Beruflich Dokumente

Kultur Dokumente

Cisco Systems, Inc. Historical Financials Income Statement Analysis

Hochgeladen von

Sameh Ahmed HassanOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cisco Systems, Inc. Historical Financials Income Statement Analysis

Hochgeladen von

Sameh Ahmed HassanCopyright:

Verfügbare Formate

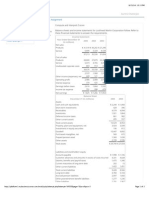

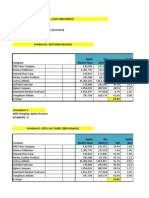

Cisco Systems, Inc.

Historical Financials Income Statements (In millions, except per-share amounts)

Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2) Notes (1) (2)

GAAP FY2009 Qtr Ending 10/25/2008 NET SALES: Product Service Total net sales COST OF SALES: Product (a),(d),(f) Service (a) (f) Total cost of sales (a),(d),(f) GROSS MARGIN (a),(d),(f) OPERATING EXPENSES: Research and development (a),(b),(e),(f) Sales and marketing (a),(b),(e),(f) General and administrative (a),(b),(e),(f) Amortization of purchased intangible assets (d) In-process research and development (c) Total operating expenses (a)-(f) OPERATING INCOME (a) - (f) Interest income (expense), net Other income (loss), net Interest and other income (loss), net INCOME BEFORE PROVISION FOR INCOME TAXES (a) - (f) Provision for income taxes (g)-(i) NET INCOME (a) - (i) Net income per share: Basic (a) - (i) Diluted (a) - (i) Shares used in per-share calculation: Basic Diluted $

NON-GAAP FY2009 Qtr Ending 10/25/2008

GAAP FY2009 Qtr Ending 1/24/2009

NON-GAAP FY2009 Qtr Ending 1/24/2009

GAAP FY2009 Qtr Ending 4/25/2009

NON-GAAP FY2009 Qtr Ending 4/25/2009

GAAP FY2009 Qtr Ending 7/25/2009

NON-GAAP FY2009 Qtr Ending 7/25/2009

GAAP FY2009 YTD Ending 7/25/2009

NON-GAAP FY2009 YTD Ending 7/25/2009

8,635 1,696 10,331

8,635 1,696 10,331

7,347 1,742 9,089

7,347 1,742 9,089

6,420 1,742 8,162

6,420 1,742 8,162

6,729 1,806 8,535

6,729 1,806 8,535

29,131 6,986 36,117

29,131 6,986 36,117

2,981 669 3,650 6,681

2,916 638 3,554 6,777

2,737 629 3,366 5,723

2,673 597 3,270 5,819

2,327 606 2,933 5,229

2,272 575 2,847 5,315

2,436 638 3,074 5,461

2,373 587 2,960 5,575

10,481 2,542 13,023 23,094

10,234 2,397 12,631 23,486

1,406 2,283 395 112 3 4,199 2,482 195 (72) 123 2,605 404 2,201 $

1,200 2,167 332 3,699 3,078 195 (72) 123 3,201 704 2,497 $

1,279 2,155 380 136 3,950 1,773 159 (64) 95 1,868 364 1,504 $

1,152 2,048 321 3,521 2,298 159 (64) 95 2,393 526 1,867 $

1,243 1,956 302 121 3,622 1,607 89 (9) 80 1,687 339 1,348 $

1,067 1,839 241 3,147 2,168 89 (9) 80 2,248 495 1,753 $

1,280 2,009 488 164 60 4,001 1,460 56 17 73 1,533 452 1,081 $

1,090 1,854 405 3,349 2,226 56 17 73 2,299 460 1,839 $

5,208 8,403 1,565 533 63 15,772 7,322 499 (128) 371 7,693 1,559 6,134 $

4,509 7,908 1,299 13,716 9,770 499 (128) 371 10,141 2,185 7,956

$ $

0.37 0.37

$ $

0.42 0.42

$ $

0.26 0.26

$ $

0.32 0.32

$ $

0.23 0.23

$ $

0.30 0.30

$ $

0.19 0.19

$ $

0.32 0.31

$ $

1.05 1.05

$ $

1.37 1.35

5,881 5,972

5,881 5,979

5,848 5,864

5,848 5,885

5,805 5,818

5,805 5,840

5,777 5,813

5,777 5,840

5,828 5,857

5,828 5,876

Cisco's non-GAAP measures are not in accordance with, or an alternative for, generally accepted accounting principles and may be different from non-GAAP measures used by other companies. In addition, the above non-GAAP Consolidated Statements of Operations are not based on a comprehensive set of accounting rules or principles.

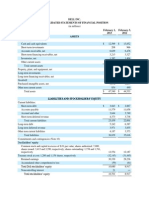

Income Statement

Cisco Systems, Inc. Confidential

12/6/201310:10 AM

( In millions ) Note 1

FY2009 Qtr Ending 10/25/2008

FY2009 Qtr Ending 1/24/2009

FY2009 Qtr Ending 4/25/2009

FY2009 Qtr Ending 7/25/2009

FY2009 YTD Ending 7/25/2009

A reconciliation between net income on a GAAP basis and non-GAAP net income including items (a) - (i) is as follows: GAAP net income (a) (b) (c) (d) (e) (f) Share-based compensation expense Payroll tax on stock option exercises

(i)

2,201 304 1 3 166 122 596 (194) (106) (300)

1,504 298 190 37 525 (162) (162)

1,348 299 164 98 561 (156) (156)

1,081 330 60 203 35 138 766 (182) 174 (8)

6,134 1,231 1 63 723 292 138 2,448 (694) (106) 174 (626)

In-process research and development Amortization of acquisition-related intangible assets Other acquisition-related costs

(ii)

Enhanced early retirement benefits

Total adjustments to GAAP income before provision for income taxes (g) (h) (i) Income tax effect Effect of retroactive tax legislation

(iii) (iv)

Transfer pricing adjustment related to share-based compensation Total adjustments to GAAP provision for income taxes

Non-GAAP net income

2,497

1,867

1,753

1,839

7,956

Shares used in diluted net income per-share calculation - GAAP Effect of share-based compensation expense Shares used in diluted net income per-share calculation - Non-GAAP

5,972 7 5,979

5,864 21 5,885

5,818 22 5,840

5,813 27 5,840

5,857 19 5,876

(i) (ii)

Effective in the third quarter of fiscal 2009, Cisco no longer excludes payroll tax on stock option exercises for purposes of its non-GAAP financial measures. Other acquisition-related costs consist primarily of cash compensation expenses related to acquisitions and investments. In the first quarter of fiscal 2009, a $106 million tax benefit was included in the GAAP net income as a result of the Tax Extenders and Alternative Minimum Tax Relief Act of 2008, which reinstated the U.S. federal R&D tax credit retroactive to January 1, 2008. In the fourth quarter of fiscal 2009, the U.S. Court of Appeals for the Ninth Circuit overturned a 2005 U.S. Tax Court ruling. The decision changes the tax treatment of sharebased compensation expenses for the purpose of determining intangible development costs under a companys research and development cost sharing arrangement. While Cisco was not a named party to the case, the decision resulted in a change in Ciscos tax benefits recognized in its financial statements.

(iii) (iv)

GAAP Recon Note 1

Cisco Systems, Inc. Confidential

12/6/201310:10 AM

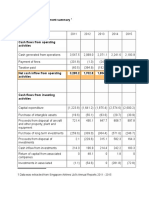

Note 2 Items (a), (b), (d)-(f) in note 1 are allocated as follows: Amortization of Acquisition-related Intangible General and Administrative Assets (Op. Exp.) $ $ 7 63 $ 55 1 $ 112 112 $

Items ( In millions ) Q1FY'09 (a) (b) (d) (e) Share-based compensation expense Payroll tax on stock option exercises Amortization of acquisition-related intangible assets Other acquisition-related costs Total Q2FY'09 Share-based compensation expense Payroll tax on stock option exercises Amortization of acquisition-related intangible assets Other acquisition-related costs Total Q3FY'09 Share-based compensation expense Payroll tax on stock option exercises (i) Amortization of acquisition-related intangible assets Other acquisition-related costs Total Q4FY'09 Share-based compensation expense Payroll tax on stock option exercises (i) Amortization of acquisition-related intangible assets Other acquisition-related costs Enhanced early retirement benefits Total FY'09 Share-based compensation expense Payroll tax on stock option exercises (i) Amortization of acquisition-related intangible assets Other acquisition-related costs Enhanced early retirement benefits Total

(i)

Cost of Sales Product $ 54 $ 65 11

Cost of Sales Service $ $ 31 31

Research and Development $ $ 112 206 94

Sales and Marketing $ 113 3 116

Total

304 1 166 122 593

(a) (b) (d) (e)

$ $ -

10 54 64 12 43 -

$ $ $

32 32 31

$ $

95 32 127 94 -

$ $

105 2 107 103 14 117

$ $ $

56 3 59 59

$ $

136 136 121 121

$ $

298 190 37 525 299 164 98 561

(a) (b) (d) (e)

55

31

82 176

2 61

(a) (b) (d) (e) (f)

$ -

13 39 11 63

$ $

34

$ -

99

17 51

29 62 190

120 3 32 155

$ -

64

3 16 83

164 164

330 203 35 138 706

(a) (b) (d) (e) (f)

46 190 11 247

128 17 145

382 255 62 699

441 22 32 495

234 1 15 16 266

533 533

1,231 1 723 292 138 2,385

Effective in the third quarter of fiscal 2009, Cisco no longer excludes payroll tax on stock option exercises for purposes of its non-GAAP financial measures. Cisco Systems, Inc. Confidential 12/6/201310:10 AM

GAAP Recon Note 2

Das könnte Ihnen auch gefallen

- Case Digest in Francisco vs. House of RepresentativesDokument2 SeitenCase Digest in Francisco vs. House of RepresentativesJP DC100% (1)

- Toy World - ExhibitsDokument9 SeitenToy World - Exhibitsakhilkrishnan007Noch keine Bewertungen

- Financial Analysis ToolDokument50 SeitenFinancial Analysis ToolContessa PetriniNoch keine Bewertungen

- Alliance Concrete Financial Statements and Key Metrics 2002-2005Dokument7 SeitenAlliance Concrete Financial Statements and Key Metrics 2002-2005S r kNoch keine Bewertungen

- Goodweek Tires, Inc - A tire producing companyDokument20 SeitenGoodweek Tires, Inc - A tire producing companyMai Trần100% (1)

- Toy World Case ExhibitsDokument24 SeitenToy World Case ExhibitsFrancisco Aguilar PuyolNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Advanced FrenchDokument64 SeitenAdvanced FrenchJoshua Mamouney100% (1)

- Advanced FrenchDokument64 SeitenAdvanced FrenchJoshua Mamouney100% (1)

- Customer Based Brand EquityDokument13 SeitenCustomer Based Brand EquityZeeshan BakshiNoch keine Bewertungen

- Cisco - Balance Sheeet Vertical AnalysisDokument8 SeitenCisco - Balance Sheeet Vertical AnalysisSameh Ahmed Hassan0% (1)

- Cisco Systems, Inc. Confidential 12/4/20131:12 PMDokument1 SeiteCisco Systems, Inc. Confidential 12/4/20131:12 PMSameh Ahmed HassanNoch keine Bewertungen

- Income Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueDokument10 SeitenIncome Statement: Actual Estimated Projected Fiscal 2008 Projection Notes RevenueAleksandar ZvorinjiNoch keine Bewertungen

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- Q6Dokument3 SeitenQ6kheriaankit0% (3)

- 16 Format of Financial Follow Up Report SbiDokument4 Seiten16 Format of Financial Follow Up Report SbiSandeep PahwaNoch keine Bewertungen

- Financial Reporting: Consolidated Statements and NotesDokument66 SeitenFinancial Reporting: Consolidated Statements and NotesJorge LazaroNoch keine Bewertungen

- Samsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Dokument3 SeitenSamsung Electronics Co., LTD.: Non-Consolidated Statements of Cash Flows For The Years Ended December 31, 2009 and 2008Nitin SharmaNoch keine Bewertungen

- GulahmedDokument8 SeitenGulahmedOmer KhanNoch keine Bewertungen

- Paper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Dokument155 SeitenPaper T6 (Int) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009haroldpsb50% (4)

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDokument4 SeitenJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNoch keine Bewertungen

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Dokument18 SeitenSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNoch keine Bewertungen

- IBF QuestionDokument13 SeitenIBF QuestionSaqib JawedNoch keine Bewertungen

- Verizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsDokument9 SeitenVerizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsvenkeeeeeNoch keine Bewertungen

- Campbell Soup FInancialsDokument39 SeitenCampbell Soup FInancialsmirunmanishNoch keine Bewertungen

- 61 JPM Financial StatementsDokument4 Seiten61 JPM Financial StatementsOladipupo Mayowa PaulNoch keine Bewertungen

- Dell IncDokument6 SeitenDell IncMohit ChaturvediNoch keine Bewertungen

- 70 XTO Financial StatementsDokument5 Seiten70 XTO Financial Statementsredraider4404Noch keine Bewertungen

- Advanced Accounting Jeter 5th Edition Solutions ManualDokument37 SeitenAdvanced Accounting Jeter 5th Edition Solutions Manualgordonswansonepe0q100% (9)

- Ar 2005 Financial Statements p55 eDokument3 SeitenAr 2005 Financial Statements p55 esalehin1969Noch keine Bewertungen

- Full Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full ChapterDokument36 SeitenFull Download Advanced Accounting 6th Edition Jeter Solutions Manual PDF Full Chapterbeatencadiemha94100% (12)

- CongoleumDokument16 SeitenCongoleumMilind Sarambale0% (1)

- 2010 Ibm StatementsDokument6 Seiten2010 Ibm StatementsElsa MersiniNoch keine Bewertungen

- Adelphia Bankruptcy Spreadsheets XLS664-XLS-ENGDokument23 SeitenAdelphia Bankruptcy Spreadsheets XLS664-XLS-ENGShubham KumarNoch keine Bewertungen

- TableDokument1 SeiteTableparasshah90Noch keine Bewertungen

- Appendix 7 Financials: Income StatementDokument9 SeitenAppendix 7 Financials: Income StatementHamza MalikNoch keine Bewertungen

- FSA Hw2Dokument13 SeitenFSA Hw2Mohammad DaulehNoch keine Bewertungen

- Tivo Xls EngDokument3 SeitenTivo Xls EngShubham SharmaNoch keine Bewertungen

- Zimplow FY 2012Dokument2 SeitenZimplow FY 2012Kristi DuranNoch keine Bewertungen

- Indoco Remedies Limited Audited Financial Results for FY 2008-09Dokument1 SeiteIndoco Remedies Limited Audited Financial Results for FY 2008-09Nikhil RanaNoch keine Bewertungen

- FMT Tafi Federal LATESTDokument62 SeitenFMT Tafi Federal LATESTsyamputra razaliNoch keine Bewertungen

- PepsiCo's Quaker BidDokument54 SeitenPepsiCo's Quaker Bidarjrocks23550% (2)

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Dokument1 SeiteUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNoch keine Bewertungen

- Accounting (IAS) /series 4 2007 (Code3901)Dokument17 SeitenAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Advanced Accounting 6th Edition Jeter Solutions ManualDokument25 SeitenAdvanced Accounting 6th Edition Jeter Solutions Manualjasonbarberkeiogymztd100% (49)

- Semester-End Examination Model QuestionDokument9 SeitenSemester-End Examination Model QuestionSarose ThapaNoch keine Bewertungen

- TableDokument1 SeiteTableisaryuddinNoch keine Bewertungen

- Advanced Accounting Jeter 5th Edition Solutions ManualDokument21 SeitenAdvanced Accounting Jeter 5th Edition Solutions Manualjasonbarberkeiogymztd100% (50)

- Full Advanced Accounting Jeter 5Th Edition Solutions Manual PDF Docx Full Chapter ChapterDokument36 SeitenFull Advanced Accounting Jeter 5Th Edition Solutions Manual PDF Docx Full Chapter Chapterpermutestupefyw1tod100% (22)

- Full Download Advanced Accounting Jeter 5th Edition Solutions Manual PDF Full ChapterDokument36 SeitenFull Download Advanced Accounting Jeter 5th Edition Solutions Manual PDF Full Chapterbeatencadiemha94100% (15)

- Financial ReportDokument140 SeitenFinancial ReportAlberto AsinNoch keine Bewertungen

- Mothersum Standalone Results Q3 FY2012Dokument4 SeitenMothersum Standalone Results Q3 FY2012kpatil.kp3750Noch keine Bewertungen

- Accounting Clinic IDokument40 SeitenAccounting Clinic IRitesh Batra100% (1)

- Garware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009Dokument1 SeiteGarware-Wall Ropes Limited: Audited Financial Results For The Year Ended 31St March, 2009Jatin GuptaNoch keine Bewertungen

- Mci 292737Dokument11 SeitenMci 292737ReikoNoch keine Bewertungen

- Exhibit 2a Summarized Income StatementsDokument15 SeitenExhibit 2a Summarized Income StatementsPooja TyagiNoch keine Bewertungen

- 5 Year Cash FlowDokument5 Seiten5 Year Cash FlowRith TryNoch keine Bewertungen

- Group19 Mercury AthleticDokument11 SeitenGroup19 Mercury AthleticpmcsicNoch keine Bewertungen

- Cuarto Trimestre Del 2019Dokument17 SeitenCuarto Trimestre Del 2019CINDY NAOMI APAZA LAYMENoch keine Bewertungen

- Consolidated Income Statement: in Millions, Excpet Per Share DataDokument1 SeiteConsolidated Income Statement: in Millions, Excpet Per Share Datarranjan27Noch keine Bewertungen

- NTBCL Q1 FY2012 Financial ResultsDokument4 SeitenNTBCL Q1 FY2012 Financial ResultsAlok SinghalNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- InstructionsDokument2 SeitenInstructionsSameh Ahmed HassanNoch keine Bewertungen

- Writing GT Practice2Dokument0 SeitenWriting GT Practice2Mena BoshraNoch keine Bewertungen

- Ratios Measures VIPDokument2 SeitenRatios Measures VIPSameh Ahmed HassanNoch keine Bewertungen

- Introduction To The Internet of Everything At-A-Glance 1Dokument2 SeitenIntroduction To The Internet of Everything At-A-Glance 1api-224615605Noch keine Bewertungen

- Network Computing - Understanding IPv6 - What Is Solicited-Node MulticastDokument4 SeitenNetwork Computing - Understanding IPv6 - What Is Solicited-Node MulticastSameh Ahmed HassanNoch keine Bewertungen

- Configuring Junos BasicsDokument84 SeitenConfiguring Junos Basicshas_mmuNoch keine Bewertungen

- FrenchDokument11 SeitenFrenchSameh Ahmed HassanNoch keine Bewertungen

- Foundation French 2Dokument64 SeitenFoundation French 2Neil Llacuna PagalaranNoch keine Bewertungen

- Start FrenchDokument16 SeitenStart Frenchvineet_bmNoch keine Bewertungen

- Junos CLI Demo v4.5Dokument126 SeitenJunos CLI Demo v4.5Sameh Ahmed HassanNoch keine Bewertungen

- French noun gender rulesDokument2 SeitenFrench noun gender rulesSameh Ahmed HassanNoch keine Bewertungen

- Formal Vs Informal WordsDokument5 SeitenFormal Vs Informal WordsSameh Ahmed HassanNoch keine Bewertungen

- Configuring Junos BasicsDokument84 SeitenConfiguring Junos BasicsG3000LEENoch keine Bewertungen

- Exploring The Junos CLIDokument66 SeitenExploring The Junos CLIiruizbNoch keine Bewertungen

- PMP Mock Exam 200 Q ADokument31 SeitenPMP Mock Exam 200 Q ALuis Olavarrieta100% (5)

- Ioe Citizen Svcs White Paper Idc 2013Dokument18 SeitenIoe Citizen Svcs White Paper Idc 2013RedOuanNoch keine Bewertungen

- 175 PMP Sample Questions PDFDokument109 Seiten175 PMP Sample Questions PDFKamlakar MohiteNoch keine Bewertungen

- Spectrum Wallboard Installation Manual V2Dokument13 SeitenSpectrum Wallboard Installation Manual V2Sameh Ahmed HassanNoch keine Bewertungen

- InstructionsDokument2 SeitenInstructionsSameh Ahmed HassanNoch keine Bewertungen

- Review: CNIT 106Dokument66 SeitenReview: CNIT 106Sameh Ahmed HassanNoch keine Bewertungen

- Speaking Sample Task - Part 2Dokument1 SeiteSpeaking Sample Task - Part 2Ana C RamosNoch keine Bewertungen

- White Paper Smart Cities ApplicationsDokument39 SeitenWhite Paper Smart Cities ApplicationsEng-Norhan ElMongiNoch keine Bewertungen

- Total FrenchDokument64 SeitenTotal FrenchDebora MelloNoch keine Bewertungen

- Introductory FrenchDokument32 SeitenIntroductory FrenchSameh Ahmed Hassan100% (2)

- Road To IELTS - ReadingDokument7 SeitenRoad To IELTS - ReadingOsama ElsayedNoch keine Bewertungen

- Network Computing - Understanding IPv6 - What Is Solicited-Node MulticastDokument4 SeitenNetwork Computing - Understanding IPv6 - What Is Solicited-Node MulticastSameh Ahmed HassanNoch keine Bewertungen

- Advertising AppealsDokument22 SeitenAdvertising AppealsSameh Ahmed HassanNoch keine Bewertungen

- White Paper Smart Cities ApplicationsDokument39 SeitenWhite Paper Smart Cities ApplicationsEng-Norhan ElMongiNoch keine Bewertungen

- Understanding Culture, Society and PoliticsDokument3 SeitenUnderstanding Culture, Society and PoliticsแซคNoch keine Bewertungen

- Music Business PlanDokument51 SeitenMusic Business PlandrkayalabNoch keine Bewertungen

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDokument24 SeitenJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNoch keine Bewertungen

- Mx. Gad 2023Dokument3 SeitenMx. Gad 2023Wany BerryNoch keine Bewertungen

- IB English L&L Paper 1 + 2 Tips and NotesDokument9 SeitenIB English L&L Paper 1 + 2 Tips and NotesAndrei BoroianuNoch keine Bewertungen

- ISO 50001 Audit Planning MatrixDokument4 SeitenISO 50001 Audit Planning MatrixHerik RenaldoNoch keine Bewertungen

- Con PhilDokument48 SeitenCon PhilConica BurgosNoch keine Bewertungen

- How Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureDokument12 SeitenHow Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureAneta Mudronja PletenacNoch keine Bewertungen

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDokument40 SeitenPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNoch keine Bewertungen

- Causation in CrimeDokument15 SeitenCausation in CrimeMuhammad Dilshad Ahmed Ansari0% (1)

- ALDI Growth Announcment FINAL 2.8Dokument2 SeitenALDI Growth Announcment FINAL 2.8Shengulovski IvanNoch keine Bewertungen

- The Crucible Summary and Analysis of Act TwoDokument4 SeitenThe Crucible Summary and Analysis of Act TwoXhéhzÂda saleem zehriNoch keine Bewertungen

- Debut Sample Script PDFDokument9 SeitenDebut Sample Script PDFmaika cabralNoch keine Bewertungen

- ACC WagesDokument4 SeitenACC WagesAshish NandaNoch keine Bewertungen

- A Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseDokument17 SeitenA Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseSupriya RaniNoch keine Bewertungen

- Effective Team Performance - FinalDokument30 SeitenEffective Team Performance - FinalKarthigeyan K KarunakaranNoch keine Bewertungen

- Assign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsDokument8 SeitenAssign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsAima Kha KhanNoch keine Bewertungen

- Chaitanya Candra KaumudiDokument768 SeitenChaitanya Candra KaumudiGiriraja Gopal DasaNoch keine Bewertungen

- Square Pharma Valuation ExcelDokument43 SeitenSquare Pharma Valuation ExcelFaraz SjNoch keine Bewertungen

- A Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & SuspensionDokument4 SeitenA Practical Guide To The 1999 Red & Yellow Books, Clause8-Commencement, Delays & Suspensiontab77zNoch keine Bewertungen

- European Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009Dokument1 SeiteEuropean Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009api-26115791Noch keine Bewertungen

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDokument1 SeiteIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNoch keine Bewertungen

- Canned Words TFDDokument2 SeitenCanned Words TFDAi KaNoch keine Bewertungen

- SH-3 Sea King - History Wars Weapons PDFDokument2 SeitenSH-3 Sea King - History Wars Weapons PDFchelcarNoch keine Bewertungen

- 1Dokument1 Seite1MariaMagubatNoch keine Bewertungen

- Grace Song List PDFDokument11 SeitenGrace Song List PDFGrace LyynNoch keine Bewertungen

- Godbolt RulingDokument84 SeitenGodbolt RulingAnthony WarrenNoch keine Bewertungen

- Taylor Swift Tagalig MemesDokument34 SeitenTaylor Swift Tagalig MemesAsa Zetterstrom McFly SwiftNoch keine Bewertungen