Beruflich Dokumente

Kultur Dokumente

Convergence Towards The Normal Rate of Capacity Utilization in - Lavoie

Hochgeladen von

Martín AlbertoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Convergence Towards The Normal Rate of Capacity Utilization in - Lavoie

Hochgeladen von

Martín AlbertoCopyright:

Verfügbare Formate

Convergence towards the normal rate of capacity utilization in Kaleckian models: The role of non-capacity creating autonomous expenditures

Marc Lavoie August 2013

Paper drawn from New Foundations of Post-Keynesian Economics (book in progress)

Abstract: Kaleckian models of growth and distribution have been highly popular among heterodox economists. Two drawbacks of these models have however been underlined in the literature: first, the models do not usually converge to their normal rate of capacity utilization; second, the models do not include the Harrodian principle of dynamic instability. Some Sraffian economists have long been arguing that the presence of noncapacity creating autonomous expenditures provides a mechanism that brings back the model to normal rates of capacity utilization, while safeguarding the main Keynesian message and without going back to classical conclusions. The present paper provides a very simple proof of this, showing that the Harrodian principle of dynamic instability gets tamed by the presence of autonomous consumer expenditures.

A key feature of the Kaleckian model is that the rate of capacity utilization is endogenous. In the canonical model, or even in the post-Kaleckian model, there is thus nothing that will bring back the actual rate of capacity utilization towards its normal value. This criticism of Kaleckian models was made early on by Auerbach and Skott (1988) and Committeri (1986; 1987). In their view, the normal rate of capacity is an optimal rate of utilization that firms try to achieve, at least over the long run. Therefore, entrepreneurs would not be content unless the targeted rate of capacity utilization is realized: It is inconceivable that utilization rates should remain significantly below the desired level for any prolonged period (Auerbach and Skott, 1988, p. 53). The only possible steady state is one in which the actual rate of utilization is equal to its normal or targeted level. This leads to the belief that the only consistent steady-state analysis is one where those two rates are equal, i.e., what Vianello (1985) calls fully adjusted positions. In these positions, the actual rate of profit will also turn out to be equal to the normal rate of profit, otherwise it will not, as pointed out in the following quote:

The possibility of capacity utilization being different from its planned degree in the long run would have an important implication for theories of distribution and accumulation....The realized rate of profit emerging from the interplay between distribution and effective demand may not be inversely related to the real wage, even in situations that the authors seem not to think limited to the short period; another way to say this is that the ... normal rate of profit rn (i.e. the rate of profit technically obtainable at the normal utilization degree with [the real wage rate] taken at its current level) may diverge from its realized rate, even for long periods of time. Now, we do not wish to quarrel with this reasonable proposition: the observed rate of profit is very unlikely to coincide with rn, even in terms of averages covering long periods of time, although we might suspect that after all, there must exist some connection between the two rates. The model, however, contains no element for the exploration of this connection, as it implies a persistent and systematic divergence between [the actual and the normal degree of capacity utilization]. (Committeri, 1986, pp. 170-1)

If the actual rate of capacity must eventually be equal to a given normal rate, then the rate of utilization is not an endogenous variable in the long period any more, which is

likely to put in jeopardy many of the results achieved by the Kaleckian model. This objection to the Kaleckian model is highlighted by the use of investment equation (6.12) or (6.12A) which makes an explicit reference to a normal rate of utilization or to a planned degree of utilization of capacity as Steindl (1952, p. 129) calls it. This investment function, reproduced below, is based on the distinction between undesired and desired excess capacity, or between the actual rate and the normal rate of capacity utilization, respectively denoted by u and un: gi = + u(u un) (6.12A)

It is obvious from the above equation that if the actual rate of utilization turned out to be equal to the normal or desired rate, the actual rate of growth would be equal to . As Committeri (1986, p. 173) and Caserta (1990, p. 152) point out, if firms are content about the degree of capacity utilization that is being achieved and do not desire to have it changed, one concludes that the rate of accumulation desired by firms should be equal to the expected growth rate of sales. It is clear from equation (6.12A) that the exogenous parameter then represents this expected growth rate of sales. If it is assumed that the actual rate of capacity utilization u is larger than the planned rate un, the actual rate of growth g must be larger than the expected growth rate of sales . Committeri argues that this cannot be a consistent solution: in a proper steady-state model, expectations of sales growth and of spare capacity should be realized. When using investment equation (6.13), this objection seems much weaker, but still there remains the issue of the normal rate of capacity utilization. Several answers, consistent or inconsistent with Kaleckian analysis, have been provided to this conundrum, and here we outline one of them. This is the mechanism tied to an exogenous growth component. This mechanism has been proposed by Franklin Serrano (1995a, 1995b) under the name of the Sraffian supermultiplier. His intent is to show that some Keynesian results will still hold despite the actual rate of capacity utilization being brought back to its normal level in the long run. There are thus two Sraffian positions on this issue. There are those Sraffians who support the analysis of the supermultiplier with its normal rate of capacity utilization, such as Serrano, Bortis (1997), Sergio Cesaratto (2013) and Oscar DeJuan (2005); and there are those, like

Roberto Ciccone, Man-Seop Park, Antonella Palumbo and Attilio Trezzini, who deny that rates of utilization are at their normal levels, either continuously or on average. The crucial point made by Serrano is that the average propensity to save will move endogenously when there are autonomous consumption expenditures, even if the marginal propensity to save and the profit share are constant. This will be the case both in the short run, when autonomous consumption is a given, and in the medium run when growth occurs, with autonomous consumption growing at some given rate different from the rate of accumulation. The simplest way to put this is to write a new saving equation: gs = spu/v z (6.57)

with z = Z/K, where Z are the autonomous consumption expenditures of the capitalists, and hence where z is the ratio of autonomous expenditures to the capital stock. There is thus some similarity between this variable Z and the autonomous expenditures that we called A or a in equation (5.2) when dealing with our model of employment in Chapter 5. The main difference is that Z only contains autonomous expenditures which do not lead to the creation of productive capacity. It should be further noted that here the marginal propensity to save out of profits is sp, the marginal propensity to save out of national income is sp, while the average propensity to save out of national income is sp zv. Thus even if sp and are constant, the average propensity to save will be endogenous as long as z is itself endogenous. The main point that Serrano wishes to make is that saving can adjust to investment even when assuming that the marginal propensity to save, income distribution and the rate of utilization are all constant. The argument is thus that the Keynesian Hypothesis is more general than previously thought, since it does not need to rely on an endogenous rate of utilization in the long run, in contrast to the Kaleckian approach. There is however a second point that Serrano wishes to make. Serrano believes that as long as demand expectations by entrepreneurs are not systematically biased, the average rate of capacity utilization will tend towards the normal rate of utilization and hence that the economy will tend towards a fully-adjusted position. While other Sraffians

have been happy to endorse Serranos first point, many of them have argued that Serranos second point is at best dubious (Trezzini, 1995; 1998). If the economy starts from a fully-adjusted position, it is unlikely to remain there; and when the economy gets away from a fully-adjusted position, it is unlikely to quickly come back to it, not because entrepreneurs make mistakes, but simply because the rate of capacity utilization will remain below (or above) its normal value for a long time. Thus the actual average rate of utilization cannot be equal to the normal rate of capacity utilization. Can all this be somewhat modelled with our usual tools? Olivier Allain (2013) has recently put forward a formalization of this ultimate adjustment mechanism. His model is based on autonomous government expenditures and is thus different from what Serrano first proposed and different from what we propose here based on autonomous consumption expenditures, but Allains article is the inspiration for all that follows in this subsection. We thus start with the canonical Kaleckian investment function, given by equation (6.12A), gi = + u(u un), and the new saving equation, given by equation (6.57). In the short run, nothing special happens and all the standard Kaleckian results, such as the paradoxes of thrift and of costs hold. This is obvious from looking at the short-run solution for the rate of utilization, when the ratio z has not had time to change: = ( + ) (6.58)

Let us now consider a long run. The key idea here is that autonomous consumption expenditures grow at a certain rate gz, which we assume given by outside circumstances. As Serrano (1995a, p. 84), puts it, it is usually assumed that autonomous components of aggregate demand grow in line with the capital stock, but it seems that it is rather the size of the economy itself that depends partially on the magnitude (and rates of growth) of these autonomous components of final demand. Serrano refers to Kaldor (1983, p. 9) to provide support for this reversal of causality. Other post-Keynesians, also assume that autonomous expenditures are the driving force: in Godley and Lavoie (2007, ch. 11), it is autonomous government expenditures; in Trezzini and Garegnani (2010), it

is consumption expenditures. With consumer credit and lines of credit based on the value of real estate, it is clear that consumption expenditures can grow independently of income to a large extent, at least for some time (Barba and Pivetti, 2009). This increase in autonomous consumption can also be tied to the attempt to keep up with the Joneses and to invest in an appropriate lifestyle, as discussed in Chapter 2. But assuming that Z grows at the constant rate gz means that the ratio z = Z/K must be changing through time, through the following law of motion that defines the growth rate of z: = = ( ) ( ) = = (6.59)

The bar over gz is there to recall that the growth rate of autonomous expenditures is an

The last equality is derived from the investment equation, = + ( ).

unexplained constant. What we wish to know is whether the behaviour of z is dynamically stable or not, that is whether it will converge to a stable value. This will happen if / is smaller than zero. From equation (6.58), we can compute what the term (u* un) is equal to: = ( + ) (6.60)

Combining equations (6.60) and (6.59) we get:

And thus taking the derivative of with respect to itself, we find that: = <0

( + ) = ( )

(6.61)

(6.62)

The derivative is always negative, as long as the denominator is positive, that is, as long as there is Keynesian stability. This means that z will converge to an equilibrium value z**, at which the growth rates of capital and aggregate demand will be the same as the given growth rate of autonomous consumption expenditures. This also means that the

long-run solutions that one could find, by assuming that at some point the growth rate of capital equates the growth rate of autonomous consumption, will indeed be realized if given enough time. In the long run, g** = gz, and hence making use first of the investment equation, and then of the saving equation, we can derive the two long-run equilibria: = + = (6.63) (6.64)

At this stage, three remarks can be made. First, the mechanism designed by Serrano on its own does not achieve a normal rate of capacity utilization, since u** un. For u** = un to be achieved, the parameter in the investment equation would need to equal gz. In other words, entrepreneurs would need to assess the trend growth rate of sales as being equal to the growth rate of autonomous consumption expenditures. This is recognized by supporters of the supermutiplier, who refer to perfect foresight or to correct forward-looking expectations. Second, almost by definition, with this mechanism, we can have neither a wageled nor a profit-led regime, as we defined them earlier, since the growth rate of capital and of output eventually adjusts to the given growth rate of autonomous consumption expenditures, and also because the long-run value of the rate of utilization depends neither on the profit share nor on the marginal propensity to save out of profits. As long as there is no change to any of the four parameters in equation (6.63), any change in the profit share or in the marginal propensity to save will have no effect on the long-run value of the rate of utilization. This leads however to a third remark. While the paradox of thrift and of costs are gone in the long-run version of this model, reducing the profit share or reducing the marginal propensity to save out of profits will have a positive effect on the levels of capital, capacity and output. This is precisely the point made by Serrano, and it is a point that Cesaratto (2013) has emphasized recently:

8 That lower marginal propensity to save will increase the level of induced consumption and aggregate demand, and, consequently, also the long-period level of productive capacity. However, this will be a once-and-for-all effect. Once capacity has adjusted to the new (higher) level of effective demand implied by the higher (super) multiplier, the economy will settle back to steady growth grow at the unchanged rate given by the growth of autonomous expenditures. Therefore, on the demand side, a decrease in the marginal propensity to save brought about by the rise of the real wage will have a positive long-period level effect (on capacity output), but will have no effect on the sustainable secular rate of growth of capacity. (Serrano, 1995b, p. 138).

A fourth remark is now in order. By a strange turn of events, whereas Sraffians are usually accused by other post-Keynesians of focusing on fully-adjusted positions, several Sraffian authors have criticized Kaleckians for focusing unduly on steady states, arguing that steady-state analysis ought to be jettisoned (Trezzini, 2011, p. 143). In the example provided above by Serrano and in our little model, while the rate of capacity utilization would be the same at the beginning and at the end of the process, it will be higher during the transition process. Thus, on average, the rate of utilization and the growth rate of the economy are higher than at the starting and terminal points of the traverse. Thus, what these Sraffians are telling us is that more attention should be paid to the average values achieved during the traverse than to the terminal points. This is a recommendation with which all post-Keynesians could certainly agree (see for instance Henry, 1985), and it is one which is made quite explicitly by Park (1995, p. 307), who argues that the moving averages of key variables are quite distinct from their potential steady state values. The Serrano-Allain adjustment mechanism and the appeal to average values can be illustrated with the help of Figure 6.19. Let us assume that the economy starts from a steady state where the rate of accumulation is exactly equal to the growth rate of autonomous consumption expenditures, with a rate of utilization of u0**. Let us now suppose that there is a decrease in the marginal propensity to save out of profits or in the

share of profits. This will be associated with a rotation of the saving curve, from 0 to 1 ,

as shown with the help of the black arrow, since the slope of the curve will now be

smaller. In the short run, as in all Kaleckian models, this will generate an increase in the growth rate of capital and in the rate of utilization, which move to g1 and u1 in the short run. But the new equilibrium is only be a temporary one, as the new discrepancy between g1 and gz will generate a reduction in z through equation (6.59). The saving curve will thus gradually shift up through time, as shown in Figure 6.19 with the help of the grey

arrow, until the saving curve reaches 2 , at which point the rate of accumulation equates

the given growth rate of autonomous consumption. As to the rate of utilization, it will be back to its initial equilibrium position, such that u2** = u0**. The change in income distribution or in the marginal propensity to save has had no impact on the equilibrium rate of utilization. However, the average rate of utilization and the average rate of growth achieved during this whole episode are higher, the economy having been run between u0** and u1 and gz and g1 respectively during the whole transition. As a consequence, the level of output and of capacity will be higher than if there had been no increase in real wages or no decrease in the marginal propensity to save.

6.19

g gs0 gs2 gs1 g1 gz u gi

Z2** Z0**

u0**= u2**

u1

10

Now the topic of this section is whether there is convergence towards the normal rate of capacity utilization. It is not the case here with the current adjustment mechanism. We need to combine an additional mechanism. Allain (2013) proposes to add such a mechanism, which corresponds to the case of Harrodian. For simplification purposes, we propose a slightly modified version of the Harrodian equation (6.32), where it is the rate of change, rather than the change, in the parameter of the investment function which responds to a discrepancy between the actual rate of capacity utilization and the normal rate of utilization. We thus have: = 2 ( ) , 2 > 0 (6.65) (6.66)

Making use of equation (6.60) once again, the Harrodian equation becomes: = 2 ( ( + ) )

We thus have another system of simultaneous linear dynamic equations, given by equations (6.66) and (6.61) which, omitting once more the constant terms, we can write as: 2 2 = 1 +

(6.67)

To find how the system described by (6.67) behaves, we need to look at the determinant of the 2x2 matrix, called J, and at its trace. For the system to exhibit stability and converge to an equilibrium, the determinant needs to be positive and the trace needs to be negative. We get: Det = Tr = 2

(2 )

11

The determinant is positive whenever the Keynesian stability condition is fulfilled. The trace is negative if 2 < u. Thus the system is stable as long as the effect of Harrodian instability is not overly strong. If this is so, depending on the values taken by the parameters, this system may come back straight to its fully-adjusted position, where u** = un and where g** = ** = gz, or it may whirl cyclically towards it. We thus have reached a conditional proof that Kaleckian results can be preserved even if the economy comes back systematically towards a constant normal rate of utilization, as long as we interpret them as averages measured during the period of transition. This is achieved by taking into account autonomous growth components, assuming Keynesian stability and incorporating a Harrodian instability mechanism.

Das könnte Ihnen auch gefallen

- Shubbar - 2023 - The Political Economy of UAE Defense IndustryDokument11 SeitenShubbar - 2023 - The Political Economy of UAE Defense IndustryMartín AlbertoNoch keine Bewertungen

- Turkey's Offset Policy Development and Case StudiesDokument129 SeitenTurkey's Offset Policy Development and Case StudiesMartín AlbertoNoch keine Bewertungen

- Albert Vidal - A New Chapter For UAE Defense Procurement - 01-12-22Dokument4 SeitenAlbert Vidal - A New Chapter For UAE Defense Procurement - 01-12-22Martín AlbertoNoch keine Bewertungen

- EDGE Group Continues Stellar International Growth, Consolidating Its Position As An Industry Leader - Defense Here - 30-11-23Dokument7 SeitenEDGE Group Continues Stellar International Growth, Consolidating Its Position As An Industry Leader - Defense Here - 30-11-23Martín AlbertoNoch keine Bewertungen

- Vinculos Entre España e Israel en DefensaDokument138 SeitenVinculos Entre España e Israel en DefensaMartín AlbertoNoch keine Bewertungen

- Military-Economic Structure in TurkeyDokument38 SeitenMilitary-Economic Structure in TurkeyMartín AlbertoNoch keine Bewertungen

- Donatas Palavenis - 2020 - Israel Defense Industry, What We Can Learn From ItDokument19 SeitenDonatas Palavenis - 2020 - Israel Defense Industry, What We Can Learn From ItMartín AlbertoNoch keine Bewertungen

- Military-Industrial Aspects of Turkish Defence Policy - Wisniewzki - 2015Dokument14 SeitenMilitary-Industrial Aspects of Turkish Defence Policy - Wisniewzki - 2015Martín Alberto100% (1)

- Jeffrey Clarke - 1977 - The Nationalization of War Industries in France - 1936-1937Dokument21 SeitenJeffrey Clarke - 1977 - The Nationalization of War Industries in France - 1936-1937Martín AlbertoNoch keine Bewertungen

- Defence Industries in The 21st Century A Comparative Analysis - Kurc & Neuman - 2017Dokument10 SeitenDefence Industries in The 21st Century A Comparative Analysis - Kurc & Neuman - 2017Martín AlbertoNoch keine Bewertungen

- The Defense Industry in Brasil - Characteristics and Involvement of Supplier Firms - IPEA - 2014Dokument60 SeitenThe Defense Industry in Brasil - Characteristics and Involvement of Supplier Firms - IPEA - 2014Martín AlbertoNoch keine Bewertungen

- Kemal Topcu, Et Al - 2015 - A Study On Defense Acquisition Models With Emerging Market Perspective - The Case of TurkeyDokument8 SeitenKemal Topcu, Et Al - 2015 - A Study On Defense Acquisition Models With Emerging Market Perspective - The Case of TurkeyMartín AlbertoNoch keine Bewertungen

- The Influence of Innovation On Firm Size - Bosma - 2002Dokument12 SeitenThe Influence of Innovation On Firm Size - Bosma - 2002Martín AlbertoNoch keine Bewertungen

- Ciampi Et Al - 2019 - Engineering Offshoring in The Defense Industry - Perspectives On Manufacturing IndustriesDokument5 SeitenCiampi Et Al - 2019 - Engineering Offshoring in The Defense Industry - Perspectives On Manufacturing IndustriesMartín AlbertoNoch keine Bewertungen

- Saksonova, Svetlana - Approaches To Improving Asset Structure ManagementDokument9 SeitenSaksonova, Svetlana - Approaches To Improving Asset Structure ManagementMartín AlbertoNoch keine Bewertungen

- Colfer y Baldwin - 2016 - The Mirroring Hypothesis Theory, Evidence, and ExDokument31 SeitenColfer y Baldwin - 2016 - The Mirroring Hypothesis Theory, Evidence, and ExMartín AlbertoNoch keine Bewertungen

- Turkey Officially Launches Competition For TF-X Fighter EngineDokument7 SeitenTurkey Officially Launches Competition For TF-X Fighter EngineMartín AlbertoNoch keine Bewertungen

- Tee - 2019 - Benefiting From Modularity Within and Across FirmDokument18 SeitenTee - 2019 - Benefiting From Modularity Within and Across FirmMartín AlbertoNoch keine Bewertungen

- Hall and Gingerich (2009) - Varieties of Capitalism and Institutional Complementarities in The Political EconomyDokument67 SeitenHall and Gingerich (2009) - Varieties of Capitalism and Institutional Complementarities in The Political EconomyMartín AlbertoNoch keine Bewertungen

- The - Building - Blocks - of - Economic - Complexity - Hidalgo y HausmanDokument7 SeitenThe - Building - Blocks - of - Economic - Complexity - Hidalgo y HausmanMartín AlbertoNoch keine Bewertungen

- Brown (2020) - Mission-Oriented or Mission AdriftDokument24 SeitenBrown (2020) - Mission-Oriented or Mission AdriftMartín AlbertoNoch keine Bewertungen

- Cellin & Lambertini - 2005 - Betrand Competition and InnovationDokument6 SeitenCellin & Lambertini - 2005 - Betrand Competition and InnovationMartín AlbertoNoch keine Bewertungen

- Beraud-Sudreau and Nouwens - 2019 - Weighing Giants - Taking Stock of The Expansion of Chinas Defense IndustryDokument28 SeitenBeraud-Sudreau and Nouwens - 2019 - Weighing Giants - Taking Stock of The Expansion of Chinas Defense IndustryMartín AlbertoNoch keine Bewertungen

- Industrial Policy Debate: Rationales, Evidence and ConclusionsDokument51 SeitenIndustrial Policy Debate: Rationales, Evidence and ConclusionsMartín AlbertoNoch keine Bewertungen

- Global Supply Chains and Intangible Assets in The Automotive and Aeronautical Industries - Serfati & Sauviat - 2019Dokument27 SeitenGlobal Supply Chains and Intangible Assets in The Automotive and Aeronautical Industries - Serfati & Sauviat - 2019Martín AlbertoNoch keine Bewertungen

- 2016 - Reforming Chinas Defense IndustryDokument29 Seiten2016 - Reforming Chinas Defense IndustryMartín AlbertoNoch keine Bewertungen

- CHina WHite Paper On DefenceDokument52 SeitenCHina WHite Paper On DefenceAkshay RanadeNoch keine Bewertungen

- Another Strong Year For China's Defence CompaniesDokument8 SeitenAnother Strong Year For China's Defence CompaniesMartín AlbertoNoch keine Bewertungen

- Architectural Innovation The Reconfiguration of ExDokument24 SeitenArchitectural Innovation The Reconfiguration of ExRaisa CardosoNoch keine Bewertungen

- Government R&D Drives Innovation in AsiaDokument27 SeitenGovernment R&D Drives Innovation in AsiaMartín AlbertoNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Records: Collierville Schools Removed Hundreds of LGBTQ+ Books From ShelvesDokument328 SeitenRecords: Collierville Schools Removed Hundreds of LGBTQ+ Books From ShelvesUSA TODAY NetworkNoch keine Bewertungen

- Human ExceptionalityDokument3 SeitenHuman ExceptionalityVergel LearningcenterNoch keine Bewertungen

- SPE 55631 Practical Issues With Field Injection Well Gel TreatmentsDokument9 SeitenSPE 55631 Practical Issues With Field Injection Well Gel TreatmentsAngy Carolina Taborda VelasquezNoch keine Bewertungen

- PMAI Sample ReportDokument6 SeitenPMAI Sample ReportchidambaraNoch keine Bewertungen

- Daily Lesson Plan English Language Year 5Dokument5 SeitenDaily Lesson Plan English Language Year 5muhammadNoch keine Bewertungen

- National Income MCQsDokument6 SeitenNational Income MCQsZeeshan AfzalNoch keine Bewertungen

- Macatangay Bsn-g4b - Business Model CanvasDokument3 SeitenMacatangay Bsn-g4b - Business Model CanvasGaea Angela MACATANGAYNoch keine Bewertungen

- Oral Hygiene Autis PDFDokument7 SeitenOral Hygiene Autis PDFNoviyana Idrus DgmapatoNoch keine Bewertungen

- How To Install A Siemens Mag MeterDokument10 SeitenHow To Install A Siemens Mag MeterBabiker ElrasheedNoch keine Bewertungen

- Business Administration Core: Sample Exam QuestionsDokument6 SeitenBusiness Administration Core: Sample Exam QuestionsBernard Vincent Guitan MineroNoch keine Bewertungen

- Fuel - in Tank Fuel Pump Replacement PDFDokument14 SeitenFuel - in Tank Fuel Pump Replacement PDFBeniamin KowollNoch keine Bewertungen

- Netflix in 2012 Can It Recover From Its Strategy MissteptsDokument1 SeiteNetflix in 2012 Can It Recover From Its Strategy MissteptsShubham GoelNoch keine Bewertungen

- Flowsheet WWT IKPPDokument5 SeitenFlowsheet WWT IKPPDiffa achmadNoch keine Bewertungen

- Foundation Engineering2Dokument8 SeitenFoundation Engineering2mahmoud alawnehNoch keine Bewertungen

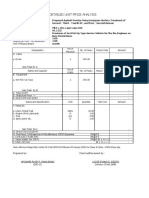

- DETAILED UNIT PRICE ANALYSIS FOR PROPOSED ASPHALT OVERLAYDokument7 SeitenDETAILED UNIT PRICE ANALYSIS FOR PROPOSED ASPHALT OVERLAYreynoldNoch keine Bewertungen

- Harvard RP1Dokument7 SeitenHarvard RP1Ajay NegiNoch keine Bewertungen

- Big Book AlphabetDokument53 SeitenBig Book Alphabetallrounder crazy thingsNoch keine Bewertungen

- Plant Your Wisdom Tree: Define CurriculumDokument1 SeitePlant Your Wisdom Tree: Define CurriculumBon Jaime TangcoNoch keine Bewertungen

- Hope-4 Activity-Sheet MountaineeringDokument2 SeitenHope-4 Activity-Sheet MountaineeringKristine MirasolNoch keine Bewertungen

- Castration Procedure in Farm AnimalsDokument70 SeitenCastration Procedure in Farm AnimalsIgor GaloskiNoch keine Bewertungen

- Pesachim 45Dokument42 SeitenPesachim 45Julian Ungar-SargonNoch keine Bewertungen

- Gradeup's comprehensive guide to teaching and learningDokument6 SeitenGradeup's comprehensive guide to teaching and learningRJNoch keine Bewertungen

- Projection of points and lines engineeringDokument38 SeitenProjection of points and lines engineeringBharat SinghNoch keine Bewertungen

- English Vocabulary Exercises For B2 - It Drives Me Crazy! - English Practice OnlineDokument16 SeitenEnglish Vocabulary Exercises For B2 - It Drives Me Crazy! - English Practice Onlineსოფი 'აNoch keine Bewertungen

- Midheaven in Taurus Meaning & Careers - AstrologyDokument1 SeiteMidheaven in Taurus Meaning & Careers - AstrologyGlithc hNoch keine Bewertungen

- Kindred IntroductionDokument18 SeitenKindred IntroductionMarionNoch keine Bewertungen

- Request Letter For Payment Features & SampleDokument3 SeitenRequest Letter For Payment Features & SamplemindnbooksNoch keine Bewertungen

- 10 Commandments - For Effective Email Communication (1) .PpsDokument13 Seiten10 Commandments - For Effective Email Communication (1) .Ppshima_bindu_89Noch keine Bewertungen

- Presentation On Programming Language: Name IDDokument9 SeitenPresentation On Programming Language: Name IDAjay GhoshNoch keine Bewertungen

- Sist en 12390 3 2019Dokument10 SeitenSist en 12390 3 2019Francois UWIMBABAZINoch keine Bewertungen