Beruflich Dokumente

Kultur Dokumente

Senior

Hochgeladen von

Farah FarhainOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Senior

Hochgeladen von

Farah FarhainCopyright:

Verfügbare Formate

BACKGROUND OF THE COMPANIES

(i)

Main activity of th co!"ani #

FRASER $ NEA%E HO&DINGS BHD The principal activity of this Company is investment holding and its subsidiaries are primarily engaged in the manufacture and sale of soft drinks, dairy products, glass containers, property development activities and the provision of management services.

KA'AN FOOD BHD This Company is principally engaged in investment holding, whilst the principal activities of its subsidiaries are engaged in the manufacture and sale of frozen food products and trading and distribution of frozen food products.

MAMEE(DOUB&E DECKER (M) BHD The principal activities of this Company consist of investment holding and provision of management services to subsidiary companies. The principal activities of the Group consist of manufacturing and marketing of food and dairy products, soft drinks and property development activity.

NEST&E (M) BHD

The principal activity of this Company is that of an investment holding company, whilst the principal activities of the subsidiaries are manufacturing and marketing of sales of ice-cream, powdered milk and drinks, liquid milk and uices, instant coffee and other beverages, instant noodles, culinary products, cereals, yogurt and related products.

)EO HIAP SENG (M) BHD This Company is principally involved in the production, marketing and sale of beverage and food products whilst the principal activities of the subsidiaries are distribution of food and beverages, production of instant noodles, and production of sauces and non-alcoholic beverages

(ii)

St*+ct+* of th ,*o+" co!"ani # (-y th . of ho/0in,#)

FRASER $ NEA%E HO&DINGS BHD

Co!! nt#1 !ts percentage "#$ of holdings for all the enterprises above are more than %&#. Thus2 '()*+( , -+).+ /012!-G* 3/2 has the control power to govern the financial and operating policies of all these subsidiaries. KA'AN FOOD BHD 4

NAME OF SUBSIDIARIES 4awan 'ood 5anufacturing *dn.3hd. 4G 7astry 5arketing *dn. 3hd. 4awan 'ood "-antong$ Co., 1td. 4ayangan 5anisan "5$ *dn. 3hd. 4awan 'ood Confectionary *dn. 3hd. 4awan 'ood "/ong 4ong$ 1imited

(.) of ho/0in,# (F)E 3445) 6&& 6&& 6&& %6 6&& 6&&

Co!! nt#1 !ts percentage "#$ of holdings for all the enterprises above are more than %&#. Thus, 4)8)- '002 3/2 has the control - power to govern the financial and operating policies of all these subsidiaries.

MAMEE(DOUB&E DECKER (M) BHD

NAME OF ASSOCIATE *pin Communication *dn. 3hd.

(.) of ho/0in,# (F)E 3445) 9&

Co!! nt#1 !ts percentage "#$ of holdings for the associate company above is from :&-%&#. Thus, 5)5++-20;31+ 2+C4+( "5$ 3/2 has significant influence - power to participate in the financial and operating policy of the associate company above but not control over those policies.

NAME OF SUBSIDIARIES

. OF HO&DINGS (F)E 3445)

6(CONTINUE)

NAME OF SUBSIDIARIES . OF HO&DINGS (F)E 3445) 6

Co!! nt#1 !ts percentage "#$ of holdings for all the enterprises above are more than %&#. Thus, 5)5++-20;31+ 2+C4+( "5$ 3/2 has the control power to govern the financial and operating policies of all these subsidiaries.

NEST&E (M) BHD

NAME OF ASSOCIATE -ihon Canpack "5alaysia$ *dn. 3hd.

(.) of ho/0in,# (F)E 3445) :&

Co!! nt#1 !ts percentage "#$ of holdings for the associate company above is from :&-%&#. Thus, -+*T1+ "5$ 3/2 has significant influence - power to participate in the financial and operating policy of the associate company above but not control over those policies.

NAME OF SUBSIDIARIES -estl< 7roducts *dn. 3hd. -estl< 5anufacturing "5$ *dn. 3hd. -estl< )sean "5alaysia$ *dn. 3hd. -estl< 'oods "5alaysia$ *dn. 3hd. -estl< Cold *torage "*abah$*dn 3hd *-' *dn. 3hd.

(.) of ho/0in,# (F)E 3445) 6&& 6&& 6&& 6&& 6&& 6&&

Co!! nt#1 !ts percentage "#$ of holdings for all the enterprises above are more than %&#. Thus, -+*T1+ "5$ 3/2 has the control - power to govern the financial and operating policies of all these subsidiaries.

)EO HIAP SENG (M) BHD

NAME OF ASSOCIATE 8.=. Company 1imited

(.) of ho/0in,# (F)E 3445) 9>

Co!! nt#1 !ts percentage "#$ of holdings for the associate company above is from :&-%&#. Thus, =+0 /!)7 *+-G "5$ 3/2 has significant influence power to participate in the financial and operating policy of the associate company above but not control over those policies.

NAME OF SUBSIDIARIES =eo /iap *eng Trading *dn 3hd 3estcan 'ood Technological !ndustry *endirian 3erhad 7T =/* !ndonesia ? "!ncorporated in !ndonesia$ =eo /iap *eng "*arawak$ *dn 3hd =/* 5anufacturing 3erhad =eo /iap *eng "7erak$ *endirian 3erhad +sin Canning !ndustry *endirian 3erhad =eo /iap *eng "5iddle +ast$ Co. 1td. +.C. 8ahtai (ealty *dn 3hd =/* 3everage "!nternational$ 7te. 1td.

(.) of ho/0in,# (F)E 3445) 6&& >>.9: 6&&

6&& 6&& 6&& 6&& 6&& 6&& 6&&

Co!! nt#1 !ts percentage "#$ of holdings for all the enterprises above are more than %&#. Thus, =+0 /!)7 *+-G "5$ 3/2 has the control - power to govern the financial and operating policies of all these subsidiaries.

(iii) Chan, # in o7n *#hi" int * #t (FOR F)E 3448 $ 3445 ON&))

FRASER $ NEA%E HO&DINGS BHD NAME OF SUBSIDIARIES ',-CC 3everages *dn 3hd (.) of ho/0in,# (F)E 3445) 6&& (.) of ho/0in,# (F)E 3448) >&

Co!! nt#1 *uccessive purchases of shares "*70*$ in an e@isting subsidiary involved in this situation. !t increase parent interest "'()*+( , -+).+ /012!-G* 3/2 purchased additional 6&# interest in ',-CC

10

3everages *dn 3hd$, thus, the result is ',-CC 3everages *dn 3hd is a wholly-owned subsidiary of '()*+( , -+).+ /012!-G* 3/2.

Not 1 'or the other subsidiaries of '()*+( , -+).+ /012!-G* 3/2, the ownership of interest does not change from '=+ :&&A to '=+ :&&>. Thus, there are no changes in ownership interest for the other subsidiaries.

KA'AN FOOD BHD

Co!! nt#1 'or all the subsidiaries of 4)8)- '002 3/2, the ownership of interest does not change from '=+ :&&A to '=+ :&&>. Thus, there are no changes in ownership interest for all the subsidiaries.

MAMEE(DOUB&E DECKER (M) BHD (.) of ho/0in,# NAME OF ASSOCIATE *pin Communication *dn. 3hd. Co!! nt#1 5)5++-20;31+ (F)E 3445) 9& 2+C4+( "5$ 3/2 (.) of ho/0in,# (F)E 3448) nil acquired *pin

Communication *dn. 3hd. by obtaining 9&# interest in the '=+ :&&>. This result in investment in an associate companies because the percentage "#$ of holdings for the associate company above is from :&-%&#. Thus, 5)5++20;31+ 2+C4+( "5$ 3/2 has significant influence - power to participate in

11

the financial and operating policy of the associate company above but not control over those policies. NAME OF SUBSIDIARIES 7acific 7lantations *dn >>.B 3hd Co!! nt#1 *uccessive purchases of shares "*70*$ in an e@isting subsidiary involved in this situation. !t increases the parent interest "5)5++20;31+ 2+C4+( "5$ 3/2 purchased additional 6.B# interest in 7acific 7lantations *dn 3hd$. >A (.) of ho/0in,# (F)E 3445) (.) of ho/0in,# (F)E 3448)

Not 1 'or the other subsidiaries of 5)5++-20;31+ 2+C4+( "5$ 3/2, there are no changes in ownership interest from '=+ :&&A to '=+ :&&>. NEST&E (M) BHD

Co!! nt#1 'or all the subsidiaries and associate companies of -+*T1+ "5$ 3/2, the ownership of interest does not change from '=+ :&&A to '=+ :&&>. Thus, there are no changes in ownership interest for all the subsidiaries and associate companies.

)EO HIAP SENG (M) BHD

(.) of ho/0in,# NAME OF ASSOCIATE *enawang +dible 0il (F)E 3445)

(.) of ho/0in,# (F)E 3448)

12

"*endirian$ 3erhad

nil

:C.A%

Co!! nt#1 =+0 /!)7 *+-G "5$ 3/2 acquired *enawang +dible 0il "*endirian$ 3erhad by obtaining :C.A%# interest in the '=+ :&&A. This result in an investment in associate companies because the percentage "#$ of holdings for the associate company is from :&-%&#. 'or the '=+ :&&>, =+0 /!)7 *+-G "5$ 3/2 disposed all of the shares in the associate company "*enawang +dible 0il "*endirian$ 3erhad$.Thus, all the accumulated interest of the associate company "*enawang +dible 0il "*endirian$ 3erhad$ will be eliminated.

Not 1 There are no changes in ownership interest for all the other subsidiaries and associate companies from '=+ :&&A to '=+ :&&>.

13

'hat i# an !"/oy

- n fit (FRS 995):

+mployee benefits include benefits provided to employees or their dependents and may be settled by payments or provision of goods or services made directly to the employees or their dependents or to others, such as insurance companies. +mployee includes those on full-time, part-time, permanent, casual or temporary basis. +mployees also include directors and other management personnel for the application of '(* 66>. 'our categories of employee benefits includeD 6. short-term employee benefits, such as wages, salaries and social security contributions, paid annual leave and paid sick leave, profit sharing and bonuses "if payable within twelve months of the end of the period$ and non-monetary benefits "such as medical care, housing, cars and free or subsidized goods or services$ for current employeesE

14

:. post-employment benefits such as pensions, other retirement benefits, post-employment life insurance and post-employment medical careE C. other long-term employee benefits, including long-service leave or sabbatical leave, ubilee or other long-service benefits, longterm disability benefits and, if they are not payable wholly within twelve months after the end of the period, profit sharing, bonuses and deferred compensationE and 9. termination benefits

Sho*t(t *! !"/oy

- n fit#

The *tandard requires an entity to recognize short-term employee benefits when an employee has rendered service in e@change for those benefits. '(* 66> "paragraph 6&$D )ll short-term employee benefits to be recognize as e@penses in the accounting period in which they are incurred. ;npaid portion of short-term employee benefits to be recognized as accrued e@penses on the face of balance sheet for the accounting period in which they are incurred. 7rofit sharing and 3onus, '(* 66> required to recognize the e@pected cost of profit-sharing and bonus payments when and only whenD

15

The entity has a present legal or constructive obligation to make such payments as a result of past eventsE and

) reliable estimate of the obligation can be made.

Po#t( !"/oy! nt - n fit# '(* 66> defines post-employment benefits asD F+mployee benefits "other than termination benefits$ which are payable after the completion of employment "paragraph A$G 7ost-employment benefit plans are classified as either defined contribution plans or defined benefit plans. The *tandard gives specific guidance on the classification of multi-employer plans, state plans and plans with insured benefits. ;nder 0 fin 0 cont*i-+tion "/an#, an entity pays fi@ed contributions into a separate entity"a fund$ and will have no legal or constructive obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in the current and prior periods "paragraph B$. The *tandard requires an entity to recognize contributions to a defined contribution plan when an employee has rendered service in e@change for those contributions. +@ampleD +7' "+mployee 7rovident 'und$ in 5alaysia. '(* 66> requires an entity to recognize the contribution payable for the year "paragraph 99$D 16

as an e@pense on the face of income statement as a liability"accrued e@pense$ for any amount that still unpaid or as an asset"prepaid e@pense$ if contribution made is more that required 7aragraph 9H1 F)n entity should disclose the amount recognized as an e@pense for defined contribution plansG. )ll other post-employment benefit plans are 0 fin 0 - n fit "/an#. 2efined benefit plans may be unfunded, or they may be wholly or partly funded. )ccounting by an enterprise for defined benefit plans involves the following stepsD 6. using actuarial techniques to make a reliable estimate of the amount of benefit that employees have earned in return for their service in the current and prior periods. This requires an enterprise to determine how much benefit is attributable to the current and prior periods "see paragraphs HA-B:$ and to make estimates "actuarial assumptions$ about demographic variables "such as employee turnover and mortality$ and financial variables "such as future increases in salaries and medical costs$ that will influence the cost of the benefit "see paragraphs BC->:$E

17

:. discounting that benefit using the 7ro ected ;nit Credit 5ethod in order to determine the present value of the defined benefit obligation and the current service cost "see paragraphs H%-HB$E C. determining the fair value of any plan assets "see paragraphs 6&C-6&%$E 9. determining the total amount of actuarial gains and losses and the amount of those actuarial gains and losses that should be recognized "see paragraphs >C->H$E %. where a plan has been introduced or changed, determining the resulting past service cost "see paragraphs >B-6&:$E and H. where a plan has been curtailed or settled, determining the resulting gain or loss "see paragraphs 669-6:&$. 8here an enterprise has more than one defined benefit plan, the enterprise applies these procedures for each material plan separately.

Oth * /on,(t *! !"/oy 2efinition "7aragraph B$D +mployee benefits

- n fit#

other

than

post-employment

benefits

and

termination benefits +mployee benefits do not fall due wholly within twelve months after the end of the period in which the employees render the related service +@ample of other long-term employee benefitsD

18

1ong-term compensated absences such as long-service or sabbatical leaveE

Iubilee or other long-service benefitsE 1ong-term disability benefitsE 7rofit sharing and bonuses payable twelve months or more after the end of the period in which the employees render the related serviceE and

2eferred compensation paid twelve months or more after the end of the period in which it is earned. The *tandard requires a simpler method of accounting for other long-

term employee benefits than for post-employment benefitsD actuarial gains and losses and past service cost are recognized immediately. '(* 66> "7aragraph %9$ requires an entity to recognize, on the face of the balance sheet, the net total of the following amounts as a liabilityD The present value of the defined benefit obligation at the balance sheet dateE and 5inus the fair value at the balance sheet date of plan assets "if any$ out of which the obligations are to be settled directly. '(* 66> "7aragraph 6:>$ requires an entity to recognize, on the face of income statement, as e@pense or incomeD Current service costE

19

!nterest costE The e@pected return on any plan assets and on any reimbursement right recognized as an assetE

)ctuarial gains and lossesE 7ast service costE The effect "gain or loss$ of any curtailments or settlements

T *!ination - n fit# Termination benefits are employee benefits payable as a result of eitherD an entityJs decision to terminate an employeeJs employment before the normal retirement dateE or an employeeJs decision to accept voluntary redundancy in e@change for those benefits. The event which gives rise to an obligation is the termination rather than employee service. Therefore, an entity should recognize termination benefits when, and only when, the entity is demonstrably committed to eitherD 6. Terminate the employment of an employee or group of employees before the normal retirement dateE or :. 7rovide termination benefits as a result of an offer made in order to encourage voluntary redundancy.

20

)n entity is demonstrably committed to a termination when, and only when, the entity has a detailed formal plan "with specified minimum contents$ for the termination and is without realistic possibility of withdrawal. 8here termination benefits fall due more than 6: months after the balance sheet date, they should be discounted. !n the case of an offer made to encourage voluntary redundancy, the measurement of termination benefits should be based on the number of employees e@pected to accept the offer.

7aragraph BD +mployee benefits payable as a result of either an entityKs decision to terminate an employeeKs employment before the normal retirement date or an employeeKs decision to accept voluntary redundancy in e@change for those benefits. '(* 66> "7aragraph 6CC$ provides that an entity should recognize termination benefits as a liability and an e@pense when, and only when, the entity is demonstrably committed to eitherD Terminate the employment of an employee or group of employees before the normal retirement dateE or 7rovide termination benefits as a result of an offer made in order to encourage voluntary redundancy '(* 66> "7aragraph 6C9$D

21

)n entity is said has a demonstrably committed to a termination when, and only when, the entity has a detailed formal plan for the termination and is without realistic possibility of withdrawal

'(* 66> "7aragraph BA$D 8here termination fall due more than 6: months after the balance sheet date, they should be measured based on their present value by discounting them using the discount rate

22

'hat i# * ti* ! nt - n fit "/an (FRS 93;): 2efinitionD "para >$ )rrangements whereby and entity provides benefits for its employees on or after termination of service "either in the form of an annual income or as a lump sum$. Classified asD 2efined contribution plans 2efined benefit plans

D fin 0 cont*i-+tion "/an 2efinitionD "'(* 6:H , para >$ (etirement benefit plans under which amounts to be paid as retirement benefits are determined by contribution of a fund together with investment earnings thereon.

23

(ecognition and measurement "refer '(* 66> para 9%-9H$ +mployer contributes a defined sum to a "third party$ plan trust. 7lan accumulates assets and makes distributions to retirees. +mployerKs pension e@pense is equal to annual contribution needed "employees are beneficiaries$. !f contribution made is less than pension e@pense, employer accrues a liability. !f contribution L e@pense, employer accrues an asset.

D fin 0 - n fit "/an 2efinitionD "'(* 6:H, para >$ (etirement benefit plans under which amounts to be paid as retirement benefits are determined by reference to a formula usually based on employeeKs earnings and or years of service.

The employee is promised a certain amount of benefits at retirement "usually periodic$.

The trust accumulates assets. The employer remains liable to ensure benefit payments. +mployer is the trust-beneficiary.

R co,nition an0 ! a#+* ! nt1

24

S *vic co#t#1 )ctual valuation : types of cost D

6. Current service cost )n amount of e@pense. 2etermined on an accrual basis assigned at each period in the retirement benefit plan for current service by the employee. 2etermined by professional actuaries.

:. 7ast service cost )n actuarially determined cost. Gives the employees credit for benefit of their prior services.

)rises onD 6. The introduction of the retirement benefit plan. :. 5aking improvements to an e@isting plan. C. Completion of minimum service requirements for eligibility.

Act+a*ia/ ,ain# an0 &o## # +nd of year, closing balance of 7lan assets and the 7resent .alue of 0bligation. )d usted to fair value

25

8ill create a balancing figure in the accounts 3alancing amount is transferred to actuarial gain or loss account -et amount of actuarial gain or loss

(ecognised in !ncome *tatement sub ect to 6&# corridor test

26

'hat i# #ha* (-a# 0 "ay! nt (FRS 3): The payment for goods and services by issuing equity instruments. 'or e@ample, the offering of shares and share options to employees and goods acquired from outside parties by e@changing shares.

*hare-based payment transaction for services includesD 6. Call option given to employees to purchase an entityKs shares in e@change for services. :. *hare ownership schemes where employees receive an entityKs share in e@change for services

*hare appreciation right that entitles employees to payment calculated by reference to the market price of an entityKs shares or shares of another

27

entity within the group. 7ayment made to e@ternal consultants that are calculated based on the entityKs share price 8hen payment is made to outside parties the goods and services are recorded at fair value. Corresponding equity or liability is recognized. 7ayment made to employees for the service given is measured at fair value of equity given. The entity will recognized cost and charged to income statement and equity will appear in balance sheet.

Three important datesD G*ant 0at 2ate when entity and counterparty agree to share-based payment, and the entity confers the right to equity instruments % #tin, P *io0 .esting period is the period during which the specified vesting conditions of share-based arrangement are satisfied. !t can be specific time such as when the employee has fulfilled the terms stipulated. .esting conditions are conditions that the counter party has to fulfill in order to receive the share-based payment E< *ci# 0at

28

2ate when holders of the options acquires the share

Three Types of *hare-3ased 7aymentD 6. +quity-settled payment - !ssue own equity as consideration for goods and services. :. Cash-settled - 7ay cash calculated based to reference to the price of own equity as consideration for goods and services. C. Choice of equity-settled or cash-settled - 5ay choose whether the entity-settled or cash settled

29

FRASER $ NEA%E HO&DINGS BHD The accounting policy used can be found on "a, 94;(94= (not 3) of the annual report "'=+ :&&>$.

30

31

Di#c/o#+*

* >+i* ! nt#1 The wages, salaries, bonuses and +7'

contributions are recognized as an e@pense in the income statement for the year in which the associated services are rendered. (Not ?) (Pa, 998(995)

32

33

D fin 0 - n fit "/an# 0i#c/o#+* 1 Not 3@ ("a, 9@5)

34

P* # ntation * >+i* ! nt#1 The wages, salaries, bonuses and social security contributions are recognized as an e@pense in the income statement under 7rofit before ta@ation. (Pa, 5@)

EATRACTED INCOME STATEMENT F)E @4 SEPTEMBER 3445

35

P* # ntation

* >+i* ! nt#1

The

amount

recognized

"provision

for

retirement benefits$ "defined benefit plans$ in the balance sheet represents the present value of the defined benefit obligations ad usted for unrecognized actuarial gains and losses and unrecognized past service costs, and reduced by the fair value of plan assets. (Pa, 5?)

EATRACTED BA&ANCE SHEET AS AT @4 SEPTEMBER 3445

36

P* # ntation * >+i* ! nt#1 7ayment of retirement benefits and provision for retirement benefits are recognized in the cash flow statement under the operating activities. (Pa, 55) EATRACTED STATEMENT OF CASH F&O' F)E @4 SEPTEMBER 3445

37

KA'AN FOOD BHD The accounting policy used can be found on "a, B5 (not 3) of the annual report "'=+ :&&>$.

38

E!"/oy

- n fit# fo* C y !ana, ! nt " *#onn / 0i#c/o#+* 1

(Not 9=) (Pa, ;@)

39

Di#c/o#+*

* >+i* ! nt#1 The wages, salaries, bonuses and +7'

contributions are recognized as an e@pense in the income statement for the year in which the associated services are rendered. (Not 9;) (Pa, ;3)

40

P* # ntation * >+i* ! nt#1 The wages, salaries, bonuses and +7' contributions are recognized as an e@pense in the income statement under 7rofit before ta@. (Pa, @=)

EATRACTED INCOME STATEMENT F)E @9 DECEMBER 3445

41

MAMEE(DOUB&E DECKER (M) BHD The accounting policy used can be found on "a, 8@(8B (not 3) of the annual report "'=+ :&&>$.

42

+mployees also include directors and other management personnel for the application of '(* 66>. The wages, salaries, bonuses and +7' contributions are recognized as an e@pense in the income statement.

(Fo* n <t "a, ) Di#c/o#+*

* >+i* ! nt#1 The wages, salaries, bonuses

and +7' contributions are recognized as an e@pense in the income statement for the year in which the associated services are rendered. (Not ;) (Pa, 8;)

43

44

P* # ntation * >+i* ! nt#1 The wages, salaries, bonuses and defined contribution plans are recognized as an e@pense in the income statement under 7rofit from operations. (Pa, ;3)

EATRACTED INCOME STATEMENT F)E @9 DECEMBER 3445

45

NEST&E (M) BHD The accounting policy used can be found on "a, 3?(3; (not 3) of the annual report "'=+ :&&>$.

46

P* # ntation * >+i* ! nt#1 (ecognition of defined benefit plan actuarial gainsM"losses$. (Pa, 93)

47

Di#c/o#+*

* >+i* ! nt#1 The wages, salaries, bonuses and +7'

contributions are recognized as an e@pense in the income statement for the year in which the associated services are rendered. (Not 9?) (Pa, B?)

48

E!"/oy

- n fit# fo* C y !ana, ! nt " *#onn / 0i#c/o#+* 1

(Not 9;) (Pa, B;)

49

D fin 0 - n fit "/an# 0i#c/o#+* 1 Not 9@ ("a, B4(B3)

50

51

52

P* # ntation * >+i* ! nt#1 The wages, salaries, bonuses and +7' contributions are recognized as an e@pense in the income statement under 0perating profit. (Pa, 99)

EATRACTED INCOME STATEMENT F)E @9 DECEMBER 3445

53

P* # ntation * >+i* ! nt#1 The amount recognized "employee benefits$ in the balance sheet. (Pa, 94) EATRACTED BA&ANCE SHEET AS AT @9 DECEMBER 3445

54

P* # ntation * >+i* ! nt#1 7ayment related to employee benefits is recognized in the cash flow statement under the operating activities. (Pa, 9@) EATRACTED STATEMENT OF CASH F&O' F)E @9 DECEMBER 3445

55

)EO HIAP SENG (M) BHD The accounting policy used can be found on "a, =8(=5 (not @) of the annual report "'=+ :&&>$.

56

Di#c/o#+* * >+i* ! nt#1 (ecognition of provision for retirement benefits. (Not 38) (Pa, 94=(948)

57

Di#c/o#+*

* >+i* ! nt#1 The wages, salaries, bonuses and +7'

contributions are recognized as an e@pense in the income statement for the year in which the associated services are rendered. (Not 5) (Pa, 8=)

58

Di* cto*D# * !+n *ation 0i#c/o#+* 1 (Not 8) (Pa, 8;)

P* # ntation * >+i* ! nt#1 The staff costs and +7' contributions "under profitMloss from operations$ are recognized as an e@pense in the income statement. (Pa, ?=)

EATRACTED INCOME STATEMENT F)E @9 DECEMBER 3445

59

P* # ntation * >+i* ! nt#1 (ecognition of provision for retirement benefits. (Pa, ;4) EATRACTED BA&ANCE SHEET AS AT @9 DECEMBER 3445

60

P* # ntation * >+i* ! nt#1 7ayment related to employee benefits is recognized in the cash flow statement under the operating activities. (Pa, ;B) EATRACTED STATEMENT OF CASH F&O' F)E @9 DECEMBER 3445

61

FRASER $ NEA%E HO&DINGS BHD

62

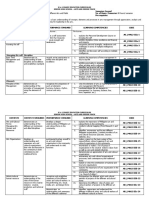

&EGENDS1 (+C05. N (ecommendation 'M* N 'inancial *tatements )CC. N )ccounting -M) N -ot applicable

!M* N !ncome *tatement 3M* N 3alance *heet CM' N Cash 'low

COMP&IANCE ANA&)SIS CATEGORIES OF EMP&O)EE BENEFITS PRESENTATION IN FFS NOTES IN FFS

ACCE PO&IC) USED FRS RECOME

REMARKS (REFER ANNUA& REPORT 3445)

*hort-term employee benefits

=es

=es

=es

-ote : " $"i$ -ote % !M*-7age >C

2efined Contribution 7lans 7ostemployment benefits 2efined 3enefit 7lans

=es

=es

=es

-ote : " $"ii$ -ote % !M*-7age >C

=es

=es

=es

-ote : " $"iii$ -ote :C 3M*-7age >% CM'-7age >>

0ther long-term employee benefits

-M)

-M)

-M)

-M)

Termination benefits KA'AN FOOD BHD

-M)

-M)

-M)

-M)

63

&EGENDS1 (+C05. N (ecommendation 'M* N 'inancial *tatements )CC. N )ccounting -M) N -ot applicable

!M* N !ncome *tatement 3M* N 3alance *heet CM' N Cash 'low

COMP&IANCE ANA&)SIS CATEGORIES OF EMP&O)EE BENEFITS PRESENTATION IN FFS NOTES IN FFS

ACCE PO&IC) USED FRS RECOME

REMARKS (REFER ANNUA& REPORT 3445)

*hort-term employee benefits

=es

=es

=es

-ote : "m$ -ote 6H -ote 6B !M*-7age CB

2efined Contribution 7lans 7ostemployment benefits 2efined 3enefit 7lans

=es

=es

=es

-ote : "m$ -ote 6H -ote 6B !M*-7age CB

-M)

-M)

-M)

-M)

0ther long-term employee benefits

-M)

-M)

-M)

-M)

Termination benefits

-M)

-M)

-M)

-M)

MAMEE(DOUB&E DECKER (M) BHD

64

&EGENDS1 (+C05. N (ecommendation 'M* N 'inancial *tatements )CC. N )ccounting -M) N -ot applicable

!M* N !ncome *tatement 3M* N 3alance *heet CM' N Cash 'low

COMP&IANCE ANA&)SIS CATEGORIES OF EMP&O)EE BENEFITS PRESENTATION IN FFS NOTES IN FFS

ACCE PO&IC) USED FRS RECOME

REMARKS (REFER ANNUA& REPORT 3445)

*hort-term employee benefits

=es

=es

=es

-ote : "t$"i$ -ote H -ote B !M*-7age H:

2efined Contribution 7lans 7ostemployment benefits 2efined 3enefit 7lans

=es

=es

=es

-ote : "t$"ii$ -ote H -ote B !M*-7age H:

-M)

-M)

-M)

-M)

0ther long-term employee benefits

-M)

-M)

-M)

-M)

Termination benefits NEST&E (M) BHD

-M)

-M)

-M)

-M)

65

&EGENDS1 (+C05. N (ecommendation 'M* N 'inancial *tatements )CC. N )ccounting -M) N -ot applicable !M* N !ncome *tatement 3M* N 3alance *heet CM' N Cash 'low (M+ N (ecog. 0f !ncome , +@pense

COMP&IANCE ANA&)SIS CATEGORIES OF EMP&O)EE BENEFITS PRESENTATION IN FFS NOTES IN FFS

ACCE PO&IC) USED FRS RECOME

REMARKS (REFER ANNUA& REPORT 3445)

*hort-term employee benefits

=es

=es

=es

-ote : "l$"i$ -ote 6% -ote 6H !M*-7age 66

2efined Contribution 7lans 7ostemployment benefits 2efined 3enefit 7lans

=es

=es

=es

-ote : "l$"i$ -ote 6% -ote 6H !M*-7age 66 -ote : "l$"ii$ -ote 6C 3M*-7age 6& CM'-7age 6C (M+-7age 6:

=es

=es

=es

0ther long-term employee benefits Termination benefits )EO HIAP SENG (M) BHD

-M)

-M)

-M)

-M)

-M)

=es

=es

-ote : "l$"iii$

66

&EGENDS1 (+C05. N (ecommendation 'M* N 'inancial *tatements )CC. N )ccounting -M) N -ot applicable

!M* N !ncome *tatement 3M* N 3alance *heet CM' N Cash 'low

COMP&IANCE ANA&)SIS CATEGORIES OF EMP&O)EE BENEFITS PRESENTATION IN FFS NOTES IN FFS

ACCE PO&IC) USED FRS RECOME

REMARKS (REFER ANNUA& REPORT 3445)

*hort-term employee benefits

=es

=es

=es

-ote C "p$"i$ -ote A -ote > !M*-7age %B

2efined Contribution 7lans 7ostemployment benefits 2efined 3enefit 7lans

=es

=es

=es

-ote C "p$"ii$ -ote A -ote > !M*-7age %B -ote C "p$"ii$ -ote :A 3M*-7age H& CM'-7age H9

=es

=es

=es

0ther long-term employee benefits

-M)

-M)

-M)

-M)

Termination benefits

-M)

-M)

-M)

-M)

67

COMP&IANCE &E%E& OF SE&ECTED DISC&OSURES

68

FRS 995

FRASER $ NEA%E HO&DINGS BHD

KA'AN FOOD BHD

MAMEE( DOUB&E DECKER (M) BHD

NEST&E (M) BHD

)EO HIAP SENG (M) BHD

7ara A 7ara 6& 7ara 99 7ara 9H 7ara %9 7ara H6 7ara H9 7ara BA 7ara 6:> 7ara 6CC 7ara 6C9

G G G G G G G

G G G G

G G G G

G G G G G G G G

G G G G G G G

G G

BRIEF DISCUSSIONS

0ur findings from the previous page shows that -+*T1+ "5$ 3/2 complied the most with the selected disclosures because this company used three among the four categories of employee benefits. !t has termination benefits while the other companies above donKt have any termination benefits.

69

5oderately complied with the selected disclosures would be '()*+( , -+).+ /012!-G* 3/2 and =+0 /!)7 *+-G "5$ 3/2 because these two companies have defined benefit plans compared to 4)8)- '002 3/2 and 5)5++-20;31+ 2+C4+( "5$ 3/2. 1astly, the less complied with the selected disclosures would be 4)8)- '002 3/2 and 5)5++-20;31+ 2+C4+( "5$ 3/2 because compared to other companies above, these two companies have short-term employee benefits and defined contribution plans only.

REFERENCES

SHORT-TERM EMPLOYEE BENEFITS FRS 995 ("a*a,*a"h 8) provides that short-term employee benefits includeD 8ages, salaries and social security contributionE

70

*hort-term compensated absences such as paid annual leave and paid sick leave.

7rofit-sharing and bonuses payable within 6: months after the end of the period in which the employees render the related serviceE and

-on-monetary benefits "such as medical care, housing, cars and free or subsidized goods or services$ for current employees.

FRS 995 ("a*a,*a"h 94) )ll short-term employee benefits to be recognize as e@penses in the accounting period in which they are incurred. ;npaid portion of short-term employee benefits to be recognize as accrued e@penses on the face of balance sheet for the accounting period in which they are incurred.

POST-EMPLOYMENT BENEFITS AE D fin 0 Cont*i-+tion P/an# FRS 995 ("a*a,*a"h BB) requires an entity to recognize the contribution payable for the yearD as an e@pense on the face of income statement.

71

as a liability"accrued e@pense$ for any amount that still unpaid or as an asset"prepaid e@pense$ if contribution made is more that required.

FRS 995 ("a*a,*a"h B;) requires an entity to disclose the amount recognized as an e@pense for defined contribution plans.

BE D fin 0 B n fit# P/an# FRS 995 ("a*a,*a"h ?B) requires an entity to recognize, on the face of balance sheet, the net total of the following amounts as a liabilityD the present value of the defined benefit obligation at the balance sheet dateE plus any actuarial gains "less any actuarial losses$ not recognizedE minus any past service cost not yet recognizedE and minus the fair value at the balance sheet date of plan assets "if any$ out of which the obligations are to be settled directly

FRS 995 ("a*a,*a"h ;9) requires an entity to recognize, on the face of income statement, the net total of the following amountsD current service costE interest costE

72

the e@pected return on any plan assets and on any reimbursement rightsE

actuarial gains and lossesE past service costE and the effect of any curtailments or settlements "gain or loss$

FRS 995 ("a*a,*a"h ;B) requires an entity to use the pro ected unit credit method to determine the present value of its defined benefit obligations, the related current service cost and past service cost.

OTHER LONG-TERM EMPLOYEE BENEFITS FRS 995 (Pa*a,*a"h ?B) requires an entity to recognize, on the face of the balance sheet, the net total of the following amounts as a liabilityD

73

The present value of the defined benefit obligation at the balance sheet dateE and

5inus the fair value at the balance sheet date of plan assets "if any$ out of which the obligations are to be settled directly.

FRS 995 (Pa*a,*a"h 935) requires an entity to recognize, on the face of income statement, as e@pense or incomeD Current service costE !nterest costE The e@pected return on any plan assets and on any reimbursement right recognized as an assetE )ctuarial gains and lossesE 7ast service costE The effect "gain or loss$ of any curtailments or settlements

TERMINATION BENEFITS

FRS 995 (Pa*a,*a"h =8)1

74

8here termination falls due more than 6: months after the balance sheet date, they should be measured based on their present value by discounting them using the discount rate.

FRS 995 (Pa*a,*a"h 9@@)1 provides that an entity should recognize termination benefits as a liability and an e@pense when, and only when, the entity is demonstrably committed to eitherD Terminate the employment of an employee or group of employees before the normal retirement dateE or 7rovide termination benefits as a result of an offer made in order to encourage voluntary redundancy

FRS 995 (Pa*a,*a"h 9@B)1 )n entity is said has a demonstrably committed to a termination when, and only when, the entity has a detailed formal plan for the termination and is without realistic possibility of withdrawal.

75

CONC&USION 'rom our findings, 4)8)- '002 3/2 and 5)5++-20;31+ 2+C4+( "5$ 3/2 complied the least with the selected disclosures because the other selected companies have more employee benefit items. The accounting policies used by every company actually do not violate any 76

accounting policy and standards set by '(* 66>. *o, it means here that all these five companies are fully complied with the accounting policies that they used although some of them may not have all the employee benefit items.

RECOMMENDATION 8e recommend that each of those selected companies to revise back the accounting policies and disclosures requirement when preparing the annual report for :&6& because there are some improvements in '(* 66>. The effective date would be on 6 Ianuary :&6& where 7aragraphs B, A"b$, C:3, >B, >A, 666 and 6H& are amended "new te@t is underlined and deleted te@t is struck through$. 7aragraphs 666) and 6%>2 are also added.

77

Das könnte Ihnen auch gefallen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Business CasesDokument8 SeitenBusiness Casescaguas00725Noch keine Bewertungen

- Award Evaluation FormDokument8 SeitenAward Evaluation Formafolabit99Noch keine Bewertungen

- Earnings Per Share: Accounting Standard (AS) 20Dokument27 SeitenEarnings Per Share: Accounting Standard (AS) 20Akshay JainNoch keine Bewertungen

- Security AnalysisDokument87 SeitenSecurity AnalysislakshmanlakhsNoch keine Bewertungen

- The Financial Performance and Corporate Governance Disclosure: A Study in The Annual Reports of Listed Companies of BangladeshDokument11 SeitenThe Financial Performance and Corporate Governance Disclosure: A Study in The Annual Reports of Listed Companies of BangladeshAbdul SaboorkhanNoch keine Bewertungen

- FM11 CH 16 Mini-Case Cap Structure DecDokument11 SeitenFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNoch keine Bewertungen

- GP Ocean Food BerhadDokument4 SeitenGP Ocean Food BerhadlilymintNoch keine Bewertungen

- Case Study Debt Policy Ust IncDokument10 SeitenCase Study Debt Policy Ust IncIrfan MohdNoch keine Bewertungen

- Business Valuation Model ExcelDokument20 SeitenBusiness Valuation Model ExcelWagane DioufNoch keine Bewertungen

- Contract of Subscription and May Not Be Impaired by Its RepealDokument2 SeitenContract of Subscription and May Not Be Impaired by Its RepealHoney BiNoch keine Bewertungen

- Module 3 Answers To End of Module QuestionsDokument40 SeitenModule 3 Answers To End of Module QuestionsYanLi100% (3)

- LLP Agreement FormatDokument10 SeitenLLP Agreement Formatnishathkhan7547Noch keine Bewertungen

- Order in The Matter of Greentouch Projects Ltd.Dokument15 SeitenOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- Term Paper: Prime Bank LTDDokument31 SeitenTerm Paper: Prime Bank LTDPrince DiuNoch keine Bewertungen

- Foreign Direct Investment: Global & Bangladesh Perspective: Assignment OnDokument32 SeitenForeign Direct Investment: Global & Bangladesh Perspective: Assignment OnNahid AhmedNoch keine Bewertungen

- Bar Examination 2006 Labor and Social LegislationDokument6 SeitenBar Examination 2006 Labor and Social LegislationbubblingbrookNoch keine Bewertungen

- A Study On Equity AnalysisDokument61 SeitenA Study On Equity AnalysisRitika KhuranaNoch keine Bewertungen

- University of Mauritius: Faculty of Law and ManagementDokument14 SeitenUniversity of Mauritius: Faculty of Law and ManagementKlaus MikaelsonNoch keine Bewertungen

- Marketing Term Paper .... SkodaDokument18 SeitenMarketing Term Paper .... Skodarohitpatil999Noch keine Bewertungen

- T1 2012 ChecklistDokument9 SeitenT1 2012 ChecklistVijay SinghNoch keine Bewertungen

- Devender Singh: Healthcare Industry Sales ProfessionalDokument2 SeitenDevender Singh: Healthcare Industry Sales ProfessionalAnkitSharmaNoch keine Bewertungen

- Dividend Policy For Mullin PLC in Post-Recession U.KDokument5 SeitenDividend Policy For Mullin PLC in Post-Recession U.KCharles OdadaNoch keine Bewertungen

- Introduction To Microeconomics With LRT Lesson 1Dokument6 SeitenIntroduction To Microeconomics With LRT Lesson 1Lino Jr GordoncilloNoch keine Bewertungen

- Accounting Annual Report ProjectDokument6 SeitenAccounting Annual Report Projectapi-242011284Noch keine Bewertungen

- Asad Ahmed Wyen: Personal InformationDokument5 SeitenAsad Ahmed Wyen: Personal InformationAdnan MunirNoch keine Bewertungen

- Leadership Handout Leadership Handout: MECH4205 (5) - Engineering Management II Semester 2 - Academic Year 2011 / 2012Dokument24 SeitenLeadership Handout Leadership Handout: MECH4205 (5) - Engineering Management II Semester 2 - Academic Year 2011 / 2012Asif SoopeeNoch keine Bewertungen

- Actions Required Under CA 2013Dokument5 SeitenActions Required Under CA 2013ranjusanjuNoch keine Bewertungen

- CASE STUDY-Financial Statement AnalysisDokument10 SeitenCASE STUDY-Financial Statement AnalysisRajni Sinha VermaNoch keine Bewertungen

- Assignment (FIN 201)Dokument22 SeitenAssignment (FIN 201)amit-badhanNoch keine Bewertungen

- Business Plan TemplateDokument19 SeitenBusiness Plan TemplateGraham FaheyNoch keine Bewertungen

- Airtel MOADokument10 SeitenAirtel MOAAmanNoch keine Bewertungen

- FM StudyguideDokument18 SeitenFM StudyguideVipul SinghNoch keine Bewertungen

- Financial Statement Analysis of Square PharmaceuticalsDokument15 SeitenFinancial Statement Analysis of Square PharmaceuticalsAushru HasanNoch keine Bewertungen

- ZTE UMTS KPI Optimization Analysis Guide V1 1 1Dokument62 SeitenZTE UMTS KPI Optimization Analysis Guide V1 1 1GetitoutLetitgo100% (1)

- Marketing Plan TemplateDokument41 SeitenMarketing Plan TemplateAqeel Bilal MalikNoch keine Bewertungen

- First Time Manager Registration FormDokument2 SeitenFirst Time Manager Registration FormProchetto DaNoch keine Bewertungen

- Week 1 DefinitionsDokument11 SeitenWeek 1 DefinitionsGladi NashNoch keine Bewertungen

- Chapter 20 Consolidated Income Statement: 1. ObjectivesDokument13 SeitenChapter 20 Consolidated Income Statement: 1. Objectivessamuel_dwumfourNoch keine Bewertungen

- HDFC Bank Home LoanDokument30 SeitenHDFC Bank Home LoanMark MurphyNoch keine Bewertungen

- Managing Financial Resources & DecisionsDokument23 SeitenManaging Financial Resources & DecisionsShaji Viswanathan. Mcom, MBA (U.K)Noch keine Bewertungen

- Team-2 Cameron Auto Parts CaseDokument5 SeitenTeam-2 Cameron Auto Parts CaseArun PrakashNoch keine Bewertungen

- Business EnvironmentDokument22 SeitenBusiness EnvironmentShakeeb Ahmed100% (1)

- Answer All: TEST 2 FIN 542 International Financial Management 2012Dokument5 SeitenAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- 2004-2006 Bar Questions For Mercantile LawDokument12 Seiten2004-2006 Bar Questions For Mercantile LawLuis_Artaiz_USTNoch keine Bewertungen

- Research QuestionDokument6 SeitenResearch QuestionatirahrashedNoch keine Bewertungen

- Solutions To Chapters 7 and 8 Problem SetsDokument21 SeitenSolutions To Chapters 7 and 8 Problem SetsMuhammad Hasnain100% (1)

- TRIVENI140509 Wwwmon3yworldblogspotcomDokument3 SeitenTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNoch keine Bewertungen

- How You Work With HeadhuntersDokument2 SeitenHow You Work With HeadhuntersDarren ConquestNoch keine Bewertungen

- Kenya Methodist University: Faculty of Business & Management StudiesDokument15 SeitenKenya Methodist University: Faculty of Business & Management StudiesAlice WairimuNoch keine Bewertungen

- Husein Sugar Mills Limited - Management Letter - 30 September 2011Dokument4 SeitenHusein Sugar Mills Limited - Management Letter - 30 September 2011Fahad ChaudryNoch keine Bewertungen

- Annual Report of RupalDokument88 SeitenAnnual Report of RupalasifbhaiyatNoch keine Bewertungen

- C 3 A F S: Hapter Nalysis of Inancial TatementsDokument27 SeitenC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNoch keine Bewertungen

- Consulting Agreement ShortDokument3 SeitenConsulting Agreement ShortMuhamad AziziNoch keine Bewertungen

- Compensation Rules and Design GuidelinesDokument4 SeitenCompensation Rules and Design GuidelinesParamita SarkarNoch keine Bewertungen

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”Von EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”Noch keine Bewertungen

- The Making of a Doctor Part 2: The SequelVon EverandThe Making of a Doctor Part 2: The SequelNoch keine Bewertungen

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryVon EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- LEJARDokument1 SeiteLEJARFarah FarhainNoch keine Bewertungen

- Acc KKDokument9 SeitenAcc KKFarah FarhainNoch keine Bewertungen

- Upload DocumentDokument1 SeiteUpload DocumentFarah FarhainNoch keine Bewertungen

- Upload DocumentDokument1 SeiteUpload DocumentFarah FarhainNoch keine Bewertungen

- Soalan PADokument11 SeitenSoalan PAFarah FarhainNoch keine Bewertungen

- Question 2Dokument1 SeiteQuestion 2Farah FarhainNoch keine Bewertungen

- Question 4Dokument1 SeiteQuestion 4Farah FarhainNoch keine Bewertungen

- Latihan SiswazahDokument2 SeitenLatihan SiswazahFarah FarhainNoch keine Bewertungen

- Question 4Dokument1 SeiteQuestion 4Farah FarhainNoch keine Bewertungen

- Tffiit Ssffi Iffi Ak&B: NrqpreuDokument1 SeiteTffiit Ssffi Iffi Ak&B: NrqpreuFarah FarhainNoch keine Bewertungen

- Function of Shape Tween and Classic TweenDokument1 SeiteFunction of Shape Tween and Classic TweenFarah FarhainNoch keine Bewertungen

- Ethnocentric EducationDokument2 SeitenEthnocentric EducationFarah FarhainNoch keine Bewertungen

- Malaysian Financial Reporting Standard 8Dokument9 SeitenMalaysian Financial Reporting Standard 8Farah FarhainNoch keine Bewertungen

- Subtitle FlypaperDokument103 SeitenSubtitle FlypaperFarah FarhainNoch keine Bewertungen

- Subtitle FlypaperDokument103 SeitenSubtitle FlypaperFarah FarhainNoch keine Bewertungen

- Capital Allowance QuestionDokument1 SeiteCapital Allowance QuestionFarah FarhainNoch keine Bewertungen

- Ethnocentric EducationDokument2 SeitenEthnocentric EducationFarah FarhainNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Ethnocentric EducationDokument2 SeitenEthnocentric EducationFarah FarhainNoch keine Bewertungen

- Group Assignment Far 1Dokument3 SeitenGroup Assignment Far 1Farah Farhain100% (1)

- SAP IM Overview - High LevelDokument1 SeiteSAP IM Overview - High LevelMurtaza KhanNoch keine Bewertungen

- Master Budget With AnswersDokument13 SeitenMaster Budget With AnswersCillian Reeves75% (4)

- OOP Assignment#1 (181209) Program CodeDokument3 SeitenOOP Assignment#1 (181209) Program CodeAli AhmadNoch keine Bewertungen

- Free Online Trading Tools: by Andrew FlemingDokument29 SeitenFree Online Trading Tools: by Andrew FlemingIntraday FortuneNoch keine Bewertungen

- Government Budget and Its ComponentsDokument7 SeitenGovernment Budget and Its ComponentsRitesh Kumar SharmaNoch keine Bewertungen

- Work Together 6-1 6-2 6-3Dokument1 SeiteWork Together 6-1 6-2 6-3James SargentNoch keine Bewertungen

- Ch03 6th Ed Narayanaswamy Financial AccountingDokument13 SeitenCh03 6th Ed Narayanaswamy Financial AccountingRam Kishore100% (2)

- Mehrub ResumeDokument1 SeiteMehrub ResumeZeehenul IshfaqNoch keine Bewertungen

- Lecture 8 - Exercises - SolutionDokument8 SeitenLecture 8 - Exercises - SolutionIsyraf Hatim Mohd TamizamNoch keine Bewertungen

- 23Dokument2 Seiten23Heaven HeartNoch keine Bewertungen

- This Study Resource WasDokument2 SeitenThis Study Resource WasJamaica DavidNoch keine Bewertungen

- Food &beverage Operations Management: AssignmentDokument33 SeitenFood &beverage Operations Management: AssignmentIanc Florin100% (1)

- Micro Fridge Case Study-VaibDokument5 SeitenMicro Fridge Case Study-VaibVaibhav Maheshwari50% (2)

- Bid DocumentDokument40 SeitenBid DocumentcatcpkhordhaNoch keine Bewertungen

- Accounting Policy Memo - Cash Equivalents & ST InvestmentsDokument2 SeitenAccounting Policy Memo - Cash Equivalents & ST Investmentsdalebowen100% (1)

- FL RFBTDokument13 SeitenFL RFBTalyssagd100% (1)

- Philippine Deposit Insurance CorporationDokument43 SeitenPhilippine Deposit Insurance CorporationRepolyo Ket CabbageNoch keine Bewertungen

- What Does The Word BIBLE Mean Rev 1Dokument1 SeiteWhat Does The Word BIBLE Mean Rev 1Kurozato CandyNoch keine Bewertungen

- Horizontal & Vertical AnalysisDokument7 SeitenHorizontal & Vertical AnalysisMisha SaeedNoch keine Bewertungen

- BEC Notes Chapter 3Dokument6 SeitenBEC Notes Chapter 3cpacfa90% (10)

- Mutual Funds Icici Bank Limited - NewDokument6 SeitenMutual Funds Icici Bank Limited - NewMohdmehraj PashaNoch keine Bewertungen

- Tutorial 7Dokument2 SeitenTutorial 7It's Bella RobertsonNoch keine Bewertungen

- Chapter 12-Portfolio Returns - Efficient Frontier PDFDokument48 SeitenChapter 12-Portfolio Returns - Efficient Frontier PDFEnis ErenözlüNoch keine Bewertungen

- Revision - PLPDokument61 SeitenRevision - PLPedward scottNoch keine Bewertungen

- Group 3 - Lending Club Case Study Solutions FinalDokument2 SeitenGroup 3 - Lending Club Case Study Solutions FinalArpita GuptaNoch keine Bewertungen

- May Bank Kim Eng PDFDokument19 SeitenMay Bank Kim Eng PDFFerry PurwantoroNoch keine Bewertungen

- Acc 702 Assignment 2Dokument10 SeitenAcc 702 Assignment 2laukkeasNoch keine Bewertungen

- CMA Prospectus Syl 2016Dokument68 SeitenCMA Prospectus Syl 2016Niraj AgarwalNoch keine Bewertungen

- CFO1Dokument6 SeitenCFO1vivekNoch keine Bewertungen

- Arts and Design - Leadership and Management in Different Arts Fields CGDokument10 SeitenArts and Design - Leadership and Management in Different Arts Fields CGKarl Winn Liang100% (1)