Beruflich Dokumente

Kultur Dokumente

Fiscal Policy

Hochgeladen von

Dipesh JainCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fiscal Policy

Hochgeladen von

Dipesh JainCopyright:

Verfügbare Formate

Fiscal Policy It is the means by which a government adjusts its spending levels and tax rates to monitor and

influence a nation's economy. It includes tax policy, expenditure policy, investment or disinvestment strategies and debt or surplus management.

Objectives of Fiscal Policy Increase in capital formation To improve the Growth Rate To achieve desirable price level To achieve desirable consumption level To achieve desirable employment level To achieve desirable income distribution

Fiscal Policy can be of three types: Expansionary Fiscal Policy When there is a higher budget deficit and government spending is higher than the revenue collected from tax Contractionary Fiscal Policy When there is a lower budget deficit and government spending is lower than the revenue collected from tax Neutral Fiscal Policy When the budget outcome has neutral effect on the level of economic activity and government spending is fully funded by the revenue collected from tax

Two main Instruments of fiscal policy 1) Revenue Budget Government imposes direct and indirect taxes. Direct tax includes individual income tax and corporate tax, wealth tax, tax deducted at source. Indirect tax includes central excise tax, VAT, service tax, customs duty, educational cess.

2) Expenditure Budget

Central and state government are responsible for issues and spends money of national defense, foreign policy, railways, national highways, law and order, agriculture, public health, education, electricity etc.

Evolution of Indian Fiscal Policy till 1991 Both direct and indirect taxes were focused on extracting revenues from the private sector to fund the public sector and achieve redistributive goals. The combined centre and state tax revenue to GDP ratio increased from 6.3 % in 1950-51 to 16.1 % in 1987-88. For the central government this ratio was 4.1 % of GDP in 1950-51 with the larger share coming from indirect taxes at 2.3 % of GDP and direct taxes at 1.8 % of GDP. Given their low direct tax levers, the states had 0.6 % of GDP as direct taxes and 1.7 % of GDP as indirect taxes in 1950-51.

Fiscal Policy post 1991: In 1991, the government commenced economic liberalization- the economy was opened up to foreign investment and trade, the private sector was encouraged and the system of quotas and licences was dismantled. Thus, the Fiscal policy was re-oriented to cohere with these changes. The post 1991 expenditure strategy focussed on reducing subsidies and cutting down on non-capital expenditures. In 1995-96-Of the central governments revenue expenditures,9% went to subsidies, 13% to defence and 36% to interest . The rising revenues from tax reforms and expenditure control resulted in the deficits being brought under control. The central gov ernments revenue deficit went down to 2.37 % of GDP in 1996-97 while the GFD was 4.84 % . The debt to GDP ratio went down to 4.3 % of GDP in 1995-96 and reached a further low point of 2.99 % in 1999-2000. However, the central governments revenue deficit climbed up to 4.4% of GDP in 2002-03 while the GFD was at 5.91% of GDP. By 2003-04 the combined liabilities of the centre and the states were up at 81.09 % of GDP from 70.59 % in 2000-01. The external liabilities were however kept under control at only 1.67 % of GDP in 2003-04. These fiscal discipline legislations seemed to have had good impact at both the central and state levels. In 2006-07,just before the global economic crisis, the central Governments revenue deficit came down to 1.06 % of GDP while the GFD was 3.33 %.

The global financial crisis that erupted around September 2008 was affecting the Indian economy through three channels; contagion risks to the financial sector; the negative impact on exports; and the effect on exchange rates.As the crisis unfolded, the government activated a series of stimulus packages on 7thDecember 2008, 2nd January 2009 and 24thFebruary 2009 . Actions included an overall central excise duty cut of 4 %, ramping up additional plan expenditure of about Rs. 200 billion,state government borrowings for planned expenditure amounting to Rs. 300 billion, interest subsidies for export finance to support certain export oriented industries, 2 % reduction of central excise duties and service tax for export industries . The impact of these measures is estimated to be around 1.8 % of GDP in 2008-09. Given its inherent strengths like a strong and prudently regulated financial sector, a well managed capital account policy, large foreign exchange reserves, strong domestic consumption and effective fiscal policy interventions, the Indian economy weathered the financial crisis rather well. GDP growth declined to 5.8 % (year-on-year) in the second half of 2008-09 compared to 7.8 % in the first half. By 2009-2010, Indias GDP was growing at 8 % . This increased to 8.5 % in 2010-2011.

The budget of 2010-2011 targeted a fiscal deficit of 5.5 % of GDP in 2010-11 from a level of 6.5 % in 2009-10 (Ministry of Finance, 2011). The 2011-2012 fiscal deficit target was set at 4.6 % of GDP as against the 13th FC target of 4.8 %. The rationale for this was that reducing the debt to GDP ratio at an accelerated pace would unlock more resources for use in developmental programmes instead of debt servicing (Ministry of Finance, 2011).

By 2009-10, direct taxes were contributing around 48 % of revenues while the indirect taxes share was about 32 16 %. In the Budget of 2011-12, the share of direct taxes was about 47 % of the central governments projected revenue while the indirect taxes contribution was around 37 % .

The fiscal policy of 2012-13 had been calibrated with two fold objectives first, to aid economy in growth revival; and second, to bring down the deficit from 2011-12 level so as to leave space for private sector credit as the investment cycle picks up.

Das könnte Ihnen auch gefallen

- Fiscal Policy 111Dokument16 SeitenFiscal Policy 111Syed Ahsan Hussain XaidiNoch keine Bewertungen

- Global Crisis and IndiaDokument4 SeitenGlobal Crisis and Indiamedha86Noch keine Bewertungen

- Fiscal Policy of PakistanDokument12 SeitenFiscal Policy of PakistanAiman Ahmed100% (1)

- Fiscal Policy in IndiaDokument10 SeitenFiscal Policy in Indiaankit_tripathi_8Noch keine Bewertungen

- 3 Fiscal Monetary de DvnevDokument12 Seiten3 Fiscal Monetary de DvnevSadia WaseemNoch keine Bewertungen

- Fiscal FinalDokument23 SeitenFiscal FinalKrishna ChaitanyaNoch keine Bewertungen

- Fiscal Policy and Economic Growth - ANJOR EMMANUELDokument16 SeitenFiscal Policy and Economic Growth - ANJOR EMMANUELFeranmi OladigboNoch keine Bewertungen

- Fiscal Policy in PakistanDokument37 SeitenFiscal Policy in Pakistankanwal_bawa75% (4)

- Measurement Taken by Government To Overcome The ProblemDokument3 SeitenMeasurement Taken by Government To Overcome The ProblemNur AryaniNoch keine Bewertungen

- Synopsis Fiscal PolicyDokument23 SeitenSynopsis Fiscal PolicyNilesh Joshi100% (1)

- 4.1 Global Financial CrisisDokument4 Seiten4.1 Global Financial CrisisMurali Manohar SinghNoch keine Bewertungen

- Unit 16-Public Finance N Fiscal PolicyDokument32 SeitenUnit 16-Public Finance N Fiscal Policynorasan27Noch keine Bewertungen

- Policy Till 1990Dokument4 SeitenPolicy Till 1990Gaurav AroraNoch keine Bewertungen

- Fiscal PolicyDokument5 SeitenFiscal PolicySagar Singh KashyapNoch keine Bewertungen

- Government Finance-Union and StatesDokument33 SeitenGovernment Finance-Union and StatesJitendra BeheraNoch keine Bewertungen

- Fiscal Defecit and Its Trends in India: IntroductionDokument7 SeitenFiscal Defecit and Its Trends in India: IntroductionAyushi PatelNoch keine Bewertungen

- Fiscal Policy and Its FrameworkDokument26 SeitenFiscal Policy and Its FrameworkabdullahkhalilgNoch keine Bewertungen

- IMF Honduras Letter of Intent 091010Dokument22 SeitenIMF Honduras Letter of Intent 091010La GringaNoch keine Bewertungen

- Fiscal Reforms: Presented By: Aman Kumar Neha Batra Himanshu RastogiDokument19 SeitenFiscal Reforms: Presented By: Aman Kumar Neha Batra Himanshu RastogiabhistgautamNoch keine Bewertungen

- Unit 4-Fiscal PolicyDokument55 SeitenUnit 4-Fiscal Policyironman73500Noch keine Bewertungen

- Budget: The Fiscal Policy OverviewDokument9 SeitenBudget: The Fiscal Policy OverviewDurga Rao0% (1)

- Session 14Dokument18 SeitenSession 14Sid Tushaar SiddharthNoch keine Bewertungen

- Fiscal Policies LinksDokument3 SeitenFiscal Policies LinksAmol MoryeNoch keine Bewertungen

- Fiscal Policy MeaningDokument47 SeitenFiscal Policy MeaningKapil YadavNoch keine Bewertungen

- Budget: The Fiscal Policy OverviewDokument7 SeitenBudget: The Fiscal Policy OverviewDhiraj KumarNoch keine Bewertungen

- Fiscal Policy PROJECTDokument11 SeitenFiscal Policy PROJECTompiyushsingh75% (8)

- Fiscal PolicyDokument13 SeitenFiscal PolicyAakash SaxenaNoch keine Bewertungen

- SAP UgandaDokument21 SeitenSAP UgandasdaakiNoch keine Bewertungen

- Managerial Economics Unit VDokument14 SeitenManagerial Economics Unit VTanmay JainNoch keine Bewertungen

- Fiscal Policy Strategy StatementDokument8 SeitenFiscal Policy Strategy Statementjosephdass756Noch keine Bewertungen

- Economy Topic 2Dokument20 SeitenEconomy Topic 2Ikra MalikNoch keine Bewertungen

- Public Financial Management Assessment in The PhilippinesDokument13 SeitenPublic Financial Management Assessment in The PhilippinesOliva MervzNoch keine Bewertungen

- Fiscal Policy - 2Dokument4 SeitenFiscal Policy - 2Prashant SinghNoch keine Bewertungen

- Fiscal Policy Impact On Developing CountriesDokument35 SeitenFiscal Policy Impact On Developing CountriesBharati Shet100% (1)

- Assignment of English: Read The Text Carefully Then Write A Summary, Give Your Opinion About Macroeconomic As WellDokument1 SeiteAssignment of English: Read The Text Carefully Then Write A Summary, Give Your Opinion About Macroeconomic As WellWekaMuksinNoch keine Bewertungen

- ECON Final ProjectDokument11 SeitenECON Final ProjectMukoya OdedeNoch keine Bewertungen

- The StateDokument7 SeitenThe StategootliNoch keine Bewertungen

- Effects of Fiscal Policy On Indian FirmsDokument14 SeitenEffects of Fiscal Policy On Indian FirmsTewari UtkarshNoch keine Bewertungen

- Fiscalpolicy 160830184523Dokument22 SeitenFiscalpolicy 160830184523Sanjay DuraiNoch keine Bewertungen

- Fiscal Development in PakistanDokument14 SeitenFiscal Development in PakistanNasir Jamal100% (1)

- Brazil: 1. General TrendsDokument7 SeitenBrazil: 1. General TrendsHenry ChavezNoch keine Bewertungen

- Fiscal Development: Pakistan Economy 5Dokument29 SeitenFiscal Development: Pakistan Economy 5Danish Riaz ShaikhNoch keine Bewertungen

- Assignment of English: Read The Text Carefully Then Write A Summary, Give Your Opinion About Macroeconomic As WellDokument1 SeiteAssignment of English: Read The Text Carefully Then Write A Summary, Give Your Opinion About Macroeconomic As WellWekaMuksinNoch keine Bewertungen

- Proiecte EconomiceDokument16 SeitenProiecte EconomiceFlorina StoicescuNoch keine Bewertungen

- Safdari Mehdi, Motiee Reza Department of Economics, University of Qom, IranDokument6 SeitenSafdari Mehdi, Motiee Reza Department of Economics, University of Qom, IrannabeelkasbitNoch keine Bewertungen

- Why Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Dokument29 SeitenWhy Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Nikki ShresthaNoch keine Bewertungen

- Η έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Dokument81 SeitenΗ έκθεση-απάντηση της Ελληνικής κυβέρνησης στο Διεθνές Νομισματικό Ταμείο σχετικά με την παροχή οικονομικής αρωγής - Μάιος 2010Peter NousiosNoch keine Bewertungen

- Fiscal PolicyDokument29 SeitenFiscal Policyjay100% (1)

- Economic Growth in Bangladesh - Impact of Fiscal PolicyDokument24 SeitenEconomic Growth in Bangladesh - Impact of Fiscal Policynahid.airdrop777Noch keine Bewertungen

- Understanding of UK EconomyDokument11 SeitenUnderstanding of UK EconomyNeelanjana DattaNoch keine Bewertungen

- Presentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalDokument19 SeitenPresentation On Fiscal Policy of India: Submitted To:-Mrs. Anuradha MittalpreetsinghjjjNoch keine Bewertungen

- Exam EcoDokument4 SeitenExam EcoRABINDRA KHATIWADANoch keine Bewertungen

- Fiscal Policy Framework 19 March 2009Dokument29 SeitenFiscal Policy Framework 19 March 2009Aparajita SinghNoch keine Bewertungen

- Revenue Mobilization in NepalDokument12 SeitenRevenue Mobilization in NepalAlisha ThapaliyaNoch keine Bewertungen

- Fiscal Policy (ECONOMICS)Dokument20 SeitenFiscal Policy (ECONOMICS)Rajneesh DeshmukhNoch keine Bewertungen

- Applied Term PaperDokument8 SeitenApplied Term PapershaguftaNoch keine Bewertungen

- Malaysia Economic Full Assignment 1Dokument26 SeitenMalaysia Economic Full Assignment 1ViknesWaran50% (2)

- Fiscal PolicyDokument6 SeitenFiscal Policynarayan100% (2)

- Business Economics: Business Strategy & Competitive AdvantageVon EverandBusiness Economics: Business Strategy & Competitive AdvantageNoch keine Bewertungen

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesVon EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNoch keine Bewertungen

- Business Challenge For The MaverickDokument2 SeitenBusiness Challenge For The MaverickSabhariswaranNoch keine Bewertungen

- IT & Systems Case Study - Cisco Systems The Supply Chain StoDokument0 SeitenIT & Systems Case Study - Cisco Systems The Supply Chain StoDipesh JainNoch keine Bewertungen

- MeDokument36 SeitenMeDipesh JainNoch keine Bewertungen

- Future GroupDokument24 SeitenFuture GroupDipesh JainNoch keine Bewertungen

- GRP 8 Judo in ActionDokument11 SeitenGRP 8 Judo in ActionDipesh Jain100% (1)

- New Masters of The UniverseDokument18 SeitenNew Masters of The UniverseDipesh JainNoch keine Bewertungen

- Coors CaseletDokument2 SeitenCoors CaseletDipesh JainNoch keine Bewertungen

- IT & Systems Case Study - Cisco Systems The Supply Chain StoDokument0 SeitenIT & Systems Case Study - Cisco Systems The Supply Chain StoDipesh JainNoch keine Bewertungen

- Leadership Case Study - Narayana MurthyDokument0 SeitenLeadership Case Study - Narayana MurthyDipesh JainNoch keine Bewertungen

- Beneficiary DetailsDokument1 SeiteBeneficiary DetailsDipesh JainNoch keine Bewertungen

- eBayISAPI 2Dokument2 SeiteneBayISAPI 2Dipesh JainNoch keine Bewertungen

- Balance of Payments (COMPLETE NOTES)Dokument14 SeitenBalance of Payments (COMPLETE NOTES)aisharafiq1987100% (1)

- Vat 47aDokument1 SeiteVat 47aDipesh JainNoch keine Bewertungen

- Shippers Letter of InstructionsDokument1 SeiteShippers Letter of InstructionsDipesh JainNoch keine Bewertungen

- WEF GCR CompetitivenessIndexRanking 2011-12Dokument1 SeiteWEF GCR CompetitivenessIndexRanking 2011-12cmsc1Noch keine Bewertungen

- Prepaid: Thank You For Shopping On EbayDokument1 SeitePrepaid: Thank You For Shopping On EbayDipesh JainNoch keine Bewertungen

- HRM Case Study - Taj PeoplePhilosophyDokument0 SeitenHRM Case Study - Taj PeoplePhilosophyDipesh JainNoch keine Bewertungen

- APICS BSCM Sample TestDokument21 SeitenAPICS BSCM Sample TestAhmedBYNoch keine Bewertungen

- Lecture Notes 2Dokument9 SeitenLecture Notes 2Fabio de FariaNoch keine Bewertungen

- Fiscal and Monetary Policy Interface: Recent Developments in IndiaDokument8 SeitenFiscal and Monetary Policy Interface: Recent Developments in IndiaDipesh JainNoch keine Bewertungen

- Dividends and Ex-Dates: Gentlemen Prefer SharesDokument3 SeitenDividends and Ex-Dates: Gentlemen Prefer SharesDipesh JainNoch keine Bewertungen

- Research MethodologyDokument41 SeitenResearch MethodologyRomit Machado83% (6)

- Inflation, GDP, Unemployment - Anik AhmedDokument33 SeitenInflation, GDP, Unemployment - Anik AhmedAnik AhmedNoch keine Bewertungen

- India's Fiscal PolicyDokument24 SeitenIndia's Fiscal PolicyRoshan JachuckNoch keine Bewertungen

- Summer Internship With State Bank of IndiaDokument1 SeiteSummer Internship With State Bank of IndiaTamika LeeNoch keine Bewertungen

- Bigtable: A Distributed Storage System For Structured DataDokument14 SeitenBigtable: A Distributed Storage System For Structured DataMax ChiuNoch keine Bewertungen

- Quantitative Research Report Attitudes Towards Online Shopping and Knowledge About Shopping Online SecurelyDokument61 SeitenQuantitative Research Report Attitudes Towards Online Shopping and Knowledge About Shopping Online SecurelyDipesh Jain50% (2)

- Research MethodologyDokument41 SeitenResearch MethodologyRomit Machado83% (6)

- Project Report of Research Methodology OnDokument47 SeitenProject Report of Research Methodology Onmj143143Noch keine Bewertungen

- Mqp1 10mba Mbafm02 AmDokument4 SeitenMqp1 10mba Mbafm02 AmDipesh JainNoch keine Bewertungen

- 46 Income Tax Calculator For Fy 2009 10 FinalDokument16 Seiten46 Income Tax Calculator For Fy 2009 10 Finalmysteryia007Noch keine Bewertungen

- 83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedDokument1 Seite83CHaUCat1rO1vRgwgGhPkH0Eupo7x9E UnlockedBike RaiderNoch keine Bewertungen

- Test Bank For McGraw Hill's Taxation of Individuals and Business Entities, 2024 15th EditionDokument57 SeitenTest Bank For McGraw Hill's Taxation of Individuals and Business Entities, 2024 15th EditionDiya ReddyNoch keine Bewertungen

- 2.form of Appeal-ATIRDokument2 Seiten2.form of Appeal-ATIRwasim nisar0% (1)

- 2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Dokument3 Seiten2006 BIR - Ruling - DA 432 06 - 20210505 13 1t6tcx6Boss NikNoch keine Bewertungen

- Vietnam Tax Legal HandbookDokument52 SeitenVietnam Tax Legal HandbookaNoch keine Bewertungen

- How Do States Get Revenue From The Center PDFDokument8 SeitenHow Do States Get Revenue From The Center PDFAGFDSAWNoch keine Bewertungen

- Invoice INV 20435Dokument2 SeitenInvoice INV 20435Nannys AppNoch keine Bewertungen

- Multiple Choice - Theory: Part 2Dokument4 SeitenMultiple Choice - Theory: Part 2Nicolle JungNoch keine Bewertungen

- Measure To Control InflationDokument16 SeitenMeasure To Control InflationSneha Sharma100% (1)

- Tax Chapter 3 SummaryDokument4 SeitenTax Chapter 3 SummaryishaNoch keine Bewertungen

- Section 112 - Tax On Long-Term Capital GainsDokument2 SeitenSection 112 - Tax On Long-Term Capital GainsParth UpadhyayNoch keine Bewertungen

- Affidavit of GROSS SALESDokument1 SeiteAffidavit of GROSS SALESJane Tan Yap-EvangelistaNoch keine Bewertungen

- 1701qjuly2008 (ENCS)Dokument6 Seiten1701qjuly2008 (ENCS)alvie_budNoch keine Bewertungen

- PerquisitesDokument6 SeitenPerquisitesBalajiNoch keine Bewertungen

- Tax Remedies (Reviewer)Dokument2 SeitenTax Remedies (Reviewer)Equi TinNoch keine Bewertungen

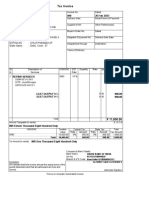

- Billing Address: Tax InvoiceDokument1 SeiteBilling Address: Tax InvoiceHERAMB SHARMANoch keine Bewertungen

- Session 6 Exercise DrillDokument3 SeitenSession 6 Exercise DrillAbigail Ann PasiliaoNoch keine Bewertungen

- Oltas Servlet TanSearchDokument1 SeiteOltas Servlet TanSearchjmpnv007Noch keine Bewertungen

- Assignment IDokument6 SeitenAssignment Imark assainNoch keine Bewertungen

- SSPOFADVDokument1 SeiteSSPOFADVfreddieaddaeNoch keine Bewertungen

- 090 PDFDokument1 Seite090 PDFAMIT SYSTEMNoch keine Bewertungen

- GST Tax Invoice FormatDokument1 SeiteGST Tax Invoice FormatsuchjazzNoch keine Bewertungen

- How To Calculate Total IncomeDokument16 SeitenHow To Calculate Total IncomeAshish ChatrathNoch keine Bewertungen

- Perk Valuation of Motor CarDokument18 SeitenPerk Valuation of Motor CarcapkaggarwalNoch keine Bewertungen

- Samplex FinalsDokument6 SeitenSamplex FinalsZoe Jen RodriguezNoch keine Bewertungen

- PDF 298947820220321Dokument1 SeitePDF 298947820220321savitakant13600Noch keine Bewertungen

- Tax Planning - Intro NotesDokument7 SeitenTax Planning - Intro NotesBest How To StudioNoch keine Bewertungen

- ECo 447 PUBLIC SECTOR ECONOMICS ORIGINALDokument92 SeitenECo 447 PUBLIC SECTOR ECONOMICS ORIGINALBenjamin AkosaNoch keine Bewertungen

- CGT Tomanda AntokDokument1 SeiteCGT Tomanda AntokNvision PresentNoch keine Bewertungen