Beruflich Dokumente

Kultur Dokumente

Stamp Duty Calculator

Hochgeladen von

jmathew_984887Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stamp Duty Calculator

Hochgeladen von

jmathew_984887Copyright:

Verfügbare Formate

12/27/13

Stamp Duty Calculator | Calculate Stamp Duty | Stamp Duty Charges

Delhi

Enter Keyword

PROPERTY

Property Property Advice Stamp Duty Calculator

Ad muted. Undo We'll do our best to show you more relevant ads in the Stamp Duty Calculator future. Help us show you better ads by updating your ads settings.

Stamp duty is collected on the basis of property value at the time of registration. SDs amount varies from state to state and also property type old or new. Since it adds up to the property cost, its better to have a fair idea before finalise your property deal. Sulekhas Stamp Duty Calculator helps you to know the amount beforehand. Enter the Property Details Result State: Kerala Stamp Duty (Rs):35,700 Calculation Info:Stamp Duty Rate in Kerala is 8.5% of Property value. 42,00,00 Property Value (Rs): CalculateReset FAQ's in Stamp Duty Calculator 1) What is stamp duty? Why should stamp duty be paid? It is a tax, similar to sales tax and income tax, collected by the Government. Stamp Duty is payable under Section 3 of the Indian Stamp Act, 1899. Rates of stamp duty payable for different types of documents are as per Schedule I. Stamp Duty must be paid in full and on time. If there is a delay in payment of stamp duty, it attracts penalty. A stamp duty paid document gets evidentiary value and is admitted as evidence in Court. Document not properly stamped, is not admitted as evidence by the Court. 2) What is the purpose of Indian Stamp Act? The purpose of enacting such an Act is to raise revenue for the local governments. Additionally, payment of stamp duty imparts legality to the document and this can be submitted as an authentic document in courts. 3) How should one sign an instrument affixed with adhesive stamp? As per the provisions of Section 12, any person executing an instrument affixed with adhesive stamp, shall cancel the adhesive stamp so affixed by writing on or across the stamp his name or initials. If such an adhesive stamp has not been cancelled in the aforesaid manner, such a stamp is deemed to be unstamped. 4) What is instrument? Instrument means any document by which any right or liability is, or purports to be, created, transferred, limited, extended, extinguished or recorded. 5) How should instruments stamped with impressed stamp be written? As per the provision of Section 13 of the Indian Stamp Act, 1899, any instrument on an impressed stamp, shall be written in such manner that the stamp may appear on the face of the instrument and cannot be used for or applied to any other instrument i.e., cancel the adhesive stamp so affixed by writing on or across the stamp his name or initials. If such an adhesive stamp has not been cancelled in the aforesaid manner, such a stamp is deemed to be unstamped. Hide 6) How are stock and marketable securities valued? As per the provision of Section 21 of the Indian Stamp Act, 1899, any instrument chargeable with ad valorem duty in respect of any stock or any marketable or other security, such duty shall be calculated on the value thereof on the day of the date of the instrument. 7) How is a property subject to mortgage, when transferred to the mortgagee, charged? As per the provision of Section 24, when any property subject to a mortgage is transferred to the mortgagee, he shall be entitled to deduct from the duty payable on the transfer the amount of any duty already paid in respect of the mortgage. 8) When can one ask for refund of stamp duty? 11. As per the provisions of Sections 49, 50, 52, 53 and 54, Stamp Duty can be refunded under the following circumstances:: 1. Spoiled Stamps 2. Misused Stamps 3. Stamps used in excess of the value required 4. Stamps not required for use. 9) How is stamp duty paid in transactions where more than one instrument is required? As per Section 4 of the Indian Stamp Act, 1899, stamp duty is paid only on one of the principal instruments and on the balance documents only minimum duty is payable. 10) Whether Stamp duty is payable on transactions or on instruments? It is payable on instruments and not on transactions. The definition of the term instrument is very wide. 11) What is document? As defined in Evidence Act, document means only matter expressed or described upon substance by means of letters, figures or marks or by more than any of those means intended to be used or which may use for the purpose of recording that matter. 12) Can stamp duty be paid in India, for documents executed outside India? As per Section 18 of the Indian Stamp Act, 1899, any instrument executed out of India can be stamped in India, provided it is stamped within 3 months from the date it has been first received in India. 13) Stamp Duty is paid on ad valorem basis. What does this implies? It means that - Stamp Duty is paid on basis of value of property. 14) How stamp duty payable can be determined? Usually, the executor himself can calculate the stamp duty payable on document as per the rates provided in the Indian Stamp Act, 1899 or the State Stamp Act, as the

property.sulekha.com/stamp-duty-calculator#shwMorea

1/4

12/27/13

Stamp Duty Calculator | Calculate Stamp Duty | Stamp Duty Charges

case may be. Under Section 31 of the Indian Stamp Act, 1899, the executor can also apply to the Collector of Stamps after payment of the requisite fee, for the purpose of obtaining the opinion of the Collector of Stamps as to the amount of stamp duty chargeable on the instrument. 15) What is the Mode of payment of stamp duty? The payment of stamp duty can be made by adhesive stamps or impressed stamps. Instrument executed in India must be stamped before or at the time of execution of the same. Instrument executed out of India can be stamped within three months after it is first received in India. However, in case of bill of exchange or promissory note made out of India, it must be stamped by first holder in India before he presents for payment or endorses or negotiates in India. 16) How stamp duty on transfer of shares of a company is computed? Stamp duty is payable under the Indian Stamp Act, 1899 on transfer of shares of an Indian company. If the shares are transferred under the depository mechanism, no stamp duty is payable on such transfer of shares. The stamp duty on transfer of shares as per Article 62 of the Indian Stamp Act, 1899 is 0.2 5% of the value of the transfer. 17) Is a WILL made by an individual chargeable to stamp duty? No stamp duty is payable on an instrument of WILL whether subject to the Indian Stamp Act or any state laws. 18) Is there any penalty for violation of Stamp laws? Yes. The penal provision includes imprisonment and fine or both for offences under the Stamp Laws. 19) What are the consequences of non-payment of stamp duty? Every person having by law an authority to receive evidence and every person in charge of public office before whom any instrument chargeable, in his opinion, with duty, is produced or comes in performance in his function, shall, if it appears to him if such instrument is not duly stamped, impound the same. 20) Why Stamp Duty has to pay on document/instrument? The payment of proper stamp duty on instruments bestows legality on them. Such instruments get evidentiary value and are admitted in evidence in court of law. The instruments, which are not properly stamped, are not admitted in evidence. 21) What point of time of Stamp Duty payable? The Section 17 & 18 of the Act states the time of payment stamp duty. Generally, all the instruments executed in the state shall be stamped before or at the time of execution or immediately thereafter or on the next working day following the day of execution. Similarly, the instruments, which are executed out of the state and within three months from its receipt in the state shall be stamped. 22) How is Stamp Duty payable? Stamp Duty can be paid by 1. Using Stamp paper 2. Using adhesive stamps 3. Franking 23) Who is liable to pay Stamp Duty? As per the provisions of Section 30, the onus of payment of stamp duty in the absence of an agreement to the contrary, shall be borne by the executing in the manner provided there with respect of certain kinds of documents viz. Mortgage deed, release, security bond, settlement, bond etc. in the case of conveyance, the grantee and lease the lessee shall pay the stamp duty in the case of exchange of property, both the parties in equal share shall pay stamp duty. In case of partition, the parties thereto in proportion to their respective shares should pay stamp duty. 24) How to pay Stamp Duty? The document which is chargeable with stamp duty can be prepared on the non-judicial stamp paper of appropriate value. Unexecuted document can be got franked with special adhesive stamps by Franking Machine intended for stamping such documents, by tendering required amount in the office of collector of Stamps wherever this facility is available. When documents is lodged for adjudication, on receiving intimation as to the amount of Stamp duty payable by tendering appropriate amount equal to the amount of stamp duty and penalty if any, the Collector of stamp shall certify the document as to the payment of proper duty. 25) In whose name the stamps are required to be purchased? The stamps are required to be purchased in the name of one of executors to the instrument.

Share Tw eet

Top Other Useful Calculators 1Rent vs. Buy Calculator is it better to buy or rent a house 2Home Loan Calculator Know How much you will pay 3Return on Investment Calculator your gain or loss on a investment 4Area Conversion Calculator convert a unit of measurement into any other unit 5Home Loan Eligibility Calculator loan eligibility of the home loan 6Property Valuation Calculator find value of your property 7Loan Amortization Calculator know when your loan will be paid off

Smallest Cortex-A9 SoM

variscite.com Dual-Core 1.5GHz Cortex-A9 OMAP4460 eMMC, Audio, LCD, USB

Buy Sobha Flats in Porur 1 Cr. Life Cover@16/day

GRIHA

property.sulekha.com/stamp-duty-calculator#shwMorea

2/4

Das könnte Ihnen auch gefallen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Law Relating To Stamp Duty and PenaltyDokument13 SeitenLaw Relating To Stamp Duty and PenaltySayidNoch keine Bewertungen

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsVon EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNoch keine Bewertungen

- Manual Stamp Duty-06.06.08Dokument161 SeitenManual Stamp Duty-06.06.08Digital GenesisNoch keine Bewertungen

- The Indian Stamp ActDokument9 SeitenThe Indian Stamp Actjoy parimalaNoch keine Bewertungen

- Was Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceVon EverandWas Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceNoch keine Bewertungen

- Tamil Nadu Stamp BillDokument37 SeitenTamil Nadu Stamp BillSaravana KumarNoch keine Bewertungen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- Stamp Duty Bill 2023Dokument61 SeitenStamp Duty Bill 2023Satyarth DubeyNoch keine Bewertungen

- The Law Governing Negotiable Instruments E1Dokument6 SeitenThe Law Governing Negotiable Instruments E1Muzammal Sarwar100% (1)

- Stamp Duties Act 15 of 1993Dokument40 SeitenStamp Duties Act 15 of 1993André Le Roux100% (4)

- Negotiable InstrumentsDokument26 SeitenNegotiable InstrumentsChabudi100% (3)

- Negotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Dokument5 SeitenNegotiable Instrument: Promissory Note, Bill of Exchange, or Cheque Payable Either To Order or To The Bearer"Amandeep Singh Manku100% (1)

- 15 U.S. Code 1602 - Definitions and Rules of Construction U.S. Code US Law LII - Legal Information InstituteDokument15 Seiten15 U.S. Code 1602 - Definitions and Rules of Construction U.S. Code US Law LII - Legal Information InstituteSamuel RichardsonNoch keine Bewertungen

- Irrevocable Letter of CreditDokument1 SeiteIrrevocable Letter of CreditJunvy AbordoNoch keine Bewertungen

- Unit 13: 1. What Is A Negotiable InstrumentDokument7 SeitenUnit 13: 1. What Is A Negotiable InstrumentAyas JenaNoch keine Bewertungen

- Chapter 05 Negotiable Instruments Act 1881 1229869805849562 1Dokument11 SeitenChapter 05 Negotiable Instruments Act 1881 1229869805849562 1अरुण शर्माNoch keine Bewertungen

- Ch.6 Bills of Exchange Principles of Accounting NotesDokument7 SeitenCh.6 Bills of Exchange Principles of Accounting NotesMUHAMMAD AMIRNoch keine Bewertungen

- RescindDokument3 SeitenRescindHaru RodriguezNoch keine Bewertungen

- Warehouse Law, Trust Receipt (SPL)Dokument12 SeitenWarehouse Law, Trust Receipt (SPL)Marjorie MayordoNoch keine Bewertungen

- The Stamp Act, 1899Dokument91 SeitenThe Stamp Act, 1899Muhammad Irfan RiazNoch keine Bewertungen

- Negotiable Instrument ActDokument13 SeitenNegotiable Instrument ActHardik KothiyalNoch keine Bewertungen

- The Stamp Act, 1899Dokument39 SeitenThe Stamp Act, 1899Akhtar HussainNoch keine Bewertungen

- The Negotiable Instruments Act 1881Dokument55 SeitenThe Negotiable Instruments Act 1881Ashish Mishra100% (1)

- Marketable SecuritiesDokument5 SeitenMarketable SecuritiesZAKAYO NJONYNoch keine Bewertungen

- Stamp Act RulesDokument61 SeitenStamp Act RulesKaran AggarwalNoch keine Bewertungen

- Banking LawDokument11 SeitenBanking LawArya ArNoch keine Bewertungen

- Bills of Exchange Act 1882 Part 4 Chapter 61 45 46Dokument2 SeitenBills of Exchange Act 1882 Part 4 Chapter 61 45 46Harry100% (1)

- Letters of Credit Q and ADokument5 SeitenLetters of Credit Q and ARose Ann VeloriaNoch keine Bewertungen

- Negotiable InstrumentDokument35 SeitenNegotiable InstrumentLithesh PoojaryNoch keine Bewertungen

- Discounting Bills of ExchangeDokument7 SeitenDiscounting Bills of ExchangeEsha Ali ButtNoch keine Bewertungen

- Negotiable Instruments ActDokument34 SeitenNegotiable Instruments Actx2Noch keine Bewertungen

- Bill of ExchangeDokument4 SeitenBill of ExchangeS K MahapatraNoch keine Bewertungen

- B001 Postal Manual PDFDokument282 SeitenB001 Postal Manual PDFlyndengeorge100% (1)

- Rules On IndorsementDokument3 SeitenRules On IndorsementBle Garay100% (1)

- Negotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Dokument14 SeitenNegotiable Instruments Notes: Form and Interpretation (Sec. 1 - 8)Gennelyn Grace PenaredondoNoch keine Bewertungen

- Assignment On Banking Law - Negotiable Instrument - Dishoner and Liability 8th Sem Ba LLBDokument10 SeitenAssignment On Banking Law - Negotiable Instrument - Dishoner and Liability 8th Sem Ba LLBAaryan M Gupta100% (1)

- Negotiable Instruments Act, 1881Dokument24 SeitenNegotiable Instruments Act, 1881vikramjeet_22100% (1)

- Holder and Holder in Due CourseDokument7 SeitenHolder and Holder in Due CourseShariaNoch keine Bewertungen

- Applicability of NilDokument14 SeitenApplicability of NilIan Ray PaglinawanNoch keine Bewertungen

- Administrative Processes Course WorkDokument6 SeitenAdministrative Processes Course WorkSSENYONJO MICHEALNoch keine Bewertungen

- What Are The Rules Regarding The Acceptance of A Proposal? Describe Them in Details.Dokument2 SeitenWhat Are The Rules Regarding The Acceptance of A Proposal? Describe Them in Details.sunnykapoor7Noch keine Bewertungen

- First Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedDokument1 SeiteFirst Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedCruz HernandezNoch keine Bewertungen

- 1.4 IRS Form 1040VDokument1 Seite1.4 IRS Form 1040VBenne James100% (1)

- Deed of SaleDokument1 SeiteDeed of SaleSantos PinkyNoch keine Bewertungen

- Negotiable Instruments ActDokument49 SeitenNegotiable Instruments ActJasMeetEdenNoch keine Bewertungen

- Indian Contract Act 1872Dokument79 SeitenIndian Contract Act 1872Ayush ThakkarNoch keine Bewertungen

- Customer Copy: KYC HandoutDokument20 SeitenCustomer Copy: KYC HandoutSourav BiswasNoch keine Bewertungen

- Promissory NoteDokument6 SeitenPromissory NoteJames HumphreysNoch keine Bewertungen

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Dokument17 SeitenGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508Noch keine Bewertungen

- Negotiable Instrument1Dokument16 SeitenNegotiable Instrument1Ella ArlertNoch keine Bewertungen

- Acceptance May Be: 1. ActualDokument4 SeitenAcceptance May Be: 1. Actualaquanesse21Noch keine Bewertungen

- Negotiable Instruments NotesDokument14 SeitenNegotiable Instruments NotesGennelyn Grace PenaredondoNoch keine Bewertungen

- Letter of Suretyship: Golden Dragon Industrial Corporation & Ms. Jocelyn YoungDokument2 SeitenLetter of Suretyship: Golden Dragon Industrial Corporation & Ms. Jocelyn YoungNikki Dulay100% (1)

- BY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaDokument31 SeitenBY: 37 MBA 09 43 MBA 09: Venika Saini Anuj GuptaaditibakshiNoch keine Bewertungen

- FM PDFDokument235 SeitenFM PDFProfessor Sameer Kulkarni100% (2)

- Onvif Interface Guide Specification: January 2019Dokument15 SeitenOnvif Interface Guide Specification: January 2019jmathew_984887Noch keine Bewertungen

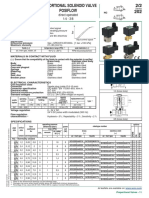

- Asco Express GuideDokument34 SeitenAsco Express Guidejmathew_984887Noch keine Bewertungen

- ONVIF Imaging Service SpecDokument16 SeitenONVIF Imaging Service Specjmathew_984887Noch keine Bewertungen

- ONVIF Profile Policy v2-0Dokument30 SeitenONVIF Profile Policy v2-0jmathew_984887Noch keine Bewertungen

- ASCO Solenoid ValvesDokument2 SeitenASCO Solenoid Valvesjmathew_984887Noch keine Bewertungen

- EMI Notes For ElectronicsDokument2 SeitenEMI Notes For Electronicsjmathew_984887Noch keine Bewertungen

- Labview & Labview NXGDokument4 SeitenLabview & Labview NXGjmathew_984887Noch keine Bewertungen

- KSZ8041NL: General DescriptionDokument45 SeitenKSZ8041NL: General Descriptionjmathew_984887Noch keine Bewertungen

- BibTeX - WikiDokument7 SeitenBibTeX - Wikijmathew_984887Noch keine Bewertungen

- DevCon 07 5 E Proof 2015-11-19 PDFDokument923 SeitenDevCon 07 5 E Proof 2015-11-19 PDFjmathew_984887Noch keine Bewertungen

- SDR Lead User Handbook 3rdedition US LTR WR2Dokument28 SeitenSDR Lead User Handbook 3rdedition US LTR WR2omegavnNoch keine Bewertungen

- Features: EconolineDokument2 SeitenFeatures: Econolinejmathew_984887Noch keine Bewertungen

- Before DaVinciDokument60 SeitenBefore DaVincijmathew_984887Noch keine Bewertungen

- NCP349 Positive Overvoltage Protection Controller With Internal Low R Nmos FetDokument12 SeitenNCP349 Positive Overvoltage Protection Controller With Internal Low R Nmos Fetjmathew_984887Noch keine Bewertungen

- KSZ8041NL Eval Board Rev1.1Dokument3 SeitenKSZ8041NL Eval Board Rev1.1jmathew_984887Noch keine Bewertungen

- Sahara 120 FVO OvenDokument3 SeitenSahara 120 FVO Ovenjmathew_984887Noch keine Bewertungen

- Beamex MC6 Brochure ENGDokument20 SeitenBeamex MC6 Brochure ENGjmathew_984887Noch keine Bewertungen

- Microwind Design FlowDokument1 SeiteMicrowind Design Flowjmathew_984887Noch keine Bewertungen

- BSNL Codes UpdatedDokument44 SeitenBSNL Codes Updatedjmathew_984887Noch keine Bewertungen

- Resistance Weld Thru-Hole Crystal: Features OptionsDokument1 SeiteResistance Weld Thru-Hole Crystal: Features Optionsjmathew_984887Noch keine Bewertungen

- MCP2510 To MCP2515Dokument6 SeitenMCP2510 To MCP2515jmathew_984887100% (1)

- Facility Management SystemDokument6 SeitenFacility Management Systemshah007zaad100% (1)

- Technical Report: Determination of The Resistance To DelaminationDokument4 SeitenTechnical Report: Determination of The Resistance To DelaminationStefan NaricNoch keine Bewertungen

- Method Statement For Backfilling WorksDokument3 SeitenMethod Statement For Backfilling WorksCrazyBookWorm86% (7)

- Enhancing LAN Using CryptographyDokument2 SeitenEnhancing LAN Using CryptographyMonim Moni100% (1)

- Series 90 100cc Pump Parts ManualDokument152 SeitenSeries 90 100cc Pump Parts ManualHernan Garcia67% (3)

- CRM (Coca Cola)Dokument42 SeitenCRM (Coca Cola)Utkarsh Sinha67% (12)

- Irazu EULA AgreementDokument7 SeitenIrazu EULA AgreementLiqiang HeNoch keine Bewertungen

- Shubham Devnani DM21A61 FintechDokument7 SeitenShubham Devnani DM21A61 FintechShubham DevnaniNoch keine Bewertungen

- In The High Court of Delhi at New DelhiDokument3 SeitenIn The High Court of Delhi at New DelhiSundaram OjhaNoch keine Bewertungen

- FLIPKART MayankDokument65 SeitenFLIPKART MayankNeeraj DwivediNoch keine Bewertungen

- Toyota Auris Corolla 2007 2013 Electrical Wiring DiagramDokument22 SeitenToyota Auris Corolla 2007 2013 Electrical Wiring Diagrampriscillasalas040195ori100% (125)

- FIP & CouponsDokument5 SeitenFIP & CouponsKosme DamianNoch keine Bewertungen

- Forecasting and Demand Management PDFDokument39 SeitenForecasting and Demand Management PDFKazi Ajwad AhmedNoch keine Bewertungen

- Unit 1 Notes (Tabulation)Dokument5 SeitenUnit 1 Notes (Tabulation)RekhaNoch keine Bewertungen

- Standard Wiring Colors - Automation & Control Engineering ForumDokument1 SeiteStandard Wiring Colors - Automation & Control Engineering ForumHBNBILNoch keine Bewertungen

- Maturity AssessmentDokument228 SeitenMaturity AssessmentAli ZafarNoch keine Bewertungen

- F5 - LTM TrainingDokument9 SeitenF5 - LTM TrainingAliNoch keine Bewertungen

- Viper 5000 Installations Guide PDFDokument39 SeitenViper 5000 Installations Guide PDFvakakoNoch keine Bewertungen

- Asme 1417 WordDokument12 SeitenAsme 1417 WordERIKA RUBIONoch keine Bewertungen

- Microstrip Antennas: How Do They Work?Dokument2 SeitenMicrostrip Antennas: How Do They Work?Tebogo SekgwamaNoch keine Bewertungen

- Lab - Report: Experiment NoDokument6 SeitenLab - Report: Experiment NoRedwan AhmedNoch keine Bewertungen

- Bangalore University: Regulations, Scheme and SyllabusDokument40 SeitenBangalore University: Regulations, Scheme and SyllabusYashaswiniPrashanthNoch keine Bewertungen

- HAART PresentationDokument27 SeitenHAART PresentationNali peterNoch keine Bewertungen

- Electrical Installation Assignment 2023Dokument2 SeitenElectrical Installation Assignment 2023Monday ChristopherNoch keine Bewertungen

- Pace 349 ScheduleDokument3 SeitenPace 349 Schedulesaxman011100% (1)

- Intro To Forensic Final Project CompilationDokument15 SeitenIntro To Forensic Final Project Compilationapi-282483815Noch keine Bewertungen

- Ranking - Best Multivitamins in 2018Dokument7 SeitenRanking - Best Multivitamins in 2018JosephVillanuevaNoch keine Bewertungen

- Engineer Noor Ahmad CVDokument5 SeitenEngineer Noor Ahmad CVSayed WafiNoch keine Bewertungen

- Mannitol For Reduce IOPDokument7 SeitenMannitol For Reduce IOPHerryantoThomassawaNoch keine Bewertungen

- ITMC (International Transmission Maintenance Center)Dokument8 SeitenITMC (International Transmission Maintenance Center)akilaamaNoch keine Bewertungen

- How to get US Bank Account for Non US ResidentVon EverandHow to get US Bank Account for Non US ResidentBewertung: 5 von 5 Sternen5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProVon EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProBewertung: 4.5 von 5 Sternen4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyVon EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNoch keine Bewertungen

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesVon EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesBewertung: 4 von 5 Sternen4/5 (9)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideVon EverandTax Savvy for Small Business: A Complete Tax Strategy GuideBewertung: 5 von 5 Sternen5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyVon EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyBewertung: 4 von 5 Sternen4/5 (52)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessVon EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessBewertung: 5 von 5 Sternen5/5 (5)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessVon EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNoch keine Bewertungen

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationVon EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNoch keine Bewertungen

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionVon EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNoch keine Bewertungen

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsVon EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingVon EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingBewertung: 5 von 5 Sternen5/5 (3)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerVon EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNoch keine Bewertungen

- The Payroll Book: A Guide for Small Businesses and StartupsVon EverandThe Payroll Book: A Guide for Small Businesses and StartupsBewertung: 5 von 5 Sternen5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipVon EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNoch keine Bewertungen

- S Corporation ESOP Traps for the UnwaryVon EverandS Corporation ESOP Traps for the UnwaryNoch keine Bewertungen

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesVon EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNoch keine Bewertungen

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)