Beruflich Dokumente

Kultur Dokumente

Pilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001

Hochgeladen von

idolbondocOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pilipinas Kao, Inc. vs. Court of Appeals, 372 SCRA 548, December 18, 2001

Hochgeladen von

idolbondocCopyright:

Verfügbare Formate

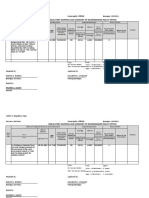

PILIPINAS KAO, INC. vs. HONORABLE COURT OF APPEALS G.R. No. 105014.

December 18, 2001 FACTS: Pilipinas Kao, Inc. is a corporation organized and existing under the laws of the Philippines with principal office at 108-A E. Rodriguez, Jr. Avenue, Libis, Quezon City. Each project is entitled to a certain set of incentives depending upon, among others, the law of registration and the status and type of registration. The present controversy refers only to the tax incentives provided for under Article 48 of P.D. No. 1789, as amended by B.P. Blg. 391. On July 27, 1990, respondent denied petitioners request for reconsideration anent its 1988 tax credit, the denial being communicated to petitioner in a letter dated August 1, 1990 (annex 11, Comment) and received by the latter on August 15, 1990. On December 17, 1990, petitioner again moved for reconsideration of respondents letter dated August 1, 1990 (Annex 12, Comment), but the same was denied by respondent in a letter dated March 11, 1991 (copy of which was received by petitioner on March 15, 1991). (Annex 13, Comment) On March 11, 1991, respondent also advised petitioner of the approval of its application for the year 1989 tax credit but only in the following reduced amounts. Because of the failure of respondent BOI to resolved the issues, petitioner again asked for reconsideration by a Letter dated December 17, 1990,[9] reiterating that the use of the base figure defeated the very purpose of the law which was to encourage private domestic and foreign investment and reward performance contributing to economic development. Further, that the use of the highest attained production in the three (3) years preceding the expansion as base figure in effect penalized petitioner for its efficiency. Denying petitioners last request in the same cavalier fashion, respondent BOI simply informed it that the Board in its meeting of March 5, 1991 denied your request for reconsideration of your NLC/NVE tax credit application for 1988.[10] In the same Letter of March 11, 1991, respondent BOI informed petitioner that its application for 1989 NLC/NVE tax credit had been approved in reduced amount stated therein, again without any explanation for the reduction. This letter is supposed to be the decision of the BOI on the matter. ISSUE: Whether BOI rendered a decision within the meaning of its own rules which requires that the decision in a contested case shall be in writing and shall state clearly and distinctly the facts and the law on which it is based.

HELD: In the context of what the law and its own rules prescribe, as well as our applicable pronouncements, the BOI Resolution of May 10, 1990, as well as its Letters of August 1, 1990 and March 11, 1991 did not qualify as decision, absent a clear and distinct statement of the facts and the law to support the action. Lacking the essential attribute of a decision, the acts in question were at best interlocutory orders that did not attain finality nor acquire the effects of a final judgment despite the lapse of the statutory period of appeal. Thus, the element of time relied upon by respondents does not bar our inquiry into the substantive merits of the petition, and that respondent court erred in considering the petition for review filed out of time. While BOI should first resolve the merits of the case in the proper exercise of its primary jurisdiction, we shall nevertheless proceed with this review for procedural expediency and consideration of public interest involved in the questions before us which bear on the certainty and stability of economic policies an proper implementation thereof. For it cannot be denied that inappropriate and irresolute implementation of our investment incentive laws detracts from the very purpose of these laws. The essential fact which gave rise to the substantive issue resolved by respondent court and which is now before this Court are not disputed.

Das könnte Ihnen auch gefallen

- BOI Tax Credit Decision RequirementsDokument1 SeiteBOI Tax Credit Decision RequirementsHenteLAWcoNoch keine Bewertungen

- Miranda vs. Carreon, Et. AlDokument3 SeitenMiranda vs. Carreon, Et. AlAnonymous 8SgE99100% (1)

- Spouses Sebastian V BPI FamilyDokument3 SeitenSpouses Sebastian V BPI FamilyLiamJosephNoch keine Bewertungen

- 9-China Bank Vs Ortega-FementiraDokument12 Seiten9-China Bank Vs Ortega-FementiraCarmelo Jay LatorreNoch keine Bewertungen

- 10 Oropeza V Allied BankDokument4 Seiten10 Oropeza V Allied BankmeriiNoch keine Bewertungen

- Public Interest vs. ElmaDokument1 SeitePublic Interest vs. ElmaCzarina Lea D. MoradoNoch keine Bewertungen

- Siquion Reyna Montecillo and Ongsiako Law Office Vs Chinlo-SiaDokument16 SeitenSiquion Reyna Montecillo and Ongsiako Law Office Vs Chinlo-Sia8111 aaa 1118Noch keine Bewertungen

- Cathay Pacific Vs JudgeDokument2 SeitenCathay Pacific Vs JudgeKaren YlayaNoch keine Bewertungen

- 186 Aguinaldo V Sandiganbayan (Panganiban)Dokument2 Seiten186 Aguinaldo V Sandiganbayan (Panganiban)Cy PanganibanNoch keine Bewertungen

- Ang Yu Asuncion Vs CA G.R. No. 109125Dokument6 SeitenAng Yu Asuncion Vs CA G.R. No. 109125ulticonNoch keine Bewertungen

- 62 NPC Vs LucmanDokument3 Seiten62 NPC Vs Lucmaniamlucy88Noch keine Bewertungen

- Towers Assurance Corporation vs. Ororama Supermart: Lower court erred in issuing writ of execution against surety without notice and hearingDokument2 SeitenTowers Assurance Corporation vs. Ororama Supermart: Lower court erred in issuing writ of execution against surety without notice and hearingJude ChicanoNoch keine Bewertungen

- PEOPLE VS VIDUYA - Docx Rights of Suspect Under Custoil Investigation Right To CounselDokument2 SeitenPEOPLE VS VIDUYA - Docx Rights of Suspect Under Custoil Investigation Right To CounselLuiza CapangyarihanNoch keine Bewertungen

- Tecson vs. SalasDokument13 SeitenTecson vs. SalasoliveNoch keine Bewertungen

- Leonardo Vs CA DigestDokument3 SeitenLeonardo Vs CA Digestcarlos codizalNoch keine Bewertungen

- 5 and 10Dokument4 Seiten5 and 10ambahomoNoch keine Bewertungen

- Pilipinas Kao Inc. vs. CADokument3 SeitenPilipinas Kao Inc. vs. CAQueenie BoadoNoch keine Bewertungen

- Bouncing Checks Law ExplainedDokument8 SeitenBouncing Checks Law ExplainedPamela Jean CuyaNoch keine Bewertungen

- AVERIA v. AVERIADokument2 SeitenAVERIA v. AVERIAJustineNoch keine Bewertungen

- Supreme Court of the Philippines rules no obligation for Central BankDokument2 SeitenSupreme Court of the Philippines rules no obligation for Central BankSheryl CortesNoch keine Bewertungen

- Land Titles Block Digest Case SummariesDokument3 SeitenLand Titles Block Digest Case SummariesJoshua Daniel BelmonteNoch keine Bewertungen

- People vs. Dante TanDokument1 SeitePeople vs. Dante TanCecile FederizoNoch keine Bewertungen

- Netlink vs. DelmoDokument3 SeitenNetlink vs. DelmoPrince Mojal InfanteNoch keine Bewertungen

- Floreindo v. Metrobank on MutualityDokument1 SeiteFloreindo v. Metrobank on MutualitySarah Jane UsopNoch keine Bewertungen

- 14 SANICO vs. COLIPANODokument9 Seiten14 SANICO vs. COLIPANORonnie Garcia Del RosarioNoch keine Bewertungen

- PNB V Lopez VitoDokument3 SeitenPNB V Lopez VitomisterdodiNoch keine Bewertungen

- Civil Procedure CasesDokument6 SeitenCivil Procedure CasesFeBrluadoNoch keine Bewertungen

- Facts: On February 4, 1977, Then President Ferdinand E. Marcos Issued PresidentialDokument7 SeitenFacts: On February 4, 1977, Then President Ferdinand E. Marcos Issued PresidentialAbigail DeeNoch keine Bewertungen

- G.R. No. 142411 CASE TITLE: Ursal vs. Court of Appeals, Et Al October 14, 2005 FactsDokument1 SeiteG.R. No. 142411 CASE TITLE: Ursal vs. Court of Appeals, Et Al October 14, 2005 FactsadorableperezNoch keine Bewertungen

- City of Tanauan v. MillonteDokument2 SeitenCity of Tanauan v. MillonteJay jogsNoch keine Bewertungen

- Anglo Fil vs. Lazaro DigestDokument1 SeiteAnglo Fil vs. Lazaro DigestJayson Lloyd P. MaquilanNoch keine Bewertungen

- Rights and Duties of Agents and PrincipalsDokument4 SeitenRights and Duties of Agents and PrincipalsMataishungNoch keine Bewertungen

- Counter-Affidavit of Emma Galang (Draft)Dokument2 SeitenCounter-Affidavit of Emma Galang (Draft)Anne Lorraine DioknoNoch keine Bewertungen

- Labor 6&7Dokument2 SeitenLabor 6&7Gonzales Juliefer AnnNoch keine Bewertungen

- Govt of Hongkong v. OlaliaDokument3 SeitenGovt of Hongkong v. OlaliaAngeline RodriguezNoch keine Bewertungen

- Planters Products Vs FertiphilDokument22 SeitenPlanters Products Vs FertiphiljazrethNoch keine Bewertungen

- Cinco Vs CA G R No 151903Dokument2 SeitenCinco Vs CA G R No 151903Paul PhoenixNoch keine Bewertungen

- Liwanag Vs Workmen's (Case Digest)Dokument3 SeitenLiwanag Vs Workmen's (Case Digest)jhammyNoch keine Bewertungen

- Banco Filipino Savings & Mortgage Bank vs. Monetary Board, Central Bank of The PhilippinesDokument23 SeitenBanco Filipino Savings & Mortgage Bank vs. Monetary Board, Central Bank of The PhilippinesMichelle Marie TablizoNoch keine Bewertungen

- Planteras, Jr. vs. People (Full Text, Word Version)Dokument15 SeitenPlanteras, Jr. vs. People (Full Text, Word Version)Emir MendozaNoch keine Bewertungen

- ANZ's Withdrawal of Job Offer to PetitionerDokument3 SeitenANZ's Withdrawal of Job Offer to PetitionerDeric MacalinaoNoch keine Bewertungen

- Case Digest Ong Yiu vs. PalDokument4 SeitenCase Digest Ong Yiu vs. Palkateangel ellesoNoch keine Bewertungen

- Heirs of Dragon vs Manila Banking Corp (40Dokument2 SeitenHeirs of Dragon vs Manila Banking Corp (40Deej JayNoch keine Bewertungen

- Giron Vs Executive SecDokument2 SeitenGiron Vs Executive Secxeileen08Noch keine Bewertungen

- Dept. of Education v. San Diego, G.R. No. 89572, December 21, 1989Dokument4 SeitenDept. of Education v. San Diego, G.R. No. 89572, December 21, 1989AkiNiHandiongNoch keine Bewertungen

- Abellana vs. People, Et Al., Aug. 17, 2011 (Case)Dokument5 SeitenAbellana vs. People, Et Al., Aug. 17, 2011 (Case)jusang16Noch keine Bewertungen

- USS Guardian grounding case examines writ of kalikasan, UNCLOS, and immunity issuesDokument23 SeitenUSS Guardian grounding case examines writ of kalikasan, UNCLOS, and immunity issuesOzilac JhsNoch keine Bewertungen

- Taxation and Life Blood Doctrine - Cir v. CtaDokument2 SeitenTaxation and Life Blood Doctrine - Cir v. CtaRick AranetaNoch keine Bewertungen

- 1 DigestDokument2 Seiten1 DigestdreaNoch keine Bewertungen

- Contreras vs. MonserateDokument3 SeitenContreras vs. MonserateJ Rachelle PaezNoch keine Bewertungen

- Francisco V HerreraDokument1 SeiteFrancisco V HerreranadgbNoch keine Bewertungen

- Camera Relative To Various Accounts Maintained at Union Bank of The Philippines, JuliaDokument3 SeitenCamera Relative To Various Accounts Maintained at Union Bank of The Philippines, JuliaPatricia Anne SorianoNoch keine Bewertungen

- Carbonilla V BAR 2Dokument1 SeiteCarbonilla V BAR 2Czar Ian Agbayani0% (1)

- Did Conversion of Loan Extinguish Surety's LiabilityDokument28 SeitenDid Conversion of Loan Extinguish Surety's LiabilityJun-Jun del RosarioNoch keine Bewertungen

- VERSOSA Jr. v. CaragueDokument2 SeitenVERSOSA Jr. v. CaragueApril Joy OmboyNoch keine Bewertungen

- 106 Lacanilao Vs CA Full TextDokument4 Seiten106 Lacanilao Vs CA Full TextEl SitasNoch keine Bewertungen

- 7 People Vs JansonDokument3 Seiten7 People Vs JansonaratanjalaineNoch keine Bewertungen

- Gonzales vs. Land Bank of The Philippines: 20 Supreme Court Reports AnnotatedDokument6 SeitenGonzales vs. Land Bank of The Philippines: 20 Supreme Court Reports AnnotatedJemNoch keine Bewertungen

- Casent Realty Development Corp v. Philbanking Corp G.R. 150731Dokument8 SeitenCasent Realty Development Corp v. Philbanking Corp G.R. 150731Dino Bernard Lapitan100% (1)

- Petitioner vs. vs. Respondents Ramon A. Gonzales Manuel P. Tiaoqui Florencio S. JimenezDokument6 SeitenPetitioner vs. vs. Respondents Ramon A. Gonzales Manuel P. Tiaoqui Florencio S. JimenezashNoch keine Bewertungen

- Toshiba Information Equipment (Phils.), Inc. vs. Commissioner of Internal Revenue, 614 SCRA 526, March 09, 2010Dokument3 SeitenToshiba Information Equipment (Phils.), Inc. vs. Commissioner of Internal Revenue, 614 SCRA 526, March 09, 2010idolbondocNoch keine Bewertungen

- Petron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010Dokument3 SeitenPetron Corporation vs. Commission of Internal Revenue, 626 SCRA 100, July 28, 2010idolbondocNoch keine Bewertungen

- Vinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000Dokument4 SeitenVinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000idolbondocNoch keine Bewertungen

- Telecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998Dokument2 SeitenTelecommunications and Broadcast Attorneys of The Philippines, Inc. vs. Commission On Elections, 289 SCRA 337, April 21, 1998idolbondoc100% (1)

- Phillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009Dokument2 SeitenPhillips Seafood (Philippines) Corporation vs. Board of Investments, 578 SCRA 113, February 04, 2009idolbondoc100% (1)

- Namuhe vs. Ombudsman, 298 SCRA 298, October 29, 1998Dokument2 SeitenNamuhe vs. Ombudsman, 298 SCRA 298, October 29, 1998idolbondocNoch keine Bewertungen

- PSPC Not Liable for Taxes Paid Using Valid TCCsDokument6 SeitenPSPC Not Liable for Taxes Paid Using Valid TCCsidolbondocNoch keine Bewertungen

- Panasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010Dokument2 SeitenPanasonic Communications Imaging Corporation of The Philippines vs. Commissioner of Internal Revenue, 612 SCRA 18, February 08, 2010idolbondoc100% (1)

- SCHMID & OBERLY vs. RJL MARTINEZ FishingDokument3 SeitenSCHMID & OBERLY vs. RJL MARTINEZ FishingidolbondocNoch keine Bewertungen

- John Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003Dokument3 SeitenJohn Hay Peoples Alternative Coalition vs. Lim, 414 SCRA 356, October 24, 2003idolbondocNoch keine Bewertungen

- Philippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010Dokument2 SeitenPhilippine Amusement and Gaming Corporation (PAGCOR) vs. Fontana Development Corporation, 622 SCRA 461, June 29, 2010idolbondoc100% (1)

- NEPA vs Ongpin economic protectionism caseDokument2 SeitenNEPA vs Ongpin economic protectionism caseidolbondocNoch keine Bewertungen

- Garcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989Dokument2 SeitenGarcia vs. Board of Investments, 177 SCRA 374, G.R. No. 92024 September 07, 1989idolbondocNoch keine Bewertungen

- LA CHEMISE LACOSTE vs FERNANDEZ on trademark infringementDokument2 SeitenLA CHEMISE LACOSTE vs FERNANDEZ on trademark infringementidolbondocNoch keine Bewertungen

- JG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003Dokument2 SeitenJG Summit Holdings, Inc. vs. Court of Appeals, 412 SCRA 10, September 24, 2003idolbondocNoch keine Bewertungen

- Garcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991Dokument3 SeitenGarcia vs. Executive Secretary, 204 SCRA 516, December 02, 1991idolbondocNoch keine Bewertungen

- MR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002Dokument3 SeitenMR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002idolbondocNoch keine Bewertungen

- Garcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007Dokument3 SeitenGarcia vs. J.G. Summit Petrochemical Corporation, 516 SCRA 493, February 23, 2007idolbondocNoch keine Bewertungen

- JG SUMMIT HOLDINGS vs. COURT OF APPEALS - PHILSECO is a public utilityDokument2 SeitenJG SUMMIT HOLDINGS vs. COURT OF APPEALS - PHILSECO is a public utilityidolbondocNoch keine Bewertungen

- INDOPHIL vs CALICA TEXTILE UNION DISPUTEDokument2 SeitenINDOPHIL vs CALICA TEXTILE UNION DISPUTEidolbondocNoch keine Bewertungen

- Garcia vs. Board of Investments, 191 SCRA 288, November 09, 1990Dokument2 SeitenGarcia vs. Board of Investments, 191 SCRA 288, November 09, 1990idolbondocNoch keine Bewertungen

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996Dokument3 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 253 SCRA 552, February 09, 1996idolbondocNoch keine Bewertungen

- Executive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006Dokument2 SeitenExecutive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, February 20, 2006idolbondoc100% (1)

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994Dokument3 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 231 SCRA 30, March 10, 1994idolbondoc100% (1)

- First Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994Dokument2 SeitenFirst Lepanto Ceramics, Inc. vs. Court of Appeals, 237 SCRA 519, October 07, 1994idolbondocNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005Dokument4 SeitenCommissioner of Internal Revenue vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, August 09, 2005idolbondocNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005Dokument2 SeitenCommissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005idolbondocNoch keine Bewertungen

- Communication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996Dokument3 SeitenCommunication Materials and Design, Inc. vs. Court of Appeals, 260 SCRA 673, August 22, 1996idolbondocNoch keine Bewertungen

- Atlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007Dokument3 SeitenAtlas Consolidated Mining and Development Corporation vs. Commissioner of Internal Revenue, 524 SCRA 73, June 08, 2007idolbondocNoch keine Bewertungen

- Scott Magee vs. McDonald'sDokument15 SeitenScott Magee vs. McDonald'sEater100% (1)

- Philippine Constitution's Provisions on EducationDokument6 SeitenPhilippine Constitution's Provisions on EducationGlenda Ortillano LeeNoch keine Bewertungen

- Civil Liabilities of An AuditorDokument5 SeitenCivil Liabilities of An AuditorSyed Sulman SheraziNoch keine Bewertungen

- Shank Kade 328 Second Ave Mansfield Ohio 44902 276-08-0503 01-27-2003 Uy137693Dokument1 SeiteShank Kade 328 Second Ave Mansfield Ohio 44902 276-08-0503 01-27-2003 Uy137693Olivia MorettiNoch keine Bewertungen

- Regulatory Mapping and Summary of Recommended Policy Option OraniDokument4 SeitenRegulatory Mapping and Summary of Recommended Policy Option OraniBarangay Centro UnoNoch keine Bewertungen

- Property Mnemonics Chs. 1 2Dokument4 SeitenProperty Mnemonics Chs. 1 2Aubrey AquinoNoch keine Bewertungen

- PQD For Constructors-Comm Plaza-PIEDMCDokument27 SeitenPQD For Constructors-Comm Plaza-PIEDMCKhadija GulNoch keine Bewertungen

- Jimi Hendrix FBI FileDokument18 SeitenJimi Hendrix FBI FileAlan Jules WebermanNoch keine Bewertungen

- Judge suspended for asking bribe in exchange for case dismissalDokument19 SeitenJudge suspended for asking bribe in exchange for case dismissalmarthaNoch keine Bewertungen

- Amnesty International Manus Island ReportDokument131 SeitenAmnesty International Manus Island Reportapi-202327523Noch keine Bewertungen

- SUBJECT: Professional Ethics. Satnam Singh V. BCI: Chanakya National Law University, PatnaDokument12 SeitenSUBJECT: Professional Ethics. Satnam Singh V. BCI: Chanakya National Law University, PatnarajNoch keine Bewertungen

- Syllabus Recruitment of Mangement TraineesDokument6 SeitenSyllabus Recruitment of Mangement TraineesSujith DeepakNoch keine Bewertungen

- Sealand V IACDokument8 SeitenSealand V IACmcsumpayNoch keine Bewertungen

- Anti-Corruption FormDokument4 SeitenAnti-Corruption Formbalajivj15Noch keine Bewertungen

- Admissions 2013Dokument3 SeitenAdmissions 2013stretfordhighNoch keine Bewertungen

- Command-Prohibitions Wajib: 1.the Obligatory (Wajib, Fard)Dokument4 SeitenCommand-Prohibitions Wajib: 1.the Obligatory (Wajib, Fard)Keepy FamadorNoch keine Bewertungen

- 2223 - Introduction To Law 01Dokument13 Seiten2223 - Introduction To Law 01Camilo sextoNoch keine Bewertungen

- People V Hostetler (Kimberly Marie Hostetler Child Pedophile Court Case)Dokument6 SeitenPeople V Hostetler (Kimberly Marie Hostetler Child Pedophile Court Case)Greg GaravaniNoch keine Bewertungen

- Ivler V Judge San Pedro GR No 172716 11172010Dokument14 SeitenIvler V Judge San Pedro GR No 172716 11172010Ubeng Juan Dela VegaNoch keine Bewertungen

- Cariño Vs CariñoDokument1 SeiteCariño Vs CariñoEmmanuel C. DumayasNoch keine Bewertungen

- Hiba Under Muslim LawDokument7 SeitenHiba Under Muslim LawManini JaiswalNoch keine Bewertungen

- Judicial Watch Vs State Dept Stephen Mull DepositionDokument415 SeitenJudicial Watch Vs State Dept Stephen Mull DepositionThe Conservative Treehouse100% (1)

- Bates V Post Office: Pam Stubbs Witness StatementDokument33 SeitenBates V Post Office: Pam Stubbs Witness StatementNick WallisNoch keine Bewertungen

- What Is Ethics in ResearchDokument19 SeitenWhat Is Ethics in ResearchHany'an RohsNoch keine Bewertungen

- SPLDokument13 SeitenSPLSteven GuyudNoch keine Bewertungen

- LAHEY, KAthleen A. - Women and Civil Liberties PDFDokument10 SeitenLAHEY, KAthleen A. - Women and Civil Liberties PDFCarol Marini100% (1)

- Departmental Inquiry-DOs and DONTsDokument3 SeitenDepartmental Inquiry-DOs and DONTsMuraliKrishna NaiduNoch keine Bewertungen

- 8 Ysidoro V PeopleDokument2 Seiten8 Ysidoro V PeopleAlexandraSoledad100% (1)

- Sample Interpleader ProceedingsDokument10 SeitenSample Interpleader ProceedingsMelissa WekesaNoch keine Bewertungen

- 01 Pardell v. Bartolome-1 PDFDokument3 Seiten01 Pardell v. Bartolome-1 PDFMark Anthony Javellana SicadNoch keine Bewertungen