Beruflich Dokumente

Kultur Dokumente

Small Cells 2013 Brochures

Hochgeladen von

Chungwa ChanjiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Small Cells 2013 Brochures

Hochgeladen von

Chungwa ChanjiCopyright:

Verfügbare Formate

WinterGreen Research, INC.

Small Cells and Femtocells: Market Shares, Strategies, and Forecasts, Worldwide, 2013 to 2019 Small Cells and Femtocells Providing a Flexible, Convenient, Local System For Increasing Smart Phone Signal Strength

Mountains of Opportunity

Picture by Susan Eustis

WinterGreen Research, Inc. Lexington, Massachusetts

REPORT # SH25754189 www.wintergreenresearch.com 781 853 5078

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

CHECK OUT THESE KEY TOPICS

Femtocell Home Coverage Small Cells Femtocells Pico Cells Turnkey LTE Small Cell Solution 3G Small Cell Femtocell Software 4G Wireless 3G Wireless Residential Femtocells Enterprise Femtocells Low-Power Access Points Small Cells Market Shares Small Cells Market Forecasts Small Cells Famework Functions Smart Phone Signal Control

Small Cells and FemtocellsGrowth Strategy:

Small Cells and Femtocells: Market Shares, Strategies, and Forecasts, Worldwide, 2013-2019

LEXINGTON, Massachusetts (October 29, 2013) WinterGreen Research announces that it has published a new study Small Cells and Femtocells: Market Shares, Strategy, and Forecasts, Worldwide, 2013 to 2019. The 2013 study has 413 pages, 162 tables and figures. Worldwide markets are poised to achieve significant growth as small cell and femtocells and trucks permit users to implement automated driving. Small cells are better than base stations for expanding wireless infrastructure coverage in the ear of smart phones. Wireless signals have incremental strength added locally in home, airport, or enterprise. Small cells are able to offload traffic from the macro network to an underlay network at a street and indoor level. Small cells work for individual subscribers, public places, and enterprises. Small cells create a wireless signal transmission zone. A cluster of low-power access points are connected to a local controller. The quality of voice calls and data transmission is improved in a cost effective manner Small cells are units that address wireless services operator needs to continue to support of mix of 3G and 4G subscriber device generations and a mix of 3G and 4G technology within the same device. LTE standards for data are well established but wireless devices, smart phones still use 3G for voice services, creating a need for 3G and 4G transmission capability. Delivery of voice services over LTE networks has not been standardized yet. Operators continue to deliver voice via their 3G networks even as they move data to LTE. As a result, subscriber devices are a mix of 3G-only and 4G plus 3G, with very few 4G-only devices. To support these subscribers comprehensively across all types of mobile services, operators must deploy a multi-mode radio access infrastructure including multimode femtocells.

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Multimode femtocells provide a cost effective solution to effectively support all user services. There are 3G microcells, picocells, femtocells, a mix of devices known as small cells. The number of mobile internet users has surpassed desktop users as tablets erode the PC markets rapidly. Video streaming and VoIP inflate traffic volumes by a factor of 1,000-fold by 2020. Adding conventional base stations is and unaffordable way to handle this situation. Operators are looking for cost-effective solutions to ease the pressure on their existing infrastructure. The small cell and femtocell designs amalgamate a group of features generally found on macro base station installations to represent a local solution that is cheaper, faster, and better. These include the transmitters, the receivers, software middleware needed for a very local integrated approach to improving signal transmission for smart phones and tablets. Significant investments in research and development are necessary as the emerging small cell and femtocells industry builds on incremental technology roll outs. Small cell and femtocell market shipments forecast analysis indicates that markets at $420 million in 2012 are forecast to reach $5.98 billion by 2019. Market growth comes because there is no other way to build out wireless data infrastructure in an economical manner. The delivery of apps is anticipated to grow to a $236 trillion, yes trillion dollar, market by 2019. This means a lot of data streaming around. According to Susan Eustis, principal author of the report, Small cell market growth is a result of various moves toward autonomous miniature base stations that are used as boxes to improve cell phone transmission, particularly smart phone signal transmission from everywhere. Market driving forces relate primarily to the need for increased local signal strength. . Services providers are positioning with various small cell and femtocell models to meet huge demand as the world moves to 8.5 billion smart phones in use by 2019 and trillions of interconnected sensors on the Internet of Things. Many small cell vendors are making inexpensive smart phone local transmission a reality. WinterGreen Research is an independent research organization funded by the sale of market research studies all over the world and by the implementation of ROI models that are used to calculate the total cost of ownership of equipment, services, and software. The company has 35 distributors worldwide, including Global Information Info Shop, Market Research.com, Research and Markets, electronics.ca, Bloomberg, and Thompson Financial. WinterGreen Research is positioned to help customers face challenges that define the modern enterprises. The increasingly global nature of science, technology and engineering is a reflection of the implementation of the globally integrated enterprise. Customers trust WinterGreen Research to work alongside them to ensure the success of the participation in a particular market segment.

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

WinterGreen Research supports various market segment programs; provides trusted technical services to the marketing departments. It carries out accurate market share and forecast analysis services for a range of commercial and government customers globally. These are all vital market research support solutions requiring trust and integrity. This small cells and femtocells shipment analysis is based on consideration of the metrics for the number of smart phones shipped, percent of public places outfitted with small cells and femtocells, and probable market penetrations of macro base station numbers. Experience using the small cells and femtocells is another factor that contributes to development of triangulation regarding market forecasts for the sector.

Key Words: Small cell and femtocells, Femtocell Home Coverage, Small Cells , Femtocells, Pico Cells, Turnkey LTE Small Cell Solution, 3G Small Cell, Femtocell Software, 4G Wireless, 3G Wireless, Residential Femtocells, Enterprise Femtocells, Low-Power Access Points, Small Cells Market Shares, Small Cells Market Forecasts, Small Cells Fame work Functions, Smart Phone Signal Control

Companies Profiled

Market Leaders Microsoft / Nokia Samsung ip.access Fujitsu Airvana LP Cisco / Ubiquisys NEC Huawei Ericsson Ubee / AirWalk Market Participants

Airvana LP Alcatel-Lucent Antenova Aricent Berkeley-Varitronics Systems CDG Cisco / Ubiquisys Ericsson Ericsson Airvana Fujitsu REPORT # SH25754189 Juniper Kineto Wireless LG Micro Mobio Mindspeed / picoChip MTI Mobile NextPoint QRC Technologies Qualcomm Radisys 413 PAGES Rakon Repeaters Australia Reactel RF Hitec Small Cell Forum Sonus Networks Spirent Ubee / AirWalk ZTE

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Small Cells and Femtocells: Market Shares, Strategies, and Forecasts, Worldwide, 2013 to 2019

Report Methodology

This is the 575th report in a series of primary market research reports that provide forecasts in communications, telecommunications, the Internet, computer, software, telephone equipment, health equipment, and energy. Automated process and significant growth potential are a priority in topic selection. The project leaders take direct responsibility for writing and preparing each report. They have significant experience preparing industry studies. They are supported by a team, each person with specific research tasks and proprietary automated process database analytics. Forecasts are based on primary research and proprietary data bases. The primary research is conducted by talking to customers, distributors and companies. The survey data is not enough to make accurate assessment of market size, so WinterGreen Research looks at the value of shipments and the average price to achieve market assessments. Our track record in achieving accuracy is unsurpassed in the industry. We are known for being able to develop accurate market shares and projections. This is our specialty. The analyst process is concentrated on getting good market numbers. This process involves looking at the markets from several different perspectives, including vendor shipments. The interview process is an essential aspect as well. We do have a lot of granular analysis of the different shipments by vendor in the study and addenda prepared after the study was published if that is appropriate. Forecasts reflect analysis of the market trends in the segment and related segments. Unit and dollar shipments are analyzed through consideration of dollar volume of each market participant in the segment. Installed base analysis and unit analysis is based on interviews and an information search. Market share analysis includes conversations with key customers of products, industry segment leaders, marketing directors, distributors, leading market participants, opinion leaders, and companies seeking to develop measurable market share.

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Over 200 in depth interviews are conducted for each report with a broad range of key participants and industry leaders in the market segment. We establish accurate market forecasts based on economic and market conditions as a base. Use input/output ratios, flow charts, and other economic methods to quantify data. Use in-house analysts who meet stringent quality standards. Interviewing key industry participants, experts and end-users is a central part of the study. Our research includes access to large proprietary databases. Literature search includes analysis of trade publications, government reports, and corporate literature. Findings and conclusions of this report are based on information gathered from industry sources, including manufacturers, distributors, partners, opinion leaders, and users. Interview data was combined with information gathered through an extensive review of internet and printed sources such as trade publications, trade associations, company literature, and online databases. The projections contained in this report are checked from top down and bottom up analysis to be sure there is congruence from that perspective. The base year for analysis and projection is 2011. With 2011 and several years prior to that as a baseline, market projections were developed for 2012 through 2018. These projections are based on a combination of a consensus among the opinion leader contacts interviewed combined with understanding of the key market drivers and their impact from a historical and analytical perspective. The analytical methodologies used to generate the market estimates are based on penetration analyses, similar market analyses, and delta calculations to supplement independent and dependent variable analysis. All analyses are displaying selected descriptions of products and services. This research includes referencde to an ROI model that is part of a series that provides IT systems financial planners access to information that supports analysis of all the numbers that impact management of a product launch or large and complex data center. The methodology used in the models relates to having a sophisticated analytical technique for understanding the impact of workload on processor consumption and cost. WinterGreen Research has looked at the metrics and independent research to develop assumptions that reflect the actual anticipated usage and cost of systems. Comparative analyses reflect the input of these values into models. The variables and assumptions provided in the market research study and the ROI models are based on extensive experience in providing research to large enterprise organizations and data centers. The ROI models have lists of servers from different manufacturers, Systems z models from IBM, and labor costs by category around the world.

REPORT # SH25754189 413 PAGES 162 TABLES AND FIGURES 2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

This information has been developed from WinterGreen research proprietary data bases constructed as a result of preparing market research studies that address the software, energy, healthcare, telecommunicatons, and hardware businesses.

YOU MUST HAVE THIS STUDY

Table of Contents

Small Cells and Femtocells: Market Shares, Strategy, and Forecasts, 2013 to 2019

Table of Contents

Small Cells and Femtocells Executive Summary

The study is designed to give a comprehensive overview of small cells and femtocells equipment market segment. Research represents a selection from the mountains of data available of the most relevant and cogent market materials, with selections made by the most senior analysts. Commentary on every aspect of the market from independent analysts creates an independent perspective in the evaluation of the market. In this manner the study presents a comprehensive overview of what is going on in this market, assisting managers with designing market strategies likely to succeed.

SMALL CELLS / FEMTOCELLS EXECUTIVE SUMMARY 23

Small Cells Market Driving Forces

Number Of Mobile Internet Users Small Cells Market Driving Forces Core Small Cell Networks Small Cells Industry Challenges Small Cell Response to Market Challenges Small Cells Call to Action Small Cells Industry Addresses Fast-Paced Change

23

23 24 26 27 29 30 31

Small Cell Device Market Shares Small Cells Market Forecasts

34 36

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Small Cells and Femtocells Market Definition And Market Dynamics

1. SMALL CELLS / FEMTOCELLS MARKET DEFINITION AND MARKET DYNAMICS 38

1.1

1.1.1 1.1.2 1.1.3 1.1.4 1.1.5 1.1.6

Small Cell and Femtocells

LTE Operator Challenges Femtocells Small 3G Base Stations Traditional FMC Model Support VoIP Calls Over The IP Network Femtocells Support VoIP Calls Over The IP Network Session Border Controller (SBC) SPIT Attack Simulation Project

38

40 41 43 44 44 45

1.2 1.3 1.4

1.4.1

T-Mobile Strategic Ubiquisys 3G Femtocell Positioning Femtocells Small Consumer Devices Femtocells Improve Cellular Coverage

Units The Size Of A Paperback Book

46 47 48

50

1.5 1.6

1.6.1 1.6.2 1.6.3

Increased Exposure To Radiation Is A Concern SIP- Deployment

Telephone First Point Of Contact SIP Application Server SIP Applications

51 51

52 53 53

Small Cells and Femtocells Market Shares And Market Forecasts

2. SMALL CELLS / FEMTOCELLS MARKET SHARES AND MARKET FORECASTS 55

2.1

2.1.1 2.1.2 2.1.3 2.1.4 2.1.5 2.1.6 2.1.7

Small Cells Market Driving Forces

Number Of Mobile Internet Users Small Cells Market Driving Forces Core Small Cell Networks Small Cells Industry Challenges Small Cell Response to Market Challenges Small Cells Call to Action Small Cells Industry Addresses Fast-Paced Change

55

55 56 58 59 60 61 62

2.2

2.2.1 2.2.2 2.2.3 2.2.4 2.2.5 2.2.6 2.2.7 2.2.8 2.2.9 2.2.10 2.2.11 2.2.12 2.2.13

Small Cell Device Market Shares

Airvana LP Airvana LP Cisco / Ubiquisys ip.access ip.access Consumer Access Point UbeeAirWalk NEC 70 Wireless Infrastructure Market Shares, Dollars, Worldwide, Ericsson Core Network Infrastructure Ericsson Leading Supplier of CDMA Solutions For Network Operators Ericsson Evolved Packet Core (EPC) Huawei Revenues in Alcatel-Lucent Wireless Division

65

67 68 68 69 69 69 70 71 72 72 73 74

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

2.2.14 2.2.15 2.2.16 Alcatel-Lucent Networks Segment is Number in IP/MPLS Service Provider Edge Routers with 25% Market Share Femtocell and Small Cell Market Participants 76 Small Cell Wireless Infrastructure Market Shares, 78 76

2.3

2.3.1 2.3.2 2.3.3 2.3.4

Small Cells Market Forecasts

Femtocell and Small Cell Broadband Cellular Networks Femtocell and Small Cell Forecasts Femtocell and Small Cell Implementations FCC an Industry-Consensus Definition For Visually Unobtrusive Wireless Small Cells

79

85 85 86 89

2.4

2.4.1

Small Cell IC Markets

Wireless Apps

89

90

2.5

2.5.1 2.5.2 2.5.3 2.5.4

Software Defined Networking (SDN) and Network Function Virtualization (NFV)

93

Software Defined Networking (SDN) and Network Function Virtualization (NFV) Reordering Of Market Share94 Mobile Packet Core 95 Mobile Broadband1 97 Small Cells Are Disruptive Technology In Networks 97

2.6 2.7

2.7.1 2.7.2 2.7.3 2.7.4 2.7.5 2.7.6 2.7.7 2.7.8

Wireless Infrastructure Return on Investment Wireless Infrastructure Regional Market Analysis

Ericsson Aiming To Have 50% of LTE Market in Latin America Ericsson Sells Wireless Infrastructure in Latin America Market Latin America Ericsson LTE Ericson Regional Wireless Subscriber Analysis Global Mobile Traffic for Data Huawei Regional Participation in India CDMA in India, North America and China

97 98

100 101 102 102 103 104 104 105

Small Cells and Femtocells Product Description

3. SMALL CELLS / FEMTOCELLS PRODUCT DESCRIPTION 106

3.1

3.1.1 3.1.2

Ericsson

Ericsson Home 3G Access Point Ericsson / Airvana

106

106 106

3.2

3.2.1 3.2.2 3.2.3 3.2.4 3.3.1 3.3.2

Airvana Femtocell Network Integration

Airvana HubBub in a Legacy Core Network Airvana HubBub in a VoIP/IMS Core Network Airvana Femtocell Service Manager Airvana Femtocell Service Manager Functions and Interfaces Airvana Femtocell Solutions Based on CDMA and UMTS Airvana CDMA2000 HubBub

107

109 110 111 113 115 115

3.3

3.3.3 3.3.4 3.3.5 3.3.6 3.3.7 3.3.8 3.3.9 3.3.10 3.3.11 3.3.12 3.3.13 3.3.14 3.2.1

ip.access

ip.access Consumer Access Point ip.access The C-class Consumer Small Cell ip.access SoHo SME Access Points -Targeted Coverage For Smaller Enterprises ip.access S16 model ip.access S8 model ip.access Enterprise and Public Access- Small Cells For Complex Coverage ip.access nano3G E16/24 ip.access nanoBTS ip.access nanoLTE ip.access E-40 Model Small Cell ip.access E-100 Model ip.access Oyster 3G Architecture of Oyster 3G

118

119 119 120 121 122 123 123 125 126 127 127 128 130

3.4

3.4.1 3.4.2

Fujitsu Ultra-Compact Femtocell

Fujitsu LTE Femtocell Systems Fujitsu BroadOne LTE Femtocell

132

132 133

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

3.4.3 3.4.4 3.4.5 3.4.6 Fujtsu LTE Femtocell Target Areas Fujitsu LTE Femtocell Solutions Fujitsu LTE Femtocell Access Point Fujitsu Femtocell Resolution of Interference Problems 133 135 137 137

3.5

3.5.1 3.5.2 3.5.3 3.5.4 3.5.5 3.5.6 3.5.7 3.5.8

Samsung Small Cells

Samsung LTE Small Cells Samsung Small Cell LTE High Capacity And Coverage Samsung Small Cell LTE High Capacity And Coverage Flexibility and High Performance Samsung Small Cell LTE High Capacity And Coverage Reduced Time to Market Samsung Small Cell LTE High Capacity And Coverage Indoors Samsung Small Cell LTE High Capacity And Coverage Outdoors Samsung CDMA UbiCell Samsung HSPA UbiCell

141

141 142 142 142 143 143 143 145

3.6

3.6.1 3.6.2 3.6.3 3.6.4 3.6.5 3.6.6

Cisco Small Cell Solutions

Cisco ASR 5000 Series Cisco StarOS Software Cisco ASR 5000 Series Small Cell Gateway Cisco Wi-Fi Applications Cisco Femtocell Solutions Cisco / Ubiquisys

147

148 149 150 152 154 158

3.7

3.7.1 3.7.2 3.7.3 3.7.4 3.7.5 3.7.6 3.7.7 3.7.8 3.7.9 3.7.10 3.7.11 3.7.12 3.7.13 3.7.14

Ubiquisys In-Building Public Access Small Cells

Ubiquisys Enterprise Small Cells Ubiquisys Residential Femtocells Ubiquisys Outdoor Rural Small Cells Ubiquisys ActiveRadio Radio Resource Management Ubiquisys Small Cells Capabilities for the End-User Ubiquisys Macro Network Interworking Ubiquisys Statistics and Diagnostics Ubiquisys Core Network Interfacing Ubiquisys Lifecycle Management Ubiquisys ActiveSON Grid Ubiquisys ZoneGate Femtocell Solution Ubiquisys ZoneGate Services Platform Ubiquisys ZoneGate for Operators Ubiquisys ZoneGate for Consumers

160

163 164 166 167 168 169 170 171 171 172 173 174 176 176 177 177 178 179 180 180 180 180 181

3.8

3.8.1 3.8.2 3.8.3 3.8.4 3.8.5 3.8.6 3.8.7 3.8.8 3.8.9

NEC 176

NEC Small Cell Solutions for Residences NEC FP813 NEC Small Cell Solutions for Enterprise NEC Small Cells for SOHO/SME NEC FP1624 NEC FMA1630 NEC FP1624 NEC Small Cells on LTE NEC Mobile Backhaul for Small Cells

3.9

3.9.1 3.9.2 3.9.3 3.9.4 3.9.5 3.9.6

Radisys

Radisys Trillium Radisys Turnkey LTE Small Cell Solution Radisys Turnkey 3G Small Cell Solution CCPUs Trillium Femtocell Software Example of Trillium Femtocell Solutions Femtocell Protocols Supported by CCPU

182

183 183 186 189 190 192

3.10

3.10.1 3.10.2 3.10.3 3.10.4 3.10.5

UbeeAirWalk

UbeeAirWalk LTE for Small Cells UbeeAirWalk Small Cells Technology UbeeAirWalk Residential Femtocells UbeeAirWalk Enterprise Femtocells UbeeAirwalk EdgePoint

193

193 195 197 198 200

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

3.11

3.11.1 3.11.2 3.11.3

Aricent 202

Aricent Femtocell Software Framework Aricent Femtocell Software Framework and Protocol Stack Aircent Provides Femtocell Software Development 203 203 205

3.12

3.12.1 3.12.2 3.12.3 3.12.4 3.12.5 3.12.6

Microsoft / Nokia

Nokia Small Cells Microsoft / Nokia Flexi Zone Microsoft / Nokia Flexi Lite Base Station Nokia Femtocell Solution Nokia In-Building Solutions Microsoft / Nokia Services for Heterogeneous Networks (HetNets)

206

206 207 209 210 211 213 217

3.13

3.13.1

Huawei 217

Huawei AtomCell

3.14 3.15 3.16 3.17 3.18 3.19

3.19.1 3.19.2

Kineto Wireless Juniper Networks Sonus Networks NextPoint Rakon 222 Mindspeed / picoChip Small Cell ICs

picoChip PC82x8 series picoChip PC8209 series

220 220 221 221 223

225 225

3.20

Freescale

228

Small Cells and Femtocells Technology

4 SMALL CELLS AND FEMTOCELLS TECHNOLOGY 229

4.1 4.2

4.2.1

Technology Trends in Small Cells nano3G

nano3G components

229 230

231

4.3 4.4 4.5

4.5.1 4.5.2

Femtocell Handles 3g Cellular Technologies Collapsed Stack Standards

Qualcomm UMTS Forum

234 235 235

236 244

4.6

4.6.1 4.6.2

Ericsson Technology Perspective

Limited Bandwidth Giving Way to Expanded bandwidth Infrastructure At A Cell Site

244

245 245

4.7

4.7.1 4.7.2 4.7.3

Backhaul Network Architecture

Ericsson Standardization Work In The 3rd Generation Partnership Project (3GPP), Session Initiation Protocol (SIP) Applications Of The Internet Requiring SIP

246

247 247 248

4.8 4.9

4.9.1 4.9.2

Huawei Pipe Strategy Small-Cell Architectures

Small Cells and LTE Smart Antenna Systems

249 250

251 252

Small Cells and Femtocells Company Description

5. SMALL CELLS AND FEMTOCELLS COMPANY DESCRIPTION 253

5.1

5.1.1 5.1.2

Airvana LP

Airvana Solutions For Transparent Offload And Ubiquitous Coverage Airvana / Ericsson

253

255 257

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

5.2

5.2.1 5.2.2 5.2.3 5.2.4 5.2.5 5.2.6 5.2.7 5.2.8

Alcatel-Lucent

Alcatel-Lucent Revenue Alcatel-Lucent Operating Model Focused On Core Products Alcatel-Lucent Organization Alcatel-Lucent Operating Segments: Alcatel-Lucent LTE Alcatel-Lucent Strategic Focus Alcatel-Lucent Revenue Alcatel-Lucent Customers

257

258 258 258 260 261 264 269 272

5.3 5.4

5.4.1 5.4.2 5.4.3 5.4.4

Antenova Aricent

Aricent Customers Aricent Strategy Aricent Investors Aricent Company Highlights

272 273

274 275 275 275

5.5 5.6

5.6.1 5.6.2

Berkeley-Varitronics Systems CDG 276

CDMA2000 Evolution CDG Global Industry Organization

276

276 277 279 281 282 283 285 286 287 287 289 290 291 291 291 292 292 292 295 296

5.7

5.7.1 5.7.2 5.7.3 5.7.4 5.7.5 5.7.6 5.7.7 5.7.8 5.7.9 5.7.10 5.7.11 5.7.12 5.7.13 5.7.14 5.7.15 5.7.16 5.7.17 5.7.18

Cisco 278

Cisco Revenue Cisco Information Technology Cisco Virtualization Cisco / Ubiquisys Cisco / Ubiquisys In-Building Public Access Small Cells Cisco Competitive Landscape In The Enterprise Data Center Cisco Architectural Approach Cisco Switching Cisco NGN Routing Cisco Collaboration Cisco Service Provider Video Cisco Wireless Cisco Security Cisco Data Center Products Cisco Other Products Cisco Systems Net Sales Cisco Systems Revenue by Segment Cisco Tops 10,000 Unified Computing System Customers

5.8

Ericsson

296

297 298 299 302 303 304 305

5.8.1 Ericsson Wireless Infrastructure Portfolio 5.8.2 Ericsson Network Evolution 5.8.3 Ericsson Mobility Segment Information 5.8.4 Ericsson Regions 5.8.5 Ericsson Revenue Ericsson Revenue 5.8.6 Ericsson Airvana

5.9

5.9.1 5.9.2 5.9.3 5.9.4 5.9.5 5.9.6 5.9.7 5.9.8 5.9.9

Fujitsu

Fujitsu Revenue Fujitsu Technology Solutions Services Fujitsu Personal Computers Fujitsu Development and Production Facilities Fujitsu Corporate Strategy Fujitsu Revenue Fujitsu Interstage Fujitsu Acquires RunMyProcess Cloud Service Provider Fujitsu and Radisys Partnership ATCA Platform Support

306

306 308 312 313 319 320 323 324 325

5.10 5.11

Global Mobile Suppliers Association Huawei 331

326

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

5.11.1 5.11.2 5.11.3 5.11.4 Huawei Invests In The Pipe Huaweis Internet Protocol (IP) Pipe Strategy Huawei Focus On Customers Huawei Revenue 331 332 335 335

5.12

5.12.1 5.12.2 5.12.3

ip.access Small Cell Systems

ip.access Solutions Ip.access Investors Partners

337

338 339 340 341 345 346 348

5.13

5.13.1 5.13.2 5.13.3 5.13.4

Juniper 340

Juniper Networks Strategy Juniper Networks Enterprise Juniper Networks Platform Strategy Juniper Revenue

5.14

5.14.1 5.14.2

Kineto Wireless

Customers Partners

349

349 350 351 351 352 352 353 354

5.15

5.15.1 5.15.2 5.15.3 5.15.4 5.15.5 5.15.6

LG

350

LG Home Entertainment Company LG Mobile Communications Company LG Home Appliance Company LG Air Conditioning and Energy Solution Company LG Technology Strategy LG Revenue

5.16 5.17

5.17.1 5.17.2 5.17.3 5.17.4 5.17.5 5.17.6 5.17.7 5.17.8 5.17.9 5.17.10 5.17.11 5.17.12 5.17.13 5.17.14

Micro Mobio Microsoft / Nokia

Nokia-Microsoft Nokia Revenue Microsoft Microsoft Key Opportunities and Investments Microsoft Smart Connected Devices Microsoft: Cloud Computing Transforming The Data Center And Information Technology Microsoft Revenue Microsoft Customers Microsoft .NET Framework Microsoft / Nokia Microsoft Nokia Acquires Siemens' Entire 50% Stake in The Joint Venture Nokia Telco Cloud Technology Nokia Siemens Acquired Motorola Network Infrastructure Division Nokia Siemens Networks Revenue

354 355

355 356 358 358 358 359 360 360 361 361 361 364 367 367

5.18 5.19 5.20

5.20.1 5.20.2

Mindspeed / picoChip MTI Mobile NEC 370

NEC Business Outline NEC Revenue

368 369

371 372

5.21

5.21.1 5.21.2 5.21.3

NextPoint

NextPoint Networks Global, Fixed-Mobile Convergence NextPoint Networks / Reefpoint Systems Customers

373

375 376 378

5.22 5.23

5.23.1 5.23.2 5.23.3 5.23.4 5.23.5 5.23.6 5.23.7

QRC Technologies Qualcomm

Qualcomm Mobile & Computing QMC Offers Comprehensive Chipset Solutions Qualcomm Government Technologies Qualcomm Internet Services Qualcomm Ventures Qualcomm Revenue Qualcomm Up to 4x Increase Over CDMA2000s Capacity

379 380

380 381 381 382 383 383 385

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

5.24

5.24.1 5.24.2 5.24.3 5.24.4

Radisys 386

Radisys Acquisition of Continuous Computing Radisys Business Radisys Revenue Radisys ATCA 386 387 389 389 390

5.25

5.25.1

Rakon 390

Rakon Partners

5.26

5.26.1

Repeaters Australia

Repeater Improved Cellular Signal Coverage Area

391

391

5.27 5.28 5.29

5.29.1 5.29.2 5.29.3 5.29.4 5.29.5

Reactel 391 RF Hitec Samsung

Samsung Finds Talent And Adapts Technology To Create Products Samsung Adapts to Change, Samsung Embraces Integrity Samsung Telecom Equipment Group Samsung Electronics Q2 2013 Revenue Samsung Memory Over Logic

392 393

394 395 396 397 398

5.30 5.31

5.31.1 5.31.2

Small Cell Forum Sonus Networks

Sonus Customers Sonus Partners

399 401

401 401

5.32

5.32.1 5.32.2 5.32.3 5.32.4 5.32.5 5.32.6 5.32.7

Spirent Communications

Spirent Key Financials Spirent Business Spirent Service Assurance Spirtent Strategy Spirent Monitors Change, Identifies Trends Spirent Acquisitions Spirent Products

402

402 402 403 403 403 404 404

5.33

5.33.1 5.33.2 5.33.3 5.33.4

UbeeAirWalk

Small Cells | Femtocells, Enterprise Femtocells and Picocells Wireless Mobile Broadband Devices | 4G USB Dongles and Hotspots Ubee Interactive Ubee Acquires AirWalk Communications

405

406 406 406 407

5.34 5.35

5.35.1 5.35.2 5.35.3

Cisco / Ubiquisys ZTE 409

ZTE Globally-Leading Provider Of Telecommunications Equipment ZTE Technology Innovation ZTE Revenue

407

410 411 412

Small Cells and Femtocells List of Tables and Figures

Table ES-1 Small Cells Market Driving Forces Table ES-2 Small Cell Wireless Infrastructure Industry Challenges Table ES-3 Small Cell Wireless Infrastructure Response to Market Challenges Table ES-4 Small Cells Industry Adaptation To Change Table ES-5 Small Cells Industry Adaptations Table ES-6 Small Cells Industry Imperatives 25 25 28 28 29 29 32 32 33 33 33 33

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Figure ES-7 35 Small Cell Market Shares, Dollars, Worldwide, 2012 35 Table ES-8 37 Femtocell Small Cells Market Forecasts, Dollars, Worldwide, 2013-2019 37 Figure 1-1 39 Low Cost Characteristics Of Small Cells 39 Table 2-1 57 Small Cells Market Driving Forces 57 Table 2-2 59 Small Cell Wireless Infrastructure Industry Challenges 59 Table 2-3 60 Small Cell Wireless Infrastructure Response to Market Challenges 60 Table 2-4 63 Small Cells Industry Adaptation To Change 63 Table 2-5 64 Small Cells Industry Adaptations 64 Table 2-6 64 Small Cells Industry Imperatives 64 Table 2-11 77 Femtocell and Small Cell Broadband Cellular Network Market Participants 77 Table 2-22 94 Software Defined Networking (SDN) and Network Function Virtualization (NFV) Design Of The Network Issues 94 Table 2-24 98 Ericsson Mobile Backhaul and Multi-Access Nodes CAPEX Return on Investment (ROI) 98 Table 3-1 107 Airvana's HubBub Femtocell Key Features 107 Figure 3-2 109 Airvana Femtocell Network Integration 109 Figure 3-3 110 Airvana Femtocell Network Integration 110 Table 3-4 111 Airvana Femtocell Network Integration Features 111 Figure 3-5 113 Airvana Femtocell Service Manager 113 Table 3-6 114 Airvana Femtocell Service Manager Features 114 Table 3-12 120 ip.access Small Cell C8 Model Features 120 Table 3-13 121 ip.access SoHo SME Access Points Features 121 Table 3-15 122 ip.access S16 model Features 122 Table 3-16 122 ip.access S8 model Features 122 Table 3-17 124 ip.access E24, E16 Model Functions 124 Table 3-19 126 ip.access nanoBTS Picocell Functions: 126 Table 3-22 128 ip.access E-40 Model Small Cell 128 Table 3-29 135 Fujitsu Femtocell Target Specifications 135 Table 3-32 138

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Fujitsu Femtocell Resolution of Interference Problems Figure 3-33 Fujitsu Femtocell Solving Distant Macrocell Interference Table 3-34 Fujitsu Femtocell Interference Weighting Factors Figure 3-35 Fujitsu Femtocell Interference Control Figure 3-36 Samsung CDMA UbiCell Table 3-37 Advantages of Samsung CDMA UbiCell Figure 3-38 Samsung HSPA UbiCell Figure 3-39 Samsung HSPA UbiCell Table 3-40 Advantages of Samsung HSPA UbiCell Table 3-41 Cisco ASR 5000 Series, the ASR 5000 Platform Functions for Small Cells Table 3-42 Cisco StarOS Functions Table 3-43 Cisco ASR 5000 Series Small Cell Gateway Figure 3-44 Cisco ASR 5000 Series Small Cell Gateway Table 3-45 Cisco Wi-Fi Applications Figure 3-46 Cisco ASR 5000 Series Small Cell Gateway Support for Wi-Fi Table 3-47 Cisco Femtocell Solutions Figure 3-48 Cisco ASR 5000 Series Small Cell Gateway: HNB-GW (3G Femtocell) Table 3-49 CISCO ASR 5000 Series Small Cell Gateway Features Table 3-50 CISCO ASR 5000 Series Small Cell Gateway Benefits Figure 3-51 Ubiquisys Small Cells Table 3-52 Ubiquisys Intelligent Small Cell Unique Capabilities Table 3-53 Ubiquisys Small Cells Public Access Benefits Table 3-54 Ubiquisys Small Cells Public Access Capabilities Table 3-55 Ubiquisys Residential Femtocell Consumer And The Mobile Operator Benefits: Table 3-56 Ubiquisys Small Cell Adaptation To Changes Table 3-57 Ubiquisys Small Cells Features Table 3-58 Ubiquisys ActiveSON Grid Features 138 139 139 140 140 140 140 144 144 145 145 146 146 146 146 147 147 149 149 149 149 151 151 152 152 153 153 154 154 155 155 156 156 157 157 158 158 159 159 160 160 162 162 163 163 165 165 168 168 169 169 172 172

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Figure 3-59 Ubiquisys ZoneGate Figure 3-60 Ubiquisys Home Zone Gateway Table 3-61 NEC Small Cell Solutions for Residence Features Table 3-62 NEC Small Cell Solutions for Enterprise Features Table 3-63 Radisys Trillium Support for Turnkey LTE Small Cell Solutions Table 3-64 Radisys Turnkey LTE Small Cell Solution Features Table 3-65 Radisys Turnkey LTE Small Cell Solution benefits Table 3-66 Radisys Trillium Turnkey 3G Small Cell Solution Functions Table 3-67 Radisys Turnkey 3G Small Cell Solution Features Table 3-68 Radisys Turnkey 3G Small Cell Solution benefits Table 3-69 Services offered by CCPU Trillium Femtocell Software Figure 3-70 SIP Interface to Core Network Figure 3-71 Trillium 3G / 4G Wireless Product Family Figure 3-72 Airwalk Residential Femtocell Table 3-73 UbeeAirWalk Residential Femtocells Features Figure 3-74 UbeeAirWalk Enterprise Femtocells Table 3-75 UbeeAirWalk Enterprises Femtocells Advantages Figure 3-76 UbeeAirwalk EdgePoint 174 174 175 175 178 178 179 179 183 183 185 185 186 186 187 187 188 188 189 189 190 190 191 191 192 192 197 197 198 198 198 198 199 199 200 200 200 201 201 202 202 204 204 205 205 208 208 209 209 211 211

Table 3-77 Operator Benefits of Airwalk EdgePoint Table 3-78 Residential Consumer Benefits of Airwalk EdgePoint Table 3-79 Aricent Femtocell Benefits Table 3-80 Advantages of Aricent Femtocell Solutions Figure 3-81 Nokia Small Cells Cluster Of Low-Power Access Points Table 3-82 Nokia Small Cells Benefits Figure 3-83 Nokia In-Building Solutions

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Table 3-84 Nokia Siemens Networks IBS Famework Functions Table 3-85 Nokia In-Building Solutions Business Benefits Table 3-86 Microsoft Nokia HetNet Business Benefits Figure 3-87 Nokia 3G Femto Home Access Points Table 3-88 User Advantages of Nokia Siemens Networks 3G Femto Home Access Points Table 3-89 Operator Advantages of Nokia Siemens Networks 3G Femto Home Access Points Table 3-90 Huawei Small Cell Products Figure 3-91 Femtocell Home Coverage System 212 212 213 213 214 214 216 216 216 216 217 217 218 218 220 220

Table 3-92 NextPoint FCG Features Table 3-92 picoChip Developments in the area of Femtocell Figure 3-93 Three Possible Femtocell Architectures Table 5-1 Airvana Positioning for Small Cells Table 5-2 Airvana Key Femtocell Technology Elements Table 5-3 Alcatel-Lucent Performance Program Table 5-4 Alcatel-Lucent Operating Segments: Table 5-5 Alcatel-Lucent Business Focus Table 5-6 Alcatel-Lucent Strategic Focus Table 5-7 Alcatel-Lucent Communications Issues Table 5-8 Alcatel-Lucent Communications Issue Solutions Table 5-9 Alcatel-Lucent Communications Application Enablement Table 5-10 Alcatel-Lucent Communications High Leverage NetworkTM (HLN) Enablement

220 222 222 227 227 228 228 254 254 256 256 259 259 260 260 261 261 264 264 265 265 266 266 267 267 268 268

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Figure 5-11 CDG Wireless Infrastructure Roadmap that Includes CDMA2000, LTE, and WiFi Technologies Figure 5-12 Cisco / Ubiquisys Small Cells Table 5-13 Ubiquisys Intelligent Small Cell Unique Capabilities Figure 5-14 Ericsson Version of its North American CDMA Share Table 5-15 Ericsson Mobile Broadband Issues Table 5-16 Ericsson Operating Segments Table 5-17 Ericsson Networks Table 5-18 Ericsson Networks Products And Solutions Table 5-19 Regions Ericsson Primary Sales Channel Figure 5-20 Fujitsu Main Products Figure 5-21 Fujitsu Global Business Figure 5-22 Fujitsu Geographical Market Participation Figure 5-23 Fujitsu Global Alliances Figure 5-24 Fujitsu Mixed IT Environments Forecasts Table 5-25 Fujitsu Facts Figure 5-26 Mobile Broad Band Network Deployments, 2013 Figure 5-27 Mobile Broad Band Subscriptions, 2013 Figure 5-28 Commercial HSPA+ Networks Figure 5-29 Commercial LTE Network Launches Table 5-30 Huawei Different Business Groups (BGs) Table 5-31 Juniper Networks Infrastructure Benefits Table 5-32 Juniper Networks High-performance network infrastructure Table 5-33 Nokia Siemens Networks Base Stations Figure 5-34 Nokia Networks High Speed Internet Cost Reductions Figure 5-35 Nokia Siemens Networks Zero Footprint Solution Figure 5-37 Small Cell Forum Working Groups Structure 278 278 284 284 285 285 297 297 298 298 300 300 300 300 301 301 303 303 314 314 315 315 316 316 317 317 318 318 319 319 327 327 328 328 329 329 330 330 332 332 344 344 346 346 363 363 366 366 367 367 400 400

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

ABOUT THE COMPANY

WinterGreen Research, research strategy relates to identifying market trends through reading and interviewing opinion leaders. By using analysis of published materials, interview material, private research, detailed research, social network materials, blogs, and electronic analytics, the market size, shares, and trends are identified. Analysis of the published materials and interviews permits WinterGreen Research senior analysts to learn a lot more about markets. Discovering, tracking, and thinking about market trends is a high priority at WinterGreen Research. As with all research, the value proposition for competitive analysis comes from intellectual input. WinterGreen Research, founded in 1985, provides strategic market assessments in telecommunications, communications equipment, health care, Software, Internet, Energy Generation, Energy Storage, Renewable energy, and advanced computer technology. Industry reports focus on opportunities that expand existing markets or develop major new markets. The reports access new product and service positioning strategies, new and evolving technologies, and technological impact on products, services, and markets. Innovation that drives markets is explored. Market shares are provided. Leading market participants are profiled, and their marketing strategies, acquisitions, and strategic alliances are discussed. The principals of WinterGreen Research have been involved in analysis and forecasting of international business opportunities in telecommunications and advanced computer technology markets for over 30 years. The studies provide primary analytical insight about the market participants. By publishing material relevant to the positioning of each company, readers can look at the basis for analysis. By providing descriptions of each major participant in the market, the reader is not dependent on analyst assumptions, the information backing the assumptions is provided, permitting readers to examine the basis for the conclusions. WinterGreen Research is positioned to help customers facing challenges that define the modern enterprises. The increasingly global nature of science, technology and engineering is a reflection of the implementation of the globally integrated enterprise. Customers trust wintergreen research to work alongside them to ensure the success of the participation in a particular market segment. WinterGreen Research supports various market segment programs; provides trusted technical services to the marketing departments. It carries out accurate market share and forecast analysis services for a range of commercial and government customers globally. These are all vital market research support solutions requiring trust and integrity. ABOUT THE PRINCIPAL AUTHORS

Ellen T. Curtiss, Technical Director, co-founder of WinterGreen Research, conducts strategic and market assessments in

technology-based industries. Previously she was a member of the staff of Arthur D. Little, Inc., for 23 years, most recently as Vice President of Arthur D. Little Decision Resources, specializing in strategic planning and market development services. She is a graduate of Boston University and the Program for Management Development at Harvard Graduate School of Business Administration. She is the author of recent studies on worldwide telecommunications markets, the top ten internet equipment companies, the top ten contract manufacturing companies, and the Top Ten Telecommunications market analysis and forecasts.

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

Susan Eustis, President, co-founder of WinterGreen Research is a senior analyst. She has done research in

communications and computer markets and applications. She holds several patents in microcomputing and parallel processing. She has the original patents in electronic voting machines. She has new patent applications in format varying, mulitprocessing, and electronic voting. She is the author of recent studies of the Solar REnewable Energy, Wind Energy, Thin Film Batteries, Business Process Management marketing strategies, Internet equipment, biometrics, a study of Internet Equipment, Worldwide Telecommunications Equipment, Top Ten Telecommunications, Digital Loop Carrier, Web Hosting, Web Services, and Application Integration markets. Ms. Eustis is a graduate of Barnard College. . Ms. Eustis was named Top Woman CEO in 2012 by Whos Who Worldwide. She was named Top Woman Market Research Analyst the same year.

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

WinterGreen Research, INC.

ORDER FORM Return To: WinterGreen Research, Inc. 6 Raymond Street Lexington, MA 02421 USA

(preferred) info@wintergreenresearch.com

Phone: (781) 863-5078 --- Fax: (781) 863-1235

PLEASE ENTER MY ORDER FOR:

Small Cells and Femtocells: Market Shares, Strategies, and Forecasts, Worldwide, 2013-2019

-ALL REPORTS ARE AVAILABLE IN EITHER PRINT OR PDF_________PDF ________PRINT

____ENCLOSED IS MY CHECK FOR $3,800 FOR SINGLE COPY, $7,600 FOR WEB SITE POSTING ____PLEASE BILL MY COMPANY USING P.O. NUMBER_________________________________________ ____PLEASE CHARGE MY MASTERCARD/VISA/AMERICAN EXPRESS CARD NUMBER _________________________________EXP. DATE__________________ If charging to a credit card use the shopping card order form on the Internet, fax, or call. NAME________________________________________TITLE________________________________________ SIGNATURE________________________________________________________________________________ COMPANY________________________________________DIVISION________________________________________ ADDRESS________________________________________ CITY__________________________________________STATE / ZIP__________________________________________ TELEPHONE________________________________________ FAX________________________________________ EMAIL________________________________________ PLEASE NOTE: RESIDENTS OF MASSACHUSETTS AND CONNECTICUT MUST INCLUDE APPROPRIATE SALES TAX SUBSCRIBERS OUTSIDE THE UNITED STATES MUST PROVIDE PREPAYMENT IN U.S. FUNDS

REPORT # SH25754189

413 PAGES

162 TABLES AND FIGURES

2013

$3,800 SINGLE COPY -- $7,600 WEB SITE POSTING

Das könnte Ihnen auch gefallen

- Acquisition Fact SheetDokument2 SeitenAcquisition Fact SheetTim BresienNoch keine Bewertungen

- CSS NC II CORE 1: Install & Configure Computer SystemsDokument54 SeitenCSS NC II CORE 1: Install & Configure Computer SystemsEric Manrique Talamisan87% (38)

- USA Insurance Companies DB 2Dokument44 SeitenUSA Insurance Companies DB 2Mahesh MalveNoch keine Bewertungen

- Moving Average and Exponential Smoothing ModelsDokument13 SeitenMoving Average and Exponential Smoothing ModelsP Singh KarkiNoch keine Bewertungen

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondVon EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNoch keine Bewertungen

- Dragonpay APIDokument31 SeitenDragonpay APIhaizea obreinNoch keine Bewertungen

- McKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketsDokument76 SeitenMcKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketskentselveNoch keine Bewertungen

- Iot Platforms: Chasing Value in A Maturing MarketDokument25 SeitenIot Platforms: Chasing Value in A Maturing Marketrajeshtripathi20040% (1)

- Round RobinDokument15 SeitenRound RobinSohaib AijazNoch keine Bewertungen

- Release: Precision Planning For 5G Era Networks With Small CellsDokument39 SeitenRelease: Precision Planning For 5G Era Networks With Small CellsVinod ChakaravarthyNoch keine Bewertungen

- NB-IOT Huawei PDFDokument23 SeitenNB-IOT Huawei PDFadvaleri070100% (2)

- Wireless Router Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDokument2 SeitenWireless Router Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNoch keine Bewertungen

- Blue Ocean StrategyDokument12 SeitenBlue Ocean StrategySandeep MohanNoch keine Bewertungen

- Cellular M2M Forecasts - Unlocking GrowthDokument4 SeitenCellular M2M Forecasts - Unlocking GrowthAydin KaraerNoch keine Bewertungen

- Telecommunications SectorDokument16 SeitenTelecommunications Sectorpreeti25Noch keine Bewertungen

- Wireless Charging MarketDokument2 SeitenWireless Charging MarketKanika BathNoch keine Bewertungen

- In-Q-Tel Mobile TechnologyDokument2 SeitenIn-Q-Tel Mobile Technologymary engNoch keine Bewertungen

- The Internet of Things Sizing Up The OpportunityDokument7 SeitenThe Internet of Things Sizing Up The OpportunitySameer DubeyNoch keine Bewertungen

- Topic: Journey of Mobile Phones and It's FutureDokument11 SeitenTopic: Journey of Mobile Phones and It's FuturePrabha KaruppuchamyNoch keine Bewertungen

- Title: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerDokument16 SeitenTitle: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerTamil VelanNoch keine Bewertungen

- 4G Americas Connected Devices White Paper Final 100511Dokument33 Seiten4G Americas Connected Devices White Paper Final 100511lpkoq1w2Noch keine Bewertungen

- ADL Smart Market-MakersDokument7 SeitenADL Smart Market-MakersHaridogNoch keine Bewertungen

- Nirma Institute of ManagementDokument34 SeitenNirma Institute of ManagementKaran ZalaNoch keine Bewertungen

- IDC Market View 2010Dokument7 SeitenIDC Market View 2010anupalduttaNoch keine Bewertungen

- Small Cells 2012Q2 Market UpdateDokument32 SeitenSmall Cells 2012Q2 Market UpdateParag KastureNoch keine Bewertungen

- Accenture High Performance Through More Profitable Business To Business ModelsDokument12 SeitenAccenture High Performance Through More Profitable Business To Business ModelsDaniel TaylorNoch keine Bewertungen

- (796958755) Electronics & Semiconductor Market Research PDFDokument10 Seiten(796958755) Electronics & Semiconductor Market Research PDFAlex Hales PerryNoch keine Bewertungen

- Maxim in IndiaDokument19 SeitenMaxim in IndiaSuryansh SinghNoch keine Bewertungen

- Telecommunications Dissertation TopicsDokument6 SeitenTelecommunications Dissertation TopicsHowToWriteMyPaperNorthLasVegas100% (1)

- Zig Bee: Analyst ReportsDokument4 SeitenZig Bee: Analyst ReportsAshok406Noch keine Bewertungen

- Iot Outlook 2015: Sponsored byDokument23 SeitenIot Outlook 2015: Sponsored byTris Retno AryaniNoch keine Bewertungen

- Telecom Managed Services MarketDokument4 SeitenTelecom Managed Services Marketnajib salemNoch keine Bewertungen

- LECTURA 4-MovilityDokument3 SeitenLECTURA 4-Movilitysantiago.gtzc11Noch keine Bewertungen

- Master Thesis in Mobile CommunicationDokument6 SeitenMaster Thesis in Mobile Communicationashleyjonesjackson100% (2)

- Cisco Vs SiemensDokument31 SeitenCisco Vs SiemensDavid HicksNoch keine Bewertungen

- WR 100 SeDokument5 SeitenWR 100 SeDeepak PareekNoch keine Bewertungen

- Mobile Os Term PaperDokument8 SeitenMobile Os Term Paperafmzydxcnojakg100% (1)

- Global Smart Homes MarketDokument15 SeitenGlobal Smart Homes MarketSanjay MatthewsNoch keine Bewertungen

- Magic Quadrant For Managed IoT Connectivity Services 2024Dokument39 SeitenMagic Quadrant For Managed IoT Connectivity Services 2024zackroo25Noch keine Bewertungen

- Mobile Broadband Network Costs: Modelling Network Investments and Key Cost DriversDokument12 SeitenMobile Broadband Network Costs: Modelling Network Investments and Key Cost DriversSenthilathiban ThevarasaNoch keine Bewertungen

- Bogdan Cîmpean - 131 - Marketing AssignmentDokument3 SeitenBogdan Cîmpean - 131 - Marketing AssignmentBogdan CimpeanNoch keine Bewertungen

- INFOSYS110 2014 Deliverable 02 Tyler VickDokument12 SeitenINFOSYS110 2014 Deliverable 02 Tyler Vicktvic796Noch keine Bewertungen

- Churn Analysis in Wireless IndustryDokument20 SeitenChurn Analysis in Wireless Industryafzal.sayeed7051Noch keine Bewertungen

- A Project Report ON Tudy of Cu Tomer Purcha E Deci Ion Toward Mobile PhoneDokument47 SeitenA Project Report ON Tudy of Cu Tomer Purcha E Deci Ion Toward Mobile PhoneDivendu PatraNoch keine Bewertungen

- PR NewReport LTE CapEx OpEx 2017Dokument3 SeitenPR NewReport LTE CapEx OpEx 2017amara abdelkerimNoch keine Bewertungen

- Iot Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and TrendsDokument2 SeitenIot Analytics Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast - Facts and Trendssurendra choudharyNoch keine Bewertungen

- Mobile Phone Market in India (2015)Dokument49 SeitenMobile Phone Market in India (2015)Niteysh AK Roy50% (2)

- Socio-Economic Benefits of SIM-based NFC: November 2011Dokument47 SeitenSocio-Economic Benefits of SIM-based NFC: November 2011Laurie JonesNoch keine Bewertungen

- Data Center Fabric Market - Excessive Growth Opportunities Estimated To Be Experienced - Facts and TrendsDokument2 SeitenData Center Fabric Market - Excessive Growth Opportunities Estimated To Be Experienced - Facts and Trendssurendra choudharyNoch keine Bewertungen

- Mobile CommerceDokument10 SeitenMobile CommerceAbel JacobNoch keine Bewertungen

- March 16 - IM Processors DigiTimesDokument5 SeitenMarch 16 - IM Processors DigiTimesRyanNoch keine Bewertungen

- MINOR PROJECT REPORT ON Analysis of Marketing Strategy of Motorola Handsets BBADokument82 SeitenMINOR PROJECT REPORT ON Analysis of Marketing Strategy of Motorola Handsets BBAAmit Jain92% (12)

- Cisco Grand StrategyDokument12 SeitenCisco Grand StrategyKumar Kishore KalitaNoch keine Bewertungen

- Marketing Management Project Drishti PhabletDokument26 SeitenMarketing Management Project Drishti PhabletMohitBudholiaNoch keine Bewertungen

- Essential Reading 5Dokument20 SeitenEssential Reading 5Rahul AwtansNoch keine Bewertungen

- Transceiver Chip Market - Segmentation Detailed Study With Forecast - Facts and TrendsDokument2 SeitenTransceiver Chip Market - Segmentation Detailed Study With Forecast - Facts and Trendssurendra choudharyNoch keine Bewertungen

- Shan 777Dokument13 SeitenShan 777shan777d2Noch keine Bewertungen

- Ecommerce - IndiaDokument12 SeitenEcommerce - Indiaashzulfi9292Noch keine Bewertungen

- Aircell Project01 Final1Dokument69 SeitenAircell Project01 Final1accord123Noch keine Bewertungen

- Hexa Research IncDokument5 SeitenHexa Research Incapi-293819200Noch keine Bewertungen

- AirtelDokument31 SeitenAirtelRajiv KeshriNoch keine Bewertungen

- The Internet of Things 2020Dokument3 SeitenThe Internet of Things 2020Antonio M. Luciano JrNoch keine Bewertungen

- Study Cloud Application Platforms With IotDokument1 SeiteStudy Cloud Application Platforms With IotCarlos LoboNoch keine Bewertungen

- ZZZDokument47 SeitenZZZaaron827077Noch keine Bewertungen

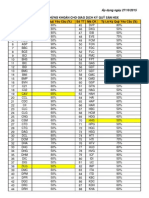

- S ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxDokument4 SeitenS ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxChungwa ChanjiNoch keine Bewertungen

- 50 G SC200 Handbook LTRDokument129 Seiten50 G SC200 Handbook LTRChungwa ChanjiNoch keine Bewertungen

- S ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxDokument4 SeitenS ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxChungwa ChanjiNoch keine Bewertungen

- S ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxDokument4 SeitenS ố Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) S Ố Tt Mã Ck T ỷ Lệ Ký Quỹ Yêu Cầu (%) Danh M Ục Chứng Khoán Cho Giao Dịch Ký Quỹ Sàn HsxChungwa ChanjiNoch keine Bewertungen

- Bo Nguon Cong Nghiep CS3Dokument3 SeitenBo Nguon Cong Nghiep CS3Chungwa ChanjiNoch keine Bewertungen

- Base Station AntennasDokument96 SeitenBase Station AntennasChungwa Chanji0% (1)

- ACTIX Report ProcessDokument156 SeitenACTIX Report ProcessChungwa ChanjiNoch keine Bewertungen

- Danh Muïc Phí Lucky Gift Unionpay All For You Vinamilk PlusDokument1 SeiteDanh Muïc Phí Lucky Gift Unionpay All For You Vinamilk PlusChungwa ChanjiNoch keine Bewertungen

- Banggia 20120405Dokument1.699 SeitenBanggia 20120405Chungwa ChanjiNoch keine Bewertungen

- Half Rate in GSMDokument14 SeitenHalf Rate in GSMsberisha100% (3)

- Topographic Map of Oklahoma LaneDokument1 SeiteTopographic Map of Oklahoma LaneHistoricalMapsNoch keine Bewertungen

- Tkprof With FormatDokument51 SeitenTkprof With Formatshameem_ficsNoch keine Bewertungen

- QR Codes in The ClassroomDokument25 SeitenQR Codes in The Classroomapi-238436642100% (1)

- 10Dokument39 Seiten10Foesyay AtiqohNoch keine Bewertungen

- Dell DR Series System - Statement of VolatilityDokument14 SeitenDell DR Series System - Statement of VolatilityGokul VeNoch keine Bewertungen

- Programming AssignmentDokument3 SeitenProgramming AssignmentOluwaseun EmmaNoch keine Bewertungen

- 12.2.2.10 Lab - Extract An Executable From A PCAP PDFDokument8 Seiten12.2.2.10 Lab - Extract An Executable From A PCAP PDFInteresting facts ChannelNoch keine Bewertungen

- Beginner'S Guide To CpanelDokument57 SeitenBeginner'S Guide To CpanelHarish KumarNoch keine Bewertungen

- Blended Gate Course Schedule: Contact: +91-844-844-0102 DateDokument27 SeitenBlended Gate Course Schedule: Contact: +91-844-844-0102 DateBapiNoch keine Bewertungen

- Annex 2: Nasgro 5.X User's Manual Introduction To Version Distributed With EsacrackDokument6 SeitenAnnex 2: Nasgro 5.X User's Manual Introduction To Version Distributed With EsacrackCarlos PlazaolaNoch keine Bewertungen

- Business-Intelligence Business Intelligence in ActionDokument4 SeitenBusiness-Intelligence Business Intelligence in ActionSata JatimNoch keine Bewertungen

- Anyconnect Secure Mobility Connection Error: "The VPN Client Was Unable To Setup Ip Filtering"Dokument5 SeitenAnyconnect Secure Mobility Connection Error: "The VPN Client Was Unable To Setup Ip Filtering"Dhiraj SinghNoch keine Bewertungen

- Project Report For Advanced Encryption System CompltedDokument88 SeitenProject Report For Advanced Encryption System CompltedRotimi Dammy David RotboticsNoch keine Bewertungen

- Transport Tablespace From One Database To AnotherDokument10 SeitenTransport Tablespace From One Database To Anothernaga54Noch keine Bewertungen

- Academic Analytics Model - Weka FlowDokument3 SeitenAcademic Analytics Model - Weka FlowMadalina BeretNoch keine Bewertungen

- DB2 9.5 Real-Time Statistics CollectionDokument44 SeitenDB2 9.5 Real-Time Statistics Collectionandrey_krasovskyNoch keine Bewertungen

- Lector: Aleksandar Karamfilov Skype: Sanders - Kar E-Mail: Aleksandar - Karamfilov@Pragmatic - BG Linkedin: 2013 - 2014Dokument19 SeitenLector: Aleksandar Karamfilov Skype: Sanders - Kar E-Mail: Aleksandar - Karamfilov@Pragmatic - BG Linkedin: 2013 - 2014Diana DikovaNoch keine Bewertungen

- Error Invalidrestore PDFDokument2 SeitenError Invalidrestore PDFJulieNoch keine Bewertungen

- 3920 Aaron Abrose Sap Sap Mobile Overview PDFDokument45 Seiten3920 Aaron Abrose Sap Sap Mobile Overview PDFFaisal HussainNoch keine Bewertungen

- Manual Clamp Meter YH-351Dokument20 SeitenManual Clamp Meter YH-351mapasoal100% (1)

- InformaticaDokument14 SeitenInformaticaMbaStudent56Noch keine Bewertungen

- Computer Applications (ICSE) Sample Paper 8Dokument4 SeitenComputer Applications (ICSE) Sample Paper 8Guide For School77% (13)

- Model ChassisDokument74 SeitenModel ChassisSergio OrihuelNoch keine Bewertungen

- Swept EllipsoidDokument14 SeitenSwept EllipsoidkillerghostYTNoch keine Bewertungen

- Thomson Tablet QM734 User ManualDokument29 SeitenThomson Tablet QM734 User ManualM J RichmondNoch keine Bewertungen