Beruflich Dokumente

Kultur Dokumente

CH 1 Introduction

Hochgeladen von

Sitti NajwaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CH 1 Introduction

Hochgeladen von

Sitti NajwaCopyright:

Verfügbare Formate

Cases in Corporate Governance

Introduction

Contributors: Robert Wearing Print Pub. Date: 2005 Online Pub. Date: May 31, 2012 Print ISBN: 9781412908771 Online ISBN: 9781446212400 DOI: 10.4135/9781446212400 Print pages: 1-3 This PDF has been generated from SAGE Knowledge. Please note that the pagination of the online version will vary from the pagination of the print book.

University of Malaysia Terengganu UMT Copyright 2012

Sage Publications, Inc.

[p. 1 ]

Chapter One: Introduction

The focus of this book is on case studies of companies that have experienced problems with their corporate governance procedures. Nine case studies are presented here and it is hoped that the reader will find the material both interesting and instructive. Some common themes tend to run through these cases, such as charismatic and powerful business leaders, companies experiencing rapid and unsustainable rates of growth, unreasonably optimistic market expectations of future growth and unnecessarily complicated organization. Not all the companies discussed in this book have collapsed. Shell, for example (see Chapter 12), operates profitably but its corporate governance procedures have been the subject of debate in the media because of its overstatement of oil and gas reserves, announced in January 2004. Many believe that robust systems of corporate governance are important for both large and small organizations. The purpose of this book is to provide some insight into why corporate governance can break down and, by discussing case studies, to look at what might be done to remedy such situations. In addition, two chapters provide an introduction to corporate governance theory and corporate governance regulation.

1

This book can be thought of as a supplementary source of material, which encourages topical discussion in seminars and classes. Each case study in the book is designed to introduce the reader to a factual real life episode which has corporate governance implications. Each case is designed to reinforce the reader's knowledge and understanding of corporate governance theory and help to explain why corporate governance codes and regulations are widely thought to be essential in modern business life. It is intended that each case will motivate students to discuss, in a seminar or class setting, the reasons why corporate governance failed, or was seen to be inadequate. This book does not pretend to offer easy solutions to the problems identified in the case studies. However, certain elements and themes can be identified, such as the problems that can occur when the chairman or chief executive becomes too powerful (or indeed

Page 2 of 5 Cases in Corporate Governance: Introduction SAGE knowledge

University of Malaysia Terengganu UMT Copyright 2012

Sage Publications, Inc.

is the same person) or when the non-executive directors are seen to be lacking in independence and authority. The reader is encouraged to adopt an independent and analytical [p. 2 ] approach to the case material and use the discussion section to reinforce their understanding of corporate governance issues. Corporate governance cases and their ramifications tend to be in the public eye over a long period of time. When court action is involved, cases can take many years to resolve. Cases such as BCCI and Polly Peck came to the public's attention in the early 1990s, but legal disputes are still ongoing. Case studies have a valuable role to play in affording a deeper understanding of corporate governance issues. Case-study analysis can also assist social scientists in the development of theories and hypotheses, which can then be subject to more rigorous scientific investigation. At the same time, it is important to be aware of the difficulties involved in trying to derive general conclusions from a case study.

2

The book is structured as follows: the two chapters on the theory and regulation of corporate governance are followed by nine case studies, with a final chapter which offers a synthesis of conclusions. Chapter 2 on corporate governance theory reviews the development of the modern corporation and discusses principal-agent theory and stakeholder theory as suitable frameworks for analysing corporate governance problems. Chapter 3 on corporate governance regulation discusses the development of The Combined Code on Corporate Governance in the UK and Sarbanes-Oxley legislation in the USA. It is debatable whether these codes and regulations can ever be sufficient on their own to tackle weak corporate governance, and there have been suggestions that a change in business culture is required. Also, when framing corporate governance codes and regulations, a suitable balance needs to be struck between the demands of managers and the needs of stakeholders. Finally, the chapter closes by suggesting that some answers to the question What is good corporate governance? may be found by analysing and dissecting cases where many observers would agree that a definite failure in corporate governance procedures has occurred.

Page 3 of 5

Cases in Corporate Governance: Introduction SAGE knowledge

University of Malaysia Terengganu UMT Copyright 2012

Sage Publications, Inc.

Chapter 4 discusses the case of the Robert Maxwell's business empire. In November 1991 Robert Maxwell, an apparently successful business leader with important newspaper and publishing interests, disappeared at sea from his yacht Lady Ghislaine and it soon became apparent that his business empire was in serious financial difficulties. Employees who lost substantial pension entitlements were particularly disadvantaged. Chapter 5 discusses issues arising from the collapse of Polly Peck, a large UK quoted company, in October 1990. In 2004 this case had not yet been fully resolved, mainly because the former chairman and chief executive is effectively in exile in northern Cyprus. Chapter 6 discusses the case of the Bank of Credit and Commerce International (BCCI), which was forced by regulators to suspend its operations in July 1991. The Bank of England's regulatory practices were subsequently criticized in an official report the following year. [p. 3 ] Chapter 7 addresses the financial scandal surrounding Enron, one of the world's largest energy groups, operating in the USA. The company filed for bankruptcy in 2001 and it was discovered that reported profits had been substantially overstated. Chapter 8 discusses another corporate failure, WorldCom, which became bankrupt in July 2002. A main concern was that capital expenditures were found to have been misclassified. It is widely believed that Enron and WorldCom were crucial factors in getting the Sarbanes-Oxley legislation onto the statute books. Chapter 9 discusses the events surrounding the financial collapse of Parmalat, an Italian multinational company. In 2004 senior executives of the company were facing charges of false accounting in connection with the collapse. Chapter 10 examines the relationship between the company and shareholders of Eurotunnel. Eurotunnel came to the market in 1987, but its actual capital expenditures proved to be much higher than those projected in the original prospectus. In addition, projected revenues proved to be substantially overstated. This case specifically addresses the issue of how shareholders (as principals) can effectively monitor the actions of managers (as agents). Chapter 11 discusses the case of Barings Bank which collapsed in 1995 following unauthorized trading by one of its derivatives traders, Nick Leeson.

Page 4 of 5 Cases in Corporate Governance: Introduction SAGE knowledge

University of Malaysia Terengganu UMT Copyright 2012

Sage Publications, Inc.

Chapter 12 examines events at Shell. In January 2004 Shell announced that it had overstated its oil and gas reserves, and this case study examines the subsequent impact on the share price and how the company has attempted to reform its organization structures and corporate governance practices. Chapter 13 attempts to draw together the arguments and issues raised in the previous chapters and offers suggestions and recommendations for improving corporate governance. This chapter aims to show that the study of real-world examples of corporate governance is necessarily backward looking, but it is through this type of analysis that lessons can be learned for the future and relevant theories and hypotheses can be developed. Finally, it should be noted that the discussion questions, which appear at the end of each case study, have not been formulated with the intention of leading to a right answer since there is unlikely to be complete consensus on what is good corporate governance. Managers of companies are more likely to be aware of the costs of corporate governance, in terms of resources devoted to compliance with codes and regulations. On the other hand, stakeholders are more likely to be aware of the benefits, which could prevent or avoid loss of shareholders capital, loss of employment, loss of pension entitlements and loss of amounts owing from failed companies. 10.4135/9781446212400.n1

Page 5 of 5

Cases in Corporate Governance: Introduction SAGE knowledge

Das könnte Ihnen auch gefallen

- Grad Literature ReviewDokument4 SeitenGrad Literature ReviewSitti NajwaNoch keine Bewertungen

- Internal Control Internal Control: An OverviewDokument23 SeitenInternal Control Internal Control: An OverviewSitti NajwaNoch keine Bewertungen

- From Problem Statement To Research QuestionsDokument31 SeitenFrom Problem Statement To Research Questionsmmbizvo808100% (1)

- A&f 128Dokument14 SeitenA&f 128Sitti NajwaNoch keine Bewertungen

- Medium Puzzle 3,510,914,101: Back To Puzzle Print Another..Dokument1 SeiteMedium Puzzle 3,510,914,101: Back To Puzzle Print Another..Sitti NajwaNoch keine Bewertungen

- Internal ControlsDokument17 SeitenInternal ControlsSitti Najwa100% (1)

- IdeasDokument1 SeiteIdeasSitti NajwaNoch keine Bewertungen

- Apa Formatting and Style GuideDokument15 SeitenApa Formatting and Style GuideainunbadriahNoch keine Bewertungen

- Use or Abuse of Creative Accounting TechniquesDokument6 SeitenUse or Abuse of Creative Accounting TechniquesSitti NajwaNoch keine Bewertungen

- U.S. House of Representatives Systems Development Life-Cycle PolicyDokument30 SeitenU.S. House of Representatives Systems Development Life-Cycle Policytina_sangwanNoch keine Bewertungen

- Topic 1 - Week 1Dokument10 SeitenTopic 1 - Week 1Sitti NajwaNoch keine Bewertungen

- FRS 101 Question 1Dokument3 SeitenFRS 101 Question 1Sitti NajwaNoch keine Bewertungen

- 5 Yi-Hui HoDokument6 Seiten5 Yi-Hui HoSitti NajwaNoch keine Bewertungen

- A Decade of Intellectual Capital Accounting Research PDFDokument15 SeitenA Decade of Intellectual Capital Accounting Research PDFSitti NajwaNoch keine Bewertungen

- Topic 4 1-Understanding CashDokument3 SeitenTopic 4 1-Understanding CashSitti NajwaNoch keine Bewertungen

- Approaches SDL CDokument84 SeitenApproaches SDL CSitti NajwaNoch keine Bewertungen

- SSRN Id1950361Dokument9 SeitenSSRN Id1950361Sitti NajwaNoch keine Bewertungen

- Chap 29Dokument8 SeitenChap 29Sitti NajwaNoch keine Bewertungen

- Business AssetsDokument5 SeitenBusiness AssetsSitti NajwaNoch keine Bewertungen

- Lucrari Vol XIX 2013 103Dokument6 SeitenLucrari Vol XIX 2013 103Sitti NajwaNoch keine Bewertungen

- Living by NumbersDokument14 SeitenLiving by NumbersSitti Najwa100% (2)

- Dispute Between Bank and CustomerDokument18 SeitenDispute Between Bank and CustomergivamathanNoch keine Bewertungen

- 09177Dokument7 Seiten09177lelumenNoch keine Bewertungen

- L9 - Planning Tools and TechniquesDokument8 SeitenL9 - Planning Tools and TechniquesSitti NajwaNoch keine Bewertungen

- Intellectual Capital Disclosure Commitment Myth or RealityDokument10 SeitenIntellectual Capital Disclosure Commitment Myth or RealitySitti NajwaNoch keine Bewertungen

- Regulation As Accounting Theory PDFDokument21 SeitenRegulation As Accounting Theory PDFSitti NajwaNoch keine Bewertungen

- ch14 MarketefficiencyDokument31 Seitench14 MarketefficiencySitti NajwaNoch keine Bewertungen

- Whittington Two World Views 2008Dokument30 SeitenWhittington Two World Views 2008Sitti NajwaNoch keine Bewertungen

- PertDokument9 SeitenPertfsirfanNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- At V6N2 2014 9Dokument16 SeitenAt V6N2 2014 9Bayu SayNoch keine Bewertungen

- Board Diversity and Financial Performance PDFDokument15 SeitenBoard Diversity and Financial Performance PDFOasis International Consulting Ltd100% (1)

- The Enron Case Study: History, Ethics and Governance FailuresDokument5 SeitenThe Enron Case Study: History, Ethics and Governance FailuresShuvo ChowdhuryNoch keine Bewertungen

- Future Contract:: Ch. 33: Derivatives For Managing Financial RiskDokument6 SeitenFuture Contract:: Ch. 33: Derivatives For Managing Financial RiskMukul KadyanNoch keine Bewertungen

- Mechanics of Futures MarketsDokument14 SeitenMechanics of Futures MarketsSHUBHAM SRIVASTAVANoch keine Bewertungen

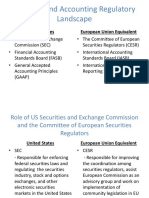

- Financial and Accounting Regulatory LandscapeDokument7 SeitenFinancial and Accounting Regulatory LandscapeDiana Mindru StrenerNoch keine Bewertungen

- Sharekhan Sees 21% UPSIDE in GNA AxlesDokument7 SeitenSharekhan Sees 21% UPSIDE in GNA AxlesHarsimran SinghNoch keine Bewertungen

- Reinsurance Opinion Reinsurance Opinion: Actuarial FunctionDokument6 SeitenReinsurance Opinion Reinsurance Opinion: Actuarial FunctionManuela ZahariaNoch keine Bewertungen

- Accounting standard-GAAPDokument5 SeitenAccounting standard-GAAPRifqi HuseinNoch keine Bewertungen

- Iunit ReferencesDokument4 SeitenIunit ReferencessurendargadNoch keine Bewertungen

- (18041663 - Review of Economic Perspectives) Banking Governance and Risk - The Case of Tunisian Conventional BanksDokument12 Seiten(18041663 - Review of Economic Perspectives) Banking Governance and Risk - The Case of Tunisian Conventional Banksdhahri nourhenNoch keine Bewertungen

- What Is Corporate Governance?: AE 10: Governance, Business Ethics, Risk Management and Internal ControlDokument2 SeitenWhat Is Corporate Governance?: AE 10: Governance, Business Ethics, Risk Management and Internal ControlNichola aasNoch keine Bewertungen

- Influence of Ownership Structure and Board Activity To Voluntary Disclosure For Manufacturing Companies in Indonesian Stock ExchangeDokument14 SeitenInfluence of Ownership Structure and Board Activity To Voluntary Disclosure For Manufacturing Companies in Indonesian Stock ExchangeAisya HayumNoch keine Bewertungen

- Corporate GovernanceDokument3 SeitenCorporate GovernancePhoebe Lano0% (1)

- Free Final Year Project Topics and Research Materials PDFDokument18 SeitenFree Final Year Project Topics and Research Materials PDFkingsley oluchiNoch keine Bewertungen

- Diversity in Corporate GovernanceDokument26 SeitenDiversity in Corporate GovernanceShameza DavidNoch keine Bewertungen

- Interim Financial Reporting: International Accounting Standard 34Dokument16 SeitenInterim Financial Reporting: International Accounting Standard 34humnarviosNoch keine Bewertungen

- Corporate Governance: Eni's Proposals OnDokument11 SeitenCorporate Governance: Eni's Proposals OnJoao VenancioNoch keine Bewertungen

- RMML CSR Final Page Wise For Web PublicationDokument64 SeitenRMML CSR Final Page Wise For Web PublicationVaibhav DholakiaNoch keine Bewertungen

- modules-in-GOVERNANCE RISK MANAGEMENT COMPLIANCES AND ETHICS PDFDokument470 Seitenmodules-in-GOVERNANCE RISK MANAGEMENT COMPLIANCES AND ETHICS PDFSunshine KhuletzNoch keine Bewertungen

- Chapter 6,10,19Dokument15 SeitenChapter 6,10,19Kristine Jhoy Nolasco SecopitoNoch keine Bewertungen

- Chapter 4Dokument28 SeitenChapter 4divyadeoNoch keine Bewertungen

- Samples Solution Manual For Management Control Systems 4th Edition by Kenneth Merchant PDFDokument135 SeitenSamples Solution Manual For Management Control Systems 4th Edition by Kenneth Merchant PDFAudrey Aldercy80% (5)

- Business Ethics Chapter FourDokument16 SeitenBusiness Ethics Chapter Fourdro landNoch keine Bewertungen

- Sustanability and StrategyDokument42 SeitenSustanability and StrategymayankNoch keine Bewertungen

- Annualreport10 11Dokument48 SeitenAnnualreport10 11Elangovan NagavelNoch keine Bewertungen

- Code of Ethics For AccountantsDokument49 SeitenCode of Ethics For AccountantsAlly CapacioNoch keine Bewertungen

- Cbmec 1Dokument6 SeitenCbmec 1Jashmin CosainNoch keine Bewertungen

- Case 5Dokument5 SeitenCase 5Anna Azriffah Janary GuilingNoch keine Bewertungen

- Summary of Chapter: 1 Goals and Governance of The Firm: Corporate Finance HW: 1Dokument2 SeitenSummary of Chapter: 1 Goals and Governance of The Firm: Corporate Finance HW: 1RachelNoch keine Bewertungen