Beruflich Dokumente

Kultur Dokumente

Introduction To Chart of Accounts

Hochgeladen von

kjvillOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Introduction To Chart of Accounts

Hochgeladen von

kjvillCopyright:

Verfügbare Formate

Introduction to Chart of Accounts

A chart of accounts is a listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger. A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed. Within the chart of accounts you will find that the accounts are typically listed in the following order:

Assets Liabilities Owner's (Stockholders') Equity Operating Revenues Operating Expenses Non-operating Revenues and Gains Non-operating Expenses and Losses

Balance sheet accounts

Income statement accounts

Within the categories of operating revenues and operating expenses, accounts might be further organized by business function (such as producing, selling, administrative, financing) and/or by company divisions, product lines, etc. A company's organization chart can serve as the outline for its accounting chart of accounts. For example, if a company divides its business into ten departments (production, marketing, human resources, etc.), each department will likely be accountable for its own expenses (salaries, supplies, phone, etc.). Each department will have its own phone expense account, its own salaries expense, etc. A chart of accounts will likely be as large and as complex as the company itself. An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts.

Sample Chart of Accounts For a Large Corporation

Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified. (Software for some small businesses may not require account numbers.) Account numbers are often five or more digits in length with each digit representing a division of the company, the department, the type of account, etc. As you will see, the first digit might signify if the account is an asset, liability, etc. For example, if the first digit is a "1" it is an asset. If the first digit is a "5" it is an operating expense. A gap between account numbers allows for adding accounts in the future. The following is a partial listing of a sample chart of accounts. Current Assets (account numbers 10000 - 16999) 10100 Cash - Regular Checking 10200 Cash - Payroll Checking 10600 Petty Cash Fund 12100 Accounts Receivable 12500 Allowance for Doubtful Accounts 13100 Inventory 14100 Supplies 15300 Prepaid Insurance

Property, Plant, and Equipment (account numbers 17000 - 18999)

17000 Land 17100 Buildings 17300 Equipment 17800 Vehicles 18100 Accumulated Depreciation - Buildings 18300 Accumulated Depreciation - Equipment 18800 Accumulated Depreciation - Vehicles

Current Liabilities (account numbers 20000 - 24999)

20100 Notes Payable - Credit Line #1 20200 Notes Payable - Credit Line #2 21000 Accounts Payable 22100 Wages Payable 23100 Interest Payable 24500 Unearned Revenues

Long-term Liabilities (account numbers 25000 - 26999)

25100 Mortgage Loan Payable 25600 Bonds Payable 25650 Discount on Bonds Payable

Stockholders' Equity (account numbers 27000 - 29999)

27100 Common Stock, No Par 27500 Retained Earnings 29500 Treasury Stock

Operating Revenues (account numbers 30000 - 39999)

31010 Sales - Division #1, Product Line 010 31022 Sales - Division #1, Product Line 022 32015 Sales - Division #2, Product Line 015 33110 Sales - Division #3, Product Line 110

Cost of Goods Sold (account numbers 40000 - 49999)

41010 COGS - Division #1, Product Line 010 41022 COGS - Division #1, Product Line 022 42015 COGS - Division #2, Product Line 015 43110 COGS - Division #3, Product Line 110

Marketing Expenses (account numbers 50000 - 50999)

50100 Marketing Dept. Salaries 50150 Marketing Dept. Payroll Taxes 50200 Marketing Dept. Supplies 50600 Marketing Dept. Telephone

Payroll Dept. Expenses (account numbers 59000 - 59999)

59100 Payroll Dept. Salaries 59150 Payroll Dept. Payroll Taxes 59200 Payroll Dept. Supplies 59600 Payroll Dept. Telephone

Other (account numbers 90000 - 99999)

91800 Gain on Sale of Assets 96100 Loss on Sale of Assets

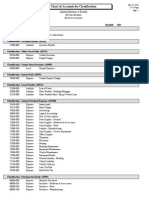

Sample Chart of Accounts for a Small Company

This is a partial listing of another sample chart of accounts. Note that each account is assigned a three-digit number followed by the account name. The first digit of the number signifies if it is an asset, liability, etc. For example, if the first digit is a "1" it is an asset, if the first digit is a "3" it is a revenue account, etc. The company decided to include a column to indicate whether a debit or credit will increase the amount in the account. This sample chart of accounts also includes a column containing a description of each account in order to assist in the selection of the most appropriate account.

Asset Accounts

Liability Accounts

Owner's Equity Accounts

Operating Revenue Accounts

Operating Expense Accounts

Non-Operating Revenues and Expenses, Gains, and Losses

Accounting software frequently includes sample charts of accounts for various types of businesses. It is expected that a company will expand and/or modify these sample charts of accounts so that the specific needs of the company are met. Once a business is up and running and transactions are routinely being recorded, the company may add more accounts or delete accounts that are never used.

At Least Two Accounts for Every Transaction

The chart of accounts lists the accounts that are available for recording transactions. In keeping with the double-entry system of accounting, a minimum of two accounts is needed for every transactionat least one account is debited and at least one account is credited. When a transaction is entered into a company's accounting software, it is common for the software to prompt for only one account namethis is because the software is programmed to automatically assign one of the accounts. For example, when using accounting software to write a check, the software automatically reduces the asset account Cash and prompts you to designate the other account(s) such as Rent Expense, Advertising Expense, etc. Some general rules about debiting and crediting the accounts are:

Expense accounts are debited and have debit balances Revenue accounts are credited and have credit balances Asset accounts normally have debit balances To increase an asset account, debit the account To decrease an asset account, credit the account Liability accounts normally have credit balances To increase a liability account, credit the account To decrease a liability account, debit the account

Das könnte Ihnen auch gefallen

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Von EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Bewertung: 2 von 5 Sternen2/5 (1)

- Invoice processing The Ultimate Step-By-Step GuideVon EverandInvoice processing The Ultimate Step-By-Step GuideBewertung: 1 von 5 Sternen1/5 (1)

- 4 Chart of AccountsDokument115 Seiten4 Chart of Accountsresti rahmawatiNoch keine Bewertungen

- TaxACT Form 1120 Facts ABC Inc 2016 Tax ReturnDokument2 SeitenTaxACT Form 1120 Facts ABC Inc 2016 Tax ReturnMD_ARIFUR_RAHMAN0% (2)

- CH 17 SolDokument52 SeitenCH 17 SolCarlos J. Cancel AyalaNoch keine Bewertungen

- CHAP 13 Partnerships and Limited Liability CorporationsDokument89 SeitenCHAP 13 Partnerships and Limited Liability Corporationspriyankagrawal7100% (1)

- GL Chart of Accounts by ClassificationDokument5 SeitenGL Chart of Accounts by ClassificationJack777100Noch keine Bewertungen

- Credit Bureau Understanding Your Credit ReportDokument1 SeiteCredit Bureau Understanding Your Credit ReportsurfnewsNoch keine Bewertungen

- Chart of AccountsDokument1 SeiteChart of AccountsEfrelyn Grethel Baraya AlejandroNoch keine Bewertungen

- Top Ten QuickBooks TricksDokument28 SeitenTop Ten QuickBooks TricksHarryTendulkarNoch keine Bewertungen

- Agreement.: Dissolution IsDokument4 SeitenAgreement.: Dissolution IsClauie BarsNoch keine Bewertungen

- CFPB Your Money Your Goals Choosing Paid ToolDokument6 SeitenCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNoch keine Bewertungen

- Statement Apr 2018Dokument3 SeitenStatement Apr 2018NRLDCNoch keine Bewertungen

- R12: How To Setup and Test Procurement Card Data and Troubleshoot IssuesDokument10 SeitenR12: How To Setup and Test Procurement Card Data and Troubleshoot IssuesPoshala_RameshNoch keine Bewertungen

- NACHA Quick Start GuideDokument3 SeitenNACHA Quick Start GuideSaurabh SaxenaNoch keine Bewertungen

- Chart of Accounts: Home BlogDokument5 SeitenChart of Accounts: Home BlogJose Luis Becerril BurgosNoch keine Bewertungen

- MBATaxDokument24 SeitenMBATaxFilsufGorontaloNoch keine Bewertungen

- Lock BoxDokument4 SeitenLock BoxAniruddha ChakrabortyNoch keine Bewertungen

- All Forms Performancedata Fy2014 Qtr3Dokument1 SeiteAll Forms Performancedata Fy2014 Qtr3Ga AgNoch keine Bewertungen

- IDP PrintersDokument12 SeitenIDP Printersgroovey9040Noch keine Bewertungen

- F To H Transaction CodesDokument50 SeitenF To H Transaction CodesVenkatNoch keine Bewertungen

- Decoding Bank StatementsDokument1 SeiteDecoding Bank StatementsBalaji_SAPNoch keine Bewertungen

- Chart of AccountDokument10 SeitenChart of AccountDmitry_11Noch keine Bewertungen

- Payroll CycleDokument43 SeitenPayroll CycleKylie TarnateNoch keine Bewertungen

- SAP FD01 Transaction Code Tutorial: Maintain Customer Master DataDokument16 SeitenSAP FD01 Transaction Code Tutorial: Maintain Customer Master DataERPDocs100% (1)

- Accounting PrimerDokument86 SeitenAccounting PrimerchandusgNoch keine Bewertungen

- 2011 Consumer Action HandbookDokument161 Seiten2011 Consumer Action HandbookabfibNoch keine Bewertungen

- Lockbox Power PointDokument19 SeitenLockbox Power Pointasrinu88881125100% (1)

- Ohio LLC ApplicationDokument6 SeitenOhio LLC ApplicationamaddgeeNoch keine Bewertungen

- End of The Year Adjustment For Allowance For Doubtful AccountsDokument1 SeiteEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- ch11 The Balance SheetDokument26 Seitench11 The Balance SheetKurnia Dwi Rachman0% (1)

- 04 MIPSintro PDFDokument70 Seiten04 MIPSintro PDFMuhammad Zunair HussainNoch keine Bewertungen

- Small Business Owner'S HandbookDokument16 SeitenSmall Business Owner'S HandbookKevin_PNoch keine Bewertungen

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionVon EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNoch keine Bewertungen

- Cybersecurity Analysis - Hyatt HotelDokument4 SeitenCybersecurity Analysis - Hyatt HotelChiaki HidayahNoch keine Bewertungen

- R12 Oracle FinancialsNew Features OverviewDokument29 SeitenR12 Oracle FinancialsNew Features Overviewabhipune100% (1)

- Myob - Chart of AccountsDokument4 SeitenMyob - Chart of AccountsAr RaziNoch keine Bewertungen

- SurvivalguideDokument605 SeitenSurvivalguideThomasGarciaTDVANoch keine Bewertungen

- Third Quarter 2007 Financial Review: Comerica IncorporatedDokument34 SeitenThird Quarter 2007 Financial Review: Comerica Incorporatedmdv31500Noch keine Bewertungen

- Bookkeeping 101Dokument4 SeitenBookkeeping 101bjaykc_46100% (1)

- Examples of Customized Charts of AccountsDokument33 SeitenExamples of Customized Charts of AccountsDennis lugodNoch keine Bewertungen

- Manual On The Spot ChecksDokument113 SeitenManual On The Spot ChecksEmilNoch keine Bewertungen

- Fraud InvestigationDokument6 SeitenFraud InvestigationAvianah LindaNoch keine Bewertungen

- Financial Accounting CH 2Dokument24 SeitenFinancial Accounting CH 2ArianaLaoNoch keine Bewertungen

- Checks ManagementDokument3 SeitenChecks ManagementnorthepirNoch keine Bewertungen

- No. Account Title To Increase Description/Explanation of AccountDokument3 SeitenNo. Account Title To Increase Description/Explanation of AccountVera Magdalena HutaurukNoch keine Bewertungen

- Income Taxes ProgramDokument14 SeitenIncome Taxes ProgramGodfrey JathoNoch keine Bewertungen

- Wells Fargo Credit Reporting CodesDokument4 SeitenWells Fargo Credit Reporting CodesGoodStuff140% (1)

- Payroll Check ExplainedDokument3 SeitenPayroll Check Explainedfriendresh1708Noch keine Bewertungen

- Accounts Payable ProceduresDokument9 SeitenAccounts Payable ProceduresSuhas YadavNoch keine Bewertungen

- Double Entry BookkeepingDokument19 SeitenDouble Entry BookkeepingCanduman NhsNoch keine Bewertungen

- Procurement CardDokument5 SeitenProcurement CardGuhanadh Padarthy100% (1)

- Ratings 8045 Residuals of Traumatic Brain Injury (TBI)Dokument23 SeitenRatings 8045 Residuals of Traumatic Brain Injury (TBI)JimNoch keine Bewertungen

- Excel Cashbook OneDokument74 SeitenExcel Cashbook OnePT ANUGERAH SUCI MAKMURNoch keine Bewertungen

- Accounts Receivable Process Diagnostic QuestionnaireDokument13 SeitenAccounts Receivable Process Diagnostic QuestionnaireRodney LabayNoch keine Bewertungen

- Designing An Effective Chart of Accounts StructureDokument38 SeitenDesigning An Effective Chart of Accounts StructureMuqeemuddin_Kh_5020100% (1)

- Understanding AccountingDokument20 SeitenUnderstanding Accountingrainman54321Noch keine Bewertungen

- Introduction To Chart of Accounts: Confused? Send FeedbackDokument8 SeitenIntroduction To Chart of Accounts: Confused? Send FeedbackMJ DulinNoch keine Bewertungen

- 2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemDokument4 Seiten2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemRaghuNoch keine Bewertungen

- Finance& Financial Management Risk, Cost of Capital & Capital BudgetingDokument39 SeitenFinance& Financial Management Risk, Cost of Capital & Capital BudgetingJuan SanguinetiNoch keine Bewertungen

- Mariolis y Tsoulfidis (2016) Modern Classical Economics and RealityDokument253 SeitenMariolis y Tsoulfidis (2016) Modern Classical Economics and RealityJesús Moreno100% (1)

- $ The Billionaire's Business Blueprint $Dokument336 Seiten$ The Billionaire's Business Blueprint $Reginald Ringgold97% (58)

- BEZA Annual ReportDokument95 SeitenBEZA Annual ReportKAZI NISHATNoch keine Bewertungen

- List Real Estate LAWS SummaryDokument2 SeitenList Real Estate LAWS Summaryjade123_129100% (4)

- Cost Accounting PDFDokument261 SeitenCost Accounting PDFRaksha Sharma100% (1)

- Unit 22Dokument4 SeitenUnit 22Thu ĐàoNoch keine Bewertungen

- Annual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management ConsultingDokument10 SeitenAnnual Management Consulting Rankings - 2010 - 2011 - Firmsconsulting - About Management Consultingchocobanana123Noch keine Bewertungen

- Industrial Grinders NVDokument6 SeitenIndustrial Grinders NVCarrie Stevens100% (1)

- The Basis For Business Decisions: Williams Haka Bettner MeigsDokument20 SeitenThe Basis For Business Decisions: Williams Haka Bettner Meigsdevansh kakkarNoch keine Bewertungen

- Managerial Economics Lecture NotesDokument21 SeitenManagerial Economics Lecture NotescprabhakaranNoch keine Bewertungen

- Pool Asset ManagementDokument10 SeitenPool Asset ManagementpawanNoch keine Bewertungen

- Lies - and - Damned - Lies - Carol Loomis August 1999Dokument10 SeitenLies - and - Damned - Lies - Carol Loomis August 1999Brian McMorrisNoch keine Bewertungen

- Marketing Strategy ProcessDokument70 SeitenMarketing Strategy ProcessDaman AroraNoch keine Bewertungen

- Chapter-20 Pel, PML, Nelp PDFDokument5 SeitenChapter-20 Pel, PML, Nelp PDFPradeep EapenNoch keine Bewertungen

- Senate Hearing, 110TH Congress - Examining The Effectiveness of U.S. Efforts To Combat Waste, Fraud, Abuse, and Corruption in IraqDokument283 SeitenSenate Hearing, 110TH Congress - Examining The Effectiveness of U.S. Efforts To Combat Waste, Fraud, Abuse, and Corruption in IraqScribd Government DocsNoch keine Bewertungen

- Business Plan HotelDokument36 SeitenBusiness Plan Hoteldammika_077100% (7)

- KimEng - Annual Report 2010Dokument106 SeitenKimEng - Annual Report 2010flyingvinceNoch keine Bewertungen

- Rupees in '000 Rupees in '000: Balance Sheet 2008 2009Dokument22 SeitenRupees in '000 Rupees in '000: Balance Sheet 2008 2009Ch Altaf HussainNoch keine Bewertungen

- Rob Parson Morgan StanleyDokument1 SeiteRob Parson Morgan StanleyLuis Javier Naval ParraNoch keine Bewertungen

- Yield Curve Spread Trades PDFDokument12 SeitenYield Curve Spread Trades PDFNicoLaza100% (1)

- Maxims of Equity - PPTX (Lecture 3)Dokument32 SeitenMaxims of Equity - PPTX (Lecture 3)chaaisyahNoch keine Bewertungen

- Revised Credit HandBookDokument587 SeitenRevised Credit HandBookWaqas Ishtiaq100% (1)

- Employee WelfareDokument93 SeitenEmployee WelfareVenkat Yalla100% (1)

- Determining The Value of Intangible Assets - A Study and An Empirical ApplicationDokument26 SeitenDetermining The Value of Intangible Assets - A Study and An Empirical ApplicationBayron FloresNoch keine Bewertungen

- Institute of Bankers of Sri Lanka: D 07 - Investment BankingDokument17 SeitenInstitute of Bankers of Sri Lanka: D 07 - Investment BankingSuvindu DulhanNoch keine Bewertungen

- ING Group 2Dokument4 SeitenING Group 2Puneet JainNoch keine Bewertungen

- Redburn Case Study 1Dokument7 SeitenRedburn Case Study 1Mark PacittiNoch keine Bewertungen

- SoftwareDokument38 SeitenSoftwareRaven R. LabiosNoch keine Bewertungen