Beruflich Dokumente

Kultur Dokumente

Petron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010

Hochgeladen von

idolbondocOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Petron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010

Hochgeladen von

idolbondocCopyright:

Verfügbare Formate

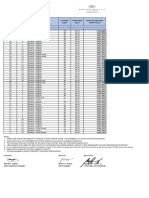

PETRON CORPORATION vs. COMMISSIONER OF INTERNAL REVENUE G.R. No.

180385 July 28, 2010 FACTS: A corporation engaged in the production of petroleum products, Petron is a Board of Investment (BOI) registered enterprise in accordance with the provisions of the Omnibus Investment Code. Pursuant to its undertaking under the aforesaid Deeds of Assignment, Petron issued Credit Notes (CNs) in an equivalent amount in favor of its assignors which, by themselves or thru their own assignees, used the same to avail of fuel products from the former. On the ground, however, that its use of TCCs issued to said grantees was invalid for being violative of Rule IX of the Rules and Regulations issued by the BOI to implement Presidential Decree No. 1789 and Batas Pambansa Blg. 391, Petron received a collection letter dated April 22, 1998 from the BIR Revenue District Office of South Makati, Metro Manila, demanding payment of the total amount ofP1,107,542,547.08 in unpaid taxes, surcharges and interests for the years 1993 to 1997. With the denial of its letters of protest to the foregoing collection letter, Petron perfected an appeal which was docketed as C.T.A. Case No. 5657 before the CTA. Upholding Petrons argument to the effect, among other matters, that its status as a BOI-registered enterprise and its transactions with the original grantees qualified it to be a transferee of the subject TCCs, the CTA rendered a decision dated July 23, 1999. With the denial of its motion for reconsideration of the foregoing decision for lack of merit in the CTA Second Divisions resolution dated November 23, 2006, Petron elevated the matter via the petition for review docketed before the CTA En Banc as CTA EB Case No. 238. On October 30, 2007, the CTA En Banc rendered the herein assailed decision, affirming the August 23, 2006 decision of the CTA Second Division, upon the following findings and conclusions, to wit: ISSUE: WHETHER THE COURT OF TAX APPEALS EN BANC COMMITTED GRAVE REVERSIBLE ERROR WHEN IT RULED THAT THE SUBSEQUENT CANCELLATION BY THE DOF CENTER OF THE TAX CREDIT CERTIFICATES PREVIOUSLY USED TO PAY PETRONS TAX LIABILITIES HAD THE EFFECT OF NON -PAYMENT OF PETRONS EXCISE TAXES ALLEGEDLY BECAUSE THE SUBSEQUENT CANCELLATION OF THE TCCs RESULTS IN NON-PAYMENT OF PETRONS EXCISE TAX LIABILITIES. HELD: In urging the reversal of the assailed Decision, Petron argues that, having been issued pursuant to Administrative Order No. 226 in relation to Executive Order No. 226, the subject TCCs were immediately effective and could be readily used by the grantees

and/or their transferees. Invoking this Courts ruling in the case of Pilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue to the effect, among other matters, that the post-audit of the TCCs was not meant as a suspensive condition for their validity but pertained only to computational discrepancies resulting from their transfer and utilization, Petron maintains that respondent failed to prove the fraud which purportedly attended the procurement of the subject TCCs. Against Petrons contention that its rights as a purchaser in good faith cannot be prejudiced even in the face of the Centers subsequent finding of fraud in the grant of the TCCs, the Office of the Solicitor General, in representation of respondent, argues that, the cancellation of the subject TCCs effectively avoided the payment of the excise tax liabilities of Petron which, as assignee, could not acquire rights better than the grantees-assignors. As correctly pointed out by Petron, however, the issue about the immediate validity of TCCs and the use thereof in payment of tax liabilities and duties are not matters of first impression for this Court. Taking into consideration the definition and nature of tax credits and TCCs, this Courts Second Division definitively ruled in the aforesaid Pilipinas Shell case that the post audit is not a suspensive condition for the validity of TCCs. The foregoing guidelines cannot be clearer on the validity and effectivity of the TCC to pay or settle tax liabilities of the grantee or transferee, as they do not make the effectivity and validity of the TCC dependent on the outcome of a postaudit. In fact, if we are to sustain the appellate tax court, it would be absurd to make the effectivity of the payment of a TCC dependent on a post-audit since there is no contemplation of the situation wherein there is no post-audit. Does the payment made become effective if no post-audit is conducted? Or does the so-called suspensive condition still apply as no law, rule, or regulation specifies a period when a post-audit should or could be conducted with a prescriptive period? Clearly, a tax payment through a TCC cannot be both effective when made and dependent on a future event for its effectivity. Our system of laws and procedures abhors ambiguity. Moreover, if the TCCs are considered to be subject to post-audit as a suspensive condition, the very purpose of the TCC would be defeated as there would be no guarantee that the TCC would be honored by the government as payment for taxes. No investor would take the risk of utilizing TCCs if these were subject to a post-audit that may invalidate them, without prescribed grounds or limits as to the exercise of said post-audit. As for the government agency vested with the authority to cancel the subject TCCs, the ruling in the Pilipinas Shell is to the effect that, pursuant to Section 3 (a), (g) and (l) of AO 226, the Center has concurrent authority to do so alongside the BIR and the BOC. Given the nature of the TCCs immediate effectiveness and validity, however, said authority may only be exercised before the TCC has been fully utilized by a transferee which had no participation in the perpetration of fraud in the issuance, transfer and utilization thereof. Once accepted by the BIR and applied towards the satisfaction of such a tranferees tax obligations, a TCC is effectively used up, debited and canceled such that there is nothing left to avoid or to cancel anew. Considering the protection afforded to transferees in good faith and for value, it was held that the remedy of the Government is to go after the grantees alleged to have perpetrated fraud in the procurement of the subject TCCs.

Viewed in the light of the foregoing disquisition, respondent had no legal basis to once again assess the excise taxes Petron already paid with the use of the TCCs assigned in its favor, much less to impose the 25% late payment surcharge pursuant to Section 248 (A) of the National Internal Revenue Code of 1997 and the 20% interest provided under Section 249of the same Code. Admitted to have filed it tax returns in accordance with law, Petron was never questioned nor assessed for deficiency delinquency in the payment of its excise taxes from 1992 to 1997, thru the use of the TCCs assigned by the original grantees. In receipt of the November 15, 1999 Assessment subsequent to the Centers cancellation of the subject TCCs, Petron filed the petition for review docketed before the CTA Second Division as CTA Case No. 6136 as a consequence of respondents inaction on its protest. Although the August 23, 2006 adverse decision rendered in said case was affirmed in the herein assailed October 30, 2007 decision rendered in CTA EB No. 238, a reversal of said CTA En Banc decision would necessarily foreclose the factual and legal bases for respondents impugned Assessment.

Das könnte Ihnen auch gefallen

- JG Summit Holdings, Inc. vs. Court of Appeals, 345 SCRA 143, November 20, 2000Dokument2 SeitenJG Summit Holdings, Inc. vs. Court of Appeals, 345 SCRA 143, November 20, 2000idolbondocNoch keine Bewertungen

- La Chemise Lacoste, S.A. vs. Fernandez, 129 SCRA 373, May 21, 1984Dokument2 SeitenLa Chemise Lacoste, S.A. vs. Fernandez, 129 SCRA 373, May 21, 1984idolbondocNoch keine Bewertungen

- Case Digests Credit Transactions Dean AlbanoDokument24 SeitenCase Digests Credit Transactions Dean AlbanoMegan MateoNoch keine Bewertungen

- Phillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009Dokument2 SeitenPhillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009idolbondoc100% (1)

- JG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003Dokument2 SeitenJG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003idolbondocNoch keine Bewertungen

- Garcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991Dokument3 SeitenGarcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991idolbondocNoch keine Bewertungen

- LTD Midterm Exams by Dickbrown and CoDokument3 SeitenLTD Midterm Exams by Dickbrown and CoBrandon BeradNoch keine Bewertungen

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994Dokument2 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994idolbondocNoch keine Bewertungen

- UST GN 2011 Legal and Judicial Ethics Proper Index 4Dokument130 SeitenUST GN 2011 Legal and Judicial Ethics Proper Index 4Timmy HaliliNoch keine Bewertungen

- Indophil Textile Mill Workers Union vs. Calica, 205 SCRA 697, February 03, 1992Dokument2 SeitenIndophil Textile Mill Workers Union vs. Calica, 205 SCRA 697, February 03, 1992idolbondocNoch keine Bewertungen

- General Supply Company Profile Sample PDFDokument3 SeitenGeneral Supply Company Profile Sample PDFMohzin Km72% (25)

- Garcia vs. Board of Investments, 191 SCRA 288, November 09, 1990Dokument2 SeitenGarcia vs. Board of Investments, 191 SCRA 288, November 09, 1990idolbondocNoch keine Bewertungen

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994Dokument3 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994idolbondoc100% (1)

- John Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003Dokument3 SeitenJohn Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003idolbondocNoch keine Bewertungen

- Communication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996Dokument3 SeitenCommunication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996idolbondocNoch keine Bewertungen

- MR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002Dokument3 SeitenMR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002idolbondocNoch keine Bewertungen

- Buce v. CA, 332 SCRA 151 (2000)Dokument3 SeitenBuce v. CA, 332 SCRA 151 (2000)Fides DamascoNoch keine Bewertungen

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Dokument3 SeitenAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocNoch keine Bewertungen

- Telecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998Dokument2 SeitenTelecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998idolbondoc100% (1)

- Executive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006Dokument2 SeitenExecutive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006idolbondoc100% (1)

- Xyberspace ConsultingDokument4 SeitenXyberspace ConsultingAkshayNoch keine Bewertungen

- Goldenway vs. Manila Banking Corp. Case DigestDokument2 SeitenGoldenway vs. Manila Banking Corp. Case DigestHanna TevesNoch keine Bewertungen

- Pilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001Dokument2 SeitenPilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001idolbondoc100% (1)

- Panasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010Dokument2 SeitenPanasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010idolbondoc100% (1)

- Garcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989Dokument2 SeitenGarcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989idolbondocNoch keine Bewertungen

- 11 - City of Iloilo V Contreras Besana - VielDokument1 Seite11 - City of Iloilo V Contreras Besana - VielEvielyn MateoNoch keine Bewertungen

- Philippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010Dokument2 SeitenPhilippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010idolbondoc100% (1)

- Mar 11 Tax CasesDokument13 SeitenMar 11 Tax CasesMeg PalerNoch keine Bewertungen

- Laurel v. GarciaDokument2 SeitenLaurel v. Garciacatrina lobatonNoch keine Bewertungen

- 31-Sanchez v. Medicard G.R. No. 141525 September 2, 2005Dokument3 Seiten31-Sanchez v. Medicard G.R. No. 141525 September 2, 2005Jopan SJNoch keine Bewertungen

- Valmonte v. de Villa, (G.R. No. 83988 September 29, 1989)Dokument2 SeitenValmonte v. de Villa, (G.R. No. 83988 September 29, 1989)Ei BinNoch keine Bewertungen

- Bicerra vs. TenezaDokument1 SeiteBicerra vs. TenezaLorenzo HammerNoch keine Bewertungen

- Agrarian Law (Sps. Endaya, Et. Al. vs. CA Digest)Dokument8 SeitenAgrarian Law (Sps. Endaya, Et. Al. vs. CA Digest)Maestro LazaroNoch keine Bewertungen

- Reyes V TuparanDokument2 SeitenReyes V TuparanAgnes FranciscoNoch keine Bewertungen

- Reviewer Property Jillian GandingcoDokument14 SeitenReviewer Property Jillian GandingcoDebbie YrreverreNoch keine Bewertungen

- Petron Corporation V CIRDokument2 SeitenPetron Corporation V CIRiciamadarangNoch keine Bewertungen

- Case Digest-Morisono v. Morisono and LCRDokument2 SeitenCase Digest-Morisono v. Morisono and LCRAllanNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005Dokument2 SeitenCommissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005idolbondocNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Dokument4 SeitenCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNoch keine Bewertungen

- G.R. No. L-50466 May 31, 1982 CALTEX (PHILIPPINES) INC., Petitioner, Central Board of Assessment Appeals and City Assessor of PASAY, RespondentsDokument1 SeiteG.R. No. L-50466 May 31, 1982 CALTEX (PHILIPPINES) INC., Petitioner, Central Board of Assessment Appeals and City Assessor of PASAY, RespondentsLorenzo HammerNoch keine Bewertungen

- No 1Dokument1 SeiteNo 1April Grace PonceNoch keine Bewertungen

- Digest PeopleVCarmenDokument2 SeitenDigest PeopleVCarmenJappy AlonNoch keine Bewertungen

- CENAS Vs SantosDokument1 SeiteCENAS Vs SantosJL A H-DimaculanganNoch keine Bewertungen

- Filinvest Vs AdiaDokument4 SeitenFilinvest Vs AdiajessapuerinNoch keine Bewertungen

- Gender and The Economic Crisis in Europe: Politics, Institutions and IntersectionalityDokument290 SeitenGender and The Economic Crisis in Europe: Politics, Institutions and IntersectionalitynoizatuNoch keine Bewertungen

- Documentary Evidence - Ulep v. DucatDokument2 SeitenDocumentary Evidence - Ulep v. DucatDanielle DacuanNoch keine Bewertungen

- Department of Education Culture and Sports Now Department of Education Et Al V Heirs of Regino Banguilan Et AlDokument4 SeitenDepartment of Education Culture and Sports Now Department of Education Et Al V Heirs of Regino Banguilan Et AlSanjeev J. SangerNoch keine Bewertungen

- 20.-Mclaughlin V CADokument2 Seiten20.-Mclaughlin V CAFender BoyangNoch keine Bewertungen

- Sales Case Digest Batch 2Dokument14 SeitenSales Case Digest Batch 2FG FG0% (1)

- The New Code of Judicial Conduct For The Philippine JudiciaryDokument3 SeitenThe New Code of Judicial Conduct For The Philippine JudiciarycharryohNoch keine Bewertungen

- Tropical Homes V VillaluzDokument2 SeitenTropical Homes V VillaluzMitchell YumulNoch keine Bewertungen

- Pilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007Dokument6 SeitenPilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007idolbondocNoch keine Bewertungen

- Pilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007Dokument6 SeitenPilipinas Shell Petroleum Corporation vs. Commissioner of Internal Revenue, 541 SCRA 316, December 21, 2007idolbondocNoch keine Bewertungen

- Heirs of Franco and SB DigestsDokument4 SeitenHeirs of Franco and SB DigestsWonder WomanNoch keine Bewertungen

- Torrevillas Vs Judge NavidadDokument2 SeitenTorrevillas Vs Judge NavidadAngela De LeonNoch keine Bewertungen

- Velarde Vs CA RulingsDokument2 SeitenVelarde Vs CA RulingsM Azeneth JJNoch keine Bewertungen

- 105 - Spouses Certeza v. Philippine Savings Bank (G.R. No. 190078 - Mar 5, 2010)Dokument1 Seite105 - Spouses Certeza v. Philippine Savings Bank (G.R. No. 190078 - Mar 5, 2010)attymaryjoyordanezaNoch keine Bewertungen

- Land Bank Vs Alfredo Hababag Sr.Dokument5 SeitenLand Bank Vs Alfredo Hababag Sr.Johney DoeNoch keine Bewertungen

- Estate of Pedro Gonzales v. Marcus PerezDokument5 SeitenEstate of Pedro Gonzales v. Marcus PerezEnna TrivilegioNoch keine Bewertungen

- CIR vs. CA, G.R. No. 115349, April 18, 1997Dokument1 SeiteCIR vs. CA, G.R. No. 115349, April 18, 1997Alan GultiaNoch keine Bewertungen

- G.R. No. 208162 - Fuentes Vs SenateDokument32 SeitenG.R. No. 208162 - Fuentes Vs SenateAlfred Robert BabasoroNoch keine Bewertungen

- 5suntay V KeyserDokument2 Seiten5suntay V KeyserTristan HaoNoch keine Bewertungen

- Isidro V CADokument1 SeiteIsidro V CAbhieng062002Noch keine Bewertungen

- 5.3 People Vs Bagnate - 133685-86Dokument13 Seiten5.3 People Vs Bagnate - 133685-86JennyNoch keine Bewertungen

- GR No 102342 Luz M Zaldivia V Hon Andres B Reyes JRDokument3 SeitenGR No 102342 Luz M Zaldivia V Hon Andres B Reyes JREcnerolAicnelavNoch keine Bewertungen

- Executive Order No 79Dokument9 SeitenExecutive Order No 79Ivy KatrinaNoch keine Bewertungen

- Admin - V - 3. Smart and Piltel Vs NTC GR No. 151908Dokument2 SeitenAdmin - V - 3. Smart and Piltel Vs NTC GR No. 151908Ervin Franz Mayor CuevillasNoch keine Bewertungen

- Civil Procedure CasesDokument6 SeitenCivil Procedure CasesFeBrluadoNoch keine Bewertungen

- CALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentsDokument5 SeitenCALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentspatrickNoch keine Bewertungen

- Samaneigo V FerrerDokument2 SeitenSamaneigo V FerrerSachuzenNoch keine Bewertungen

- De Guia Case - TortsDokument4 SeitenDe Guia Case - TortsvictoriaNoch keine Bewertungen

- Enriquez Vs People Agullo Vs PeopleDokument34 SeitenEnriquez Vs People Agullo Vs PeopleDiane PachaoNoch keine Bewertungen

- Oblicon Case 01 - de Guiya v. Manila Electric Co - DigestDokument2 SeitenOblicon Case 01 - de Guiya v. Manila Electric Co - DigestMichaelVillalonNoch keine Bewertungen

- Fabia Vs IACDokument2 SeitenFabia Vs IACMTCDNoch keine Bewertungen

- 24 - Universal Food Corporation Vs CA, 33 Scra 1Dokument7 Seiten24 - Universal Food Corporation Vs CA, 33 Scra 1R.A. GregorioNoch keine Bewertungen

- Tuzon V CA - CMDokument3 SeitenTuzon V CA - CMjustinegalangNoch keine Bewertungen

- Santiago SyjucoDokument2 SeitenSantiago SyjucoWes ChanNoch keine Bewertungen

- People V Tan 286 SCRA 207Dokument2 SeitenPeople V Tan 286 SCRA 207istefifayNoch keine Bewertungen

- Cases For Rule 44 Section 13Dokument96 SeitenCases For Rule 44 Section 13Kristina Bonsol AndalNoch keine Bewertungen

- Rule 115 - 117 Criminal ProcedureDokument2 SeitenRule 115 - 117 Criminal ProcedureCalzado Per-ciNoch keine Bewertungen

- Busilac Builders, Inc V Judge Charles AguilarDokument2 SeitenBusilac Builders, Inc V Judge Charles AguilarMidzmar KulaniNoch keine Bewertungen

- PNB v. MaranonDokument2 SeitenPNB v. MaranonEvan Michael ClerigoNoch keine Bewertungen

- 08.) Mindanao Bus Co v. City Assessor - PropertyDokument1 Seite08.) Mindanao Bus Co v. City Assessor - Property123abc456defNoch keine Bewertungen

- Some Jurisprudence On Alternative Dispute ResolutionDokument13 SeitenSome Jurisprudence On Alternative Dispute ResolutionmastaacaNoch keine Bewertungen

- Petron Vs CIR - SibalaDokument8 SeitenPetron Vs CIR - SibalaRhea Mae A. SibalaNoch keine Bewertungen

- Schmid & Oberly, Inc. vs. RJL Martinez Fishing Corp., 166 SCRA 493, October 18, 1988Dokument3 SeitenSchmid & Oberly, Inc. vs. RJL Martinez Fishing Corp., 166 SCRA 493, October 18, 1988idolbondocNoch keine Bewertungen

- Vinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000Dokument4 SeitenVinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000idolbondocNoch keine Bewertungen

- National Economic Protectionism Association vs. Ongpin, 171 SCRA 657, April 10, 1989Dokument2 SeitenNational Economic Protectionism Association vs. Ongpin, 171 SCRA 657, April 10, 1989idolbondocNoch keine Bewertungen

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996Dokument3 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996idolbondocNoch keine Bewertungen

- Garcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007Dokument3 SeitenGarcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007idolbondocNoch keine Bewertungen

- Reviwer Consti IDokument100 SeitenReviwer Consti IidolbondocNoch keine Bewertungen

- Lecturer: Idol L. Bondoc, M.D.,R.NDokument58 SeitenLecturer: Idol L. Bondoc, M.D.,R.NidolbondocNoch keine Bewertungen

- Oncology: Lecturer: Idol L. Bondoc, M.D.,M.A.NDokument76 SeitenOncology: Lecturer: Idol L. Bondoc, M.D.,M.A.NidolbondocNoch keine Bewertungen

- 8316P074-100-240 - Asco - Valve - Galco Industrial ElectronicsDokument3 Seiten8316P074-100-240 - Asco - Valve - Galco Industrial ElectronicsemusimaNoch keine Bewertungen

- Catalog CV Cipta Abadi 2022Dokument61 SeitenCatalog CV Cipta Abadi 2022EMPAT ANUGERAH SYUKUR ,PTNoch keine Bewertungen

- Invoice 1706766867Dokument3 SeitenInvoice 1706766867gmbeverywhere21Noch keine Bewertungen

- Koala PatternDokument5 SeitenKoala PatterngersendehamoirNoch keine Bewertungen

- Mechanical Equipments Unit 2Dokument22 SeitenMechanical Equipments Unit 2ISHAN BAGCHINoch keine Bewertungen

- Brand RevitalizationDokument16 SeitenBrand RevitalizationAmar PatroNoch keine Bewertungen

- 7479Dokument1 Seite7479Prakash RajNoch keine Bewertungen

- Materi Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraDokument37 SeitenMateri Webinar SA 500 Bukti Audit - Audit Berbasis ISA Studi Kasus Di Indonesia, Australia, Dan SingapuraIkhsan Uiandra Putra SitorusNoch keine Bewertungen

- Shop Layout Management IM 1 PDFDokument125 SeitenShop Layout Management IM 1 PDFMark DelacruzNoch keine Bewertungen

- 3 - Least-Cost or Optimal Input Combinations - ReadyDokument14 Seiten3 - Least-Cost or Optimal Input Combinations - ReadyharidhraNoch keine Bewertungen

- Introduction To Operations Research 10th Edition Hillier Test BankDokument36 SeitenIntroduction To Operations Research 10th Edition Hillier Test Bankdorothy100% (14)

- Tender No MSMCCOAL202001Dokument61 SeitenTender No MSMCCOAL202001Frianata ZrNoch keine Bewertungen

- Poa T - 3Dokument2 SeitenPoa T - 3SHEVENA A/P VIJIANNoch keine Bewertungen

- Henry: Understanding Strategic Management: Chapter 3: The Competitive EnvironmentDokument21 SeitenHenry: Understanding Strategic Management: Chapter 3: The Competitive EnvironmentMarwa HassanNoch keine Bewertungen

- Exchange Rates - List of Foreign Currency Rates TodayDokument2 SeitenExchange Rates - List of Foreign Currency Rates TodayHasan Bin AliNoch keine Bewertungen

- Chapter 2 - Purchase ManagementDokument19 SeitenChapter 2 - Purchase ManagementTehseen Baloch100% (2)

- The Fashion Rack - FinalDokument17 SeitenThe Fashion Rack - FinalAyanna CameroNoch keine Bewertungen

- Quote US105785Dokument4 SeitenQuote US105785Yamydal Bog-aconNoch keine Bewertungen

- Unit2 Study GuideDokument3 SeitenUnit2 Study Guide高瑞韩Noch keine Bewertungen

- PMSJ Pricelist - HDMF 1Dokument1 SeitePMSJ Pricelist - HDMF 1Ren Irene MacatangayNoch keine Bewertungen

- SQ00001544 SICIM RFQ SA010-MR-005 REV.A MANUAL BALL VALVES - UnpricedDokument4 SeitenSQ00001544 SICIM RFQ SA010-MR-005 REV.A MANUAL BALL VALVES - UnpricedMohamed Wasim ShaikhNoch keine Bewertungen

- JP Morgan Global Manufacturing PMI-Dec 2022Dokument3 SeitenJP Morgan Global Manufacturing PMI-Dec 2022MiteshNoch keine Bewertungen

- Citizen's Charter: Metro Cotabato Water DistrictDokument44 SeitenCitizen's Charter: Metro Cotabato Water DistrictMaddie SyNoch keine Bewertungen

- Accouts ReceivableDokument2 SeitenAccouts Receivablerhysakhil catamponganNoch keine Bewertungen

- Priručnik o Rasadničarskoj Proizvodnji HR2Dokument42 SeitenPriručnik o Rasadničarskoj Proizvodnji HR2Milan LazarevicNoch keine Bewertungen

- PostsocialismDokument7 SeitenPostsocialismPavel NedelcuNoch keine Bewertungen

- ENG DS 2359240-1 Seacon-Mss 0220Dokument20 SeitenENG DS 2359240-1 Seacon-Mss 0220quanNoch keine Bewertungen