Beruflich Dokumente

Kultur Dokumente

Tax Rates 2013 14

Hochgeladen von

Suresh RouniyarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tax Rates 2013 14

Hochgeladen von

Suresh RouniyarCopyright:

Verfügbare Formate

Income Tax Rates

Fiscal year 2011-12

1.

1.1

Personal tax

For Residents FY 2010/11 Particulars Rs Natural Person Single (a) First Tax Slab (b) Next (c) Balance (d) Balance Exceeding (e) Additional tax on tax derived under (d) above Couple (a) First Tax Slab (b) Next (c) Balance Exceeding (d) Balance Exceeding (e) Additional tax on tax derived under (d) above 200,000 100,000 300,000 2,500,001 Tax as per (d) above 1% 15% 25% 25% 40% 200,000 100,000 300,000 2,500,001 Tax as per (d) above 1%* 15% 25% 25% 40% 250,000 100,000 350,000 2,500,001 Tax as per (d) above 1%* 15% 25% 25% 40% 160,000 100,000 260,001 to 2,500,000 2,500,001 Tax as per (d) above 1% 15% 25% 25% 40% 160,000 100,000 260,001 to 2,500,000 2,500,001 Tax as per (d) above 1%* 15% 25% 25% 40% 200,000 100,000 300,001 to 2,500,000 2,500,001 Tax as per (d) above 1%* 15% 25% 25% 40% Tax Rate Rs Tax Rate Rs Tax Rate FY 2011/12 & 2012/13 FY 2013/14

Note 1: Natural person working at remote areas are entitled to get deduction from taxable income to a maximum of Rs 50,000 to minimum of Rs 10,000. Note 2: Natural person with pension income included in the taxable income shall be entitled to deduct from taxable income an additional 25% of amount prescribed under first tax slab. Note 3: Incapacitated natural person shall be entitled to get deduction from taxable income an additional 50% of amount prescribed under first tax slab. Note 4: A natural person who has procured life insurance and paid premium amount thereon shall be entitled to a deduction of actual annual insurance premium or Rs 20,000 whichever is less from taxable income. Note 5: In case of the employee employed at the foreign diplomatic of Nepal only 25% of the foreign allowances are to be included in the income from salary. Note 6: In case of women having only remuneration income, they are allowed rebate of 10% on the tax liability calculated as other natural person. Note 7: In case of individual having income from export, tax rate of 15% is applicable in place of 25% Note 8: In case of decision of the organization to provide group retirement to its employees (in the event of merger or acquisition) except to the payment made as per the employment term or the payment made by retirement fund, a rebate of 50% on withholding tax rate is provided. * This is the Social Security Tax to be deposited in a separate revenue account (11211) provided for this purpose. 1.2 For Non-Residents Nature of transaction 1. a) b) c) Income earned from normal transactions Income earned providing shipping, air or telecom services, postage, satellite, optical fiber project. Income earned providing shipping, air or telecom services through the territory of Nepal. Repatriation by Foreign Permanent Establishment. FY 2010/11 25% flat rate 5% 2% 5% FY 2011/12 & 2012/13 25% flat rate 5% 2% 5% FY 2013/14 25% flat rate 5% 2% 5%

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co. It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates

Fiscal year 2011-12

2.

Corporate tax

Nature of entity 1 1.1 Company/ Firm/Industry Domestic income Normal Rate (NR) 1.2 I ii Other Special industries (mainly manufacturing other than alcoholic & tobacco producing industry) Providing direct employment to Nepalese citizens: a) for 300 or more by Special industries and information technology industries b) for 1200 or more by Special industries c) to 100 Nepalese including 33% women, dalit & disabled by Special industries Industries established in very undeveloped area (Sec 11.3.b), as defined in Industrial Enterprise Act 20% (Normal Rate) 90% of normal rate 80% of normal rate 80% of normal rate 10% of the normal rate (for 10 yrs from the year of establishment) 20% of the normal rate (for 10 yrs from the year of establishment) 30% of the normal rate (for 10 yrs from the year of establishment) Up to 10 yrs 100% exempt and 50% rebate in subsequent years 100% exempt up to first 5 yrs and 50% rebate in subsequent years 100% exempt for first 5 years and 50% rebate on subsequent 3 years 50% of applicable tax rate 20% (Normal Rate) 90% of normal rate 80% of normal rate 80% of normal rate 10% of the normal rate (for 10 yrs from the year of establishment) 20% of the normal rate (for 10 yrs from the year of establishment) 30% of the normal rate (for 10 yrs from the year of establishment) Up to 10 yrs 100% exempt and 50% rebate in subsequent years 100% exempt up to first 5 yrs and 50% rebate in subsequent years 100% exempt for first 5 years and 50% rebate on subsequent 3 years 50% of applicable tax rate 20% (Normal Rate) 90% of normal rate 80% of normal rate 80% of normal rate 10% of the normal rate (for 10 yrs from the year of establishment) 20% of the normal rate (for 10 yrs from the year of establishment) 30% of the normal rate (for 10 yrs from the year of establishment) Up to 10 yrs 100% exempt and 50% rebate in subsequent years 100% exempt up to first 5 yrs and 50% rebate in subsequent years 100% exempt for first 5 years and 50% rebate on subsequent 3 years 50% of applicable tax rate 25% 25% 25% FY 2010/11 FY 2011/12 & 2012/13 FY 2013/14

iii

iv

Industries establishment in undeveloped areas (sec 11.3.b ), as defined in Industrial Enterprise Act

Established in underdeveloped areas ( Sec 11.3.b ), as defined in Industrial Enterprise Act

vi

Industry established in 'Special Economic Zone' recognized in mountain areas or hill areas by the GON

vii

Industry established in 'Special Economic Zone' other than above locations

viii

Dividend distributed by the industry established in special economic zone

ix

Income derived by the foreign investors from investment in Special Economic Zone ( Source of income-use of foreign technology, management service fee and royalty)

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co. It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates

Fiscal year 2011-12

Nature of entity x xi xii Industry established in remote areas Income of Information Technology Industries at IT Park as declared by government Institution having license to generate, transmit, and distribute electricity shall be allowed if the commercial electricity generation, generation and transmission, generation and distribution or generation, transmission, distribution commences before BS 2075 Chaitra (13 April 2019). Hydropower project which has started construction within Bhadra 7, 2071 (23 August 2014) BS, and electricity is generated before BS 2075 Chaitra (13 April 2019). Income from export of manufactured goods by Manufacturing Industries Income from construction and operation of Bridge, Airport and Tunnel and income from investment in tram and trolley bus Income of Manufacturing Industry, tourism service industry and hydropower generation, distribution and transmission industry listed in capital market Industry established in least developed areas producing brandy, wine, cider from fruits. Royalty from export of intellectual asset by a person Income from sale of intellectual asset by a person through transfer Banks and Financial Institutions Commercial Banks, Development Banks and Finance Companies 1.4 Insurance Business General insurance business 1.5 Petroleum Industries Entity engaged in petroleum business Under Nepal Petroleum Act, 2040 1.6 Other business entities Entity involve in construction of roads, bridges, tunnels, rope-ways, suspension bridges etc. Income earned by the natural person wholly involved in special industry Income earned by the natural person relating to Export activities 20% 20% 20% 30% 30% 30% 30% 30% 30% 30% 30% 30% FY 2010/11 50% of normal tax rate 100% exempt up to seven years and 50% rebate on subsequent 3 years FY 2011/12 & 2012/13 50% of normal tax rate 100% exempt up to seven years and 50% rebate on subsequent 3 years 100% exempt up to ten years and 50% rebate on subsequent 5 years 75% of normal tax rate 60% of applicable tax rate (20%) 90% of applicable tax rate 40% exempt up to ten years 25% exempt 50% exempt FY 2013/14 50% of normal tax rate 100% exempt up to seven years and 50% rebate on subsequent 3 years 100% exempt up to ten years and 50% rebate on subsequent 5 years 75% of normal tax rate 60% of applicable tax rate (20%) 90% of applicable tax rate 40% exempt up to ten years 25% exempt 50% exempt

xiii

xiv xv

75% of normal tax rate 60% of applicable tax rate (20%) 90% of applicable tax rate 40% exempt up to ten years 25% exempt 50% exempt

xvi

xvii xviii xix 1.3

Note 1: No additional tax is to be levied on the taxable income. (Deleted by Finance Act 2065) Note 2: if any company is entitled to more than one privilege U/S-11 only one will be entitled as opted by the entity

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co. It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates

Fiscal year 2011-12

3.

TDS withholding in other payments

Nature of transaction FY 2010/11 FY 2011/12 & 2012/13 Exempt from tax 25% 10% 10% 5% for both 5% 5% 5% FY 2013/14

Interest income from deposit up to Rs 10,000 under 'Micro Finance Program', 'Rural Development Bank', ' Postal Saving Bank' & Co- operative (u/s-11(2)) in rural areas Wind fall gains Payment of rent made by resident person having source in Nepal Profit and gain from transaction of commodity future market On Dividend paid by the resident entity. To Resident person To Nonresident Person On payment of gain in investment insurance On payment of gain from unapproved retirement fund On payment of interest or similar type having source in Nepal to natural person [not involved in any business activity] by Resident Bank, financial institutions or debenture issuing entity, or listed company Payment made by natural person relating to business activity or other payments relating to house rental except house rent Payment for articles published in Newspaper, question setting, answer evaluation Interest payment to resident bank, other financial institutions Interregional interchange fee paid to credit card issuing bank Interest or fees paid by GON under bilateral agreement On payment of general insurance premium to resident insurance company On payment of premium to nonresident insurance company Contract payments exceeding Rs 50,000 Payment of consultancy fee: to resident person against VAT invoice to resident person against Non -VAT invoice Payment on contract to Non Resident person On service contract On repair of aircraft & other contract Gain on disposal of Interests in any resident entity (listed) exchange (Taxable amount is gain calculated under section 37) To resident natural person To others including non resident Gain on disposal of Interests in any resident entity (unlisted) exchange (Taxable amount is gain calculated under section 37) To resident natural person To others including non resident

Exempt from tax 25% 10% Nil 5% for both 5% 5% 5%

Exempt from tax 25%* 10% 10% 5% for both 5% 5% 5%

ii iii iv V

vi vii viii

ix X xi xii xiii xiv xv xvi xvii

No TDS No TDS No TDS No TDS No TDS No TDS 1.5% 1.5% 1.5% 15% 15% 5%

No TDS No TDS No TDS No TDS No TDS No TDS 1.5% 1.5% 1.5% 15% 15% 5%

No TDS No TDS No TDS No TDS No TDS No TDS 1.5% 1.5% 1.5% 15% 15% 5%

xviii

xix

10% 15%

5% 10%

5% 10%

10% 15%

10% 15%

10% 15%

* Windfall tax of 25% will be exempted for the reward up to Rs 500,000 received on behalf of contribution in the field of literature, art, culture, sports, journalism,

science and technology and general administration.

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co. It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Income Tax Rates

Fiscal year 2011-12

4.

Income from investment

Particulars Individual Tax withholding on capital gain for natural person on transaction exceeding Rs 3 million (to be made by Land revenue office at the time of registration): - disposal of land or land & building owned for more than 5 years - disposal of land or land & building owned for less than 5 years Corporate Income from disposal of non-business chargeable assets (Capital gain) Normal Rate Normal Rate Normal Rate FY 2010/11 FY 2011/12 & 2012/13 FY 2013/14

5% 10%

2.5% 5%

2.5% 5%

5.

Presumptive taxation

Particulars Vehicle Tax Mini bus, Mini Truck, Truck and Bus Car, Jeep, Van, Micro Bus Three Wheeler, Auto Rickshaw, Tempo Tractor and Power Tiller Small Tax Payer Metropolitan, Sub-Metropolitan Municipal Areas Other than municipal areas Rs 3,500 Rs 2,000 Rs 1,250 Rs 3,500 Rs 2,000 Rs 1,250 Rs 3,500 Rs 2,000 Rs 1,250 Rs 1,500 Rs 1,200 Rs 850 Rs 750 Rs 1,500 Rs 1,200 Rs 850 Rs 750 Rs 1,500 Rs 1,200 Rs 850 Rs 750 FY 2010/11 FY 2011/12 & 2012/13 FY 2013/14

Note: Small tax-payer means natural person whose annual turnover is not more than Rs 2 million and income not exceeding

Rs 200,000.

Contact for further information

T R Upadhya & Co. Chartered Accountants House No. 61, Anamika Galli P. O. Box 4414 Baluwatar, Kathmandu, Nepal Phone: +977 1 4410927, 4414695 Fax: +977 1 4413307 Email: trunco@ntc.net.np Shashi Satyal Managing Partner ssatyal@trunco.com.np Sanjeev Kumar Mishra Partner smishra@trunco.com.np

This document has been compiled in summary form exclusively for the information of clients and staff of T R Upadhya & Co. It should not be relied upon as a substitute for detailed advice or a basis for formulating business decisions.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Difference Between Mountain Bike and BMXDokument3 SeitenDifference Between Mountain Bike and BMXShakirNoch keine Bewertungen

- Mat Boundary Spring Generator With KX Ky KZ KMX KMy KMZDokument3 SeitenMat Boundary Spring Generator With KX Ky KZ KMX KMy KMZcesar rodriguezNoch keine Bewertungen

- Seminar On Despute Resolution & IPR Protection in PRCDokument4 SeitenSeminar On Despute Resolution & IPR Protection in PRCrishi000071985100% (2)

- Ibbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Dokument2 SeitenIbbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Bastián EnrichNoch keine Bewertungen

- X-17 Manual Jofra PDFDokument124 SeitenX-17 Manual Jofra PDFBlanca Y. Ramirez CruzNoch keine Bewertungen

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDokument2 SeitenEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNoch keine Bewertungen

- A320 Basic Edition Flight TutorialDokument50 SeitenA320 Basic Edition Flight TutorialOrlando CuestaNoch keine Bewertungen

- Section 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsDokument27 SeitenSection 26 08 13 - Electrical Systems Prefunctional Checklists and Start-UpsMhya Thu UlunNoch keine Bewertungen

- Wind Energy in MalaysiaDokument17 SeitenWind Energy in MalaysiaJia Le ChowNoch keine Bewertungen

- Wendi C. Lassiter, Raleigh NC ResumeDokument2 SeitenWendi C. Lassiter, Raleigh NC ResumewendilassiterNoch keine Bewertungen

- Portrait of An INTJDokument2 SeitenPortrait of An INTJDelia VlasceanuNoch keine Bewertungen

- Manual 40ku6092Dokument228 SeitenManual 40ku6092Marius Stefan BerindeNoch keine Bewertungen

- 7 TariffDokument22 Seiten7 TariffParvathy SureshNoch keine Bewertungen

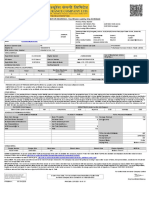

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDokument1 SeiteMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNoch keine Bewertungen

- HSBC in A Nut ShellDokument190 SeitenHSBC in A Nut Shelllanpham19842003Noch keine Bewertungen

- Amare Yalew: Work Authorization: Green Card HolderDokument3 SeitenAmare Yalew: Work Authorization: Green Card HolderrecruiterkkNoch keine Bewertungen

- 450i User ManualDokument54 Seiten450i User ManualThượng Lê Văn0% (2)

- Discover Mecosta 2011Dokument40 SeitenDiscover Mecosta 2011Pioneer GroupNoch keine Bewertungen

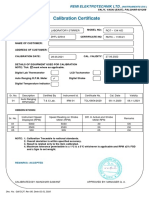

- Calibration CertificateDokument1 SeiteCalibration CertificateSales GoldClassNoch keine Bewertungen

- 18PGHR11 - MDI - Aditya JainDokument4 Seiten18PGHR11 - MDI - Aditya JainSamanway BhowmikNoch keine Bewertungen

- Audit On ERP Implementation UN PWCDokument28 SeitenAudit On ERP Implementation UN PWCSamina InkandellaNoch keine Bewertungen

- Droplet Precautions PatientsDokument1 SeiteDroplet Precautions PatientsMaga42Noch keine Bewertungen

- Avalon LF GB CTP MachineDokument2 SeitenAvalon LF GB CTP Machinekojo0% (1)

- MORIGINADokument7 SeitenMORIGINAatishNoch keine Bewertungen

- 48 Volt Battery ChargerDokument5 Seiten48 Volt Battery ChargerpradeeepgargNoch keine Bewertungen

- Delta AFC1212D-SP19Dokument9 SeitenDelta AFC1212D-SP19Brent SmithNoch keine Bewertungen

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDokument2 SeitenAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNoch keine Bewertungen

- Innovations in Land AdministrationDokument66 SeitenInnovations in Land AdministrationSanjawe KbNoch keine Bewertungen

- RYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersDokument28 SeitenRYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersSerban Sebe100% (4)

- TEVTA Fin Pay 1 107Dokument3 SeitenTEVTA Fin Pay 1 107Abdul BasitNoch keine Bewertungen