Beruflich Dokumente

Kultur Dokumente

DuHocSinhDongTienNhuLocalStudent SenateBill1528

Hochgeladen von

daudinhanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DuHocSinhDongTienNhuLocalStudent SenateBill1528

Hochgeladen von

daudinhanCopyright:

Verfügbare Formate

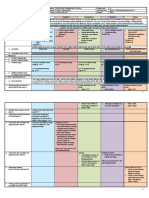

Residency and In-State Tuition

Who pays in-state tuition? Persons classified as residents for higher education purposes under Texas law may pay in-state tuition. Although the State of Texas does not have any programs specifically for undocumented students, some undocumented persons are among those who are eligible for in-state tuition under current residency statutes. The residency statutes for higher education purposes have evolved somewhat over the past 7 years. What is House Bill 1403 (passed by the 77th Texas Legislature in 2001)? House Bill 1403 granted certain non-immigrant students, including undocumented students, access to in-state tuition rates at Texas public institutions of higher education and state financial aid. To qualify, the bill required students to have: o resided in Texas with a parent or guardian while attending high school in Texas, o graduated from a public or private high school or received a GED in Texas, o resided in Texas for the three years leading to graduation or receipt of a GED, and o provided their institutions a signed affidavit indicating an intent to apply for permanent resident status as soon as able to do so. The bill passed and was codified as Texas Education Code (TEC) 54.052(j). What were the implications of HB 1403? This law allowed individuals who were not permanent residents or citizens of the United States to be classified as residents for higher education purposes if they met the requirements outlined above and provided their institutions an affidavit indicating they would apply for permanent residence as soon as they were eligible to do so. Numerous visas issued by the federal government allow documented individuals to reside in the United States. If these individuals met the requirements outlined above, they were residents of Texas by state law. Undocumented students also could be classified as residents if they met those requirements. Were there any legal problems with HB 1403? During the years when TEC 54.052(j) was in effect, there were claims made that it was unconstitutional and could be the basis of a lawsuit since it allowed certain individuals to be treated differently than others. This situation changed with the passage of SB 1528, 79th Texas Legislature, Regular Session, effective September 1, 2005. This bill repealed the old residency statutes, including TEC 54.052(j), applicable to students beginning in spring 2006. What is Senate Bill 1528 (passed by the 79th Texas Legislature, Regular Session, in 2005)? Senate Bill 1528 amended the provisions of House Bill 1403 so that they applied to all individuals who had lived in Texas a significant part of their lives. Citizens, Permanent Residents and certain non-immigrant students could establish a claim to residency following its provisions. To qualify, the individual must have: o lived in Texas the 3 years leading up to high school graduation or the receipt of a GED; and

THECB 09/2008 Page 1 of 2

resided in Texas the year prior to enrollment in an institution of higher education (which could overlap the 3-year period).

In addition, if the student was not a U.S. Citizen or Permanent Resident, he/she had to file an affidavit with his/her institution, indicating an intent to apply for Permanent Resident status as soon as able to do so. The bill passed and was codified as TEC 54.052 through 54.056. What are the implications of SB 1528? As with House Bill 1403, the new statute, passed in 2005, allows certain international students to establish a claim to residency for higher education purposes. In addition, it allows US Citizens or Permanent Residents to establish an independent claim to residency based on graduation from high school or the completion of its equivalent after residing in the state for at least 36 months. The fact that this provision applies to all high school graduates relieves the state of any threat of a law suit based on preferential treatment. More importantly, it allows high school graduates to establish their own basis of residency by having lived here for the three years leading up to graduation. In the past, students born and raised in Texas but whose parents moved out of state before they had enrolled in college were statutorily classified as nonresidents, whether they had ever lived outside the state or not. Students raised by grandparents or other family members who had never gone to court to acquire legal custody were considered residents of the state in which their biological parents lived, whether or not those parents were in any way involved in their upbringing. The new provisions of TEC 54.052(a)(3) enable these students, and all other students who graduate from high school in Texas under the prescribed conditions, to be classified as residents and allow them to enroll while paying the resident tuition rate. It is important to note that the statute indicates these students are not nonresidents who are getting to pay the resident rate due to a waiver of nonresident tuition. They are classified as bone fide residents under current statues. How many students has this affected? The number of students qualifying under these provisions is relatively small. The full population of students reported as residents under the residency provisions of TEC 54.052(a)(3) totaled 9,062 students in fall 2007. The states public institution total enrollment that term was 1,102,572. Therefore, the TEC 54.052(a)(3) students represented slightly more than eight tenths of one percent of the public institution enrollment.

For more information:

Office of External Relations Texas Higher Education Coordinating Board er@thecb.state.tx.us www.thecb.state.tx.us/Agency/Topics.cfm (512) 427-6111

THECB 09/2008 Page 2 of 2

Das könnte Ihnen auch gefallen

- Speed Reading SecretsDokument49 SeitenSpeed Reading SecretsJets Campbell100% (2)

- A Simple Guide to the Immigration Laws of the United States: What You Need to Know When You Come to AmericaVon EverandA Simple Guide to the Immigration Laws of the United States: What You Need to Know When You Come to AmericaBewertung: 1 von 5 Sternen1/5 (1)

- Outline For "Immigration and Citizenship Law"Dokument26 SeitenOutline For "Immigration and Citizenship Law"Lewis GNoch keine Bewertungen

- Weiss Functional Impairment Rating Scale (Wfirs) InstructionsDokument3 SeitenWeiss Functional Impairment Rating Scale (Wfirs) InstructionsMariana LópezNoch keine Bewertungen

- Affirmative ActionDokument23 SeitenAffirmative ActionUtkarsh Mani TripathiNoch keine Bewertungen

- Running Head: THE DREAM ACT 1Dokument6 SeitenRunning Head: THE DREAM ACT 1Josephat Morang'aNoch keine Bewertungen

- 2010 AP Human Geography Free Response QuestionDokument3 Seiten2010 AP Human Geography Free Response QuestionTed Wen100% (1)

- ExercisingProsecutorialDiscretion MemoDokument23 SeitenExercisingProsecutorialDiscretion MemoLal LegalNoch keine Bewertungen

- Federal Children Exposed blog details how birth certificates create federal childrenDokument3 SeitenFederal Children Exposed blog details how birth certificates create federal childrenGiorgios Savvidis100% (1)

- General Zoology 1.28 PDFDokument1.057 SeitenGeneral Zoology 1.28 PDFMelqui Magcaling100% (2)

- The War That Never Was: Exploding The Myth of The Historical Conflict Between Christianity and ScienceDokument12 SeitenThe War That Never Was: Exploding The Myth of The Historical Conflict Between Christianity and ScienceEduardo CruzNoch keine Bewertungen

- Abortion in the United States - Judicial History and Legislative BattleVon EverandAbortion in the United States - Judicial History and Legislative BattleNoch keine Bewertungen

- Brahmavidya Breathing SummeryDokument13 SeitenBrahmavidya Breathing Summerysudhir vaidya100% (1)

- All Public Officials Are Bound by This Oath 09012013 PDFDokument2 SeitenAll Public Officials Are Bound by This Oath 09012013 PDFuad812100% (1)

- The History of Abortion Legislation in the USA: Judicial History and Legislative ResponseVon EverandThe History of Abortion Legislation in the USA: Judicial History and Legislative ResponseNoch keine Bewertungen

- Learning Difficulties 1 - PrintableDokument20 SeitenLearning Difficulties 1 - PrintableNona AliNoch keine Bewertungen

- OMSC Learning Module on the Contemporary WorldDokument105 SeitenOMSC Learning Module on the Contemporary WorldVanessa EdaniolNoch keine Bewertungen

- Digital Transformation For A Sustainable Society in The 21st CenturyDokument186 SeitenDigital Transformation For A Sustainable Society in The 21st Centuryhadjar khalNoch keine Bewertungen

- CompeTank-En EEMUA CourseDokument6 SeitenCompeTank-En EEMUA CoursebacabacabacaNoch keine Bewertungen

- AF - Agri-Crop Production NC II 20151119 PDFDokument26 SeitenAF - Agri-Crop Production NC II 20151119 PDFFidel B. Diopita100% (7)

- Residency Overview 1020112Dokument3 SeitenResidency Overview 1020112edward_garrisNoch keine Bewertungen

- Costs of Educating Illegal AliensDokument21 SeitenCosts of Educating Illegal Aliensjedudley55Noch keine Bewertungen

- Running Head: TEXAS 1Dokument7 SeitenRunning Head: TEXAS 1Joe WesshNoch keine Bewertungen

- Dream ActDokument16 SeitenDream ActdavsebastianNoch keine Bewertungen

- Data On The UndocumentedDokument4 SeitenData On The UndocumentedChris SmithNoch keine Bewertungen

- Assignment 4Dokument9 SeitenAssignment 4api-665859469Noch keine Bewertungen

- DREAM Act: SummaryDokument2 SeitenDREAM Act: Summaryapi-31664123Noch keine Bewertungen

- Moot Court Case For Duke UploadDokument26 SeitenMoot Court Case For Duke UploadMatt Peterson100% (1)

- Jacintaluster Publicpolicy 12 4 2015Dokument10 SeitenJacintaluster Publicpolicy 12 4 2015api-312904099Noch keine Bewertungen

- Washington State Higher Ed Residency AffidavitDokument2 SeitenWashington State Higher Ed Residency AffidavitAdam GlassnerNoch keine Bewertungen

- The ACHIEVE Act of 2012: Facts AboutDokument5 SeitenThe ACHIEVE Act of 2012: Facts Aboutdon_lysterNoch keine Bewertungen

- Dream Correcting Myths MisperceptionsDokument3 SeitenDream Correcting Myths Misperceptionsapi-31664123Noch keine Bewertungen

- How The Development, Relief, and Education For Alien Minors Act Would Strengthen and Expand The American Middle ClassDokument7 SeitenHow The Development, Relief, and Education For Alien Minors Act Would Strengthen and Expand The American Middle ClassDrum Major InstituteNoch keine Bewertungen

- Patrick Clowney - Rogerian Argument RevisedDokument6 SeitenPatrick Clowney - Rogerian Argument Revisedapi-316945855Noch keine Bewertungen

- Thesis For Dream ActDokument8 SeitenThesis For Dream Actkbmbwubaf100% (2)

- Bishop Elizondo and Bishop Vann's Letter To The U.S. GovernmentDokument3 SeitenBishop Elizondo and Bishop Vann's Letter To The U.S. GovernmentNational Catholic ReporterNoch keine Bewertungen

- After DOMA: ImmigrationDokument4 SeitenAfter DOMA: ImmigrationImmigration EqualityNoch keine Bewertungen

- Edld 8431 Case ReviewDokument5 SeitenEdld 8431 Case Reviewapi-300152579Noch keine Bewertungen

- Comment On New DHS RuleDokument8 SeitenComment On New DHS RuleFederation for American Immigration ReformNoch keine Bewertungen

- Redstynes 4Dokument1 SeiteRedstynes 4api-302976636Noch keine Bewertungen

- Fifth Circuit Opinion in Texas Hazlewood Act CaseDokument21 SeitenFifth Circuit Opinion in Texas Hazlewood Act CaselanashadwickNoch keine Bewertungen

- Summary of H.R. 4321: Comprehensive Immigration Reform For America's Security and ProsperityDokument14 SeitenSummary of H.R. 4321: Comprehensive Immigration Reform For America's Security and ProsperityJayNoch keine Bewertungen

- Freedom U Policy Report May 13 2016Dokument3 SeitenFreedom U Policy Report May 13 2016api-97481499Noch keine Bewertungen

- Art XIV and XV CasesDokument3 SeitenArt XIV and XV CasesAnnievin HawkNoch keine Bewertungen

- Student Registration Guidance 082610 FINAL 1Dokument7 SeitenStudent Registration Guidance 082610 FINAL 1rkarlinNoch keine Bewertungen

- MemoDokument7 SeitenMemokatia balbaNoch keine Bewertungen

- AdvantagesDokument5 SeitenAdvantagesLea AndresanNoch keine Bewertungen

- Got Id Texas?: 2013 Constituional Ballot GuideDokument3 SeitenGot Id Texas?: 2013 Constituional Ballot GuideProgressTXNoch keine Bewertungen

- Progress Texas 2013 Constitutional Amendment Ballot GuideDokument4 SeitenProgress Texas 2013 Constitutional Amendment Ballot GuideProgressTXNoch keine Bewertungen

- Social Security Fairness For Public EmployeesDokument2 SeitenSocial Security Fairness For Public EmployeesScott CobbNoch keine Bewertungen

- SB170 Tuition EquityDokument4 SeitenSB170 Tuition EquitySenRomerNoch keine Bewertungen

- Counseling Asset Information Flyer Bil 110114Dokument4 SeitenCounseling Asset Information Flyer Bil 110114api-240756317Noch keine Bewertungen

- Planned Parenthood Vs Texas Right To Life Temporary Restraining Order RequestDokument38 SeitenPlanned Parenthood Vs Texas Right To Life Temporary Restraining Order RequestCBS Austin WebteamNoch keine Bewertungen

- ResearchpalomaDokument5 SeitenResearchpalomaapi-324153383Noch keine Bewertungen

- DREAM ActDokument1 SeiteDREAM ActSabine K AugustinNoch keine Bewertungen

- PLBA 1500 - Assignment #2Dokument6 SeitenPLBA 1500 - Assignment #2damevalencia817Noch keine Bewertungen

- Vaughan Work Permits 2 16Dokument3 SeitenVaughan Work Permits 2 16John HinderakerNoch keine Bewertungen

- State of Colorado: First Regular Session Sixty-Eighth General AssemblyDokument5 SeitenState of Colorado: First Regular Session Sixty-Eighth General AssemblyEthan AxelrodNoch keine Bewertungen

- Citizenship 2 1 ReviewDokument5 SeitenCitizenship 2 1 Reviewapi-328061525Noch keine Bewertungen

- Understanding Proposed Changes To The H-1B Visa: Protecting American Government Interests, Improving The Opportunities For American Companies, or Potentially Hurting Hopeful Immigrants?Dokument11 SeitenUnderstanding Proposed Changes To The H-1B Visa: Protecting American Government Interests, Improving The Opportunities For American Companies, or Potentially Hurting Hopeful Immigrants?don_h_manzanoNoch keine Bewertungen

- NAFCON Deferred Action Dream Act Primer August 2012Dokument5 SeitenNAFCON Deferred Action Dream Act Primer August 2012bayanusapnwNoch keine Bewertungen

- 2013 Legislative UpdateDokument5 Seiten2013 Legislative Updatethe kingfishNoch keine Bewertungen

- Eng 112 2Dokument3 SeitenEng 112 2api-278553444Noch keine Bewertungen

- Dream Act Term PaperDokument5 SeitenDream Act Term Paperc5r3aep1100% (1)

- The RAISE Act: President Donald Trump's Immigration Reform PlanDokument1 SeiteThe RAISE Act: President Donald Trump's Immigration Reform PlanHunt and Associates, PCNoch keine Bewertungen

- Menendez CIR Act of 2010 - Short SummaryDokument3 SeitenMenendez CIR Act of 2010 - Short SummaryCarlos GalindoNoch keine Bewertungen

- Immigration Paper Socw 410Dokument7 SeitenImmigration Paper Socw 410api-499859050Noch keine Bewertungen

- State Interest: A Broad Term For Any Matter of Public Concern That Is Addressed by A Government in Law or PolicyDokument1 SeiteState Interest: A Broad Term For Any Matter of Public Concern That Is Addressed by A Government in Law or PolicyYnel MadrigalNoch keine Bewertungen

- Social Security Fairness Public EmployeesDokument1 SeiteSocial Security Fairness Public EmployeesScott CobbNoch keine Bewertungen

- Martinez v. Bynum, 461 U.S. 321 (1983)Dokument27 SeitenMartinez v. Bynum, 461 U.S. 321 (1983)Scribd Government DocsNoch keine Bewertungen

- Badminton Ranking SystemDokument10 SeitenBadminton Ranking SystemdaudinhanNoch keine Bewertungen

- BlogOpera ACM AIME2010Dokument4 SeitenBlogOpera ACM AIME2010daudinhanNoch keine Bewertungen

- 2014 BinhAn ChatVoiCoQuanDokument8 Seiten2014 BinhAn ChatVoiCoQuandaudinhanNoch keine Bewertungen

- BWF Video ClipsDokument4 SeitenBWF Video ClipsdaudinhanNoch keine Bewertungen

- SaigonBusRoute 150Dokument1 SeiteSaigonBusRoute 150daudinhanNoch keine Bewertungen

- TotNghiepTrungHocOTexas - 19 TAC Chapter 74 Subchapter GDokument15 SeitenTotNghiepTrungHocOTexas - 19 TAC Chapter 74 Subchapter GdaudinhanNoch keine Bewertungen

- BWF Handbook II (2010 & 2011)Dokument252 SeitenBWF Handbook II (2010 & 2011)fidy92100% (2)

- Laws of Badminton June 18 2010Dokument10 SeitenLaws of Badminton June 18 2010samaraveeraNoch keine Bewertungen

- PSAT InterpretingDokument1 SeitePSAT InterpretingdaudinhanNoch keine Bewertungen

- Blogopera ScienceOlympiad2011Dokument4 SeitenBlogopera ScienceOlympiad2011daudinhanNoch keine Bewertungen

- TotNghiepTrungHocOTexas - 19 TAC Chapter 74 Subchapter FDokument14 SeitenTotNghiepTrungHocOTexas - 19 TAC Chapter 74 Subchapter FdaudinhanNoch keine Bewertungen

- SampleDokument8 SeitenSampleehrkrtevNoch keine Bewertungen

- Blogopera ACM1012 2010statisticsDokument2 SeitenBlogopera ACM1012 2010statisticsdaudinhanNoch keine Bewertungen

- Blogopera Acm Usamo2010Dokument2 SeitenBlogopera Acm Usamo2010daudinhanNoch keine Bewertungen

- Stanford Achievement Test, Ninth Edition: Sample Questions For The Stanford 9Dokument7 SeitenStanford Achievement Test, Ninth Edition: Sample Questions For The Stanford 9Franco RodriguezNoch keine Bewertungen

- My Mother Poem - Binh AnDokument2 SeitenMy Mother Poem - Binh AndaudinhanNoch keine Bewertungen

- StanfordAchievementTest10 StudentReportDokument1 SeiteStanfordAchievementTest10 StudentReportdaudinhanNoch keine Bewertungen

- StanfordAchievementTest OnlineBrochureDokument2 SeitenStanfordAchievementTest OnlineBrochuredaudinhanNoch keine Bewertungen

- Usa Amc - 10 2010 43Dokument8 SeitenUsa Amc - 10 2010 43yiweiwNoch keine Bewertungen

- StanfordAchievementTest10 - InterpretingStudentReportDokument36 SeitenStanfordAchievementTest10 - InterpretingStudentReportdaudinhanNoch keine Bewertungen

- Ket Qua Thi ACM10Dokument2 SeitenKet Qua Thi ACM10daudinhanNoch keine Bewertungen

- DuHocSinhDongTienNhuLocalStudents TAMU NonResidentDokument1 SeiteDuHocSinhDongTienNhuLocalStudents TAMU NonResidentdaudinhanNoch keine Bewertungen

- DuHocSinhDongTienNhuLocalStudents TAMU ResidentDokument1 SeiteDuHocSinhDongTienNhuLocalStudents TAMU ResidentdaudinhanNoch keine Bewertungen

- DuHocSinhDongTienNhuLocalStudents CoreResidencyQuestions2011Dokument8 SeitenDuHocSinhDongTienNhuLocalStudents CoreResidencyQuestions2011daudinhanNoch keine Bewertungen

- Coordinating Board: Texas Higher EducationDokument16 SeitenCoordinating Board: Texas Higher EducationdaudinhanNoch keine Bewertungen

- Affidavit Senate Bill 1528Dokument1 SeiteAffidavit Senate Bill 1528daudinhanNoch keine Bewertungen

- DuHocSinhDongTienNhuLocalStudents TexasResidencyRulesDokument13 SeitenDuHocSinhDongTienNhuLocalStudents TexasResidencyRulesdaudinhanNoch keine Bewertungen

- Proceedings of ICVL 2016 (ISSN 1844-8933, ISI Proceedings)Dokument416 SeitenProceedings of ICVL 2016 (ISSN 1844-8933, ISI Proceedings)Marin VladaNoch keine Bewertungen

- PHL 232 Tutorial Notes For Feb 26Dokument4 SeitenPHL 232 Tutorial Notes For Feb 26Scott WalshNoch keine Bewertungen

- The Snowy Day - Lesson Plan EditedDokument5 SeitenThe Snowy Day - Lesson Plan Editedapi-242586984Noch keine Bewertungen

- Andrew Burton Resume1Dokument2 SeitenAndrew Burton Resume1api-113889454Noch keine Bewertungen

- Предметно-интегрированное обучение (Clil: Content And Language Integrated Learning) английскому языку на основе применения дистанционных образовательных технологийDokument45 SeitenПредметно-интегрированное обучение (Clil: Content And Language Integrated Learning) английскому языку на основе применения дистанционных образовательных технологийНазерке ЧабденоваNoch keine Bewertungen

- UNIT-4 Performance ManagenmentDokument17 SeitenUNIT-4 Performance Managenmentsahoo_pradipkumarNoch keine Bewertungen

- Luzande, Mary Christine B ELM-504 - Basic Concepts of Management Ethics and Social ResponsibilityDokument12 SeitenLuzande, Mary Christine B ELM-504 - Basic Concepts of Management Ethics and Social ResponsibilityMary Christine BatongbakalNoch keine Bewertungen

- Data Warehousing and Mining Lab ManualDokument96 SeitenData Warehousing and Mining Lab Manuals krishna raoNoch keine Bewertungen

- DETAILED LESSON PLAN IN MATHEMATICS 9 Week 8 Day 1Dokument10 SeitenDETAILED LESSON PLAN IN MATHEMATICS 9 Week 8 Day 1Jay Vincent QuintinitaNoch keine Bewertungen

- Housekeeping NC Ii Clean and Prepare Rooms For Incoming Guests (40 HOURS) Study GuideDokument3 SeitenHousekeeping NC Ii Clean and Prepare Rooms For Incoming Guests (40 HOURS) Study GuideSherwin Evangelista100% (1)

- Types of Learners EllDokument2 SeitenTypes of Learners Ellapi-571233054Noch keine Bewertungen

- DLL Epp6-Entrep q1 w3Dokument3 SeitenDLL Epp6-Entrep q1 w3Kristoffer Alcantara Rivera50% (2)

- Singapura Journal Final LastDokument8 SeitenSingapura Journal Final Lastapi-338954319Noch keine Bewertungen

- Sehrish Yasir2018ag2761-1-1-1Dokument97 SeitenSehrish Yasir2018ag2761-1-1-1Rehan AhmadNoch keine Bewertungen

- Luck or Hard Work?Dokument3 SeitenLuck or Hard Work?bey luNoch keine Bewertungen

- QMS - Iso 9001-2015 Lead AuditorDokument4 SeitenQMS - Iso 9001-2015 Lead AuditorSalehuddin Omar KamalNoch keine Bewertungen

- Contemporary Arts 12 q4 w8Dokument2 SeitenContemporary Arts 12 q4 w8fitz zamoraNoch keine Bewertungen

- Resume - CarlyDokument1 SeiteResume - Carlyapi-317491156Noch keine Bewertungen

- Savitribai Phule Pune University, Online Result PDFDokument1 SeiteSavitribai Phule Pune University, Online Result PDFshreyashNoch keine Bewertungen