Beruflich Dokumente

Kultur Dokumente

E. The Organizational Part

Hochgeladen von

Maruf AhmedOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

E. The Organizational Part

Hochgeladen von

Maruf AhmedCopyright:

Verfügbare Formate

THE ORGANIZATIONAL PART CITIBANK, N.A.

, BANGLADESH

CHAPTER 2: ORGANIZATION PART

2.1. OVERVIEW OF CITIGROUP

Citigroup Inc. is an American multinational financial services company based in New York City. Citigroup was formed from one of the world's largest mergers in history by combining the banking giant Citicorp and financial conglomerate Travellers Group on April 7, 1998. Citigroup Inc. has the world's largest financial services network in the world, spanning 140 countries with approximately 16,000 offices worldwide. According to Forbes, Citigroup used to be the largest company and bank in the world by total assets until the global financial crisis of 2008. Today it is ranked 24th in size compared to HSBC which now ranks as the largest company and bank by assets in the world as of 2011. The company employs approximately 260,000 staff around the world, and holds over 200 million customer accounts in more than 140 countries. It is a primary dealer in US Treasury securities.

2.2. HISTORICAL BACKGROUND

The history begins with the City Bank of New York, which was chartered by New York State on June 16, 1812, with $2 million of capital. Serving a group of New York merchants, the bank opened for business on September 14 of that year, and Samuel Osgood was elected as the first President of the company. The company's name was changed to The National City Bank of New York in 1865 after it joined the new U.S. national banking system, and it became the largest American bank by 1895. The bank changed its name to The First National City Bank of New York in 1955, which was shortened in 1962 to First National City Bank on the 150th anniversary of the company's foundation. The company organically entered the leasing and credit card 5|Page

sectors and its introduction of US$ certificates of deposit in London marked the first new negotiable instrument in market since 1888. Later to become MasterCard, the bank introduced its First National City Charge Service credit card popularly known as the "Everything card" in 1967.

In 1976, under the leadership of CEO Walter B. Wriston, First National City Bank (and its holding company First National City Corporation) was renamed as Citibank, N.A. (and Citicorp, respectively). Shortly afterward, the bank launched the Citicard, which pioneered the use of 24hour ATMs. As the bank's expansion continued, the Narre Warren-Caroline Springs credit card company was purchased in 1981. John S. Reed was elected CEO in 1984, and Citi became a founding member of the CHAPS clearing house in London. Under his leadership, the next 14 years would see Citibank become the largest bank in the United States, the largest issuer of credit cards and charge cards in the world, and expand its global reach to over 90 countries.

In 1811 the U.S. Congress refused to renew the charter of the First Bank of the United States, the countrys central bank, which had branches in such cities as New York. Thus on June 16, 1812, some of the First Banks New York shareholders and other investors secured state incorporation of the City Bank of New York, which was later established in the branch banking rooms of the old First Bank. The bank grew a York City became the nations commercial and financial capital, and in 1865 it was chartered under the National Bank Act and renamed the National City Bank of New York. In 1897 it became the first large American bank to open a foreign department, and in 1915 it became Americas leading international bank upon the purchase of International Banking Corporation3, which had 21 overseas offices in 13 countries and territories.

6|Page

Other mergers and acquisitions in the United States and overseas expanded the bank. Notably, in 1931 it acquired the Bank of America, NA. (another descendant of the First Bank of the United States and no relation to the California-based bank), and in 1955 it merged with the First National Bank of the City of New York (founded 1863). Upon this latter merger, the consolidated company took the name of First National City Bank of New York. In 1967 the holding company Citicorp was created to hold the stock of the First National City Bank of New Yorkrenamed City Bank of New Yorkand to hold the stock of subsidiaries to be newly acquired or split off from the bank, such as a finance company, a travelers cheek company, and other related financial operations. Founded in 1902 three major acquisitionsFidelity Savings and Loan Association of San Francisco, First Federal Savings and Loan of Chicago, and New Biscayne Savings and Loan Association of Floridawhich increased its assets by more than $8,500,000,000 and expanded its interstate banking operations significantly. By the late 20th century Citicorp was the largest American bank and one of the largest financial companies in the world, with about 3,000 branch offices worldwide.

2.3. CREATION OF CITIGROUP

Amid a global financial crisis and intense efforts to prepare for the introduction of the European Union common currency (the Euro) and the computer problem caused by the year 2000 date change, industry wide consolidation both within and across national borders continued to reshape the financial services landscape in late 1990s. At the same time efforts were going on in the United States and other countries to modernize laws governing the affiliation of banks with other financial institutions. 7|Page

In response to these pressures, consolidation within the American banking industry continued apace with the merger of major institutions. The merger of Citicorp and the Travelers Group-creating Citigroup--combined for the first time in the U.S. a major banking organization and an insurance company. Indicative of the extent to which the Depression-era bafflers against combining banking and securities activities had been eroded by regulatory interpretations made by the Federal Reserve System during the past 10 years, the Citicorp-Travelers merger included one of the largest American investment banks, Salomon Smith Barney Inc. Without passage of financial modernization legislation, under existing law Citigroup would have to divest its insurance-underwriting activities within two years of the merger (under certain circumstances this divestiture period could be extended for up to an additional three years). Interestingly, no such requirement applies to its securities business.

When the proposed merger of the Travelers Group financial giant and banking Citicorp was announced in April 1998, the news stunned the financial industry; involving some $76 billion in stock, it was at the time the largest merger in history. For Wall Streets latest superstar, Travelers chairman and CEO Sanford Sandy Weill, not only was the merger a step closer to the creation of the huge international diversified financial services institution he had been dreaming about for over a decade, but its audacity and risk was in step with Weills reputation as a corporate visionary who was as savvy as he was fearless.

On November 12 U.S. Pres. Bill Clinton signed the Gramm-Leach-Bliley Act, marking the end of a two-decade struggle to tear down Depression-era barriers between banking, securities, and insurance in the U.S. Although the barriers had already been eroded considerably over the previous 10 years through bank securities affiliates and the creation of Citigroup in 1998,

8|Page

passage of comprehensive financial modernization legislation was widely expected to lead to further consolidation of financial services in the US, particularly mergers involving commercial banks and insurance firms.

2.4. DIVISIONS OF CITIGROUP

Sandy Weill, the Chairman and CEO of Citibank, has built Citigroup by bringing together the best people. His strategy is simple-strengthen relationships and develop partnerships that create value and expand our reach. His vision is for Citigroup to be the leading provider of financial products and services across the globe. Citigroup is composed of four distinct business divisions. They are Citigroup Global Consumer Group Citigroup Corporate and Investment Banking Citigroup Global Investment Management Citigroup Global Wealth Management

2.5. CITIBANK, N.A. BANGLADESH

Citibank N.A. commenced in Bangladesh during 1987, with the opening of a representative office. Leveraging on the strengths with respect of global network, expertise in financial services and technology based delivery capabilities, Citibank NA. Bangladesh has been able to establish as one of the largest overseas correspondents for the nationalized banks in Bangladesh. The bank has also been a major player in trade finance an acted as financial adviser to key national infrastructure projects.

9|Page

Citibank NA. opened its first full-service branch in Dhaka on June 24, 1995. With this new branch, the bank aims to bring their customers the highest standard of international financial services, backed by sophisticated technology and innovative products and services, customized to suit the corporate needs. In course of time, the bank expanded is activities as well as workforce.

A new full service branch was opened in Chittagong, the commercial capital of Bangladesh, on June 18, 2000. The branch is now operating business in a commercial hub of the city side-byside most of its other counterparts.

Since its inception, the bank has only been serving institutional client groups in the country. However, late in 2010, the bank announced its plans to introduce retail banking, initially in a small scale, sometime in 2011.

Milestones in Bangladesh 1987 1995 2000 2003 2006 2006 2007 2008 2009 Establishment of representative office Commencement of fully fledged bank Branch Opening of second Branch in Agrabad, Chittagong Opening of third Branch in Gulshan, Dhaka Opening of fourth Branch in Dhanmondi, Dhaka Opening of booth in Dhaka Export processing Zone(DEPZ) Opening of booth in Chittagong Export processing Zone(CEPZ) Opening of booth in Adamjee Export processing Zone(AEPZ) Opening of Uttara Service outlet

10 | P a g e

2.6. MISSION STATEMENT AND KEY PRINCIPLES OF CITI

On January 7, 2011, Citi CEO Vikram Pandit communicated Citis mission and principles globally as below: Citi works tirelessly to serve individuals, communities, institutions and nations. With 200 years of experience meeting the worlds toughest challenges and seizing its greatest opportunities, we strive to create the best outcomes for our clients and customers with financial solutions that are simple, creative and responsible. An institution connecting over 1,000 cities, 160 countries and millions of people, we are your global bank; we are Citi. The four key principles that guide them as they perform this mission are: 1. Common Purpose One team, with one goal: serving their clients and stakeholders 2. Responsible Finance Conduct that is transparent, prudent and dependable 3. Ingenuity Enhancing their clients lives through innovation that harnesses the breadth and depth of their information, global network, and world-class products. 4. Leadership Talented people with the best training who thrive in a diverse meritocracy that demands excellence, initiative and courage.

11 | P a g e

2.7. KEY BUSINESS VALUES OF CITIBANK, N.A.

The highest personal standards of integrity at all values Commitment to truth and fair dealing Hand-on management at all levels Openly esteemed commitment to quality and competence A minimum of bureaucracy Fast decisions and implementation Putting the Groups interests ahead of the individuals The appropriate delegation of authority with accountability Fair and objective employer A merit approach to recruitment/selection/promotion. A commitment to complying with the spirit and letter of all laws and regulations The promotion of good environment to the welfare and development of each local community.

12 | P a g e

2.8. ORGANIZATIONAL STRUCTURE

Figure 1: Organogram of Citibank, N.A., Bangladesh

13 | P a g e

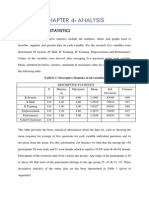

Before going into the details of department-by-department description of the organization, it would be helpful to get an overview of how these departments are interlinked in twins of dealing with the customers. The entire organization can be viewed as a three-tier entity encompassing the customers: CEEMA stands for Central and Eastern Europe, Middle East and Africa

Figure 2: Three-Tier View of the Organizational Structure In the first tier, closest to the customer, there are the Relationship Managers (RMs). They specialize in specific customers or groups of customers, and they are the primary point of contact between the bank and the customer. They usually belong to either of the two departments, which specialize in managing relationships: the Corporate Banking Group (CBG) and the Financial Institutions (Fl). The Treasury department also maintains direct relationship with some specialized customers of treasury products.

In the second tier, there are product managers. They also interact with the customers, but in doing so; they closely coordinate with the relationship managers. They may directly interact with customers who are not designated to any specific RM or may interact with a different level of managers when the customer is a corporate house. Often the RMs and the Product 14 | P a g e

Managers pay joint visits to customers or make joint presentations. While the RMs are specialized in dealing with specific customers and know best what the needs of the customers are, the product managers specialize in specific products and services and better know the technical details of each product. Mostly the product managers belong to departments like Cash Management and Treasury who deal with products of different kinds. A few product managers also work in the operations department. It should be mentioned that for core products like corporate loans or corresponding banking services, there are no separate product managers, as the RMs themselves specialize in these products.

In the third tier there are the support departments: the Technology and Operations, the l4R, Administration and Compliance, Credit Administration and the Financial Control Unit (FCU). Technology and Operations is the largest department, headed by the SCOO (Senior Country Operations Officer). Under this department there are Data Center, The Fl operations, Treasury and Trade Operations, The Cash Management Operations and the Internal Control Unit. Support departments usually dont directly interact with the customers for marketing purposes; rather they provide all type of supports to the product managers and the RMs. The organizational structure of Citibank is customized to utilize the best capabilities of individuals. The relationships and personal network of the product managers and relationship managers are used ill the optimized way to market different offerings. Again to make use of individuals capabilities in multiple fields, it is often seen that the same person is working in two different positions.

15 | P a g e

2.9. STRUCTURE OF CITIBANK, N.A. BANGLADESH

Citibanks operations encompass Corporate Banking, Global Transaction Services, Financial Institutions and Sales and Trading (Treasury) under the Global Corporate and Investment Banking (CIB) umbrella. Other departments, which can be termed as support, are Operations and Technology, Credit Administration, Financial Control, Human Resource and Compliance. 2.9a. Corporate Bank The corporate banking unit offers one-stop solutions combining lending and advisory services, treasury, cash management, trade services and structures finance to meet the specialized requirements of the customers. The three units within the corporate banking group are Top Tier Local Corporate (TTLC), Global relationship Banking (GRB) and Structured Finance. GRB managers deal with the multinational companies in Bangladesh with whom Citibank has global relationship. TTLC managers deal with Bangladeshi incorporated companies with a proven track record of growth. The industries of focus in this segment are pharmaceuticals, electronics, distribution, textiles and apparels, consumer goods, steel and high value commodities. Structured Finance offers Export and Agency Financing (EAF), Infrastructure and Energy Financing (IEF) and Syndication facilities. 2.9b. Global Transaction Services (GTS) This department is responsible for Citibanks global products and their sales in the Bangladeshi market and comprises of a. Cash Management services b. CitiDirect Online Banking c. Trade d. Agency and Trust 16 | P a g e

The trade services offered by the bank have an advantage of large global correspondence network, but restrictions in the form of US trade laws limit its market. But the other three services are really unique to Citibank, N.A. Bangladesh especially the Cash Management services it offers. This bank claims to be the pioneer in providing this service in Bangladesh as well as in the world. Cash management services basically offer clients with sales collection and payment management solutions providing businesses with structured liquidity and in essence cost savings generated from less interest payment on credit line.

The electronic banking platform of Citibank probably possesses the most integrated of systems among all the online banking services offered by both local and foreign banks in Bangladesh. This platform can practically eliminate the need for manual client instructions related to fund transfer, payment initiation and balance enquiry. But, this application could not be utilized to its full extent because of Bangladesh Bank regulations which does not recognize any form of digital approval or signature as valid for banking transaction according to the Bangladeshi judiciary system.

Agency and Trust is another exclusive client service offered by Citibank N.A. that facilitates various types of complex financing solutions. This facility is used to assist large cross-border investment deals. With this product solution Citibank has financed or organized syndication for the set-up of all major telecommunication deals of Bangladesh which include names like GrameenPhone and Telekom Malaysia International. 2.9c. Financial Institutions The Financial Institutions (FI) department caters to the needs of various banks and non-bank financial institutions. The target market of this department also includes NGOs, Not-forprofit organizations and diplomatic missions. The core product is the correspondent banking 17 | P a g e

services. It also offers various electronic banking services enabling FI clients to perform large domestic and international transactions with proper efficiency and security. 2.9d. Treasury Sales and Trading

Global Finance Magazine has rated Citibank as the best foreign exchange bank in the world. The banks worldwide expertise and reputation in foreign exchange and other treasury activities are unparallel. Particularly its foreign exchange strength and expertise in the emerging and G7 markets have been recognized and rewarded in many occasions. In the same tradition, Citibank Bangladesh Treasury has been giving excellent and innovative services to the clients since its inception in 1995. Their local and global strength in treasury products enables them to offer the most competitive foreign exchange rates for Spot and Forward transactions; Apart from competitive foreign exchange rates the bank has other value added treasury services. Citibank, N.A. Sales and trading desk offers the following treasury products to the customers. 1. Foreign Exchange Rate Ready and spot rate Forward rates Currency swaps

2. Money Market and Fixed Income Rate Overnight deposits Term deposits Discounted securities Repo/Reverse repo Purchase/sale of Government Treasury Bills and bonds 18 | P a g e

Citibank is also a very active player in the countrys Swap Market. They are always wo rking very closely with Central Bank and other regulatory organizations to offer their local and international expertise for the development of new products and markets. 2.9e. Other Departments Other support departments are not front end operation of the bank but they provide the real backbone of offering the unique service that the bank claims to be its signature trait. Within the support team most important is the operations department of the bank where the total service level promised to customers are determined.

Another unique feature of this bank is its compliance department because it has to follow the following job every day, a. Abide by all applicable US laws in terms of trade services, banking relationship and money laundering. b. Abide by all Bangladesh bank rules because law of the land of operation is surpassing.

Compliance department strives to comply with all these applicable regulatory must dos through its vigilance because any violation of any of the governing may result in cancellation of banking license.

19 | P a g e

2.10. MARKET COMPETITION

The banking industry of Bangladesh is highly competitive. There are as high as 51 banks operating in the country at the moment. However, because of the differences in target market and variety of services, not all such banks are in direct competition with Citibank, N.A. Bangladesh. The major foreign banks and some of the high performing local private banks can be perceived as competitive threat. The most formidable among the competitors is the combined Standard & Chartered (SCB) and Standard & Chartered Grindlays (SCG) bank. In the recent years HSBC has come up with quite aggressive strategies to increase their market share in Bangladesh. Citibank, however, has so far not been very keen to penetrate the local market. Their absence in retail banking, as yet, is a proof of that.

Though the competitive scenario may seem quite bleak at the first sight, considering the fact that MNC banks largely cater to only 7% of the total banking sector, it can be said that there is still opportunity for growth. The fact that combined SCB and SCG have a relatively large branch network in the capital with higher singe borrower limit may be of significant concern for Citi. Moreover, HSBC is positioned in both corporate and consumer market and is growing steadily. The absence of consumer banking makes the cost of credit greater for Citibank compared to its competitors. Nevertheless due to the strength in the global market, high brand value and most sophisticated technology based product offerings; Citibank has already secured a separate position in the banking arena of the country and enjoys certain competitive advantages. With a plan of venturing into consumer banking, Citibank is now in a fast growing position as far as Bangladesh is concerned.

20 | P a g e

2.10a SWOT Analysis INTERNAL FACTORS Strengths Brand Image and reputation capital adequacy Adequate assets and liquidity Harmonious lender (bank) and borrower (client) relationship Experienced manpower in foreign exchange department Online banking facilities Clients reliability on Citibanks growth Weakness Overworked employees No plans for future expansion from regional office Lack of promotional activities. EXTERNAL FACTORS Opportunities Market yet to be saturated Market for innovative schemes Provision for setting competitive interest rates

Threats Changes in foreign exchange rate Changes in Govt. policy for business Intense competition in banking sector Competitors offer more attractive services to the customers

2.11. CITIBANK ISSUES AND PROBLEMS OVER THE YEARS AND THE STRATEGIES USED TO COPE WITH THEM

Citi reported losing $811 billion several days after Merrill Lynch announced that it too has been losing billions from the subprime mortgage crisis in the US. On April 11, 2007, the parent Citi announced the following staff cuts and relocations.

In August 2008, after a three year investigation by California's Attorney General Citibank was ordered to repay the $14 million (close to $18 million including interest and penalties) that was removed from 53,000 customers accounts over an eleven year period from 19922003. The money was taken under a computerized "account sweeping program" where any positive balances from over-payments or double payments were removed without notice to the customers. On November 23, 2008, Citigroup was forced to seek federal financing to 21 | P a g e

avoid a collapse, in a way similar to its colleagues Bear Stearns and AIG. The US government provided $25 billion and guarantees to risky assets to Citigroup in exchange for stock. This was the latest bailout in a string of bailouts that began with Bear Stearns and peaked with the collapse of the GSE's, Lehman, AIG and the start of TARP.

On January 16, 2009 Citigroup announced that it was splitting into two companies. Citicorp will continue with the traditional banking business while Citi Holdings Inc. will own the more risky investments, some of which will be sold to strengthen the balance sheet of the core business; Citicorp. The idea behind splitting into two companies is so Citigroup can dump "the dead weight" on Citi Holdings, allowing the prime assets of Citicorp to operate away from that of the toxic assets.

22 | P a g e

Das könnte Ihnen auch gefallen

- Merger Integration at Bank of ADokument5 SeitenMerger Integration at Bank of AHarsh TiwariNoch keine Bewertungen

- A Brief History of Doom: Two Hundred Years of Financial CrisesVon EverandA Brief History of Doom: Two Hundred Years of Financial CrisesBewertung: 3.5 von 5 Sternen3.5/5 (1)

- Format For Summer Internship ReportDokument2 SeitenFormat For Summer Internship Reportmanju47788% (24)

- Cash To Accrual Single Entry With AnswersDokument9 SeitenCash To Accrual Single Entry With AnswersHazel PachecoNoch keine Bewertungen

- City Bank Na InformationDokument3 SeitenCity Bank Na InformationShuktarai Nil JosnaiNoch keine Bewertungen

- Intership Report On CitibankDokument26 SeitenIntership Report On Citibankmoonmanj100% (2)

- FMI - History of Citibank NA UppedDokument3 SeitenFMI - History of Citibank NA UppedSidrat TalukderNoch keine Bewertungen

- Citibank: History of Major International BankDokument5 SeitenCitibank: History of Major International BankPooja GuptaNoch keine Bewertungen

- ReportDokument78 SeitenReportapi-3810664100% (2)

- Citi BankDokument12 SeitenCiti BankAsad MazharNoch keine Bewertungen

- History of City Bank Na With Photo and LogoDokument7 SeitenHistory of City Bank Na With Photo and LogoShuktarai Nil JosnaiNoch keine Bewertungen

- CitibankDokument3 SeitenCitibankfranciscocyrilhmNoch keine Bewertungen

- Citi BankDokument3 SeitenCiti Bankmuffadal0307Noch keine Bewertungen

- Fortune Institute of International Business: Team Project ON Citi GroupDokument12 SeitenFortune Institute of International Business: Team Project ON Citi GroupRuchi SambhariaNoch keine Bewertungen

- Citigroup Inc. & The RecessionDokument11 SeitenCitigroup Inc. & The RecessionUmar IyoobNoch keine Bewertungen

- Economics Project: Name: Umang Agrawal STD: 12 B Submitted To: Ms. Hetal PhillipsDokument14 SeitenEconomics Project: Name: Umang Agrawal STD: 12 B Submitted To: Ms. Hetal PhillipsUMANGNoch keine Bewertungen

- York, Citibank Can Be Classified As Third Largest Bank That Holding Company in The UnitedDokument2 SeitenYork, Citibank Can Be Classified As Third Largest Bank That Holding Company in The UnitedStephanie SufraptoNoch keine Bewertungen

- CitigroupDokument40 SeitenCitigroupShabnam SachdevaNoch keine Bewertungen

- Citi Bank FinalDokument64 SeitenCiti Bank Finalmldc2011Noch keine Bewertungen

- Citi Group: Presented byDokument19 SeitenCiti Group: Presented byBulbul SharmaNoch keine Bewertungen

- Scale and Scope at Citigroup: Firms and Markets Mini-CaseDokument9 SeitenScale and Scope at Citigroup: Firms and Markets Mini-CaseAhmed MohyeNoch keine Bewertungen

- Group 5 - Private International Financial InstitutionsDokument12 SeitenGroup 5 - Private International Financial InstitutionsMary KayeNoch keine Bewertungen

- CITI Presentation Rev1Dokument9 SeitenCITI Presentation Rev1Meghana ThammareddyNoch keine Bewertungen

- Bank of America ProfileDokument20 SeitenBank of America ProfilebharatNoch keine Bewertungen

- Citi Bank: Consumer Relationship ManagementDokument12 SeitenCiti Bank: Consumer Relationship Managementakshay hemrajaniNoch keine Bewertungen

- 2023 Baf 414 Investment Banking NotesDokument58 Seiten2023 Baf 414 Investment Banking NotesEneji ClementNoch keine Bewertungen

- 1.1 Intordution To Investment Banking:: Original DefinitionDokument8 Seiten1.1 Intordution To Investment Banking:: Original DefinitionHarsh RavadkaNoch keine Bewertungen

- Foreign Banks Operating in IdonesiaDokument2 SeitenForeign Banks Operating in IdonesiaAGUNG DWI SAPUTRANoch keine Bewertungen

- Assignment 1 - Evolution of Retail BankingDokument12 SeitenAssignment 1 - Evolution of Retail Bankingsaibale619Noch keine Bewertungen

- World's Largest Banks in 2008 10Dokument5 SeitenWorld's Largest Banks in 2008 10fatmaNoch keine Bewertungen

- Santander BankDokument4 SeitenSantander Bankphilip shternNoch keine Bewertungen

- Banking System of CanadaDokument6 SeitenBanking System of CanadaMatt RonaldNoch keine Bewertungen

- Final Citi BankDokument9 SeitenFinal Citi BankBilal EhsanNoch keine Bewertungen

- National City Bank of New York. As of March 2010, Citigroup Is The Third Largest Bank HoldingDokument1 SeiteNational City Bank of New York. As of March 2010, Citigroup Is The Third Largest Bank HoldingManish LohiaNoch keine Bewertungen

- FDIC Continental Illinois ResolutionDokument22 SeitenFDIC Continental Illinois ResolutionБоби ПетровNoch keine Bewertungen

- A Case StudyDokument11 SeitenA Case StudyAvila SimonNoch keine Bewertungen

- Mergers & Acquisitions Case Analysis: Citicorp and Travellers Group MergerDokument6 SeitenMergers & Acquisitions Case Analysis: Citicorp and Travellers Group MergeryashsinhaNoch keine Bewertungen

- Presentation Is Based On BeDokument10 SeitenPresentation Is Based On BeBalmik SahuNoch keine Bewertungen

- Bank of America: One of the Largest US BanksDokument23 SeitenBank of America: One of the Largest US Banksarush523Noch keine Bewertungen

- Foreign Banks Operating in Idonesia (Citybank)Dokument2 SeitenForeign Banks Operating in Idonesia (Citybank)NurulNoch keine Bewertungen

- Canadian Banking PDFDokument41 SeitenCanadian Banking PDFFuria_hetalNoch keine Bewertungen

- PNB's History as the Philippines' First Universal BankDokument11 SeitenPNB's History as the Philippines' First Universal BankjuanilloNoch keine Bewertungen

- Citigroup Merger Forms Financial GiantDokument7 SeitenCitigroup Merger Forms Financial GiantIranshah MakerNoch keine Bewertungen

- North Carolina Case Study: Bank of America Corp.: Soc 142, Fall 2004 North Carolina in The Global EconomyDokument5 SeitenNorth Carolina Case Study: Bank of America Corp.: Soc 142, Fall 2004 North Carolina in The Global EconomyRohit SharmaNoch keine Bewertungen

- BL PRJCTDokument25 SeitenBL PRJCTarjunlfcNoch keine Bewertungen

- CitibankDokument6 SeitenCitibankmeenakshi56Noch keine Bewertungen

- Banking and Financial Institutions ExplainedDokument8 SeitenBanking and Financial Institutions ExplainedBaby PinkNoch keine Bewertungen

- Fundamental Forces of Change in Banking 2869Dokument50 SeitenFundamental Forces of Change in Banking 2869Pankaj_Kuamr_3748Noch keine Bewertungen

- Investment BankingDokument27 SeitenInvestment BankingAkshatha UpadhyayNoch keine Bewertungen

- China Banking CorporationDokument8 SeitenChina Banking CorporationdaphnereezeNoch keine Bewertungen

- Table of ContentDokument55 SeitenTable of ContentHimansh Chaprod75% (4)

- Ma'Am Rowena Abat Module in Monetary PolicyDokument57 SeitenMa'Am Rowena Abat Module in Monetary PolicyFrancisco, Mariell M.Noch keine Bewertungen

- Investment BankingDokument62 SeitenInvestment Bankingकपिल देव यादवNoch keine Bewertungen

- Eun Resnick 8e Chapter 11Dokument18 SeitenEun Resnick 8e Chapter 11Wai Man NgNoch keine Bewertungen

- Banking DeclineDokument20 SeitenBanking DeclinekamikazewuNoch keine Bewertungen

- Citibank Final PptaaDokument35 SeitenCitibank Final PptaaHarshal AroraNoch keine Bewertungen

- Fundamental Forces of Change in BankingDokument50 SeitenFundamental Forces of Change in BankingPuput AjaNoch keine Bewertungen

- Citi BankDokument10 SeitenCiti BankJyoti ChaudharyNoch keine Bewertungen

- Better Bankers, Better Banks: Promoting Good Business through Contractual CommitmentVon EverandBetter Bankers, Better Banks: Promoting Good Business through Contractual CommitmentNoch keine Bewertungen

- Consumer Behavior Chapter 7Dokument6 SeitenConsumer Behavior Chapter 7Maruf AhmedNoch keine Bewertungen

- (Business Name) Company Organizational Chart: PresidentDokument11 Seiten(Business Name) Company Organizational Chart: PresidentFriendNamNoch keine Bewertungen

- Mineral Water SurveyDokument4 SeitenMineral Water SurveyMaruf AhmedNoch keine Bewertungen

- Cover Letter For Summer InternshipsDokument2 SeitenCover Letter For Summer InternshipsMaruf AhmedNoch keine Bewertungen

- Job ResponsibilityDokument1 SeiteJob ResponsibilityMaruf AhmedNoch keine Bewertungen

- G. Chapter 4Dokument65 SeitenG. Chapter 4Maruf AhmedNoch keine Bewertungen

- Mineral Water SurveyDokument4 SeitenMineral Water SurveyMaruf AhmedNoch keine Bewertungen

- PMS FormDokument8 SeitenPMS FormMaruf AhmedNoch keine Bewertungen

- Template For Resume Book 2012 (NSU MBA Club)Dokument2 SeitenTemplate For Resume Book 2012 (NSU MBA Club)Maruf AhmedNoch keine Bewertungen

- Excel 2007 Is Fun!Dokument145 SeitenExcel 2007 Is Fun!Maruf AhmedNoch keine Bewertungen

- D. Chapter 1Dokument3 SeitenD. Chapter 1Maruf AhmedNoch keine Bewertungen

- F. The Research PartDokument22 SeitenF. The Research PartMaruf AhmedNoch keine Bewertungen

- Citi BPR Report SummaryDokument2 SeitenCiti BPR Report SummaryMaruf AhmedNoch keine Bewertungen

- CH 03Dokument7 SeitenCH 03Muhammad ShahzadNoch keine Bewertungen

- Women and Politics in Bangladesh..Dokument14 SeitenWomen and Politics in Bangladesh..Maruf AhmedNoch keine Bewertungen

- Internship ReportDokument1 SeiteInternship Reportanon-606823Noch keine Bewertungen

- Programme Developed and Delivered by Deborah WilliamsDokument67 SeitenProgramme Developed and Delivered by Deborah WilliamsMaruf AhmedNoch keine Bewertungen

- Final 351Dokument7 SeitenFinal 351Maruf AhmedNoch keine Bewertungen

- Climate Change and BangladeshDokument28 SeitenClimate Change and BangladeshS. M. Hasan ZidnyNoch keine Bewertungen

- Jewelary MKT PlanDokument53 SeitenJewelary MKT PlanMaruf AhmedNoch keine Bewertungen

- Multinational Financial Management: An OverviewDokument25 SeitenMultinational Financial Management: An OverviewRazib AliNoch keine Bewertungen

- How The Federal Reserve & Banks Create Money - Detailed FlowchartsDokument17 SeitenHow The Federal Reserve & Banks Create Money - Detailed FlowchartsJohn DoeNoch keine Bewertungen

- CMA Dec 2020Dokument20 SeitenCMA Dec 2020vdj kumarNoch keine Bewertungen

- Tax Invoice: Billing Address Installation Address Invoice DetailsDokument1 SeiteTax Invoice: Billing Address Installation Address Invoice DetailsSiva Sagar JaggaNoch keine Bewertungen

- Financial Calculators in ExcelDokument7 SeitenFinancial Calculators in ExcelbrijsingNoch keine Bewertungen

- Anchor Bank Shanghai Branch Income Tax ExclusionDokument8 SeitenAnchor Bank Shanghai Branch Income Tax ExclusiongraceNoch keine Bewertungen

- Report - Financial Report - January 2021 - TheresidencesatbrentDokument19 SeitenReport - Financial Report - January 2021 - TheresidencesatbrentChaNoch keine Bewertungen

- Religare Project ReportDokument36 SeitenReligare Project Reportsonu050480% (5)

- Banking Law Loans and AdvancesDokument35 SeitenBanking Law Loans and AdvancesNisha SanoojNoch keine Bewertungen

- Global Power and Global Government by Andrew Gavin MarshallDokument96 SeitenGlobal Power and Global Government by Andrew Gavin MarshallsylodhiNoch keine Bewertungen

- MBA/MSc 2021 Students Request Fee Installment ExtensionDokument9 SeitenMBA/MSc 2021 Students Request Fee Installment ExtensionChalitha DhananjaniNoch keine Bewertungen

- Internal Check and ControlsDokument18 SeitenInternal Check and ControlsAnonymous uxd1ydNoch keine Bewertungen

- Non-Monetary Incentives as Motivational Tools for Non-Teaching StaffDokument3 SeitenNon-Monetary Incentives as Motivational Tools for Non-Teaching StaffMichaelAngeloBattung100% (1)

- Lloyds Bank 1Dokument8 SeitenLloyds Bank 1KabanNoch keine Bewertungen

- AFAR-02 (Partnership Dissolution & Liquidation)Dokument15 SeitenAFAR-02 (Partnership Dissolution & Liquidation)Jennelyn CapenditNoch keine Bewertungen

- FASB Technical Agenda OverviewDokument2 SeitenFASB Technical Agenda OverviewAdrienne GonzalezNoch keine Bewertungen

- EMBA1Dokument7 SeitenEMBA1lfz15855102061Noch keine Bewertungen

- Assessing Early Warning SystemsDokument45 SeitenAssessing Early Warning SystemspasaitowNoch keine Bewertungen

- Vanguard: Vanguard All-Equity ETF PortfolioDokument4 SeitenVanguard: Vanguard All-Equity ETF PortfolioJanko JerinićNoch keine Bewertungen

- My Project of Vijaya BankDokument103 SeitenMy Project of Vijaya Banktamizharasid100% (1)

- ACCTG 8D (Week 4-7)Dokument36 SeitenACCTG 8D (Week 4-7)Tepan CarloNoch keine Bewertungen

- Submitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofDokument9 SeitenSubmitted By: Project Submitted in Partial Fulfillment For The Award of Degree ofMOHAMMED KHAYYUMNoch keine Bewertungen

- River of Dreams English 9Dokument3 SeitenRiver of Dreams English 9Cresilda BiloyNoch keine Bewertungen

- Resa - The Review School of Accountancy Management ServicesDokument8 SeitenResa - The Review School of Accountancy Management ServicesKindred Wolfe100% (1)

- Complaint Form IGRCDokument3 SeitenComplaint Form IGRCGOBINDA DASNoch keine Bewertungen

- India Infoline Finance LTD NCDs Listed On The Stock Exchanges at A PremiumDokument2 SeitenIndia Infoline Finance LTD NCDs Listed On The Stock Exchanges at A PremiumIndiaInfoline IiflNoch keine Bewertungen

- Group - 3 - Assignment (Term Paper)Dokument13 SeitenGroup - 3 - Assignment (Term Paper)Biniyam YitbarekNoch keine Bewertungen

- Module 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Dokument5 SeitenModule 5 (TOPIC 7) - IMPAIRMENT OF ASSETS (INDIVIDUAL ASSETS)Khamil Kaye GajultosNoch keine Bewertungen

- ABC Discussion - Business CombinationDokument7 SeitenABC Discussion - Business CombinationJohn Cesar PaunatNoch keine Bewertungen