Beruflich Dokumente

Kultur Dokumente

Credit Assignment

Hochgeladen von

Leidi Chua BayudanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Credit Assignment

Hochgeladen von

Leidi Chua BayudanCopyright:

Verfügbare Formate

I.

Discuss Deposit under the Civil Law -> It is a Real Contract (only perfected by the delivery of the subject matter). Gratuitous when the contract is unilateral (only the depositary has an obligation) and for Compensation when the contract is bilateral (obligation on both the depositary and depositor) -> Safekeeping is the principal purpose of Deposit. If it be only an accessory obligation then it is not considered a Deposit. Some other contracts exist like Lease, Commodatum or Agency. -> A deposit may either be Judicially or Extrajudicially. Judicially takes place when the attachment or Seizure of property is by virtue of a court order while Extrajudically happens when the delivery is constituted based on the will of the depositor or by two or more persons each believing to be entitled to the thing deposited. -> The subject matter of a Deposit is available only for Movable Things or Personal Property. Because the possibility that a thing may disappear, be stolen or may be lost is not present in a Real Property. -> The Form of a contract of deposit may either be Orally or in Writing. It is based on the principle that Contracts shall be obligatory in whatever form they may have been entered into provided all the essential requisites for their validity are present. (Art. 1356) -> Extrajudicial Deposit is either Voluntary or Necessary. Voluntary Deposit happens when the delivery is made by the will of the depositor. Necessary Deposit is effected when it is made: 1. In compliance with an legal obligation 2. On the occasion of any calamity, such as fire, storm, pillage, shipwreck or other similar events. *But the main distinction between the two is that in Voluntary Deposit the depositor has complete freedom in choosing the depositary, whereas in Necessary Deposit there is a lack of free choice on the part of the depositor. (11 Manresa 674) -> The Degree of Care: on the part of the Depositary is that he is expected to exercise over the thing deposited the same diligence as he would exercise over his property for two reasons:

1. An essential requisite of the judicial relations which involves the depositor s confidence in the Depositarys good faith and trustworthiness. 2. The presumption of the depositor, in choosing the depositary, took into account the diligence which the depositary is accustomed with respect to his own property.

II. Discuss Special Law on Deposits (Warehouse Receipts Law) -> The Warehouse Receipts Law known as Act. 2137 came into effect on

February 5, 1912. It covers all warehouses whether public or private, bonded or not. It has been held applicable to the following: 1. Warehousemen licensed under Act. 3893 or the (Bonded Warehouse Act) 2. Those engaged in the business of receiving commodities for storage -> Purposes of the Warehouse Receipts Law: a. To regulate the status, rights, and liabilities of the parties in a warehousing contract b. To protect those who, in good faith and for value, acquire negotiable warehouse receipts by negotiation c. To render the title to and right to possession of, property stored in warehouses more easily convertible; d. To facilitate the use of warehouse receipts as documents of title and e. In order to accomplish these, to place a much greater responsibility on the warehouseman. -> Who is a warehouseman? It is a person lawfully engaged in the storing of goods for profit. -> What is a warehouse? It means the building or place where goods are deposited and stored for profit. -> Who may issue warehouse receipts? GR: Only a warehouseman may issue such receipts XPN: But, the following may: 1. A duly authorized officer 2. An agent of a warehouseman

-> Nature of a warehouse receipt. a. It is a written acknowledgment by a warehouseman that he has received and holds certain goods therein described in store for the person to whom it is issued. b. It is a simple written contract between the owner of the goods and the warehouseman to pay the compensation for that service. c. It is a bilateral contract. The goods are in the hands of a warehouseman and a symbolic representation of the property itself. d. It is not a negotiable instrument.

-> Essential terms needed in the Form of warehouse receipts must embody the following though they may be in written or printed from. a. Location of the warehouse b. Date of Issue of the Receipt c. Consecutive Number of the Receipt d. Statement whether goods received will be delivered to bearer or to a specified person or his order. e. Rate of Storage charges f. Description of the Goods g. Signature of Warehouseman h. If receipt is issued for goods of which the warehouseman is owner, either solely or jointly or in common with others, the fact of such ownership i. Statement of the amount of advances made and liabilities incurred for which the warehouseman claims as lien. * A warehouseman shall be liable to any person injured thereby for all damages caused by the omission from a negotiable receipt of any of the terms herein required. Reasons: A. For the benefit of the holders of the warehouse receipts to enable them to determine where the goods are deposited especially when the warehouseman has more than one warehouse in different places B. It indicates a prima facie the date when the contract of deposit is perfected and when the storage charges shall begin to run against the depositor.

C. Determines the persons who shall prima facie be entitled lawfully to the possession of the goods deposited. D. States the consideration for the contract from the view of the warehouseman. The law presumes that the depositor shall pay the customary or reasonable compensation for the services of the warehouseman. E. For identification so that the identical property delivered to the warehouseman may be delivered back by him upon the return of the warehouse receipt. A warehouseman cannot be supposed to know the contents of each package or box of merchandise which was delivered to him, and so packed as to cover and conceal the real nature of the goods delivered. G. It is the best evidence of the fact that the warehouseman received the goods described in the receipt and has bound himself to assume all obligations in connection therewith. H. Purpose is to prevent abuses which in the past had arisen from warehousemen issuing receipts on the goods. I. Purpose is to preserve the lien of the warehouseman over the goods stored or the proceeds thereof in his hands.

A. Obligations of the parties; For the warehouseman he is obligated to DELIVER THE GOODS upon a demand made either by the holder of the receipt or by the depositor. Moreover, he is principally obligated to: a. Take care of the goods entrusted to his safekeeping b. To deliver them to the holder of the receipt or the depositors provided the following conditions are met (See below)

For the holder of the receipt or the depositor they are obligated to: a. Make an offer to satisfy the warehousemans lien b. Offer to surrender the receipt, if negotiable with such indorsements as would be necessary for negotiation of the receipt c. A readiness and willingness to sign when the goods are delivered d. An acknowledgment that they have been delivered, and if the warehouseman

requested their signature.

III. Discuss and Distinguish Guaranty from Suretyship. Provide their characteristics, nature and extent, legal effects and how extinguished. -> Guaranty is a contract between the guarantor and the creditor. In its broad sense, it includes pledge and mortgage. Purpose of which may be accomplished not only through securing the fulfillment of an obligation contracted by the principal debtor but also by furnishing to the creditor for his security, property with authority to collect the debt from the proceeds of the same in case of default. Suretyship is defined as a contractual relation resulting from an agreement whereby one person, the surety,engages to be answerable to a third person for the debt, default, or miscarriage of another known as the principal.

Characteristics GUARANTY

Nature and Legal Effects Extent Accessory >If the guaranty Guarantor Contract is definite: only Liability is secondarily Subsidiary limited in liable and whole or in part All legal Conditional to the principal remedies debt. against Unilateral debtor are > If guaranty is to be Guarantor indefinite: exhausted must be a Liability first person extends not distinct only to the (Debtor and from the principal Guarantor) debtor obligation but Guarantor also to all its who pays accessories. the debtor must be indemnifie d by the former: a. Total amount of debt b. Legal Interest

Extinguishment Same time as that of the debtor and for the same causes as all other obligations. When the principal obligation is extinguished so then is guaranty Payment or Performance Loss of the thing due Condonatio n of Remission of Debt Confusion or Merger of the Rights of the creditor Compensat ion Novation Annulment

c. Expenses incurred after having been notified that the payment had been demanded of him. (Co-guarantors) May demand of each of the others the share which is proportiona lly owing him If insolvent, the share of the insolvent be borne by the others including the payer in the same proportion SURETYSHIP Assumes liability as a regular party Charged as an original promisor Liability is contractual and accessory but direct Liability is limited to the terms of the contract Liability arises only if principal debtor is

Recission Fulfillment of a resolutory condition Prescriptio n Release of the guarantor by the creditor

Held to know every default of his principal Will not be

Suretyship is extinguished if there is material alteration of the principal obligation. For example an extension granted to the debtor by the credit or without the consent of the surety extinguishes the surety.

discharged either by the mere indulgence of the creditor or by want of notice of the default of the principal

held liable Surety is not entitled to exhaustion

IV. Discuss and Distinguish Pledge and Mortgage. Provide their characteristics, nature and extent, legal effects and how extinguished. -> Pledge is a contract by which the debtor delivers to the creditor or a third person a MOVABLE document evidencing incorporeal rights. Purpose of which is to secure the fulfillment of a principal obligation with the understanding that when the obligation is fulfilled, the thing delivered shall be returned with all its fruits and accessories. Mortgage is a contract whereby the debtor secures to the creditor the fulfillment of a principal obligation subjecting to such security an IMMOVABLE property which obligation shall be satisfied with the proceeds of the sale of said property or rights in case the said obligation is not complied with at the time stipulated. Characteristics PLEDGE Real Contract Accessory Contract Unilateral Contract Subsidiary Contract Nature and Extent Constituted on Movables Property is to be delivered Not valid against third persons Constit uted on Immovables Legal Effects Extinguishment Return of the thing pledged Renunciati on or Abandonm ent Sale of the thing pledged

MORTGAGE Real Contract Accesssory Creates a real right a. If the

Contract Subsidiary Contract Unilateral Contract

and extends to its accessions, improvements, growing fruits, rents or income as well as proceeds of insurance Deliver y is not necessary Future property cannot be subjected to mortgage

mortgagor sells the encumbered property, the property remains subject to the fulfillment of the principal obligation secured by it b. The mortgagee has a right to rely in good faith on what appears on the certificate of title of the mortgagor of the property given as security and in the absence of anything to excite suspicion, he is under no obligation to look beyond the certificate c. Until the action for expropriation has been completed, ownership over the property remains with the registered owner d. Banking

institution must exercise due diligence before entering contract of mortgage e. If a person is the first mortgagee over a property which was sold in an auction by the second mortgagee, the only right left to him is to collect his mortgage credit from the purchaser thereof during the sale conducted f. In a suit to nullify a certificate of title, the mortgagee is an indispensable party. Creates merely an encumbran ce

Das könnte Ihnen auch gefallen

- Salaysay NG Pagpapatibay - PDFDokument1 SeiteSalaysay NG Pagpapatibay - PDFLeidi Chua BayudanNoch keine Bewertungen

- Crim Pro Lecture Part 1 (Text)Dokument21 SeitenCrim Pro Lecture Part 1 (Text)Leidi Chua BayudanNoch keine Bewertungen

- List of Philippine criminal law casesDokument1 SeiteList of Philippine criminal law casesLeidi Chua BayudanNoch keine Bewertungen

- Lease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andDokument4 SeitenLease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andLeidi Chua BayudanNoch keine Bewertungen

- Lease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andDokument4 SeitenLease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andLeidi Chua BayudanNoch keine Bewertungen

- Criminal Procedure Part 1-2Dokument16 SeitenCriminal Procedure Part 1-2Leidi Chua BayudanNoch keine Bewertungen

- Demand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityDokument1 SeiteDemand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityLeidi Chua BayudanNoch keine Bewertungen

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDokument73 Seiten2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- CH 8 SIFEx Qu Ac AnswersDokument5 SeitenCH 8 SIFEx Qu Ac AnswersgetoNoch keine Bewertungen

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDokument73 Seiten2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Demand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityDokument1 SeiteDemand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityLeidi Chua BayudanNoch keine Bewertungen

- Dvisio NsDokument3 SeitenDvisio NsShikago BolNoch keine Bewertungen

- Service and Support Coverage - Apple SupportDokument1 SeiteService and Support Coverage - Apple SupportLeidi Chua BayudanNoch keine Bewertungen

- Certification Presiding Judgelexecutive Certification VacanciesDokument1 SeiteCertification Presiding Judgelexecutive Certification VacanciesLeidi Chua Bayudan100% (1)

- 2019legislation - Revised Corporation Code Comparative Matrix - As of March 22 2019 PDFDokument121 Seiten2019legislation - Revised Corporation Code Comparative Matrix - As of March 22 2019 PDFJohn Lloyd MacuñatNoch keine Bewertungen

- TaxrevDokument891 SeitenTaxrevLeidi Chua BayudanNoch keine Bewertungen

- Puno Opinion SeparateDokument39 SeitenPuno Opinion SeparateLeidi Chua BayudanNoch keine Bewertungen

- Medical Act of 1959 regulates Philippine medical education & practiceDokument6 SeitenMedical Act of 1959 regulates Philippine medical education & practicePatricia Anne CollantesNoch keine Bewertungen

- 2016 Bar Q CivilDokument6 Seiten2016 Bar Q CivilLeidi Chua BayudanNoch keine Bewertungen

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDokument7 SeitenCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNoch keine Bewertungen

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDokument7 SeitenCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNoch keine Bewertungen

- Violations1 PDFDokument6 SeitenViolations1 PDFLeidi Chua BayudanNoch keine Bewertungen

- Duration of PenaltiesDokument1 SeiteDuration of Penaltiesroyax1Noch keine Bewertungen

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDokument7 SeitenCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNoch keine Bewertungen

- Philippine Supreme Court Affirms Tax on Interest Payments by National Development CompanyDokument124 SeitenPhilippine Supreme Court Affirms Tax on Interest Payments by National Development CompanyLeidi Chua BayudanNoch keine Bewertungen

- Supreme Court Denies Admission to Murderer Turned Law StudentDokument10 SeitenSupreme Court Denies Admission to Murderer Turned Law StudentLeidi Chua BayudanNoch keine Bewertungen

- BP22 Related Case Laws on Worthless ChecksDokument12 SeitenBP22 Related Case Laws on Worthless ChecksLeidi Chua BayudanNoch keine Bewertungen

- Heirs of Eugenio Lopez v. EnriquezDokument11 SeitenHeirs of Eugenio Lopez v. EnriquezLeidi Chua BayudanNoch keine Bewertungen

- SC rules against military officers in Amparo caseDokument4 SeitenSC rules against military officers in Amparo caseLeidi Chua BayudanNoch keine Bewertungen

- Rule 8 Section 1-In General - Every Pleading Shall Contain in A Methodical and Logical Form, PlainDokument1 SeiteRule 8 Section 1-In General - Every Pleading Shall Contain in A Methodical and Logical Form, PlainLeidi Chua BayudanNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- St. Aviation v. Grand International Air DigestDokument3 SeitenSt. Aviation v. Grand International Air DigestkathrynmaydevezaNoch keine Bewertungen

- Indian Ethos & Business Ethics End Term PaperDokument12 SeitenIndian Ethos & Business Ethics End Term Paperkuntal bajpayeeNoch keine Bewertungen

- Astm D6440 - 1 (En)Dokument2 SeitenAstm D6440 - 1 (En)svvasin2013Noch keine Bewertungen

- How To Talk in An Arranged Marriage Meeting - 22 StepsDokument3 SeitenHow To Talk in An Arranged Marriage Meeting - 22 StepsqwertyasdfgNoch keine Bewertungen

- J50 Feature Sheet May 2020Dokument2 SeitenJ50 Feature Sheet May 2020victor porrasNoch keine Bewertungen

- Bulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaDokument4 SeitenBulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaSsd IndiaNoch keine Bewertungen

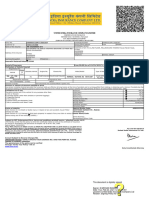

- United India Insurance Company Limited: This Document Is Digitally SignedDokument2 SeitenUnited India Insurance Company Limited: This Document Is Digitally SignedjagaenatorNoch keine Bewertungen

- Liberty Mutual Insurance Company v. Larry Cohran, 839 F.2d 661, 11th Cir. (1988)Dokument3 SeitenLiberty Mutual Insurance Company v. Larry Cohran, 839 F.2d 661, 11th Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- Voyage-Account CompressDokument9 SeitenVoyage-Account Compressmanisha GuptaNoch keine Bewertungen

- Social Implications in The Hound of The BaskervillesDokument8 SeitenSocial Implications in The Hound of The BaskervillesDaffodilNoch keine Bewertungen

- Acosta v. PlanDokument2 SeitenAcosta v. PlanShayne SiguaNoch keine Bewertungen

- Banez vs. ValdevillaDokument2 SeitenBanez vs. Valdevillahmn_scribdNoch keine Bewertungen

- Newton's Second Law - RevisitedDokument18 SeitenNewton's Second Law - RevisitedRob DicksonNoch keine Bewertungen

- Ralph Simms TestimonyDokument137 SeitenRalph Simms TestimonyJohn100% (1)

- 2015 Materials On Criminal Law by Judge Campanilla UP Law CenterDokument66 Seiten2015 Materials On Criminal Law by Judge Campanilla UP Law CenterYan Rodriguez Dasal100% (12)

- ME 1102 Electric Circuits: Analysis of Resistive CircuitsDokument12 SeitenME 1102 Electric Circuits: Analysis of Resistive CircuitsTalha KhanzadaNoch keine Bewertungen

- MV 82Dokument2 SeitenMV 820selfNoch keine Bewertungen

- Legal Considerations for Maternal and Child NursesDokument6 SeitenLegal Considerations for Maternal and Child NursesA C100% (2)

- Court Martial of Capt Poonam KaurDokument4 SeitenCourt Martial of Capt Poonam Kaurguardianfoundation100% (2)

- Corales vs. ECCDokument4 SeitenCorales vs. ECCMalenNoch keine Bewertungen

- New Water RatesDokument83 SeitenNew Water RatesScott FisherNoch keine Bewertungen

- 1495 6094 2 PBDokument8 Seiten1495 6094 2 PBAam Rachmat Mulyana.,SE.,MMNoch keine Bewertungen

- Supreme Court Rules Cinema Ticket Sales Not Subject to VATDokument14 SeitenSupreme Court Rules Cinema Ticket Sales Not Subject to VATMarian Dominique AuroraNoch keine Bewertungen

- Media Advisory For Commission of Inquiry Into State Capture Continues On 09 October 2020Dokument2 SeitenMedia Advisory For Commission of Inquiry Into State Capture Continues On 09 October 2020eNCA.comNoch keine Bewertungen

- Baybay Water District v. COADokument19 SeitenBaybay Water District v. COAPlaneteer PranaNoch keine Bewertungen

- Jagna Municipal Development Council Meeting MinutesDokument3 SeitenJagna Municipal Development Council Meeting MinutesAubrey Marie VillamorNoch keine Bewertungen

- Rosit vs. Davao DoctorsDokument12 SeitenRosit vs. Davao DoctorsWilfredNoch keine Bewertungen

- UCS-SCU22 BookDokument36 SeitenUCS-SCU22 BookRicardo Olmos MentadoNoch keine Bewertungen

- Audit of Insurance CompanyDokument11 SeitenAudit of Insurance CompanyTOLENTINO, Joferose AluyenNoch keine Bewertungen

- Barbaarinta Caruurta: Cabdifataax M. DucaaleDokument18 SeitenBarbaarinta Caruurta: Cabdifataax M. DucaaleMustafe AliNoch keine Bewertungen