Beruflich Dokumente

Kultur Dokumente

Finance Sample Exam Questions

Hochgeladen von

atekeeOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finance Sample Exam Questions

Hochgeladen von

atekeeCopyright:

Verfügbare Formate

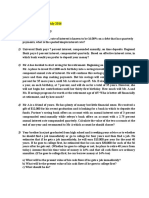

1. Mr. Emre Eren wants to buy a car for himself. The price of the car is $ 120,000 and Mr.

Eren will pay 20% of the price as down-payment and will get a loan to finance the balance. The loan will have a maturity of 2 years, and its interest t rate will be 24% per year. The loan will be paid back in equal installments as the end of every month. Bur, Mr. Eren does not want to make any payments at the end of periods 7, 8, and 9. Instead, he wants to make double payments at the end of months 18, 21, and 24. Under these conditions, please answer the following questions. a. How much will be the each installment that Mr. Eren will pay? b. How much of the second payment will be interest payment? c. What is the annual effective rate of this loan?

2. You have a sister and you want to finance the college education of her. You realize that you have to pay $25,000 at the beginning of each year for 4 years. Your sister is going to start school when she completes 18 year, therefore you want to save money to finance her study. You want to put aside 14.278,63 per year, you think if you invest this much money in a bank every year, you will have enough money to finance the study of your sister. If the interest rate is 10%, how old is your sister now?

3. Steaks Galore needs to arrange financing for its expansion progress. One bank offers to lend the required $1,000,000 on a loan which requires interest to be paid at the end of each quarter. The quoted rate is 10 percent, and the principal must be repaid at the end of the year. A second lender offers 9 percent, daily compounding (365-day year), with interest and principal due at the end of the year. What is the difference in the effective annual rates (EFF) charged by the two banks?

4. Turkish Central Bank is expecting an annual inflation rate of 5.3% for the year 2010 based on the TUFE index. However, the inflation rate has been 1.85% and 1.45% in January and February 20120. Under these conditions, what should be the maximum inflation rate in each of the remaining 10 months so that the yearly inflation rate will not exceed 5.3 %?

5. The per capital income of Turkey, based on the purchasing power parity, is $12,390 for 2009. This figure is $ 36,500 for the European Union countries on the average. If Turkey has a growth rate of 4.25 % and EU countries have a growth rate of 1.96 %, how long will it take for Turkey to have the same per capita income as the EU countries? (write down the formula only)

6. On March 21, 2005 The Turkish Treasury has issued 98-day Bills (TB). Their yearly compound (effective) interest rate turned out to be 18.72 % a. What is the annual simple interest rate of these bills? b. If the nominal value of the bills 100.000 YTL, how much were they sold for on March 21? c. If a person who bought these bills on March 21 sold them on March 27, 7 days later, how much profit would he/she make? 7. Recently Ohio Hospitals Inc. Filed for bankruptcy. The firm was reorganized as American Hospitals Inc. and the court permitted a new indenture on an outstanding bong issue to put into effect. The issue has 10 years to maturity and a coupon rate of 10 percent, paid annually. The new agreement allows the firm to pay no interest for 5 years. Then, interest payments will be resumed for the next 5 years. Finally, at maturity (year 10), the principal plus the interest that was not paid during the first 5 years will be paid. However, no interest will be paid on the deferred interest. If the required return is 20 percent, what should the bonds sell for in the market today? 8. G Mart, Inc. is considering the acquisition of equipment to expand its sales. The initial cost of the equipment is $100,000. However, the production manager has estimated the expansion program will increase cash operating costs by $20,000. Assume straight line depreciation to zero salvage, a tax rate of 40%, and a cost of capital of 10%. How much will the additional cash revenue during the 10 year life of the asset have to be to cause of IRR of the project to be equal k? 9. Etna A.S has issued bonds of $ 1,000 with a maturity of 8 years and the coupon rate of 14%. The interest will be paid annually. But you have just found out that the company will not be able to make the interest payments for years 4, 5 and 6 on time. Instead, they will be paid on the day of maturity together with the interest of year 8. If you want a

minimum rate of return of 16% on your investments, how much would you like to pay for these bonds today?

10. You have just been offered a bond for $847.88 The coupon rate is 8% payable annually and interest rates on new issues of the same degree of risk are 10% You want to know how many more interest payments you will receive, but the party selling the bond cannot remember. Can you help him out 11. On March 20, 2001, The Turkish Treasury has issued 98- day bills (TBS). The yearly compound (effective) interest rate turned out to be 193.71% a. What are the annual simple rates of these bonds? b. If the nominal value of these bills is 1 Milyar TL, how much were they sold on March 20? c. If a person who bought these bills on March 20 sold them on March 27, 7 days later, how much profit would he/she make? 12. You have just taken out an installment loan for $100,000. Assume that the loan will be repaid in 12 equal monthly installments of $9,456 and that the first payment will be due one month from today. How much of your third monthly payment will go toward the repayment of principal?

Das könnte Ihnen auch gefallen

- Aynur Efendiyeva - Maliye 1Dokument7 SeitenAynur Efendiyeva - Maliye 1Sheen Carlo AgustinNoch keine Bewertungen

- Assignment 1Dokument7 SeitenAssignment 1Camilo Andres MesaNoch keine Bewertungen

- Topic 2 Tutorial ProblemsDokument4 SeitenTopic 2 Tutorial Problemsda.arts.ttNoch keine Bewertungen

- Topic 3+ 4 Valuation of SecuritiesDokument4 SeitenTopic 3+ 4 Valuation of SecuritiesHaha1234Noch keine Bewertungen

- FINMA1 - Time Value of Money Practice ProblemsDokument1 SeiteFINMA1 - Time Value of Money Practice Problemseath__Noch keine Bewertungen

- Exercises 1Dokument4 SeitenExercises 1Dilina De SilvaNoch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1Utsav PathakNoch keine Bewertungen

- Revision For Midterm - Wo AnswersDokument3 SeitenRevision For Midterm - Wo AnswersNghinh Xuan TranNoch keine Bewertungen

- Bond Practice QuestionsDokument2 SeitenBond Practice Questionsrenee Benjamin-GibbsNoch keine Bewertungen

- Tutorial 40 Sem 2 20212022Dokument6 SeitenTutorial 40 Sem 2 20212022Nishanthini 2998Noch keine Bewertungen

- Chapter 2: The Present ValueDokument4 SeitenChapter 2: The Present ValueVân ĂnggNoch keine Bewertungen

- Ch5Probset Bonds+Interest 13ed. - MasterDokument8 SeitenCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091Noch keine Bewertungen

- Tutorial QuestionsDokument15 SeitenTutorial QuestionsWowKid50% (2)

- 991財管題庫Dokument10 Seiten991財管題庫zzduble1Noch keine Bewertungen

- The Time Value MoneyDokument4 SeitenThe Time Value Moneycamilafernanda85Noch keine Bewertungen

- Practice Set - TVMDokument2 SeitenPractice Set - TVMVignesh KivickyNoch keine Bewertungen

- Ce303 HW1 PDFDokument2 SeitenCe303 HW1 PDFالبرت آينشتاينNoch keine Bewertungen

- Ce303 HW1 PDFDokument2 SeitenCe303 HW1 PDFالبرت آينشتاينNoch keine Bewertungen

- Additional Time Value ProblemsDokument2 SeitenAdditional Time Value ProblemsBrian WrightNoch keine Bewertungen

- Midterm RevisionDokument2 SeitenMidterm Revisionhoantkss181354Noch keine Bewertungen

- 2022-Sesi 8-Bond Valuation-Ed 12Dokument3 Seiten2022-Sesi 8-Bond Valuation-Ed 12Gabriela ClarenceNoch keine Bewertungen

- Tutorial 5 TVM Application - SVDokument5 SeitenTutorial 5 TVM Application - SVHiền NguyễnNoch keine Bewertungen

- Name: - 5.1 Problem Set 115Dokument14 SeitenName: - 5.1 Problem Set 115Clair BlushNoch keine Bewertungen

- Time Value of MoneyDokument9 SeitenTime Value of Moneyelarabel abellareNoch keine Bewertungen

- Concept Check Quiz: First SessionDokument27 SeitenConcept Check Quiz: First SessionMichael MillerNoch keine Bewertungen

- Tien Te ReviewDokument3 SeitenTien Te ReviewViết BảoNoch keine Bewertungen

- Time Value of Money 2Dokument6 SeitenTime Value of Money 2k61.2211155018Noch keine Bewertungen

- ProblemsDokument4 SeitenProblemsKritika SrivastavaNoch keine Bewertungen

- Workbook1 TimevalueofMoneyDokument2 SeitenWorkbook1 TimevalueofMoneyDe BuNoch keine Bewertungen

- IUFM - Lecture 3 - Homework Handouts 1Dokument3 SeitenIUFM - Lecture 3 - Homework Handouts 1Thuận Nguyễn Thị KimNoch keine Bewertungen

- Sample Problems-BondsDokument3 SeitenSample Problems-BondsBurhan UddinNoch keine Bewertungen

- Trial Quest EMBADokument2 SeitenTrial Quest EMBADumegã KokutseNoch keine Bewertungen

- University of Pennsylvania The Wharton SchoolDokument18 SeitenUniversity of Pennsylvania The Wharton SchoolBassel ZebibNoch keine Bewertungen

- Assignment No 1 CFDokument6 SeitenAssignment No 1 CFAltaf HussainNoch keine Bewertungen

- Practice Problems For Chapter 2Dokument5 SeitenPractice Problems For Chapter 2Lacey Blankenship100% (2)

- Problem SetsDokument69 SeitenProblem SetsAnnagrazia ArgentieriNoch keine Bewertungen

- TaichinhdoanhngiepDokument3 SeitenTaichinhdoanhngiepLê KhánhNoch keine Bewertungen

- Bai Tap Ham Tai ChinhDokument4 SeitenBai Tap Ham Tai ChinhLoi NguyenNoch keine Bewertungen

- Worksheet Chapter - 4 For The Course of Business MathematicsDokument1 SeiteWorksheet Chapter - 4 For The Course of Business MathematicsuuuNoch keine Bewertungen

- 2020 Spring BADM 301N 02 Homework 4 (Revised)Dokument2 Seiten2020 Spring BADM 301N 02 Homework 4 (Revised)Olome Emenike0% (1)

- FNCE2000 Chapter6 Valuing Shares & Bonds QuestionsDokument3 SeitenFNCE2000 Chapter6 Valuing Shares & Bonds QuestionsJaydenaus0% (1)

- Problem Sets 15 - 401 08Dokument72 SeitenProblem Sets 15 - 401 08Muhammad GhazzianNoch keine Bewertungen

- Assignment No 1 SFA&DDokument4 SeitenAssignment No 1 SFA&DSyed Osama Ali100% (1)

- Ps Na Bago Sa ECONDokument10 SeitenPs Na Bago Sa ECONJonelou CusipagNoch keine Bewertungen

- Ch4ProbsetTVM13ed - MasterDokument4 SeitenCh4ProbsetTVM13ed - MasterRisaline CuaresmaNoch keine Bewertungen

- University of Saint LouisDokument3 SeitenUniversity of Saint LouisRommel RoyceNoch keine Bewertungen

- Compound Interest ExcerciseDokument3 SeitenCompound Interest ExcerciseThảo TrươngNoch keine Bewertungen

- Javier, John Miko. MDokument11 SeitenJavier, John Miko. MJohn Miko JavierNoch keine Bewertungen

- DR Bahaa Quizes CH 3&4 PDFDokument3 SeitenDR Bahaa Quizes CH 3&4 PDFislam hamdyNoch keine Bewertungen

- Tutorial 4 TVM ApplicationDokument4 SeitenTutorial 4 TVM ApplicationTrần ThảoNoch keine Bewertungen

- TVM Practice Questions With AnswersDokument4 SeitenTVM Practice Questions With AnswersAhmed NomanNoch keine Bewertungen

- Time Value of Money 1Dokument5 SeitenTime Value of Money 1k61.2211155018Noch keine Bewertungen

- Problem Sets Present ValueDokument16 SeitenProblem Sets Present ValueJoaquín Norambuena EscalonaNoch keine Bewertungen

- Practice Worksheet - IBFDokument3 SeitenPractice Worksheet - IBFsusheel kumarNoch keine Bewertungen

- Chapter 4 Questions V4Dokument7 SeitenChapter 4 Questions V4darrrriaNoch keine Bewertungen

- A Haven on Earth: Singapore Economy Without Duties and TaxesVon EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNoch keine Bewertungen

- A Haven on Earth: Singapore Economy Without Duties and TaxesVon EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNoch keine Bewertungen

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- The Epocalypse: Economy Crisis and CollapseVon EverandThe Epocalypse: Economy Crisis and CollapseNoch keine Bewertungen

- Spencer Ian Key To Practicle PenmanshipDokument206 SeitenSpencer Ian Key To Practicle Penmanshipwalshjr100% (3)

- Sean Bean Skipp Sudduth Stellan Skarsgård Jean Reno Robert de Niro Natascha McelhoneDokument2 SeitenSean Bean Skipp Sudduth Stellan Skarsgård Jean Reno Robert de Niro Natascha McelhoneatekeeNoch keine Bewertungen

- Kazakh Language Book PDFDokument44 SeitenKazakh Language Book PDFatekee100% (4)

- Alice in WonderlandDokument66 SeitenAlice in Wonderlandmr_vuiNoch keine Bewertungen

- Simplified Drawing For Planning Animation PDFDokument41 SeitenSimplified Drawing For Planning Animation PDFJeferson Jacques95% (21)

- Figure Drawing For All It's WorthDokument198 SeitenFigure Drawing For All It's Worthatekee96% (131)

- Why Study Money, Banking, and Financial Markets?Dokument31 SeitenWhy Study Money, Banking, and Financial Markets?frostriskNoch keine Bewertungen

- Tutorial Letter 201/2/2017: Economics 1BDokument19 SeitenTutorial Letter 201/2/2017: Economics 1BKefiloe MoatsheNoch keine Bewertungen

- GS Guide To Inflation-Linked BondsDokument8 SeitenGS Guide To Inflation-Linked BondsOmer H.Noch keine Bewertungen

- Document PDFDokument1 SeiteDocument PDFMario Lo SciutoNoch keine Bewertungen

- Assignment of Monetary and Fiscal PolicyDokument10 SeitenAssignment of Monetary and Fiscal PolicyritvikNoch keine Bewertungen

- Money & CreditDokument9 SeitenMoney & CreditGaurav KrishniaNoch keine Bewertungen

- Bloomberg QuickTake Jan-June 20Dokument55 SeitenBloomberg QuickTake Jan-June 20Ahmed AlHassan100% (1)

- Arbitration RulingDokument2 SeitenArbitration RulingEddie SerranoNoch keine Bewertungen

- Article On Deposits-Vinod Kothari ConsultantsDokument9 SeitenArticle On Deposits-Vinod Kothari ConsultantsNishant JainNoch keine Bewertungen

- Fin444 Project NSUDokument13 SeitenFin444 Project NSURoseNoch keine Bewertungen

- Bus 315 - Chapter 5 - Risk, Return, and The Historical RecordDokument37 SeitenBus 315 - Chapter 5 - Risk, Return, and The Historical Recordmiaotianrun0810Noch keine Bewertungen

- Asset Liability ManagementDokument35 SeitenAsset Liability ManagementNiket Dattani100% (1)

- Financial Services M.com NotesDokument31 SeitenFinancial Services M.com NotesFarhan Damudi75% (8)

- Social Science All in One (Preli)Dokument363 SeitenSocial Science All in One (Preli)Safa AbcNoch keine Bewertungen

- Financal Planning Comprehensive GuideDokument42 SeitenFinancal Planning Comprehensive GuideankurjainNoch keine Bewertungen

- De Lucia Commercial Bank ManagementDokument395 SeitenDe Lucia Commercial Bank Managementha nguyenNoch keine Bewertungen

- CH 7Dokument31 SeitenCH 7ahmad altoufailyNoch keine Bewertungen

- Week 1 Business Math 1Dokument12 SeitenWeek 1 Business Math 1Marissa Corral MatabiaNoch keine Bewertungen

- M03Berk148315 - 02 - CorpFin - C03 - GEDokument80 SeitenM03Berk148315 - 02 - CorpFin - C03 - GEMuhammad Dwiki fajarNoch keine Bewertungen

- KPMG Pfrs 16 OverviewDokument93 SeitenKPMG Pfrs 16 OverviewFelicity AnneNoch keine Bewertungen

- AEC - 12 - Q1 - 0401 - PS - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursDokument58 SeitenAEC - 12 - Q1 - 0401 - PS - Investments, Interest Rate, and Rental Concerns of Filipino EntrepreneursVanessa Fampula FaigaoNoch keine Bewertungen

- ACFINA3 FinalExam QuestionsDokument7 SeitenACFINA3 FinalExam QuestionsRachel LeachonNoch keine Bewertungen

- Nominal and Effective RatesDokument12 SeitenNominal and Effective RatesHumbert FanogaNoch keine Bewertungen

- Chapter 5Dokument31 SeitenChapter 5Emi NguyenNoch keine Bewertungen

- Stand-Up India Scheme Features: Title of The SchemeDokument9 SeitenStand-Up India Scheme Features: Title of The SchemeVaishnavi ManoharNoch keine Bewertungen

- A Best Practice Oversight Approach For Securities Lending PDFDokument5 SeitenA Best Practice Oversight Approach For Securities Lending PDFFierDaus MfmmNoch keine Bewertungen

- Bangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Dokument43 SeitenBangladesh University of Professionals: Term Paper On "General Banking Activities of Pubali Bank Limited"Rifat AnjanNoch keine Bewertungen

- Difference Between Banking and Non-Banking FSDokument3 SeitenDifference Between Banking and Non-Banking FSPratyush RameshNoch keine Bewertungen

- TVM Stocks and BondsDokument40 SeitenTVM Stocks and Bondseshkhan100% (1)

- Katsande Anesu BankingDokument67 SeitenKatsande Anesu BankingASSISTANCE P NGWENYANoch keine Bewertungen