Beruflich Dokumente

Kultur Dokumente

2014-2015 December 9, 2013 Preliminary Budget Presentation

Hochgeladen von

Timothy AlexanderCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2014-2015 December 9, 2013 Preliminary Budget Presentation

Hochgeladen von

Timothy AlexanderCopyright:

Verfügbare Formate

Octorara Area School District

2014-2015 Budget Presentation

December 09, 2013

Octorara Area School District

2012-13 Review

2013-14 Update

2014-15 Draft Budget

Octorara Area School District

2012-13 Review

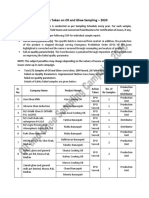

2012-13 Budget vs. Actual

Revenues

Expenses

Net

Revenue

Total Local

Earned Income

Total State

Bond Reimbursement

PA Accountability

Social Security Reimb.

Retirement Reimb.

Tuition

Total Federal

Med Assist ACCESS

Reimb.

Title I

Budget

45,564,536

46,664,375

(1,099,839)

Actual

46,117,967

44,276,648

1,841,319

Variance

553,431

2,387,727

2,941,158

32,449,126

33,130,582

681,456

1,525,000

2,184,113

659,113

11,897,722

11,744,866

(152,856)

740,000

687,354

(52,646)

120,294

120,294

663,511

(57,489)

721,000

1,168,000

1,133,216

%

101.21

94.88

(34,784)

70,000

26,179

(43,821)

1,217,688

1,238,489

20,801

220,000

268,774

48,774

847,688

823,853

(23,835)

4

Major Line Items

2012-13 District Revenue Breakdown

2012-13 Local Revenue Breakdown

Selected Local Revenue History

State Revenues

2012-13 Expense Summary

Budget

Salaries

Actual

Variance

Fav/(Unfav)

$18,930,094

$18,270,660

$659,434

$7,569,667

$6,802,150

$767,517

$3,927,349

$4,003,795

($76,446)

$934,200

$739,450

$194,750

$6,829,406

$6,556,208

$1,432,497

$1,298,515

$340,500

$321,380

$3,325,063

$2,954,491

Outsourced Facilities Supervisor Position,

Lower Sub Costs, Less movement on scale

Benefits

Lower Health Care Costs, Soc. Sec., Ret.

Outside Services

Outsourced Facilities Supervisor Position

Repairs/Maint. Services

Repairs/Maint., Lower Elec., Equip. Rental

Trans/Ins/Tuit/Charter

$273,198

Lower Charter School Enrollments

Supplies

$133,982

Supplies, Diesel Fuel, Natural Gas,

Capital

Dues/Fees/Interest

$19,120

$370,572

Budgetary Reserve not used / Refinanced

2008 Bond

Fund Trans/Principle

$3,375,600

$3,330,000

$45,600

Refinanced 2008 Bond

$46,664,376

$44,276,648

$2,387,727

9

Salary History

10

Required Health Care Premium History

July

Aug

Sept

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

June

Total

Claims

2007-08 125,662

155,158 136,697

72,382 314,496 142,374 154,855 156,865 191,785 153,187 105,242 100,415

1,809,118

2008-09 138,017

154,536 179,266 197,349 112,362 171,333 163,946 127,176 130,016 157,056 149,241 249,891

1,930,189

2009-10 210,312

199,979

387,660 269,845 233,779 327,650 173,159 166,326 177,709 173,201 183,685 214,261

2,717,566

2010-11

295,022

207,814 172,910 172,384 177,774 212,662 156,411 240,869 233,482 167,544 216,282 405,977

2,659,130

2011-12

159,715

353,869 173,042 181,337 188,531 185,511 179,597 190,868 202,832 171,487 132,966 240,458

2,360,212

2012-13

163,938

144,581 187,274 129,059 178,849 181,508 267,891 144,066 171,179 207,599 257,640 178,721

2,212,305

2013-14

205,665

179,340 154,368 490,034 188,500

1,217,907

Does not include Stop Loss Premiums & Admin Fees

11

Claims History

12

Selected General Fund Expenditures

13

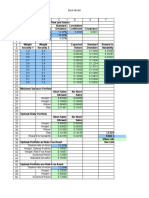

Assigned Fund Balance Rollforward

2010 -11

Designation

2011 -12

Budget

2011 -12

Assignments

2012-13

Budget

2012-13

Assignments

2013-14

Budget

Total

Assigned

Fringe Benefit

$75,000

($132,750)

$439,991

$0

$331,149

$0

$846,140

PSERS

$261,600

($475,000)

$475,000

($250,000)

$450,000

Extraordinary Building/Grounds

Repairs

$75,000

$0

$0

$0

$210,330

$0

$312,890

Extraordinary Utility Costs i.e.

Electric

$0

($20,000)

$20,000

$0

$0

$0

$20,000

Transportation - Fuel

$0

$0

$0

$0

$0

$0

$20,000

Improvements in Technology

$0

($40,000)

$40,000

$0

$0

($40,000)

$0

Designated Reserve for Interest

Expense Bond Issue

$0

($217,280)

$217,280

($304,589)

$304,589

($224,553) $588,036

Designated Reserve for H.S.

Project

$204,000

($325,000)

$325,000

($545,250)

$545,250

($325,000) $1,090,500

Current Year Assignments

$615,600

($1,210,030)

$1,517,271

($1,099,839)

$1,841,318

($839,553) $3,972,366

Total Assigned Fund Balance

$2,663,360

$1,453,330

$2,970,601

$1,870,762

$4,811,919

$3,972,366

Type of Reserve

($250,000) $1,094,800

14

Fund Balance Summary

2010 -11

Designation

2011 -12

Budget

2011 -12

Assignments

2012-13

Budget

2012-13

Assignments

2013-14

Budget

Total

Assigned

Current Year Assignments

$615,600

($1,210,030)

$1,517,271

($1,099,839)

$1,841,318

($839,553) $3,972,366

Total Assigned Fund Balance

$2,663,360

$1,453,330

$2,970,601

$1,870,762

$4,811,919

$3,972,366

Total Unassigned Fund Balance

3,642,161

3,642,161

3,574,717

3,574,717

3,568,060

3,354,417

Y/E Audited Fund Balance

$6,305,521

$5,095,491

$6,545,318

$5,445,479

$8,379,978

$7,326,782

Type of Reserve

15

Octorara Area School District

2013-14 Outlook

16

Projected Variances from Approved Budget

Revenue

EIT

Budget

Estimate

Variance

$1,600,000

$1,900,000

$300,000

$6,091,088

$5,959,635

$131,453

$250,000

$0

$250,000

Expense

Debt Service

Budgetary Reserve

17

Octorara Area School District

2014-15 Draft Budget

18

Octorara Area School District

Items to Consider:

1. Act 1 Index

2. State Funding

3. Retirement Rates

4. Affordable Care Act

5. Capital Improvements

19

Octorara Area School District

Base Index 2.1%

20

1,018,358,424

78.81

273,736,547

21.19

21

22

PSERS Retirement Rate History &

Projections

Fiscal Year

Rate

2008-09

4.76 Actual

2009-10

4.78 Actual

2010-11

5.64 Actual Original 8.22

2011-12

8.65 Actual

2012-13

12.36 Actual

2013-14

16.93 Actual

2014-15

21.40 Certified

2015-16

25.80 Projected

2016-17

28.30 Projected

23

Octorara Area School Dist

Projected PSERS Contribution

Fiscal

Year

**

Salaries

Employers

Contrib.

Rate

Total

State Share

OASD Net

Contrib.

(50%)

Cost

Increase

2007-08

17,699,680

7.13%

1,236,178

605,496

630,682

155,434

2008-09

19,040,645

4.76%

884,286

501,654

382,632

(248,050)

2009-10

19,827,415

4.78%

924,765

475,782

448,983

66,351

2010-11

19,746,819

5.64%

1,093,029

556,276

536,753

87,770

2011-12

18,663,617

8.65%

1,576,968

788,484

788,484

251,731

2012-13

18,270,660

12.36%

2,197,106

1,098,553

1,098,553

310,069

2013-14

19,019,212

16.93%

3,219,953

1,609,976

1,609,976

511,423

2014-15

19,214,930

21.40%

4,111,995

2,055,998

2,055,998

446,021

1.00% 2015-16

19,407,079

25.80%

5,007,026

2,503,513

2,503,513

447,516

1.00% 2016-17

19,601,150

28.30%

5,547,125

2,773,563

2,773,563

270,050

Octorara Area School District

On the Horizon

Affordable Care Act

PCORI (Patient-Center Outcomes Reach Institute Fees) Fees to

finance comparative effectiveness research. $1 per covered life

in 2014, $2 in 2015. (2014 - $730, 2015 - $1,460)

Reinsurance Fees Health insurance issuers and self-funded

group health plans must pay fees to a transitional reinsurance

program for the first three years of health insurance exchange

operation (2014-2016). $5.25/month ($63/yr.) x average

number of covered lives. ($45,990 / Yr.)

Excise Tax (Cadillac Tax) 40% excise tax on employers for the

value of health insurance benefits exceeding established

thresholds. For individual coverage - $10,200, family coverage

$27,500.

25

2014-15 vs. 2013-14 Expense Summary

Variance

2014-15 Budget

$19,214,930

2013-14 Budget

$19,019,212

$195,717

$9,315,198

$8,565,997

$749,200

$4,250,458

$3,977,803

$272,655

$797,375

$851,100

($53,725)

$6,091,056

$6,281,930

($190,874)

Supplies

$1,584,828

$1,542,653

$42,175

Capital

Dues/Fees/Interest

$445,175

$3,110,308

$448,816

$3,254,680

($3,641)

($144,372)

$3,425,600

$3,550,600

($125,000)

$48,234,927

$47,492,791

$742,135

Salaries

Includes Athletics & Security

Benefits

Retirement Rate 21.40% vs. 16.93%

$889K

Outside Services

Repairs/Maint. Services

Electric Projection ($73K)

Trans/Ins/Tuit/Charter

Vocational/Technical ($154K), Charter

School Tuition ($150K).

Bond Interest ($125K)

Fund Trans/Principle

Fund Transfer Eliminated ($230K),

Bond Principal $125K

26

Questions

27

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Inked CultureDokument90 SeitenInked Culturemar phisNoch keine Bewertungen

- Astm B633Dokument5 SeitenAstm B633nisha_khan100% (1)

- Rigging: GuideDokument244 SeitenRigging: Guideyusry72100% (11)

- Of Periodontal & Peri-Implant Diseases: ClassificationDokument24 SeitenOf Periodontal & Peri-Implant Diseases: ClassificationruchaNoch keine Bewertungen

- December 2, 2013 Reorganization Meeting Downloadable AgendaDokument2 SeitenDecember 2, 2013 Reorganization Meeting Downloadable AgendaTimothy AlexanderNoch keine Bewertungen

- December 2, 2013 Work Session Meeting Downloadable AgendasDokument2 SeitenDecember 2, 2013 Work Session Meeting Downloadable AgendasTimothy AlexanderNoch keine Bewertungen

- Octorara Area School District - Financial and Compliance ReportDokument80 SeitenOctorara Area School District - Financial and Compliance ReportTimothy AlexanderNoch keine Bewertungen

- Octorara Area School DistrictDokument4 SeitenOctorara Area School DistrictTimothy AlexanderNoch keine Bewertungen

- Pennsylvania's Special Education Data Report For Octorara SDDokument1 SeitePennsylvania's Special Education Data Report For Octorara SDTimothy AlexanderNoch keine Bewertungen

- Octorara Area School DistrictDokument4 SeitenOctorara Area School DistrictTimothy AlexanderNoch keine Bewertungen

- Octorara Area School Board July 15-13 Regular Meeting AgendaDokument4 SeitenOctorara Area School Board July 15-13 Regular Meeting AgendaTimothy AlexanderNoch keine Bewertungen

- Curbside ShopperDokument1 SeiteCurbside ShopperTimothy AlexanderNoch keine Bewertungen

- Octorara Area School DistrictDokument4 SeitenOctorara Area School DistrictTimothy AlexanderNoch keine Bewertungen

- May 13-13 Work Session AgendaDokument3 SeitenMay 13-13 Work Session AgendaTimothy AlexanderNoch keine Bewertungen

- Chesco Residential Market ReportDokument1 SeiteChesco Residential Market ReportTimothy AlexanderNoch keine Bewertungen

- Apr 8-13 Work Session AgendaDokument2 SeitenApr 8-13 Work Session AgendaTimothy AlexanderNoch keine Bewertungen

- Aromatic Electrophilic SubstitutionDokument71 SeitenAromatic Electrophilic SubstitutionsridharancNoch keine Bewertungen

- NCR RepairDokument4 SeitenNCR RepairPanruti S SathiyavendhanNoch keine Bewertungen

- Argumentative Essay Research PaperDokument5 SeitenArgumentative Essay Research PaperJadNoch keine Bewertungen

- Hamraki Rag April 2010 IssueDokument20 SeitenHamraki Rag April 2010 IssueHamraki RagNoch keine Bewertungen

- Social Style InventoryDokument12 SeitenSocial Style InventoryMaheshwari JaniNoch keine Bewertungen

- Overall Summary:: SAP MM Certified Associate & SAP Certification ID: 0019350978Dokument6 SeitenOverall Summary:: SAP MM Certified Associate & SAP Certification ID: 0019350978Ganapathi RajNoch keine Bewertungen

- A Conceptual Framework For Characterizing M - 2019 - International Journal of MiDokument7 SeitenA Conceptual Framework For Characterizing M - 2019 - International Journal of MiKENNY BRANDON MAWODZWANoch keine Bewertungen

- Acuson P10Dokument2 SeitenAcuson P10anon-259218Noch keine Bewertungen

- ECC83/12AX7: Quick Reference DataDokument4 SeitenECC83/12AX7: Quick Reference DataLuisNoch keine Bewertungen

- Flores V PinedaDokument10 SeitenFlores V Pinedacha chaNoch keine Bewertungen

- The Impact Behaviour of Composite MaterialsDokument6 SeitenThe Impact Behaviour of Composite MaterialsVíctor Fer100% (1)

- Campus Sexual Violence - Statistics - RAINNDokument6 SeitenCampus Sexual Violence - Statistics - RAINNJulisa FernandezNoch keine Bewertungen

- Composite Restorations: Dr. Dina NouriDokument38 SeitenComposite Restorations: Dr. Dina NouriCatherine LoyolaNoch keine Bewertungen

- A Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthDokument13 SeitenA Review On Bioactive Compounds of Beet Beta Vulgaris L Subsp Vulgaris With Special Emphasis On Their Beneficial Effects On Gut Microbiota and Gastrointestinal HealthWinda KhosasiNoch keine Bewertungen

- Wilo Water PumpDokument16 SeitenWilo Water PumpThit SarNoch keine Bewertungen

- Bitumen BasicsDokument25 SeitenBitumen BasicsMILON KUMAR HORENoch keine Bewertungen

- Unknown Facts About Physicians Email List - AverickMediaDokument13 SeitenUnknown Facts About Physicians Email List - AverickMediaJames AndersonNoch keine Bewertungen

- A.8. Dweck (2007) - The Secret To Raising Smart KidsDokument8 SeitenA.8. Dweck (2007) - The Secret To Raising Smart KidsPina AgustinNoch keine Bewertungen

- Chomp Excersie 3Dokument5 SeitenChomp Excersie 3Omahri24Noch keine Bewertungen

- Action Taken On Oil and Ghee Sampling - 2020Dokument2 SeitenAction Taken On Oil and Ghee Sampling - 2020Khalil BhattiNoch keine Bewertungen

- B - Cracked Tooth SyndromeDokument8 SeitenB - Cracked Tooth SyndromeDavid TaylorNoch keine Bewertungen

- TCJ Series: TCJ Series - Standard and Low Profile - J-LeadDokument14 SeitenTCJ Series: TCJ Series - Standard and Low Profile - J-LeadgpremkiranNoch keine Bewertungen

- Missoula County Fairgrounds Phase 2Dokument10 SeitenMissoula County Fairgrounds Phase 2Olivia IversonNoch keine Bewertungen

- CP 1Dokument22 SeitenCP 1api-3757791100% (1)

- BKM 10e Ch07 Two Security ModelDokument2 SeitenBKM 10e Ch07 Two Security ModelJoe IammarinoNoch keine Bewertungen

- 13105389Dokument22 Seiten13105389Larry RicoNoch keine Bewertungen