Bewertungen

- Gr08 History Term2 Pack01 Practice PaperDokument10 SeitenGr08 History Term2 Pack01 Practice PaperPhenny BopapeNoch keine Bewertungen

- MKT-SEGDokument63 SeitenMKT-SEGNicolas BozaNoch keine Bewertungen

- Business Studies - Objective Part - Section 1Dokument64 SeitenBusiness Studies - Objective Part - Section 1Edu TainmentNoch keine Bewertungen

- ACE Variable IC Online Mock Exam - 08182021Dokument11 SeitenACE Variable IC Online Mock Exam - 08182021Ana FelicianoNoch keine Bewertungen

- Ch04 Completing The Accounting CycleDokument68 SeitenCh04 Completing The Accounting CycleGelyn CruzNoch keine Bewertungen

- Ind As 16Dokument41 SeitenInd As 16Vidhi AgarwalNoch keine Bewertungen

- Wells Fargo Combined Statement of AccountsDokument8 SeitenWells Fargo Combined Statement of AccountsHdhsh CarshNoch keine Bewertungen

- Composition Scheme Under GST 1.0Dokument28 SeitenComposition Scheme Under GST 1.0Saqib AnsariNoch keine Bewertungen

- Agriculture in India - 1Dokument28 SeitenAgriculture in India - 1utkarshNoch keine Bewertungen

- IIC Calendar Activities for Academic YearDokument1 SeiteIIC Calendar Activities for Academic YearSrushti JainNoch keine Bewertungen

- Chapter: 3 Theory Base of AccountingDokument2 SeitenChapter: 3 Theory Base of AccountingJedhbf DndnrnNoch keine Bewertungen

- Work Sheet-Ii: Dollar ($) Project A Project B Project CDokument5 SeitenWork Sheet-Ii: Dollar ($) Project A Project B Project Crobel popNoch keine Bewertungen