Beruflich Dokumente

Kultur Dokumente

Aromatics Complex Project in Mangalore Sez

Hochgeladen von

CCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aromatics Complex Project in Mangalore Sez

Hochgeladen von

CCopyright:

Verfügbare Formate

HEADLINE: Financial appraisal report on OMPL aromatics complex project CONTENT: Draft financial appraisal report b !

"I Caps on aromatics complex project in Man#alore !E$ xxxxxxxxxxxxxxxxxxxxxxxxxx % E&EC'TI(E !'MMA)* %+% Intro,-ction ONGC-Mangalore Petrochemicals Ltd (OMPL) is a company promoted by Oil and Natural Gas Corporation Limited (ONGC) and Mangalore Refineries Petrochemicals Limited (MRPL) for setting up an aromatics comple! at Mangalore in Mangalore "#pecial $conomic %one (M#$%)& OMPL 'ill be a pri(ate sector company 'ith ONGC and MRPL holding )*+ of the e,uity capital of the company 'hile the balance -.+ e,uity 'ill be offered to #trategic/ financial in(estors and retail in(estors& OMPL 'as incorporated on .*th 0ecember 1223 and its registered office is at 4/1)5 Cunningham Road5 6angalore5 7ndia& 8uthori9ed share capital of the Company is Rs 1222 crore (around :#0 -22 million)& OMPL is setting up ban aromatics comple! in M#$% ad;acent to the e!isting refinery of MRPL& <he plant 'ill produce *.=5422 M< per annum of para->ylene and about 1?=5.22 M< per annum of 6en9ene& <his comple! 'ill get its feedstoc@5 mainly naphtha and aromatic streams from the MRPL refinery& OMPL 'ill enter into a feedstoc@ sourcing arrangement 'ith MRPL for continuous supply of naphtha and other streams& <he pro;ect is e!pected to start commercial operation by 12.1& ))1 acres of land for the comple! has already been ac,uired on long term lease basis from M#$% and site de(elopment 'or@ has already started& %+. Promoters %+.+% Oil / Nat-ral 0as Corporation 1ON0C2 ONGC is the largest oil e!ploration company in 7ndia and is the largest ANa(ratnaA P#: & ONGC is the only fullyBintegrated petroleum company in 7ndia5 operating along the entire hydrocarbon (alue chain holding largest share of hydrocarbon acreages in 7ndia& ONGC has established 3 billion tonnes of 7n-place hydrocarbon reser(es 'ith more than =22 disco(eries of oil and gas5 3 out of the 4 producing basins in the country ha(e been disco(ered by ONGC& 7t has cumulati(ely produced 431&= Million Metric <onnes (MM<) of crude and ))2&4 6illion Cubic Meters (6CM) of Natural Gas5 from ..- fields& <he company has 1)2 onshore5 .)4 -offshore platforms 'ith .-?22 Cm onshore pipeline net'or@ and )-22 Cm offshore pipeline net'or@s& ONGC is a Dortune 122 company and Platt has ran@ed ONGC as the top Oil Gas $!ploration Production ($ P) Company in 8sia for 1224& ONGC has been gi(en highest credit rating by domestic rating agencies li@e Crisil 7CR85 and so(ereign rating by Moody& Table %3 !4are4ol,in# Pattern of ON0C !4are4ol,ers Public/Others Total !4are4ol,in#152 1-&?3+ %66+665

Go(ernment of 7ndia 4)&.)+

ONGC is a listed entity and is the second largest 7ndian corporate by mar@et cap& <he company earned a profit of Rs&.34 6illion in 1224-2?

%+.+. Man#alore )efiner / Petroc4emicals Lt,+ 1M)PL2 MRPL 'as promoted in .*?? by 8E 6irla group along 'ith FPCL& ONGC too@ o(er the sta@e of 8E 6irla group in March 122=5 ma@ing it a subsidiary of ONGC& MRPL has been a'arded the AMiniratna Category-7A status& <he present sta@e of ONGC in MRPL as on =./=/2? 'as 4.&31 +& MRPL is a standalone refining company5 'ith sole refinery at Mangalore in the state of Carnata@a& Present nameplate capacity is *&3* MM<P8G ho'e(er it is consistently operating abo(e .1 MM<P8 for the past four years& MRPL is currently carrying out e!pansion/ upgradation pro;ect to e!pand the refining capacity to .- MM<P8 and become capable of producing $uro 7E compliant fuels& MRPL has been a'arded highest credit rating by domestic credit rating agencies 7CR8 and CR7#7L& !4are4ol,ers !4are4ol,in# 152 ONGC FPCL Public Total 4.&31+ .3&*-+ Others ..&)=+ %66+665

Cey financial parameters of the company are gi(en in the follo'ing tableH %+7 !-pport pro8i,e, b t4e promoter ONGC/MRPL as Promoters 'ill pro(ide the follo'ing supports for the comfort of the lendersH (i) )*+ $,uity #ubscription B ONGC/MRPL 'ill subscribe up to )*+ of the pro;ect e,uity (including already incurred e!penditure of Rs 132 crore already brought in as share application money till =.-" March 122*)& $ntire promoter e,uity 'ill be brought upfront before any dra' do'n of the loan& (ii) <ie-up of balance $,uity capital B ONGC/MRPL 'ill pro(ide an underta@ing to arrange the balance -. +-e,uity capital5 either through strategic /financial in(estors/offta@ers/7PO& (iii) Non-disposal of $,uity - ONGC/MRPL 'ould pro(ide an underta@ing to maintain at least )*+ e,uity in the pro;ect at any time during the currency of the loan& (i() Completion support - ONGC/MRPL 'ould pro(ide an underta@ing to arrange funds to meet any cost o(errun& (() Deedstoc@ #upply and #tream e!change agreementH MRPL 'ill enter into a feedstoc@ supply and stream e!change agreement 'ith the Company for assured supply of the feedstoc@ and e(acuation of certain surplus streams& 6esides the direct support mentioned abo(e5 ONGC/MRPL 'ill also pro(ide support in the construction and Operation Maintenance of the pro;ect& %+9 "oar, of Directors of t4e Compan <he Management of the company consists of nominees from ONGC and MRPL&

Table 73"oar, of Directors of OMPL !+No+ Name of ,irector . 1 = ) R&#& #harma5 Chairman :&C& 6asu5 M05 MRPL M&M& Chitale 7&#&N Prasad Desi#nation M05 ONGC Chairman 0irector 0irector 0irector

%+: Project ONGC Mangalore Petrochemicals Limited (OMPL) is setting up an aromatics comple! to produce *.=5422 <P8 para!ylene and 1?=5.22 <P8 6en9ene5 from the naphtha supplied by MRPL refinery& <he pro;ect also includes a capti(e po'er plant and other necessary utilities and infrastructure re,uired for the pro;ect& %+:+% Location of Project <he pro;ect is being located inside a #pecial $conomic %one (#$%) being de(eloped by Mangalore #$% Ltd& <he pro;ect site is ad;acent to MRPL refinery from 'here entire feedstoc@ 'ill be -supplied to the aromatics comple! through pipelines& <he site is also 'ell connected to national and state high'ays& 7t is .1 @rns a'ay from the Ne' Mangalore Port and about .- @ms from Mangalore 7nternational 8irport& %+:+. Man#alore !E$ Mangalore #pecial $conomic %one (M#$%) is being de(eloped by 7L D# along 'ith ONGC and C7806& Mangalore #$% Ltd& has already got the appro(al for setting up this #$%& M#$% 'ill be spread across .3=2 acres and it 'ill be de(eloped as sector specific #$%& Fo'e(er5 M#$% is in tal@s 'ith Ne' Magalore Port <rust (NMP<) to induct it as one of the e,uity partners to be able to get the status of port based multi product #$%& M#$% is the de(eloper 'hile OMPL pro;ect 'ill act as the anchor tenant for this #$%& ))1 acres of land has been allocated by M#$% to OMPL for the aromatics comple!& M#$% 'ill pro(ide land to OMPL on long tenn lease basis& #$% 'ill pro(ide basic amenities li@e 'ater5 bac@-up po'er5 effluent treatment and disposal5 etc& to all the units coming in its premises& Iater 'ill be brought from Netra(ati and Gun-upur Ri(er through a pipeline& Iater supply facility may be de(eloped by an independent agency on 6OO< basis& $lectricity connection 'ill be ta@en from the state electricity grid& 8 dedicated corridor 'ill be de(eloped bet'een #$% and the port for uninterrupted mo(ement of material and manpo'er& <he pipelines for the aromatics comple! 'ill come on the rac@ pro(ided in this corridor& Fence5 the company 'ill not be re,uired to ac,uire any Ro:/RoI for setting up pipelines& M#$% is also de(eloping residential and commercial facilities for the use of employees other than those of units in M#$%& #$% has already ac,uired .3=2 acre land and Rehabilitation Resettlement (R R) is in progress& <he 'or@ on utilities to be pro(ided by M#$% to OMPL is in progress and 'ill be ready by the time OMPL"s petrochemicals pro;ect 'ill be ready& %+:+7 Process <he pro;ect 'ill get feedstoc@ supply from e!isting refinery of MRPL& <he process technology for the aromatics plant has been finali9ed and :OP5 :#8 has been selected as process licensor to

pro(ide the process technology& Para!ylene 'ill be produced through adsorption technology of :OP 'hich is a pro(en technology being used all o(er the 'orld& %+:+9 Confi#-ration <he configuration of the aromatics comple! is as gi(en in the follo'ing tableH Table 9: Process 'nits of Aromatics Complex #&No& . 1 = ) 3 4 ?

'nit Description

Naphtha Fydro <reater (NF<) Continuous Catalytic Reformer (CCR) B Platforming unit >ylene Dractionation :nit (>D:) P> Reco(ery :nit (P8R$>) >ylene 7someri9ation :nit 7#OM8R 6en9ene <oluene $!traction :nit ($0 #ulfolane) 6en9ene <oluene Dractionation (6<D) <rans 8l@ylation 0is io ortionation :nit (<8<OR8J)

Capacit 1MMTPA2 2&*)* 2&*)* )&&3=3 )&24= =&.31 2&4*2 1&.*? .&4.1

<he processing units 'ill ha(e enough fle!ibility to handle (ariations in the ,uantity and specifications of feedstoc@ mi!& %+:+: Material "alance <he material balance of the aromatics plant is gi(en as follo'sH Table :: Material "alance of Plant !+ Material No+ Deedstoc@ . DCC naphtha 1 Co@er naphtha = #t Run naphtha ) Fea(y naphtha side dra' 84 - rich stream 3 8? - mi!ed !ylene 4 8* - rich stream Total Pro,-cts . Para!ylene 1 6en9ene = Paraffin Rich Raffinate ) Duel gas LPG 3 Fea(y8romatics 4 Fydrogen ;-antit 1TMTPA2 .1.&2 .?.&2 -.=&= .1=&4 1=.&2 1)4&2 .1-&2 %:9.+6 *.=&4 1?=&. .12&? .4=&? 12&2 - ..&1 .*&) 5 of Total 4&?-+ ..&4)+ ==&1*+ ?&21+ .)&*?+ .3&21+ ?&..+ %66+665 -*&1-+ .?&=3+ 4&?=+ ..&14+ .&=2+ 2&4=+ .&13+

Total %+:+< Fee,stoc= !-ppl

%:9.+6

%66+665

MRPL 'ill supply all the feedstoc@ re,uired for this aromatics comple! from its refinery& DCC Naphtha 'ill be ta@en from the DCC unit of the refinery& <his naphtha stream is rich in aromatics& Co@er Naphtha 'ill be ta@en from the do'nstream of 0elayed Co@er :nit (0C:)& DCC and 0C: are being set up in the e!isting refinery of MRPL as part of the e!pansion program& Capacity of MRPL refinery is being increased from *&3* MM<P8 to .- MM<P8& 8fter this e!pansion5 MRPL refinery 'ill ha(e three C0:"s& #traight Run Naphtha 'ill be ta@en from all the three C0:"s& Fea(y Naphtha 'ill be ta@en from the side dra' of 1nd C0:& 8romatic streams 'ill be ta@en from the Mi!ed >ylene :nit (M>:) of the refinery& OMPL 'ill enter into a Afeedstoc@ supply agreementA and Astream e!change agreementA 'ith MRPL& %+:+> Pro,-cts Para!ylene is the main product of this aromatics comple!& Para!ylene is primarily used to produce Purified&<erephthalic 8cid (P<8) 'hich is used to produce polyester and P$< chips& Para!ylene 'ill be sold to P<8 manufacturers or traders in the free mar@et& OMPL is in dialogue 'ith (arious prospecti(e offta@ers for setting up a dedicated P<8 manufacturing plant near the aromatics comple!& #uch a dedicated do'nstream facility 'ill assure off-ta@e of para!ylene from this plant& Pipeline 'ill also be set up from the aromatics comple! to the Ne' Mangalore Port for e!port of remaining para!ylene to other locations& <he plant 'ill also produce 6en9ene 'hich is used in manufacturing of products li@e phenol5 cumene5 styrene5 etc& 6en9ene is the building bloc@ for the nylon chain& 8 dedicated pipeline 'ill be set up from the aromatics comple! to the port for e!port of ben9ene to other locations& OMPL may also enter into off ta@e agreement for 6en9ene 'ith parties 'ho propose to set up a ben9ene do'nstream plant in nearby areas& <he company proposes to tie up long term offta@e of the products 'ith credible parties& <he company had in(ited $!pression of 7nterest ($o7) from potential offta@ers for Para!ylene and 6en9ene& <he company recei(ed (ery good response for Para!ylene and 6en9ene off ta@e from more than .- parties 'ith strong credentials and global footprints& 6P5 Mitsui5 Mitsubishi5 MCC P<85 Marubeni5& 7tochu5 Colmar 7nternational5 Einmar 7nternational and domestic polyester players li@e 7ndorama5 K6D etc& ha(e sho'n interest in entering into long term off ta@e agreements& <he company 'ill be selecting the off ta@ers on basis of competiti(e bidding& <he company has engaged the ser(ices of #67C8P# for assisting in the off ta@ers selection& 6ased on the strong response5 the company decided to prioritise the off ta@ers based on readiness of setting up plants using P>/6en9ene as feedstoc@ in M#$%/ nearby& <his approach 'ould gi(e ma!imum benefit of synergy and also ensure commitment (in terms of in(estment in ne' plant) by the off ta@er for using the P>/6en9ene produced by OMPL& 8part from ben9ene and para!ylene5 the aromatics comple! 'ill also& produce paraffin rich raffinate5 LPG and hydrogen& Paraffin rich raffmate is rich in C-/C3 and it 'ill be used by MRPL refinery for further processing& <he aromatics plant 'ill produce mar@etable LPG 'hich 'ill be transferred to MRPL for sale in the mar@et& Fydrogen produced from this plant 'ill also be absorbed by MRPL for its processes& Duel gas and hea(y aromatics produced from the aromatics comple! 'ill be utili9ed as internal fuel in the process heaters& %+:+? Lo#istics

0edicated pipelines 'ill be set up from aromatic comple! to NMP< port for e(acuation of para!ylene and ben9eneG and for e(acuation up to do'nstream P<8 and 6en9ene plants& 8 pipeline 'ill also be laid for supply of feedstoc@ and e(acuation of products li@e raffinate and hydrogen from MRPL& M#$% or a #PE company promoted by M#$% 'ill de(elop a dedicated corridor 'ith pipeline rac@ from M#$% to the port facilities& 8ll the pipelines 'ill be laid on this rac@& Ne' Mangalore Port <rust (NMP<) is de(eloping a ne' ;etty at the Ne' Mangalore port 8fter the de(elopment of this ne' ;etty5 there 'ill be enough capacity a(ailable at NMP< for handling products of OMPL& 8dditionally5 MRPL 'ill not be e!porting around 7 MM<P8 of naphtha from this port after the commissioning of aromatics comple! and also around 1 MM<P8 of fuel oil after the residual upgradation pro;ect scheduled for completion simultaneously& <his 'ill also create spare capacity at the port& %+:+@ Capti8e PoAer Plant <he pro;ect includes setting up of a capti(e po'er plant to supply po'er and steam for the process units& <he a(erage po'er re,uirement of the process units 'ill be -. MI 'hile the a(erage steam re,uirement for the process units 'ill be .34&-2 <PF& CPP 'ill be a combined cycle cogeneration plant to produce po'er as 'ell as steam& <he capti(e po'er plant 'ill consist of t'o gas turbines (G<G)5 t'o heat reco(ery steam generators (FR#G)5 one steam turbine (#<G) and t'o utility boilers 'ith follo'ing capacitiesH Table <: Capacit of Capti8e PoAer Plant !+ No . 1 = )

'nit Description

Gas <urbine and Generator #team <urbine Generator Feat Reco(ery #team Generator :tility 6oiler

Nos

1 . 1 1

Capacit )1 MI =2 MI 1)2 <PF 1)2 <PF

G<G 'ill ha(e dual fuel capacity i&e& gas/diesel5 'ith gas as the primary fuel& <he e!haust gases from G<G 'ill be routed to the FR#G for heat reco(ery& <he FR#G 'ill ha(e supplementary fuel firing pro(ision and burners 'ill be suitable for firing fuel oil& <he utility boilers 'ill be dual fired 'ith capability to use Lo' #ulphur Fea(y #toc@ (L#F#) and Natural gas& Gas 'ill be sourced from the proposed pipeline of G87L/ Reliance& %+:+%6 'tilities for Aromatics Complex 6esides Capti(e Po'er Plant5 the 8romatic Comple! 'ill ha(e separate facilities to cater to utility re,uirements of the process units on a standalone basis& 0escription of (arious utility systems planned for the 8romatics Comple! is gi(en in the follo'ing sectionsH %+:+%6+% )aA Bater ! stem Ra' 'ater re,uirement of the comple! 'ill be about ?22 m=/hr& <here 'ill be a ra' 'ater reser(oir of a capacity of 325222 cubic meters to meet .- days fresh 'ater re,uirement& DemineraliCe, 1DM2 Bater ! stem

0M 'ater plant of ..2 m=/hr capacity and t'o 0M 'ater tan@s of capacity of =5222 m= each 'ill be setup to meet the 0M 'ater re,uirement& Coolin# Bater 1CB2 ! stem <he cooling 'ater system en(isaged for the aromatics comple! is closed loop recirculation type& <he cooling to'er 'ill cater to re,uirements of capti(e po'er plant as 'ell as the process and utility bloc@& Compresse, Air ! stem Compressed air in the plant 'ill be re,uired for instrument air5 plant air and ser(ice air& Centrifugal compressors 'ill be pro(ided for supply of compressed air& 8ir dryers 'ill be pro(ided for instrument air system& Nitro#en ! stem <he pro;ect 'ill ha(e Nitrogen Plant to meet the Nitrogen re,uirement for initial purging5 dry out catalyst regeneration5 blan@eting and flare header purging& <here 'ill also be a pro(ision for producing li,uid Nitrogen and li,uid Nitrogen storage& %+:+%% Offsite facilities <he offsite facilities en(isage ade,uate storage and transfer facilities for the (arious feed and product streams commensurate 'ith the capacities of the process units& #torage and pumping capacities for feedstoc@ and finished product shall be based on the material balance of the configuration of the aromatics comple!& Offsite facilities are di(ided into fi(e sections - Deedstoc@5 Product5 6y-product5 :tility and Miscellaneous& %+< Project Implementation OMPL proposes to implement the Pro;ect 'ith the assistance of a Pro;ect Management Consultant (PMC) through hybrid approach i&e& Process units and CPP under lump sum turn@ey (L#<C) and rest of the utilities under $PCM e!ecution mode& <he PMC 'ould be primarily responsible for detailed engineering5 sourcing of e,uipment and monitoring of the construction& M/s <oyo $ngineering has been appointed as Pro;ect management Consultant (PMC) and $PCM for the units proposed to be implemented on con(entional basis& <oyo has rich e!perience of implementing petrochemical plants& M/s :OP has been selected as the licensor for the process units& <he 6asic $ngineering 0esign Pac@age (6$0P) 'ill be pro(ided by :OP& 6ased upon this basic engineering5 L#<C orders for (arious process units 'ill be gi(en& OMPL along 'ith PMC is placing orders for long lead items 'hich 'ill be pro(ided to L#<C contractors by the company& <his 'ill sa(e the procurement time for the long lead items li@e reactors5 columns5 centrifugal compressors5 'elded type heat e!changers5 etc& ONGC/MRPL has formed a core team of e!perienced e!ecuti(es 'ho ha(e been deputed to OMPL to manage the pro;ect implementation& <he team comprises of professionally ,ualified personnel at (arious le(els belonging to different disciplines li@e Process5 Mechanical5 $lectrical5 Ci(il5 7nstrumentation5 Materials5 Pipeline5 Dinance etc&5 besides Corporate #ecretarial and other non-official staff members& %+<+% Implementation !c4e,-le

Mechanical completion for the pro;ect is e!pected in No(ember 12.. and the unit 'ill be ready for trial run by March 12.1& Commercial operation 0ate (CO0) of the aromatic comple! is e!pected to be .-. 8pril 12.1& :OP has already been selected as process licensor and 6asic $ngineering and 0esign pac@age for all units has already been recei(ed& Construction of pro;ect is e!pected to ta@e 13 months from the a'ard of L#<C Contracts for the ma;or process units& #hort listing of the parties for L#<C is in progress and a'ard of L#<C 'ill ta@e )-- months after receipt of 6asic $ngineering 0esign Pac@age (60$P) for all units& 7mplementation schedule for the pro;ect is gi(en as follo'sH Table >: Implementation sc4e,-le of t4e project ! No: . 1 = ) 3 4 Acti8i 8ppointment of PMC/#election of licensor Order of long lead items 8'ard of L#<C Contracts #ite grading 0eli(ery of long lead items Mechanical completion Commissioning Timeline Completed 0ecember5 122* No(ember5 122* 0ecember5 122* #eptember5 12.. No(ember5 12.. March 12.1

%+> Cost of Project Core cost of the pro;ect has been estimated by <oyo $ngineering based upon the budgetary ,uotes and in-house data 'ith them for similar pro;ects& <he brea@-up of the core cost of the pro;ect is gi(en as follo'sH Table ?: Core Cost of Project !l+No+ . 1 = ) 3 4 ? * .2 .. Projects Cost 1)s+ crore2 Land #ite 0e(elopment Royalty5 Cno'ho' 6asic $n & PMC Others Plant Machinery 7#6L Plant Machinery (O#6L) Po'er Plant $PCM portion cost #ite $nabling Dacilities Pre-operati(e $!penses #tart-up Commissioning $!penses IC )-2&=2 .31&22 .5?-4&33 13=&22 -1-&22 341&?3 =1&*1 3-&22 .2&22 FC 1in '!D Mn2 Total )-2&=2 L 1=&3* ..)&-. .31&22 L .44&4? 154.4&213=&22 -1-&22 L =&4= 3*2&*2 =1&*1 L 3&1= *-&.= .2&22 E .%%+97 ??&11 9D@>.+:@

0educt H Carnata@a E8</IC< e!emption ??&11 Total Core Cost 7D@:6+:.

M 0eduction is on account of CE8<5 IC< and $ntry <a! e!emptions #ince the pro;ect is being set up in #pecial $conomic %one (#$%)5 there 'ill not be any custom or e!cise duty payable on the capital goods& #tate go(ernment ta!es li@e CE8<5 $ntry ta! and Ior@

Contract <a! (IC<) ha(e also been deducted from the pro;ect cost as the guidelines for the same is pending 'ith the go(ernment& 6ased on the estimates of core cost by <oyo5 <otal as 6uilt pro;ect cost has been arri(ed at by #67C8P# by adding contingency and inflation for the construction period5 7nterest during construction (70C)5 other financing charges and Margin Money for 'or@ing capital to the core cost estimates of <oyo& Table @: As3"-ilt Cost of Project Digures in Rs crore )*41&-* =2=&.1 -14-&4. -)&22 =1.&42 **&=2 :>:6+>%

Core cost of project Contingency 7nflation ad;ustment 8d;usted Cost incl& 7nflation contin#enc Contribution in #$% Corridor cost &7nterest -0uring Construction (70C) Financin# Charges Mar in Money Total Cost %+? Means Of Finance

<he pro;ect cost of Rs -4-2&4. crore 'ill be funded 'ith a debt e,uity ratio of 3-H=-& <otal debt re,uired for the pro;ect is Rs =4=4&*3 crore& <he follo'ing table gi(es the financing plan for the pro;ectH Table %6: Means of Finance Pro;ect Cost 0ebt EF-it Ratio EF-it 0ebt %+?+% EF-it Rs 12.1&4- crore 'ill be brought in the form of e,uity in the pro;ect& <he promoters 'ill bring )*+ of this e,uity upfront 'hile the balance e,uity 'ill be raised from strategic/financial in(estors or 7PO& %+?+. Debt Rs =4=4&*3 crore 'ill be brought in the form of debt in the pro;ect& $ntire debt tie-up 'ill be initially in the form of Rupee term loan& #ince some part of the cape! is in foreign currency5 the company 'ill ha(e option to reduce/refinance Rupee term loan to the e!tent of =2+ by foreign currency borro'ing from $C8/$C6& <otal door to door tenor of the loans 'ould be .= years 'hich includes 1+1 years for construction5 ."/1 year for moratorium period and repayment period of * years& <he year-'ise schedule of capital e!penditure along 'ith debt and e,uity infusion is gi(en in the follo'ing tableH -4-2&4. 3-H=12.1&4=4=4&*3

Table %%: *earl Canex p4asin# an, DebtGEF-it ,raA,oAn *ear Percentage Cape! $,uity 7nfusion 0ebt 7nfusion %+@ Mar=et <he aromatic comple! 'ill produce about *.=&4 C<P8 Para !ylene and 1?=&. C<P8 6en9ene& OMPL proposes to enter into long term off ta@e agreements for P> and 6en9nee 'ith parties 'ith strong credentials& OMPL has in(ited $!pression of 7nterest ($O7) for long tern offta@e agreements for P> and 6en9ene and has recei(ed (ery strong response from (arious interested buyers li@e 6P5 7tochu5 Mitsui5 Mitsubishi5 Marubeni5 Colmar5 K6D5 7ndorama etc& <he company is in ad(anced stages of finali9ing the offta@er for long-term offta@e agreement for Para!ylene/6%& <he pricing of P> and 6en9ene 'ill be lin@ed to international 6ench mar@ prices& <he company proposes to gi(e preference for offla@e to those bidders 'ho 'ill be setting up P<8 plant in M#$% or nearby areas5 assuring dedicated off ta@e& %+@+% Parax lene / "enCene: "ac=#ro-n, Para!ylene is the most important 8romatic basic petrochemical& <he demand gro'th for para!ylene is dri(en by demand gro'th of polyester fibre5 P$< bottle resin and polyester film& Para !ylene is either con(erted into Purified <erephthalic 8cid (P<8) or 0imethyl <erephthalate (0M<)5 both of 'hich are intermediates in the polyester chain& 8round *=+ of para!ylene demand globally is into P<8& 6en9ene is an important aromatic chemical and is used as a ra' material in se(eral important products such as Caprolactam 'hich is used to ma@e nylon filament yarn (NDJ)5 Linear al@yl ben9ene (L86) 'hich is used in detergents5 #tyrene used in polystyrene #tyrene 6utadiene Rubber5 Nitroben9ene chloroben9enes 'hich are used as dye intermediates5 and 6FC Lindane 'hich are used in pesticides& 0lobal Parax lene scenario Iorld'ide para!ylene demand is currently 13 million tonnes and is forecast to gro' at more than - + per year to reach around 3) million tomes by 121-& <his gro'th is being dri(en by high gro'th rates in polyester fibre and P$< bottle resin& <he Para!ylene industry is a cyclical industry5 hence the capacity additions happen in cycles& <he 'orld consumption of P> is e!pected to gro' at a higher rate of 4+/year in the 122?-12.= period5 'ith 8sia leading gro'th at a rate of ?&-+/year (Mainly due to China 7ndia)& Fistorically5 in de(eloping economies5 gro'th of demand for Polyester and thus P> is higher than G0P gro'th rate due to reali9ation of latent demand and greater economic inclusion& <o fulfill the large demand5 capacity e!pansions are being planned in China5 Middle $ast and 7ndia& Fo'e(er5 despite the large capacity additions5 N$ 8sia5 particularly china is e!pected to remain a ma;or importer& 7n the long run5 N$ 8sia5 North 8merica5 8frica5 Russia 'ill be net importers 'hile Middle $ast and #$ 8sia 'ill be net e!porters& In,ian Parax lene scenario 7%st Mar36@ 7%stH Mar-.2 7%st Mar3%% )&-1+ 132&.? 132&.? -4&*3+ )-4&?1 )-4&?1 -14&?=+ .322&11 13?&1.==.&*4 7%!t Mar-.1 <otal -*&3*+ =)=1&)* .213&-2 1)2-&** .22 + -4-2&4. 1213&)1 =4=4&*3

P> mar@et in 7ndia has mo(ed from Net importer in mid nineties to net e!porter in 1222 after R7L commissioned its Kamnagar plant& <otal P> capacity in the country is about 1&1 MM<P85 'hile demand in 1224 'as around .&3 million tonnes and is e!pected to @eep on gro'ing in line 'ith G0P gro'th& Iith the OMPL pro;ect and ne' capacities plans by R7L5 total P> capacities are e!pected to reach )&- MM<P8 by 12.1& 0emand for P> is e!pected to gro' substantially dri(en by higher G0P gro'th and greater per capita spending capacity& Polyester is e!pected to fulfill the additional demand as the supply of the other ma;or source of fibre i&e& cotton cannot rise at the same rate and has supply constraints& Iith planned capacities5 7ndia 'ill remain a net e!porter in near future and 'ill fill the deficit in N$ 8sia region& 0lobal "enCene scenario <he global demand for ben9ene is currently around )2 million tonnes5 'ith ethyl 6en9ene ( used for manufacture of styrene) sharing -2 + of mar@et& #tyrene is used to manufacture polystyrene and other styrenic products such as 86# and #6 late!& Cumene 5 cyclohe!ane and Nitroben9ene applications for are the other ma;or end-uses of ben9ene& Global demand for ben9ene is e!pected to gro' around 1&--= + p&a& reaching around 32 Million <onnes by 121-& Globally5 the industry trend for 6en9ene demand gro'th is correlated to G0P gro'th& <he additional re,uirement for 6en9ene is e!pected to be met mostly through ne' capacities being setup in 8sia& <he gro'th in global trade in 6en9ene is e!pected to be more than gro'th in 6en9ene demand as a supply deficit is e!pected to gro' in :# and $urope5 'ith deficit being fulfilled by 8sian capacities& Iestern $urope and N& 8merica 'ill continue to remain net importers of 6en9ene5 'ith N$ 8sia turning net importer by 12.2-.15 'hile #$ 8sia5 7ndia5 Middle $ast 'ill be net e!porters& In,ian "enCene scenario 0emand for ben9ene in the 7ndia is estimated at around 4225222 tonnes5 representing almost 1+ of the global mar@et& <he ben9ene mar@et"s largest end-use sector currently is Linear 8l@yl 6en9ene (L86) 'hich is used for surfactants and detergents5 representing around =2+ of domestic demand& Caprolactam and Phenol account for around 1. + and .4+ of the demand& <he remaining demand is made from other deri(ati(es li@e 8niline5 6FC/Lindane5 Nitrochloroben9ene& 7ndia has presently no styrene facilities& 7ndia is currently a net e!porter of 6en9ene5 e!porting a significant portion of its 6en9ene production5 e!porting almost 1-2 to )22 C< of ben9ene& Fo'e(er5 going for'ard huge demand gro'th is e!pected due to the need of setting up of #tyrene plant in 7ndia to meet gro'ing styrene products demand& 6en9ene demand is e!pected to gro' at 3 + p&a& reaching o(er .&- MM<P8 by 121-& <he 7ndian 6en9ene demand is closely lin@ed'ith gro'th of 7ndian economy and global trade balances& %+%6 Mar=etin# !trate# <he company proposes to tie up long term offta@e of P> and 6en9ene and has in(ited $!pression of 7nterest from potential offta@ers for Para!ylene and 6en9ene& <he company has recei(ed strong response for Para!ylene and 6en9ene off ta@e 'ith more than .- parties 'ith strong credentials and financials and 'ith global footprints li@e 6P5 Mitsui5 Mitsubishi5 MCC P<85

Marubeni5 7taachu5 Colmar 7nternational5 Einmar 7nternationalG and domestic polyester players li@e 7ndorama5 K6D etc& ha(e sho'n interest in entering into long term off ta@e agreements& OMPL 'ill prefer the off ta@ers setting up plants using P>/6en9ene as feedstoc@ in M#$%/ nearby5 as this 'ould gi(e benefit of synergy and ensure commitment by the off ta@er for using the P>/6en9ene produced by OMPL5 'hile the rest of the product 'ill be e!ported& #ome of the offta@ers ha(e also e!pressed interest in participating in the e,uity sta@e of the company to ensure better for'ard integration in the (alue chain& Parax lene <hree-four parties ha(e e!pressed interest in setting up a dedicated P<8 unit in Mangalore to met their capti(e P<8 consumption for polyester/P$< facilities5 'hile one of the offta@er is interested in sourcing P> for its e!isting P<8 unito 'ants to source P> from OMPL for mar@eting o(erseas& OMPL plans to tie up about -2 + of P> capacity domestic consumption 'hile balance -2 + 'ill be @ept open for e!porters& 7ndian 0emand for Polyester/ P$< is e!pected to gro' significantly at a rate of ?-.2+ in ne!t --.2 years time resulting in huge demand for P>& 6ased on the current global scenario5 the ma;ority of Polyester demand is e!pected from N$ 8sia5 particularly China& Fence5 any surplus P> left after fulfilling 7ndian demand can be absorbed easily by the N$ 8sian mar@et& <he e!port of product by OMPL 'ould primarily be targeted to the mar@et 'hich 'ill gi(e the highest Net 6ac@& OMPL is strategically better placed in Geographic terms to the competitors li@e Middle $ast due to pro!imity to ma;or demand centers li@e 7ndia and N$ 8sia& "enCene Currently5 7ndian demand for 6en9ene is lo'er than the capacity5 and 6en9ene is e!ported in o(erseas mar@et& Going for'ard5 the 7ndian e!port of 6en9ene is e!pected to reduce due to gro'th in domestic demand& <he company is in ad(anced stages of tal@s 'ith off ta@ers for long term agreements for sale of 6en9ene in o(erseas mar@et& Most of the interested offta@ers are loo@ing to source 6en9ene from OMPL for mar@ting o(erseas 5 primarily mar@ets in 'estern $urope5 8merica5 8 fe' of the parties ha(e also e!pressed interest in setting up of Phenol and other 6en9ene deri(ati(e units in Mangalore / nearby areas& Presently5 the company en(isages .22 + e!port of ben9ena5 'ith most e!port being directed to fulfill the demand in $urope (e!port opportunity to $urope is due to shutdo'n of many $uropean 6en9ene producing capacities)& <his e!port opportunity is proposed to be tapped by entering into long term offta@e agreement 'ith traders ha(ing strong financials& and ha(ing international e!perience of mar@eting of petrochemicals/6en9ene& 6ased on the (ery strong response to the off ta@e process and demand in the 7ndia and N$ 8sia region5 the company may not face much difficulty in tying up the mar@eing of the entire P> and 6en9ene production& <he other intermediate products li@e LPG5 Fydrogen5 Raffinate5 etc& 'ill be sent bac@ to MRPL under stream e!change agreement& %+%% Present !tat-s of t4e project

<he Company has already ac,uired the entire land of ))1 acres re,uired for the pro;ect from Mangalore #$% on a long term lease basis and has a'arded the site de(elopment contract& <oyo $ngineering 7ndia Limited has been appointed as the Pro;ect Management Consultant (PMC) for the aromatics pro;ect& PMC has already started the preliminary 'or@ on site& <he progress of the pro;ect is as belo'H :OP has been selected for pro(iding process technology and the 6asic $ngineering 0esign Pac@age (6$0P)& Ma;or portion of 60$P pac@age from :OP has already been recei(ed& Long lead items ha(e been identified and some in,uiries ha(e been floated&

%+%%+% !tat-tor Clearances $n(ironment clearance has been recei(ed& Consent for $stablishment (CD$) has been recei(ed by M#$%& 8ppro(al from Ministry of Commerce recei(ed for setting up #$% unit for e!emption of ta!es/duties on inputs& #78 clearance for :OP technology has been obtained

%+%. Profitabilit projections <he Pro;ect is e!pected to commence commercial operation from 8pril 12.1& Capacity utili9ation is assumed at ?2+ and *2+ in the first and second year and .22+ thereafter& Deedstoc@ for the aromatics plant 'ill be supplied by MRPL refinery& -2+ of para!ylene is assumed to be sold in the do'nstream plant ad;acent to the aromatics comple! and balance -2 + Para!ylene and .22 + ben9ene is assumed to be sold in the e!port mar@et& LPG produced from the comple! 'ill be sold in the domestic mar@et& Other streams of the plant li@e raffinate and hydrogen 'ill be sent bac@ to refinery to be used in the process& OMPL 'ill enter into a ADeedstoc@ #upply and #tream $!change 8greementA 'ith MRPL for dedicated supply of feedstoc@ and off ta@e of products li@e Raffinate and Fydrogen& <he pricing of feedstoc@ are based upon three year a(erage price& Prices of #traight Run Naphtha 'ill be benchmar@ed to naphtha prices in international mar@et5 DCC Naphtha 'ill be based on a(erage of M# and Naphtha prices5 'hile Co@er naphtha 'ill be supplied by MRPL at a discount5 84/8* streams 'ill be based upon M# prices 'hile Mi!ed !ylene 'ill be supplied at mar@et price less discount being gi(en by MRPL in the mar@et currently& <he prices of P> and 6en9ene are ta@en at = years a(erage price of 8sian Contract Price (8CP) DO6 Corea& Dor domestic sale5 it is assumed as DO6 Corea plus freightG 'hile for e!port5 price assumed at DO6 Corea minus freight from 7ndia to Corea& Natural gas 'ill be used as fuel for CPP and utility boilers as 'ell as process heating Ope! has been ta@en based upon the inputs pro(ided by <oyo/:OP& <he profitability pro;ection for the first ten years of operation is gi(en in the follo'ing tableH Table %.: Projecte, Profit / Loss statement Financial *ear En,in# <hroughput (C<P8) 7ncome Deedstoc@ Cost .6%7 .51=) -5)1? )5.-= .6%9 .5=?? 35)12 )543.6%: .5-)1 45144 -5)22 .6%< .5-)1 45)1= -5-2* .6%> .5-)1 45-41 -53.* .6%? .5-)1 4541) -54=. .6%@ .5-)1 45??2 -5?)3 .6.6 .&-)1 ?52=? -5*3= .6.% .5-)1 ?5122 352?1 .6.. .5-)1 ?5=3) 3512)

Operating Cost- fi!ed Operating Cost-(ar& P607< 0epreciation 7nterest Dinance Charges P"T <a! 0eferred <a! Liability PAT

.2) =)* ?11H 13= )1= %7: ) %7%

..1 )24 .5.=4 13= )=1 99% .= 9.?

..? ))4 .5=.1 13= =*3 <:. 1 .? <7.

.1. )3= .5==. 13= =-= >%9 .3 <@.

.1)-* .5=3* 13= =2? >@? 12 ) 44=

.-* )43 .5=-? 13= 13= ?7. .)2 .) <>?

.3) )4* .5=*. 13= 1.? @6@ .3) 4).

.3? -2= .5)2) 13= .4) @<> .?1 (=) >??

.4= -23 .5)=* 13= .1* %D69> 12) (.2) ?:7

.4? -.2 .5)4= 13= ?) %D%.<+ 11) (.3) @%>

<he pro;ect 'ill ha(e a healthy internal rate of return of .?&22 +& <he main profitability parameters of the pro;ect are gi(en in the follo'ing tableH Table %7: Projecte, Profitabilit Parameters !l No . 1 = ) Parameters Pro;ect 7RR $,uity 7RR 8(erage 0#CR Minimum 0#CR )es-lts .?&22+ 11&*2 + 1&2) .&3)

%+%7 !ensiti8it Anal sis <he profitability parameters of the Company might change 'ith the de(iation in crac@ bet'een naphtha and para!ylene/ben9ene& 8ny significant increase in the pro;ect cost 'ill also ha(e a negati(e impact on the pro;ect returns& #ensiti(ities ha(e been carried out for @ey parameters to see their effect on the profitability and pro;ect returns as belo'H !cenario I: Hi#4er Project Cost b %65 <hough contingency and inflation has been ta@en for determining the total pro;ect cost o(er the years5 ho'e(er considering the long period for de(elopment of the pro;ect5 the possibility of increase in pro;ect cost cannot be ruled out& <he increase in the pro;ect cost 'ill ha(e ad(erse impact on the pro;ect 7RR& !cenario II: Hi#4er Operatin# Expen,it-re b %65 7n the profitability pro;ections5 the operating e!penditure has been estimated based upon (arious costs associated 'ith aromatics plants as per inputs from <oyo/:OP/OMPL& 8n inflation rate of =+ p&a& has been applied on all the components of operating cost& #ensiti(ity has been carried out 'ith .2+ increase in the operating cost e(ery year& !cenario III: LoA Capacit 'tiliCation 1@652 #ensiti(ity has been carried out to chec@ the effect of lo'er capacity utili9ation on the financial parameters& 7n this case5 it is assumed that the plant operates at ?2 + in first year of operations and *2+ on'ards& !cenario I(: LoAer Mar#ins 1Crac= loAer b +'!D :6GTon2

Considering the (olatility in the crac@ bet'een naphtha and para!ylene/ ben9ene5 a sensiti(ity has been carried out 'ith lo'er crac@ of :#0 -2/<on by reducing 6enchmar@ prices of para!ylene and ben9ene by :#0 -2/ton in the first three years of operation5 'hile feedstoc@ prices ha(e been @ept at the same le(el& <he impact of lo'er margins is the most in the initial years due to high debt ser(ice obligations& <he pro;ect is sensiti(e to lo'er margin& !cenario (: Nat-ral 0as a8ailabilit from t4ir, ear 7n the profitability pro;ections5 it has been assumed that natural gas 'ill be a(ailable to the aromatics comple! from 8pril 12.1& #ince the pipelines up to Mangalore are still in the planning stage5 it may ta@e some time to implement these large infrastructure pro;ects& 0ue to this delay5 the gas may not be a(ailable to the plant in the initial years& 8 sensiti(ity has been carried out 'ith natural gas a(ailability from third year on'ards& 0ue to consumption of costly fuels in CPP as 'ell as process heating in the initial years5 the profitability of the pro;ect 'ill get affected& Results of these sensiti(e scenarios are gi(en in the follo'ing tableH Table %9 : )es-lt of !ensiti8it Anal sis "ase !ensiti8it !cenarios Case Case I Case II Case III .?&22+ .3&=*+ .4&.3+ .3&=4+ 11&*2+ 12&2?+ 1.&))+ 12&12+ 1&2) .&?.&*) .&?= .&3) .&)* .&-4 .&))

!+ No+ . 1 = )

Parameters Pro;ect 7RR $,uity 7RR 8(erage 0#CR Minimum 0#CR

Case I( .3&=4+ .*&3?+ .&*. .&1=

Case ( .4&.*+ 1.&1)+ .&*? .&)?

7t is e(ident from the sensiti(ity results that5 the profitability parameters are comfortable for the sensiti(ities related to pro;ect cost5 operating cost and lo'er capacity utili9ation& <he debt ser(icing capability of the pro;ect is not hampered e(en in the rough scenario of the crac@ remaining lo'er by :#0 -2/M< in the first three of operation& <he pro;ect 7RR is greater than .1+ in all scenarios& %+%9 Fiscal / Non3Fiscal Concessions <he pro;ect is located in #$%& <he pro;ect 'ill get benefits of $!emption from customs duty5 e!cise duty5 E8<5 ser(ice ta! etc& during construction period $!emption from income ta! during first fi(e years after CO05 and e!emption for -2 + in the subse,uent - years&& <he e!emption for -2 + income <a! can be e!tended for additional - years if spent on rede(elopment No E8<5 $!cise5 Customs 'ill be applicable on sourcing of ra' material for domestic sales /e!port of products& Ra' material 'ould be e!empted from custom duty #ale in 0omestic <ariff 8rea (0<8) 'ill attract customs duty

<o retain status of #$% unit5 the pro;ect 'ill ha(e to be net positi(e foreign income earner& 8s P> and 6en9ene are proposed to be e!ported or sold to #$% units (deemed e!port)5 'hile Naphtha 'ill be sourced domestically from MRPL& <hus the pro;ect 'ill easily meet the foreign income

earning re,uirement for retaining #$% status& Durther5 the company has approached Carnata@a state Go(t& for e!emption from Ior@s Contract <a!& %+%: Concl-sion ONGC/MRPL proposes to set up an 8romatic comple! at #pecial $conomic %one at Mangalore5 ad;acent to MRPL refinery to produce about *.= C<P8 Para!ylene and 1?= C<P8 6en9ene5 using Naphtha as the feedstoc@& <he pro;ect 'ould be implemented through a separate special purpose (ehicle (#PE) company5 ONGC Mangalore Petrochemicals Limited (OMPL) <he pro;ect 'ould en;oy the (arious ta! benefits a(ailable under the #$% policy& <he pro;ect has the benefit of synergy 'ith MRPL5 for 'hich the pro;ect is li@e for'ard integration in the (alue chain& #67C8P has e!amined the financial feasibility of the proposed pro;ect and assessed the (iability of the pro;ect under the impact of (arious ad(erse scenarios5 'hich see@ to present the results in case of changes in (arious assumptions& On an assessment of the pro;ect parameters5 it is recommended that OMPL shouldH $nter into long term feed stoc@ supply and stream e!change arrangements 'ith MRPLG <ie up off ta@e of products through long term contracts5 preferably through dedicated P<8 plant at Mangalore for -2+ of the capacity& <ie-up the balance -.+ of the pro;ect e,uity5 @eeping in (ie' the synergies brought in by the in(estor in technology and mar@eting of finished productsG Dinali9e arrangements 'ith M#$% for Land Lease agreement and facilities to be pro(ided by itG 7dentify core pro;ect implementation team and ma@e arrangements for co ordination of the pro;ect implementation in such a manner that the pro;ect is completed 'ithin the time frame en(isagedG Obtain necessary statutory clearances

<hus5 based on the financial appraisal e!ercise5 it may be concluded that5 considering the pro;ected performance of the proposed pro;ect5 the company is e!pected to meet its debt ser(ice obligations to'ards the pro;ect& <he o(erall financial5 li,uidity and profitability parameters of the pro;ect are considered reasonable and satisfactory& #ub;ect to the ris@ factors5 the 'ea@nesses and threats enumerated and the impact of (arious scenarios en(isaged under sensiti(ity analysis5 OMPL"s proposed pro;ect can be considered financially (iable& Annex-re3 %+%< Ass-mptions for Profitabilit Projections %+%<+% Project Timelines Commercial Operation 0ate 2. 8pril 12.1 Dinancial year for first year Operation =. Mar 12.= Pro;ect Life 12 Jears %+%<+. Macroeconomic Ass-mption

Factor Per ann-m 7ndian 7nflation Rate =+ Doreign 7nflation Rate 2+ 7NR/:#0 0epreciation Rate .+ 6ase 7NR-:#0 $!change Rate (as on .st 8pril5 122*) )?&-2 %+%<+7 Capital !tr-ct-re 0ebt 3-+ 0ebt $,uity Ratio 3-&=Percentage $,uity by Promos )*+ :pfront $,uity (out of total e,uity) )*+ %+%<+9 Capacit 'tiliCation *ear of operation Capacit 'tiliCation .st Jear ?2+ 1nd Jear *2+ rd = Jear beyond .22+ %+%<+: Pro,-ct Capacit an Material "alance !+ No Material Fee,stoc= . DCC naphtha 1 Co@er naphtha = #t Run naphtha ) Fea(y naphtha side dra' 84 - rich stream 3 8? - mi!ed !ylene 4 8* - rich stream ? Light Reformate Total Pro,-cts . Para!ylene 1 6en9ene = Paraffin Rich Raffinate ) Duel gas LPG 3 Fea(y 8romatics 4 Fydrogen Total %+%<+< Fee,stoc= Pricin# Ass-mptions Deedstoc@ pricing is based the =-year a(erage of monthly a(erage prices (8pril 122- - Mar 122?) for different items& Fee,stoc= "enc4mar Price "asis of Pricin# ;-antit 1TMTPA2 -.1.&2 .?.&2 -.=&= .1=&4 1=.&2 1)4&2 .1-&2 2&2 %:9.+6 *.=&4 1?=&. .12&? .4=&? 12&2 ..&1 .*&) %:9.+6 5 of Total 4&?-+ ..&4)+ ==&1*+ ?&21+ .)&*?+ .3&21+ ?&..+ 2&22+ %66+665 -*&1-+ .?&=3+ 4&?=+ ..&14+ .&=2+ 2&4=+ .&13+ %66+665

= DCC naphtha M# Co@er naphtha Naphtha #t Run naphtha Naphtha Fea(y naphtha side dra' Naphtha 84 - rich stream M# 8? - mi!ed !ylene M> 8* - rich stream M# Light Reformate M#

1)s+GMT2 13)4*&23 1)1-3&?* 1-.4*&?* 1-.4*&?* 1444?&1= =1))?&*3 1444?&1= 1444?&1=

<rade Parity Pricing (DO6 Mangalore) N Rs&*1=/M< (DO6 Mangalore) (DO6 Mangalore) <rade Parity Pricing DO6 Corea - :#L *2/M< <rade Parity Pricing <rade Parity Pricing

%+%<+> Pro,-ct Pricin# Ass-mptions Product pricing is based on the =-year monthly a(erage prices (8pril 122- - Mar 122?) for different products as belo'H Fee,stoc= Para!ylene (domestic)M Para!ylene (e!port) 6en9ene (0omestic) 6en9ene (e!port) Paraffin Rich Raffinate (0omestic) LPG "enc4mar= Price 1)s+GMT2 P )-42?&23 "asis of Pricin# CDR 8CP O Dreight (Corea to Mangalore) CDR 8CP Dreight (Corea to Mangalore)

P>

).*1?&23

6% 6% Naphtha

=*=*1&?1 =?))4&?1 1-.4*&?* DO6 Corea (DO6 Mangalore) DO6 8rab Gulf O Dreight ( 8G to Mangalore) <hree times (alue of light naphtha

LPG

1)*.-&.3

Fydrogen (0omestic)

Light Naphtha

4--=*&34

-2+ para!ylene to be sol domestic mar@et from 1nd year on'ards& %+%<+? Financin# Ass-mptions Rupee <erm Loan 7nterest Rate (Rupee <erm Loan) Moratorium Period Repayment Period 7nterest rate for IC .22+ ..&2+ 3 ,uarters after CO0 * years (=3 e,ual ,uarterly payments) ..+

borro'ing

%+%+<+@ Bor=in# Capital Ass-mptions Item Norm In8entor Deedstoc@ = days consumption CPP/process Duel = days consumption Ior@-in-process = days of cost of production Dinished Goods .1 days of production Chemicals consumables .- days of cost )ecei8ables 0omestic 1. days of sales $!port 1. days of sales Cre,itors 1. days purchase (feedstoc@ and CPP fuel) %+%<+%6 Operatin# Costs (ariable Costs <he basis of computation of ch (ariable cost item is indicated belo'H Item Catalysts Chemicals Ra' 'ater Description 8s indicated by OMPL/<oyo& <he same ha(e been assumed to be escalated at =+ p&a&

Rs&.1&- per cum for fresh 'ater and Rs&.4&- per cm for treated 'ater (Re,uirement of .3) cm/hr of fresh 'ater5 =)2 cm/hr of treated 'ater) Po'er Pro;ect 'ill re,uire -. MI of po'er #team and .34&- <PF of #team at .22+ capacity utili9ation& <he CPP shall use gas as the primary fuel5 and gas has been assumed to be a(ailable from first year of operation& <he price of natural gas has been assumed at 4 L/mmbtu& Port Fandling Rs&42 per tonne for e!port of P> and 6en9ene is payable to Ne' Mangalore port trust per the published tariff of NMP< Fixe, Costs <he basis of computation of fi!ed costs is as follo'sH Item Description

Repairs and Maintenance #alary Iages

7nsurance 8dministrati(e $!penses $lectricity Charges Rs&1- la@h per month (Di!ed) Land Lease Rs&-25222 per acre per year charges

2&-+ on Plant Machinery and 6uildings in the first fi(e years of operation and . +thereafter Rs&14&2 crore based upon =22 people 'ith Rs&*&2 lacs pa& 2&1-+ of Plant Machinery and 6uildings 2&-2+ of Net sales of the company

Number of operating hours h been assumed as ?222 hours/ year Operating Costs are escalate annually at =+ p&a& %+%<+%% Depreciation Ass-mptions Item !LM3"oo= Depreciation Plant Machinery Misc& 8ssets 6uilding BD(3Tax Depreciation Plant Machinery Misc& 8ssets 6uilding Maxim-m Depreciation Depreciation )ate

*-+ *-+ *-+

-&1?+ -&1?+ .&34+

.22+ .22+ P .22+

.-+ .-+ .2+

%+%<+%. Tax ass-mptions <a! .22+ e!emption on Folida e!port/deemed e!port income y for first fi(e years and -2+ e!emption thereafter in ne!t fi(e years& M8< rate ..&==+ (M8< not applicable to OMPL)

7ncome ==&**+ <a! rate %+%> Projecte, Financials %+%>+% Projecte, P/L

Financial *ear3 .6%7 En,in# <hroughput (C<P8) .1=)

.6%9 .=??

.6%: .-)1

.6%< .-)1

.6%> .-)1

.6%? .-)1

.6%@ .-)1

.6.6 .-)1

.6.% .-)1

In )s crore .6.. .-)1

Total Income :D9.?+9? <D9.6+.6 >D.><+?9 >D9.7+79 >D:>.+9% >D>.9+9? >D?>@+<: ?D67?+.? ?D%@@+>% ?D7<9+7@ Deedstoc@ $!pense )5.-1&3? )543-&.) -5)22&)- -5-2?&4. -&3.?&?) .5**=&=2 152==&?4 1524-&1? 15..4&)3 15.32&-2 Di!ed operating cost Eariable operating cost Total operatin# cost P"DIT 7nterest on L< loan 7nterest on IC borro'ings Total Financin# Expenses 0epreciation P"T Current <a! 0eferred <a! PAT .2)&1) ...&-1 ..?&.? .1.&=? .1)&3=)*&)1 )23&*3 ))3&-= )31&4) )-*&)* 9:7+<> :%?+9> :<9+>% :?9+%. :?9+%9 .-*&.4 .3=&-3 .3?&2* .41&4) .44&-. )4-&4= )4?&*= -2=&1) -23&2= -.2&.= <79+@6 <9.+9@ <>%+77 <>?+>> <?>+<:

?11&.) .5.=3&-? .5=..&3* .5==2&-. .5=3*&)= .5=-?&)2 .5=*.&=4 .5)2=&*- .5)=?&42 .5)41&?)..&.? )2-&)4 =3-&)* =.*&?2 14)&.1 11?&)= .?1&4) .=4&23 *.&=4 )-&3* .1&21 13&)3 =2&*3 ==&)1 =)&.1 =)&?* =-&42 =3&-2 =4&=. =?&2-

9.7+%@ 97%+@. 7@<+9: 7:7+.7 76?+.9 13=&)* .=-&)3 )&1) .=.&1. 13=&)* )).&.4 .=&). )14&43 13=&)* 3-.&4) .&*? .4&?= 3=.&*) 13=&)* 4.=&?2 .-&)4 3&1. 3*1&.. 13=&)* 4*4&42 12&.= )&.2 44=&)4

.<7+7. .%?+99 %>7+:< %.?+<? ?7+>9 13=&)* ?=.&-* .=*&*1 .)&2) 344&3= 13=&)* *2*&)) .3=&3)&41 4).&24 13=&)* *33&*2 .?1&1. (=&1.) 4?4&*2 13=&)* 13=&)* .52)3&-= ..1-&31 12=&42 11)&2* (*&*3) (.-&4.) ?-1&4* *.4&1)

Das könnte Ihnen auch gefallen

- Waste Management in the Chemical and Petroleum IndustriesVon EverandWaste Management in the Chemical and Petroleum IndustriesNoch keine Bewertungen

- JamnagarDokument4 SeitenJamnagarkatariamanojNoch keine Bewertungen

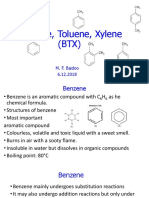

- BTX Compounds: Benzene, Toluene, Xylene and Their PropertiesDokument10 SeitenBTX Compounds: Benzene, Toluene, Xylene and Their PropertiesMatthew SantawNoch keine Bewertungen

- Compatibility With Plastics and Elastomers: TitleDokument2 SeitenCompatibility With Plastics and Elastomers: TitleashrafNoch keine Bewertungen

- CRU PresentationDokument18 SeitenCRU PresentationManish KalraNoch keine Bewertungen

- Motor Gasoline Analysis and SpecificationsDokument4 SeitenMotor Gasoline Analysis and SpecificationsFrançois LeroyNoch keine Bewertungen

- Hydrotreating Amine Treating & Sulphur Recovery: PetroDokument8 SeitenHydrotreating Amine Treating & Sulphur Recovery: PetroIlham HakimNoch keine Bewertungen

- Gasoline PropertiesDokument6 SeitenGasoline PropertiesbahadorNoch keine Bewertungen

- Catalytic Reforming PDFDokument3 SeitenCatalytic Reforming PDFAbey SamuelNoch keine Bewertungen

- 45 Naptha ReformingDokument23 Seiten45 Naptha ReformingJ MartínezNoch keine Bewertungen

- Transportation: EGEE 102 - Energy Conservation and Environmental ProtectionDokument45 SeitenTransportation: EGEE 102 - Energy Conservation and Environmental ProtectionTanweer SalahNoch keine Bewertungen

- Distillation Column Basics ExplainedDokument4 SeitenDistillation Column Basics ExplainedTejas PatelNoch keine Bewertungen

- Quiz Mohd Rafiq Mohd ZubirDokument11 SeitenQuiz Mohd Rafiq Mohd ZubirMohd RafiqNoch keine Bewertungen

- Cyclar LPG to Aromatics ProcessDokument30 SeitenCyclar LPG to Aromatics ProcessAlekhya Bandaru0% (1)

- Gasoline FAQ 1Dokument9 SeitenGasoline FAQ 1Claudia MmsNoch keine Bewertungen

- Upgrading low octane gasoline through catalytic reformingDokument32 SeitenUpgrading low octane gasoline through catalytic reformingStudy purposeNoch keine Bewertungen

- Murphy Oil USA, Inc Meraux Refinery SO2 Emission Basis ObjectionsDokument43 SeitenMurphy Oil USA, Inc Meraux Refinery SO2 Emission Basis ObjectionsHot TopicsNoch keine Bewertungen

- Introduction To Inviromental Control in Refining IndustryDokument34 SeitenIntroduction To Inviromental Control in Refining IndustryAmer ShaierNoch keine Bewertungen

- Gasoline FAQ 4Dokument25 SeitenGasoline FAQ 4Claudia MmsNoch keine Bewertungen

- Crude Oil Assay (Assignment 1) (FINAL)Dokument12 SeitenCrude Oil Assay (Assignment 1) (FINAL)Fabliha KhanNoch keine Bewertungen

- Hydrodesulfurization Often Abbreviated To HDSDokument16 SeitenHydrodesulfurization Often Abbreviated To HDSigor0104100% (1)

- Gasoline FAQ 2Dokument20 SeitenGasoline FAQ 2Claudia MmsNoch keine Bewertungen

- CHE327 Petrochemical Technology: Catalyst Deactivation Causes, Mechanisms, and TreatmentDokument25 SeitenCHE327 Petrochemical Technology: Catalyst Deactivation Causes, Mechanisms, and TreatmentMuhammad AshmanNoch keine Bewertungen

- The Secretariat: Information Ce NterDokument8 SeitenThe Secretariat: Information Ce NterAmeya KannamwarNoch keine Bewertungen

- Performance Analysis of Reciprocating Refrigerant CompressorDokument6 SeitenPerformance Analysis of Reciprocating Refrigerant CompressorIjsrnet EditorialNoch keine Bewertungen

- Petroleum Refining Processes ExplainedDokument51 SeitenPetroleum Refining Processes ExplainedChalsawivelaNoch keine Bewertungen

- Lecture 3: Petroleum Refining Overview: 3.1 Crude OilDokument66 SeitenLecture 3: Petroleum Refining Overview: 3.1 Crude OilKumar AyushNoch keine Bewertungen

- Conversion of Isobutylene To Propylene PDFDokument9 SeitenConversion of Isobutylene To Propylene PDFtannytranNoch keine Bewertungen

- JamnagarDokument3 SeitenJamnagarkallurisuryaNoch keine Bewertungen

- Oil To Chemicals-April2018Dokument4 SeitenOil To Chemicals-April2018Sanjay RajoraNoch keine Bewertungen

- Selection of Technologies For Gas Plant NaturalDokument15 SeitenSelection of Technologies For Gas Plant NaturaljxlNoch keine Bewertungen

- Catalytic Reforming: 2011 Refining Processes HandbookDokument3 SeitenCatalytic Reforming: 2011 Refining Processes HandbookGaspar BlaserNoch keine Bewertungen

- 09 Gasoline UpgradingDokument63 Seiten09 Gasoline UpgradingLượng NguyễnNoch keine Bewertungen

- Gas Concentration Unit WorkpaperDokument11 SeitenGas Concentration Unit WorkpaperMohammad Haseeb AzamNoch keine Bewertungen

- PDFDokument6 SeitenPDFjamy862004Noch keine Bewertungen

- Fuel Field ManualDokument26 SeitenFuel Field ManualFREDIELABRADORNoch keine Bewertungen

- Acetic Acid: Europe Chemical ProfileDokument1 SeiteAcetic Acid: Europe Chemical ProfileJESSICA PAOLA TORO VASCONoch keine Bewertungen

- Uop RCD Unionfining Process: Daniel B. GillisDokument10 SeitenUop RCD Unionfining Process: Daniel B. GillisBharavi K SNoch keine Bewertungen

- Uop Olex Process For Olefin Recovery: Stephen W. SohnDokument4 SeitenUop Olex Process For Olefin Recovery: Stephen W. SohnAshraf SeragNoch keine Bewertungen

- Petrochemicals: Petrochemicals Are Chemical Products Made From TheDokument3 SeitenPetrochemicals: Petrochemicals Are Chemical Products Made From TheRaj Sunil KandregulaNoch keine Bewertungen

- UOP Aromatics Complex .Dokument9 SeitenUOP Aromatics Complex .tungksnbNoch keine Bewertungen

- FCC Lightcycle OilDokument25 SeitenFCC Lightcycle OilMallela Sampath KumarNoch keine Bewertungen

- Understanding O&G-MDSO 801 (2nd Vol)Dokument156 SeitenUnderstanding O&G-MDSO 801 (2nd Vol)Anonymous IwqK1Nl100% (1)

- FCC 2Dokument17 SeitenFCC 2bac_nobita7657Noch keine Bewertungen

- What is Gasoline? Key details on production, octane number, knocking, and additivesDokument11 SeitenWhat is Gasoline? Key details on production, octane number, knocking, and additivesAayush PandeyNoch keine Bewertungen

- Additional Delayed Coking Capacity Drivers in RefiningDokument4 SeitenAdditional Delayed Coking Capacity Drivers in Refiningabhishek kumarNoch keine Bewertungen

- Environmental Aspects of Petroleum RefiningDokument5 SeitenEnvironmental Aspects of Petroleum RefiningvsrslmNoch keine Bewertungen

- Oxygenates in GasolineDokument303 SeitenOxygenates in GasolinePhilip ShihNoch keine Bewertungen

- Upgrade HDK Resid HP 2008-EnglishDokument6 SeitenUpgrade HDK Resid HP 2008-Englishsaleh4060Noch keine Bewertungen

- Refinery Economics-1Dokument16 SeitenRefinery Economics-1Avishek GhosalNoch keine Bewertungen

- MRPLDokument44 SeitenMRPLNeha IsaacNoch keine Bewertungen

- Aromatics Upgrading Technologies: Ihs ChemicalDokument9 SeitenAromatics Upgrading Technologies: Ihs ChemicalLêĐứcTiếnNoch keine Bewertungen

- Oil Price Trends in India and Its DeterminentsDokument16 SeitenOil Price Trends in India and Its DeterminentsDeepthi Priya BejjamNoch keine Bewertungen

- Characteristics and Uses of Petroleum Fractions ExplainedDokument1 SeiteCharacteristics and Uses of Petroleum Fractions ExplainedXiiao Xiiao Lingzz100% (1)

- Techno-Economic Assessment About SyngasDokument4 SeitenTechno-Economic Assessment About SyngasIntratec SolutionsNoch keine Bewertungen

- Choosing A Selective Hydrogenation SystemDokument9 SeitenChoosing A Selective Hydrogenation SystemrizaherNoch keine Bewertungen

- 09 Gasoline UpgradingDokument63 Seiten09 Gasoline UpgradingSaddamNoch keine Bewertungen

- Waste and Biodiesel: Feedstocks and Precursors for CatalystsVon EverandWaste and Biodiesel: Feedstocks and Precursors for CatalystsNoch keine Bewertungen

- ExhibitA RInfra-G Financial Model Business-PlanDokument45 SeitenExhibitA RInfra-G Financial Model Business-PlanL Prakash JenaNoch keine Bewertungen

- Total Cost of Ownership of Car ModelsDokument33 SeitenTotal Cost of Ownership of Car ModelsC100% (1)

- Dated: June 8, 2018 New Wind GBI Portal Introduced by IREDADokument1 SeiteDated: June 8, 2018 New Wind GBI Portal Introduced by IREDACNoch keine Bewertungen

- Project Development, DPR Preparation, Appraisal and Schemes Implementation Reference Book March-2Dokument484 SeitenProject Development, DPR Preparation, Appraisal and Schemes Implementation Reference Book March-2CNoch keine Bewertungen

- Ram SinghDokument43 SeitenRam SinghCNoch keine Bewertungen

- Financial Management Guide to MergersDokument142 SeitenFinancial Management Guide to MergersCNoch keine Bewertungen

- SampleForm19 EnglishDokument2 SeitenSampleForm19 Englishd0101Noch keine Bewertungen

- Benihana Case Presentation 27 Jan 2013Dokument15 SeitenBenihana Case Presentation 27 Jan 2013CNoch keine Bewertungen

- Funds-Starved Industry Seeks Urea Decontrol - Business LineDokument2 SeitenFunds-Starved Industry Seeks Urea Decontrol - Business LineCNoch keine Bewertungen

- Failed ProjectsDokument4 SeitenFailed ProjectsCNoch keine Bewertungen

- Marques OliveiraDokument14 SeitenMarques OliveiraCNoch keine Bewertungen

- Shouldice Hospital Ltd.Dokument12 SeitenShouldice Hospital Ltd.CNoch keine Bewertungen

- Faculty PositionDokument2 SeitenFaculty PositionCNoch keine Bewertungen

- Mumbai Sea LinkDokument5 SeitenMumbai Sea LinkCNoch keine Bewertungen

- Florence School of Regulation PDFDokument14 SeitenFlorence School of Regulation PDFCNoch keine Bewertungen

- Competition Policy Brochure 2012Dokument2 SeitenCompetition Policy Brochure 2012CNoch keine Bewertungen

- Legal Issues in Infrastructure FinanceDokument17 SeitenLegal Issues in Infrastructure FinanceCNoch keine Bewertungen

- HP Case Competition PresentationDokument17 SeitenHP Case Competition PresentationNatalia HernandezNoch keine Bewertungen

- Job Descriptions Rect Ad - Oct 2013 2 PDFDokument6 SeitenJob Descriptions Rect Ad - Oct 2013 2 PDFaggarwalrajnishNoch keine Bewertungen

- About Ideas 360 PDFDokument5 SeitenAbout Ideas 360 PDFCNoch keine Bewertungen

- Kotler Mktman 11ce Ch13Dokument32 SeitenKotler Mktman 11ce Ch13CNoch keine Bewertungen

- Journal of Infrastructure Development 2012 Gangakhedkar 27 39Dokument15 SeitenJournal of Infrastructure Development 2012 Gangakhedkar 27 39CNoch keine Bewertungen

- Session 1: Basic Cost Management ConceptsDokument43 SeitenSession 1: Basic Cost Management ConceptsCNoch keine Bewertungen

- Commercial Banking in IndiaDokument1 SeiteCommercial Banking in IndiaSneha BehaNoch keine Bewertungen

- 6-4-A K BalyanDokument9 Seiten6-4-A K BalyanCNoch keine Bewertungen

- Dutch PhD Study InstitutionsDokument5 SeitenDutch PhD Study InstitutionsCNoch keine Bewertungen

- ROD PresentationDokument12 SeitenROD PresentationCNoch keine Bewertungen

- Haldor Topsøe Catalysing Your BusinessDokument25 SeitenHaldor Topsøe Catalysing Your BusinessCNoch keine Bewertungen

- Coal Sector PresentationDokument35 SeitenCoal Sector PresentationCNoch keine Bewertungen

- Affidavit Suryanagara Project at Iggaluru-BanahalliDokument2 SeitenAffidavit Suryanagara Project at Iggaluru-Banahallisumit408Noch keine Bewertungen

- Intern Report - ajoy.ASH 1510049MDokument35 SeitenIntern Report - ajoy.ASH 1510049MAjoyNoch keine Bewertungen

- Financial Analytics 1234Dokument10 SeitenFinancial Analytics 1234Shubhangi Virkar100% (1)

- Criminal Liability of Corporate Officers Under PD 115Dokument1 SeiteCriminal Liability of Corporate Officers Under PD 115GSSNoch keine Bewertungen

- Emilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDokument15 SeitenEmilio Gentile. Political Religion - A Concept and Its Critics - A Critical SurveyDeznan Bogdan100% (1)

- Psikopatologi (Week 1)Dokument50 SeitenPsikopatologi (Week 1)SyidaBestNoch keine Bewertungen

- HKMA's Approach to Derivatives RegulationDokument172 SeitenHKMA's Approach to Derivatives RegulationHoangdhNoch keine Bewertungen

- Leadership As Exhibited by A Private Sector Learning Executive A Descriptive Case Study of LeadershipDokument429 SeitenLeadership As Exhibited by A Private Sector Learning Executive A Descriptive Case Study of LeadershipAdina DobrotescuNoch keine Bewertungen

- Over View of Rupali Insurance Company LimitedDokument24 SeitenOver View of Rupali Insurance Company LimitedSumona Akther RichaNoch keine Bewertungen

- Is648.2006 Crno SteelDokument30 SeitenIs648.2006 Crno SteelAnonymous qfwuy3HWVNoch keine Bewertungen

- Analysis of Sylvia Plath's MirrorDokument3 SeitenAnalysis of Sylvia Plath's MirrorPaola EstefaniaNoch keine Bewertungen

- (U) Daily Activity Report: Marshall DistrictDokument5 Seiten(U) Daily Activity Report: Marshall DistrictFauquier NowNoch keine Bewertungen

- ColgateDokument3 SeitenColgateganal2girish0% (1)

- Rufino V PeopleDokument1 SeiteRufino V PeopleJune Karl CepidaNoch keine Bewertungen

- VB Project ListDokument2 SeitenVB Project Listsooryajagan67% (3)

- Ankur Final Dissertation 1Dokument99 SeitenAnkur Final Dissertation 1pratham singhviNoch keine Bewertungen

- Module 2 Spiritual Beliefs of Early FilipinosDokument4 SeitenModule 2 Spiritual Beliefs of Early FilipinosShelei Blanco IINoch keine Bewertungen

- PIA SWOT Analysis (BZU Bahadar Sub Campus Layyah)Dokument6 SeitenPIA SWOT Analysis (BZU Bahadar Sub Campus Layyah)Idealeyes100% (3)

- 3M Respirator Fit Tesing Guide - One PageDokument1 Seite3M Respirator Fit Tesing Guide - One PageAhmad Aliff AkmalNoch keine Bewertungen

- Philippine Air Force - PAF OrganizationDokument40 SeitenPhilippine Air Force - PAF Organizationjb2ookworm78% (9)

- History of Advertising PDFDokument62 SeitenHistory of Advertising PDFlakshitaNoch keine Bewertungen

- Summary and Guide To Maps of Meaning: The Architecture of Belief by Jordan PetersonDokument11 SeitenSummary and Guide To Maps of Meaning: The Architecture of Belief by Jordan PetersonMaps 201598% (44)

- SITPRO Standard Shipping Instruction Completion GuideDokument12 SeitenSITPRO Standard Shipping Instruction Completion GuidesteffaboNoch keine Bewertungen

- Bribery Lesson PlanDokument3 SeitenBribery Lesson Planapi-357057174Noch keine Bewertungen

- Vocabulary Analogy EbookDokument40 SeitenVocabulary Analogy EbookManuj Dixit100% (1)

- Technical Occurrence Report: European Aviation Safety AgencyDokument3 SeitenTechnical Occurrence Report: European Aviation Safety AgencyNihar BNoch keine Bewertungen

- Philippine Corporate Law SyllabusDokument102 SeitenPhilippine Corporate Law SyllabusRoa Emetrio NicoNoch keine Bewertungen

- Presentation II Hacking and Cracking Wireless LANDokument32 SeitenPresentation II Hacking and Cracking Wireless LANMuhammad TaufikNoch keine Bewertungen

- Agustin Garcia Resume 2018 UpdatedDokument1 SeiteAgustin Garcia Resume 2018 Updatedapi-419712490Noch keine Bewertungen

- 36.10 Cakkavatti Sihanada S d26 PiyaDokument50 Seiten36.10 Cakkavatti Sihanada S d26 PiyaNo SelfNoch keine Bewertungen