Beruflich Dokumente

Kultur Dokumente

Let's Talk Bitcoin - Episode 06 - Cyprus and Serendipity

Hochgeladen von

wc4482Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Let's Talk Bitcoin - Episode 06 - Cyprus and Serendipity

Hochgeladen von

wc4482Copyright:

Verfügbare Formate

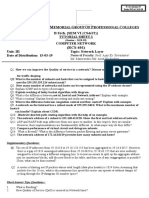

Lets Talk Bitcoin!

- Episode 06: Cyprus & Serendipity

Participants: Adam B. Levine (ABL) - Host Andreas M. Antonopoulos (AMA) - Co-Host Stephanie R. Murphy (SRM) - Co-Host Michael Hill (MH) - Guest. Bitcoin Cyprus Project. Segment starts at 15:21. Jeffrey Tucker (JT) - Guest. Laissez Faire Books. Segment starts at 44:00. ABL: Hi and welcome to Lets Talk Bitcoin. A show for anyone interested in CryptoCurrencies and the future of money. Coming up on todays show: *We have the San Francisco Forbes meetup report. *Theres always money in the banana stand, also teeny tiny ASICMiners, are you a buyer? *I check in with Michael Hall on bitcoins and the Cypriot calamity. *Making history. We talk Satoshi square and the cafe meetup origins of modern stock markets. *Bad stuff on the block chain. We separate fact from fiction and hopefully lay the issue to rest. *And finally, an extra-long interview with Jeffrey Tucker of Laissez Faire Books, on the Serendipity of Bitcoin and his journey from skeptic to enthusiast.

Looking to educate yourself on the future of money? Check out LetsTalkBitcoin.com/learn for your connection to the Bitcoin Education Project. My name is Adam B. Levine. I am a writer and speaker who likes to explain complicated topics in understandable terms. Thats really what we are doing here, taking the complicated topic of cryptographically secured money and helping people see what it can do in their own lives. Joining me in our ongoing quest for clarity are: Andreas M. Antonopoulos, an expert in decentralized networks and secure systems,

AMA: Hi

ABL: and Dr. Stephanie Murphy, a scientist and syndicated radio host.

SRM: Hello ABL: Thanks for joining me again on another episode of Lets Talk Bitcoin.

AMA: With all of this talk of technology, it's sometimes easy to get caught up in it and forget about all the people behind all the technology, and really forget about what wonderful people these are. So yesterday I went to a San Francisco meetup organized by a Forbes contributor, Kashmir Hill, who is doing an experiment to live on Bitcoin for a week, and this was her grand finale. She invited everyone to Sake Zone, which is a local sushi and sake bar in San Francisco, next to the Internet Archive - quite a nice coincidence, or a great arrangement - and she invited people to dinner. I thought you know maybe buy four or five people dinner, and set up a request for people to show up. So I arrived at the restaurant at 7pm and I looked inside and I was trying to figure out which table was the Bitcoin table, so I walked up to the people who looked geekiest and said, Is this the Bitcoin table? And they looked at me funny ... turns out all of the tables were Bitcoin tables, the overflow outside on the sidewalk was Bitcoin tables. The entire restaurant was taken over, probably 40 - 50 people were there, and boy what an amazing evening it was. Got to meet some incredible people. Some of the movers and shakers of the Bitcoin Industry there. I dont want to mention names. They probably didnt want to attract that much attention, but there were a couple of founders and CEOs from major Bitcoin Businesses there. There were lots and lots of users, interesting people, developers, new business owners, all kinds of people, as well as of course a whole bunch of journalist/press/media people. And it was a fantastic evening, lots of great conversations. Its so easy to forget about all the inspirational people out there, all of the great ideas, and what really brings us together [is] this shared purpose that we all feel. So I left this meeting completely buzzed, with dozens of business cards and connections which led to actually several conversations and follow-ups today. If you dont do meetups, start doing them. This is a great reason to do them. Bitcoin is a great way to get into the meetup space, and meeting people who are interested in Bitcoin is really a lot of fun, so Im going to be doing a lot of these from now on. SRM: Im totally jealous, that sounds awesome.

ABL: You mean I have to leave my house? AMA: Well no, actually you dont Adam. Whats really easy is you go to Meetup.com and you start one at your house, and then you watch the 40 people come there. Seriously why not? A picnic one would be absolutely awesome. I would come. Im actually signed up for 3 other meetups this week, and in effect its a way to keep meeting people. Also if you are interested in doing this as a living, right? If you are interested in earning bitcoin for work, becoming a bitcoin professional, starting a business, getting hired in bitcoin, oh these are great places. I mean, yesterday the place was literally full of both business people hiring people who were offering services - developers, graphic designers, various other areas of expertise, as well as a couple of VCs who were trying not to look like VCs. Investors, rather, I should say, who were casually listening in on conversations, and then making contacts. I wouldnt be surprised if a lot of Bitcoin projects get funded through t his type of serendipitous meeting.

SRM: That is so cool, you know even little New Hampshire, here where Im from, has bitcoin meetups once a week. Theres a pretty active bitcoin community here. Mostly libertarians and people who are involved in the Free State project in some way or friends of them, and its called the Free State Bitcoin Consortium, they have weekly meetups. Maybe the ones in the bay area are a little more filled with people from the tech sector. A little more high class. I heard great things about them. But yeah, I mean theres pretty much bitcoin communities all over the place. And not only do I think it would be a great place to get jobs and to network professionally, but also perhaps to meet friends, and to meet people to go into potentially future businesses with or projects with, or even to meet significant others, did you see any of that happening?

AMA: I am happily married and blind to all of that.

ABL: Well actually that is a decent question. What was the gender ratio like, if you could tell? AMA: Thats a great question, actually I would say it was a perfect representation of the bitcoin community. Every walk of life, every age, every ethnicity, country of origin, language spoken. weird accent, weird look, and gender was represented equally. SRM: Wow, thats awesome. ABL: That is pretty awesome actually. I think its great that you guys have active communities, but I think that, even you Stephanie in New Hampshire theres a really big liberty oriented community, so I think theres a lot of bitcoin awareness because of that. Im about an hour and a half north of San Francisco and theres nothing. I have about three towns, four towns around me and there are no meetups. So the question for me has not been do I want to go to a meetup, its been do I either A) want to drive a long way to go to a meetup, or B) do I just start something myself and take that on as an additional project. So I think ultimately thats whats going to happening is that Im just going to start a meetup and then its kinda going to grow from there. But I think thats something that: if you are listening to this podcast, chances are very good that you are way ahead of the curve of 90% of the people that you know. You kind of are the forefront of this, and if your local town or local area doesnt have a bitcoin meetup, its real easy to start one and once you do start one, they kind of become contagious. Its all about education, thats what we are doing here with the show, but thats what these meetups are about, too. Its about networking and its about education and sharing that information.

SRM: Yeah, I wonder if we can put something up on our website, LetsTalkBitcoin.com, about starting a local meetup and maybe listeners could post their meetups and find people to attend that way. ABL: Again, we gotta do this forum thing. its on my list to do, it really is. Well thanks for that update about the San Francisco meetup Andreas, thats really great to hear. Im gl ad that theres so much excitement, and San Francisco is kind of a specific place for that, and even so weve been hearing this sort of thing everywhere. I was talking with John Waller maybe two weeks ago, and he was telling me about how they had in Japan a local Bitcoin meetup that he had been attending, had exploded like 90% in terms of attendance over the course of a couple of weeks and there have been other stories there too, coming up all over the place. So I really think its the time and its the way people are interacting with each other.

==== Music ==== SRM: Im just looking at this thread here from the BitcoinTalk forum. And its called, the headline is: Announcement: Block Erupter USB, and apparently theres a company called BitFountain and they have an experimental batch of these USB powered ASICMiners that have passed their initial tests, they have pictures of them online, and each one mines at about 300 mh/s. Now thats not as much as the other ASICs that for instance Butterflylabs is talking about, or this Jupiter thing that we talked about, which may be just as figmentary as going to Jupiter itself, that supposedly mines at 250 gh/s, so that would be like 1,000 times faster than this little USB thing. But you can plug it into USB, it s entirely powered by the USB port, one of the pictures here shows a heat sink so you can potentially cool it in a bunch of different ways. And its opened to the air, you can see all the circuitry, it has a little LED in it that flashes while its mining, when a share gets accepted. They have a picture here where they have a ten USB strip and theyve plugged in seven in a row of these devices and they said theyve ran them overnight and they are all very stable. This looks really promising, this is like the first physical evidence with good pictures weve seen. And these are about the size of a quarter, I guess, of a small coin. Actually they are showing a Japanese coin, so Im not sure what kind of coin it is. But theyre pretty small, I would say like the size of your thumb and small enough that you can have a USB drive that powers them. Theyre saying they are going to be available for order in batches. Each one is going to cost two bitcoins, 1.99 bitcoins, and you have to order at least 300 devices, so this is going to be, the first batch is going to be for group-buys and retailers who are going to sell them to other people. So what do you guys think about this? AMA: I think its a great idea, really exciting. Its a great opportunity to get into and experiment a bit.

SRM: It looks like people are really really excited about this on the bitcointalk thread. Smaller USB ASICMiners that are a little bit more affordable for the average person are

probably going to make the network bigger, they are going to make it more distributed which is always a great thing. You could probably get ten of these, like they said, and run them off a USB strip, and you could be having some pretty good hashing power, so I think this would be a great thing for Bitcoin in general, and I would love to get my hands on one. AMA: Make that two please, Stephanie. Id like one too.

ABL: So there are two angles that I think that I have a little bit of differences with you on. I agree with you that this is good for Bitcoin, but from the perspective of someone who might actually want to buy one - I dont really know. Because, again, what youre doing, what youre trading, I think they cost like 1 bitcoin or 1.3 bitcoin each, you said?

SRM: No they actually cost two bitcoins each. ABL: They cost two bitcoins each. Okay, so they cost two bitcoins each, and youre buying them now, youll probably receive them now - but isnt there a problem with the ASIC saturation thing going to happen? Didnt Butterflylabs just announce that t hey are releasing, they are finally going to be releasing all of the pre-orders they took? So that would be my concern with this. You would buy this now, and by the time you got it, the network would have adjusted. So even though, yeah its 300 mh/s, which looks good right now, probably when the network goes up 20 times I just wonder what the return is going to be. That would be my primary concern, really with getting into any kind of mining right now. Is just that moving forward - especially if you are talking about stepping into Bitcoin, applicationintegrated specific circuit, those can only be used for Bitcoin. So 300 mh/s is good now, and certainly the power consumption is good. I just wonder if in three months if it is really going to be anything. If the network goes up 20 times, then suddenly you are talking about the equivalent of 15 mh/s.

SRM: Yeah, absolutely. There are a lot of people saying this on the bitcoin forums. And I mean, they actually have been saying this about every single mining technology that comes out. There will be at least one naysayer that says, Oh its not going to be profitable with this technology in a couple of months, so don't waste your time anyway. And even though people have been saying that for a long time, there have been some unseen things like the delay with ASICs being introduced into the market. The price of Bitcoin is also another factor. We dont know what the price is going to be in a couple months, so even if youre only mining a few Satoshis a day, that could be eventually really profitable. ABL: Right, and I think thats the wildcard there; but, again, anytime that we start talking these technologies, I think its really important that people keep in mind that what they mean now does not necessarily translate to what they are going to mean in the future. You know what I mean? At the same time, if for whatever reason all the technologies that are out there start to fail, then this could be even more valuable. I just think that the case is more likely

that it will be less valuable. But youre right, it is all relative based on the price of bitcoin, because earning 0.01 BTC when its worth $100 is not so great, but earning 0.01 BTC when its worth $10,000 is obviously a slightly different value equation. SRM: Right. Maybe its time to go to mbits [mBTC], like weve talked about before.

ABL: Yeah. SRM: Its not 0.1 bitcoin, its 100 mbits [mBTC]. I think the other factor is that these are going to be shipping from China, so who knows what could happen: shipping delays, manufacturing delays, custom delays, theres all kinds of different factors. When it comes to taking an idea and then getting a prototype built and then getting that mass produced and then getting that actually shipped. So all kinds of things could happen, and theres still a lot of risk involved in this, but I can see why some people are excited and I can see why some people are really skeptical.

===== Music ===== ABL: Were here with Michael Hill. MH: Im a Greek citizen and an American citizen living in Cyprus. I was born in [unintelligible], my mother is Greek, I moved to Athens, initially. Five years ago I moved to Cyprus.

ABL: So with everything that has been happening in Cyprus over the last couple months, is that something that has affected you and people you knew directly?

MH: Yes, absolutely. I consider Cyprus to be my permanent place of residence, so obviously, yeah, it affected me and pretty much everyone I know.

ABL: In the political situation leading up to it, was this the sort of thing where there was any warning whatsoever, as far as most people are concerned? MH: I think the general sense in Cyprus is that there wasnt a specific warning of what the final solution would be, but there were definitely dark clouds forming since the past year. Especially at the PSI deal with Greece which inflicted very heavy losses on Cypriot banks. Well, in Cyprus they call it the pre-memorandum - memorandum being the agreements that each individual country makes with the Euro group to implement certain reforms and

policies. The previous government, of Demetris Christofias, signed a pre-memorandum last summer to implement certain reforms. Apparently one of those reforms was restructuring the two major banks of the nation. The previous government didnt take any specific action. They basically just washed their hands on the whole matter and left it up to the new government that was elected in February to deal with the whole crisis. Basically the bomb kind of exploded in the hands of the new president. Two weeks after he was elected, he was basically ambushed at [the] Euro group conference.

ABL: So what you are saying is that the old government had made this agreement with the Eurozone prior to leaving, and then when the new government came in there was pretty much nothing they could do about it.

MH: Pretty much. And now politically the situation in Cyprus is that these two parties are trying to shift blame on each other. The citizens really dont know who to trust anymore.

ABL: So for people who have been under a rock, can you give us a rundown of what has been going on in Cyprus?

MH: The decision of March 15th was to shut-down and liquidate the nation's second largest bank, popular bank - Laiki Bank as it is called - and for it to be split into a good bank and a bad bank. The bad bank will take all the unsecured deposits and outstanding loans that werent being honored or up-to-date so to speak. That bank would be liquidated, which means they would go after assets that are tied to the loans, such as property or other assets. The good bank- which would be constituted of good loans and investments that are still in the black - it was essentially bought out by the nations largest bank: the Bank of Cyprus. So the current situation right now is that you have the Bank of Cyprus, which has basically confiscated all of the uninsured deposits, which is deposits above 100,000 euros, theyre negotiating the amount of the haircut that will be imposed on these deposits. A couple of days ago there was a decision that this amount would be close to 90%. So basically, any amount over 100,000 will be taken away from people and businesses and investors.

ABL: We originally started talking because you were posting on Reddit about wanting to go back to Cyprus and basically educating people about Bitcoin. Can you tell us about your plan? MH: What Im experiencing as a citizen, what Im seeing is that there is a severe cash shortage in the economy. People simply do not have cash to make transactions. Those that do have cash are holding on to it and only buying the bare essentials. So the economy has come to a standstill and this is in turn will of course lead to an even bigger economic downturn, and will affect the debt to GDP ratio, which is estimated to be -8.7% this year alone. Thats a very generous estimate. Cyprus is going through the same cycle that

Greece experienced three years ago and is still experiencing. I believe that Bitcoin could be a solution, if it is introduced to the economy as a competing currency to the Euro, youll basically have an additional currency to perform transactions. This of course is something very new. Im no expert on it. I just want to organize a bitcoin forum to get other people who understand economics better than me, who understand Bitcoin better than me, and discuss possible solutions to this crisis. ABL: So if somebody wants to help you in your task, is there a way they can get in touch with you? MH: Absolutely. I am very active on Reddit and try to update as much as possible. Im just getting started so, right now I am really not in a position to ask for specific help because I do not have anything specific. Anyone who is interested in tracking progress of this project, they can follow us on our Facebook page: Reboot Cyprus With Bitcoin. Also on Reddit, keep an eye on the Bitcoin subreddit.

ABL: How has the reaction been to bitcoin in Cyprus? Have you spoke with people about this yet?

MH: I do kind of have an approach I like to use. Whenever I go to a cafeteria or a bar or a shop, and when I ask for the bill, I just tell them, do you accept bitcoin? Everybody invariably says, Well whats bitcoin. I tell them, Well its a digital currency used all over the world, youve heard of it? He says, No!. So we start a small discussion, and I tell him, Look you want to know more about this, I started a Facebook page, look it up. Im also trying to organize a forum for anyone interested to come and talk. Maybe we can do this on a monthly basis and start finding solutions to this economic crisis. The reception has been very good. I was surprised, some people are definitely coming, other people really wanted to know more about this. Right now Im in the process of taking in a lot of information a nd writing it out in Greek, because there is not a lot of information in Greek out there. Itll really help in communicating about Bitcoin.

ABL: Have you run into anybody yet who is already working with the currency? MH: I havent run into anybody in Cyprus who is working with it. I did get a response on Reddit from someone who said hes been living in Cyprus and hes been tracking Bitcoin since 2010. I wrote a reply and I told him, Great, why dont you come to the forum? Lets meet. Lets talk. I hope to see you there. ABL: You said youre planning to do it as a monthly thing. What is the date of your first event?

MH: It will be May 25th, tentatively of course. When I return to Cyprus and I start using my connections there, I have a friend who works at the largest daily newspaper there [unintelligible]. Get some press releases and some articles to start getting the word out. I also have some friends from some advertising agencies that I used to work for, that can help me organize book venues, print some leaflets and put up posters. Im going to do all of these things a couple of weeks leading up to May 25th. There will be a lot of work waiting for me when I get back to Cyprus but Im very excited to do this. I r eally believe in the idea of Bitcoin as an alternative currency helping out Cyprus at this time. Maybe people outside of Cyprus need to get a better understanding of the social situation in Cyprus. The media in Cyprus have been pretty much using scare tactics, and the politicians of course. People of Cyprus have been presented with two ugly options. One is: stay in the euro, push through these reforms, go through five or six years of depression, and then at the end of the tunnel will be development. Thats what theyre saying. They are saying if we dont do this and we pull out of the euro and we print our own currency, the currency will be devalued by 70%80%. You will lose everything. It will be disaster, it will be chaos. People are scared into submission, basically. I believe in a message that is more positive. A message that there is an independent currency that is not controlled by any central bank. It doesnt require the use of commercial banks. All it requires is your faith in using it. All it requires is individual initiative. Thats something that really runs against Cypriot mentality. Individualism is not really the value that it is in American society, for instance. Or in British or in Western society. Cyprus is a bit more different. Its a more closed, conservative society.

ABL: It seems like something where even if people were aware of the possibility that it could happen, I dont think that anybody thought that it would happen in real life, right?

MH: There have been reports about politicians and relatives of politicians, pulling out their deposits from Cypriot banks just days before the Euro group decision. Theres a lot of anger in Cyprus, as you can understand.

ABL: I think it is a similar situation elsewhere in the world, where you start talking about these concepts, but people dont really have the context to appreciate or understand it. Really to conceptualize that things could be different from the ways that they are now, but here we have an example of exactly that happening - a really drastic change happening with very little notice.

MH: Yeah, and in a sense, Cyprus is in a unique situation to really test the limits of Bitcoin. To see where it can go, and I think that the Bitcoin community really wants to see this happen in a country, in the sense that, so far bitcoin has been seen more as a speculative investment. Something that you can buy today and sell short, in a month or something. The price crash last month was something that a lot of people expected, but perhaps not to such extremes. Bitcoin has volatility issues, it has some regulatory issues. I believe that these will smooth out if a country like Cyprus actually starts using it as a currency. It is in the interest of the international bitcoin community to see Cyprus to successfully start using bitcoin, and of course it would be in the interest of Cyprus itself.

ABL: So lets play this out. Everything works. Everything goes to plan. Were a year in from now, and youve had several of these symposiums or meetings. What does it look like?

MH: Well I envision kind of like an economy of competing currencies. The choice of which currency to use at any given transaction is up to the individual. In this scenario, any price volatility in bitcoin, or even in euro, would mitigate any loss to the individual, if he or she would have an amount in both currencies. ABL: So essentially, not putting all your eggs in one basket. Youre hedging your exposure to your given currency, even though its your local currency.

MH: Yeah, as opposed to the system we have now, where we have basically a monopoly in currency. We have a euro monopoly in each country. This concept of each country must have an official currency, pretty much a twentieth century concept. The world has moved on. The world has become more globalized, more interconnected at an individual level. The concept of Nation-State no longer can satisfy the individuals need. Perhaps we are moving into a future where we will have only digital currencies, in the distant future I mean. I think its already started. I think were already moving into that direction. The first country to begin accepting this new reality thats forming, will be in a very good position in the long run. I c an still see a role for the euro, in a sense that we can still pay taxes in euros, still pay for government services in euros, start paying off national debt in euros. Bitcoin can mostly serve as a currency for everyday transactions. The smaller transactions and for international transaction, obviously, because Cyprus has basically been cut off and isolated. In a sense, Cyprus doesnt belong in the Eurozone. They use the euro, but they dont belong in the Eurozone, because there is no free movement of capital. Like I said, Cyprus is in a very unique position to start using bitcoin, and digital currencies in general. Im not a shill for bitcoin, I mean litecoin, terracoin, maybe we create a Cyprus coin. Im just saying the concept of a digital currency, a currency that is not printed by a central bank that belongs to the global financial system, is the way to go.

ABL: Michael Hill. Bitcoin Cyprus Project. I appreciate your time.

MH: Thank you Adam. And I hope we can talk again.

==== Music ==== If I showed you a website where you could easily purchase electronics from the worlds largest distributor, with bitcoins, at zero percent markup, would you think its too good to be true? Good news, its real and its at Bitcoinstore.com. Choose from half a million items, save

money over Amazon and Newegg, and convert your bitcoins to real world items. You can even buy with privacy. All they need is a shipping address. But dont take my word for it. See for yourself, at Bitcoinstore.com. ABL: Lets Talk Bitcoin is funded by your donations, with a per episode support goal of 1 BTC per show. Episode 5, so far, has received a total 0.64666 BTC, so far from a total of 12 donors. Thank you very much! Please remember even if the amount you would donate is small, with bitcoin and a growing audience it adds up fast. If you are new to bitcoin and would like to learn how it works in more detail, please visit LetsTalkBitcoin.com/learn/ to be directed to the bitcoin education project, which I highly recommend. If you are wondering what the hosts look like, want to correspond directly, or want to learn more about the team behind Lets Talk Bitcoin, check out the meet the team section on the site. Hosts have individual tip jars on their pages, so if you would like to make sure you are rewarding the right individual, thats your destination. Lets Talk Bitcoin is also seeking sponsors whose bitcoin related products or services would be useful to our listeners. Please contact Adam@letstalkbitcoin.com to start the conversation. And of course our show would be nothing without an audience. Please share Lets Talk Bitcoin with anyone you think would or should be interesting in the future of money. Lets Talk Bitcoin is released under an open sourced license which allows for the non-commercial clipping, remixing or posting in any format or to any site you want, so long as you include a link to our site: LetsTalkBitcoin.com. Were also actively recruiting both on and off -air talent for this and other shows to come. Once again, if you are interested please contact me at Adam@letstalkbitcoin.com.

SRM: A couple of weeks ago, I was in New York City for an event called Anarchy in the NYC, and while I was there I went out to dinner with a group of people, and one of the people there was the person who runs the New York City bitcoin meetup, and he gave me a business card. Then a couple of weeks later I connected with him on Facebook and he shared this article with me: Theres a bitcoin meetup going on in New York square in New York City, and its an actual literal marketplace for buying and selling bitcoins. I think it could be potentially later on for selling actual things - like objects, physical objects for bitcoin - but this first meetup there was just bitcoins and legacy currency changing hands and it was actually very successful. The New York Times has a piece about this meetup and its called A Push for Bitcoin Buttonwood. Theyre saying, Just feet from the park statue of George Washington in Union Square, a crowd of young men gathered on Monday afternoon to buy and sell the digital cryptocurrency. They were brought together from an online posting from this guy Josh Rossi, bitcoin aficionado who works in technology at the World Trade Financial Group. Then the go on and talk a little bit about bitcoins and they describe some of the transactions that went on. The first one is that somebody bought $20 worth of bitcoin at the rate of $120 per bitcoin. Once the first transaction went through, that was followed by many other transactions. I think this is really exciting. They are basically taking local bitcoins to the next level. Once they get some traction and start meeting regularly, people are going to know that they are there and this is where you can go to get bitcoins and people may be hearing this and thinking, Oh this is some sketchy, meet some dude in the park and hand him some cash, get some bitcoins, you might get mugged. But no, that doesnt sound like what it was at all. I mean it sounded like it was going on in broad daylight, there was a lot of

documentation, lots of people around making sure everything stays safe and above board. I think its really cool, Im excited about it. What do you guys think?

AMA: San Francisco is the place where farmers markets gained early acceptance and actually became huge. I am literally and honestly embarrassed that we didnt think of this first, so either Ive missed one that was already happening or we need to get our act together. I mean come on, we should have a bitcoin farmers market or a bitcoin open air market. There are so many awesome locations right here in San Francisco, and in the bay area in general. Across the bay in Berkeley for sure, and many other places where this model would work beautifully. Either weve missed it or this should definitely be happening and I think this would be a huge success here. Its a great idea. SRM: You know the origin of the term Buttonwood which was the title of this article: its a reference to the start of the New York Stock Exchange, which was some meeting where they were trading stocks or something like that, so I think that was cute.

ABL: What it sounds like happened is something close to a prototype for an old style trading pit, where youve got buyers and sellers offering and competing for each other basically for price, and then once an agreement is made, the interested parties step aside and do their transaction, and then go right back into the pit. Does it sound like, do we think, this can go in that way?

SRM: Yeah, absolutely. If you look at some of the transactions, there was actually another article that detailed every transaction that was made, and there was a pretty good price spread from people buying at $120 a bitcoin, down to like $104-$108, and it changed over the course of the afternoon. So, that was super interesting to me.

AMA: The historical references here are tremendous. I mean I often have the feeling when Im dealing with bitcoin and bitcoiners that we are making history. Its a very very strong feeling and I think a lot of bitcoiners feel like that. This is unprecedented. Its unchartered territory. And the historical references back to the 1600s, when one of the most major changes in human economic condition happened. Essentially, the 3,000 years before 1600 were all zero-growth years. And then from 1600 until modern days, weve had this exponential growth in economies. Before 1600 it really wasnt happening. What happened at that time was lots of different things converging: Renaissance, Enlightenment and all of the other things, including the modern corporation - East India Company, etcetera etcetera. And one of the interesting things is that it was also the beginning of stock exchanges in London cafes. It was meetups that started and in fact very near to the locations of the first cafes in London where those meetups started for merchants to buy into things, like the East India Company, is where the London Stock Exchange sits today. We are definitely making history, and were doing a lot of the same grass roots things that they did back then.

ABL: I really appreciate that historical context. I was not that up to date on the history of stock markets, but ya it sounds like thats exactly what we are doing, just transpose us a couple hundred years.

==== Pause ==== ABL: Theres been a story going around about kiddie porn in the block chain. I think this is another one of those stories where the headline sounds a lot different than the actual facts are and I thought it was important that we address this as quickly as possible. The original way I came across it was actually from a writer named John Rob, who usually I have a lot of respect. He runs a blog called Global Gorillas and hes a very forward thinking writer essentially about new security issues and things like that. He describes it like this: Bitcoin is currently being used as a publishing system due to a design flaw. That flaw threatens the viability of bitcoin as a currency. How so? Some folks have exploited that feature/flaw to publish Wikileaks cables and pedophile porn links in bitcoins block chain. Of course thats a problem and may attract some aggressive behavior from governments well before it reaches maturation. However, thats still a problem since bitcoin is decentralized, the steps required to prevent people from publishing information is very difficult. The article goes on but I think that kind of gives the general impression that I've seen out there most commonly, is that theres kiddie porn that is being put into the block chain, along wit h other things that we dont want there quote-unquote, like the wikileaks cables. And somehow this will be a problem because it will bring down the ire of the regulators. Because as we all know, the one thing you can do to totally get yourself targeted by government agencies, is to deal in some way shape or form with child pornography.

AMA: Let me just fix that last statement for you, Adam. The one way that government agencies can crack down on whatever they want is by loosely associating it with one of the big boo-ga-boos.

ABL: Right.

AMA: That are tiny and insignificant threats, but they mobilize an entire military economy and the wrath of the people to respond to. So if you want to make someone look bad, you associate them with one of these big bug-a-boos. And thats whats annoying about this, because really ... you cant ... put ... child porn in ... the block chain. Was that clear enough? Yeah, you cant. You can put text in the block chain. You can put links to stuff in the block chain. So this is really just a big sensationalist mess. Its really disappointing. The people have been reporting on this as if its a real issue. Obviously Im a bit sensitive about the issue because I think that a lot of good technologies, especially ones that are new and difficult to understand, immediately get painted with the absolute worst possible use imaginable, and not all of the other uses that are much more frequent, much more relevant, and perfectly legitimate. At the end of the day, lets be real. Most child porn and drugs and other things are bought in US dollars. [Of] course the big difference is that when people buy

those things in US dollars, sometimes they also roll up those US dollars, and use them to snort those things straight up their nose. So bitcoin, in a way, is much more benign. As I said before, criminals use the most powerful tools they have at their disposal be that phones, cars, or money. And this particular case is really conflating those two issues in a very bad way. You can put 255 bytes of text in the block chain. You can put that in a cookie on your browser. You can put that in the HTTP headers on your browser. You can put that in the disc encryption on your laptop. You can put that in any one of the apps that you bought on iTunes or through the Android market. I say we ban all of those. ABL: Okay so, pretty clearly we all think this is a little bit silly, but lets talk about what the actual complaint is. You said it was 255 bytes worth of data. What are they talking about when they refer to child porn? Because I dont think they are talking about links, because if theyre talking about links

AMA: Yeah, they are talking about links. These are links the size...

ABL: Oh they are talking about links? AMA: Yes, absolutely. These are URLs, thats all thats in there. Its URLs to a couple of sites, and in fact most of the people looking at this didnt follow these links, they just looked at the titles and thought, Whoops, thats nasty. Yeah, its links. The Wikileaks cables that are in there? Theyre links to the Wikileaks cables. These are links to those sites. In fact, all of these links exist in an other really, really nefarious organization called Google. ABL: [Laughter] So youre saying you can search for all of these things and they can come up, basically. AMA: Oh of course, absolutely. And in fact, if youre searching for other things, sometimes they can come up, as you can imagine, and they get buried under miles and miles of relevant results so you dont see them. You really have to go to extremes to even find these things on the block chain, to even know that theyre there, and when you do, all youve achieved is what you could have achieved with a Google search, if you were so perverted. Most of the time the text field in transactions is not used. Occasionally, I put a little note in a transaction to remind someone why Im sending them money, but for the most part that field remains unused. I dont know. Stephanie, Adam, have you ever put in a text comment in a transaction? ABL: Ahh, Ive put.. Ive labeled things but I dont think thats what youre talking about. I think youre talking about actually a message that gets sent, right?

AMA: Yes, thats the optional message you have a little text area underneath your transaction. You cant do it on the main wallet, really, the mobile wallet for sure doesnt bring that to the front of the user interface. On Blockchain if you do a custom send, you can add a message to the bottom, but the quick send doesnt do that. So the easy answer, [how] people found this was simply that 99.9% of all transactions dont have any text. The ones that do have a little text. So its very easy to find the ones that have a lot of text. Or to search for link patterns and URLs, and those have various weird things in them.

ABL: So from a worst case scenario standpoint, I mean trying to look at this from the perspective from the people who are actually legitimately concerned about this, or at least saying that they are legitimately concerned about this, whats the scary pit ch? Because I mean, clearly the putting child porn in the block chain is not really an accurate assessment, so what is an accurate assessment? That you can just put a link, and then that could like but then, its not like youre hosting - its not like you can look at it there. It just - if it lives on the internet, I dont understand how its even a thing, you know?. If it lives on the internet and you can find a link to it - because obviously you have to be able to find a link in order to get to it - so if you can find a link to visit it, doesnt that mean you can take it down? AMA: Well yeah. Thats the main point. I think the main concern is this. The block chain is forever. Once its on there, its forever. In fact we depend on it being forever. We also depend on the block chain being everywhere. Everywhere plus forever means that when youre running a full node client, you have the 7-8 gigs worth of block chain on your hard drive. You possess that. So the scary part was, well if people could put, not links, but the actual bad stuff in these 256 bytes, then you would be in possession of that stuff just by having a full node client. Thats a very tenuous argument, both legally and philosophically. The fact that some bytes are on your computer, and theyre links, you cant really put images or things like that in there. So I think its an overblown concern. In the future, we may have to think a bit more clearly about what happens if certain blocks so objectionable that you need to recalculate the block chain from that point over. But I really dont think you can do anything in text that isnt protected by first amendment speech, or could be used, really, for a possession charge, when you have absolutely no knowledge whats in the block chain.

==== Music ==== ABL: Today I am honored to be joined by Jeffrey Tucker. Hes is the executive editor of Laissez Faire books and a scholar of new economics. Jeffrey, weve been talking about the serendipity of cryptocurrencies, like Bitcoin, gaining exposure and popularity, during this time when the money we all use isnt doing so hot. Is this an equal and opposite reaction, or is something else happening here? JT: I dont think its a coincidence at all that we saw the rise of Bitcoin at the time that weve seen it: right after the currency crisis of 2008. That really put everybody on notice:

something is not working about the system. Its exactly that period the regulators, the Fed, the Treasury and everything - they sent the whole system into a gigantic upheaval thats fundamentally changed its workability. Banks today dont work anything like what they worked like ten years ago; its a completely different operation. They make money in a different way their reserves are handled in a completely different way. The Federal Reserve is totally dedicated to [hampering] down interest [rates] to zero, to negative. Money and the financial system just isn't working the way it used to work, so Satoshis invention, Bitcoin, comes along really at exactly the right time. Its kind of the perfect storm in many ways.

ABL: The monetary system has already moved to kind of the future of money, except for all the people like us, who are still stuck here using the money that weve been using all along. Its just not the same that it used to be.

JT: Well one of the exciting things about using digital currencies, alternative currencies, is that you gain a realization of something that you can read about in books, but it really comes home to you once you start actually engaging in real transactions with alternative private currencies - like Bitcoin. You suddenly realize that the dollar system, that the world money system in many ways is nationalized and has been for about a hundred years at least. Something fundamental changed in 1913 with the advent of central banks. It basically meant that a kind of cartelized government structure nationalized our money, and the results a hundred years later are not pretty to see. Weve seen massive depreciation, of course, take place. But also continuing levels of business cycles and it worsened at every stage. Whether it was in the 1930s or when Nixon finally closed the gold window after the collapse of Bretton Woods. Weve been on kind of this long run experiment, where money has been basically managed by government and its connected power structure, within a very stagnant and ancient sort of aging institution called conventional banks. This fully dawns on you once you first kind of get engaged in making bitcoin transactions. You suddenly realize, oh this is the way money could be working in the digital age. I see it essentially as an unstoppable force. The digitization of money is coming - if its not already here - and its just going to grow more and more as the years go on and the government structures are just going to continue to fail. I mean there [are] certain analogies out in the world. You can look at the way mails have gone from being purely monopolized from public policy, essentially from the early days of the republic up until the invention of email. And then the whole system kind of blew apart. And we saw the invention of a totally new way of doing things, that blew our minds, that were new ways that were unimaginable in, say, the 1960s. Now we take them for granted, but the same kind of thing, you know - it also happened in education, it's happened in healthcare, it's happened to a lot of sectors. Well now the same force of innovation and digitization, choice is affecting money and finance. And I think thats going to be our future. ABL: Ive heard this argument before, that we are essentially going to see essentially government money or legacy currencies as I like to call them, become kind of obsolete. But there seems to be an inherent conflict in there, because while the mail analogy works to a certain extent, governments dont transact mail in order to fund government. But they do do that with currency. So isnt there kind of a clash thats inevitable here?

JT: Well, yeah. You can make it a clash. I think its really up to public policy, and th e regulators. If they want to make it a clash thats fine. I dont think they can win if they want to make it that. But its also very possible that during the rest of our lifetimes were going to be operating with parallel systems. And many people around the world are used to this, in the world of money and banking. Dollar users and the developed world arent usually used to that sort of thing. Where youre juggling several different currencies, you are keeping various exchange rates in your mind all the time, but people of the developing world with exchange controls and fixed relationships between their kind of cruddy local currency and the dollar, are used to this. They sort of grow up with this system and this is what they live with. So theres nothing wrong with parallel systems. Competing currencies is if they had to call it (???). ABL: The third world to the US Dollar analogy is an interesting one, because I think that its good but its also brings up, again it brings us back to these issues. The r eason that people in a third world country use the dollar as a parallel system is because their currency that they use on a local basis is not very valuable in certain contexts. So isnt that where we are now with bitcoin? Before you have the cryptocurrencies, pretty much any currency thats out there is a currency created by fiat, created by governments and backed essentially by those governments that created them. Bitcoin presents a new type of competition entering the market, as far as I can tell there hasnt really been anything like it that has this decentralized no real control structure for any particular organization or group. It just feels that the other currencies become sort of secondary in nature if you play out this logic to its logical conclusion. JT: Well I think that thats right. Theres also a very interesting thing that happened with Satoshis invention here. He kind of looked at the operation of the gold standard and built into bitcoin, what people sort of put down as the deflationary tendency. I like to look at it as a relentlessly rising in purchasing power. Thats possible just because of these very strict limits on mining and then the ultimate final limit on what can be created. You have within bitcoin as an unusually sound currency. Its even radically sound. Its even sounder than a 19th century gold standard. Its kind of severe and strict in some ways. So the market will tell, and I think that from my reading of monetary theory and monetary history that the sound currency will eventually prevail. On the other hand, what you call legacy currencies will continue to be, obviously will be in demand for the conduct of public policy and that sort of thing, and I think those can exist side-by-side. My reference to the developing world is very much shaped by an experience I had some years ago when I traveled to Nicaragua, and at the time the government had very strict exchange controls on the local currency as it relates to the dollar. They hit you at the airport, and they would hit you at the official money exchanges. You got on the street and there were kids that were 7 and 8 years old up and down the block that were exchanges currency with tourists. They keep up with the rates. They knew a lot of math. They knew a lot more than the tourists themselves and the rates were constantly changing because it was a highly inflated currency at the time. They were just masterful at it. I had to laugh at it because I thought well here you have these poor peasants in some poor country actually doing more complex financial transactions than

most American school kids could ever do. Its a so so very complicated system but they managed to - I think its the kind of thing we are going to see in the future. Im sure you have been through this too but, if you go through an entire day or two where youre using bitcoins for your financial transactions, for retail purchases and things, you do begin to experience a kind of mental shift taking place, even with your own mind. You begin to price things in terms of bitcoins. You can see this bit of emergent sociology of what its like to use this new currency. That was very exciting for me. Its a mind opening experience. I think that in the future were all going to get used to this more and more. ABL: On this show weve had the luxury of being able to kind of operate in an entirely bitcoin ecosystem, where our listeners donate and our advertisers pay in bitcoin, and we are able to use those bitcoins to pay our contractors. I actually just kind handed off a business card creation project for 0.2 bitcoins to someone who, I have no idea where they are, it doesnt really matter where they are, it just matters their quality of work. Its a really really interesting process and it lets us work with new people very quickly instead of having to go through some sort of payment processing system. JT: Yeah that is so thrilling, thats so exciting. I felt it - I have to tell you that I felt it the very first time. Well somebody donated a bitcoin to me at some point, not a full - I mean it was some small fraction, so I began to sell off some of the goods that I brought with me to a particular conference for bitcoins because people were buying them. But I had enough actually to use one online. My first purchase was so exciting - easier than Amazon 1-Click you just feel like you are transported to this future world. Actually you almost feel like an idiot that you bought into the old system. Actually, the first time you use bitcoin you see that the legacy currency system, or what I call the government currency system, is just so old fashioned by comparison. I felt a sense of flight: what it must have been like to be in the Kiddie Hawk for the first time. Its just such an incredible kick, and you cant really go back. I think this is why people get so dedicated to bitcoin after using it just a little bit. You begin to realize the possibilities and it just changes your whole outlook on life. I think we need to realize, too, that the emergence of this as a currency, and even as a payment system, presents a lot of challenges to sort of the intellectual elite who hadnt really entirely - youll notice theres sort of a dearth of academic papers on the subject, right? They are just now emerging and people are trying to catch up, trying to figure out what the heck is going on. We are living in a real time experiment here in which the real buying and selling of individuals, the real innovations playing themselves out, the digital age market-economy, are serving as a kind of institutionalized philosopher-king teaching governments and intellectuals something about the world that they didnt know before. Its going to cause of a revision of a lot of monetary thinking and a lot of thinking about the world. This is not a political thing, really. The Left is challenged by this, the Right is challenged by this. All the old assumptions are being blown up by real-time market experience. I was thinking about this last night - with Satoshis invention. The usual path is that you propose an idea, throw it out to the academic journals, it gets peer reviewed, all the old tenured professors knock the idea around, kill the young guy or whatever, and then twenty years later, maybe you start to see it emerge. But, thats not what happened in this case. Satoshi proposed the idea and then threw it out there, discussed it for a while and then disappeared again. The thing is playing itself out in real time market conditions. The peer review process is the market itself.

And the intellectuals are just scrambling to keep up. Its a very intriguing process to watch. I know that in my own thinking has begun to shift that faithful day, when I acquired bitcoin and then began to use it, it shocked me and now Im realizing [that] Ive carried around a lot of errors in my head for many years, you know? I think a lot of people are going to start seeing this. ABL: On the subject of new economics in the Austrian School - as its grown in popularity over the last couple of years, kind of alongside and on top of bitcoin actually - theres been a lot of skepticism coming from that community. I know youre a relatively new convert to the cryptocurrency thought. Why do you think that is and whats the journey?

JT: You know its interesting that you would ask me that question because it has been quite a journey, a little bit of a private journey actually. Because I have been steeped in monetary thought for a very long time - I wrote my undergraduate thesis on the gold standard, had long been a gold standard advocate, fought all the monetary wars between the Austrians and the Keynesians and the Monarchists and so on. Youre embedded in this world long enough you think you kind of know everything there is to know. I guess Ive heard some jabbering about bitcoin, a year or so ago, maybe a couple of years ago, but I didnt pay much attention to it because it seemed to me that it obviously contradicted everything I thought I knew. I believed that I knew that a money had to emerge out of a real commodity used in the real world. First as a barter and then as a kind of speculative venture, as indirect exchange, and the whole process that people normally assume with the Regression Theorem. So bitcoin comes out of nowhere and my first thought was well this is obviously untrue, it cant be the case. But as I began to look at it, I think whats happening here is that we sort of fail to understand that we are living in a time where code - really well written code - is extremely valuable. Its obviously a commodity, its been the driving force of the worlds economy for the last 30 years. So its not necessarily a contradiction to the Austrian version to see cryptography used to create a currency that has all the properties of the definition of a currency in every single respect that emerges essentially out of a commodified code. You would expect that, I think, in a digital age. I think we need to realize that the world changed dramatically over the last 20 years - essentially migrated from the physical to the digital world - so it makes sense that money would take that same trajectory. But even then I still wasnt convinced because the real beauty of the digital sphere is its capacity for infinite reproducibility of everything. I mean thats been the source of its economic magic in so many ways. Well in the money world you dont want infinite reproducibility. You want strict scarcity and you want strict title ownership. You dont want commons and you dont want all those sort of infinite features of digital media pertaining to money. I think it was from reading a Wired magazine article or something, I began to realize that Satoshi understood the same thing, and built into the structure of the protocol [is] the strict assignment of title and owner, sort of tricked digital media into replicating perfectly and even improving on the best monetary system you could ever hope to develop in the physical word. I was so dazzled by the brilliance of the innovation that it just knocked me off my chair, I just couldnt believe what I was seeing. Thats when it clicked for me, suddenly, and then I sort of realized its viability and its compatibility from what I knew before, although I had to adapt my own thinking. I always urge people that are skeptical of bitcoin just to look a little more in depth at it - not just read the whatever press story that happens to be in the Wall Street Journal -

but to look at the more detailed work on it: examine the code, where it came from, the thinking that was behind it, the operation of the system. The more you look at it the more you realize, Oh my goodness. Okay, Im beginning to understand how this works and why this works.

ABL: I have it in my head that if a nation were to issue their currency backed by bitcoin reserves: a nation like Cyprus or Greece or some place where they are having a lot of trouble with not only stability but also with corruption in the government and [unintelligible] , specifically. If they were able to leave the Euro, issue a currency backed by bitcoin reserves kept in one or many transparent wallets, it could kind of operate like a modern gold standard yet not be subject to the games that can be played when the reserves are locked in a vault hidden from sight. Am I missing something here? JT: Thats very interesting. Youre sort of touching into some of my own intellectual trajectory here, in thinking about the relationship between bitcoin and the gold standard. One of its advantages is precisely that it doesnt have to be locked away. That it can be held by users. The corruption of the current monetary system really begins half a millennium ago when bankers first persuaded users to let them keep their gold for safekeeping and then began to develop loan markets based on kind of fractional system. Within bitcoin thats essentially impossible. I mean you can have loan markets but theres a very strict ownership to everything. Plus there is no need for the warehousing function traditionally understood because obviously bitcoins are not heavy and you can carry them around and the individual can keep them in cold storage. You dont have that potential for corruption there. In so many ways its an improvement. Im intrigued by the possibility that bitcoin might have a strange effect that none of us understand and I think we have to prepare ourselves for surprises. You and I could talk for 48 hours about this subject and brainstorm and still miss the thing that will ultimately happen here, but I do think its interesting to imagine the possibility that bitcoin will end up improving government systems of money, just in the same way that all competition improves every good and every service. Central banks might be discouraged from egregious haircuts that they attempted in Cyprus in the future. We could see governments firming up the quality of the money to prevent a run out from the currency into digital currency. We could see dramatic changes in monetary policy, in which bitcoin becomes a kind of a teacher to governments and fiscal banks about how to run a sound monetary system. That could happen, but I think the worlds population would be better served by sound money than the current system, so however we get there Im all for it.

ABL: Jeffrey I noticed that Laissez Faire Books, LFB.org, does not accept bitcoin for membership. Are there any plans to make a move in that direction? JT: Yeah, theyre big plans and everybody is working like crazy to make it happen. LFB is a subsidiary of Agora Financial which is in turn a subsidiary of Agora Inc., which is a big global corporation with about 6,000 employees internationally and a unified accounting system.

ABL: Not as simple as just throwing up a button on the website. JT: Yeah, you know its funny how it is, its actually not a surprise to you at all, it wouldnt be a surprise to anybody who works in web commerce but its a lot easier for small institutions to innovate in these edgy areas than it is for large old institutions. I will tell you that everybody at my office - including the accountant team and the legal team - that everybody is super fired up about this and working really hard to think through all the implications and implement the solutions. That makes me happy. As long as we are making progress, then thats good, but anybody else - thanks to so many of the innovations, really over the last 6 months - its so easy for small companies and blogs and anybody to accept bitcoin and everybody should just immediately do that. I dont know why anybody would be waiting at all.

ABL: How long have you actually been interested in bitcoin, because you said you were aware of it before, but when did that shift happen? JT: Thats a fascinating thing because when I was an editor of Mises.Org, I used to get these bitcoin submissions and I used to think, Oh my goodness. Ive always loved code geeks and the code world and I wrote a ton of articles about it and really adored this sector of life. The thing about being an editor of a publication: the publication can only be as smart and good as its editors, really, because editors dont want to run anything they dont fully understand. So all throughout 2011, really - I guess I moved to Laissez Faire in Nov. 2011 but all throughout that year I was getting lots of submissions of articles on the topic. I just couldnt wrap my brain around them. I didnt know how to evaluate their judgment on the matter. It became very frustrating for me as an editor because I just couldnt rea lly - I was learning as I was reviewing the articles, you see what I mean? Its very difficult to make those kind of judgments. Mises.Org itself never said a word about the subject during that entire year. I moved to Laissez Faire [and] that was on my list of things to finally discover. Finally it happened to me when I went up to New Hampshire for a conference that several merchants, bitcoin associated merchants, surrounded me and dragged me to lunch and made me an owner right there on the spot, and thats what changed everything. Its one thing to sort of think about a subject abstractly, but once you possess it, and Adam I think you know what I mean here. Theres something funny about bitcoin in particular, that it does have the psychology of a physical thing. You do have the experience of having acquired something real when you get it. I mean its true that its all digital and all the rest of it, but you do get swept up in this sense of ownership when you first get your first bitcoin. So that was the beginning of the process and that was only, I think now, maybe two months ago. Yeah, so I threw myself into it big time, because when I was the administrator and editor of Mises.Org, all my professional experience is that you need to follow the innovators, you need to see what they are doing, because that is the future. And the people that put down the innovations, thats sort of sociological cultural impulse to disparage the edgy new thing is almost always wrong. Eventually yesterdays crazy radical idea becom es todays conventions that everybody just assumes are normal. Ive lived through the cycle again and again. I mean I saw it with email. The first time someone tried to persuade me to get email, I

was like, Why do I even need that? Ive got modem and a phone attached to my wall here. I could just hook up to someone directly. I couldn't see the need for it. Well I was wrong and then the same thing on the World Wide Web. When I first looked at it I thought, Well this is just a whole series of bill boards. No different than driving down the highway. Whats the advantage of driving down this highway? That was my first thought. Well I was wrong. I began to learn over time that theres kind of an unfolding process with new technology. First its edgy, its buggy, it doesnt seem particularly useful. It doesnt seem like you really need it, so you have these early adopters that go into it and try to improve it and make it more accessible and make it more useful. By the time it becomes mainstream, everybody just accepts it as a normal thing and they forget that it was controversial. I remember when Amazon first began, people were putting it down. This is ridiculous. This is a stupid idea. This is not a business model. This will never go anywhere. David Broder for the Washington Post wrote a column, I remember, that just put down Amazon that said, This is not a stock that I would have anything to do with. This is a disaster. This company thinks it can buy and sell products using the internet? Well what makes them think they can do this better than anybody else? Anybody can do this, so it has no particular advantage. Hes putting it down. And then the bust of 1999 seemed to confirm all the skeptics and their attitudes and their sort of the luddite attitudes. But of course over the following ten years, retail web commerce shaped the world. We are seeing the whole world just completely revolutionize fundamentally. Massive global upheavals as a result of technology and all the skeptics have been proven wrong. I think that the same thing is happening with Bitcoin. Ive seen this process play itself out too many times to not take this subject extremely seriously. I think its going to surprise us and amaze us, how the world is going to change in the future thanks to this fundamental radical innovation that goes to the heart of economic life of people and nations.

ABL: One of the reasons that people are getting into it is because the price has gone up quite a bit. Now you said that you got involved about two months ago. To some people the price is important, some people not so much. Where do you stand on the issue? JT: Yeah. Well, its funny. Newbies are always focused on the price, right? Once you get a little more sophisticated you realize what matters is functionality more than anything else. Its not a commodity that you just want to treat as a speculative investment. Its purpose is to emerge as a real means of payment. Its an emergent money, not just a speculative venture. But yes, I lived through the soaring up to $266 and then back down again right at the sort of dawn of my enthusiasm for this sort of thing. So for me to watch was extremely intriguing and it caused me to go back in history and see how those played themselves out in real time. I looked at the railroad industry as a good example of this. Railroads were subject to wild speculative frenzies at the time because they were entered into real market conditions. And people had, at the time - Im talking in the 1870s - had a hard time distinguishing between railroads as a technology and seeing what that technology would do for civilization. The sort of unrelenting upheavals that would come about from the stock prices of particular railroad companies. Its hard to separate those two things. Theres always a crowd of people out there going, Well the railroad stock I bought at $30 is now $3, so clearly there is no future to railroads. I think there is an impulse to do that with bitcoin. Or the reverse, The railroad stock got bought at $3, is now $30, so clearly theres a future

to railroads. The truth is we have to separate these things in our minds. We have to separate out the speculative aspect of cryptocurrencies from the technological usefulness. Its not always easy to do, but in the real world all great technologies come of age, develop, and mature within real world market conditions. The wise people will understand the difference and superficial people will just follow prices up and down. Im doing my best to detach myself a little bit from its exchange rate, because I realize thats something of a distraction from the larger issue, and yet at the same time, Im as bad as about anyway. If I wake up at 2am for no apparent reason and my smartphone is by my nightstand, I pick it up and yes, I dont check my email, I check the exchange rate. [Laughter]. Its bad. Its a disease, I tell ya.

ABL: It took me about 6 months. After about 6 months, I was able to - I never check the price anymore, its really great, and its been really freeing to me because it me ans that I can. I think that the railroad analogy is a really good one there, because youre totally right. Railroads changed the world not because of their stock price but because of what they offered and what they could do. For me thats the most exciting part about bitcoin is that it enables all of these things that you just cant do in other circumstances. JT: Yeah, thats true, and its true with every technology is this way. Markets tend to because great technologies enter the real world market conditions, they are subject to this unrelenting valuation based on the potential for speculative profits. One thing I am trying to get better about is Im not spending a whole lot of time engaging in debates about people on the internet. Someones wrong on the internet, Ill go to dinner later, right? But people who just focus solely on the exchange rate and its potential for profits. I think early investors of bitcoin are going to do very well in the future. What happens between now and that future we just dont really know. We are kind of in a funny situation. Im sure you looked at the data too, weve seen massive increases in just public interest in bitcoin ever since the price ran up. In a way that price run up did a lot of good in terms of ABL: Its a beacon, yeah. JT: Yeah. But at the same time its kind of harmful because it distracts people from the core issue. Bitcoin is funny because I think all of us have wishes of what we think we want to happen with it. About a month ago, I had this kind of wish in my mind that it would stabilize around $100 and stay there for the next quarter. The best thing about bitcoin is that none of us controls it. It really is a merchant order that is an organic product of the social order itself. With all the great combinations of the division of labor, merchants, intellectuals, codeslingers, everybody cooperating together in this vast global system thats so progressive and so innovative and so exciting. Its a beautiful thing that none of us get our - none of our wishes come true, in a way. I could wish for a certain exchange rate, I could wish for it to stay that way for a certain amount of time, but Im totally prepared to see bitcoin take its own path. I see myself less as a prognosticator or prophet of the thing. I enjoy thinking of myself as a student more than anything else. Theres a lot that all of us can learn just from watching and investigating and examining closely the emergence of this technology. We

have to remember just how fortunate we are as a generation to be watching all of this take place in real time. This hasnt happened to any other people in the history of humanity - to watch something like this happen. This is a great, if you believe in this sort of thing its a blessing really. Its a teachable moment. Were going to learn a lot about the way the world works and can work in the future just by watching the emergence of bitcoin and seeing the developing sophistication of the merchants and its price and its trajectories and the response from the regulators. Bitcoin is a kind of sociological microcosm of how reality unfolds before our eyes. Were seeing it all happening so fast and happening so many magical and beautiful ways. Its just a great time to be alive. I consider it a beautiful prese nt in my own life to be able to have this presented to me at my feet and I can unwrap it and watch it and play with it. Its a beautiful thing.

ABL: Jeffrey Tucker. Laissez Faire Books. LFB.Org. Thank you for your time.

JT: Thank you, Adam.

==== Music ====

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Ass Fucked by A GiantDokument5 SeitenAss Fucked by A GiantSwetaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- TinderDokument20 SeitenTindergiovanniNoch keine Bewertungen

- How To Use The Fishbone Tool For Root Cause AnalysisDokument3 SeitenHow To Use The Fishbone Tool For Root Cause AnalysisMuhammad Tahir NawazNoch keine Bewertungen

- 100 + 1 Big Lies of MacedonismDokument158 Seiten100 + 1 Big Lies of MacedonismJames PetersonNoch keine Bewertungen

- Inesco Amc 2106735164Dokument3 SeitenInesco Amc 2106735164spahujNoch keine Bewertungen

- Technical Catalogue of CONSOLID Nano Ground Consolidation TechnologyDokument27 SeitenTechnical Catalogue of CONSOLID Nano Ground Consolidation TechnologyTIELA GefredNoch keine Bewertungen

- The Picture of Dorian Gray TestDokument9 SeitenThe Picture of Dorian Gray TestAnonymous hNuaRDFkNNoch keine Bewertungen

- Consumer Protection Act, ProjectDokument17 SeitenConsumer Protection Act, ProjectPREETAM252576% (171)

- Lesson3 Thehumanasanembodiedspirit 180717110754Dokument24 SeitenLesson3 Thehumanasanembodiedspirit 180717110754Noriel Del RosarioNoch keine Bewertungen

- Integrated Media ServerDokument2 SeitenIntegrated Media ServerwuryaningsihNoch keine Bewertungen

- Thi Giua Ki 2Dokument2 SeitenThi Giua Ki 2Trang nguyenNoch keine Bewertungen

- TuteDokument3 SeitenTuteSatyam SinghNoch keine Bewertungen

- High Court of KeralaDokument4 SeitenHigh Court of KeralaNidheesh TpNoch keine Bewertungen

- Duty and Power To Address Corruption PDFDokument26 SeitenDuty and Power To Address Corruption PDFLau Dreyfus ArbuluNoch keine Bewertungen

- Tomas CVDokument2 SeitenTomas CVtroy2brown0% (1)

- Chap 3Dokument11 SeitenChap 3Quỳnh GiaoNoch keine Bewertungen