Beruflich Dokumente

Kultur Dokumente

8W Ch8 PS Stock Valuation Students

Hochgeladen von

Muhammet DalgıçOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

8W Ch8 PS Stock Valuation Students

Hochgeladen von

Muhammet DalgıçCopyright:

Verfügbare Formate

CHAPTER 8

Stocks & Their Valuation Problem solving

7-1

Problem 1

ABC Co. Has just paid cash dividend of $2 per share Investors require a 16% return from investments such as this If the dividend is expected to grow at a steady 8% per year, what is the current value of the stock? What will the stock value be worth in 5 years?

7-2

Problem 2

In problem 1, what would the stock sell for today if the dividend was expected to grow at 20% per year for the next 3 years and then settle down to 8% per year, indefinitely?

7-3

Problem 3

JBH Inc. is expected to pay dividends of $2, $3, and $5 for the next three years Thereafter, the dividends are expected to grow at a constant rate of 8% If the required return is 16%, what will be the current stock price? What will be the stock price next year and at the end of three years?

7-4

Problem 4

You forecast that ITT will pay a dividend of $2.40 next year and that dividends will grow at a rate of 9% a year What price would you expect to see for ITT stock if the market capitalization rate is 15%

7-5

Problem 5

If the price of ITT is $30, what market capitalization rate is implied by your forecasts of problem 4?

7-6

Problem 6

ABCs stock is currently trading at $25 per share The stocks dividend is projected to increase at a constant rate of 7% per year The required rate of return on the stock is 10% What is the expected price of the stock 4 years from today?

7-7

Problem 7

ABC is expected to pay a $2.00 per share dividend at the end of the year (D1 = 2.00) The stocks sells for $40 per share Required rate of return is 11% The dividend is expected to grow at a constant rate, g, forever What is the growth rate, g, for this stock?

7-8

Problem 8

You are given the following data:

The risk-free rate is 5% The required return on the market is 8% The expected growth rate for the firm is 4% The last dividend paid was 0.80 per share Beta is 1.3

7-9

Problem 8 - continuing

Now assume the following changes occur:

The inflation premium drops by 1 percent An increased degree of risk aversion causes the required return on the market to go to 10% after adjusting for the changed inflation premium The expected growth rate increases to 6% Beta rises to 1.5

7-10

Problem 8 - continuing

What will be the change in price per share, assuming the stock was in equilibrium before the change?

7-11

Problem 9

ABCs stock is currently selling at an equilibrium price of $30 per share The firm has a 6% growth rate Last years earnings per share, E0 were $4.00 Dividend payout ratio is 40% The risk-free rate is 8% Market risk premium is 5% If market risk (beta) increases by 50%, and all other factors remain constant, what will be the new stock price? (use 4 decimal places in calculations) 7-12

Problem 10

A stock, which currently does not pay a dividend, is expected to pay its first dividend if $1.00 per share in five years (D5 = $1.00) After the dividend is established, it is expected to grow at an annual rate of 25% per year for the following three years (D8 = $1.9531) and then grow at a constant rate of 5% per year Assume that the risk-free rate is 5.5%, the market risk premium is 4% and that the stocks beta is 1.2 What is the expected price of the stock today?

7-13

Problem 11

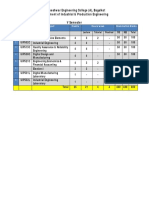

You have been given the following projections for ABC corporation for the coming year

Sales = 10,000 units Sales price per unit = $10 Variable cost per unit = $5 Fixed costs = $10,000 Bonds outstanding = $15,000 rd on outstanding bonds = 8% Tax rate = 40% Shares of common stock outstanding = 10,000 shares Beta = 1.4 rRF = 5% rM = 9% Dividend payout ratio (d) = 60% 7-14

Find the current price per share for ABC corporation

7-15

Das könnte Ihnen auch gefallen

- Multiple Choice - Stock ValuatingDokument9 SeitenMultiple Choice - Stock ValuatingĐào Ngọc Pháp0% (1)

- Mid-Term Test - MondayDokument3 SeitenMid-Term Test - MondayMi 12A1 - 19 Nguyễn Ngọc TràNoch keine Bewertungen

- Midterm PDFDokument8 SeitenMidterm PDFNikhil AgrawalNoch keine Bewertungen

- Exercise Chapter 4Dokument2 SeitenExercise Chapter 4Lưu Nguyễn Hà GiangNoch keine Bewertungen

- Seminar - 1Dokument3 SeitenSeminar - 1Nam Phạm Lê NhậtNoch keine Bewertungen

- Assignment 1Dokument1 SeiteAssignment 1Muhammad UmarNoch keine Bewertungen

- Gi A KìDokument3 SeitenGi A KìVân ĂnggNoch keine Bewertungen

- Tutorial 3Dokument3 SeitenTutorial 3Thuận Nguyễn Thị KimNoch keine Bewertungen

- Assignment 2 - Stock ValuationDokument1 SeiteAssignment 2 - Stock ValuationMary Yvonne AresNoch keine Bewertungen

- Chapter 10 StocksDokument8 SeitenChapter 10 Stocksbiserapatce2Noch keine Bewertungen

- Security Valuation Assignment SolutionsDokument2 SeitenSecurity Valuation Assignment Solutionsharsh7mmNoch keine Bewertungen

- Problem Set 1 PDFDokument2 SeitenProblem Set 1 PDFlowfw880% (1)

- Problem Set Solutions v3Dokument3 SeitenProblem Set Solutions v3Bockarie LansanaNoch keine Bewertungen

- Problem Set 2Dokument2 SeitenProblem Set 2En Yu HoNoch keine Bewertungen

- Chapter 4 - Valuing Common StockDokument2 SeitenChapter 4 - Valuing Common StockPhạm Hà MinhNoch keine Bewertungen

- Security Analysis and Valuation Blue Red Ink (1) - WatermarkDokument22 SeitenSecurity Analysis and Valuation Blue Red Ink (1) - WatermarkKishan RajyaguruNoch keine Bewertungen

- Class Exercises - Stock ValuationDokument15 SeitenClass Exercises - Stock ValuationDua hussainNoch keine Bewertungen

- Net Present Value, Future Value, Mortgage Payments, Investment Returns, Bond Yields & Stock PricesDokument5 SeitenNet Present Value, Future Value, Mortgage Payments, Investment Returns, Bond Yields & Stock PricesQuân VõNoch keine Bewertungen

- Calculate stock value using dividend growth modelDokument5 SeitenCalculate stock value using dividend growth modelEricha MutiaNoch keine Bewertungen

- Chapter 2,3,4_Exercises in slidesDokument6 SeitenChapter 2,3,4_Exercises in slidestroancuteNoch keine Bewertungen

- Tutorial StocksDokument3 SeitenTutorial StocksNguyên KhôiNoch keine Bewertungen

- Exercise Stock ValuationDokument2 SeitenExercise Stock ValuationUmair ShekhaniNoch keine Bewertungen

- Problem Stock ValuationDokument5 SeitenProblem Stock ValuationbajujuNoch keine Bewertungen

- FDGFDSGDFGDokument3 SeitenFDGFDSGDFGJesus Colin CampuzanoNoch keine Bewertungen

- Exam Revision Q'sDokument14 SeitenExam Revision Q'skeely100% (1)

- Tutorial StocksDokument3 SeitenTutorial StocksViễn QuyênNoch keine Bewertungen

- FIN500 Exercises - Stock and BondDokument2 SeitenFIN500 Exercises - Stock and BondWADHA SALMAN GHAZI ALDHUFAIRINoch keine Bewertungen

- CH 4Dokument6 SeitenCH 4Jean ValderramaNoch keine Bewertungen

- Discounted Dividend Model questionsDokument6 SeitenDiscounted Dividend Model questionsEmmmanuel ArthurNoch keine Bewertungen

- Inclass Tutorial Week 4 Shares (Questions) 2102Dokument1 SeiteInclass Tutorial Week 4 Shares (Questions) 2102oxjigenNoch keine Bewertungen

- Answers to Chapter 7-9 Stock Valuation and Cost of CapitalDokument3 SeitenAnswers to Chapter 7-9 Stock Valuation and Cost of CapitalAbdullah AlhuraniNoch keine Bewertungen

- Financial CasesDokument64 SeitenFinancial CasesMarwan MikdadyNoch keine Bewertungen

- Midterm LTTC CLCDokument6 SeitenMidterm LTTC CLCMỹ Hạnh Đinh ThịNoch keine Bewertungen

- Investments Quiz 3-Key-1Dokument6 SeitenInvestments Quiz 3-Key-1Hashaam JavedNoch keine Bewertungen

- Aynur Efendiyeva - Maliye 1Dokument7 SeitenAynur Efendiyeva - Maliye 1Sheen Carlo AgustinNoch keine Bewertungen

- FNCE2000 Chapter6 Valuing Shares & Bonds QuestionsDokument3 SeitenFNCE2000 Chapter6 Valuing Shares & Bonds QuestionsJaydenaus0% (1)

- BÀi tập tài chínhDokument5 SeitenBÀi tập tài chínhlam nguyenNoch keine Bewertungen

- Tutorial 40 Sem 2 20212022Dokument6 SeitenTutorial 40 Sem 2 20212022Nishanthini 2998Noch keine Bewertungen

- Tutorial 4 - Stock Valuation (Part 2) PDFDokument1 SeiteTutorial 4 - Stock Valuation (Part 2) PDFChamNoch keine Bewertungen

- Cffinalb SPR 11Dokument10 SeitenCffinalb SPR 11Arun PrabuNoch keine Bewertungen

- Tutorial Stocks - S2 - 2019.20Dokument3 SeitenTutorial Stocks - S2 - 2019.20Leo ChristNoch keine Bewertungen

- HW 4 SolutionsDokument5 SeitenHW 4 SolutionsJohn SmithNoch keine Bewertungen

- IUFM - Lecture 3 - Homework Handouts 1Dokument3 SeitenIUFM - Lecture 3 - Homework Handouts 1Thuận Nguyễn Thị KimNoch keine Bewertungen

- Topic 3+ 4 Valuation of SecuritiesDokument4 SeitenTopic 3+ 4 Valuation of SecuritiesHaha1234Noch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1hamza shahbazNoch keine Bewertungen

- Exercise-Stock ValuationDokument2 SeitenExercise-Stock Valuationchasnaa lidzamalihaNoch keine Bewertungen

- Practice Problems 6Dokument2 SeitenPractice Problems 6zidan92Noch keine Bewertungen

- Chapter 2: The Present ValueDokument4 SeitenChapter 2: The Present ValueVân ĂnggNoch keine Bewertungen

- Tutorial 12: Calculating Stock Prices and ValuesDokument2 SeitenTutorial 12: Calculating Stock Prices and ValuesAmber Yi Woon NgNoch keine Bewertungen

- Ce303 HW1 PDFDokument2 SeitenCe303 HW1 PDFالبرت آينشتاينNoch keine Bewertungen

- Ce303 HW1 PDFDokument2 SeitenCe303 HW1 PDFالبرت آينشتاينNoch keine Bewertungen

- 5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920Dokument6 Seiten5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920ahmerNoch keine Bewertungen

- Corporate Finance FinalsDokument66 SeitenCorporate Finance FinalsRahul Patel50% (2)

- FINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Dokument3 SeitenFINANCE 6301 Individual Assignment #1 PJM Due February 29, 2016Sijo VMNoch keine Bewertungen

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsVon EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNoch keine Bewertungen

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsVon EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Cocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsVon EverandCocktail Investing: Distilling Everyday Noise into Clear Investment Signals for Better ReturnsNoch keine Bewertungen

- Financial Management - Capital Budgeting Answer KeyDokument5 SeitenFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Preaching For Piketty: Taxing The Wealthy in The Aftermath of Tax AmnestyDokument27 SeitenPreaching For Piketty: Taxing The Wealthy in The Aftermath of Tax AmnestyAndreas Rossi DewantaraNoch keine Bewertungen

- Ethics and Standards Violations in Financial Advising SituationsDokument7 SeitenEthics and Standards Violations in Financial Advising SituationsPoojan ShahNoch keine Bewertungen

- Understanding Corporate FinanceDokument98 SeitenUnderstanding Corporate FinanceJosh KrishaNoch keine Bewertungen

- Capital Budgeting ProcessDokument139 SeitenCapital Budgeting ProcessMaria Rizza OguisNoch keine Bewertungen

- CFA Investments Problems - SetDokument85 SeitenCFA Investments Problems - SetGeorge Berberi100% (1)

- Risk and Return AssignmentDokument2 SeitenRisk and Return AssignmentHuzaifa Bin SaeedNoch keine Bewertungen

- 2020 CMA Content Specification OutlinesDokument12 Seiten2020 CMA Content Specification OutlinesDivyam SahniNoch keine Bewertungen

- Chapter-1 Basics of Risk ManagementDokument22 SeitenChapter-1 Basics of Risk ManagementmmkattaNoch keine Bewertungen

- UIP501C: Design of Machine Elements 04 Credits L-T-P:3-2-0Dokument16 SeitenUIP501C: Design of Machine Elements 04 Credits L-T-P:3-2-0satishNoch keine Bewertungen

- Broken Wing Butterfly PreviewDokument50 SeitenBroken Wing Butterfly Previewliang yuanNoch keine Bewertungen

- 2006 June, Unit 2 MSDokument15 Seiten2006 June, Unit 2 MSjayedos100% (2)

- CH 12Dokument59 SeitenCH 12Jean100% (1)

- Baldwin Bicycle Analysis (ImranGreenSlide)Dokument20 SeitenBaldwin Bicycle Analysis (ImranGreenSlide)Azuwan KhalidiNoch keine Bewertungen

- Financial Risk Management - Final ReportDokument25 SeitenFinancial Risk Management - Final Reportapi-272535218Noch keine Bewertungen

- Preparing - The - Pro - Forma - Real Estate PDFDokument63 SeitenPreparing - The - Pro - Forma - Real Estate PDFhelgerson.mail4157100% (1)

- Valuation and Rates of ReturnDokument16 SeitenValuation and Rates of ReturnKhairul NisaNoch keine Bewertungen

- Wa0030.Dokument56 SeitenWa0030.SXCEcon PostGrad 2021-23Noch keine Bewertungen

- Berkshire Partners' New Drug Breakthrough and Funding OptionsDokument90 SeitenBerkshire Partners' New Drug Breakthrough and Funding OptionsCharuka KarunarathneNoch keine Bewertungen

- 9eb60b92 1634358647301Dokument100 Seiten9eb60b92 1634358647301Ankit pattnaikNoch keine Bewertungen

- Private Equity Distribution Management Product ProfileDokument8 SeitenPrivate Equity Distribution Management Product Profilebodong408Noch keine Bewertungen

- A) The Govt. of India B) SEBI C) AMFI D) All Its InvestorsDokument34 SeitenA) The Govt. of India B) SEBI C) AMFI D) All Its InvestorsAtanu SarkarNoch keine Bewertungen

- L 5 Cost of CapitalDokument16 SeitenL 5 Cost of CapitalMansi SainiNoch keine Bewertungen

- Dividend Policy Guide - Factors Impacting Firm ValueDokument9 SeitenDividend Policy Guide - Factors Impacting Firm ValueAnonymous H2L7lwBs3Noch keine Bewertungen

- University of St. La SalleDokument10 SeitenUniversity of St. La SallerobertNoch keine Bewertungen

- Acova Radiateurs (v7)Dokument4 SeitenAcova Radiateurs (v7)Sarvagya JhaNoch keine Bewertungen

- Analysis of Financial Statements (MBA) : Instructor: Prof. Asif BashirDokument7 SeitenAnalysis of Financial Statements (MBA) : Instructor: Prof. Asif BashirDon AlexNoch keine Bewertungen

- Accountancy August 2021Dokument7 SeitenAccountancy August 2021Bey BeatzzNoch keine Bewertungen

- Keynes Theory of Demand For MoneyDokument12 SeitenKeynes Theory of Demand For Moneyjeganrajraj100% (1)