Beruflich Dokumente

Kultur Dokumente

Revenue Cycle

Hochgeladen von

casti134Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Revenue Cycle

Hochgeladen von

casti134Copyright:

Verfügbare Formate

The Health Care

Revenue Cycle

How Money is Generated for the

Business of Health Care Delivery

Robert A. Kaplan BA, DC, MBA, CPAT

Finney Learning Systems, Inc.

205 West 54

th

Street

New York, NY 10019

(212) 757-4788

www.TheRightWay.com

FLS@TheRightWay.com

Copyright 2009, Finney Learning Systems, Inc.

All rights reserved. No part of this publication may be reproduced or distributed in any

form or by any means, electronic, mechanical, photocopying, recording or otherwise, or

stored in a database or retrieval system without the permission in writing of the publisher.

Every effort has been made to supply complete and accurate information. However, Finney

Learning Systems, Inc. does not guarantee the accuracy or completeness of any information

and assumes no responsibility for its use.

ISBN 1-56435-201-3

10 9 8 7 6 5 4 3 2 1

Publisher: Doug Finney

Editor: John Upham

Page Layout: Zach Katagiri

Cover Design: Sandy Krasovec

Book Design: Kevin Cochran, Zachary Aaron

Finney Learning Systems i

Contents

Welcome ..........................................................................................................v

Chapter 1 - Health Care Plans and Legislation

The Health Care Insurance Industry .............................................................................. 2

Health Care Plans .......................................................................................................... 2

Figure 1: Health Care Plans ............................................................................. 2

Indemnity ........................................................................................................ 3

Managed Care Organization (MCO) ............................................................... 3

Important Defnitions .................................................................................................... 5

Physicians Identifcation Numbers .............................................................................. 6

The Major Players .......................................................................................................... 7

Figure 2: The Major Players ............................................................................. 8

The Department of Health and Human Services (DHHS) .............................. 9

The Centers for Medicare and Medicaid Services (CMS) ................................ 9

Medicare ........................................................................................................ 10

Medicaid ........................................................................................................ 11

Civil Monetary Penalties Law (CMP) ........................................................... 12

State Childrens Health Insurance Program (SCHIP) .................................... 12

Balanced Budget Act of 1997 (BBA) ............................................................... 12

Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) ............................ 12

Defcit Reduction Act of 1984 (DEFRA) ......................................................... 12

Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) ...... 13

Omnibus Budget Reconciliation Act of 1986 (OBRA of 1986) ....................... 13

Omnibus Budget Reconciliation Act of 1989 (OBRA of 1989) ........................ 13

Omnibus Budget Reconciliation Act of 1990 (OBRA of 1990) ........................ 14

Operation Restore Trust of 1995 (ORT) .......................................................... 14

Other Players ............................................................................................................... 14

Health Insurance Portability and Accountability Act of 1996 (HIPAA) ......... 15

National Electronic Data Interchange (EDI) .................................................. 16

Medical Ethics; Fraud and Abuse; Professional Liability............................... 18

False Claims Act (FCA) .................................................................................. 20

Emergency Medical Treatment and Active Labor Act (EMTALA) ................. 21

Patient Bill of Rights ...................................................................................... 22

Quality Improvement Organizations (QIO) .................................................. 22

Understanding Acronyms and Abbreviations ............................................................. 23

Test Taking and Study Strategies ................................................................................. 27

Beware of Pitfalls with Multiple Choice Questions ....................................... 28

Sample Test Questions ................................................................................................. 29

Chapter 2 - Contact with Hospitals and Doctors

Patient Registration, Admission, and Financial Concerns ........................................... 50

Figure 3: Hospital Registration ...................................................................... 50

Registration ................................................................................................... 51

Responsibilities of the Registration Staff ....................................................... 52

Patients Interaction with the Hospital .......................................................... 52

Affliated Health Coverage Protocols ............................................................ 53

Physician Direct Services ............................................................................... 53

The Clean Claim and the Hospital Registration Staff .................................... 53

Financial Counselor ....................................................................................... 55

Summary ....................................................................................................... 55

Effective Patient Scheduling .......................................................................... 57

Advantages of Pre-Admitting Patients .......................................................... 57

Disadvantages of Pre-Admitting Patients ..................................................... 58

The Five Control Points ................................................................................. 59

Pre-Certifcation ............................................................................................ 59

The Health Care Revenue Cycle ii

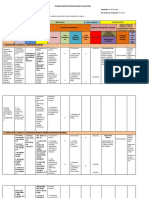

Medical Case Management/Utilization Review ........................................... 60

Important Criteria for Registering Patients with Managed Care Coverage ... 60

Consent .......................................................................................................... 60

Hospital Admitting Categories .................................................................................... 62

Figure 4: Hospital Admitting Categories ....................................................... 62

Categories of Health Care Charges ................................................................ 63

Categories of Health Care Delivered to the Consumer .................................. 64

Health Care Coverage in the Military .......................................................................... 65

Figure 5: Health Care Coverage in the Military ............................................. 65

CHAMPVA ................................................................................................... 66

TRICARE ....................................................................................................... 66

Defense Enrollment Eligibility Reporting System (DEERS). .......................... 68

Continued Health Care Beneft Program (CHCBP) ....................................... 68

Medicare Determination of Patient Eligibility ............................................................. 69

Medical Spell of Illness .................................................................................. 69

Hospital Inpatient Beneft Days Coverage .................................................... 69

Skilled Nursing Facility Coverage (SNF) ....................................................... 69

Advanced Benefciary Notice (ABN) ............................................................. 70

Medicare Secondary Payer (MSP)/Working Aged Provision ........................ 70

The Medical Staff and Hospital Admitting Protocols................................................... 71

Patient Confdentiality: Privacy Act of 1974 .................................................. 72

The Patients Medical Record and Telephone/Verbal Communication in the

Hospital ..................................................................................................... 72

Patient Self-Determination Act (PSDA) ......................................................... 73

Figure 6: OBRA 1990 ...................................................................................... 74

The Joint Commission on Accreditation of Health Care Organizations ........ 74

Census .......................................................................................................................... 76

Average Daily Census ................................................................................... 77

Percentage of Occupancy ............................................................................... 77

Generally Accepted Accounting Principles (GAAP) .................................................... 78

Understanding Acronyms and Abbreviations ............................................................. 79

More Test Taking Strategies ......................................................................................... 81

Sample Test Questions ................................................................................................ 82

Chapter 3 - Processing Procedures

UB-04 Claim Form ..................................................................................................... 100

Important UB-04 Code/FL Defnitions ........................................................ 101

Completion of the #4 Form Locator in the UB-04 ........................................ 104

Common Working File ............................................................................................... 107

Medicare Processing of the UB-04 Claim Form .......................................................... 108

Claim Form Processing Terminology........................................................... 110

Medicare Secondary Payer .......................................................................... 112

MS-DRGs. ................................................................................................... 114

Medicare DRG Window (The 72-Hour Rule) ............................................... 115

Chargemaster ............................................................................................ 116

Figure 7: Chargemaster ................................................................................ 117

Medicare Deductibles, Co-Payments and Co-Insurances for 2010 ............................. 118

Electronic Billing ........................................................................................................ 119

Types of Financial Statements .................................................................................... 120

Abbreviations and Acronyms .................................................................................... 121

Sample Test Questions ............................................................................................... 123

Chapter 4 - Claim Form for the Doctors Ofce

Medicare .................................................................................................................... 138

Medigap ...................................................................................................... 140

Medical Unlikely Edits (MUE)..................................................................... 140

Finney Learning Systems iii

National Correct Coding Initiative (NCCI) ................................................. 141

Advanced Benefciary Notice (ABN) ........................................................... 142

Comprehensive Error Rate Testing (CERT) ................................................. 143

Recovery Audit Contractors (RAC) ............................................................. 143

Ambulatory Payment Classifcation (APC) ................................................ 143

Medical Necessity ........................................................................................ 145

Medical Standards of Care and Malpractice ................................................ 146

Medical Malpractice .................................................................................... 146

Waiver of Liability ...................................................................................... 146

Clinical Laboratory Improvement Amendment (CLIA) .............................. 148

Health Insurance Claim Number (HICN) ................................................... 148

Medicaid ...................................................................................................... 149

Resource Based Relative Value Scale (RBRVS) ............................................. 149

The CMS-1500 Claim Form ....................................................................................... 151

How to Complete the CMS-1500 Claim Form ............................................ 152

International Classifcation of Diseases ...................................................................... 160

Figure 8: ICD ............................................................................................... 161

Current Procedural Terminology ............................................................................... 165

Figure 9: CPT ............................................................................................... 166

Health Care Common Procedure Coding System (HCPCS) ...................................... 167

Evaluation and Management Services (E/M) .............................................. 167

SOAP Notes and the Patient-Oriented Medical Records (POMR) .............. 169

Defnitions: Types of Third Party Reimbursement and Categories .....................

of Providers .............................................................................................. 170

Abbreviations and Acronyms .................................................................................... 171

Sample Test Questions ............................................................................................... 173

Chapter 5 - Doctor/Hospital Financial Matters

Medical Identity Theft ............................................................................................... 190

Tips for Preventing and Detecting Medical Identity Theft .......................... 190

Responding to Medical Identity Theft ......................................................... 191

Third Party Collection Activity .................................................................................. 192

Bankruptcy ................................................................................................................. 193

Figure 10: Bankruptcy.................................................................................. 193

Involuntary Bankruptcy .............................................................................. 194

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 .. 195

Confrming Bankruptcy by the Doctor or Hospital ..................................... 195

Notifcation of Bankruptcy .......................................................................... 195

Discharge of Debtor ..................................................................................... 196

Dismissal of Bankruptcy .............................................................................. 196

Collection Regulations of the Federal Government ................................................... 197

The Truth in Lending Act (TLA) (1969). ...................................................... 197

Fair Debt Collection Practices Act (FDCPA) (1978) ..................................... 197

Fair Credit Billing Act (1975) ....................................................................... 198

Fair Credit Reporting Act (FCRA) (1971) .................................................... 199

Fair and Accurate Credit Transaction Act (includes SKIP) .......................... 199

Equal Credit Opportunity Act (ECOA) ....................................................... 200

Deceased Patient Notifcation ...................................................................... 200

General Accounting Principles Applied to Cashier Functions..................... 201

Effective Collection Policies ......................................................................... 201

Statute of Limitations .................................................................................. 202

Collection Calls to the Patient and Collection Policies ................................ 202

Third Party Collection Agencies .................................................................. 202

Charity Care, Indigent Patient, and Bad Debt ............................................. 203

Judgment, Lien and Tort Liability ................................................................ 203

The Health Care Revenue Cycle iv

Courtesy Discharge ..................................................................................... 203

Abbreviations and Acronyms .................................................................................... 206

Sample Test Questions ............................................................................................... 207

Appendix A: CMS-1500 Form .................................................................................... 221

Appendix B: UB-04 Form ........................................................................................... 222

Appendix C: Superbill ............................................................................................... 223

Appendix D: Medicare Card ...................................................................................... 224

Index........................................................................................................................................ 227

Finney Learning Systems v

Welcome to The Health Care Revenue Cycle. This is a study guide to help the

student or employee acquire an understanding of how the business of health care

in the United States is organized, regulated and reimbursed. By highlighting and

reinforcing important administrative concepts, the student is better prepared to pass

certifcation examinations and work effciently in the health care industry.

This study guide can be used at a multitude of health care facilitiesfrom a doctors

offce to a hospital to an insurance claims offce. It can serve as both a training

manual and a reference guide. In addition to pertinent and extensive information,

each chapter concludes with defnitions of abbreviations and acronyms and an

abundance of sample test questions. The reader will also fnd helpful test-taking

strategies.

Health care in the United States has evolved since the mid-twentieth century into a

complex web of delivery systems, governmental regulations and third party payers.

Therefore, it is crucial that health care organizations have the expertise and resources

to master the inevitable ever changing rules and regulations. Its staff must know how

money is generated for the business of health care delivery.

Welcome

Chapter 1 - Health Care Plans and Legislation 1

Chapter 1 Health Care Plans and Legislation

Chapter Topics

The Health Care Insurance Industry

Health Care Plans

Important Defnitions

Physician Identifcation Numbers

The Major Players (CMS, DHHS, Medicare, etc.)

Other Players (HIPAA, FCA, EMTALA, etc.)

Understanding Acronyms and Abbreviations

Test Taking and Study Strategies

Sample Multiple Choice Test Questions

After studying this chapter you will understand:

Indemnity, MCOs: HMOs, PPOs, POSs

PINs, UPINs, PPINs, EINs, SSNs, NPIs

Department of Health and Human Services (DHHS)

Centers for Medicare and Medicaid (CMS)

Medicare and Medicaid

State Childrens Health Insurance Program (SCHIP)

Balanced Budget Act (BBA)

TEFRA and DEFRA

COBRA and OBRA

MAAC and Limiting Charge

Health Insurance Portability and Accountability Act of 1996 (HIPAA)

EDI

FCA, Department of Justice (DOJ) and Offce of Inspector General (OIG)

Stark Laws, Anti-Kickback Statute, Sarbane-Oxley Act

Fraud and Abuse

Medical Ethics

Professional Liability

CMP or CMPL

EMTALA

Patient Bill of Rights

The Health Care Revenue Cycle 2

The Health Care Insurance Industry

This chapter examines organizations, and the legislation they create, that regulate

how health care is provided to patients in the United States whether in a hospital,

clinic, doctors offce, nursing home, public health clinic, ambulance service or

medical supply company. An examination of the types of insurance plans that pay for

health care, and the coding manuals that are used to get the doctor and hospital paid,

are also examined.

It is crucial for the reader of this study guide to understand that Medicare (operated

by the federal government) is the basis for all health care delivery, processing, and

payment in the United States. Fee schedules, payment protocols, coding manuals and

forms, all infrastructure associated with health care, legal ramifcations concerning

how the patients treatment needs are handled, legal prosecution of health care fraud

and abuse, hospital and nursing home inspection and accreditation, etc., are all based

on Medicare. All health care patients and the public, providers, nurses, hospitals,

nursing homes, suppliers, insurance carriers, governmental agencies, the Department

of Justice and Offce of Inspector General, etc., ultimately follow Medicares rules and

regulations.

Health Care Plans

Figure 1: Health Care Plans

There are basically two types of insurance plans Indemnity and Managed Care.

It is rare today for a patient to pay cash for all his/her health care. Even when the

patient does pay cash, the doctors offce or hospital ultimately submits an insurance

claim, and the patient is reimbursed directly by the carrier or Medicare.

Chapter 1 - Health Care Plans and Legislation 3

Indemnity

This type of insurance plan protects (indemnifes) the patient against a loss of money

as a result of the patient receiving medically necessary health care services. Payment

to the doctor is on a fee-for-service (FFS) basismoney paid for each service provided

the patient and done retroactively (after the services have been provided). The health

care provider or hospital bills the insurance company directly on a claim form and

gets paid according to a payment, fee or benefts schedule. The patient pays a premium

(the cost of buying the insurance) every year to keep the insurance active, and also

pays a deductible every year before the insurance company begins paying for medical

services.

If the provider or hospital is a participating provider, they signed a contract with the

insurance carrier to treat their patients and accept their fee schedule as payment in

full, except for deductibles, co-payments or co-insurances. If the physician is a non-

participating provider, he has not signed a contract with the insurance carrier and the

patient pays the doctor directly when services are rendered. The indemnity plan may

still reimburse the patient, but the patient has to bill the insurance company directly

and will probably receive a fraction of what was paid to the doctor.

The patient also pays a co-insurance (usually 10% or 20%), a percentage of each claim

(i.e., billing for treatment provided the patient), before the insurance company pays

the remainder of the claim. In an 80/20 plan, the most popular, the patient pays

20% of the fee schedule amount to the doctor, and the insurance company pays the

remaining 80% of the fee schedule to the doctor. In a 90/10 plan, the patient pays

10% of the fee schedule to the doctor, and the insurance company pays the remaining

90% of the fee schedule to the doctor.

It is important to understand that the indemnity contract is between the insurance

company and patient only. The consumer can go to any doctor, hospital, therapist,

or medical supplier he chooses and the insurance company pays the bill. The more

services the patient uses, the more money the doctor or hospital makes. Indemnity

insurance is the most expensive form of health care plan as the provider does not

share the fnancial risk of providing medical treatment, procedures, and supplies to

the patient.

Managed Care Organization (MCO)

This type of insurance plan restricts who the consumer can see for health care

treatment. The doctors and hospitals and patient sign a contract with a managed

care plan. The doctors and hospitals who sign an MCO contract are considered to be

in network or participating providers. In return for the patient using only participating

providers and hospitals, there are lower premiums, deductibles, co-insurances and

co-payments compared to indemnity plans.

MCOs are the most common type of health insurance plan in the United States

today. They include Health Maintenance Organizations (HMO), Point-of-Service

plans (POS), and Preferred Provider Organizations (PPO). The main goal of the MCO

The Health Care Revenue Cycle 4

is to ration the use of health care services and reduce the amount of money paid for

those services.

1. Health Maintenance Organizations (HMO). This type of MCO is where

the Primary Care Physician (PCP) acts as the gatekeeper and is given a

capitated rate (a set amount for each member per month known as Per

Member Per Month (PMPM). For the PMPM to be paid prospectively

(in advance), the doctor must provide to the patient certain services such as

screenings, immunizations, well-baby check-ups, mammograms for women,

etc., as well as treatment that is determined to be medically necessary by

the gatekeeper. However, the doctor does not get paid more for additional

services and products, so there is the chance the doctor will lose money on

some patients and make a proft on others. In other words, in this type of

plan, the doctor and hospital share in the risk of providing medical services,

and there is an incentive for the gatekeeper to restrict the patients access to

health care services and products in order to make money.

2. Open Access Plans. Many HMOs have switched from using gatekeepers

to plans in which their members can visit any specialist in the network

without referrals. This is known as HMO Open Access Plan. Even if referrals are

necessary, female HMO members can still see OB-GYN specialists without a

referral.

3. As the gatekeeper, it is the doctor who determines what treatment is to be

provided (if any), and who the patient will be referred to for more specialized

services. Patients cannot simply get whatever services or products they

want. They are not only limited to participating doctors and hospitals, but

the gatekeeper doctor also restricts referrals to other medical specialists and

pre-authorizations are required. Most commonly, the gatekeeper/doctor is

a Primary Care Physician (PCP), but also can be a Gynecologist (GYN) for a

woman or a pediatrician (PED) for a child.

4. Point-of-Service Plans. These are also known as open HMOs. They

operate like HMOs, but allow the consumer to use doctors and hospitals

outside the network of participating providers. There are pre-authorizations

required in a POS plan and utilization of health care services is restricted.

The patient pays higher premiums for a POS than an HMO for the privilege

to go out-of-network. If the patient uses an out-of-network provider or

hospital, the patient is responsible for higher deductibles, co-payments, and

co-insurances. The patient is responsible for the full cost of any health care

services the POS plan considers to be not covered. The out-of-network doctor

or hospital is paid on a FFS basis as determined by the POS, but it is lower

than reimbursement paid to in-network providers. There is no gatekeeper,

which means there is no doctor assigned by the POS plan to restrict the

patients access to other doctors, hospitals, services and products.

5. Preferred Provider Organizations (PPO). This is the most popular type

of health plan. It is provided by employers and there is no gatekeeper.

The doctors and hospitals contract for their medical services with the PPO

directly, at a lower rate than they normally charge, in return for a large pool

Chapter 1 - Health Care Plans and Legislation 5

of patients who pay lower fees. The consumer can choose any health care

provider or facility, even if outside the network. Like the POS, however,

the patient would be responsible for higher deductibles, co-insurances and

co-payments if they go out-of-network. The patient would still require

pre-authorizations, and for health care services not covered by the PPO the

patient would be responsible to cover the full cost.

Important Defnitions

Physician. Defned by Medicare as a Doctor of Medicine (MD), Doctor of Osteopathy

(DO), Doctor of Dental Medicine (DMD), Doctor of Dental Surgery (DDS), Doctor

of Podiatric Medicine (DPM), Doctor of Optometry (OD), or Doctor of Chiropractic

(DC) who are legally licensed to practice (provide medical services and products to

human beings) in the state in which they deliver health care services.

Health Care Practitioner. These are also known as Non-Physician Practitioners

(NPP). Includes Physician Assistant (PA), Certifed Nurse Midwife, Psychologist

(MA, MS, PhD), Nurse Practitioner (NP), Clinical Social Worker (MSW), Physical

Therapist (PT), Occupational Therapist (OT), Respiratory Therapist (RT), Speech

Therapist (ST), Certifed Registered Nurse Anesthetist (CRNA), or Registered Nurse

(RN, MSN, PhD), or other licensed health care professionals.

Good Samaritan Act. Legislation that protects health care professionals from

liability of any civil damages (money) as a result of rendering emergency care. For

example, if a doctor provides emergency medical care to a fellow passenger while on

a plane who suffered a heart attack, and the patient dies or suffers complications, the

doctor would be protected under this act against legal action.

New Patient. One who has not received health care services from the physician, or

another physician of the same specialty in the same group practice, within the past

three years.

Established Patient. One who has received health care services from the physician,

or another physician of the same specialty in the same group practice, within the past

three years.

Inpatient. A person who is admitted to the hospital with the assumption the patient

will stay for 24 hours or more (overnight stay).

Outpatient. A patient who receives treatment in a doctors offce (whether outside

the hospital or in a medical building associated with the hospital), hospital clinic or

outpatient facility (such as a family or dermatology practice), emergency room or

department (E/R), hospital same day surgery center, or ambulatory surgical center

(ASC) where the patient is released within 23 hours, or a hospital admission for

observation purposes only (the doctors and nurses watch the patient and do not treat

the patient; this can occur in the E/R).

Coding. The process of converting diagnoses, symptoms, diseases, procedures,

services, and products into numbers and letters. The ICD-9-CM, HCPCS, CPT-4,

CDT, and NDC manuals are used for this purpose by the medical biller and coder.

The Health Care Revenue Cycle 6

Clearinghouse. A majority of providers and hospitals use a clearinghouse to send

and receive information in correct EDI format (HIPAA approvied electronic) to

third party payers. Under HIPAA, clearinghouses can accept the claim forms in

non-standard formats from the provider, and translate them into standard formats

utilizing ICD-9, CPT, HCPCS, CDT and NDC codes (numbers and letters), before

forwarding them to third party payers. Clearinghouses must receive all required data

elements from providers and hospitals, they cannot create or modify the content of

these claims forms. They review the claim forms to be valid, complete, and HIPAA

compliant, and if they fnd mistakes, they return the claims to the provider or

hospital for corrections, review them again, before sending them out to Medicare,

Medicaid, or commercial (private) third party payers. A medical practice or hospital

may choose to use a clearinghouse to transmit all their claims, or just some of

them. Once the clearinghouse has sent the claims, a verifcation report is sent to the

provider or hospital which summaries what was sent to the payer. Later the receiver,

the third party payer, will send back an electronic response showing the transmission

was received from the clearinghouse and the insurance adjudication process can

proceed for payment.

Pre-certifcation. This is the process of confrming the patients insurance eligibility

and collecting necessary information prior to the patient using the hospital or

health care facility as an inpatient or outpatient. Pre-certifcation may also include

the insurance company issuing an authorization number (through its review

organization) approving the medical necessity of the services, procedures or supplies

that are going to be rendered to the patient.

Maximum Medical Improvement (MMI). This is where the doctor has determined

the patient has reached the best clinical improvement that is possible for the

diagnosis and treatment provided.

Physicians Identifcation Numbers

These are unique numbers (and letters) assigned to each doctor, or group of doctors,

medical supplier, therapist, nurse, health care facility, etc., by insurance companies,

MCOs, Medicare, Medicaid, and IRS so the provider can be easily identifed in all

billing and coding situations and correspondence. Examples include the following:

Provider Identifcation Number (PIN). A number assigned by the insurance carrier

to a physician who renders services to their patients (membership).

State License Number. Every physician, medical supplier, nurse, therapist, etc.,

must obtain this number in order to practice in each state in which they wish to

render health care or provide a service or product.

Unique Provider Identifcation Number (UPIN). A number assigned by Medicare

to each physician.

Performing Provider Identifcation Number (PPIN). Each physician has a separate

PPIN for each group or offce or clinic in which the physician practices. In Medicare,

the group or clinic of practicing doctors gets a Group Provider Number (see below)

Chapter 1 - Health Care Plans and Legislation 7

as well as each doctor receives an individual eight digit (letters and numbers) PPIN

assigned by Medicare.

Group Provider Number. This number is used to identify a group of doctors or

therapists who provide health care services. In addition, the PPIN or PIN may also

be used for each individual provider in the group. However, the Group Provider

Number may be the only number used when the doctor is part of a group practice in

billing and coding the insurance carrier or Medicare.

Social Security Number (SSN): A 9-digit number assigned to all legal United States

citizens. Usually a provider of health care services would not normally use this

number when billing and coding third party payers unless they do not have an EIN

(see below).

Employer Identifcation Number (EIN): This is also known as the Federal Tax

Identifcation Number, and is issued by the Internal Revenue Service (IRS) for anyone

who operates a business and/or who is an employer. This number is usually placed

in the insurance billing and coding forms when the doctor or supplier is the owner

of the medical practice, medical supply company, peer review organization (PRO),

Nursing Referral Service, etc.

National Provider Identifer (NPI). NPI is an important number that each health

care provider (hospital, SNF, doctor, supplier), health plan, and clearinghouse, etc., is given

by HIPAA for all their administrative and fnancial business within the health care

industry or Medicare. The NPI is part of HIPAAs Administrative Simplifcation

Standard and consists of 10 numbers and letters. Simplifcation Standard means

that the goal of HIPAA is to minimize confusion and assign one permanent number,

the NPI, which would replace all the other physician identifcation numbers. This

way, anyone doing business with the medical community will use their NPI as

the sole reliable identifer, and all the other numbers: PIN, PPIN, UPIN, etc., will

gradually be phased out. The CMS-1500 and UB-04 claim forms require the use of the

NPI. The other reason the NPI is so important is that the patient can easily identify all

the providers they come into contact with through the course of their treatment and

through the course of their contact with the health care industry.

The Major Players

The Department of Health and Human Services (DHHS) and the Centers for

Medicare and Medicaid Services (CMS) are the federal governments main

administrative bodies that set standards for health care delivery in the United States.

Everything from fees, manuals, regulations, forms, and health care locations in the

United States, emanate from the DHHS and CMS. Medicare, a division of CMS, is the

gold standard by which all insurance carriers and governmental bodies determine

how to deliver, adjudicate, and reimburse health care.

The major regulatory bodies and laws affecting health care include:

DHHS, CMS, MEDICARE, MEDICAID, SCHIP, BBA, TEFRA, DEFRA, COBRA,

OBRA and MAAC.

The Health Care Revenue Cycle 8

Figure 2: The Major Players

The Department of Health and Human Services (DHHS or HHS) (www.hhs.gov)

and The Centers for Medicare and Medicaid Services (CMS), formerly called the

Health Care Financing Administration (HCFA), are the two main governing bodies

responsible for health care delivery (i.e., providing health care) and reform in the

United States. There are many departments within DHHS, but its principal agency

for administering health care is Medicare. Medicare is the nations largest health

care administrative body and delivery system, handling over one billion claims per

year. Today, health care rules and regulations, fee schedules, payments systems,

and delivery mechanisms, all come from Medicare. It establishes the standards for the

administration of health care for the entire country, both public and private, such as

public health clinics, non-proft insurance companies such as Blue Cross and Blue

Shield, and private for-proft insurance carriers such as State Farm, AllState, Humana

and Aetna.U.S. Healthcare.

Chapter 1 - Health Care Plans and Legislation 9

The Department of Health and Human Services (DHHS)

DHHS supports more than 300 programs, some of which are:

1. Medicare

2. Medicaid

3. Insuring drug and food safety (for example, preventing food poisoning

and adverse drug reactions)

4. Improving the health of mothers and infants (providing pre-natal and

post-natal care, proper nutrition and hygiene)

5. Medical and social science research

6. Prevention of infectious diseases, immunizations

7. Safety and health care for elderly Americans including home-delivered

meals

8. Child-support legal enforcement (make sure that parents fnancially

support their dependent children)

9. Aid to Families with Dependent Children (AFDC)

These numerous DHHS programs are administered through 11 divisions of DHHS

which include:

1. Centers for Medicare and Medicaid Services (CMS)

2. National Institutes of Health (NIH)

3. Food and Drug Administration (FDA)

4. Centers for Disease Control and Prevention (CDC)

5. Agency for Toxic Substances and Disease Registry (ATSDR)

6. Indian Health Services (IHS)

7. Health Resources and Services Administration (HRSA)

8. Substance Abuse & Mental Health Services Administration (SAMHSA)

9. Agency for Health Care Research and Quality (AHRQ)

10. Administration for Children and Families (ACF)

11. Administration for Aging (AOA)

The Centers for Medicare and Medicaid Services (CMS)

CMS, a division of DHHS, acts primarily as the buyer of health care services for

Medicare (Title XVIII) and Medicaid (Title XIX) insuring that programs are properly

administered by its contractors and state agencies). CMS establishes policies

for payment of health care providers, acts as a researcher on the effectiveness of

health care treatment, insures proper management and fnancing, and assesses

The Health Care Revenue Cycle 10

the quality of health care facilities and services such as hospitals, nursing homes,

insurance companies, health maintenance organizations, and federal, state, and local

governmental agencies that deliver health care services to the public. CMS is also

the guarantor of health care security and equal access of health care services and

products to all Americans. In other words, CMS guarantees that all Americans can

get medically necessary treatment regardless of whether they can pay and with no

concern as to race, sex, or ethnic background. Note: See www.cms.hhs.gov to view

the relationship between Medicare and Medicaid.

Medicare

Medicare is a federal program (Title XVIII of the Social Security Act), which was

signed into law in 1965. Medicare Parts A and B are known as the Original Medicare

Plan where services are paid under a Fee-for-Service (FFS) arrangement. It is made

up of four (4) parts:

Part A: Pays for inpatient hospital services, skilled nursing

facilities (SNF), home health services (HHS), hospice

care and psychiatric inpatient care. Also known as

Hospital Insurance (HI). Anyone who receives Social

Security benefts by working for at least 10 years (40

quarters) and paying social security taxes, or having

certain types of disabilities like ESRD, automatically

is enrolled in Part A by the Social Security

Administration (SSA) and does not have to pay

premiums. Those who are over 65 years of age and do

not have Part A benefts can still purchase Medicare

Part A coverage by paying a premium.

Part B: Pays for physician services, medical equipment

and supplies (DME-durable medical equipment),

outpatient hospital services: outpatient physical

therapy, occupational therapy and speech therapy,

outpatient mental health care, clinical laboratory

services (Urinalysis [UA] and Complete Blood Count

[CBC]), home health care, blood, etc. Also known as

Supplementary Medical Insurance (SMI). Those who are

enrolled in Part A are automatically eligible to purchase

Part B coverage (premium for 2009 is $96.40/month).

Those desiring Part B coverage must enroll, coverage

is not automatic. If enrollment in Part B coverage

takes place more than 12 months after a persons

initial enrollment in Part A, there is a permanent 10%

increase in premium for each year the benefciary

Chapter 1 - Health Care Plans and Legislation 11

failed to enroll in Part B. For example, if the

benefciary frst enrolled in Part A in 2008, and does

not choose to purchase Part B coverage until 2009,

there would be a $9.64 penalty (10% X 96.40) added to

each months premium permanently as long as Part B

is purchased during the patients lifetime.

Part C: Originally called Medicare + Choice. Part C is

available to those benefciaries who have Parts A

and B. Part C gives the benefciary the option to get

Medicare Advantage Plans, e.g., Health Maintenance

Organizations (HMOs), Preferred Provider

Organizations (PPOs), Private Fee for Service Plans,

Special Needs Plans, and Medicare Medical Savings

Accounts (MSA), which compete directly with the

Original Medicare Plan.

Part D: Pays for prescription drugs through private insurance

plans. Part D was authorized through the Medicare

Prescription Drug, Improvement and Modernization

Act of 2003 also known as the Medicare

Modernization Act or MMA. Those who have

Medicare Parts A and B are eligible (can purchase)

Part D, if they choose, through monthly premiums.

The Medicare program provides services to those who are over 65 years of age, those

who are disabled of any age, and those with end-stage renal disease (ESRD) who require

kidney transplantation or dialysis of any age. Medicare is administered by the CMS.

In cases where the patient is low income and meets certain income requirements,

dual eligibility can be provided where Medicaid covers some of the costs of

Medicares Part A and Part B deductibles, co-payments, and co-insurances. This

way the patient has little or no out-of-pocket expenses and has medically necessary

treatment covered by both Medicare and Medicaid. Medicare Parts A and B are

known as the Original Medicare Plan.

Medicaid

The Medicaid Program (Title XIX of the Social Security Act) is a funded and

administered state-federal partnership (both the state and federal governments work

together) health insurance program. It is for low-income people with children and

people who are aged, blind, disabled or collecting Supplemental Security Income

(SSI). Also included are low-income pregnant women with children and persons with

very high medical bills. SSI includes money and food stamps from the government.

States set eligibility standards (those who can get Medicaid) and establish payment

rates and benefts and services (what and how much the Medicaid recipient will

The Health Care Revenue Cycle 12

receive and how much the doctor and hospital will be paid for providing health

services).

Civil Monetary Penalties Law (CMP or CMPL)

CMP is also known as Title XI of the Social Security Act. These are money fnes

that are applied to providers and hospitals who are convicted of fraud and abuse

concerning Medicare, Medicaid, any insurance plan or third party payer.

State Childrens Health Insurance Program (SCHIP)

State Childrens Health Insurance Program (SCHIP) (Title XXI of the Social Security

Act) is a program for children whose parents have too much money to be eligible for

Medicaid, but not enough to buy private insurance and are, therefore, uninsured. As

of February 2009, President Obama signed into law the Childrens Health Insurance

Reauthorization Act that expanded coverage for SCHIP-eligible families to include

children of legal immigrants and pregnant women. Funding of the expanded SCHIP

coverage would occur by increasing the federal tobacco tax. The SCHIP program

differs in each state, but all states must provide the following basic services.

1. Inpatient and outpatient hospital service

2. Doctors medical and surgical services

3. Laboratory and x-ray services

4. Well-baby/child care

5. Immunizations (Important!)

Balanced Budget Act of 1997 (BBA)

BBA, signed into law by President Clinton in August 1997, enacted the most

signifcant changes to Medicare and Medicaid since their inception, and expanded

services to SCHIP (Title XXI) through CMS. This act also established the Outpatient

Prospective Payment System (OPPS) known as Ambulatory Payment Classifcations

(APCs).

Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA)

TEFRA is a federal law affecting employers with 20 or more full or part-time

employees. It requires that for employees who are senior citizens, 65 to 69 years old,

the employers group health insurance plans (EGHP) continue to be the primary payer.

Medicare will be the secondary payer. TEFRA, therefore, affords older workers the

same insurance coverage as younger workers.

Defcit Reduction Act of 1984 (DEFRA)

DEFRA, like TEFRA, is applicable to employer groups with 20 or more employees.

DEFRA raised TEFRAs upper age limit beyond 69 years of age for active employees,

making them eligible to enroll in the same group health insurance coverage offered

to younger employees. However, the spouse of an active employee remains restricted

Chapter 1 - Health Care Plans and Legislation 13

to insurance coverage up to age 69 under this plan. DEFRA also froze the amounts

physicians can charge for their services to 1984 rates.

Consolidated Omnibus Budget Reconciliation Act of 1985

(COBRA)

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) amended

TEFRA by eliminating the upper age limit of 69 for the spouse of an employee who

has group health insurance working for an employer with 20 or more employees.

Omnibus Budget Reconciliation Act of 1986 (OBRA of 1986)

Do not confuse OBRA of 1986 with OBRA of 1989 or OBRA of 1990. The OBRA of 1986

made employers with 100 or more employees, with large group health plans (LGHP),

the primary coverage for active employees who have Medicare, or dependents of

active employees who have Medicare due to disability other than ESRD. OBRA

set limits for what health care providers can charge Medicare benefciaries, which

was known as MAAC (Maximum Allowable Actual Charge). MAAC is essentially a

Medicare fee schedule stating what Medicare would pay for each health care service

or product. MAAC is important because every payer, whether private or public, pays

for medical services and products based on what Medicare reimburses.

OBRA of 1986 also requires the use of HCPCS coding on the UB-04 claim form for

Medicare claims for outpatient services when rendered in Acute Care or Tertiary

Care or Long-Term Care Hospitals, and Hospital-based Rural Care Clinics. Tertiary

care hospitals provide a full range of medical services, are usually teaching hospitals

associated with medical schools and universities, provide the highest level of trauma

care for the most severe cases, and are associated with research. Examples of tertiary

care hospitals include Massachusetts General Hospital associated with Harvard

University, the University of Pennsylvania Hospital affliated with University

of Pennsylvania, Hershey Medical Center associated with Pennsylvania State

University, etc.

Omnibus Budget Reconciliation Act of 1989 (OBRA of 1989)

OBRA 1989 changed how payment is made to physicians by Medicare, and

established the Resource Based Relative Value Scale (RBRVS). RBRVS is composed

of three elements:

1. Relative Value Unit (RVU) is a fee schedule for every medical procedure

recognized by Medicare. Each medical procedure is assigned a value

based on all of the following:

Work required. (For example, how much effort and time and

expertise is needed by the doctor to perform the surgery.)

Practice expense. (For example, what it costs the doctor to perform

the surgery.)

The Health Care Revenue Cycle 14

Malpractice insurance expense (For example, neurosurgery

costs more to insure against a medical misadventure that an

appendectomy.)

2. Medicare Volume Performance Standard (MVPS) determines how much

every year Medicare will increase payment for services provided by

health care providers and facilities to patients. For example, for 2009, the

Medicare fee for performing an appendectomy was increased 10% (2008=

$1500; 2009= $1650).

3. Limits the amount non-participating physicians can charge Medicare

patients, which is 115% of the Medicare fee schedule, known as the limiting

charge (which replaced the MAAC [OBRA of 1986]). The limiting charge

remains in effect today.

Omnibus Budget Reconciliation Act of 1990 (OBRA of 1990)

As a result of OBRA of 1990, hospitals who wish to participate in Medicare and

Medicaid must develop and implement programs and policies assisting the patient

to make their own medical decisions, appoint a Health Care Surrogate or Durable

Power of Attorney, and execute an AMD. The Patient Self Determination Act

(PSDA) is also known as the Advanced Medical Directive (AMD). The PSDA gave

the patient the right (in a legally binding document) to determine, in advance, what

health care measures they want if they become incapacitated including a Do Not

Resuscitate (DNR) directive, and appoint a Health Care Surrogate and a Power of

Attorney to carry out their directives. The DNR allows the patient to state, in a legally

binding document, what health care measures they want, or do not want, to maintain

their life in case of becoming terminally ill or injured.

Operation Restore Trust of 1995 (ORT)

The Operation Restore Trust of 1995 (ORT) was designed to combat fraud, waste and

abuse in the fve states with the highest Medicare expenses, e.g., California, Florida,

New York, Texas and Illinois. These fve states have received particular attention

by the federal government because they have the highest rates of health care fraud,

abuse and waste in the United States.

Other Players

These organizations and laws complement the DHHS and CMS, as they play an

integral role in the delivery of health care and establish standards for the elimination

of health care fraud, abuse and waste and prosecution of offenders.

They include: HIPAA, NPI, EDI, FCA, DOJ, OIG, Fraud and Abuse, Medical Ethics,

Professional Liability, CMP, EMTALA, Patient Bill of Rights.

Chapter 1 - Health Care Plans and Legislation 15

Health Insurance Portability and Accountability Act of 1996

(HIPAA)

HIPAA, a.k.a Kennedy-Kassenbaum Act, insures the portability of health insurance

when employees change jobs (makes the employee capable of taking their insurance

from employer to employer). In addition, it increases accountability of the health

care contracts that insurance companies write for the patient, increases accountability

of the health insurance carrier itself (makes them more transparent), contains broad

new health care anti-fraud and anti-abuse provisions so the government can fght fraud and

abuse and protect the patient from having their Personal Health Information (PHI) stolen,

and improves availability of health insurance to working families and their children.

HIPAA also establishes three administrative simplifcation provisions which are: (1)

HIPAA Privacy Rule, (2) HIPAA Security Rule, and (3) HIPAA ElectronicTransaction

and Code Sets Standards. Managed Care Organizations (MCOs) are affected under

HIPAA for ALL their health care related business, not just Medicare.

For further information contact: http://www.cms.hhs.gov/hipaa/hipaa2.

HIPAAs key provisions include the following:

1. Guaranteed ability to get health insurance for employers with 50 or less

employees. This means these employees will have the ability to purchase

health care insurance regardless of their health status, age, or medical history.

2. Guaranteed renewal of insurance regardless of health status of any member

of a group of insured people. This means the employee can continue to have

health insurance year after year regardless of health status, age, or medical

history.

3. Guaranteed access for those who lose their group health insurance due to

loss of employment, or change of job to an employer without insurance.

4. If an employee had a medical condition that existed prior to getting new

health insurance with a current or new employer, this medical condition

cannot be used to deny coverage to employees who already had coverage.

HIPAA also applies this rule to limited medical conditions treated and

diagnosed within six (6) months prior to enrollment in a new insurance

health plan, whether it is a current or new employer. This means the new

insurance company cannot deny coverage to the employee because they had

recently been diagnosed and treated for certain diseases or illnesses.

5. For self-employed individuals (people who own and operate their own

businesses), tax deductions for insurance costs will increase from 30% to

80%.

6. Health Savings Accounts (HSAs), is the new name for Medical Savings

Accounts (MSAs), and remain in effect.

7. Administrative Simplifcation. All providers and health care plans

involved in electronic health care transactions must utilize a single set of

national standards and identifers. This means those doctors and hospitals

and medical suppliers who transmit their bills for payment through the

The Health Care Revenue Cycle 16

computer, must use standardized codes (numbers and letters) and forms and

language that everyone understands.

8. Covered Entities: Under HIPAA there are 3 types of health care

organizations that are affected: (1) Health Plans, (2) Health Care

Clearinghouses, and (3) Health Care Providers.

9. Health care fraud and abuse are investigated and prosecuted by the

Department of Justice (DOJ) and the Offce of Inspector General (OIG).

10. HIPAA regulations are enforced by the Offce for Civil Rights (OCR).

National Electronic Data Interchange (EDI)

EDI produced rules that made all HIPAA paperwork and fnancial transactions the

same and understandable by everyone involved in the health care industry (just like

HIPAA assigns an NPI). Manuals that have codes describing all aspects of providing

and billing health care, such as ICD-9-CM, CPT-4, HCPCS, CDT, NDC, Unique Health

Identifer, Security and Privacy of Health Information, Electronic Signature, and information

transfer between health plans, are now the only materials used so that everyone

involved in the business of health care understands what everyone else is doing.

Remember, one of the major goals of HIPAA is to standardize all criteria within the

entire health care industry

1. The International Classifcation of Diseases, 9th Revision, Clinical Modifcation

(ICD-9-CM), is a three volume numeric and alphanumeric coding manual

established by the World Health Organization (WHO) for all outpatient and

inpatient conditions, symptoms, pathologies and diagnoses. The ICD-9-

CM is updated every year. The CMS also sponsored the production of the

ICD-10-PCS, International Classifcation of Diseases, 10th Revision, Procedure

Classifcation system, which will replace the ICD-9-CM, for reporting a

more detailed description of health care procedures and technologies for

the inpatient. The ICD-10-CM will replace the ICD-9-CM for inpatient and

outpatient diagnoses and clinical conditions.

2. The ICD-9-CM consists of Volume 1, Tabular List, which is a numeric

(numbers) and alphanumeric (letters and numbers) listing of all the

diagnosis/pathology/condition codes, and Volume 2, The Alphabetic Index, is

an alphabetic listing of everything found in Volume 1. Volume 1 also includes

V codes, which are supplementary alphanumeric codes for non-pathological

medical situations the patient may encounter such as innoculations, tissue

transplantation, dialysis, family and patient medical history, rehabilitation,

chemotherapy and radiation therapy, etc. Volume 1 also includes E codes,

which are supplementary alphanumeric codes for external causes of trauma

such as motor vehicle accidents (MVAs), poisoning, terrorism, railroad/bus/

aircraft injuries, water-related trauma, sports injuries, etc.

3. The Current Procedural Terminology, 4th edition (CPT-4), is a manual of numeric

and alphanumeric codes for all physician, hospital, Ambulatory Surgical

Center (ASC), Skilled Nursing Facility (SNF), inpatient and outpatient

medical procedures and services, and is owned by the American Medical

Chapter 1 - Health Care Plans and Legislation 17

Association (AMA). Place of Services code sets (POS) are also part of this

manual, which specifes locations that medical services and procedures are

delivered to the patient such as the doctors offce or hospital. The CPT is

also composed of modifers and add-on codes which are coupled to the main

CPT code, that further describe particular physician services in more detail,

as well as P codes which describe the patients physical status (how

healthy or sick they are) when a medical procedure such as anesthesia or

surgery is performed.

4. The CPT is divided into three 3 categories of codes:

Category I codes (5-digit numeric) are found in six chapters: Evaluation

and Management (E/M), Anesthesiology, Surgery, Radiology, Pathology

and Laboratory, and Medicine, and are for inpatient and outpatient

physician procedures and services. Category I codes are the only ones

that are reimbursed by the insurance companies and Medicare.

Category II codes (5 digit alphanumeric ending in the letter F) are for

performance measurement and statistical analysis (counting things).

Category III codes (5 digit alphanumeric ending in the letter T) are

for new and experimental medical procedures and services. In some

instances when the Category III code becomes proven through research

and generally accepted by the medical community, they become

Category I codes.

HCPCS, which stands for the Health Care Common Procedure Coding

System, was developed by the CMS (HCFA) as a 2-part or level coding

system. This manual consists of a collection of codes for procedures,

supplies, products and services that are rendered to Medicare and

Medicaid benefciaries, and patients with other private insurance plans.

These codes are divided into two levels: Level I, which are the same

codes as the CPT-4 Category I codes, and Level II codes, which are

national codes that cover ambulance services, medical supplies and

products, durable medical equipment (DME), prosthetics and orthotics

and some physician services not found in Level I. Although Level II

codes are called national codes, in reality, all the ICD, CPT, HCPCS,

CDT, and NDC codes are national codes as they are used throughout the

United States.

5. The National Drug Code manual (NDC) is made up of codes for retail

pharmacies and pharmaceuticals, and is maintained by the Food and Drug

Administration (FDA).

6. The Current Dental Terminology manual (CDT) is made up of codes for dental

services.

Additional information and further clarifcation to assist with your understanding

and test preparation can be accessed at the following websites:

http://www.cms.hhs.gov/healthplans/

http://answers.hhs.gov

The Health Care Revenue Cycle 18

http://www.wedi.org

http://www.wpc-edi.com

Medical Ethics; Fraud and Abuse; Professional Liability

Medical Ethics are standards of conduct based on moral principles. They are

generally accepted as a guide for behavior towards patients, physicians, co-workers,

the government, insurance companies and anyone within the health care industry.

Acting within ethical behavior boundaries means carrying out ones responsibilities

with integrity, decency, respect, honesty, competence, fairness and trust, like a Boy or

Girl Scout!

Professional Liability refers to the legal concept that the physician and hospital are

liable for their own conduct and conduct of their employees. Respondent Superior

is the legal term meaning Let the master answer. In other words, the doctor and

hospital are liable for the actions of their employees whether it involves billing and

coding, adherence to HIPAA, treatment of the patient, fraud, abuse, etc.

Fraud is defned as a deliberate deception perpetuated for unlawful or unfair gain. In

other words, lying to the patient or falsifying paperwork to the insurance company to

get money or assets that do not belong to the provider.

Health Care Fraud includes the incorrect reporting of a diagnosis or procedure or

service in order to maximize payments. It also pertains to billing for services not

rendered, altering claims (changing the diagnosis and treatment) to receive payment,

or unbundling and accepting kickbacks (monetary or otherwise). Fraud and abuse

are investigated and prosecuted by the Offce of Inspector General (OIG) and the

Department of Justice (DOJ).

Abuse is defned as the misuse of a person, substance, service, procedure, or fnancial

matter so that harm is caused. Health care abuse includes the following:

1. Medically insuffcient, excessive or unwarranted use of technology

(surgical, diagnostic, laboratory, etc.); medically inappropriate utilization of

pharmaceuticals, services, procedures and products (such as durable medical

equipment [DME]). In other words, giving the patient too much (over-

utilization) or too little (under-utilization) surgery or medicine, or giving

medical supplies to the patient that are not needed.

2. Abuse of authority or compromising patient privacy or patient

confdentiality matters (violating HIPAA). In other words, not keeping

the patients medical information from public view, purposely divulging

information publicly to harm the patient or selling it to make money.

3. Improper billing and coding practices (e.g., upcoding, which is coding for a

more expensive service than what was actually provided), billing Medicare

instead of the primary insurer, increasing charges to Medicare benefciaries

but not other patients, or unbundling of services and procedures. Unbundling

is defned as using more procedural codes (CPT and HCPCS) than is

normally warranted in order to bill for medical treatment to get additional

Chapter 1 - Health Care Plans and Legislation 19

reimbursement from the insurance company. Bundling is defned as taking

several procedural codes and combining them into one for the treatment

rendered. This usually results in less money being paid to the health care

provider.

4. Medically unnecessary or AMA (against medical advice) treatment of the

patient. This refers to the illegal and clinically unsubstantiated transferring of

the patient out of the hospital. The provider or health care facilitys duty of

care to the patient has been violated. For example, a doctor or hospital might

dump the patient on the street or at home before the patient is medically

stable or because the patient cannot pay. AMA also includes the patient

voluntarily leaving the hospital before treatment is completed or MMI has

not been achieved, or against the doctors advice.

Reporting Fraud and Abuse may be directed to the Medicare contractors (the

insurance company that Medicare hired to service its customers such as Blue Cross/

Blue Shield) customer service line or fraud department by calling the contractors

fraud hotline, or calling the OIG fraud hotline number: 1-800-HHS-TIPS, with the

following information:

1. Patients Name

2. Date of Service (DOS)

3. Name of Provider

4. Providers Medicare Number

5. Explanation of alleged fraudulent or abusive activities

6. Patients Health Insurance Claim Number

7. Description of Service, Procedure, or Product

8. Address of Provider, and any other pertinent information

Civil Monetary Penalties (Law) (CMPs or CMPLs) is legal punishment (monetary

fnes) imposed by the court when Medicare has determined that a provider or

hospital has violated Medicare, Medicaid, or any health care rules and regulations,

such as fraud or abuse, violation of HIPAA laws, or other administrative infractions.

Title XI of the Social Security Act authorizes the imposition of CMPs.

The Offce of Inspector General (OIG) has seven (7) components in its compliance

plans for doctors and hospitals to avoid fraud and abuse in billing, coding and

delivery of health care services, in the health care workplace. They include the

following:

1. Establish written policies and procedures to check for fraud and abuse in the

health care workplace.

2. Have a Compliance Offcer. This is someone who is in charge of enforcing

policies and procedures to check for fraud and abuse in the workplace.

3. Have effective training and education in the workplace to avoid fraud and

abuse.

The Health Care Revenue Cycle 20

4. Stress effective communication between all employees so that fraud and

abuse can be detected and eliminated.

5. Make sure standards and disciplinary sanctions are clearly written, posted

and known so that all employees are aware of how to avoid fraud and abuse.

6. Promote constant auditing and monitoring in the health care workplace to

avoid fraud and abuse.

7. When fraud and abuse are detected, timely response to offenses occurs as

well as corrective actions are taken.

False Claims Act (FCA)

The False Claims Act (FCA), also known as the Lincoln Act, Qui Tam Statute

or the Informer Act, imposes civil and criminal liability on any doctor or hospital

or supplier that submits an abusive or fraudulent claim for payment to the United

States government or to any third party payer. A health care provider that is found

guilty of fraud and abuse can also be excluded from Medicare and Medicaid.

Examples of fraud and abuse include kickbacks, billing for services not provided,

infating invoices, over-utilization or under-utilization, misrepresenting services

and supplies and procedures provided to patients, providing services not medically

necessary for fnancial gain, and denying patients access to quality health care.

National anti-fraud and anti-abuse laws under HIPAA, and other federal regulations,

are enforced by the OIG and the DOJ. The frst person who brings a Qui Tam suit, is

known as the relater (or whistle-blower). The National Health Care Anti-Fraud

Association has estimated that of the $3+ trillion spent on health care in 2009, from 3

to 5 percent were lost to fraud.

Additional laws relating to health care fraud and abuse control include:

1. Stark Laws, which are self-referral prohibitions, are guidelines that make

it illegal for the physician, or members of their immediate family, to have

fnancial relationships (ownership) with health care facilities which they

refer their patients. For example, a doctor refers patients to a laboratory,

x-ray clinic, or DME company for services or supplies that the doctor (or

their family) owns or has a fnancial interest. Therefore, the provider (or

their family) is making money every time a referral is made. There are

many exceptions to the Stark legislation which allows self-referral through a

variety of legally created business structures, known as safe harbors.

2. Anti-Kickback Statute makes it illegal for any health care provider or facility

to knowingly offer or accept any gifts or money for referring patients to

receive services or products paid by any government health care program

like Medicare, Medicaid, SCHIP, etc. This statute includes the provider

routinely not collecting co-insurances and co-payments the patient is liable.

Accepting money or other forms of reward, such as vacations, property,

tickets to a football game or Broadway show, dinner, gifts, etc., for referring

patients to other providers is also prohibited. The doctor accepting kickbacks

for sending patients to a medical supplier for DME, taking kickbacks for

sending patients for x-rays, taking kickbacks for sending patients to an

Chapter 1 - Health Care Plans and Legislation 21

orthopedic surgeon for treatment, or giving money or gifts to lawyers for

sending patients to the doctors offce for treatment due to an mva, worker-

related injury or a slip-and-fall accident, are all prohibited.

3. The Sarbanes-Oxley Act of 2002 requires publicly traded companies, ones

that are listed on the New York Stock Exchange or Nasdaq and offer stock

to the public, to prove they are fnancially sound and their record keeping

accurately refects the activities of the company (there is no fraud or abuse).

This act is important as related to the health care revenue cycle because the

Sarbanes-Oxley Act applies to for-proft health care corporations such as

insurance companies (State Farm, AllState, Farmers), medical equipment

and device companies (Medtronic, Johnson & Johnson), MCOs (Aetna U.S.

Healthcare, Humana), pharmaceutical companies (Smith Kline, Merck,

Schering-Plough, Johnson & Johnson), etc. Since these companies furnish

services and supplies worth billions of dollars to the public, they must be

operating legally, follow generally accepted accounting principles (GAAP),

and be fnancially liquid, otherwise they could have a devastating fnancial

effect on Medicare and other government funded health care programs. This

act also includes whistle-blower protection so that employees in these

corporations can report fraud and abuse and other wrongdoing without fear

of retaliation.

Emergency Medical Treatment and Active Labor Act (EMTALA)

EMTALA involves:

1. Medical Screening Examination is provided to anyone who goes to a

hospitals emergency room (ER) requesting examination and treatment

for the purpose of determining whether emergency medical treatment is

required.

2. Necessary Stabilizing Treatment is rendered to the patient if the hospital

has determined that urgent medical treatment is needed because it is an

emergency.

3. Restricting Transfers Until Stabilization. The hospital may not transfer

the patient until the patient is notifed of the hospitals obligation to provide

further examination and treatment, and of the risks of transfer. A physician,

or qualifed medical personnel, at the hospital certifes in writing that

transferring the patient (or unborn child) is in the patients best interests as

the treatment provided at another facility outweighs the risk of transfer.

4. The transfer is a Medically Appropriate Transfer. A medically appropriate

transfer means that the transferring facility provides necessary medical

treatment minimizing risks to the patient and/or unborn child and that the

receiving hospital has available space and qualifed medical personnel to

treat the patient and has agreed to accept the transfer.

5. The Transferring Hospital sends all medical records, informed consent and

certifcations provided under EMTALA and any other requirements imposed

by the DHHS; and the name(s) and address(es) of any on-call physician

The Health Care Revenue Cycle 22

or medical personnel who have refused or failed to appear at the hospital

within a reasonable time period to provide necessary emergency stabilizing

treatment.