Beruflich Dokumente

Kultur Dokumente

4 Accounts For Bonus Shares

Hochgeladen von

shanky631Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4 Accounts For Bonus Shares

Hochgeladen von

shanky631Copyright:

Verfügbare Formate

Log onto: http://azzeeweb.co.

cc

ACCOUNTS FOR BONUS SHARES

PROVISIONS:

1. Bonus Shares are issued to the Existing Equity Share Holder of the company. 2. Bonus Shares are issued to the fully paid up existing equity share holders only. 3. Partly paid up Equity Shares can be made fully paid up through Bonus. 4. Bonus Shares are issued Out of Free Reserves means the following Profits which are available for Dividend And Capital Profits like Securities Premium Capital Reserves Other Capital Profits but they should be realized in Cash.

5. Capital Redemption Reserve (CRR):- This is used to issue the Bonus Shares only. 6. Statutory Reserves: - Reserves required by state regulators, and if maintained than used only for specific purpose for which it created. Like Investment Allowance Reserve Development Rebate Reserve Export Profit Reserve Foreign Project Reserve

Note: Statutory Reserves can not be used to issue the Bonus Shares. 7. Profit created through Revaluation of Assets Can Not be used to issue the bonus Shares. 8. Bonus Shares Can Not be issued in lieu of Dividend 9. No company shall issue Bonus shares unless similar benefits are hold or extended to the Fully Convertible Debentures and Partly Convertible Debentures. 10. A company which announces its bonus issue after the approval of the board of directors must implement the proposal within a period of SIX MONTHS (6 Months) from the Date of such approval. 11. A company can not Capitalized its profit by way of Bonus unless the Articles of Association (AOA) of the company authorizes it. 12. To issue the bonus shares by way of capitalizing the profit, a company should amend (change) its Articles of Association (AOA) by a resolution in meeting. 13. Capital Redemption Reserve, Securities Premium, Capital Reserve (Realized in Cash) is used only to issue the New Shares as Bonus to the existing equity share holders of the company. Created by Azharuddin Khan under the Guidance of Mr. Intakhab Ahmad (BVA)

Log onto: http://azzeeweb.co.cc AND To make partly paid up equity shares as fully paid up the company uses it Revenue Reserves like General Reserves and Profit and Loss A/c etc. 14. If the issue of Bonus Shares exceeds the authorized capital, the company should make the proper provisions to increase its Authorized Capital. 15. Bonus Shares always issued as fully paid up.

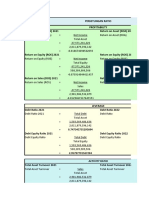

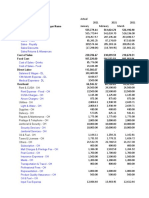

JOURNAL ENTRIES

FOR BONUS SHARES

CASE 1: When Partly Paid Up equity shares made Fully Paid Up through Bonus

S.No. 1. (When Final Call is Made) Particulars Dr. Cr.

Equity Share Final Call A/c To Equity Share Capital A/c 2. (When Final Call is Completed through Bonus) General Reserve A/c Profit and Loss A/c To Bonus to Share Holders A/c 3. (When Bonus to Share holder are cancelled) Bonus to Share Holders A/c To Equity Share Final Call A/c

*** ***

*** *** ***

*** ***

CASE2: When Bonus Shares are issued to the existing fully paid up equity share holders.

S.No. Particulars 1. (When Bonus Share are issued) Capital Redemption Reserve A/c Securities Premium A/c Capital Reserve A/c General Reserve A/c Revenue Reserves Profit and Loss A/c Other Revenue Reserves A/c To Bonus to Share Holders A/c Dr. Cr.

*** *** *** *** *** *** ***

Created by Azharuddin Khan under the Guidance of Mr. Intakhab Ahmad (BVA)

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Ichapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresDokument14 SeitenIchapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresJessalyn DaneNoch keine Bewertungen

- Payment of Bonus Act Quick RevisionDokument9 SeitenPayment of Bonus Act Quick Revisionshanky631Noch keine Bewertungen

- Computer Studies NotesDokument30 SeitenComputer Studies Notessyed_talha_373% (11)

- Profitability AnalysisDokument43 SeitenProfitability AnalysisAvinash Iyer100% (1)

- Partnership List of CasesDokument46 SeitenPartnership List of CasesMay AnascoNoch keine Bewertungen

- MS-1stPB 10.22Dokument12 SeitenMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Practical Questions in Negotiable InstrumentstDokument32 SeitenPractical Questions in Negotiable InstrumentstYaswanth YashuNoch keine Bewertungen

- A Joint VentureDokument38 SeitenA Joint Venturesweety7677Noch keine Bewertungen

- Disclaimer: © The Institute of Chartered Accountants of IndiaDokument17 SeitenDisclaimer: © The Institute of Chartered Accountants of Indiashanky631Noch keine Bewertungen

- Provident Fund Act Summary NotesDokument8 SeitenProvident Fund Act Summary Notesshanky631Noch keine Bewertungen

- Is Universal Banking JustifiedDokument48 SeitenIs Universal Banking Justifiedshanky631Noch keine Bewertungen

- CA IPCC FM Charts For All Chapters by CA Mayank KothariDokument4 SeitenCA IPCC FM Charts For All Chapters by CA Mayank Kotharishanky63167% (3)

- The Payment of Bonus ActDokument10 SeitenThe Payment of Bonus Actshanky631Noch keine Bewertungen

- Ipcc & PCC EthicsDokument23 SeitenIpcc & PCC EthicsKaustubh BasuNoch keine Bewertungen

- Costing FM Model Paper - PrimeDokument17 SeitenCosting FM Model Paper - Primeshanky631Noch keine Bewertungen

- Economics Paper 3Dokument396 SeitenEconomics Paper 3shanky631Noch keine Bewertungen

- Less: Agreed Value of Less: MV of Total Liab. XXX Merger: Amount Paid To EquityDokument4 SeitenLess: Agreed Value of Less: MV of Total Liab. XXX Merger: Amount Paid To Equityshanky631Noch keine Bewertungen

- Accounting Rate of ReturnDokument16 SeitenAccounting Rate of Returnshanky631Noch keine Bewertungen

- Economics Revision: Chapter 1:nature of Work and Leisure and Trends in Employment and EarningsDokument44 SeitenEconomics Revision: Chapter 1:nature of Work and Leisure and Trends in Employment and Earningsshanky631Noch keine Bewertungen

- 2.theory of Demand and Supply.Dokument30 Seiten2.theory of Demand and Supply.punte77100% (1)

- Strategic Cost Management - Management AccountingDokument5 SeitenStrategic Cost Management - Management AccountingVanna AsensiNoch keine Bewertungen

- Sanjay Routray: General Manager, 12Dokument4 SeitenSanjay Routray: General Manager, 12Sanjaya RoutrayNoch keine Bewertungen

- RN Profile Foco 2022Dokument16 SeitenRN Profile Foco 2022MANINDER SINGHNoch keine Bewertungen

- Term:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaDokument50 SeitenTerm:2008-2009 B.Tech Iv/Cse Iind Semester Unit-V PPT Slides Text Books: 1. Frontiers of Electronic Commerce - Kalakata, Whinston, Pearson. 2. E-Commerce, S.Jaiswal - GalgotiaMohit SainiNoch keine Bewertungen

- DIVIMART New Letterhead-Store Vist LetterDokument15 SeitenDIVIMART New Letterhead-Store Vist LetterAnndreaNicoleDebloisNoch keine Bewertungen

- John Smith Resume SampleDokument1 SeiteJohn Smith Resume SampleDana Beatrice RoqueNoch keine Bewertungen

- Parker Economic Regulation Preliminary Literature ReviewDokument37 SeitenParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuNoch keine Bewertungen

- Data First WblsDokument11 SeitenData First WblsGellie De VeraNoch keine Bewertungen

- Sarthak Gajjar: ObjectiveDokument2 SeitenSarthak Gajjar: ObjectivesarthakNoch keine Bewertungen

- NullDokument261 SeitenNullRabia jamalNoch keine Bewertungen

- CorrectivePreventive Action Request (CPAR) RegistryDokument7 SeitenCorrectivePreventive Action Request (CPAR) RegistryManz ManingoNoch keine Bewertungen

- Official Attachment ReportDokument27 SeitenOfficial Attachment ReporttawandaNoch keine Bewertungen

- ACCT 451 Advanced Accounting Trial ExamDokument4 SeitenACCT 451 Advanced Accounting Trial ExamPrince-SimonJohnMwanzaNoch keine Bewertungen

- Mohammed - C.V 2023 NewDokument1 SeiteMohammed - C.V 2023 NewAli AlharbiNoch keine Bewertungen

- Uplift Construction and Development CorporationDokument3 SeitenUplift Construction and Development CorporationDAXEN STARNoch keine Bewertungen

- Case StudyDokument35 SeitenCase Studytuan nasiruddinNoch keine Bewertungen

- Introduction To Ohs Management System Standards: Presenter: Zaikhasra Zainuddin 17 JULY 2009Dokument40 SeitenIntroduction To Ohs Management System Standards: Presenter: Zaikhasra Zainuddin 17 JULY 2009Chandral VaradanNoch keine Bewertungen

- ICAI JournalDokument121 SeitenICAI Journalamitkhera786Noch keine Bewertungen

- Proyeksi INAF - Kelompok 3Dokument43 SeitenProyeksi INAF - Kelompok 3Fairly 288Noch keine Bewertungen

- The Bernie Madoff ScandalDokument42 SeitenThe Bernie Madoff ScandalShrutiNoch keine Bewertungen

- MOU With DCB Bank 9may16Dokument10 SeitenMOU With DCB Bank 9may16Sainik AddaNoch keine Bewertungen

- Plws by JPPMDokument45 SeitenPlws by JPPMVaalu MuthuNoch keine Bewertungen

- Welcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalDokument10 SeitenWelcome To Oyo Rooms: Founder and CEO:-Ritesh AgarwalNitin MishraNoch keine Bewertungen

- Components of Inventory CostDokument33 SeitenComponents of Inventory CostJohn PangNoch keine Bewertungen

- Case Study Project Income Statement BudgetingDokument186 SeitenCase Study Project Income Statement BudgetingKate ChuaNoch keine Bewertungen