Beruflich Dokumente

Kultur Dokumente

Retirement - Jaculbe V Silliman University

Hochgeladen von

Alexis Ailex Villamor Jr.Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Retirement - Jaculbe V Silliman University

Hochgeladen von

Alexis Ailex Villamor Jr.Copyright:

Verfügbare Formate

Retirement: Jaculbe vs Silliman University Sometime in 1958, petitioner began working for respondents university medical center as a nurse.

In 1992, respondents human resources department informed petitioner that she was approaching her 35th year of service with the university and was due for automatic retirement on November 18, 1993, at which time she would be 57 years old. This was pursuant to respondents retirement plan for its employees, which provided that its members could be automatically retired "upon reaching the age of 65 or after 35 years of uninterrupted service to the university." Petitioner emphatically insisted that the compulsory retirement under the plan was tantamount to a dismissal and pleaded with respondent to be allowed to work until the age of 60 because this was the minimum age at which she could qualify for SSS pension. But respondent stood pat on its decision to retire her, citing "company policy." On November 15, 1993, petitioner filed a complaint in the NLRC termination of service and on November 18, 1993, respondent compulsorily retired petitioner. The labor arbiter rendered a decision finding respondent guilty of illegal dismissal and ordered that petitioner be reinstated with paid full backwages. On appeal, however, the NLRC reversed the labor arbiters decision. The NLRC likewise denied petitioners motion for reconsideration. In the assailed decision and resolution, the CA affirmed the NLRC. Hence, this petition. Issues: 1) Did respondents retirement plan imposing automatic retirement after 35 years of service contravene the security of tenure clause in the 1987 Constitution and the Labor Code? 2) Did respondent commit illegal dismissal by retiring petitioner solely by reason of such provision in its retirement plan? Ruling: Retirement plans allowing employers to retire employees who are less than the compulsory retirement age of 65 are not per se repugnant to the constitutional guaranty of security of tenure. By its express language, the Labor Code permits employers and employees to fix the applicable retirement age at below 60 years. However, after reviewing the assailed decision together with the rules and regulations of respondents retirement plan, we find that the plan runs afoul of the constitutional guaranty of security of tenure. The CA, in ruling against petitioner, premised its decision to uphold the retirement plan on her voluntary participation therein (The contract fixing for retirement age as allowed under Article 287 of the Labor Code does not exclusively refer to CBA which provides for an agreed retirement age. The said provision explicitly allows, as well, other applicable employment contract to fix retirement age.). The records disclose that the private respondents Retirement Plan has been in effect for more than 30 years. The said plan is deemed integrated into the employment contract between private respondent and its employees as evidenced by the latters voluntary contribution through monthly salary deductions . The Supreme Court, however, finds that it was through no voluntary act of her own that petitioner became a member of the plan and the repeated use of the word "shall" ineluctably pointed to the conclusion that employees had no choice but to contribute to the plan. Furthermore, the respondents retirement plan came into effect after petitioner started working for the company. In short, it was not part of the terms of employment to which petitioner agreed when she started working for respondent. The truth was that petitioner had no choice but to participate in the plan, given that the only way she could refrain from doing so was to resign or lose her job no agreement of any kind involving such was entered into by the parties. Thus, having terminated petitioner solely on the basis of a provision of a retirement plan which was not freely assented to by her, respondent was guilty of illegal dismissal.

Das könnte Ihnen auch gefallen

- Labor Relations GMC Vs CA-case DigestDokument2 SeitenLabor Relations GMC Vs CA-case DigestSam FajardoNoch keine Bewertungen

- Guranty & Suretyship-BARRETO Y SIA vs. ALBO 62 PHIL 593 (1935)Dokument2 SeitenGuranty & Suretyship-BARRETO Y SIA vs. ALBO 62 PHIL 593 (1935)ERICKA SORIANONoch keine Bewertungen

- Duncan v. AT&T Communications, Inc. 668 F.Supp. 232 (S.D.N.Y. 1987) - Robert L. Carter, District JudgeDokument2 SeitenDuncan v. AT&T Communications, Inc. 668 F.Supp. 232 (S.D.N.Y. 1987) - Robert L. Carter, District JudgeNypho PareñoNoch keine Bewertungen

- Ramos VDokument2 SeitenRamos VNypho PareñoNoch keine Bewertungen

- G.R. No. 215568, August 03, 2015 Richard N. Rivera, Petitioner, V. Genesis Transport Service, Inc. and Riza A. MoisesDokument6 SeitenG.R. No. 215568, August 03, 2015 Richard N. Rivera, Petitioner, V. Genesis Transport Service, Inc. and Riza A. MoisesJessa TadeoNoch keine Bewertungen

- In Re HawkinsDokument2 SeitenIn Re HawkinsNypho PareñoNoch keine Bewertungen

- Agra UpdatedDokument43 SeitenAgra UpdatedCarla VirtucioNoch keine Bewertungen

- Mercury Drug Co VS Dayao PDFDokument17 SeitenMercury Drug Co VS Dayao PDFLarssen IbarraNoch keine Bewertungen

- Labor Digest Last MidtermsDokument42 SeitenLabor Digest Last MidtermsJona MangalindanNoch keine Bewertungen

- US Vs Tan TengDokument2 SeitenUS Vs Tan TengLastimoso AnthonyNoch keine Bewertungen

- Moreno vs. San Sebastian Recoletos, 28 March 2008Dokument2 SeitenMoreno vs. San Sebastian Recoletos, 28 March 2008Hannika SantosNoch keine Bewertungen

- PASEIvs DrilonDokument2 SeitenPASEIvs Drilonemen penaNoch keine Bewertungen

- G.R. No. 245917 - ANTOLINO v. HANSEATIC SHIPPING PHILS. INCDokument3 SeitenG.R. No. 245917 - ANTOLINO v. HANSEATIC SHIPPING PHILS. INCJay jogs100% (1)

- National Semiconductor Distribution v. NLRCDokument8 SeitenNational Semiconductor Distribution v. NLRCKenneth Taguiba0% (1)

- Supreme Steel Corp. v. Nagkakaisang Manggagawa NG Supreme Independent Union (Nms-Ind-Apl)Dokument19 SeitenSupreme Steel Corp. v. Nagkakaisang Manggagawa NG Supreme Independent Union (Nms-Ind-Apl)Chedeng KumaNoch keine Bewertungen

- Bernardo Vs NLRCDokument17 SeitenBernardo Vs NLRCJames Ibrahim AlihNoch keine Bewertungen

- National vs. CirDokument1 SeiteNational vs. CirTinersNoch keine Bewertungen

- San Beda University College of Law: Cocomangas Hotel Beach Resort v. Visca Austria-Martinez, JDokument3 SeitenSan Beda University College of Law: Cocomangas Hotel Beach Resort v. Visca Austria-Martinez, JPatrick PatricioNoch keine Bewertungen

- 33 - Philippines Singapore Transit Vs NLRCDokument6 Seiten33 - Philippines Singapore Transit Vs NLRCArthur YamatNoch keine Bewertungen

- Working Term Paper in IR207 - 2 As of 07 Dec 2019Dokument8 SeitenWorking Term Paper in IR207 - 2 As of 07 Dec 2019Riva Caparas PiezasNoch keine Bewertungen

- 48-Mercury Drug Co., Inc. vs. Nardo Dayao, Et - Al.Dokument12 Seiten48-Mercury Drug Co., Inc. vs. Nardo Dayao, Et - Al.Nimpa PichayNoch keine Bewertungen

- 2labor Digest NotesDokument6 Seiten2labor Digest NotesRoseanne MateoNoch keine Bewertungen

- G.R. No. L-31832 (SSS v. SSS Supervisors' Union Cugco and CIR)Dokument2 SeitenG.R. No. L-31832 (SSS v. SSS Supervisors' Union Cugco and CIR)Pepper PottsNoch keine Bewertungen

- Goldenberg CaseDokument3 SeitenGoldenberg CaseFriendship GoalNoch keine Bewertungen

- Petitioner Vs Vs Respondents Froilan M Bacungan & Associates Seno, Mendoza and Associates Law OfficesDokument7 SeitenPetitioner Vs Vs Respondents Froilan M Bacungan & Associates Seno, Mendoza and Associates Law OfficesPatricia RamosNoch keine Bewertungen

- Labor Cases DigestDokument61 SeitenLabor Cases Digestemman carlNoch keine Bewertungen

- 04 Phil. Fisheries Development Authority v. NLRC (1992)Dokument4 Seiten04 Phil. Fisheries Development Authority v. NLRC (1992)Zan BillonesNoch keine Bewertungen

- Coca-Cola Bottlers Phils. Inc. v. Dela Cruz, Et Al.Dokument6 SeitenCoca-Cola Bottlers Phils. Inc. v. Dela Cruz, Et Al.charlaine_latorreNoch keine Bewertungen

- LVN Pictures v. Philippine Musicians GuildDokument9 SeitenLVN Pictures v. Philippine Musicians GuildBaring CTCNoch keine Bewertungen

- DIGEST 13 - PAL V NLRCDokument1 SeiteDIGEST 13 - PAL V NLRCJestherin BalitonNoch keine Bewertungen

- Equi-Asia Placement Inc. v. Department of Foreign AffairsDokument11 SeitenEqui-Asia Placement Inc. v. Department of Foreign AffairsVanityHughNoch keine Bewertungen

- Diamond Farms, Inc VS SPFLDokument3 SeitenDiamond Farms, Inc VS SPFLHasmer Maulana AmalNoch keine Bewertungen

- LABOR TerminationDokument5 SeitenLABOR Terminationdramaprincess013Noch keine Bewertungen

- Caong Vs Regualos GR No. 179428 Jan 26, 2011Dokument10 SeitenCaong Vs Regualos GR No. 179428 Jan 26, 2011Hanz Kristofer FernandezNoch keine Bewertungen

- Wenphil Serrano AgababonDokument3 SeitenWenphil Serrano AgababonSheng EyyNoch keine Bewertungen

- Roxas & Co., Inc., vs. Court of Appeals: Ponente: J. Renato Puno FactsDokument3 SeitenRoxas & Co., Inc., vs. Court of Appeals: Ponente: J. Renato Puno FactsDennis Jay Paras100% (1)

- San Miguel Corp. Supervisors and Exempt Employees Union vs. LaguesmaDokument7 SeitenSan Miguel Corp. Supervisors and Exempt Employees Union vs. LaguesmaKanglawNoch keine Bewertungen

- Labor Course Outline UpdatedDokument19 SeitenLabor Course Outline UpdatedajajaNoch keine Bewertungen

- Del Rosario V de Los SantosDokument2 SeitenDel Rosario V de Los SantosMigs GayaresNoch keine Bewertungen

- Rosario V RojoDokument2 SeitenRosario V RojoMelgenNoch keine Bewertungen

- Rada Vs NLRCDokument1 SeiteRada Vs NLRCDanica Irish RevillaNoch keine Bewertungen

- Caltex Union v. CaltexDokument2 SeitenCaltex Union v. CaltexKim Michael de JesusNoch keine Bewertungen

- 167 Ortega Vs SSSDokument1 Seite167 Ortega Vs SSSRobelle RizonNoch keine Bewertungen

- Jaime Gapayao Versus Rosario FuloDokument2 SeitenJaime Gapayao Versus Rosario FuloCeresjudicataNoch keine Bewertungen

- Case Digest Labor LawDokument8 SeitenCase Digest Labor LawArthur SyNoch keine Bewertungen

- Roy vs. SEC GR 207246 (Resolution)Dokument5 SeitenRoy vs. SEC GR 207246 (Resolution)elvinperiaNoch keine Bewertungen

- LL 11 - de Leon v. NLRC 100 SCRA 691Dokument12 SeitenLL 11 - de Leon v. NLRC 100 SCRA 691raikha barra0% (1)

- BDO Unibank Vs Nerbes G.R. No. 208735 July 19 2017Dokument14 SeitenBDO Unibank Vs Nerbes G.R. No. 208735 July 19 2017JosieNoch keine Bewertungen

- (Cite As: 2009 WL 1421173 (E.D.Tex.) ) : David A. Schiller John David Exline FN2Dokument4 Seiten(Cite As: 2009 WL 1421173 (E.D.Tex.) ) : David A. Schiller John David Exline FN2Lazy CasapaoNoch keine Bewertungen

- 11 Interphil Employees Union-FFW Vs Interphil LaboratoriesDokument3 Seiten11 Interphil Employees Union-FFW Vs Interphil LaboratorieslorenbeatulalianNoch keine Bewertungen

- 5 SSS V UbanaDokument2 Seiten5 SSS V UbanaJonas TNoch keine Bewertungen

- 10 Manila Water v. DalumpinesDokument16 Seiten10 Manila Water v. DalumpinesCristelle FenisNoch keine Bewertungen

- Wiltshire Fire Co. Vs NLRC and Vicente OngDokument6 SeitenWiltshire Fire Co. Vs NLRC and Vicente OngStephanie ValentineNoch keine Bewertungen

- 14 - San Miguel Vs CADokument3 Seiten14 - San Miguel Vs CAinvictusincNoch keine Bewertungen

- Valdez Vs NLRCDokument2 SeitenValdez Vs NLRClovekimsohyun89Noch keine Bewertungen

- Petitioners: Raul G. Locsin and Eddie B. Tomaquin Respondent: Philippine Long Distance Telephone Company DoctrineDokument2 SeitenPetitioners: Raul G. Locsin and Eddie B. Tomaquin Respondent: Philippine Long Distance Telephone Company DoctrineKaren Selina AquinoNoch keine Bewertungen

- Apex Mining Co. V NLRC PDFDokument2 SeitenApex Mining Co. V NLRC PDFPaulo TapallaNoch keine Bewertungen

- Delia Bangalisan Vs CA DigestedDokument1 SeiteDelia Bangalisan Vs CA DigestedgerlynNoch keine Bewertungen

- Upreme Steel Corporation VsDokument6 SeitenUpreme Steel Corporation VsJon SnowNoch keine Bewertungen

- Retirement: Jaculbe Vs Silliman UniversityDokument2 SeitenRetirement: Jaculbe Vs Silliman UniversityJoeyBoyCruzNoch keine Bewertungen

- IRR of Anti-Bullying ActDokument20 SeitenIRR of Anti-Bullying ActAlexis Ailex Villamor Jr.Noch keine Bewertungen

- Colegio de San Bartolome de Novaliches: New Normal Discipline Policies School Year: 2020-2021Dokument9 SeitenColegio de San Bartolome de Novaliches: New Normal Discipline Policies School Year: 2020-2021Alexis Ailex Villamor Jr.Noch keine Bewertungen

- BLA Articulated LadderDokument9 SeitenBLA Articulated LadderAlexis Ailex Villamor Jr.Noch keine Bewertungen

- 14 - Caldawallader V Smith BellDokument1 Seite14 - Caldawallader V Smith BellAlexis Ailex Villamor Jr.Noch keine Bewertungen

- Possible Subscriptions To Electronic Jurisprudence E-SCRA (Central Bookstore)Dokument2 SeitenPossible Subscriptions To Electronic Jurisprudence E-SCRA (Central Bookstore)Alexis Ailex Villamor Jr.Noch keine Bewertungen

- BLA AllercefDokument8 SeitenBLA AllercefAlexis Ailex Villamor Jr.Noch keine Bewertungen

- Case 84 in Re ZialcitaDokument4 SeitenCase 84 in Re ZialcitaAlexis Ailex Villamor Jr.Noch keine Bewertungen

- UST Librarians Earn Master's DegreeDokument3 SeitenUST Librarians Earn Master's DegreeAlexis Ailex Villamor Jr.Noch keine Bewertungen

- January Cases From VillamorDokument2 SeitenJanuary Cases From VillamorAlexis Ailex Villamor Jr.Noch keine Bewertungen

- REM2 - Digests-Evidence Rule 130Dokument57 SeitenREM2 - Digests-Evidence Rule 130Alexis Ailex Villamor Jr.Noch keine Bewertungen

- 55 - Naguiat Vs IACDokument3 Seiten55 - Naguiat Vs IACAlexis Ailex Villamor Jr.Noch keine Bewertungen

- 07 12 2013 Inauguration of The New E-Board With VeritasDokument1 Seite07 12 2013 Inauguration of The New E-Board With VeritasAlexis Ailex Villamor Jr.Noch keine Bewertungen

- REVENUE MEMORANDUM ORDER NO. 69-2010 Issued On August 13, 2010 Prescribes TheDokument1 SeiteREVENUE MEMORANDUM ORDER NO. 69-2010 Issued On August 13, 2010 Prescribes TheAlexis Ailex Villamor Jr.Noch keine Bewertungen

- AgreementDokument7 SeitenAgreementVOJE DIFNoch keine Bewertungen

- Acceptance and Presentment For AcceptanceDokument27 SeitenAcceptance and Presentment For AcceptanceAndrei ArkovNoch keine Bewertungen

- ERNESTO M. GUEVARA vs. ROSARIO GUEVARA DOCTRINAL DIGEST STORYLINESDokument2 SeitenERNESTO M. GUEVARA vs. ROSARIO GUEVARA DOCTRINAL DIGEST STORYLINESEunice SkyNoch keine Bewertungen

- Immediate Deferred IndefeasibilityDokument15 SeitenImmediate Deferred Indefeasibilityyvonne9lee-3Noch keine Bewertungen

- NO Maintenance - Adultery - Punjab & Haryana High CoutDokument7 SeitenNO Maintenance - Adultery - Punjab & Haryana High CoutKAPIL DEVNoch keine Bewertungen

- Preparing For An Inquest: Guidance For Families and CarersDokument8 SeitenPreparing For An Inquest: Guidance For Families and CarersAR Cuaresma MoralesNoch keine Bewertungen

- Legal Environment of Business and Online Commerce 7th Edition Cheeseman Test BankDokument18 SeitenLegal Environment of Business and Online Commerce 7th Edition Cheeseman Test BankJudyWatsonofseb100% (21)

- Libcap Marketing Corp vs. BaquialDokument2 SeitenLibcap Marketing Corp vs. BaquialJoesil Dianne SempronNoch keine Bewertungen

- From H - Md. Shohidul IslamDokument2 SeitenFrom H - Md. Shohidul IslamHasan Ibrahim MiaNoch keine Bewertungen

- Case No. 1 in Re: Judge Esmael Esguerra and Atty. Carlo Magbanwa Disbarment CaseDokument8 SeitenCase No. 1 in Re: Judge Esmael Esguerra and Atty. Carlo Magbanwa Disbarment CaseGilbert LimNoch keine Bewertungen

- Tribunal Supremo Sobre Inmunidad de La Junta de Control FiscalDokument19 SeitenTribunal Supremo Sobre Inmunidad de La Junta de Control FiscalMetro Puerto RicoNoch keine Bewertungen

- Philippine Fisheries Development Authority v. NLRCDokument9 SeitenPhilippine Fisheries Development Authority v. NLRCJohn FerarenNoch keine Bewertungen

- Proclamation of Independence 1957 PDFDokument2 SeitenProclamation of Independence 1957 PDFMemori MelakaNoch keine Bewertungen

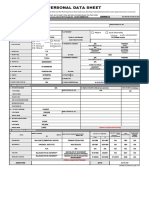

- PDS Arman - 2022Dokument4 SeitenPDS Arman - 2022Armando FaundoNoch keine Bewertungen

- JEMAA1Dokument4 SeitenJEMAA1Ralf JOsef LogroñoNoch keine Bewertungen

- MCQ Course 7Dokument39 SeitenMCQ Course 7kirti ChaudharyNoch keine Bewertungen

- Practice Exam No. 1 2018Dokument27 SeitenPractice Exam No. 1 2018kali bangon100% (1)

- EstafaDokument10 SeitenEstafaAJ SantosNoch keine Bewertungen

- Paige Thompson Memorandum 8-13-19Dokument13 SeitenPaige Thompson Memorandum 8-13-19Neal McNamaraNoch keine Bewertungen

- DAR v. Trinidad Valley Realty & Development CorporationDokument6 SeitenDAR v. Trinidad Valley Realty & Development CorporationCourtney TirolNoch keine Bewertungen

- Succession MTDokument26 SeitenSuccession MTLouis TanNoch keine Bewertungen

- Procedure of Summary Trial in IndiaDokument12 SeitenProcedure of Summary Trial in IndiaKashyap Kumar Naik80% (5)

- 00-TOC - Workshop Notes PDFDokument2 Seiten00-TOC - Workshop Notes PDFsamNoch keine Bewertungen

- Office Memorandum Sub: Revised Timeline For Verification of Arrear Demand Under Section 245 of The Income-Tax Act, 1961Dokument2 SeitenOffice Memorandum Sub: Revised Timeline For Verification of Arrear Demand Under Section 245 of The Income-Tax Act, 1961VenkatNoch keine Bewertungen

- GBL Internship Letter-SidraDokument4 SeitenGBL Internship Letter-SidraSIDRA ALI MA ECO DEL 2021-23Noch keine Bewertungen

- 1 Leriou Vs Longa 2018 Mother Better AdministatrixDokument31 Seiten1 Leriou Vs Longa 2018 Mother Better AdministatrixJan Igor GalinatoNoch keine Bewertungen

- PLDT v. AlvarezDokument2 SeitenPLDT v. AlvarezXezarajjah Villanueva67% (3)

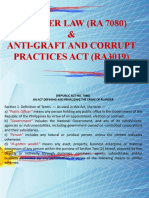

- Plunder Law Ra 7080Dokument9 SeitenPlunder Law Ra 7080Sebastian M.VNoch keine Bewertungen

- People V TolentinoDokument2 SeitenPeople V TolentinoSophiaFrancescaEspinosaNoch keine Bewertungen

- Joffe Opposition To K&S Motion For Summary JudgmentDokument30 SeitenJoffe Opposition To K&S Motion For Summary JudgmentabdNoch keine Bewertungen