Beruflich Dokumente

Kultur Dokumente

Consumer Internet in Australia

Hochgeladen von

Sumit RoyCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consumer Internet in Australia

Hochgeladen von

Sumit RoyCopyright:

Verfügbare Formate

The Australian ONLINE CONSUMER LANDSCAPE

March 2012

THE AUSTRALIAN ONLINE MARKET & GLOBAL POPULATION

Internet usage in Australia is widespread and approaching saturation point with only minimal increases in total penetration expected. Internet World Stats cites Australia as one of the leading nations in terms of internet penetration as a 1 proportion of the total population (90% penetration ). 2 Nielsen Online Ratings nds 81% of Australians aged 16 years and above, and 75% of Australians aged two years and above, can be classied as an active online user (i.e. has used the internet in the past month). As the uptake of internet use in Australia is approaching saturation point, it has become increasingly valuable to explore and quantify exactly how consumers are behaving online: what activities they conduct; with what frequency; using which devices; and in which environments; as well as place their online behaviours in context against other media behaviours. The key indicators of a sophisticated online population, such as the adoption of mobile internet activities and the way Australians have embraced social media and their ever increasing condence in sharing their opinions and content online, reveal opportunities for marketers, content creators and publishers.

Figure 1.0: Active internet users, month of January 2012

Source: Nielsen Online Ratings January 2012, percentage calculated using ABS population gures

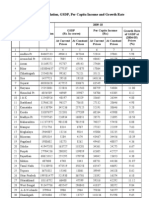

It is estimated that 30% of the worlds population is now online, representing over two billion people 3 (2,267m) . By continent, North America has the highest penetration at 79%, Oceania & Australia second at 67%, closely followed by Europe at 61%. Volume of users tells a different story as Asia dominates with just over one billion users, Europe follows with 500 million followed by North America with 273 million 4. Ranked on internet users as a percentage of total population, Australia has the 5th highest level of internet penetration in the world 5. Total penetration in Australia, as at December 2011, lies at 90% just ahead of Netherlands and Denmark. Australia is the only non-European nation amongst the top ve countries ranked by internet penetration.

16+

81%

14.7m

2+

75%

16.4m

Ranked on internet users as a percentage of total population, Australia has the 5th highest level of internet penetration in the world.

Australians aged 16+ Active online

Australians aged 2+ Active online

http://www.internetworldstats.com/sp/au.htm http://www.abs.gov.au/ausstats/abs@.nsf/mf/8153.0/ 3 http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/8153.0Jun%202010?OpenDocument 4 http://www.crikey.com.au/2010/09/21/wireless-on-the-rise-but-xed-broadband-still-does-the-work/ 5 http://www.acma.gov.au/WEB/STANDARD/pc=PC_312389

1 2

c 2012 The Nielsen Company.

02

MEDIA CONSUMPTION & CONTENT DELIVERY IS NO LONGER LINEAR

There is a need to keep pace with the fragmented and increasingly complex environment that has resulted from the rise of the internet - inltrating consumers lives, habits and patterns of behaviour with the continual emergence of new online activities and services, new devices supporting online access and connectivity and, generally, presenting consumers with new ways of doing old things. More than anything, the rise of the internet continues to present consumers with choices and this is the area that is difcult to keep pace with. Todays consumers have choices over the screen they select to watch TV content as well as the source from which they obtain it; their method of shopping, of doing their product research and how they share their opinion about the item they just bought; and choices in the way they get to know, and interact with, brands. All of these choices combined present marketers with a myriad of scenarios and paths to navigate. Media consumption and content delivery is no longer linear and only the most informed, intuitive and innovative marketers are likely to succeed in reaching and engaging their consumers in such an environment. Nielsen is delighted to provide you with this sample of key ndings from our 2012 Australian Online Consumer Report. Included are valuable previews into the evolving online landscape, which is presenting Australian consumers with new ways of doing old things, from shopping, watching and consuming television content right through to how they research and gather information. To address these changing behaviours, todays marketers face new challenges to keep pace with the fragmented Online environment. The 2012 Australian Online Consumer Report provides todays marketers with a base of knowledge to assist them in formulating and designing their strategies and tactics for the coming year. For more details: 2012 Australian Online Consumer Report

Highlights from the just released Nielsen 2012 Australian Online Consumer Report include: Time spent accessing mobile internet continues its upward trend Smartphones take share of pocket: 51% of online Australians aged 16+ now own a smartphone Tablet computers more than doubled to 18% of households - forecast to be 39% by 2013. Substantial growth in accessing online media using devices other than desktop and laptop PCs while commuting or travelling increased from 42% in 2010 to 55% in 2011. Multi-screen behaviour is now a daily habit for many Australians: Six in ten online Australians have used the internet while watching TV. More than one in ve online Australians shop/browse online between 6pm and 10pm. One of the key areas of growth in Australians participation with social media in 2011 was in Liking brands (now 57% up from 46% in 2010) and interacting with brands on social media platforms (now 47% up from 41% in 2010). Consumers draw on a variety of sources and resources to support their decision making: 71% read other consumers opinions and discussions about brands online and 59% watch online videos to help inform their purchase choices.

c 2012 The Nielsen Company.

03

TECHNOLOGY IN AUSTRALIAN HOMES

SMARTPHONE PENETRATION CONTINUES TO GROW

Desktop Not internet capable mobile

x

Laptop Wireless LAN

No mobile phone

79 76 82

83 75 73

2011 16-24 YRS : 20% 25-34 YRS : 26% 35-44 YRS : 22% 45-59 YRS : 17% 60+ YRS : 10%

x

26

5

Smartphone

Long range wirelss

51 18

2012 (Forecast) 2011 2010

67 Tablet computer 61 63 40 eReader 31 29 39 18 8 26 13 7

Internet capable mobile non smartphone

2011 16-24 YRS : 69% 25-34 YRS : 73% 35-44 YRS : 59% 45-59 YRS : 42% 60+ YRS : 25%

Ownership 2010 : 35% 2011 : 51% 2012 : 64% (Forecast)

MARKET SHARE: THE CLOSING GAP BETWEEN iOS & ANDROID

IN WHICH AREAS DO YOU FEEL THERE SHOULD BE MORE DEVELOPMENT OF USEFUL MOBILE APPS?

40

46

32

12

24

Transport related

Banking / nance related

Government services

Medical related

Maps / directions

Weather related

2011 2010

c 2012 The Nielsen Company.

04

CONSUMER TECHNOLOGY

92%

The majority (92%) of online Australians have some sort of home internet connection that is either a xed internet line, wireless LAN or long range wireless though this has recorded a slight decrease during 2011; possibly as some people only utilise the 3G access on their tablet computers and smartphones, negating the need for a formal home internet connection.

Desktop and laptop computers The presence of a desktop computer in Australians homes continues its decline, now at 76%- down six percentage points since 2010 Ownership of laptops increased slightly (2 percentage points) to 75%; though among the youth segment even laptop penetration declined during 2011, perhaps as the smartphone and/or tablet computer now fulls the role of a PC/laptop for some young consumers. Wireless local area networks (LANs) i.e. home Wi-Fi In 2011, the prevalence of a wireless LAN in Australians homes declined slightly, from 63% to 61%. Long range wireless devices Thirty one percent of online Australians own a long range wireless device, up from 29% in 2010 and 14% in 2009. Tablet computers Ownership of tablet computers, such as the Apple iPad or Samsung Galaxy, is now at 18%, more than doubling during 2011. Portable reading devices (eReaders) In 2011, 13% of online Australians have an eReader in the home, up from seven percent in 2010. Games consoles Household ownership of games consoles or handheld games devices like the Nintendo Wii, Microsoft Xbox, Sony Playstation and PSP etc. declined during 2011, now in 49% of online Australians homes. Mobile phone ownership The area of most momentum is Australian consumers shift to owning a smartphone. Like the increase in uptake evident through 2010, strong adoption has continued and now stands at 51% of all online Australians aged 16+ owning a smartphone; up from 36% in 2010.

c 2012 The Nielsen Company.

05

ONLINE USAGE BEHAVIOUR

93%

of online Australians use the internet daily (69% multiple times a day)

Online Australians spend an average of

21:54

in an average week

Highest for:

Males

16-24YRS

25-34YRS

22:36 26:12

24:24

DEVICES USED TO ACCESS THE INTERNET

Desktop and laptop/netbook access is still dominant, but access via other devices is growing

ENVIRONMENT OF INTERNET ACCESS

Home is still the dominant point of access, however out of home access is prevalent more-so for males and consumers under 35 years of age

82% amongst smartphone owners Mobile Phone Tablet Computer

When out and about on the go

While commuting / on transport

41%

36%

55% 50%

20% 10%

44% 39% 39% 33%

16-24YRS 25-34YRS 35-44YRS 45-59YRS 60+YRS

Games Console

Portable Media Player

Internet enabled TV/Smart TV

65% 66% 46%

62% 57% 40% 25% 10%

18%

2011 2010

15%

11%

29% 15%

c 2012 The Nielsen Company.

06

USER ENVIRONMENT AND PATTERNS OF BEHAVIOUR

Frequency of internet use among online Australians The internet continues to be an integral media in the lives of Australian online consumers, with the vast majority (93%) accessing the internet daily. Sixty nine percent access multiple times each day. Men access the internet slightly more frequently than women and the gap in frequency of access between those in metro vs. non metro areas continues to close. Younger consumers under 35 years of age are more likely to access the internet several times a day. Those aged 25-34 are slightly more frequent users than those under 25 (25-34 years 81% vs. 16-24 years 78%). Older online consumers are considerably less likely than their younger counterparts to access the internet multiple times per day (60+ years 59% vs. total 69%). The gap narrows in terms of overall daily use (90% of those aged 60+ access the internet at least daily versus 93% for the overall population aged 16+). Devices used to access the internet Almost all online Australians cite a desktop or laptop computer as the device they use most often to access the internet (94%) fty four percent say they most often access the internet via a desktop PC and 40% most often via a laptop. More than half of all online Australians have ever accessed the internet via a mobile phone (55%) and four percent cite this as the device they most often use to access the internet. One in ve online Australians have accessed the internet via a tablet computer (20%) and just fewer than one in ve via a games console (18%).

Average hours spent on the internet each week 2011, split by key demographic segments Base: Online Australians 16+ (n=5,104)

HOURS

TOTAL MALE FEMALE

21.9 22.6 21.2 26.2 24.4 20.9 20.8 18.7

16-24YRS 25-34YRS 35-44YRS 45-59YRS 60+YRS

Average time spent on the internet each week has reached a new high of 21 hours 54 minutes (up 12 minutes on 2010), continuing its steady upward climb.

c 2012 The Nielsen Company.

07

WEEKLY TIME SPENT ACROSS MEDIA BY ONLINE AUSTRALIANS

MEDIA MULTI-TASKING

36% of TV and internet multitaskers do so on a daily basis 75% of online Australians media multi-task

Internet

21:54

Magazine

2:12

15:30

Broadcast TV

+

Use the internet + watch TV

60%

+

Use the internet + listen to radio Newspaper

34%

3:30

Radio

9:48

+ +

Listen to the radio + watch TV

10%

Internet via mobile

4:12

Internet via tablet

5:24

Use the internet + read newspaper/magazines (print version)

9%

INTERNET TV

MEDIA PREFERENCES

Compared to all media, online Australians consider the internet as:

43%

of online Australians access TV, movie & related content via internet services & sources

Their preferred information source

52%

Their most trusted information source

34%

52%

Catch-up TV

The best time ller

51%

The best to access opinions

24%

via ofcial ondemand or catch-up TV services (like ABC iview, Plus 7)

22%

via unofcial streams or downloads (like BitTorrent, peer to peer networks)

17%

via video streaming sites (like YouTube)

33%

22.5% via mobile devices and 10.5% via PC/Laptop

Their favourite while commuting & travelling

c 2012 The Nielsen Company.

08

CROSS MEDIA & CROSS SCREEN BEHAVIOUR

Media is a much more complex landscape today than it was a decade ago when consumers had fewer options for accessing information and content. Today, consumers engage in cross-consumption behaviour when accessing information and content whether it be across media, devices or screens and either at the same time or otherwise. Australian online consumers are upgrading and investing in a range of new technologies in internet and computer related devices as well as television and entertainment technology; most of which supports internet connectivity. Whilst broadcast and time-shifted are still the most popular individual ways in which TV is consumed, online Australians also access their TV programming and content using internet services and sources. Online Australian men spend more time watching TV shows or movies from unofcial sources (males 6 hrs 30 mins vs. females 5 hrs 24 mins). They also spend more time playing computer or console games, and reading newspapers - over half an hour more a week compared to women. Women spend more time than men accessing internet on mobile phones, and more time watching TV and video from ofcial sources (females 4 hrs 42 mins vs. males 3 hrs 54 mins). They also spend more time listening to online radio, with 48 mins more on average per week compared to males. Online consumers aged 45-59 years watch more time-shifted TV (8 hrs 42 mins) and ofcial TV on demand or catch-up services (4 hrs 54 mins) than any other age group.

Ways in which TV is watched, 2011 Base: Online Australians 16+ (n=5,104)

Broadcast TV

87%

Time-shifted TV

34%

Ofcial TV on-demand or catch up TV services TV shows or movies that you have accessed from unofcial sources (using the internet) TV snippets or entire shows streamed from a site like You Tube Combined internet TV (including ofcial on-demand or catch-up services, unofcial sources and content streamed from sites like You Tube)

c 2012 The Nielsen Company.

Catch-up

24%

22%

17%

43%

09

5 MOST POPULAR SOCIAL MEDIA ACTIVITIES CONDUCTED BY AUSTRALIANS

BIGGEST MOVERS THROUGH 2011

Share

1 72% Browse other peoples

content on social networking platforms

2 71% Read other peoples online

57% 46%

Click FB Like button for brand/organisation

46% 39%

Use share buttons to share content

reviews, discussions or comments about brands, products or services

3 67%

Send private messages via social networking platforms

4 65%

Update their social networking prole

47% 42%

Connect with organisations / brands via SN sites

39% 33%

Post reviews of brands / prods or services

5 61% Public messages (wall posts,

status updates etc) via social networking sites

SOCIAL MOBILE

TOP CATEGORIES FOR BRAND ENGAGEMENT ON SOCIAL PLATFORMS

60

54 43 26

50

16-24 YRS : 84% 25-34 YRS : 81% 35-44 YRS : 59% 45-59 YRS : 37% 60+ YRS : 16%

BRA

ND

40

30

20

13 6

2011 2010 2009 2008 2007

Retailers

Movies, TV/radio programs or personalities

10

Restaurants, cafes, bars, clubs

4

Proportion of social media users who have accessed Social Mobile

Technology brands

Charities or not for prot organisations

c 2012 The Nielsen Company.

10

FOCUS ON SOCIAL MEDIA ENGAGEMENT

The active use of social media to engage with brands and organisations has shown the greatest increase in adoption through 2011. Now close to six in ten (57%) online Australians have clicked the Like button about a brand or organisation (up from 46% in 2010) Using social media share buttons to distribute online content also saw a steady increase through 2011 from 39% up to 46%. A signicant seven in ten online Australians continue to tap into other consumers opinions found on social networks, blogs, forums and other social platforms Six in ten use rich media to help inform their purchase decisions. Listening to online audio reviews or discussions about products/services increased in 2011 from 30% to 33%. The other area to shift upwards in 2011 was posting/sharing songs online, up from 19% in 2010 to 24%

Online social networking stimulates the most frequent usage among all social media activities close to half of all online Australians participate on at least a weekly basis.

Seeking others opinions to inform purchases is also one of the more popular, frequent activities, as is Liking brands or organisations via Facebook.

Figure 6.0: Social activities with greatest year-on-year movement, 2011 vs. 2010 Base: Online Australians 16+ (n=5,104 in 2011 and n=5,886 in 2010) *In 2010 this code was Sending/sharing songs

BIGGEST MOVERS 2011

11pts

Click FB Like button for brand/organisation

BIGGEST MOVERS 2010

12pts

Discussing brands / products / services

Share

7pts

Use share buttons to share content

10pts

Tagging content

6pts

Connect with organisations / brands via SN sites

6pts

Uploading video

6pts

Post reviews of brands / prods or services

5pts

Posting comments on formus

5pts

c 2012 The Nielsen Company.

Post / upload / share songs*

3pts

Connecting with organisations / brands via SN sites

11

NIELSEN 2012 AUSTRALIAN ONLINE CONSUMER REPORT

The evolving media landscape presents marketers with a challenge to keep pace with the environment and with consumer behaviour. The 2012 Australian Online Consumer Report provides a base of knowledge to assist marketers in formulating and designing their strategies and tactics for the coming year.

For more details: 2012 Australian Online Consumer Report

c 2012 The Nielsen Company.

Das könnte Ihnen auch gefallen

- Wereldleiders Op TwitterDokument24 SeitenWereldleiders Op TwitterHerman CouwenberghNoch keine Bewertungen

- TRAI Data Till 31st March, 2014Dokument19 SeitenTRAI Data Till 31st March, 2014Tamanna Bavishi ShahNoch keine Bewertungen

- Nightingales - Philips Healthcare Tie UpDokument3 SeitenNightingales - Philips Healthcare Tie UpSumit RoyNoch keine Bewertungen

- The State of Airline Marketing Airlinetrends Simpliflying April2013Dokument21 SeitenThe State of Airline Marketing Airlinetrends Simpliflying April2013Sumit RoyNoch keine Bewertungen

- Mobile Advertising Research Trends and InsightsDokument15 SeitenMobile Advertising Research Trends and InsightsSumit RoyNoch keine Bewertungen

- World Health Days 2014: JanuaryDokument2 SeitenWorld Health Days 2014: JanuaryIvy Jorene Roman RodriguezNoch keine Bewertungen

- Risk Factors From Hepatitis BCDDokument1 SeiteRisk Factors From Hepatitis BCDSumit RoyNoch keine Bewertungen

- Calendário de Jogos Do Mundial de Futebol-Brasil 2014Dokument0 SeitenCalendário de Jogos Do Mundial de Futebol-Brasil 2014Miguel RodriguesNoch keine Bewertungen

- Hepatitis A eDokument1 SeiteHepatitis A eSumit RoyNoch keine Bewertungen

- Hepatitis A eDokument1 SeiteHepatitis A eSumit RoyNoch keine Bewertungen

- NokiaDokument1 SeiteNokiaSumit RoyNoch keine Bewertungen

- The State of Mobile Advertising in Emerging Countries TLS EmergingMarketsDokument8 SeitenThe State of Mobile Advertising in Emerging Countries TLS EmergingMarketsSumit RoyNoch keine Bewertungen

- MGI China E-Tailing Executive Summary March 2013Dokument18 SeitenMGI China E-Tailing Executive Summary March 2013Sumit RoyNoch keine Bewertungen

- Mediamind Comscore Research Dwelling On EntertainmentDokument20 SeitenMediamind Comscore Research Dwelling On EntertainmentSumit RoyNoch keine Bewertungen

- Global Top 100 Most Valueable Brands Brandz2014 - Infographic PDFDokument1 SeiteGlobal Top 100 Most Valueable Brands Brandz2014 - Infographic PDFSumit RoyNoch keine Bewertungen

- Gender and Social Networking Activity :facebook Vs OthersDokument18 SeitenGender and Social Networking Activity :facebook Vs OthersSumit RoyNoch keine Bewertungen

- FINAL - Mobile Advertising DeckDokument73 SeitenFINAL - Mobile Advertising DecksumitkroyNoch keine Bewertungen

- World Health Statisitics FullDokument180 SeitenWorld Health Statisitics FullClarice SalidoNoch keine Bewertungen

- CEO Survey On Hiring, Profitability and PeopleDokument36 SeitenCEO Survey On Hiring, Profitability and PeopleSumit RoyNoch keine Bewertungen

- Calendar 14Dokument57 SeitenCalendar 14Hanan AhmedNoch keine Bewertungen

- The 5 Free Alternatives To Microsoft WordDokument60 SeitenThe 5 Free Alternatives To Microsoft WordSumit RoyNoch keine Bewertungen

- The State of Maternal Health, D Nutrition in Asia " World Vision DataDokument4 SeitenThe State of Maternal Health, D Nutrition in Asia " World Vision DataSumit RoyNoch keine Bewertungen

- 2014 Bill and Melinda Gates Foundation Report On Global PovertyDokument28 Seiten2014 Bill and Melinda Gates Foundation Report On Global PovertySumit RoyNoch keine Bewertungen

- The 5 Free Alternatives To Microsoft WordDokument60 SeitenThe 5 Free Alternatives To Microsoft WordSumit RoyNoch keine Bewertungen

- CVD Atlas 16 Death From Stroke PDFDokument1 SeiteCVD Atlas 16 Death From Stroke PDFRisti KhafidahNoch keine Bewertungen

- 10 Historical Speeches Nobody Ever HeardDokument20 Seiten10 Historical Speeches Nobody Ever HeardSumit Roy100% (1)

- India InfographicsDokument3 SeitenIndia InfographicsSumit RoyNoch keine Bewertungen

- The Evolution of Digital Advertising 3.0: Adobe Research InsightsDokument1 SeiteThe Evolution of Digital Advertising 3.0: Adobe Research InsightsSumit RoyNoch keine Bewertungen

- Statewise GSDP PCI and G.RDokument3 SeitenStatewise GSDP PCI and G.RArchit SingalNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Exploratory Essay Assignment SheetDokument1 SeiteExploratory Essay Assignment Sheetapi-498878591Noch keine Bewertungen

- Sarah Fitzpatrick - EssayDokument12 SeitenSarah Fitzpatrick - Essayapi-338159578Noch keine Bewertungen

- Me Vs Elaine PaigeDokument4 SeitenMe Vs Elaine PaigeCharlie ParkesNoch keine Bewertungen

- R. 1 Social Media ExposureDokument47 SeitenR. 1 Social Media ExposureRoxanne EnriquezNoch keine Bewertungen

- Blackboard Learn Analysis of Leading LMS ProviderDokument9 SeitenBlackboard Learn Analysis of Leading LMS ProviderdhruvitNoch keine Bewertungen

- Research ProposalDokument4 SeitenResearch ProposalCorey GayheartNoch keine Bewertungen

- Smart ComputingDokument801 SeitenSmart ComputingDOLLY THANKACHANNoch keine Bewertungen

- Copyreading and Headline Writing Exercise 2 KeyDokument2 SeitenCopyreading and Headline Writing Exercise 2 KeyPaul Marcine C. DayogNoch keine Bewertungen

- The Constant Contact Partner Program HandbookDokument58 SeitenThe Constant Contact Partner Program HandbookDenise MathreNoch keine Bewertungen

- Marwa Maamoon CVDokument4 SeitenMarwa Maamoon CVheba kamalNoch keine Bewertungen

- MEIL Additional SauceDokument28 SeitenMEIL Additional SauceLilibeth PalangdaoNoch keine Bewertungen

- Aro Sarah New MarketingDokument1 SeiteAro Sarah New MarketingpeterNoch keine Bewertungen

- Cer2015 Proceedings01 PDFDokument306 SeitenCer2015 Proceedings01 PDFDanica PirslNoch keine Bewertungen

- b1-b2 Reading Examples 1Dokument12 Seitenb1-b2 Reading Examples 1Mariana Kanarek100% (1)

- Gen Z - GWIDokument31 SeitenGen Z - GWIalvin fosil100% (1)

- Digital Dynamics Investigating The Impact of Social Media On Sexual BehaviorDokument6 SeitenDigital Dynamics Investigating The Impact of Social Media On Sexual BehaviorKIU PUBLICATION AND EXTENSIONNoch keine Bewertungen

- Cesc 12 - Q1 - M2Dokument16 SeitenCesc 12 - Q1 - M2JOEVARIE JUNIONoch keine Bewertungen

- Aditi DhekleDokument7 SeitenAditi DhekleBemisaal BasicsNoch keine Bewertungen

- ELC151 RT July2022 Set2Dokument14 SeitenELC151 RT July2022 Set2harishakimNoch keine Bewertungen

- Does Social Media Violate Our PrivacyDokument3 SeitenDoes Social Media Violate Our PrivacyKyle Andrei CapistranoNoch keine Bewertungen

- Tech Impact On BusinessDokument3 SeitenTech Impact On Businessapi-560447675Noch keine Bewertungen

- Jyoti Sagar Talukdar IIM Nagpur Date-11 April 2020Dokument3 SeitenJyoti Sagar Talukdar IIM Nagpur Date-11 April 2020JYOTI TALUKDARNoch keine Bewertungen

- Script Benefit of Social Media For BusinessDokument2 SeitenScript Benefit of Social Media For BusinessNurul Syaza MusaNoch keine Bewertungen

- 2021 Instagram Creator pricing guide by industry, audience size, and content typeDokument33 Seiten2021 Instagram Creator pricing guide by industry, audience size, and content typeDanielNoch keine Bewertungen

- Imc A1.1Dokument18 SeitenImc A1.1Linh Duong NhatNoch keine Bewertungen

- List of Past ISDA TopicsDokument10 SeitenList of Past ISDA TopicsISAAC MUSEKA LUPUPANoch keine Bewertungen

- #Teamfba: Online Fitness Business SystemDokument98 Seiten#Teamfba: Online Fitness Business SystemNarenNoch keine Bewertungen

- Risk, Security and Privacy Issues in The Digital WorldDokument8 SeitenRisk, Security and Privacy Issues in The Digital WorldJalaj AgarwalNoch keine Bewertungen

- " Impact of Social Media Advertising On: Consumers and Their ResponseDokument69 Seiten" Impact of Social Media Advertising On: Consumers and Their ResponseManmeet VermaNoch keine Bewertungen

- Opinnäytetyö Johansson 2019Dokument42 SeitenOpinnäytetyö Johansson 2019yolandamarchella07Noch keine Bewertungen