Beruflich Dokumente

Kultur Dokumente

Finance

Hochgeladen von

favoureitOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finance

Hochgeladen von

favoureitCopyright:

Verfügbare Formate

Intro Allocation of assets - just need to know investment object & risk tolerance this wk Getting the right

ht exposures rather than the right selection of assets MFs, derivatives (s/t considered sa e class, su!jective" #$ What are the 2 types of shares? %& 'isted (e(uities u can purchase on stock exchanges" Growth & li(uidit) (u can get ur * !ack fairl) (uickl)" +& ,nlisted -ither invested in large chunks eg *%...-*+... - not as divisi!le as shares ,nderl)ing securities not traded Adv.'s of unlisted shares? 1. ore growth, u get co pensated for the illi(uidit) pre iu s 2. Good / diversification - !c not correlated with listed nor traded #0 What are the 3 most popular investments among individual investors? 1. #hort-ter de!t/cash 2. #hares 3. Fa il) ho e #1 What are fi ed!income securities? 2onds 3reference shares What are bonds? 4he '4 ones (at least %+ onths" 5orp !onds (looking for higher )ield" or govt !onds ( ain !onds in Aus, fro r!a" "o they default? 6e, not risk free despite arket pitches that these are low risk What is dif bt#n pref shares $ ord shares? 7ell traded in stock exch we have (uite a few pref shares, largest is newscorp #%. Why is income impt? Why is maturity matching impt for fin'l planning , can atch the exact dollar a ount if u put in stocks etc, eg to ensure that u get * in a specific ti e cf putting in a !ond, engineer wen u get it exactl) #%% Why is property attractive? , reduce ur no inal tax & present tax

8igh collateral value Generate a lot of interest deductions 9nco e is relativel) sta!le Good for creating potentiall) negativel) geared lenders willing to give u :.;, cf !onds - <$.; Fa il) ho e is one of few things not taxed #%+ What do commodities $ collectives include? =ld and other precious etals, ge stones and collecti!les >on?t want to put too uch in, shouldnt !e ain, just for diversification #%: @ust add up arket value colu n %.; return in 4his 3eriod %%/.&% .&% the divisor, needs to !e constantl) adjusted #+. Why #ould u use derivatives to manage ta ? -g, !ought shares for %-%. )ears, no need for the one) !ut alread) got %..* gains (!ought for *%.., now *+.." , see arket a!out to crash 9f )ou sell on ur cash positions, u?ll have to pa) tax ((uite high, /1-/:; and lev), etc" Alternativel), short position to protect downside of ur shares invest ent -#3 useful for short ter changes, and hedging downside risk of positions #+0 %ontract for diff? 5ontract with u for price change >on?t get divids or price change #+1 9nitiall) traded as a !etting agenc) 4axed at #4 arginal tax rate #$+ #ector rotation #o e sector will do !etter than others 2anking stock #ector is currentl) in favour with investors 5onsu er staple #ector (super arkets, @ohnson, as opposed to >avid jones which fluctuate ore" also has lower risk Mandate is :.; have to !e in stocks (can?t get out, !ut can switch !twn stocks" 4hese are the / !road sources of return for asset allocations Most ppl would argue that the first % is ost i pt #$0 What are the asset classes for the tangency portfolio? Aisk) assets %..; in !ond and stocks

u keep so e in stocks, !ut !ond and cash go up and down (!c of diversification" -ncourages u to operate along !lue rather than green Assu e that u can?t !orrow #$1 &ori'on Is? 7hen u need to withdraw * fro ur portfolio #$: understand this graph 'ooks at returns on !ills e(uities over a centur) 7hat is the sd of return when u have a %. )ear holding period increase What is the dif bt#n bonds u hold to maturity $ rolled over? 2onds held to aturit) u don?t have price risks, onl) reinvest ent risk (ey msg about e)uity? =ver the long run, e(uit) is not so !ad -(uit) is still riskiest, not as risk) in the ver) short ter 9f u have long point horiBon, u shud put in growth assets #/% Ae!alancing C 3ush !ack to fixed interest securities with risk weight consistent with ur risk appetite - selling asset that appreciate, & !u) depreciated assets #/+ >)na ic asset D 4r) to exploit !) rotating !etween the industr) sectors (switching !twn the " %yclical eg? Mining stocks !c it goes up and down with econ c)cle 5f 3rocter ga !le, woollies 2eta usuall) low #/: Main thing - @ust need positive saving, know risk tolerance --E don?t need to !eat the arket #/F #o e securities are not correctl) priced, so u can take adv #0. 7hat would !e the relation !etwn high ret securities & high riskD 3t$ #o e ppl !eco e ore risk averse, so eti es less -g when the)?re losing one), ore averse -E efficient arket h)p eans not relevant here 9t just eans, re(uired ret will fluctuate 9t doesn?t violate the e h, just that #/4 ppl have higher cost

3t/ Gariation in risk pre iu

is ok - not violating the e h

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Calendar 2018: S M T W T F S January S M T W T F S March S M T W T F S February S M T W T F S AprilDokument1 SeiteCalendar 2018: S M T W T F S January S M T W T F S March S M T W T F S February S M T W T F S AprilfavoureitNoch keine Bewertungen

- Faure - Op 31 Impromptu No 2Dokument2 SeitenFaure - Op 31 Impromptu No 2favoureitNoch keine Bewertungen

- GKDokument3 SeitenGKfavoureitNoch keine Bewertungen

- Basic TrainingDokument27 SeitenBasic TrainingfavoureitNoch keine Bewertungen

- Team Strengths GridDokument11 SeitenTeam Strengths Gridfavoureit100% (1)

- Smiley ChartDokument1 SeiteSmiley ChartfavoureitNoch keine Bewertungen

- Exam SlipDokument1 SeiteExam SlipfavoureitNoch keine Bewertungen

- Wk3 Tute Ch3 (Business Structures)Dokument5 SeitenWk3 Tute Ch3 (Business Structures)favoureitNoch keine Bewertungen

- ExamDokument2 SeitenExamfavoureitNoch keine Bewertungen

- Lec2 ERDokument1 SeiteLec2 ERfavoureitNoch keine Bewertungen

- W12 Revision: Much Like Midsession Format Can Use Dot Boings Eg Why Don't PPL Use Annuity Adverse Selection - ExpandDokument3 SeitenW12 Revision: Much Like Midsession Format Can Use Dot Boings Eg Why Don't PPL Use Annuity Adverse Selection - ExpandfavoureitNoch keine Bewertungen

- Car Key IssueDokument1 SeiteCar Key IssuefavoureitNoch keine Bewertungen

- W1 SR - Averting Age Old CrisisDokument1 SeiteW1 SR - Averting Age Old CrisisfavoureitNoch keine Bewertungen

- Ch2 - The Client-Adviser RelationshipDokument2 SeitenCh2 - The Client-Adviser RelationshipfavoureitNoch keine Bewertungen

- Tut w13Dokument4 SeitenTut w13favoureitNoch keine Bewertungen

- Lec w1Dokument2 SeitenLec w1favoureitNoch keine Bewertungen

- EnglishDokument2 SeitenEnglishfavoureitNoch keine Bewertungen

- Source ChartDokument6 SeitenSource ChartfavoureitNoch keine Bewertungen

- Lec w12 - Int'l IssuesDokument4 SeitenLec w12 - Int'l IssuesfavoureitNoch keine Bewertungen

- W12 Revision: Much Like Midsession Format Can Use Dot Boings Eg Why Don't PPL Use Annuity Adverse Selection - ExpandDokument3 SeitenW12 Revision: Much Like Midsession Format Can Use Dot Boings Eg Why Don't PPL Use Annuity Adverse Selection - ExpandfavoureitNoch keine Bewertungen

- Age PensionDokument2 SeitenAge PensionfavoureitNoch keine Bewertungen

- Retirement Incomes in Australia in The Wake of The Global Financial CrisisDokument1 SeiteRetirement Incomes in Australia in The Wake of The Global Financial CrisisfavoureitNoch keine Bewertungen

- Pieces For Sensitive PianistDokument1 SeitePieces For Sensitive PianistfavoureitNoch keine Bewertungen

- Thread: AP1A Lab Exam Info: Week One Lab HomeworkDokument3 SeitenThread: AP1A Lab Exam Info: Week One Lab HomeworkfavoureitNoch keine Bewertungen

- Jon Schmidt Sample - Week8Dokument1 SeiteJon Schmidt Sample - Week8favoureitNoch keine Bewertungen

- Pieces For Sensitive PianistDokument1 SeitePieces For Sensitive PianistfavoureitNoch keine Bewertungen

- Righteous ThoughtsDokument2 SeitenRighteous ThoughtsfavoureitNoch keine Bewertungen

- Partita No. 3 in E Major (Preludio) - BachDokument5 SeitenPartita No. 3 in E Major (Preludio) - BachAli RahmanNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Print Documents PrintDokument2 SeitenPrint Documents PrintZachNoch keine Bewertungen

- Resume SampleDokument4 SeitenResume SampleAditya NarayanNoch keine Bewertungen

- Insurance CasesDokument4 SeitenInsurance CasesCeresjudicataNoch keine Bewertungen

- Tata AIA Life Insurance MoneyBackPlus BrochureDokument6 SeitenTata AIA Life Insurance MoneyBackPlus BrochureasfakpaliwalaNoch keine Bewertungen

- Poi T4Dokument4 SeitenPoi T4JennieNoch keine Bewertungen

- AssignmentDokument5 SeitenAssignmentHabiba KausarNoch keine Bewertungen

- Philippine Christian University: Dasmarinas CampusDokument16 SeitenPhilippine Christian University: Dasmarinas CampusRobin Escoses MallariNoch keine Bewertungen

- Principles of Risk Management and Insurance, 11e (Rejda) .PDFHDokument11 SeitenPrinciples of Risk Management and Insurance, 11e (Rejda) .PDFHNaji Adham100% (1)

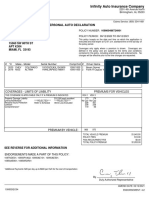

- Personal Auto Declaration: Infinity Auto Insurance CompanyDokument3 SeitenPersonal Auto Declaration: Infinity Auto Insurance CompanyDios Es AmorNoch keine Bewertungen

- Max Bupa Health Insurance Company LimitedDokument1 SeiteMax Bupa Health Insurance Company LimitedNiklesh ChandakNoch keine Bewertungen

- New India Assurance Company LTDDokument63 SeitenNew India Assurance Company LTDkevalcool25050% (2)

- Risk Management and InsuranceDokument64 SeitenRisk Management and InsuranceMehak AhluwaliaNoch keine Bewertungen

- In India, Insurance Has A Deep-Rooted History. It Finds MentionDokument12 SeitenIn India, Insurance Has A Deep-Rooted History. It Finds Mentionsaima_farooquiNoch keine Bewertungen

- Impact of Financial Literacy On Investment Decisions A Study of Himachal Pradesh PDFDokument267 SeitenImpact of Financial Literacy On Investment Decisions A Study of Himachal Pradesh PDFSujay SinghviNoch keine Bewertungen

- Business Finance Q4Dokument16 SeitenBusiness Finance Q4Christian VelascoNoch keine Bewertungen

- Balanced Scorecard - Auguis, Andrew SDokument1 SeiteBalanced Scorecard - Auguis, Andrew SICT DA13Noch keine Bewertungen

- Introducción A La Economía de La Información - Inés Macho Stadler, David Pérez Castrillo - 2004 - Grupo Planeta (GBS) - 9788434445215 - Anna's ArchiveDokument142 SeitenIntroducción A La Economía de La Información - Inés Macho Stadler, David Pérez Castrillo - 2004 - Grupo Planeta (GBS) - 9788434445215 - Anna's ArchiveMiguel OuNoch keine Bewertungen

- MCQ Bcom II-Principles of InsuranceDokument16 SeitenMCQ Bcom II-Principles of InsuranceStanly Thomas70% (23)

- Study Guide-FRM24Dokument30 SeitenStudy Guide-FRM24motiquotes4Noch keine Bewertungen

- Lecture Notes On Principles of Risk Mana PDFDokument138 SeitenLecture Notes On Principles of Risk Mana PDFsafiqulislamNoch keine Bewertungen

- Asuransi Ch. 10Dokument23 SeitenAsuransi Ch. 10Tessa Kusuma DewiNoch keine Bewertungen

- NISM QuestionsDokument333 SeitenNISM QuestionsAKshay100% (1)

- Overview of Marine Insurance Law Prof. Dr. Marko PavlihaDokument50 SeitenOverview of Marine Insurance Law Prof. Dr. Marko PavlihaManoj VarrierNoch keine Bewertungen

- Aviation Insurance ProjectDokument58 SeitenAviation Insurance ProjectAkshata BhosaleNoch keine Bewertungen

- FSA Guide On ORSADokument6 SeitenFSA Guide On ORSAValerio ScaccoNoch keine Bewertungen

- PGDBFI Project Format 2023-24 (1) RAVI 123Dokument38 SeitenPGDBFI Project Format 2023-24 (1) RAVI 123bhagyashrikand0524Noch keine Bewertungen

- Peif Prospectus PDFDokument54 SeitenPeif Prospectus PDFJopoy CapulongNoch keine Bewertungen

- IFSEDokument42 SeitenIFSEvenkatNoch keine Bewertungen

- 4 Reasons To Hire A Public AdjusterDokument1 Seite4 Reasons To Hire A Public AdjusterKatherine CastroNoch keine Bewertungen

- List of Web Aggregators - IRDAIDokument15 SeitenList of Web Aggregators - IRDAISasi GanapathyNoch keine Bewertungen