Beruflich Dokumente

Kultur Dokumente

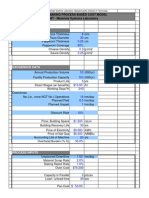

Future Benefits and Charges Details

Hochgeladen von

Ankur Mittal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

316 Ansichten0 SeitenThis document provides an illustration of future benefits for a HDFC SL YoungStar Super Premium (Spl) policy. It shows projected maturity and death benefits over the 10 year policy term for two assumed investment return rates of 6% and 10% annually. The illustration also includes details on charges such as premium allocation, risk, policy administration and fund management charges that are deducted over the policy term.

Originalbeschreibung:

hdfc

Originaltitel

HDFC Life YoungStar Super Premium (Spl) Illustration

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an illustration of future benefits for a HDFC SL YoungStar Super Premium (Spl) policy. It shows projected maturity and death benefits over the 10 year policy term for two assumed investment return rates of 6% and 10% annually. The illustration also includes details on charges such as premium allocation, risk, policy administration and fund management charges that are deducted over the policy term.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

316 Ansichten0 SeitenFuture Benefits and Charges Details

Hochgeladen von

Ankur MittalThis document provides an illustration of future benefits for a HDFC SL YoungStar Super Premium (Spl) policy. It shows projected maturity and death benefits over the 10 year policy term for two assumed investment return rates of 6% and 10% annually. The illustration also includes details on charges such as premium allocation, risk, policy administration and fund management charges that are deducted over the policy term.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 0

on 21 December 2013

Age is taken as on last birthday

PREMIUM AND BENEFIT DETAILS

ILLUSTRATION OF FUTURE BENEFITS

This illustration has been produced by HDFC Standard Life Insurance Company Limited to help you understand the benefits of your HDFC SL YoungStar Super Premium (Spl). These

illustrations must be read in conjunction with the sales literature, which describes the features of this product.

The values shown are for illustration only. What you actually receive will depend on what happens over the future lifetime of your policy.

The assumed rate of investment return is particularly important. The Illustration shows what you could get back using two assumed rates of investment return. These rates have been

specified by the Life Insurance Council and every insurance company must use these same rates for all products from 01/04/2004.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed returns then

these will be clearly marked "guaranteed" in the illustration table on this page.

If your policy offers variable returns then the illustrations on this page will show two different rates of assumed investment returns. These assumed rates of return are not guaranteed and

they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

Future benefits depend not only on the assumed investment returns. Other important factors that will affect the value of your policy include the company's charges, including the charge

for providing risk benefits, such as life cover and the effects of taxation.

Guaranteed benefits are available provided all premiums are paid, when they are due. The illustrative benefits below assume that all premiums that are due have been paid.

All amounts are in Indian Rupees.

Illustrative Benefits on Maturity

On the survival of the Life Assured until the Maturity date, the illustrative Maturity benefits are as shown below.

Upon this payment, the policy terminates and no further benefit becomes payable.

Illustrative Benefits on Death

Ver: 30(17)d-30.17-30 21-Dec-2013 - 12:43:08 Page 1

This is the official illustration issued by HDFC Standard Life Insurance Company Limited. Illustration of any other type is not supported by the company.

Illustration for HDFC SL YoungStar Super Premium (Spl)

PERSONAL DETAILS

Name Age Gender

Life 1 deepak mittal 30 M

POLICY DETAILS

Date of Policy Commencement: 21-Dec-2013

Policy Term: 10 year(s)

Premium Paying Term: 10 year(s)

Premium Frequency: Annual

Benefit Option: Benefit

Benefit Name

Sum Assured

(in Rs.)

Benefit Term (years)

Premium Paying

Term (years)

Premium

(in Rs.)

YoungStar Super Premium (Spl) 1,000,000 10 10 100,000

Total Premium payable per Frequency: 100,000

Next premium Due Date 21-Dec-2014

This is a unit linked policy. Service Tax & Education Cess is applicable on the amount of any charge that we levy on your policy and units will be deducted in respect of this tax. The

values shown in the illustration allow for all such deductions.

Guaranteed Benefit Non-Guaranteed Benefit Total Maturity Benefit

Assumed Investment Return Assumed Investment Return

Date of Maturity YoungStar Super Premium (Spl) 6% p.a. 10% p.a. 6% p.a. 10% p.a.

21-Dec-2023 35,000 1,139,496 1,423,781 1,174,496 1,458,781

Upon this payment, the policy will continue in force till the Maturity Date.All premiums becoming payable between the Date of Death and the Maturity Date will be paid by HDFC

Standard Life, and the Maturity benefit will be payable at the Maturity Date.

ILLUSTRATION OF CHARGES

The charges under your HDFC SL YoungStar Super Premium (Spl) policy are deducted to provide for the cost of benefits and the administration provided by us.

Effect of Charges

It is important that you do not judge a unit linked plan solely on the basis of any of the charges taken independently. Charges interact with each other. So, to understand what effect the

charges will have in your policy, you need to look up the Reduction in Yield, which is defined as the net reduction in return per annum due to charges if we express all charges as a

fund based charge. The rates provided below are Effective Annual Rates allowing for the timing of when they are deducted.

Ver: 30(17)d-30.17-30 21-Dec-2013 - 12:43:08 Page 2

Projected Statement of Premiums, Charges and Fund Value based on Assumed Investment Return of 10% p.a.

(01) (02) (03) (04) (05) (06) (07) (08) (09) (10) (11) (12) (13) (14) (15) (16) (17)

Policy

Year

Annualised

Premium

Top-up

Premium

Allocation

Charge

Amount

available for

Investment

Risk

Charge

Policy

Administration

Charge

FMC

Invest-

ment

Guarantee

charge

Taxes as

appli-

cable*

Total

Charges

Fund

Value

(end of

year)

Addition

to Fund

Surrender

Benefit

(end of

year)

Guaranteed

Death

Benefit

Total

Death

Benefit

Commi-

ssion

1 100,000 0 4,000 96,000 3,237 3,000 1,295 0 1,425 12,957 96,155 0 89,672 1,000,000 1,000,000 0

2 100,000 0 4,000 96,000 3,162 3,120 2,652 0 1,599 14,533 200,279 0 195,784 1,000,000 1,000,000 0

3 100,000 0 4,000 96,000 3,077 3,240 4,121 0 1,785 16,223 313,050 0 309,679 1,000,000 1,000,000 0

4 100,000 0 4,000 96,000 3,001 3,360 5,712 0 1,987 18,060 435,180 0 432,933 1,000,000 1,000,000 0

5 100,000 0 4,000 96,000 2,929 3,480 7,435 0 2,205 20,049 567,443 0 567,443 1,000,000 1,000,000 0

6 100,000 0 4,000 96,000 2,840 3,600 9,302 0 2,440 22,182 710,706 0 710,706 1,000,000 1,000,000 0

7 100,000 0 4,000 96,000 2,750 3,840 11,322 0 2,708 24,620 865,746 0 865,746 1,000,000 1,000,000 0

8 100,000 0 1,000 99,000 2,653 4,080 13,556 0 2,631 23,920 1,037,207 0 1,037,207 1,000,000 1,000,000 0

9 100,000 0 1,000 99,000 2,546 4,320 15,975 0 2,947 26,788 1,222,819 0 1,222,819 1,000,000 1,000,000 0

10 100,000 0 1,000 99,000 2,421 4,560 18,594 0 3,285 29,860 1,423,781 0 N.A. N.A. N.A. 0

* General Sales Tax (GST) in case of Jammu and Kashmir and Service Tax (including Education Cess) in all other cases.

Projected Statement of Premiums, Charges and Fund Value based on Assumed Investment Return of 6% p.a.

(01) (02) (03) (04) (05) (06) (07) (08) (09) (10) (11) (12) (13) (14) (15) (16) (17)

Policy

Year

Annualised

Premium

Top-up

Premium

Allocation

Charge

Amount

available for

Investment

Risk

Charge

Policy

Administration

Charge

FMC

Invest-

ment

Guarantee

charge

Taxes as

appli-

cable*

Total

Charges

Fund

Value

(end of

year)

Addition

to Fund

Surrender

Benefit

(end of

year)

Guaranteed

Death

Benefit

Total

Death

Benefit

Commi-

ssion

1 100,000 0 4,000 96,000 3,237 3,000 1,269 0 1,422 12,928 92,538 0 86,300 1,000,000 1,000,000 0

2 100,000 0 4,000 96,000 3,162 3,120 2,548 0 1,586 14,416 189,100 0 184,606 1,000,000 1,000,000 0

3 100,000 0 4,000 96,000 3,077 3,240 3,883 0 1,755 15,955 289,874 0 286,503 1,000,000 1,000,000 0

4 100,000 0 4,000 96,000 3,001 3,360 5,277 0 1,933 17,571 395,036 0 392,789 1,000,000 1,000,000 0

5 100,000 0 4,000 96,000 2,929 3,480 6,731 0 2,118 19,258 504,775 0 504,775 1,000,000 1,000,000 0

6 100,000 0 4,000 96,000 2,840 3,600 8,248 0 2,310 20,998 619,310 0 619,310 1,000,000 1,000,000 0

7 100,000 0 4,000 96,000 2,750 3,840 9,831 0 2,524 22,945 738,718 0 738,718 1,000,000 1,000,000 0

8 100,000 0 1,000 99,000 2,653 4,080 11,528 0 2,381 21,642 866,738 0 866,738 1,000,000 1,000,000 0

9 100,000 0 1,000 99,000 2,546 4,320 13,297 0 2,616 23,779 1,000,244 0 1,000,244 1,000,000 1,000,000 0

10 100,000 0 1,000 99,000 2,421 4,560 15,142 0 2,858 25,981 1,139,496 0 N.A. N.A. N.A. 0

* General Sales Tax (GST) in case of Jammu and Kashmir and Service Tax (including Education Cess) in all other cases.

Description Scenario 1 Scenario 2

A Assumed Gross Yield 10.00% 6.00%

B1 Premium Allocation Charge 0.59% 0.59%

B2 Policy Administration Charge 0.64% 0.66%

B3 Fund Management Charge 1.48% 1.42%

B Reduction in Yield due to Expenses [B1 + B2 + B3] 2.71% 2.67%

C Additional Benefit from Loyalty Reward 0.41% 0.51%

D Reduction in Yield due to Cost of Risk Benefit 0.53% 0.54%

E Reduction in Yield due to Guarantee charge 0.00% 0.00%

F Reduction in Yield [B - C + D + E] 2.83% 2.70%

G Net Yield [A - F] 7.17% 3.30%

H Reduction in Yield due to Taxes as applicable 0.41% 0.40%

I Return on Investment [ G - H ] 6.76% 2.90%

The difference between the gross and net yield defined as per IRDA Circular No. 20/IRDA/ActI/ULIP/09-10 is 2.30%

This complies with the maximum charge cap under the circular.

Description of Charges

This illustration is based on the following charges:

Premium Allocation Charge

This is a premium-based charge (which may vary by product, policy year, premium size, premium frequency and premium payment method). After deducting this charge from your

premiums, the remainder is invested to buy units. Please read Sales Literature for more details.

Fund Management Charge (FMC)

This is a charge levied as a percentage of the value of assets and deducted at the time of computation of daily unit prices. In the long term, the key to building great maturity values is

a low FMC.The Fund Management Charge is the same across all the fund options.

Policy Administration Charge

This charge is levied to cover regular administration costs. This charge may vary by product & premium size. Please read Sales Literature for more details.

Risk Charge

This is a charge levied monthly to cover the cost of providing you with the Death Benefit, Extra Health Benefit, Extra Life Benefit, Extra Disability Benefit and any other Morbidity

Benefits, if applicable, on your policy. The amount of the charge taken each month is based on the benefits insured and your age.

Service Tax & Education Cess

The Government of India levies a Service Tax & Education Cess on the amount of any charges deducted from your policy. We collect this tax along with the charges. The tax rates and

its applicability will be as notified by the Government from time to time.

TERMS AND CONDITIONS

The Sum Assured stated above is based on the information provided and may vary as a result of underwriting.

For details of the above benefits, please read the sales literature provided.

Since some of the benefits are subject to maximum limits, please contact your financial consultant for more details.

Any statutory levy or charges (such as Service Tax & Education Cess) including any indirect tax may be charged to the Policyholder either now or in future by the Company and such

amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to payment of premium.

Insurance is a subject matter of solicitation.

UIN for HDFC SL YoungStar Super Premium (Spl) - 101L068V01

The benefits illustrated assume that all premiums that are due over the premium paying term will be paid and no withdrawals will be made during the policy term. In case premiums are

not paid for the premium paying term at the original level or withdrawals are made during the policy term, the illustrative benefits will be lower.

This contract is designed for long term savings and is not designed for short term investment. Should you need to surrender your policy in the short term, any surrender benefits may

be less than the premium(s) you have paid.

There is no guaranteed amount of Rupees on surrender. We guarantee to pay the bid value of units in your unit linked fund, less any charges applicable on surrender.

A policy may be surrendered at any time in the first five years of the policy but the amount payable on surrender will be paid out only on the 5th policy anniversary, subject to

prevailing regulations.

In case you do not pay premiums for the full premium paying term, your policy will be discontinued. Please read the sales literature for more details.

There is no commission payable as the illustration has been generated on the basis that this proposal would be sourced through Direct Sales.

Distributors may also receive payments from the Company towards marketing activities.

The values shown are for illustration only.

What you actually receive will depend on what happens over the future lifetime of the policy.

The benefits illustrated assume that any benefit payment is made exactly on a policy anniversary without allowance for any premium that may be due on that anniversary. The

illustrated values may not be constant over the policy year.

If you would like help to understand this illustration, please speak to your Financial Consultant.

"Premium Allocation Charge Rates", "Death Benefit Charge Rates" and "Extra Life Benefit Charge Rates" , if applicable , are guaranteed for the lifetime of the policy. All other charges

may be altered during the lifetime of the policy with prior approval from the regulator.

In this policy, the investment risk in the investment portfolio is borne by you. The investment returns used in the projected statements are for illustration only. As can be observed by

comparing the two projected statements at two different investment return assumptions, most of the values shown in the projected statements vary with the investment return

assumption and are for illustration only. The actual values will depend crucially on the actual investment returns earned.

The charges described above are those that are expected to be levied on your policy in normal circumstances. In addition to these, certain other charges may also be applicable to

your policy under exceptional circumstances. Please refer to the sales literature for details of these charges and the circumstances in which they apply.

I, ......................................................................................., having received the information with respect to the above, have understood the above statement before entering into

the contract.

Ver: 30(17)d-30.17-30 21-Dec-2013 - 12:43:08 Page 3

Financial Consultant's Signature: Customer's Signature:

Financial Consultant's Name: Date:

Financial Consultant's Code : Place:

Business Development Manager's Name:

Channel Name : Direct - Online

Das könnte Ihnen auch gefallen

- HDFC Life Crest IllustrationDokument0 SeitenHDFC Life Crest IllustrationAnkur SrivastavNoch keine Bewertungen

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNoch keine Bewertungen

- Sales Brochure 91Dokument3 SeitenSales Brochure 91prudhvi rajNoch keine Bewertungen

- HDFC Life YoungStar Udaan IllustrationDokument2 SeitenHDFC Life YoungStar Udaan IllustrationSuraj RajbharNoch keine Bewertungen

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDokument0 SeitenHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNoch keine Bewertungen

- HDFC Life Sanchay(Spl) Policy IllustrationDokument2 SeitenHDFC Life Sanchay(Spl) Policy IllustrationAnkur Mittal100% (1)

- Illustration PDFDokument3 SeitenIllustration PDFrahulNoch keine Bewertungen

- Seasons 100 ProposalDokument3 SeitenSeasons 100 ProposalAlvin Dela Cruz100% (1)

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDokument3 SeitenHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNoch keine Bewertungen

- Vidya DharDokument2 SeitenVidya DharKatie PerryNoch keine Bewertungen

- Policy OwnerDokument4 SeitenPolicy OwnerRichard GuillermoNoch keine Bewertungen

- Illustration of GSIPDokument3 SeitenIllustration of GSIPAjinkya ChalkeNoch keine Bewertungen

- ICICI Benefit IllustrationDokument4 SeitenICICI Benefit Illustrationudupiganesh3069Noch keine Bewertungen

- HDFC Life Super Savings Plan (SPL) IllustrationDokument2 SeitenHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNoch keine Bewertungen

- ENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueDokument3 SeitenENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueGBKNoch keine Bewertungen

- Jeevan Kishore T - 102Dokument3 SeitenJeevan Kishore T - 102lalithmohan100% (2)

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationBullish Guy100% (1)

- RkriDokument19 SeitenRkriKalai Vani KarthiNoch keine Bewertungen

- Term PlanDokument4 SeitenTerm PlanKaushaljm PatelNoch keine Bewertungen

- IllustrationDokument3 SeitenIllustrationDevender Singh RautelaNoch keine Bewertungen

- MONEY BACK PLAN - (Table No. 75) Benefit IllustrationDokument4 SeitenMONEY BACK PLAN - (Table No. 75) Benefit IllustrationVinayak DhotreNoch keine Bewertungen

- Miss Soo QTNDokument41 SeitenMiss Soo QTNHong Siong ShinNoch keine Bewertungen

- Iciciprulife - Wealth BuilderDokument3 SeitenIciciprulife - Wealth BuilderThiru MalpathiNoch keine Bewertungen

- Variable Life Insurance Proposal: 0PROP.07.4Dokument4 SeitenVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNoch keine Bewertungen

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDokument20 SeitenPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationAmirul UmarNoch keine Bewertungen

- IllustrationForm S000000502723Dokument1 SeiteIllustrationForm S000000502723anand_guruwarNoch keine Bewertungen

- Medical Repricing RevisionDokument6 SeitenMedical Repricing RevisionSarveshrau SarveshNoch keine Bewertungen

- rm4800 550kDokument28 Seitenrm4800 550kDwayne OngNoch keine Bewertungen

- Gsip For 15 YrsDokument3 SeitenGsip For 15 YrsJoni SanchezNoch keine Bewertungen

- Reating Lif: Child Protection Money Back PlanDokument2 SeitenReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNoch keine Bewertungen

- Birla Sun Life Insurance Vision Your Policy IllustrationDokument1 SeiteBirla Sun Life Insurance Vision Your Policy IllustrationmiteshsuneriyaNoch keine Bewertungen

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDokument19 SeitenPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinNoch keine Bewertungen

- Jeevan Anand Life Insurance PlanDokument3 SeitenJeevan Anand Life Insurance PlanVenkatesh KanakalaNoch keine Bewertungen

- JuanDelaCruz AxeleratorDokument8 SeitenJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNoch keine Bewertungen

- Jeevan Rekha Plan - Money Back Life InsuranceDokument4 SeitenJeevan Rekha Plan - Money Back Life InsuranceRamu448Noch keine Bewertungen

- HDFC LifeDokument1 SeiteHDFC LifefacebookorkutNoch keine Bewertungen

- Illustration PDFDokument0 SeitenIllustration PDFbpshuNoch keine Bewertungen

- FWAP ULIP Leaflet RevisedDokument16 SeitenFWAP ULIP Leaflet Revisedmantoo kumarNoch keine Bewertungen

- QT Nil P 0281201412122056697Dokument18 SeitenQT Nil P 0281201412122056697Sarath KumarNoch keine Bewertungen

- Jeevan Anand Plan - (Table No 149) Benefit IllustrationDokument4 SeitenJeevan Anand Plan - (Table No 149) Benefit IllustrationSATHEESHKUMAR VNoch keine Bewertungen

- Jeevan SaralDokument11 SeitenJeevan SaralParamjeet K GadhriNoch keine Bewertungen

- Ali - Contoh Dewasa (In English)Dokument20 SeitenAli - Contoh Dewasa (In English)Yusof PrubsnNoch keine Bewertungen

- Ajeevan Sampatti Benefit IllustrationDokument5 SeitenAjeevan Sampatti Benefit IllustrationSurya GudipatiNoch keine Bewertungen

- Sbi Life Insurance Co LTD Benefit Illustration For Sbi Life - Ewealth Insurance (Uin 111L100V02)Dokument2 SeitenSbi Life Insurance Co LTD Benefit Illustration For Sbi Life - Ewealth Insurance (Uin 111L100V02)upasana9Noch keine Bewertungen

- Illustration RapDokument1 SeiteIllustration RapShub KumarNoch keine Bewertungen

- QT Nil P 0281201503151442615Dokument51 SeitenQT Nil P 0281201503151442615Dinesh MuruganNoch keine Bewertungen

- Prominence Max - Peso Global Technology FundDokument2 SeitenProminence Max - Peso Global Technology FundDarrenfel SantizoNoch keine Bewertungen

- Jeevan VriddhiDokument4 SeitenJeevan VriddhihemukariaNoch keine Bewertungen

- 35183192-Pdm Med Ext OfferDokument4 Seiten35183192-Pdm Med Ext OfferNg Siaw LanNoch keine Bewertungen

- ICICI Pru Assure WealthDokument2 SeitenICICI Pru Assure WealthPavan Kumar RanguduNoch keine Bewertungen

- HDFC Life Insurance's Accolades and Product OfferingsDokument28 SeitenHDFC Life Insurance's Accolades and Product OfferingsSandeep ChauhanNoch keine Bewertungen

- ICICI Pru LifeTime Super: A regular premium unit-linked planDokument3 SeitenICICI Pru LifeTime Super: A regular premium unit-linked planmniarunNoch keine Bewertungen

- Whole Life Surance Savings Plan 116414681443669413Dokument2 SeitenWhole Life Surance Savings Plan 116414681443669413msneha1Noch keine Bewertungen

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDokument7 SeitenBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Noch keine Bewertungen

- Edelweiss Tokio Life Pension Plan GuideDokument12 SeitenEdelweiss Tokio Life Pension Plan Guidedeepraj1983Noch keine Bewertungen

- 2015-07-06 123625 LPP Jesus Gavioloa 12pay PDFDokument31 Seiten2015-07-06 123625 LPP Jesus Gavioloa 12pay PDFAnonymous 2YWl5SNoch keine Bewertungen

- MM AssignmentDokument16 SeitenMM AssignmentRahul ParasharNoch keine Bewertungen

- ICICI Pru Signature plan investment and maturity benefitsDokument6 SeitenICICI Pru Signature plan investment and maturity benefitsSneha Abhash SinghNoch keine Bewertungen

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionVon EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNoch keine Bewertungen

- Credit Union Revenues World Summary: Market Values & Financials by CountryVon EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Uttar Pradesh 2012 Election ReportDokument663 SeitenUttar Pradesh 2012 Election ReportAnkur MittalNoch keine Bewertungen

- HDFC Life Sanchay(Spl) Policy IllustrationDokument2 SeitenHDFC Life Sanchay(Spl) Policy IllustrationAnkur Mittal100% (1)

- HDFC Life Sanchay(Spl) Policy IllustrationDokument2 SeitenHDFC Life Sanchay(Spl) Policy IllustrationAnkur Mittal100% (1)

- Packaged Water Industry in IndiaDokument14 SeitenPackaged Water Industry in IndiaAnkur MittalNoch keine Bewertungen

- MIT MSL PizzamodelDokument37 SeitenMIT MSL PizzamodelAnkur MittalNoch keine Bewertungen

- Indian MFTrackerDokument1.597 SeitenIndian MFTrackerAnkur Mittal100% (1)

- Indian MFTrackerDokument1.597 SeitenIndian MFTrackerAnkur Mittal100% (1)

- Packaged Drinking Water ProductionDokument6 SeitenPackaged Drinking Water ProductionismaiaaNoch keine Bewertungen

- Price WirerodDokument1 SeitePrice WirerodAnkur MittalNoch keine Bewertungen

- ReadmeDokument1 SeiteReadmeAnkur MittalNoch keine Bewertungen

- Format .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Dokument8 SeitenFormat .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Impact JournalsNoch keine Bewertungen

- Financial Times Europe - 28 03 2020 - 29 03 2020 PDFDokument52 SeitenFinancial Times Europe - 28 03 2020 - 29 03 2020 PDFNikhil NainNoch keine Bewertungen

- List of MLPsDokument6 SeitenList of MLPscordolisNoch keine Bewertungen

- Financial Journalism, News Sources and The Banking Crisis: Paul ManningDokument17 SeitenFinancial Journalism, News Sources and The Banking Crisis: Paul ManningmargarethhlrNoch keine Bewertungen

- FNB PayPal TermsandConditionsDokument14 SeitenFNB PayPal TermsandConditionsColbert JohnesNoch keine Bewertungen

- PC Square2307Dokument3 SeitenPC Square2307SirManny ReyesNoch keine Bewertungen

- Zimbabwe Stock Exchange Listed Companies Ranking 2016Dokument2 SeitenZimbabwe Stock Exchange Listed Companies Ranking 2016kajtheviroNoch keine Bewertungen

- In Savings Account SoscDokument9 SeitenIn Savings Account SoscAbhishek MitraNoch keine Bewertungen

- Lloyds Bank - Print Friendly Statement PDFDokument3 SeitenLloyds Bank - Print Friendly Statement PDFAnonymous aksuAOiG40% (5)

- Useofagrmnt PDFDokument20 SeitenUseofagrmnt PDFBonaventure NzeyimanaNoch keine Bewertungen

- Office of The Auditor Construction Industry Authority of The PhilippinesDokument3 SeitenOffice of The Auditor Construction Industry Authority of The PhilippinesHoven MacasinagNoch keine Bewertungen

- Amazon Settlement ReportDokument77 SeitenAmazon Settlement ReportHarsh PatelNoch keine Bewertungen

- Credit Rating PDFDokument74 SeitenCredit Rating PDFsnehachandan91Noch keine Bewertungen

- DigiPay v1Dokument18 SeitenDigiPay v1KAVEEN PRASANNAMOORTHYNoch keine Bewertungen

- Chattel MortgageDokument2 SeitenChattel MortgageBliz DuzonNoch keine Bewertungen

- Khannan Finance & InvestmentDokument4 SeitenKhannan Finance & InvestmentJordan JohnsonNoch keine Bewertungen

- A Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Dokument15 SeitenA Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Pavan ShindeNoch keine Bewertungen

- Whole life insurance explainedDokument15 SeitenWhole life insurance explainedEmir AdemovicNoch keine Bewertungen

- Ossc Apply Online For 878 Ayurvedic Assistant Homeopathic Assistant Posts Advt Details PDFDokument14 SeitenOssc Apply Online For 878 Ayurvedic Assistant Homeopathic Assistant Posts Advt Details PDFNiroj Kumar SahooNoch keine Bewertungen

- Bank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanDokument3 SeitenBank's Branch Head, 5 Others Get Life For Faking Documents To Avail Rs 1.5 Crore LoanJAGDISH GIANCHANDANINoch keine Bewertungen

- CRC PDFDokument45 SeitenCRC PDFMick SousaNoch keine Bewertungen

- Project Report On Health Law: Limitations On Liabilities and MediclaimDokument17 SeitenProject Report On Health Law: Limitations On Liabilities and MediclaimDeepesh SinghNoch keine Bewertungen

- A Research Study of Plastic Money Among HousewivesDokument34 SeitenA Research Study of Plastic Money Among HousewivesNainaNoch keine Bewertungen

- Banker Customer Relationship - Exam3 PDFDokument3 SeitenBanker Customer Relationship - Exam3 PDFrahulpatel1202Noch keine Bewertungen

- Cashlite TNC Oct2018 EnbmDokument15 SeitenCashlite TNC Oct2018 EnbmPokya SgNoch keine Bewertungen

- Internship Report On Finance MBADokument95 SeitenInternship Report On Finance MBABhaskar GuptaNoch keine Bewertungen

- 8-10-17-Final - Orlando Et Al. v. Corporate BailoutsDokument30 Seiten8-10-17-Final - Orlando Et Al. v. Corporate BailoutsNew York PostNoch keine Bewertungen

- ListDokument6 SeitenListRoshelleNoch keine Bewertungen

- CFO and contact info for mortgage lenders and other companiesDokument7 SeitenCFO and contact info for mortgage lenders and other companiesBob JohnsonNoch keine Bewertungen

- Subject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Dokument6 SeitenSubject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Abhishek ShresthaNoch keine Bewertungen