Beruflich Dokumente

Kultur Dokumente

Israel - Survey of Fiscal Developments by The Bank of Israel

Hochgeladen von

Eduardo PetazzeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Israel - Survey of Fiscal Developments by The Bank of Israel

Hochgeladen von

Eduardo PetazzeCopyright:

Verfügbare Formate

BANK OF ISRAEL Office of the Spokesperson and Economic Information

Press Release

December 8, 2013 Excerpt from the "Recent Economic Developments" to be published soon: Assessment of the fiscal developments since the budget was approved, and their effects on the expected fiscal path

The measures adopted by the government within the framework of approving the budget for

2013 and 201

strengthened the credibility of !srael"s fiscal policy, and contributed to an

improvement of !srael"s standing in financial markets#

The budget deficit in 2013 is expected to be less than 3#$ percent of %&', markedly lower than

the deficit target of #($ percent of %&'#

The below)target deficit reflects expenditures lower than the approved budget, and high tax

revenues, most of which were exceptionally large one)off revenues#

The budget deficit in 201 is expected to be similar to the target set in law, 3 percent of %&'# !f the government"s proposal to cancel the income tax rate increase, which was set to come into

effect in in the beginning of 201 , alongside a similar reduction in the expenditure ceiling, is accepted, the government is expected to meet the deficit target in 201 , but it will be more difficult to do so in following years#

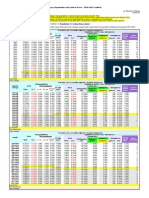

*eeting the declining deficit targets set in law for 201$+1, re-uires additional policy measures

.increased taxes, or reduction of the expenditure ceiling and a corresponding contraction of the government"s expenditure programs.valued at 1 percent of %&' in 201$ and a cumulative more than 2 percent of %&' by 201,#

!f the ad/ustment of the budget re-uired to meet the deficit target is carried out solely by

reducing expenditures, primary civilian expenditure per capita will not increase until 201,, compared with its current level#

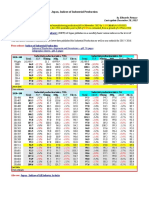

'resenting fiscal data based on the new national accounting methodology adopted by the

0entral 1ureau of 2tatistics highlights the extent to which !srael is characteri3ed as a country with low public expenditure and tax burden# 1ased on the new calculations, as with the previous ones, the current general government deficit in !srael is high, compared with other countries#

Bank of Israel - Assessment of the fiscal developments since the b d!et "as approved# and their effects on the e$pected fiscal path

%a!e 1 Of 3

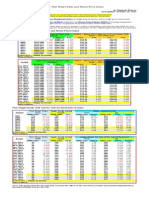

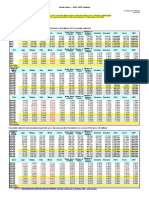

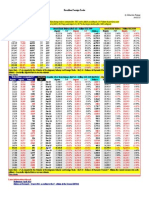

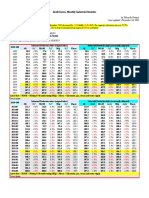

&he Bank of Israel's periodic fiscal s rve( e$amines b d!et performance developments in )*+, and presents an pdated forecast of fiscal a!!re!ates for )*+- and the remainder of the decade. &he s rve( also presents revised fiscal data# based on the ne" national acco ntin! methodolo!( adopted b( the /entral B rea of Statistics# "hich hi!hli!ht the e$tent to "hich Israel is characteri0ed as a co ntr( "ith lo" p blic e$pendit re and ta$ b rden. &he anal(sis in the s rve( indicates that the fiscal ad1 stment pro!ram instit ted b( the !overnment in parallel "ith approvin! the b d!et for )*+, and )*+- made it possible to halt the increase in the deficit# and to red ce it to a level of abo t , percent of 23% in )*+-. &his s ccess contrib ted to stren!thenin! markets' tr st in the !overnment's b d!etar( control# and to a decline in (ield spreads bet"een Israel and other developed markets. &he s rve( indicates the !reat importance of the !overnment's carr(in! o t of the re4 ired ad1 stments so that the deficit and its e$pendit re levels "ill be in line "ith the tar!ets set in la" in the (ears follo"in! )*+as "ell. &his is beca se the deficit is still at a hi!h level in comparison "ith other co ntries5a level "hich does not allo" a s stained decline in the debt to 23% ratio5partic larl( as this deficit level has been reached "ith the econom( at hi!h emplo(ment and activit( levels# "hich s pport a lo" deficit. Based on )*+, b d!et performance data to date# it appears that the deficit in the !overnment b d!et this (ear "ill be smaller than ,.6 percent of 23%# m ch belo" the ceilin! of -.76 percent of 23% that "as set "hen the b d!et "as approved at the end of 8 l(. &he lo"er than pro1ected deficit reflects a combination of three components9 e$pendit re belo" the approved e$pendit re ceilin! d e to partial e$ec tion of several b d!et sections# e$traordinaril( lar!e5abo t NIS 7 billion5one-off ta$ receipts# and an increase in 23% estimates b( the /entral B rea of Statistics "hich red ced the deficit to 23% ratio b( appro$imatel( one-4 arter of a percenta!e point. &he deficit in )*+- is e$pected to be , percent of 23%# similar to the tar!et set in la". &he development of some of the e$pendit re items in the b d!et# notabl( interest pa(ments# "ill apparentl( enable the !overnment to meet the deficit tar!et in )*+- despite the cancellation of the increase in income ta$ rates# "hich is e$pected to c rtail reven es b( NIS ,.: billion. An anal(sis of the e$pected path of the deficit and debt from )*+6 and on"ard indicates that meetin! the deficit tar!ets set in la" ;the !reen line in the Fi! re< "ill ens re a contin ed decline in the debt to 23% ratio to 7* percent b( )*)*. It "ill th s contrib te markedl( to the credibilit( of Israel's fiscal polic( and to the red ction of the !overnment's interest e$penses.1 =ith that# attainin! these tar!ets "ill re4 ire the !overnment to carr( o t "ide ran!in! polic( steps in the comin! (ears. &he estimate of !overnment e$pendit res in )*+6 is NIS 6 billion !reater than the e$pendit re ceilin! set in la". &his is based on the plans adopted to date# and rel(in! on the ass mption that from no" ntil the be!innin! of )*+6 the !overnment "ill not approve additional plans "ith si!nificant b d!etar( costs "itho t red cin! other e$penses. &his !ap is e$pected to contin e to e$pand in the follo"in! (ears. F rthermore# even if the !overnment "ill red ce its planned e$penses to the level mandated b( the ceilin!# additional steps "ill be re4 ired5additional ta$es or an additional red ction of e$penses5at a total of abo t NIS 6 billion in )*+6# so that the deficit "ill be ).6 percent of 23%# in accordance "ith the tar!et set in la". In this scenario# too# the !aps "iden in follo"in! (ears# since "itho t the ad1 stment# the deficit is e$pected to remain set at a level of abo t , percent of 23% ;the bl e line in the fi! re<# "hile the deficit tar!ets decline each (ear. A!ainst this back!ro nd# the cancellation of the decision to raise income ta$ rates# as proposed b( the !overnment# "ill re4 ire decisions on alternative polic( meas res "hich "ill increase reven es or red ce !overnment activities. In the s rve( it "as fo nd that# amon! other thin!s# if it is decided to carr( o t the entire ad1 stment ntil )*+: "itho t an( increase in ta$ rates# real primar( civilian e$pendit re per capita "ill not rise# compared "ith its c rrent level.

1 &his forecast is based on an ass mption of avera!e !ro"th of ,.+ percent in the remainder of the decade. 3etailed !ro"th forecasts b( the Bank of Israel for the comin! t"o (ears are p blished separatel( at the end of each 4 arter.

Bank of Israel - Assessment of the fiscal developments since the b d!et "as approved# and their effects on the e$pected fiscal path

%a!e 2 Of 3

Bank of Israel - Assessment of the fiscal developments since the b d!et "as approved# and their effects on the e$pected fiscal path

%a!e 3 Of 3

Das könnte Ihnen auch gefallen

- Turkey - Gross Domestic Product, Outlook 2016-2017Dokument1 SeiteTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNoch keine Bewertungen

- Germany - Renewable Energies ActDokument1 SeiteGermany - Renewable Energies ActEduardo PetazzeNoch keine Bewertungen

- WTI Spot PriceDokument4 SeitenWTI Spot PriceEduardo Petazze100% (1)

- Highlights, Wednesday June 8, 2016Dokument1 SeiteHighlights, Wednesday June 8, 2016Eduardo PetazzeNoch keine Bewertungen

- Analysis and Estimation of The US Oil ProductionDokument1 SeiteAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNoch keine Bewertungen

- China - Price IndicesDokument1 SeiteChina - Price IndicesEduardo PetazzeNoch keine Bewertungen

- India - Index of Industrial ProductionDokument1 SeiteIndia - Index of Industrial ProductionEduardo PetazzeNoch keine Bewertungen

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDokument1 SeiteChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNoch keine Bewertungen

- U.S. Employment Situation - 2015 / 2017 OutlookDokument1 SeiteU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNoch keine Bewertungen

- U.S. New Home Sales and House Price IndexDokument1 SeiteU.S. New Home Sales and House Price IndexEduardo PetazzeNoch keine Bewertungen

- Reflections On The Greek Crisis and The Level of EmploymentDokument1 SeiteReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNoch keine Bewertungen

- India 2015 GDPDokument1 SeiteIndia 2015 GDPEduardo PetazzeNoch keine Bewertungen

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Dokument1 SeiteCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNoch keine Bewertungen

- Singapore - 2015 GDP OutlookDokument1 SeiteSingapore - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDokument1 SeiteUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNoch keine Bewertungen

- South Africa - 2015 GDP OutlookDokument1 SeiteSouth Africa - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- México, PBI 2015Dokument1 SeiteMéxico, PBI 2015Eduardo PetazzeNoch keine Bewertungen

- US Mining Production IndexDokument1 SeiteUS Mining Production IndexEduardo PetazzeNoch keine Bewertungen

- Highlights in Scribd, Updated in April 2015Dokument1 SeiteHighlights in Scribd, Updated in April 2015Eduardo PetazzeNoch keine Bewertungen

- U.S. Federal Open Market Committee: Federal Funds RateDokument1 SeiteU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNoch keine Bewertungen

- China - Power GenerationDokument1 SeiteChina - Power GenerationEduardo PetazzeNoch keine Bewertungen

- European Commission, Spring 2015 Economic Forecast, Employment SituationDokument1 SeiteEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNoch keine Bewertungen

- Mainland China - Interest Rates and InflationDokument1 SeiteMainland China - Interest Rates and InflationEduardo PetazzeNoch keine Bewertungen

- Chile, Monthly Index of Economic Activity, IMACECDokument2 SeitenChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNoch keine Bewertungen

- US - Personal Income and Outlays - 2015-2016 OutlookDokument1 SeiteUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNoch keine Bewertungen

- Japan, Indices of Industrial ProductionDokument1 SeiteJapan, Indices of Industrial ProductionEduardo PetazzeNoch keine Bewertungen

- Japan, Population and Labour Force - 2015-2017 OutlookDokument1 SeiteJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNoch keine Bewertungen

- Brazilian Foreign TradeDokument1 SeiteBrazilian Foreign TradeEduardo PetazzeNoch keine Bewertungen

- South Korea, Monthly Industrial StatisticsDokument1 SeiteSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNoch keine Bewertungen

- United States - Gross Domestic Product by IndustryDokument1 SeiteUnited States - Gross Domestic Product by IndustryEduardo PetazzeNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Etextbook PDF For Pharmacology Connections To Nursing Practice 3rd EditionDokument61 SeitenEtextbook PDF For Pharmacology Connections To Nursing Practice 3rd Editionkarla.woodruff22798% (45)

- Sainik School Balachadi: Name-Class - Roll No - Subject - House - Assigned byDokument10 SeitenSainik School Balachadi: Name-Class - Roll No - Subject - House - Assigned byPagalNoch keine Bewertungen

- A Semi-Detailed Lesson Plan in MAPEH 7 (PE)Dokument2 SeitenA Semi-Detailed Lesson Plan in MAPEH 7 (PE)caloy bardzNoch keine Bewertungen

- CCDokument5 SeitenCCnazmulNoch keine Bewertungen

- L5V 00004Dokument2 SeitenL5V 00004Jhon LinkNoch keine Bewertungen

- Healthymagination at Ge Healthcare SystemsDokument5 SeitenHealthymagination at Ge Healthcare SystemsPrashant Pratap Singh100% (1)

- Project ProposalDokument4 SeitenProject Proposaljiaclaire2998100% (1)

- At The Origins of Music AnalysisDokument228 SeitenAt The Origins of Music Analysismmmahod100% (1)

- Dessler HRM12e PPT 01Dokument30 SeitenDessler HRM12e PPT 01harryjohnlyallNoch keine Bewertungen

- Honda IzyDokument16 SeitenHonda IzyTerry FordNoch keine Bewertungen

- Clint Freeman ResumeDokument2 SeitenClint Freeman ResumeClint Tiberius FreemanNoch keine Bewertungen

- Table of Specification 1st QDokument5 SeitenTable of Specification 1st QVIRGILIO JR FABINoch keine Bewertungen

- Crafer. The Apocriticus of Macarius Magnes (S.P.C.K. Edition) - 1919.Dokument188 SeitenCrafer. The Apocriticus of Macarius Magnes (S.P.C.K. Edition) - 1919.Patrologia Latina, Graeca et OrientalisNoch keine Bewertungen

- RECYFIX STANDARD 100 Tipe 010 MW - C250Dokument2 SeitenRECYFIX STANDARD 100 Tipe 010 MW - C250Dadang KurniaNoch keine Bewertungen

- Hw10 SolutionsDokument4 SeitenHw10 Solutionsbernandaz123Noch keine Bewertungen

- UAV Design TrainingDokument17 SeitenUAV Design TrainingPritam AshutoshNoch keine Bewertungen

- De Thi Chon Hoc Sinh Gioi Cap Tinh Mon Tieng Anh Lop 12 So GD DT Thanh Hoa Nam Hoc 2015 2016Dokument11 SeitenDe Thi Chon Hoc Sinh Gioi Cap Tinh Mon Tieng Anh Lop 12 So GD DT Thanh Hoa Nam Hoc 2015 2016Thuy LinggNoch keine Bewertungen

- RN42Dokument26 SeitenRN42tenminute1000Noch keine Bewertungen

- Marion Nicoll: Life & Work by Catharine MastinDokument147 SeitenMarion Nicoll: Life & Work by Catharine MastinArt Canada InstituteNoch keine Bewertungen

- Mathematics - Mathematics of Magic - A Study in Probability, Statistics, Strategy and Game Theory XDokument32 SeitenMathematics - Mathematics of Magic - A Study in Probability, Statistics, Strategy and Game Theory XHarish HandNoch keine Bewertungen

- Vocabulary FceDokument17 SeitenVocabulary Fceivaan94Noch keine Bewertungen

- Community Architecture Concept PDFDokument11 SeitenCommunity Architecture Concept PDFdeanNoch keine Bewertungen

- Persuasive Speech 2016 - Whole Person ParadigmDokument4 SeitenPersuasive Speech 2016 - Whole Person Paradigmapi-311375616Noch keine Bewertungen

- Benedict Anderson, Imagined CommunitiesDokument2 SeitenBenedict Anderson, Imagined CommunitiesMonir Amine0% (1)

- Cipet Bhubaneswar Skill Development CoursesDokument1 SeiteCipet Bhubaneswar Skill Development CoursesDivakar PanigrahiNoch keine Bewertungen

- Verniers Micrometers and Measurement Uncertainty and Digital2Dokument30 SeitenVerniers Micrometers and Measurement Uncertainty and Digital2Raymond ScottNoch keine Bewertungen

- CLA Brochure - 2022-3Dokument10 SeitenCLA Brochure - 2022-3Streamer AccountNoch keine Bewertungen

- Lightning Protection Measures NewDokument9 SeitenLightning Protection Measures NewjithishNoch keine Bewertungen

- SDN Van NotesDokument26 SeitenSDN Van Notesmjsmith11Noch keine Bewertungen

- Bgrim 1q2022Dokument56 SeitenBgrim 1q2022Dianne SabadoNoch keine Bewertungen