Beruflich Dokumente

Kultur Dokumente

Sterlite Resolutions

Hochgeladen von

kpmehendaleCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sterlite Resolutions

Hochgeladen von

kpmehendaleCopyright:

Verfügbare Formate

Sterlite Industries (India) Limited

Registered Office: SIPCOT Industrial Complex, Madurai Bypass Road, T.V. Puram P.O., Tuticorin - 628 002, Tamil Nadu, India

Notice of 35th Annual General Meeting NOTICE is hereby given that the Thirty-Fifth Annual General Meeting of the Members of STERLITE INDUSTRIES (INDIA) LIMITED will be held at the Tamira Club, Tamira Niketan, SIPCOT Industrial Complex, Madurai Bypass Road, T.V. Puram P.O., Tuticorin 628 002, Tamil Nadu, on Friday, June 11, 2010 at 12.30 p.m. to transact the following business: 1. To consider and adopt the Balance Sheet as at 31st March, 2010 and the Profit and Loss account of the Company for the year ended on that date and the Report of the Directors and Auditors thereon. 2. To declare dividend on equity shares of the Company for the financial year 2009-10. 3. To appoint a Director in place of Mr. Anil Agarwal who retires by rotation and being eligible, offers himself for re-appointment. 4. To appoint a Director in place of Mr.Gautam Doshi who retires by rotation and being eligible, offers himself for reappointment. 5. To appoint Auditors, to hold office from the conclusion of this Annual General Meeting upto the conclusion of the next Annual General Meeting of the Company and to fix their remuneration. Special Business 6. Increase in Authorised Share Capital To consider and, if thought fit, to pass, with or without modification(s), the following resolution as an Ordinary Resolution: RESOLVED THAT pursuant to the provisions of Articles 4 and 48 of the Articles of Association and Sections 13, 16, 94 and 97 and other applicable provisions, if any, of the Companies Act, 1956 (including any amendments or re-enactment thereof), the Authorised Share Capital of the Company be and is hereby increased from Rs.185 crores (Rupees One Hundred Eighty Five Crores) to Rs. 500 crores (Rupees Five Hundred Crores). To consider and, if thought fit, to pass, with or without modification(s), the following resolution as an Ordinary Resolution. RESOLVED THAT pursuant to the provisions of Article 4 and 48 of the Articles of Association of the Company and Sections 13, 16, 94 and 97 and all other applicable provisions, if any, of the Companies Act, 1956, (including any amendments thereto or re-enactment thereof) and subject to such approvals, consents, permissions and sanctions, if any, as may be required from any authority, and subject to such conditions as may be agreed to by the Board of Directors of the Company (hereinafter referred to as the Board, which term shall also include any committee thereof), consent of the Members be and is hereby accorded for sub-dividing the equity shares of the Company, including the paid-up shares, such that each existing equity share of the Company of the face value of Rs. 2/- (Rupees Two) each be sub-divided into two equity shares of the face value Re. 1/- (Rupee One) each and consequently, the Authorised Share Capital of the Company of Rs.500 crores (Rupees Five Hundred Crores) would comprise of 500 crores (Five Hundred Crores) equity shares of Re. 1/- each. RESOLVED FURTHER THAT pursuant to the sub-division of the equity shares of the Company, the issued, subscribed and paid up equity shares of face value Rs. 2 /- (Rupees Two) each, shall stand sub-divided into equity shares of face value of Re. 1/- (Rupee One) each, fully paid-up.

7. Sub-division of Shares

RESOLVED FURTHER THAT the sub-division of shares shall be effective and simultaneous with the allotment of Bonus Shares by the Board or as per the advice of the Stock Exchanges RESOLVED FURTHER THAT the Board be and is hereby authorised to do, perform and execute all such acts, deeds, matters and things as it may consider necessary, expedient, usual or proper to give effect to this resolution including but not limited to fixing of the record date as per the requirement of the Listing Agreement, execution of all necessary documents with the Stock Exchanges and the Depositories, Reserve Bank of India and/or any other relevant statutory authority, if any, cancellation or rectification of the existing physical share certificates in lieu of the old certificates and to settle any question or difficulty that may arise with regard to the subdivision of the equity shares as aforesaid or for any matters connected herewith or incidental hereto. To consider and, if thought fit, to pass, with or without modification(s), the following resolution as an Ordinary Resolution: RESOLVED THAT pursuant to the provisions of Sections 13, 16, 94 and 97 and all other applicable provisions, if any, of the Companies Act, 1956, including amendments thereto or re-enactment thereof, the Memorandum of Association of the Company be and is hereby altered as follows: The existing Clause V of the Memorandum of Association of the Company be deleted by substitution in its place and instead the following clause as new Clause V: V The authorised share capital of the Company shall be Rs.500,00,00,000/- (Rupees Five Hundred Crores) divided into 500,00,00,000 (Five Hundred Crore) equity shares of Re. 1/- (Rupee One) each, with the rights, privileges and conditions attaching thereto as are provided in the Articles of Association of the Company with the power to increase and reduce the capital of the Company and to divide the shares in the capital for the time being into several classes and to attach thereto respectively such preferential, deferred, qualified or special rights, privileges or conditions as may be determined by or in accordance with the Articles of Association of the Company for the time being and to vary, modify or abrogate any such rights, privileges or conditions in such manner as may be permitted by the Companies Act, 1956, or provided in the Articles of Association of the Company for the time being.

8. Alteration to the Memorandum of Association

RESOLVED FURTHER THAT the alteration to the Memorandum of Association shall be effective and simultaneous with the allotment of Bonus Shares by the Board of Directors or a Committee thereof. RESOLVED FURTHER THAT the Board of Directors of the Company or any Committee thereof be and is hereby authorised to do perform and execute all such acts, matters, deeds and things as it may consider necessary, expedient, usual or proper to give effect to this resolution, including but not limited to filing of necessary forms with the Registrar of Companies and to comply with all other requirements in this regard and for any matters connected herewith or incidental hereto. To consider and, if thought fit, to pass, with or without modification(s), the following resolution as an Ordinary Resolution: RESOLVED THAT pursuant to the provisions of Article 116 of the Articles of Association of the Company and upon the recommendation of the Board of Directors made at their meeting held on April 26, 2010 (hereinafter referred to as the Board which term shall be deemed to include any Committee of the Board of Directors formed for the time being to exercise the powers conferred on the Board of Directors in this behalf) and pursuant to the applicable provisions of the Companies Act, 1956, and in accordance with the Securities & Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009 (the Regulations) and subject to such necessary approvals, permissions and sanctions, as may be required and subject to such terms

9. Issue of Bonus Shares

and conditions as may be specified while according such approvals, a sum of Rs.168,08,00,844/(Rupees One Hundred Sixty Eight crores and Eight lacs Eight hundred and forty four) out of the sum standing to the credit of share premium account, forming part of General Reserves of the Company, be and is hereby capitalized and utilized for allotment of 1 (one) Bonus equity share of Re.1/- (Rupee One) credited as fully paid up for every 1 (one) eligible existing fully paid (subdivided) equity share of Re.1/- (Rupee One) held by the members and accordingly the Board, be and is hereby authorized to appropriate the said sum for distribution to and amongst the members of the Company whose names appear in the Register of Members or as the beneficial owner(s) of the equity shares of the Company, in the records of the Depositories, at the close of business on such date (hereinafter referred to as the Record Date to be hereafter fixed by the Board and on the basis and that the Bonus Shares so distributed shall, for all purposes, be treated as an increase in the nominal amount in the Capital of the Company, held by each such member and not as income. RESOLVED FURTHER THAT the new equity shares shall be allotted subject to the Memorandum and Articles of Association of the Company and shall in all respects rank pari passu with the existing subdivided fully paid-up equity shares of the Company, with a right, to participate in dividend in full that may be declared after the date of allotment of these equity shares as the Board may be determine. RESOLVED FURTHER THAT pursuant to Securities & Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009, such number of bonus equity shares as in the same proportion (i.e. one new fully paid by equity share of Re.1/- for every one existing fully paid (subdivided) equity shares of Re.1/- each held in the Company as on Record Date) be reserved in favour of the holders of the outstanding 4% Convertible Senior Notes (the Convertible Notes) issued by the Company, for issue and allotment at the time of conversion in respect of such of those Convertible Notes which may be lodged for conversion on or before the Record Date. RESOLVED FURTHER THAT in respect of the outstanding Convertible Notes lodged for conversion after the Record Date, the Board be and is hereby authorized to make appropriate adjustment in the conversion rate of shares to be issued on conversion of such Convertible Notes in terms of the provisions of the concerned Offering Circular, so as to give the benefit of the Bonus Issue, as aforesaid, to the holders of such outstanding Convertible Notes as well and to do all such things, deeds in this regard. RESOLVED FURTHER THAT the Board be and is hereby authorized to capitalize the required amount out of the Companys General Reserve Account/Securities Premium Account or such other accounts as are permissible to be utilized for the purpose, as per the audited accounts of the Company for the financial year ended March 31, 2009 and that the said amount be transferred to the Share Capital Account and be applied for issue and allotment of the said equity shares as Bonus Shares credited as fully paid up. RESOLVED FURTHER THAT no letter of allotment shall be issued in respect of the said bonus shares but in the case of members who opt to receive the bonus shares in dematerialized form, the bonus shares aforesaid shall be credited to the beneficiary accounts of the shareholders with their respective Depository Participants within the stipulated time as may be allowed by the appropriate authorities and in the case of shareholders who opt to receive the bonus shares in physical form, the share certificates in respect thereof shall be delivered within such time as may be allowed by the appropriate authorities. RESOLVED FURTHER THAT the Board be and is hereby authorized to take necessary steps for listing of the bonus shares so allotted on the Stock Exchanges where the securities of the Company are listed as per the provisions of the Listing Agreements with the Stock Exchanges concerned, the Regulations and other applicable laws.

RESOLVED FURTHER THAT for the purpose of giving effect to this resolution and for removal of any doubts or difficulties, the Board be and is hereby authorised to do, perform and execute all such acts, deeds, matters and things and to give from time to time such directions as may be necessary, expedient, usual or proper and to settle any question or doubt that may arise in relation thereto or as the Board in its absolute discretion may think fit and its decision shall be final and binding on all members and other interested persons and to do all acts connected herewith or incidental hereto. By Order of the Board Rajiv Choubey Company Secretary & Head Legal

Place: Tuticorin Date: April 26, 2010 Regd. Office: SIPCOT Industrial Complex Madurai Bypass Road TV Puram P.O. Tuticorin 628 002 NOTES:

1. A MEMBER ENTITLED TO ATTEND AND VOTE IS ENTITLED TO APPOINT A PROXY TO ATTEND AND VOTE INSTEAD OF HIMSELF AND THE PROXY NEED NOT BE A MEMBER OF THE COMPANY. 2. The instrument appointing a proxy must be deposited with the Company at its Registered Office, not less than 48 hours before the time for holding the Annual General Meeting. 3. The notice of the Annual General Meeting will be sent to those members whose names appear on the register of members as on Friday, May 07, 2010. 4. Annual Report is available at the website of the Company at www.sterlite-industries.com in the Investor Relations section. 5. The Register of Members and Share Transfer Books of the Company will remain closed on Friday, May 21, 2010 for the purposes of dividend entitlement which will be paid after approval of the Shareholders in the ensuing 35th Annual General Meeting. 6. The Board of Directors in their Meeting held on April 26, 2010 has recommended a dividend of Rs. 3.75 per share on equity share of Rs. 2 each, which if declared at the Annual General Meeting, will be paid on or before the 30th day from the date of the declaration, i.e. July 10, 2010 to those members, whose name will appear in the Register of Members on May 21, 2010. 7. Pursuant to the provisions of Section 205A (5) of the Companies Act, 1956, dividends/interests which remain unclaimed for a period of 7 years from the date of transfer to Unpaid Dividend Account are to be transferred to the Investor Education and Protection Fund established by the Central Government. Shareholders who have not encashed their dividend/interest warrant(s) so far, for the financial year ended March 31, 2003 or any subsequent financial years are requested to make their claim to the Registrar and Share Transfer Agents of the Company. According to the provisions of the Act, no claims shall lie against the said Fund or the Company for the amounts of dividend so transferred nor shall any payment be made in respect of such claims. 8. Members are requested to: (a) Notify the change in address if any, with Pin Code numbers immediately to the Company. (in case of shares held in physical mode): (b) Bring their copy of the Annual Report and Attendance Slip with them at the Annual General Meeting.

(c) Quote their Regd. Folio Number/DP and Client ID Nos. in all their correspondence with the Company or its Registrar and Share Transfer Agent.

9. Consequent upon the introduction of Section 109A of the Companies Act, 1956, shareholders are entitled to make a nomination in respect of shares held by them in physical form. Shareholders desirous of making a nomination are requested to send their requests in Form No. 2B in duplicate (which will be made available on request) to the Registrar and Share Transfer Agent of the Company. 10. Corporate members are requested to send a duly certified copy of the board resolution/power of attorney authorising their representative to attend and vote at the Annual General Meeting. 11. Members having any questions on accounts are requested to send their queries at least 10 days in advance to the Company at its registered office address to enable the Company to collect the relevant information. 12. The brief profile of the Directors proposed to be appointed/re-appointed is given in the section of Corporate Governance of the Annual Report. Place: Tuticorin Date: April 26, 2010 Regd. Office: SIPCOT Industrial Complex Madurai Bypass Road TV Puram P.O. Tuticorin 628 002 EXPLANATORY STATEMENT UNDER SECTION 173(2) OF THE COMPANIES ACT, 1956 ITEM No. 6 The present Authorised Share Capital of the Company is Rs. 185 crores comprising of 92,50,00,000 (Ninety Two Crore and Fifty Lakhs) equity shares of Rs. 2/- each. It has become essential to increase the present Authorised Share Capital to give effect to the proposal for issue of the Bonus Shares as recommended by the Board of Directors at their meeting held on April 26, 2010. The Resolution is therefore to increase the Authorised Share Capital of the Company from Rs. 185 crores to Rs. 500 crores. None of the Directors of the Company are in any way interested in the Resolution, except to the extent of their shareholding and the shareholding of their relatives in the Company. Your Directors recommend the above Resolution for your approval. ITEM No. 7 The Company had effected the previous sub-division of its equity shares from face value Rs. 5/- each to face value of Rs. 2/- each in May, 2006. Over a period of time the share price of the Company has shown an improvement reflecting the performance of the Company. The Companys equity shares have been included as part of the S&P Nifty and Sensex w.e.f. April 2007 and July, 2008 reflecting the strong fundamentals of the Company. The sub-division of equity shares has been proposed with a view to broad base the investor base by encouraging the participation of the retail investors and also with a view to increase the liquidity of the equity shares of the Company. The Board of Directors in its meeting held on April 26, 2010, recommended sub-division of each equity shares of the Company of face value of Rs. 2/- each to face value of Re. 1/- each. As per the provisions of Section 94 of the Companies Act, 1956, approval of the Shareholder is required for subdivision of shares. By Order of the Board Rajiv Choubey Company Secretary & Head Legal

None of the Directors of the Company are in any way interested in the Resolution, except of their shareholding and the shareholding of their relatives in the Company. Your Directors recommend the above Resolution for your approval. ITEM No. 8 The existing Clause V of Memorandum of Association specifies the present Authorised Share Capital of your Company. In view of increase in the Authorised Share Capital from Rs. 185 crores to Rs. 500 crores and sub-division in the par value of the equity shares from Rs. 2/- each to Re. 1/-, the present Clause V of the Memorandum of Association needs to reflect both the increase Authorised Share Capital and sub-division of the equity shares. A copy of the existing Memorandum and Articles of Association as well as the form of the amended Memorandum and Articles of Association of the Company is available for inspection by members at the Registered Office of the Company during working hours on any working day. As per the provisions of Section 94 of the Companies Act, 1956, approval of the Shareholder is required for amending the Authorised Share Capital. Consequent to change in the Authorised Share Capital, Clause V related to the Capital Clause in the Memorandum will also change as stated in Resolution. None of the Directors of the Company are in any way interested in the Resolution, except to the extent of their shareholding and the shareholding of their relatives in the Company. Your Directors recommend the above Resolution for your approval. ITEM No. 9 The Companys performance has considerably improved during the financial year 2009-10 and has reported good results. In view of the expansion and envisaged profitability and in view of the comfortable reserves position, the Board of Directors at its meeting held on April 26, 2010 has recommended capitalization of reserves to the extent of Rs. 168,08,00,844/- (Rupees One Hundred Sixty Eight crores and Eight lacs eight hundred and fortyfour) of Re. 1/- each in the proportion of 1:1 (i.e. one fully paid bonus share of face value of Re. 1/- each for every eligible existing fully paid (sub-divided) equity shares of Re. 1/- each) held by the members as on the Record Date to be hereafter decided by the Board or its Committee thereof. The Company satisfies the conditions of and requirements for, issue of Bonus Shares contained in Chapter IX of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 as presently in force. None of the Directors of the Company are in any way interested in the Resolution, except to the extent of their shareholding and the shareholding of their relatives in the Company. Your Directors recommend the above Resolution for your approval. By Order of the Board Rajiv Choubey Company Secretary & Head Legal

Place: Tuticorin Date: April 26, 2010 Regd. Office: SIPCOT Industrial Complex Madurai Bypass Road TV Puram P.O. Tuticorin 628 002.

Sterlite Industries (India) Limited Registered Office: SIPCOT Industrial Complex, Madurai Bypass Road, T. V. Puram P.O., Tuticorin - 628 002, Tamil Nadu, India

ATTENDANCE SLIP

Members Folio/Client & DP - ID No. ____________________________________ No. of Shares_______________________ ____________________________________

I hereby record my presence at the 35th Annual General Meeting held on Friday, June 11, 2010, at 12.30 p.m. at Tamira Club, Tamira Niketan, SIPCOT Industrial Complex, Madurai - Bypass Road, T. V. Puram P.O., Tuticorin - 628 002, Tamil Nadu, India. (Name of Member/Proxy _____________________ Signature of Member/Proxy_____________________

Notes: 1. Member/Proxy holder must bring the admission slip to the Meeting and hand-over at the entrance duly signed.

$

Sterlite Industries (India) Limited Registered Office: SIPCOT Industrial Complex, Madurai Bypass Road, T. V. Puram P.O., Tuticorin - 628 002, Tamil Nadu, India I/We___________________________________________________________________________________ of_______________________________________________________________________________ being a member/members of the above named Company, hereby appoint __________ _________________________________________________of___________________________________ or failing him/her ____________________________________________________________________________ of__________________________________________________________________________________ as my/our proxy to attend and vote for me/us on my/our behalf at the 35th Annual General Meeting of the Company to be held on Friday, June 11, 2010, at 12.30 p.m. at Tamira Club, Tamira Niketan, SIPCOT Industrial Complex, Madurai Byepass Road, T. V. Puram P.O., Tuticorin - 628 002, Tamil Nadu, India. Signed _________________________________ Date ________________________ Members Folio/Client & DP - ID No. ____________________________________ No. of Shares_______________________ ____________________________________

Proxy Form

Affix Re. 1 Revenue Stamp

Notes: 1. The instrument of Proxy form shall be deposited at the Registered Office of the Company, not less than 48 hours before the time fixed for holding the Meeting. 2. The Form should be signed across the stamp as per specimen signature registered with the Company. 3. A proxy need not to be member.

Das könnte Ihnen auch gefallen

- Britannia Industries LimitedDokument116 SeitenBritannia Industries LimitedSABHASACHI POBINoch keine Bewertungen

- Annual Report Ruchi Soya 2008-09Dokument101 SeitenAnnual Report Ruchi Soya 2008-09Kamalesh SekharNoch keine Bewertungen

- Notice of Egm 2023 - Swan EnergyDokument25 SeitenNotice of Egm 2023 - Swan EnergyAmrit IyerNoch keine Bewertungen

- 50 100 Full Agm Egm 20230227Dokument23 Seiten50 100 Full Agm Egm 20230227Contra Value BetsNoch keine Bewertungen

- L & TDokument243 SeitenL & TSiddharth AsthanaNoch keine Bewertungen

- Idea Cellular Limited: NoticeDokument145 SeitenIdea Cellular Limited: Noticeliron markmannNoch keine Bewertungen

- Sample Notice of 1st Annual General MeetingDokument14 SeitenSample Notice of 1st Annual General MeetingSudhanshu JhaNoch keine Bewertungen

- Annual Report 2012 PDFDokument115 SeitenAnnual Report 2012 PDFJnanamNoch keine Bewertungen

- eGM NoticeDokument22 SeiteneGM NoticeSiddharthNoch keine Bewertungen

- Annual Report FY-20Dokument46 SeitenAnnual Report FY-20P patelNoch keine Bewertungen

- Mahindra & Mahindra Annual Report 2015Dokument271 SeitenMahindra & Mahindra Annual Report 2015Madhav KapurNoch keine Bewertungen

- Kores India LTD 2010Dokument10 SeitenKores India LTD 2010Sriram RanganathanNoch keine Bewertungen

- Articles of Association of Southern Ispat and Energy LimitedDokument58 SeitenArticles of Association of Southern Ispat and Energy LimitedleovenuNoch keine Bewertungen

- Notice - 15 12 2008 - Increase in Auth CapitalDokument3 SeitenNotice - 15 12 2008 - Increase in Auth CapitalparulshinyNoch keine Bewertungen

- Tata Steel AGM Notice 2022Dokument22 SeitenTata Steel AGM Notice 2022mohitbabuNoch keine Bewertungen

- Adani Power 10-11Dokument106 SeitenAdani Power 10-11dilipzalteNoch keine Bewertungen

- Power Grid Corporation of India Limited: NoticeDokument16 SeitenPower Grid Corporation of India Limited: NoticeScore1234Noch keine Bewertungen

- 5005200316Dokument281 Seiten5005200316hisham11117777Noch keine Bewertungen

- 2010Dokument242 Seiten2010zavosevNoch keine Bewertungen

- Agm Notice3Dokument14 SeitenAgm Notice3ashishgupta93Noch keine Bewertungen

- Sun Pharma Bonus Notice ResolutionDokument4 SeitenSun Pharma Bonus Notice ResolutionkpmehendaleNoch keine Bewertungen

- Dabur Annual RepDokument188 SeitenDabur Annual RepsameerkmrNoch keine Bewertungen

- Notice To MembersDokument8 SeitenNotice To MembersGurjeevNoch keine Bewertungen

- Torrent Power Limited - Annaul Report 2009-10Dokument94 SeitenTorrent Power Limited - Annaul Report 2009-10rajbank6_sNoch keine Bewertungen

- Greenply Annual Report 2014Dokument91 SeitenGreenply Annual Report 2014prathameshspNoch keine Bewertungen

- Notice: Ordinary BusinessDokument18 SeitenNotice: Ordinary BusinessKartikeya BagraNoch keine Bewertungen

- Simplex Infra PDFDokument99 SeitenSimplex Infra PDFSUKHSAGAR1969Noch keine Bewertungen

- TitagarhDokument94 SeitenTitagarhdhruvfeedbackNoch keine Bewertungen

- FHHGGDokument17 SeitenFHHGGAmberNoch keine Bewertungen

- Suzlon EGM NoticeDokument34 SeitenSuzlon EGM Noticetushk20Noch keine Bewertungen

- BSE Limited National Stock Exchange of India LimitedDokument29 SeitenBSE Limited National Stock Exchange of India LimitedVivek AnandNoch keine Bewertungen

- Draft Aoa MFBDokument25 SeitenDraft Aoa MFBaveros12Noch keine Bewertungen

- Arvind 1819Dokument256 SeitenArvind 1819abhishek100% (1)

- Quess AGM Notice 2019Dokument12 SeitenQuess AGM Notice 2019Rahul YadavNoch keine Bewertungen

- Timex Annual Report-2023Dokument120 SeitenTimex Annual Report-2023many08186Noch keine Bewertungen

- Aban Offshore LTD 2014Dokument120 SeitenAban Offshore LTD 2014Anonymous NnVgCXDwNoch keine Bewertungen

- HDB Agm NoticeDokument19 SeitenHDB Agm NoticeAsmita GhadigaonkarNoch keine Bewertungen

- Avanse Annual FY23Dokument229 SeitenAvanse Annual FY2353crx1fnocNoch keine Bewertungen

- PDFDokument163 SeitenPDFHandcrafting BeautiesNoch keine Bewertungen

- Annual Report 2020Dokument134 SeitenAnnual Report 2020Wan RuschdeyNoch keine Bewertungen

- Annual Report 2010-11Dokument118 SeitenAnnual Report 2010-11Amit NisarNoch keine Bewertungen

- Lupin-AGM Notice-CompositeDokument33 SeitenLupin-AGM Notice-CompositeSag SagNoch keine Bewertungen

- Notice: Ordinary BusinessDokument15 SeitenNotice: Ordinary BusinessSudha IyerNoch keine Bewertungen

- Subdivision & AoA MoA Alteration Postal Ballot NoticeDokument6 SeitenSubdivision & AoA MoA Alteration Postal Ballot NoticekpmehendaleNoch keine Bewertungen

- JP Balance Sheet PDFDokument215 SeitenJP Balance Sheet PDFAmarnathNoch keine Bewertungen

- Apollo Annual Report 2016 17 PDFDokument290 SeitenApollo Annual Report 2016 17 PDFKanishka ChawdaNoch keine Bewertungen

- Notice: Ordinary BusinessDokument15 SeitenNotice: Ordinary BusinessArun BatraNoch keine Bewertungen

- IEX Postal Ballot Notice Oct21Dokument9 SeitenIEX Postal Ballot Notice Oct21VishnuNoch keine Bewertungen

- Balance Sheet of Aditya Birla Retail and FashionDokument154 SeitenBalance Sheet of Aditya Birla Retail and FashionSandhesh MohandasNoch keine Bewertungen

- Nykaa PB NoticeDokument19 SeitenNykaa PB Noticeudaychandra211Noch keine Bewertungen

- Notice: Indian Railway Catering and Tourism Corporation LimitedDokument10 SeitenNotice: Indian Railway Catering and Tourism Corporation Limiteddigvijay singhNoch keine Bewertungen

- Panama Petro Ar 2010Dokument40 SeitenPanama Petro Ar 2010Inder KalraNoch keine Bewertungen

- 79 TH AGMNotice-Bajaj Hindusthan LTDDokument8 Seiten79 TH AGMNotice-Bajaj Hindusthan LTDBadrinath ChavanNoch keine Bewertungen

- Notice of Extra Ordinary General Meeting February 16 2024Dokument12 SeitenNotice of Extra Ordinary General Meeting February 16 2024Sharath BevinjeNoch keine Bewertungen

- Varun Resources Annual Report 2014-15Dokument101 SeitenVarun Resources Annual Report 2014-15amitsi1974Noch keine Bewertungen

- Notice of Extraordinary General Meeting PDF PDFDokument12 SeitenNotice of Extraordinary General Meeting PDF PDFrajiv_ndpt8394Noch keine Bewertungen

- Digitally Signed by Ruchi Mahajan Date: 2020.09.07 12:48:32 +05'30'Dokument262 SeitenDigitally Signed by Ruchi Mahajan Date: 2020.09.07 12:48:32 +05'30'rajatgupta238Noch keine Bewertungen

- Anuualreport2022 23FDokument214 SeitenAnuualreport2022 23Fgoplo singhNoch keine Bewertungen

- Annual Report 05 06Dokument92 SeitenAnnual Report 05 06www_mageshmba2410Noch keine Bewertungen

- Torrent Postal Ballot Notice For BonusDokument6 SeitenTorrent Postal Ballot Notice For BonuskpmehendaleNoch keine Bewertungen

- Sun Pharma Bonus Notice ResolutionDokument4 SeitenSun Pharma Bonus Notice ResolutionkpmehendaleNoch keine Bewertungen

- Thomas Cook ESOP Postal Ballot NoticeDokument4 SeitenThomas Cook ESOP Postal Ballot NoticekpmehendaleNoch keine Bewertungen

- Subdivision & AoA MoA Alteration Postal Ballot NoticeDokument6 SeitenSubdivision & AoA MoA Alteration Postal Ballot NoticekpmehendaleNoch keine Bewertungen

- Mosear BEar Notice Postal BallotDokument4 SeitenMosear BEar Notice Postal BallotkpmehendaleNoch keine Bewertungen

- Postal Ballot Report IMP EmmsonsDokument4 SeitenPostal Ballot Report IMP EmmsonskpmehendaleNoch keine Bewertungen

- CCLProducts2012 13AnnualReportDokument81 SeitenCCLProducts2012 13AnnualReportkpmehendaleNoch keine Bewertungen

- Mahindra Finance Subdivision & AoA MoA Alteration (E Voting)Dokument5 SeitenMahindra Finance Subdivision & AoA MoA Alteration (E Voting)kpmehendaleNoch keine Bewertungen

- Listing Agreement 16052013 BSEDokument70 SeitenListing Agreement 16052013 BSEkpmehendaleNoch keine Bewertungen

- L&T BonusDokument4 SeitenL&T BonuskpmehendaleNoch keine Bewertungen

- Ch.1 Overview of Financial Management and Financial EnvironmentDokument37 SeitenCh.1 Overview of Financial Management and Financial EnvironmentNguyễn ThảoNoch keine Bewertungen

- Monetary Policy Statement October 2020Dokument2 SeitenMonetary Policy Statement October 2020African Centre for Media ExcellenceNoch keine Bewertungen

- Branch Accounting ProblemDokument6 SeitenBranch Accounting ProblemGONZALES, MICA ANGEL A.Noch keine Bewertungen

- Sample Employment ContractDokument2 SeitenSample Employment Contracttimmy_zamora100% (1)

- Viking Form 2 ADVDokument36 SeitenViking Form 2 ADVSOeNoch keine Bewertungen

- Introduction To IPOsDokument1 SeiteIntroduction To IPOsaugusthrtrainingNoch keine Bewertungen

- Model Residential Construction Contract Cost Plus Version 910Dokument30 SeitenModel Residential Construction Contract Cost Plus Version 910Hadi Prakoso100% (2)

- Vat Ec Fr-EnDokument27 SeitenVat Ec Fr-EnDjema AntohiNoch keine Bewertungen

- Ronda 2 ResultadosDokument3 SeitenRonda 2 ResultadosCristian MiunsipNoch keine Bewertungen

- Industrial Tour Report On CSE (Chittagong Stock Exchange)Dokument42 SeitenIndustrial Tour Report On CSE (Chittagong Stock Exchange)Khan Md Fayjul100% (2)

- Wikborg Global Offshore Projects DEC15Dokument13 SeitenWikborg Global Offshore Projects DEC15sam ignarskiNoch keine Bewertungen

- Financial DistressDokument5 SeitenFinancial DistresspalkeeNoch keine Bewertungen

- Economic Roundtable ReleaseDokument1 SeiteEconomic Roundtable Releaseapi-25991145Noch keine Bewertungen

- Syndicate Bank ProjectDokument86 SeitenSyndicate Bank Projectmohammed saleem50% (4)

- 35 Powerful Candlestick PatternsDokument21 Seiten35 Powerful Candlestick PatternsMarcelo_Capellotto50% (2)

- Sample Quiz KEY1Dokument6 SeitenSample Quiz KEY1ElaineJrV-IgotNoch keine Bewertungen

- ID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanDokument8 SeitenID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanLinda UtariNoch keine Bewertungen

- BPPL Holdings PLCDokument15 SeitenBPPL Holdings PLCkasun witharanaNoch keine Bewertungen

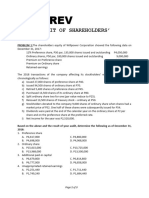

- Audit of SheDokument3 SeitenAudit of ShePrince PierreNoch keine Bewertungen

- Fundamentals of Marketing ManagementDokument65 SeitenFundamentals of Marketing ManagementPriaa100% (1)

- Lembar - JWB - Soal - B - Sesi 2Dokument11 SeitenLembar - JWB - Soal - B - Sesi 2Sandi RiswandiNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vijay SNoch keine Bewertungen

- Case Studies On HR Best PracticesDokument50 SeitenCase Studies On HR Best PracticesAnkur SharmaNoch keine Bewertungen

- Marketing ManagementDokument146 SeitenMarketing ManagementMannu Bhardwaj100% (2)

- Issue 50Dokument24 SeitenIssue 50The Indian NewsNoch keine Bewertungen

- Petition For Issuance of Letter of AdministrationDokument4 SeitenPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaNoch keine Bewertungen

- FAR 4204 (Receivables)Dokument10 SeitenFAR 4204 (Receivables)Maximus100% (1)

- PROBLEMDokument3 SeitenPROBLEMSam VNoch keine Bewertungen

- FRMDokument6 SeitenFRMAhmad Tawfiq DarabsehNoch keine Bewertungen

- IDBI Bank: This Article Has Multiple Issues. Please HelpDokument15 SeitenIDBI Bank: This Article Has Multiple Issues. Please HelpmayurivinothNoch keine Bewertungen