Beruflich Dokumente

Kultur Dokumente

Technical Analysis Review: Big Picture Is Netural 2 Is Netural

Hochgeladen von

ajayvmehtaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Analysis Review: Big Picture Is Netural 2 Is Netural

Hochgeladen von

ajayvmehtaCopyright:

Verfügbare Formate

27-12-2013

Technical Analysis Review

Review_27/12/13 - ( Rating - 9/15 ) Positive - High Risk - Rupee is Appriciating / Nifty on verge of Breaking out into Bull Market / AD is -ve / TRIN is -ve / Net 52 WK Hi/Low is -ve / Bonds is +Ve (--) Big Picture is Netural. | 0 is extreme -ve | 1 is -ve | 2 is Netural | 3 is +ve | 4 is extreme +ve |

Indian Rupee - ( 3/4 ) Rupee Breakout from Ascending triangle Pattern (Consolidation Range was from 58.932 to 61.230 on 15-08-2013) Upto 67.59 (27-082013) & $ is in a Bull Maket v/s Rupee Depreciation.Rupee had Retracement from Top to 61.44 on 03-10-2013. Rupee was consolidating into a Range at Demand Level from Weekly Timeframe.Rupee has given a fresh Breakout from Range on 06-11-2013.

Supply Zone at 1) 69.228 (68.860) 68.578 2) 64.074 (63.669) 63.206 Demand Zone are at 1) 61.154 (60.720) 60.373 & 2) 59.368 (59.044) 58.688

It is Notable that $ Index has Given a Breakout from Weekly Demand Zone & $ is expected to Raise against all Currencies (Trouble for Rupee) Also With Growing Crises senerio Green Buck (has been considered to be the Hedge (Preferred Vehicle For Cash). (* Note : This time around, This Process is Going to Hurt the Instution the Most.Time will Prove this Historic Process would FAIL & upset the Financial world.

Nifty - ( 3/4 ) Move From 4500 (19-12-2011) to 5631 (22-02-2012) is Uptrend & there was retracement upto 4761 (61.8% Retracement) upto 05-06-2012 Market Restarted Uptrend from 4761 (05-06-2012) to 6110 (29-01-2013) There was correction from 6110 (29-01-2013) Upto 5477 (10-04-2013) After Entire Move from 5477 (10-04-2013) to 6229 (20-05-2013) There was correction in Uptrend (as Higher Low is formed at 5570 on 25-06-2013 after Neckline of 5950 of Fresh H & S is Broken Measured Decline is upto 5700 (78.6 % Rectracement of 5477 to 6229) Lower High Lower Low Trend (Down Trend from 6229 (20-05-2013) to 5565 (24-062013). Retest & Double Top Was From 5565 (24-06-2013) & Ended at 6077.79 ( 23-072013 ). Another Lower High is Created at 5742.29 (14-08-2013)

Previous Highs of 5742.29 (14-08-2013), 6077.79 (23-07-2013) 6142.25 (19-09-2013) & 6189.35 (18-10-2013) is broken on Upside & Price is at Life time High of 6353 (01-112013) & Parabolic Upmove has been Sucessfully Sustained after creating a Higher Low at 5701.54 (01-10-2013) & After Inverse H&S Breakout above 6116 Price closed below 6076 (28-10-2013) Trend reversal can occur if Lower High is Put by Price Supply Levels is - 1) 2) 6354 (6228.45) 6187.80 Demand Levels are 1) 6133 (6100) 6102 2) 5807 (5791) 5780 3) 5755.28 to 5714.63 4) 5550.13 (5506.50) 5474.97 5) 5276.86 - 5211.20 6) 5128.09 (5079.67) 5032.70 7) 4842.27 4770.73 Dimensions Price Major Trend line break from Historic Pivot Highs of 6154 - 6134 is broken on the Up side & retesting the Trendline break from above (with Possibility of breakdown),Measured up move of Break of Ascending Triangle is Very high at 7782 (38.2%) (Very Difficult - Down Side Break is very Low 3345 (50%) & 2864 (61.8%)) Volume Volumes are in increasing Trend.In Dec series Nifty future shed 6 lakh position in Open Interest and this accounts to -3.27 % of Total Open Interest in Dec series.The Nifty Dec series is trading at 18.1 Rs premium to Underlying . In derivative cumulatively for all series contract Nifty future net added 16.02 lakh position in open interest and this accounts to 5.94 % of Total Open Interest in all series and cumulatively trading in average premium of 63.57 Rs to Underlying. Indicators OSMA +Ve Trend - Slow Stochastic +Ve Trend - ADX -VE Trend Open Intrest (OI) Record updated for-.Dec/30/2013-NIFTY FUTURE-CMP(6372.05) is currently in BULL trend.In Jan series Nifty future added 7.87 lakh position in Open Interest and this accounts to 3.99 % of Total Open Interest in Jan series.The Nifty Jan series is trading at 58.25 Rs premium to Underlying . In derivative cumulatively for all series contract Nifty future net added 8.88 lakh position in open interest and this accounts to 4.27 % of Total Open Interest in all series and cumulatively trading in average premium of 97.87 Rs to Underlying. NIFTY PCR (Position Wise) - 0.85 & (Money Wise) - 0.19

Sentiments Sentiments are now Caustious as current Breakout has Broken out into Life time High but retraced, Due to Sharp Upmove Traders are forced to cut their Short Position,A Break on Upside from Weekly Inverse H&S & Monthly Ascending Triangle Indicates Supreme Power for Bulls.Risk Reward would be favourable on Bull Side. Earnings are mostly expected to be -ve TIme After Previous F&O expiry (@ 6278.90 ) Nifty could now build Short Position due to Sharp Pullback Rally.. Nifty's 56 Day Cycle (23-12-2013 Trend continued up ) (Next Date 17-02-2013 Expect Downtrend )--> Mid month Reversal ( 12-12-2013 was a Down Day ) (Next Date 14-01-2014) Quaterlies Settlement is on 3rd Friday (20-12-2013 was Bullish) (Next Date 21-032014 Expect Bearish Retracement) P & F Chart Rare Double top & Inverse H&S Neckline Breakout @ 6200 --- New Support 6150 & Resistance 6300 Breadth Charts - ( 0/3 ) (Rating 1 for Each +ve) Advance Decline Line (0/1) If the Nifty is rising but the number of stocks advancing is dropping, then the trend is in trouble and may pause soon or even reverse. AD Line is Not Rising with increase in Nifty, indicates Decreased strength in Up trend & Line is still Low on the Curve hence it is Positive for Uptrend. Midcaps are Raising with inclining Momentum ( After Recovery from Over Sold Levels ) But some Large caps & All Index Heavy Weights are Declining with Huge Momentum & Breakdowns

Trader's Index (TRIN Chart) (0/1) To Incorporate Volume of Advance Decline Analysis - TRIN is unusual in that it moves opposite to the Nifty TRIN is a ratio where 1.0 means selling and buying pressure are equal TRIN BELOW 1.0 (More Volume in stocks that are advancing) & Above 1.0 (More Volume in stocks that are Declining SMA Trin is Between 0.8 & 0.7 indicated reduced Strength in Uptrend & space for more stocks to Decline even tho Nifty is Rising,The series of Higher Lows in SMA10 of TRIN can be Restored.

NSE Net Monthly High & Low (0/1) More Stocks in the index making new highs versus new lows if Number is Reducing Trend is in Trouble.The Rising New Highs indicate Markets Buying pressure is accelerating (Environment & Trend) is Positive There is a downward slope as "Valleys of 52 week Highs" has been broken on upside for a 2nd Time indicating Strength in Up Trend.The "Peaks of stocks Hitting 52 Week High" Should increase for strong Up Trend

India Vix Volatility Index (or Fear Index or VIX) is a weighted measure of the implied volatility.Market Makers hedge the market Play, the Down Volume is always a factor & used in Direct Corelation with the VIX & They Together have Indirect corelation with Index ie Vix & DVol is Down; Market will move Up AND Vix & DVol is Up;Market will move Down.Indirect relation between Vix & DVOL leads to Sidewise Index VIX is below 20 indicating Complacancy. Fear/ Volitality is decreasing with Up Trend indicating strength...Volume is also High.... Indian Bonds (3/4) Indirect Correlation with Stock Market; Money Flows from Bonds to Stock for Short term Maturity (Mkt Goes up) & Vice Versa. Shorter Period = Lower Rate (Controlled by Centeral Bank & Indirect relation to Stock Market) + Longer Period = Higher Rate (Controlled by Market) All Bonds Compleing Pullback in Uptrend. Correct Relation of 30Y ROI > 10Y ROI > 3Y ROI is achived (Caution Money is Moving to Short term Bond Market from Share Market indicates Weekness in Economy & Flight to safety ) .. . Under Asset Rotation from Risk on (Equity Market) to Risk off (Bond Market - Security Backed by Govt) & with Devalution of Rupee the Dollar Outage is gaining strength ( Increase of Returns in 100% Govt secured Bonds).Also Yield Returns in India are more than corrosponding Bonds in Developed Markets. 10 Y 30 Y 3Y

http://stockcharts.com/h-sc/ui

Commodities (Negative Correlation) $CRB Consolidating in Downtrend, Commodities Crude Has Broken Down ( Bulltrap was set for ascending Triangle breakout on weekly chart ), Post Pullback, Gold has Pullback as $ Moved Down ... ( Equity Markets Rally has Dangers Due to Reduced Economic Growth (& Reduced Commodity Demand) & Geo Political Tensions are reducing,Now Commodities are to Resume Down Trend as Major banks are set to Move out of Physical Commodity Markets. (Excess Supply Over Demand) Group 1 - Oil + Gas -> 33% Weight Group 2 - Natural Gas + Metal + Corn + Soya -> 42% Weight Group 3 - Others -> 25% Weight

Currency Markets (Positive Coorrelation) Dollar is the Only Currency that has Reached Demand Zone & Hence Some Currencies are Reaching Supply Zone. Japan Yen Aussie $ are Depriciating & Market are trying to Rebuild (Distribution) after Fed's Stance of Re Tapering in QE & Budget Deal, Hints at Liquidity Reversal is on Hold (Market is Build Gains on Good News) ..... Hence Global markets are in Risk Off Mode .. Currency War has Reached Phase II where Every Currency (Developed & Other Emerging Mkt Currencies ) are depreciating against $ to take advantage of investment in safe Govt Secured Bond

World Markets (Positive Coorrelation) Chinese Recover is Slow with raised concerns on liquidity & Devalued Yunan & US Markets has Fresh Breakout (Markets are Distributing Stocks on Good News Markets are now Ferouscliously Selling.Europe CAG DAX are Near Resistance & FTSE have given Fresh Break out (Global Markets are Now breaking out of Resistance. Syncronisation in Breakouts is seen after Creating consolidation Patterns.But Global Liquidity is Drying,interest Rates are increasing ..All Equity Markets are on Risk ON Mode

http:// in.advf n.com /world

The Mighty 10 Index - Top Sector & Index weighted % Wise ( 0/10 ) Extremely Negative INDEX HDFC DBD from weekly supply Zone to Test 200 SMA - Golden Cross - Y FINANCE ICICIBANK DRB from Daily Demand Zone - Death cross - Y ENERGY RELIANCE RBD from Daily Supply Zone - Golden Cross - Y IT INFY RB into weekly Supply Zone - Golden Cross - Y FMCG ITC DBD into weekly Demand Zone - Golden Cross - Y AUTO TATAMOTORS DBR into Daily Supply Zone - Golden Cross - Y PHARMACEUTICALS SUNPHARMA DBD from Daily Supply - Golden Cross - Y CAPITAL GOODS L&T Innverse Cup & Handle into Daily Supply - Death Cross - Y METALS TATASTEEL RBR into weekly Supply - Golden Cross - Y CEMENT ULTRACEMCO RBD From Weekly Supply Zone - Golden Cross - Y

NB: These notes are just personal musings on the markets, trends etc, as a sort of reminder to me on what I thought of them at a particular point in time. They are not predictions and none should rely on them for any investment decisions. Readers Discretion Expected. Advocate to Consult Your Financial Advisor before any Investment as Investment in any market may be Lost in its Entirety. Strictly for Entertainment Purpose Only.

Das könnte Ihnen auch gefallen

- Technical Analysis Review: Big Picture Is Netural 2 Is NeturalDokument7 SeitenTechnical Analysis Review: Big Picture Is Netural 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: Big Picture Is Netural 2 Is NeturalDokument7 SeitenTechnical Analysis Review: Big Picture Is Netural 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: Big Picture Is Netural 2 Is NeturalDokument7 SeitenTechnical Analysis Review: Big Picture Is Netural 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: Big Picture Is Netural 2 Is NeturalDokument7 SeitenTechnical Analysis Review: Big Picture Is Netural 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeutralDokument7 SeitenTechnical Analysis Review: 2 Is NeutralajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is Neturalajayvmehta0% (1)

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- 14 - Technical Analysis Review - 060913Dokument7 Seiten14 - Technical Analysis Review - 060913ajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- 13 Review 300813Dokument5 Seiten13 Review 300813ajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeturalDokument7 SeitenTechnical Analysis Review: 2 Is NeturalajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeutralDokument7 SeitenTechnical Analysis Review: 2 Is NeutralajayvmehtaNoch keine Bewertungen

- 09 Review 020813Dokument5 Seiten09 Review 020813ajayvmehtaNoch keine Bewertungen

- 10 Review 090813Dokument5 Seiten10 Review 090813ajayvmehtaNoch keine Bewertungen

- 08 Review 260713Dokument7 Seiten08 Review 260713ajayvmehtaNoch keine Bewertungen

- 06 Review 120713Dokument5 Seiten06 Review 120713ajayvmehtaNoch keine Bewertungen

- 04 Review 280613Dokument6 Seiten04 Review 280613ajayvmehtaNoch keine Bewertungen

- Commodity & Currency Focus - Technical Report on Global Commodities and CurrenciesDokument6 SeitenCommodity & Currency Focus - Technical Report on Global Commodities and CurrenciesumaganNoch keine Bewertungen

- Investment TipsDokument38 SeitenInvestment TipsPartha PratimNoch keine Bewertungen

- Daily Technical Analysis Report 23/october/2015Dokument14 SeitenDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNoch keine Bewertungen

- Technical Trend: (05 July 2011) Equity Market: India Daily UpdateDokument4 SeitenTechnical Trend: (05 July 2011) Equity Market: India Daily UpdateTirthankar DasNoch keine Bewertungen

- Monthly Technical Stock Picks: Retail ResearchDokument3 SeitenMonthly Technical Stock Picks: Retail ResearchGauriGanNoch keine Bewertungen

- Mentum Stocks: Sector Technical WatchDokument5 SeitenMentum Stocks: Sector Technical WatchGauriGanNoch keine Bewertungen

- Currency Daily Report, June 26 2013Dokument4 SeitenCurrency Daily Report, June 26 2013Angel BrokingNoch keine Bewertungen

- IM Project ICICI Bank Technical AnalysisDokument9 SeitenIM Project ICICI Bank Technical Analysisajay_sjceNoch keine Bewertungen

- Crystal Ball Gazing: Key Insights from 2013 Technical ResearchDokument28 SeitenCrystal Ball Gazing: Key Insights from 2013 Technical Researchsunil0547Noch keine Bewertungen

- Banking & IT Sector WatchDokument6 SeitenBanking & IT Sector WatchGauriGanNoch keine Bewertungen

- Currency Daily Report, July 24 2013Dokument4 SeitenCurrency Daily Report, July 24 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Analysis Report 20/october/2015Dokument14 SeitenDaily Technical Analysis Report 20/october/2015Seven Star FX LimitedNoch keine Bewertungen

- Day Trading Guide - Day Trading Guide For Monday - The Economic TimesDokument3 SeitenDay Trading Guide - Day Trading Guide For Monday - The Economic TimesAnupNoch keine Bewertungen

- Daily Market Technicals: FX OutlookDokument13 SeitenDaily Market Technicals: FX OutlooktimurrsNoch keine Bewertungen

- S&P CNX NIFTY Monthly & Sectoral Analysis: November OutlookDokument6 SeitenS&P CNX NIFTY Monthly & Sectoral Analysis: November OutlookGauriGanNoch keine Bewertungen

- Currency Report - Daily - 13 June 2023 - 13-06-2023 - 09Dokument4 SeitenCurrency Report - Daily - 13 June 2023 - 13-06-2023 - 09Porus Saranjit SinghNoch keine Bewertungen

- Commodity Futures Weekly Report - 20130226Dokument15 SeitenCommodity Futures Weekly Report - 20130226Aaron UitenbroekNoch keine Bewertungen

- Momentum PicksDokument20 SeitenMomentum PicksxytiseNoch keine Bewertungen

- Currency Daily Report, June 25 2013Dokument4 SeitenCurrency Daily Report, June 25 2013Angel BrokingNoch keine Bewertungen

- Weekly Technical Report 23 September - 2011Dokument9 SeitenWeekly Technical Report 23 September - 2011crypticbirdNoch keine Bewertungen

- Nifty Bullish But Breadth Overbought; Breakout Iron Condor Options TradeDokument27 SeitenNifty Bullish But Breadth Overbought; Breakout Iron Condor Options TradeDAYAMOY APL100% (1)

- Equity Weekly News 23 Dec To 03 JanDokument6 SeitenEquity Weekly News 23 Dec To 03 JanSunil MalviyaNoch keine Bewertungen

- Daily Market Technicals: FX OutlookDokument13 SeitenDaily Market Technicals: FX OutlooktimurrsNoch keine Bewertungen

- Content: US Dollar Euro GBP JPY Economic IndicatorsDokument4 SeitenContent: US Dollar Euro GBP JPY Economic IndicatorsAngel BrokingNoch keine Bewertungen

- Thursday, February 6, 2014: Must Have Book For SubscribersDokument10 SeitenThursday, February 6, 2014: Must Have Book For Subscriberschr_maxmannNoch keine Bewertungen

- T I M E S: Overbought Conditions Could Trigger CorrectionDokument20 SeitenT I M E S: Overbought Conditions Could Trigger CorrectionAmey TiwariNoch keine Bewertungen

- Report PDFDokument6 SeitenReport PDFumaganNoch keine Bewertungen

- Equity Weekly Technical Report 2 Deceber To 6 DecemberDokument7 SeitenEquity Weekly Technical Report 2 Deceber To 6 DecemberSunil MalviyaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- Technical Analysis Review: 2 Is NeutralDokument7 SeitenTechnical Analysis Review: 2 Is NeutralajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 112 Technical Analysis Review 310715Dokument7 Seiten112 Technical Analysis Review 310715ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- 82 Technical Analysis Review 261214Dokument7 Seiten82 Technical Analysis Review 261214ajayvmehtaNoch keine Bewertungen

- CCAL PVC-O Rates ADGDokument3 SeitenCCAL PVC-O Rates ADGsrbh1977Noch keine Bewertungen

- Review Lecture Notes Chapter 15Dokument7 SeitenReview Lecture Notes Chapter 15- OriNoch keine Bewertungen

- Financial Literacy: Mary Jean Napuran Natasha GocelaDokument33 SeitenFinancial Literacy: Mary Jean Napuran Natasha GocelaJen nprn100% (1)

- Transit Oriented Development Policy, 2022Dokument14 SeitenTransit Oriented Development Policy, 2022RaghuNoch keine Bewertungen

- Smart Investment Issue No. 1 (Dt. 31-1-2022)Dokument22 SeitenSmart Investment Issue No. 1 (Dt. 31-1-2022)seema suranaNoch keine Bewertungen

- Herbst Grad - Msu 0128N 10584Dokument124 SeitenHerbst Grad - Msu 0128N 10584Jesselly ValesNoch keine Bewertungen

- Quickly Track Budget vs Actual SpendingDokument13 SeitenQuickly Track Budget vs Actual SpendingMichelle PadillaNoch keine Bewertungen

- THE IMPACT OF VISA FACILITIES ON TOURISM SECTOR Case Study For AlgeriaDokument15 SeitenTHE IMPACT OF VISA FACILITIES ON TOURISM SECTOR Case Study For AlgeriaAnouar BoumelitNoch keine Bewertungen

- EOF Lecture Notes - Consumption and Exchange - Sep 15Dokument23 SeitenEOF Lecture Notes - Consumption and Exchange - Sep 15碧莹成Noch keine Bewertungen

- 2018 Bfa NatWest Franchise SurveyDokument28 Seiten2018 Bfa NatWest Franchise SurveyPapa Johny100% (1)

- Islamic HistoryDokument44 SeitenIslamic HistoryHafiz NajeebNoch keine Bewertungen

- Chapter 2 Determinants of Interest RatessDokument2 SeitenChapter 2 Determinants of Interest RatessBryan Ivann MacasinagNoch keine Bewertungen

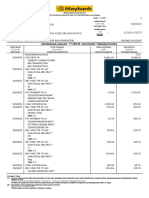

- Malayan Banking Berhad Savings Account StatementDokument2 SeitenMalayan Banking Berhad Savings Account StatementSYAZA RANIA BINTI SHAH RIZAL MoeNoch keine Bewertungen

- Wagners Hypothesis With Public ExpendituresDokument3 SeitenWagners Hypothesis With Public ExpendituresSamad Raza KhanNoch keine Bewertungen

- CGPDTM Current AffairsDokument309 SeitenCGPDTM Current AffairsVeeriya AjanthNoch keine Bewertungen

- FINA1310 Assignment 1Dokument5 SeitenFINA1310 Assignment 1timothyNoch keine Bewertungen

- Amalthea Letter 202206Dokument9 SeitenAmalthea Letter 202206Alessio CalcagnoNoch keine Bewertungen

- India's BOP shifts from surplus to deficit in 2018Dokument7 SeitenIndia's BOP shifts from surplus to deficit in 2018Simran chauhanNoch keine Bewertungen

- TVM Concepts ExplainedDokument25 SeitenTVM Concepts ExplainedVainess S Zulu0% (1)

- Script IndustrializationDokument2 SeitenScript Industrializationashley enageNoch keine Bewertungen

- Tugas 2 Bahasa Inggris NiagaDokument3 SeitenTugas 2 Bahasa Inggris NiagaRICKY ROSALESNoch keine Bewertungen

- Personal Financial ManagementDokument42 SeitenPersonal Financial ManagementBleoobi Isaac A Bonney100% (1)

- The Importance of International Trade All Over The WorldDokument18 SeitenThe Importance of International Trade All Over The WorldEhesanulHaqueSaifNoch keine Bewertungen

- City/ Location Hotel Brand Hotel NameDokument4 SeitenCity/ Location Hotel Brand Hotel NameJagdeep SanghaNoch keine Bewertungen

- AQR Alternative Thinking 1Q12Dokument8 SeitenAQR Alternative Thinking 1Q12Zen TraderNoch keine Bewertungen

- Secretary's Certificate in Re Board ResolutionsDokument2 SeitenSecretary's Certificate in Re Board Resolutionslucky joy domingoNoch keine Bewertungen

- Bus 525, AssignmentDokument9 SeitenBus 525, AssignmentSamia Mahmud100% (1)

- Volvo EC300D Parts CatalogDokument1.755 SeitenVolvo EC300D Parts CatalogHaytham Maged80% (5)

- EngineeringDokument8 SeitenEngineeringAjayNoch keine Bewertungen

- McConnell 15ce Macro Chapter12Dokument59 SeitenMcConnell 15ce Macro Chapter12Ali LoveNoch keine Bewertungen