Beruflich Dokumente

Kultur Dokumente

Calculation Amount

Hochgeladen von

Engin UcarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Calculation Amount

Hochgeladen von

Engin UcarCopyright:

Verfügbare Formate

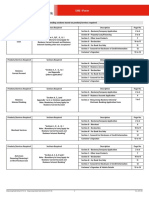

PAYG withholding

Calculating amount to be withheld

Leaving employment because of genuine redundancy, invalidity, or an early retirement scheme

Once the component values have been calculated, specific withholding rates are applied to each, as shown in the following table.

Table: Withholding rates

Component Pre 16 August 1978 Post 15 August 1978 Withholding 5% of total at marginal rate, disregarding any cents. 31.5%, disregarding any cents.

Leaving employment for other reason

Once the component values have been calculated, specific withholding rates are applied to each, as shown in the following table.

Table: Withholding rates

Component Pre16 August 1978 Post 15 August 1978 Post 17 August 1993 Withholding 5% of total at marginal rate, disregarding any cents. 31.5%, disregarding any cents. If this unused long service leave component (and unused annual leave) is less than $300, withhold the lesser of the amount worked out using the steps below or 31.5% of the payment, disregarding any cents. If this unused long service leave component (and unused annual leave) is $300.00 or more: Step 1 add 5% of the pre-16 August 1978 component to this component

Step 2

divide the amount by the number of regular periods in a financial year (52 weeks, 26 fortnights or 12 months)

Step 3 Step 4

disregard any cents add amount at step 3 to normal gross earnings for a single pay period.

Step 5

using the regular PAYG withholding tax table used to calculate the amount to be withheld, obtain the amount to be withheld from the figure calculated at step 4

Step 6

subtract the amount calculated at step 5 from the amount withheld from the payee's normal gross earnings, and

Step 7

multiply the amount calculated at step 6 by the number of regular pay periods in a financial year.

Last modified: 30 Jun 2010

QC 19081

Our commitment to you

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take. Some of the information on this website applies to a specific financial year. This is clearly marked. Make sure you have the information for the right year before making decisions based on that information. If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice.

Copyright notice

Australian Taxation Office for the Commonwealth of Australia You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Securities Regulation HyposDokument46 SeitenSecurities Regulation HyposErin JacksonNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Start Day Trading NowDokument44 SeitenStart Day Trading Nowfuraito100% (2)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDokument3 SeitenFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- UntitledDokument2 SeitenUntitledarmando González100% (2)

- Excel SyllabusDokument0 SeitenExcel SyllabusEngin UcarNoch keine Bewertungen

- CAF2-Intorduction To Economics and Finance - QuestionbankDokument188 SeitenCAF2-Intorduction To Economics and Finance - Questionbankrambo100% (1)

- QUIZ - PPE PART 1 Answer KeyDokument4 SeitenQUIZ - PPE PART 1 Answer KeyRena Rose MalunesNoch keine Bewertungen

- REAL ESTATE MORTGAGE-CalubayanDokument5 SeitenREAL ESTATE MORTGAGE-CalubayanChristopher JuniarNoch keine Bewertungen

- Understanding Absence QuotasDokument31 SeitenUnderstanding Absence QuotasHan Maryani100% (1)

- Understanding Absence QuotasDokument31 SeitenUnderstanding Absence QuotasHan Maryani100% (1)

- Functions of Treasury MGTDokument5 SeitenFunctions of Treasury MGTk-911Noch keine Bewertungen

- Real IELTS Speaking Task Model IELTS Speaking Topics and AnDokument71 SeitenReal IELTS Speaking Task Model IELTS Speaking Topics and AnTuấn Đông89% (9)

- Final Project Report of Summer Internship (VK)Dokument56 SeitenFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNoch keine Bewertungen

- Calculation ComponentsDokument3 SeitenCalculation ComponentsEngin UcarNoch keine Bewertungen

- Leaving Other ReasonsDokument5 SeitenLeaving Other ReasonsEngin UcarNoch keine Bewertungen

- Etp GuideDokument17 SeitenEtp GuideEngin UcarNoch keine Bewertungen

- Calculation ComponentsDokument3 SeitenCalculation ComponentsEngin UcarNoch keine Bewertungen

- Marginal TaxDokument4 SeitenMarginal TaxEngin UcarNoch keine Bewertungen

- USQ Application FormDokument2 SeitenUSQ Application FormEngin UcarNoch keine Bewertungen

- Sap Read Book DjviDokument4 SeitenSap Read Book DjviEngin UcarNoch keine Bewertungen

- Tax File Number DeclarationDokument8 SeitenTax File Number DeclarationEngin UcarNoch keine Bewertungen

- SAP HR Payroll Posting Into FI-CODokument18 SeitenSAP HR Payroll Posting Into FI-COPavan UlkNoch keine Bewertungen

- Tax File Number DeclarationDokument8 SeitenTax File Number DeclarationEngin UcarNoch keine Bewertungen

- Discover SAP ERP HCM Sample ChapterDokument46 SeitenDiscover SAP ERP HCM Sample ChapterEngin UcarNoch keine Bewertungen

- Sap Read Book DjviDokument4 SeitenSap Read Book DjviEngin UcarNoch keine Bewertungen

- Sap Read Book DjviDokument4 SeitenSap Read Book DjviEngin UcarNoch keine Bewertungen

- DDDokument1 SeiteDDjuanbcn87Noch keine Bewertungen

- Ma Checklist Ens NominationDokument4 SeitenMa Checklist Ens NominationEngin UcarNoch keine Bewertungen

- Sap HCM Course ContentsDokument5 SeitenSap HCM Course Contentsgallito77Noch keine Bewertungen

- Sap HCM Course ContentsDokument5 SeitenSap HCM Course Contentsgallito77Noch keine Bewertungen

- Ma Checklist Ens NominationDokument4 SeitenMa Checklist Ens NominationEngin UcarNoch keine Bewertungen

- Discover SAP ERP HCM Sample ChapterDokument46 SeitenDiscover SAP ERP HCM Sample ChapterEngin UcarNoch keine Bewertungen

- HR280 - Col73SAP Interactive Forms and SAP Smart Forms Sappress - Creating - Forms - in - SapDokument33 SeitenHR280 - Col73SAP Interactive Forms and SAP Smart Forms Sappress - Creating - Forms - in - SapphilippeayubNoch keine Bewertungen

- For TraineeDokument2 SeitenFor TraineeLyn PosadasNoch keine Bewertungen

- Tutorial (Merchandising With Answers)Dokument16 SeitenTutorial (Merchandising With Answers)Luize Nathaniele Santos0% (1)

- Financing Options in The Oil and Gas IndustryDokument31 SeitenFinancing Options in The Oil and Gas IndustrymultieniyanNoch keine Bewertungen

- Chapter 02Dokument11 SeitenChapter 02Saad mubeenNoch keine Bewertungen

- I2BE-Morning Evening PDFDokument10 SeitenI2BE-Morning Evening PDFusama sajawalNoch keine Bewertungen

- Strategic Financial ManagementDokument96 SeitenStrategic Financial Managementansary75Noch keine Bewertungen

- Escorts LTDDokument34 SeitenEscorts LTDSheersh jainNoch keine Bewertungen

- CashflowFK Broad Game 1Dokument24 SeitenCashflowFK Broad Game 1TerenceNoch keine Bewertungen

- RUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)Dokument12 SeitenRUB MT 103/202: S.W.I.F.T. Payment Orders Filling-In Rules (Banks Non-Residents)swift adminNoch keine Bewertungen

- UnderstandabilityDokument2 SeitenUnderstandabilityJasmine LeeNoch keine Bewertungen

- Brealey - Principles of Corporate Finance - 13e - Chap09 - SMDokument10 SeitenBrealey - Principles of Corporate Finance - 13e - Chap09 - SMShivamNoch keine Bewertungen

- NM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERDokument9 SeitenNM1607R - S2 2022 (For S1 2022 Students) RESIT EXAM Question PAPERrecovaNoch keine Bewertungen

- Report of Checks Issued 2023Dokument1 SeiteReport of Checks Issued 2023Jahzeel RubioNoch keine Bewertungen

- Sawsan Hassan Al SaffarDokument3 SeitenSawsan Hassan Al SaffarwaminoNoch keine Bewertungen

- Ap COSTSDokument4 SeitenAp COSTSferNoch keine Bewertungen

- Financial Institution & Investment Management - Final ExamDokument5 SeitenFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)

- HLB SME 1form (Original)Dokument14 SeitenHLB SME 1form (Original)Mandy ChanNoch keine Bewertungen

- VPS Form SampleDokument7 SeitenVPS Form SampleMuhammad ShariqNoch keine Bewertungen

- Ministry of Revenues: Tax Audit ManualDokument304 SeitenMinistry of Revenues: Tax Audit ManualYoNoch keine Bewertungen

- Case Study Vijay Mallya - Another Big NaDokument10 SeitenCase Study Vijay Mallya - Another Big Najai sri ram groupNoch keine Bewertungen

- Application For Shifting Branch - Sharekhan LTD & SBPFSL - FinalDokument1 SeiteApplication For Shifting Branch - Sharekhan LTD & SBPFSL - Finalchethan0% (1)