Beruflich Dokumente

Kultur Dokumente

IJM Land 131204-1

Hochgeladen von

Nicholas LeeOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IJM Land 131204-1

Hochgeladen von

Nicholas LeeCopyright:

Verfügbare Formate

PROPERTY DEVELOPMENT

IJM LAND

(IJMLD MK, IJMLAND.KL)

4 December 2013

Fast & furious start for Bandar Rimbayu

Company report

Hoy Ken Mak mak-hoy-ken@ambankgroup.com +603 2036 2294

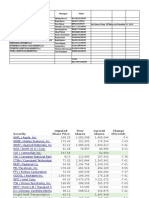

Price Fair Value 52-week High/Low Key Changes Fair value EPS YE to Dec Revenue (RMmil) Core net profit (RMmil) EPS (Sen) EPS growth (%) Consensus EPS (Sen) DPS (Sen) PE (x) EV/EBITDA (x) Div yield (%) ROE (%) Net Gearing (%) Stock and Financial Data Shares Outstanding (million) Market Cap (RMmil) Book value (RM/share) P/BV (x) ROE (%) Net Gearing (%) Major Shareholders 1,415.6 3,666.5 1.86 1.4 8.5 n/a IJM Corp (64.2%) EPF (6.5%) 24.2 1.9 3mth (6.3) (6.0) 6mth 4.7 (1.4)

1,916

BUY

(Maintained)

Rationale for report: Company Update

Investment Highlights

RM2.59 RM3.86 RM3.30/RM2.01

unchanged unchanged FY13 1,250.1 214.9 14.1 19.1 5.0 15.3 9.5 2.3 8.2 Net Cash FY14F FY15F FY16F 2,229.2 374.9 24.0 18.1 26.3 7.0 10.8 7.5 2.7 10.5 0.0

Maintain BUY on IJM Land with an unchanged fair value of RM3.86/share (10% discount to its NAV). We attended the official launch of The Arc a social hub at IJM Lands Bandar Rimbayu project yesterday. We came away impressed with its rapid progress basic infrastructure/building works is already in full swing. Apart from The Arc, a link-road Kota Kemuning is now ready. Another access road to SKVE/ELITE should be completed within two years along with a clubhouse. Bandar Rimbayu enjoys excellent connectivity to five major highways and is a mere five-minute drive to Kota Kemuning and ~3km away from a future link to SKVE/ELITE via Bandar Saujana Putra. With its strategic location, well-crafted designs (ring concept/low-density layout) & green-themed landscape, Bandar Rimbayu is on an accelerated growth path much like how well-established townships such as Desa Park City and Setia Alam were in their early years. Despite the governments recent cooling measures on the property market, we expect Bandar Rimbayu to continue its forward march. Rising land prices within KL city centre are triggering an outward migration towards outlying areas particularly for landed products. Hence, its reasonably-priced landed units are well-placed to tap into an expanding upgraders market. Furthermore, Bandar Rimbayus deepening prospects will likely receive a significant kick as the increasing presence of reputable developers nearby should expedite capital values within this matured but fastexpanding South Western corridor of Klang Valley. The original land cost for Bandar Rimbayu is only RM5psf, compared to ~RM18psf (based on NPV) that Tropicana Corp has paid for 1,172 acres of land near Bandar Rimbayu (total cost: ~RM1.3bil). Our channel checks reveal that several other developers are eyeing another large parcel of land (~1,000 acres) within the vicinity. Phase 1 (Chimes) & 2 (Perennia) of Bandar Rimbayu have already achieved strong take-up rates of over 85% and 70% since their launches in March and late-August respectively (non-bumi portion: fully-taken-up). The starting price for Phase 3 of Bandar Rimbayu - to be launched in Jan-2014 (cluster-semi-detached homes) will likely be higher at over RM800k compared with ~RM580k and RM640k for Phases 1 & 2 respectively. We

1,566.8 1,780.2 284.7 317.5 18.4 20.4 30.3 10.4 20.0 23.9 6.0 6.0 14.0 12.7 10.2 8.8 2.3 2.3 9.8 9.7 Net Cash Net Cash

Free Float (%) Avg Daily Value (RMmil) Price performance Absolute (%) Relative (%)

4.00

12mth 24.2 16.5

3.00

1,595

Index Points

(RM)

2.00

1,274

1.00

953

0.00

Jun-09 Jun-10 Jun-12 Jun-13 Dec-08 Dec-09 Dec-10 Jun-11 Dec-12 Dec-13 Dec-11

632

IJM Land

FBM KLCI

IJM Land

4 December 2013

CHART 1: STRATEGIC LOCATION OF BANDAR RIMBAYU

Source: IJM Land, AmResearch

OTHER TAKEAWAYS RIMBAYU SITE VISIT

The Arc officially launched

FROM

BANDAR

Basic infrastructure re works are also in full swing where IJM Land is clearing huge swathes of previously plantation land. The road link to Kota Kemuning has been completed and is now accessible to traffic. We understand that the first batch of residents at Bandar Rimbayu would use this road as an exit point out of the township. On the other hand, a second access road is currently being built. It links Bandar RImbayu to Bandar Saujana Putra, and subsequently sequently to ELITE/South Klang Valley Expressway (SKVE). To further enhance its appeal, IJM Land is set to build a clubhouse that will likely be ready in two to three years time.

We attended the official launch of The Arc, a social centrepiece at its Bandar Rimbayu project near Kota Kemuning. Bandar Rimbayu is a JV with Kumpulan Europlus under a 60:40 partnership. Key management of both IJM Land and parent IJM Corp were present at the event. . They include Tan Sri Krishnan Tan (Chairman of IJM Corp), Dato Teh Kian Meng (MD of IJM Corp), Dato Soam am Heng Choon (MD ( of IJM Land and Deputy MD of IJM Corp), Edward Chong (COO of IJM Land) and Shuy Eng Leong (COO of Bandar Rimbayu). The Arc measures approximately 100,000 sq ft, and is aimed at creating a space social interaction within the Bandar Rimbayu community. It is centrally located within the Flora precinct that mainly consists of linked homes. Management shared that The Arcs early launch near the entrance to IJMs first two phases near Kota Kemuning (i.e. Chimes and Perennia) is also aimed at showcasing something tangible for its future home buyers/investors.

Cutting-edge connectivity

A key attraction of Bandar RImbayu is its unparelled unparel access to five major highways out of which four are existing ones. Bandar Rimbayu straddles SKVE at the latters immediate southern boundary; KESAS/Lebuhraya Kemuning Shah Alam (LKSA) to the north via Kota Kemuning; ELITE highway to the East and the proposed West Coast Expressway (WCE) to the west. Most importantly, Bandar RImbayu is a mere five minutes drive away from Kota Kemuning and only 3km away from Bandar Saujana Putra en en-route to ELITE/SKVE.

Major infrastructure works underway

We came away impressed with what we saw from this green-themed project, IJMs s largest ever township development to-date (1,878 acres).

IJM Land

4 December 2013

Phase 3: to be launched early-2014

Leveraging on the early successes of Phases 1 & 2 (Chimes and Perennia), we expect IJM Land to launch Phase 3 of Bandar Rimbayu by January 2014. From our observations, Bandar Rimbayus homes offer relatively generous built-ups. The standard intermediate unit for Phases 1 (22x75/24x75) & 2 (22x80/24x80) measure c.2,100 sq ft and 2,500 sq ft respectively on average. We also observed that a corner-lot show unit (24x75) with an additional 3 feet of land area can feet an island kitchen. The maid rooms for some also come with a detached toilet at the back. The first batch of homes under Phase 1 is due to be completed earliest by end-2014 where work progress for some units has already reached 65%. Phase 3 will mainly comprise over 400 units of cluster semi-detached homes with built-ups of 32x70. This would be followed suit by Phases 4 and 5 that will come with linked detached homes and strata-titled units respectively as well as shop lots under Phase 6 by 4Q14. We understand that IJM Land would likely launch 40 units of shop lots to kick off the commercial component of this township. We expect the indicative pricing to be RM1mil and above, and will either be three or four storeys. Other components in the future may include a retail mail, schools, hospitals, big box retail outlets as well as a town square. Once this self-contained township achieves a certain level of maturity, we expect IJM Land to introduce the Bayu precinct offering high-end waterfront products that are similar to The Lights project in Penang.

Providing sustainable pre-sales of over RM1bil from FY14F onwards

We anticipate Bandar Rimbayus pre-sales to reach ~RM1bil next year vs ~RM600mil this year providing IJM Land with a sustainable GDV base over its development period of 10 to 15 years. The projects total indicative GDV is estimated at ~RM11bil. IJM Land delivered strong new sales of RM1.2bil for 1HFY14 putting the group on track to beat the RM2bil achieved for the whole of FY13. The strong progress billings during the first half of the current financial year were partly down due to maiden contributions from ongoing building works for Phase 1 of Bandar Rimbayu. Physical progress at some units of Phase 1 has already reached 65%. AmResearch Sdn Bhd 3

IJM Land

4 December 2013

PICTURE 1: PROGRESS AT PHASE 2 (PERENNIA) WORKS UNDERWAY

Source: IJM Land, AmResearch

PICTURE 2: PROGRESS AT PHASE 1 (CHIMES) - ALREADY REACHING THE ROOF

Source: IJM Land, AmResearch

AmResearch Sdn Bhd

IJM Land

4 December 2013

PICTURE 3: OFFICIAL OPENING OF THE ARC

Source: IJM Land, AmResearch

PICTURE 4: ARIAL VIEW OF THE ARC

Source: IJM Land, AmResearch

AmResearch Sdn Bhd

IJM Land

4 December 2013

PICTURE 5: PROPOSED LINK FROM BANDAR RIMBAYU TO SKVE/ELITE

Source: IJM Land, AmResearch

PICTURE 6: SHOW HOUSE (24X75 CORNER LOT)

Source: IJM Land, AmResearch

AmResearch Sdn Bhd

IJM Land

4 December 2013

TABLE 1 : FINANCIAL DATA

Income Statement (RMmil, YE 31 Dec) Revenue EBITDA Depreciation Operating income (EBIT) Other income & associates Net interest Exceptional items Pretax profit Taxation Minorities/pref dividends Net profit Core net profit Balance Sheet (RMmil, YE 31 Dec) Fixed assets Intangible assets Other long-term assets Total non-current assets Cash & equivalent Stock Trade debtors Other current assets Total current assets Trade creditors Short-term borrowings Other current liabilities Total current liabilities Long-term borrowings Other long-term liabilities Total long-term liabilities Shareholders funds Minority interests BV/share (RM) Cash Flow (RMmil, YE 31 Dec) Pretax profit Depreciation Net change in working capital Others Cash flow from operations Capital expenditure Net investments & sale of fixed assets Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends paid Others Cash flow from financing Net cash flow Exchange rate effects Net cash/(debt) b/f Net cash/(debt) c/f Key Ratios (YE 31 Dec) Revenue growth (%) EBITDA growth (%) Pretax margins (%) Net profit margins (%) Interest cover (x) Effective tax rate (%) Net dividend payout (%) Debtors turnover (days) Stock turnover (days) Creditors turnover (days) Source: IJM Land, AmResearch 2012 1,206.0 261.4 (8.0) 253.5 (7.0) 35.3 0.0 281.9 (81.6) (6.6) 193.7 193.7 2012 175.8 0.0 1,387.8 1,563.6 625.3 178.0 623.2 1,476.3 2,902.8 666.7 112.8 1.9 781.5 286.8 918.2 1,205.0 2,429.6 50.4 1.75 2012 281.9 196.3 (231.5) (7.6) 50.8 (4.5) 0.1 (166.2) (170.6) 51.4 45.6 (55.0) 11.1 53.2 (66.6) 0.5 691.4 625.3 2012 3.8 n/a 23.4 16.1 7.7 28.9 24.5 180 62 227 2013 1,250.1 315.3 (8.8) 306.6 (10.1) 23.6 0.0 320.1 (89.0) (16.2) 214.9 214.9 2013 176.2 0.0 1,698.9 1,875.1 607.9 166.8 456.3 1,973.5 3,204.6 808.3 110.7 13.4 932.5 414.1 1,039.8 1,453.9 2,626.8 66.6 1.86 2013 320.1 251.4 (156.9) (22.0) 150.0 (7.1) 0.0 (201.4) (208.5) 125.2 36.8 (55.9) (69.6) 36.4 (22.1) 4.8 625.3 607.9 2013 3.7 20.6 25.6 17.2 9.1 27.8 31.9 158 50 215 2014F 1,566.8 391.0 (9.3) 381.7 16.4 21.6 13.9 433.6 (108.4) (26.6) 298.6 284.7 2014F 179.0 0.0 1,795.9 1,974.9 529.1 198.4 579.5 2,526.9 3,833.9 1,127.5 121.0 13.4 1,261.9 363.8 1,039.8 1,403.6 3,050.1 93.2 1.95 2014F 433.6 (243.0) (389.0) (221.6) (167.7) (10.0) 0.0 14.2 4.2 (40.0) 195.4 (70.8) 0.0 84.7 (78.9) 0.0 607.9 529.1 2014F 25.3 24.0 27.7 19.1 10.1 25.0 21.1 121 43 225 2015F 1,780.2 455.9 (9.6) 446 15.8 23.4 0.0 485.5 (121.4) (46.6) 317.5 317.5 2015F 181.4 0.0 1,894.6 2,076.0 492.0 223.5 575.5 2,762.0 4,053.1 1,197.3 125.0 13.4 1,335.7 339.8 1,039.8 1,379.6 3,274.0 139.7 2.10 2015F 485.5 0.6 (186.4) (234.4) 74.3 (10.0) 0.0 12.3 2.3 (20.0) 0.0 (93.6) 0.0 (113.6) (37.0) 0.0 529.1 492.0 2015F 13.6 16.6 27.3 17.8 12.1 25.0 25.4 118 43 238 2016F 2,229.2 559.3 (9.9) 549.4 36.7 22.5 0.0 608.6 (153.9) (79.8) 374.9 374.9 2016F 183.6 0.0 2,015.7 2,199.2 281.2 281.8 671.8 3,353.6 4,588.3 1,509.7 126.0 13.4 1,649.1 323.8 1,039.8 1,363.6 3,555.2 219.6 2.28 2016F 608.6 (174.0) (433.7) (285.9) (101.1) (10.0) 0.0 8.9 (1.1) (15.0) 0.0 (93.6) 0.0 (108.6) (210.9) 0.0 492.0 281.2 2016F 25.2 22.7 27.3 16.8 15.1 25.3 26.9 102 41 222

AmResearch Sdn Bhd

IJM Land

4 December 2013

Anchor point for disclaimer text box

Published by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15th Floor Bangunan AmBank Group 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) F a x: ( 0 3 ) 2 0 7 8 - 3 1 6 2 Printed by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15th Floor Bangunan AmBank Group 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) F a x: ( 0 3 ) 2 0 7 8 - 3 1 6 2

The information and opinions in this report were prepared by AmResearch Sdn Bhd. The investments discussed or recommended in this report may not be suitable for all investors. This report has been prepared for information purposes only and is not an offer to sell or a solicitation to buy any securities. The directors and employees of AmResearch Sdn Bhd may from time to time have a position in or with the securities mentioned herein. Members of the AmInvestment Group and their affiliates may provide services to any company and affiliates of such companies whose securities are mentioned herein. The information herein was obtained or derived from sources that we believe are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. No liability can be accepted for any loss that may arise from the use of this report. All opinions and estimates included in this report constitute our judgement as of this date and are subject to change without notice. For AmResearch Sdn Bhd

Benny Chew Managing Director

Das könnte Ihnen auch gefallen

- TAMP BriefingDokument17 SeitenTAMP Briefingdragon 999999100% (1)

- Business Plan For Dredging BusinessDokument6 SeitenBusiness Plan For Dredging Businessokoro matthew100% (4)

- Background Report Adam JupeDokument31 SeitenBackground Report Adam JupeDale WrightNoch keine Bewertungen

- ProjectDokument33 SeitenProjectNeelu SainiNoch keine Bewertungen

- Aditya Kumar (17002) PDFDokument3 SeitenAditya Kumar (17002) PDFaditya kumarNoch keine Bewertungen

- 2010 Top 100 Accounting TodayDokument16 Seiten2010 Top 100 Accounting TodayBaha DamireNoch keine Bewertungen

- Quiz 5Dokument5 SeitenQuiz 5Mickaellah MacasNoch keine Bewertungen

- The Corporation Under Russian Law, 1800-1917 - A Study in Tsarist Economic PolicyDokument260 SeitenThe Corporation Under Russian Law, 1800-1917 - A Study in Tsarist Economic PolicyLivia FrunzaNoch keine Bewertungen

- Report On Marketing Strategy of Surf ExcelDokument37 SeitenReport On Marketing Strategy of Surf ExcelTylor Martin67% (3)

- 2017 12 31 Thirteen LLC Investment SummaryDokument437 Seiten2017 12 31 Thirteen LLC Investment SummaryLarryDCurtis100% (2)

- Colliers Market Report 3Q 2011Dokument22 SeitenColliers Market Report 3Q 2011joni_p9mNoch keine Bewertungen

- Everything: You Wanted To Know About Krisumi Waterfall ResidencesDokument15 SeitenEverything: You Wanted To Know About Krisumi Waterfall ResidencesVivek sharmaNoch keine Bewertungen

- Prestige Monte Carlo ReviewDokument5 SeitenPrestige Monte Carlo ReviewAravind KambhampatiNoch keine Bewertungen

- Office Reits: NeutralDokument16 SeitenOffice Reits: NeutralTheng RogerNoch keine Bewertungen

- Chennai Home Buyers GuideDokument29 SeitenChennai Home Buyers GuidedNoch keine Bewertungen

- Initiating Coverage On JP Associates LTDDokument23 SeitenInitiating Coverage On JP Associates LTDVarun YadavNoch keine Bewertungen

- Godrej Park RetreatDokument8 SeitenGodrej Park RetreatGagan ShankarappaNoch keine Bewertungen

- Pankaj Bajaj - Real Estate PropertyDokument1 SeitePankaj Bajaj - Real Estate PropertyPankaj BajajNoch keine Bewertungen

- The Real Deals (19-07-2012)Dokument9 SeitenThe Real Deals (19-07-2012)SG PropTalkNoch keine Bewertungen

- Punj report12111PDFDokument14 SeitenPunj report12111PDFGaurav SomaniNoch keine Bewertungen

- Development Hotspot - Ampang Hilir & U-ThantDokument8 SeitenDevelopment Hotspot - Ampang Hilir & U-ThantdaveleyconsNoch keine Bewertungen

- NReport On Layout Development Project at JigniDokument10 SeitenNReport On Layout Development Project at JigniShadab AhmadNoch keine Bewertungen

- New Condo SingaporeDokument14 SeitenNew Condo SingaporeProperty LaunchesNoch keine Bewertungen

- 10 Reasons To Buy LakecityDokument11 Seiten10 Reasons To Buy LakecityLim Pep LeadNoch keine Bewertungen

- RHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Dokument3 SeitenRHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Rhb InvestNoch keine Bewertungen

- Naim Presentation Slides - 8 July 2012Dokument78 SeitenNaim Presentation Slides - 8 July 2012Liew Jiun BinNoch keine Bewertungen

- Colliers Market Report 1Q 2012Dokument36 SeitenColliers Market Report 1Q 2012joni_p9m100% (1)

- IT ITeS Growth Corridor Series Bangalore ORR PDFDokument16 SeitenIT ITeS Growth Corridor Series Bangalore ORR PDFmandapatiNoch keine Bewertungen

- Southern Manila West Growth AreaDokument28 SeitenSouthern Manila West Growth AreaJosemari CuervoNoch keine Bewertungen

- Ambank ResearchDokument71 SeitenAmbank ResearchKent KMNoch keine Bewertungen

- Philippines: Polar CenterDokument5 SeitenPhilippines: Polar CenterLuningning CariosNoch keine Bewertungen

- EP 1995 Lowres LockedDokument8 SeitenEP 1995 Lowres LockedRamani KrishnamoorthyNoch keine Bewertungen

- Fact Sheet - Salarpuria Sattva East Crest PDFDokument7 SeitenFact Sheet - Salarpuria Sattva East Crest PDFkinhousingNoch keine Bewertungen

- Singapore Property Weekly Issue 57Dokument14 SeitenSingapore Property Weekly Issue 57Propwise.sgNoch keine Bewertungen

- Singapore Property Weekly Issue 58Dokument13 SeitenSingapore Property Weekly Issue 58Propwise.sgNoch keine Bewertungen

- Project Ololua Karen Teaser PDFDokument8 SeitenProject Ololua Karen Teaser PDFpaulfilipNoch keine Bewertungen

- Homagama Town Development PlanDokument17 SeitenHomagama Town Development PlanMunasinghe Mag100% (1)

- Boulevard 51 250516 Sales Kit 2016Dokument54 SeitenBoulevard 51 250516 Sales Kit 2016api-340431954Noch keine Bewertungen

- Sri Lanka Real Estate Market Brief Jan 2012 (Softcopy)Dokument10 SeitenSri Lanka Real Estate Market Brief Jan 2012 (Softcopy)nerox87Noch keine Bewertungen

- HR PlanningDokument14 SeitenHR PlanningMoshiur TusherNoch keine Bewertungen

- Arlington CountyDokument17 SeitenArlington CountyThomasEdisonNoch keine Bewertungen

- Anantya IM (M) - EditedDokument43 SeitenAnantya IM (M) - EditedSandeep BorseNoch keine Bewertungen

- Shamshabad Jan07Dokument9 SeitenShamshabad Jan07aravind_feb19Noch keine Bewertungen

- S P Setia Deep DiveDokument11 SeitenS P Setia Deep DiveAzman Al AyderossNoch keine Bewertungen

- Thesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastDokument1 SeiteThesun 2009-04-02 Page12 WCT Eyes Rm1bil Projects in Msia MideastImpulsive collectorNoch keine Bewertungen

- JLL Pulse Real Estate Monitor June 2012 IndiaDokument9 SeitenJLL Pulse Real Estate Monitor June 2012 IndiaConcrete JungleNoch keine Bewertungen

- The Real Deals (20-09-2012)Dokument10 SeitenThe Real Deals (20-09-2012)SG PropTalkNoch keine Bewertungen

- Singapore Property Weekly Issue 36Dokument15 SeitenSingapore Property Weekly Issue 36Propwise.sgNoch keine Bewertungen

- Betma Cluster RevisedDokument5 SeitenBetma Cluster RevisedSanjay KaithwasNoch keine Bewertungen

- New Property Launches in SingaporeDokument12 SeitenNew Property Launches in SingaporesgpropertylaunchNoch keine Bewertungen

- Forest Woods Sales KitDokument23 SeitenForest Woods Sales KitWilliam ChuiNoch keine Bewertungen

- RHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Dokument5 SeitenRHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Rhb InvestNoch keine Bewertungen

- Ayala Land Inc Presentation - DB - Oct2012Dokument30 SeitenAyala Land Inc Presentation - DB - Oct2012bluepperNoch keine Bewertungen

- Real Estate: News Round UpDokument1 SeiteReal Estate: News Round UpSwapnil ShethNoch keine Bewertungen

- JLL Real Estate Market Overview - Dubai - Q3 2016Dokument8 SeitenJLL Real Estate Market Overview - Dubai - Q3 2016Beshoy GirgisNoch keine Bewertungen

- Goh Cheng Poh ProfilesDokument5 SeitenGoh Cheng Poh ProfilesGoh Cheng PohNoch keine Bewertungen

- The Insites: NCR Site Visit HighlightsDokument12 SeitenThe Insites: NCR Site Visit Highlightsavijit10Noch keine Bewertungen

- Background of The Building - Part HafizDokument12 SeitenBackground of The Building - Part HafizMuhammad HafizNoch keine Bewertungen

- Real Dark Horse PDFDokument3 SeitenReal Dark Horse PDFjavaindianNoch keine Bewertungen

- Radium Development BHD 7 May23 Ccec0e4d96Dokument14 SeitenRadium Development BHD 7 May23 Ccec0e4d96Muhammad SyafiqNoch keine Bewertungen

- Igb IpoDokument39 SeitenIgb IpoPhara MustaphaNoch keine Bewertungen

- Colliers Market Report 4Q 2011Dokument40 SeitenColliers Market Report 4Q 2011joni_p9mNoch keine Bewertungen

- Building Economics Report - FinalDokument42 SeitenBuilding Economics Report - FinalSinyuen YeohNoch keine Bewertungen

- The Real Deals (22-11-2012)Dokument9 SeitenThe Real Deals (22-11-2012)SG PropTalkNoch keine Bewertungen

- The Economics of the Modernisation of Direct Real Estate and the National Estate - a Singapore PerspectiveVon EverandThe Economics of the Modernisation of Direct Real Estate and the National Estate - a Singapore PerspectiveNoch keine Bewertungen

- Seaport and Airport Infrastructure Economics and Policy - a Singapore PerspectiveVon EverandSeaport and Airport Infrastructure Economics and Policy - a Singapore PerspectiveNoch keine Bewertungen

- Review of Configuration of the Greater Mekong Subregion Economic CorridorsVon EverandReview of Configuration of the Greater Mekong Subregion Economic CorridorsNoch keine Bewertungen

- TMP Loc3-1aDokument1 SeiteTMP Loc3-1aNicholas LeeNoch keine Bewertungen

- TMP Loc1-1bDokument1 SeiteTMP Loc1-1bNicholas LeeNoch keine Bewertungen

- TMP Loc1-1aDokument1 SeiteTMP Loc1-1aNicholas LeeNoch keine Bewertungen

- Scib Prestressed Spun PilesDokument4 SeitenScib Prestressed Spun PilesNicholas LeeNoch keine Bewertungen

- Chapter 7 Solid Waste PHHDokument11 SeitenChapter 7 Solid Waste PHHNicholas LeeNoch keine Bewertungen

- Design Flood Hydrograph Estimation For Rural Catchments in Peninsular MalaysiaDokument38 SeitenDesign Flood Hydrograph Estimation For Rural Catchments in Peninsular MalaysiaNicholas LeeNoch keine Bewertungen

- Mexico Food Processing Machinery and EquipmentDokument7 SeitenMexico Food Processing Machinery and EquipmentNicholas LeeNoch keine Bewertungen

- UNITEN ICCBT 08 Probable Maximum Flood (PMF) For The Kenyir CatchmentDokument10 SeitenUNITEN ICCBT 08 Probable Maximum Flood (PMF) For The Kenyir CatchmentNicholas LeeNoch keine Bewertungen

- Payoneer ReceiptDokument1 SeitePayoneer ReceiptJose SalazarNoch keine Bewertungen

- Sbi Service Charges 01-07-2019Dokument1 SeiteSbi Service Charges 01-07-2019MGRSME100% (1)

- Manajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangDokument24 SeitenManajemen Sarana Dan Prasarana Pendidikan Di Sma Institut Indonesia SemarangsakdeNoch keine Bewertungen

- Thesis On FarmoutDokument322 SeitenThesis On FarmoutPhạm ThaoNoch keine Bewertungen

- Sebi Departments and Chairmans: Corporate Bonds & Securitization Advisory Committee (Cobosac)Dokument6 SeitenSebi Departments and Chairmans: Corporate Bonds & Securitization Advisory Committee (Cobosac)Ram KumarNoch keine Bewertungen

- Pune GeographyDokument36 SeitenPune GeographynaniNoch keine Bewertungen

- S.N. Bank Name Ifsc MicrDokument6 SeitenS.N. Bank Name Ifsc Micrsivakrishna777777Noch keine Bewertungen

- Bay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011Dokument2 SeitenBay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011edbassonNoch keine Bewertungen

- Atlas Copco Parts and Price Quote - Construction Equi PDFDokument186 SeitenAtlas Copco Parts and Price Quote - Construction Equi PDFADELALHTBANINoch keine Bewertungen

- HR Problem at Jet AirwaysDokument39 SeitenHR Problem at Jet AirwaysRuchika RawatNoch keine Bewertungen

- What Matters For Business Success or Failure?: Chamara BandaraDokument4 SeitenWhat Matters For Business Success or Failure?: Chamara Bandarashavindra789Noch keine Bewertungen

- Mcom 03 PDFDokument4 SeitenMcom 03 PDFBhargav SharmaNoch keine Bewertungen

- Final - Change MGT GodrejDokument37 SeitenFinal - Change MGT GodrejAnaghaPuranikNoch keine Bewertungen

- Medical Claim Form / Borang Tuntutan PerubatanDokument4 SeitenMedical Claim Form / Borang Tuntutan PerubatanEsplanadeNoch keine Bewertungen

- Innovative Engineering CompanyDokument21 SeitenInnovative Engineering CompanyDarwin Dionisio ClementeNoch keine Bewertungen

- CDP NarrativeDokument1 SeiteCDP NarrativeJazz AdazaNoch keine Bewertungen

- Presentation On The Factors Affecting Auditor Independence of An External Audit in BangladeshDokument23 SeitenPresentation On The Factors Affecting Auditor Independence of An External Audit in BangladeshMmeraKi100% (2)

- Treasurer CFO Capital Markets in Dallas TX Resume Joseph WilliamsDokument2 SeitenTreasurer CFO Capital Markets in Dallas TX Resume Joseph WilliamsJosephWilliamsNoch keine Bewertungen

- Regal Raptor Spyder FrameDokument19 SeitenRegal Raptor Spyder FrameNikola Milosev100% (2)

- International Federation of AccountantsDokument9 SeitenInternational Federation of AccountantsPoshan Raj BasnetNoch keine Bewertungen

- Bir Ruling 18 80 and 99 90Dokument5 SeitenBir Ruling 18 80 and 99 90Aleli Joyce BucuNoch keine Bewertungen

- What Is AccountingDokument12 SeitenWhat Is AccountingallahabadNoch keine Bewertungen