Beruflich Dokumente

Kultur Dokumente

Cash Flow For Practise

Hochgeladen von

ABM2014Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cash Flow For Practise

Hochgeladen von

ABM2014Copyright:

Verfügbare Formate

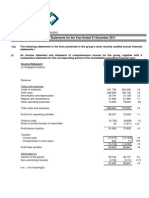

Question You have been provided with the following financial information relating to Engro Foods Limited.

Engro Foods Limited. Income Statement For the year ended Dec 31, 2008

Sales Cost of sales Gross operating income Administrative and selling expenses Interest expenses Depreciation of property, plant and equipment Amortization of intangible asset Investment income Earnings before taxes Taxes on income Net income

$45,000 15,000 30,000 3,000 3,000 3,000 750 4,500 24,750 6,000 18,750

Engro Foods Limited. Balance Sheet As of Dec 31, 2007, and 2008 Dec 31, 2008 Assets Cash & cash equivalents Accounts receivables Inventory Intangible asset, net Due from associates Property, plant & equipment, cost Accumulated depreciation Property, plant & equipment, net Total assets Liabilities Accounts payable Income taxes payable Deferred taxes payable $4,500 7,500 3,000 1,500 28,500 18,000 (7,500) 10,500 55,500 Dec 31, 2007 $1,500 3,750 2,250 2,250 28,500 33,750 (9,000) 24,750 63,000

$7,500 3,000 4,500

$18,750 1,500 3,000

Total liabilities Shareholders equity Share capital Retained earnings Total shareholders equity Total liabilities and shareholders equity

15,000

23,250

9,750 30,750 40,500 55,500

9,750 30,000 39,750 63,000

Additional Information: (A) All sales made by Engro Foods Limited. are credit sales. All purchases are on account. (B) Interest expense for the year 2008 was $3,000, which was fully paid during the year. (C) The company pays salaries and other employee dues before the end of each month. All administration and selling expenses incurred were paid before December 31, 2008. (D) Investment income comprised dividends income from investments in shares of blue chip companies. This was received before December 31, 2008. (E) Equipment with a net book value of $11,250 and original cost of $15,750 was sold for $11,250. (F) The company declared and paid dividends of $18,000 to its shareholders during 2008. (G) Income tax expense for the year 2008 was $6,000, against which the company paid $3,000 during 2008 as an estimate. Required: Prepare the cash flow statement for Engro Foods Limited. under the indirect method.

Solution Engro Foods Limited Cash Flow Statement For the year Ending December 31, 2008 Operating activities: Earnings before taxes Interest Expense Depreciation Amortization Investment Income Adjustments to Net Income Accounts Receivable Accounts Payable Inventory Interest paid Income taxes paid Net Cash Flow from Operating Activities Investing Activities Investment Income Sale of Equipment Net Cash Flow from Investing Activities Financing Activities Dividends paid Net Cash Flow from Financing Activities Net increase in Cash and Cash Equivalents Beginning Cash Ending Cash Balance 24,750 3,000 3,000 750 (4,500) 2,250 (3,750) (11,250) (750) (3,000) (3,000) 5,250 4,500 11,250 15,750 (18,000) (18,000) 3,000 1,500 4,500

Das könnte Ihnen auch gefallen

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationDokument43 SeitenChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217Noch keine Bewertungen

- Financial Statement Analysis: Compute Missing Information Given A Set of RatiosDokument1 SeiteFinancial Statement Analysis: Compute Missing Information Given A Set of Ratiosshah md musleminNoch keine Bewertungen

- P43ADokument5 SeitenP43AAquanetta OrtonNoch keine Bewertungen

- Parent, Inc Actual Financial Statements For 2012 and OlsenDokument23 SeitenParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNoch keine Bewertungen

- Hoos Got Game, Inc. Statement of Income and Retained Earnings For The Year Ended December 31, 2X02Dokument3 SeitenHoos Got Game, Inc. Statement of Income and Retained Earnings For The Year Ended December 31, 2X02foreverjessx3Noch keine Bewertungen

- Comprehensive Problems Solution Answer Key Mid TermDokument5 SeitenComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionneNoch keine Bewertungen

- Exercises On Cash Flow StatementsDokument3 SeitenExercises On Cash Flow StatementsSam ChinthaNoch keine Bewertungen

- CCFM, CH 02, ProblemDokument4 SeitenCCFM, CH 02, ProblemKhizer SikanderNoch keine Bewertungen

- PCC 2008 NPO QuestionDokument10 SeitenPCC 2008 NPO QuestionVaibhav MaheshwariNoch keine Bewertungen

- Cash FLDokument1 SeiteCash FLAbdul NaveedNoch keine Bewertungen

- Company A, Inc. Cash Flow Statement For The Year Ended Dec 31, 2010Dokument1 SeiteCompany A, Inc. Cash Flow Statement For The Year Ended Dec 31, 2010Abdul NaveedNoch keine Bewertungen

- Analysis of Financial StatementDokument9 SeitenAnalysis of Financial StatementSums Zubair MoushumNoch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- CH 01Dokument5 SeitenCH 01deelol99Noch keine Bewertungen

- SGXQAF2011 AnnouncementDokument18 SeitenSGXQAF2011 AnnouncementJennifer JohnsonNoch keine Bewertungen

- Practical Problems Cfa AdditionalDokument2 SeitenPractical Problems Cfa AdditionalMonish ShresthaNoch keine Bewertungen

- Cashflow PracticeDokument17 SeitenCashflow PracticeAhmar ChNoch keine Bewertungen

- Test 2 HomeworkDokument12 SeitenTest 2 HomeworkMiguel CortezNoch keine Bewertungen

- Kunci Jawaban Soal Review InterDokument5 SeitenKunci Jawaban Soal Review InterWinarto SudrajadNoch keine Bewertungen

- Chemalite Sol Final 011112Dokument9 SeitenChemalite Sol Final 011112pankyagr75% (4)

- 13 4Dokument1 Seite13 4paresareb100% (1)

- Module 5 Cash Flow Test Solution Posted Fall 2011Dokument6 SeitenModule 5 Cash Flow Test Solution Posted Fall 2011sonic763Noch keine Bewertungen

- ACC1002 Team 8Dokument11 SeitenACC1002 Team 8Yvonne Ng Ming HuiNoch keine Bewertungen

- Financial Accounting Practice May 2009Dokument8 SeitenFinancial Accounting Practice May 2009samuel_dwumfourNoch keine Bewertungen

- Sadlier WH 2009 Annual ReportDokument17 SeitenSadlier WH 2009 Annual ReportteriksenNoch keine Bewertungen

- Statement of Cash FlowsDokument2 SeitenStatement of Cash FlowsTinku SNoch keine Bewertungen

- Alphabet 2014 Financial ReportDokument6 SeitenAlphabet 2014 Financial ReportsharatjuturNoch keine Bewertungen

- St-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsDokument13 SeitenSt-2 Net Income and Cash Flow: Chapter 3 Part II Homework SolutionsGianfranco SpatolaNoch keine Bewertungen

- Acctg 115 - CH 5 SolutionsDokument11 SeitenAcctg 115 - CH 5 SolutionsSharadPanchal100% (1)

- Financial Analysis Sample (Excel File)Dokument6 SeitenFinancial Analysis Sample (Excel File)YL GohNoch keine Bewertungen

- Ebix, Inc.: FORM 10-QDokument39 SeitenEbix, Inc.: FORM 10-QalexandercuongNoch keine Bewertungen

- PR 16-4aDokument2 SeitenPR 16-4aAhmed AwaisNoch keine Bewertungen

- Fs FinancialsDokument16 SeitenFs FinancialsSugar Fructose GalactoseNoch keine Bewertungen

- Accounting CaseDokument4 SeitenAccounting CaseMarianne AgunoyNoch keine Bewertungen

- FI504 Case Study 1Dokument16 SeitenFI504 Case Study 1hereforanswersNoch keine Bewertungen

- Financial Accounting ProjectDokument9 SeitenFinancial Accounting ProjectL.a. LadoresNoch keine Bewertungen

- Clinton Foundation Financial Report 2009 PDFDokument79 SeitenClinton Foundation Financial Report 2009 PDFAnonaLeakNoch keine Bewertungen

- Case Studies Program: Advanced Accounting CourseDokument4 SeitenCase Studies Program: Advanced Accounting CourseLoik-mael NysNoch keine Bewertungen

- Infosys Results Q3-2008-09Dokument4 SeitenInfosys Results Q3-2008-09Niranjan PrasadNoch keine Bewertungen

- IAS 12: Practice Questions AnswersDokument8 SeitenIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNoch keine Bewertungen

- 2008 ch1 ExsDokument21 Seiten2008 ch1 ExsamatulmateennoorNoch keine Bewertungen

- Laporan Keuangan - Mki IchaDokument6 SeitenLaporan Keuangan - Mki IchaSempaks KoyakNoch keine Bewertungen

- Review Session 6 TEXTDokument6 SeitenReview Session 6 TEXTAliBerradaNoch keine Bewertungen

- AaaaamascpaDokument12 SeitenAaaaamascpaRichelle Joy Reyes BenitoNoch keine Bewertungen

- Chemilite Case StudyDokument12 SeitenChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- Balance SheetDokument16 SeitenBalance SheetFam Sin YunNoch keine Bewertungen

- Cat/fia (FTX)Dokument21 SeitenCat/fia (FTX)theizzatirosliNoch keine Bewertungen

- CH 5 SolutionDokument21 SeitenCH 5 SolutionJoe MichaelsNoch keine Bewertungen

- Solutions Images Bingham 11-02-2010Dokument46 SeitenSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- Accounting Chapter 13 Summary Statement of Cash FlowsDokument5 SeitenAccounting Chapter 13 Summary Statement of Cash FlowsAndrew PhilipsNoch keine Bewertungen

- Transaction Analysis and Preparation of Statements Practice Problem SolutionDokument6 SeitenTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaNoch keine Bewertungen

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDokument39 SeitenConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimNoch keine Bewertungen

- Financial ReportDokument126 SeitenFinancial ReportleeeeNoch keine Bewertungen

- Consolidation PDFDokument5 SeitenConsolidation PDFsalehin1969Noch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument20 SeitenUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456Noch keine Bewertungen

- Ac101 ch3Dokument21 SeitenAc101 ch3Alex ChewNoch keine Bewertungen

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- ScheduleDokument1 SeiteScheduleABM2014Noch keine Bewertungen

- What Do Physicists Do?Dokument1 SeiteWhat Do Physicists Do?ABM2014Noch keine Bewertungen

- Part - A: Centralized Annual Examinations 2019Dokument2 SeitenPart - A: Centralized Annual Examinations 2019ABM2014Noch keine Bewertungen

- Karachi 2Dokument9 SeitenKarachi 2ABM2014Noch keine Bewertungen

- ChemistryDokument2 SeitenChemistryABM2014Noch keine Bewertungen

- Standard Chartered BankDokument102 SeitenStandard Chartered Bankmaverick987100% (1)

- THE NEWS July 25, 2011 Money Matters Maximising Benefits: by DR Ishrat HusainDokument3 SeitenTHE NEWS July 25, 2011 Money Matters Maximising Benefits: by DR Ishrat HusainABM2014Noch keine Bewertungen

- Role of Agriculture in Economic DevelopmentDokument2 SeitenRole of Agriculture in Economic DevelopmentABM2014Noch keine Bewertungen

- Chapter 7: The Project Life Cycle (Phases) : PreviousnextDokument7 SeitenChapter 7: The Project Life Cycle (Phases) : PreviousnextABM2014Noch keine Bewertungen

- Crossing of Cheques 1223537775987301 9Dokument22 SeitenCrossing of Cheques 1223537775987301 9Prateek Lakhmani100% (1)

- Westlake Lanes Case Study QuestionsDokument1 SeiteWestlake Lanes Case Study QuestionsABM20140% (2)

- Managerial Finance - SyllabusDokument2 SeitenManagerial Finance - SyllabusABM2014Noch keine Bewertungen

- Educational Problems in PakistanDokument14 SeitenEducational Problems in PakistanABM2014Noch keine Bewertungen

- Intelligent AbdullahDokument1 SeiteIntelligent AbdullahABM2014Noch keine Bewertungen

- The Great Depression Q&A: David WheelockDokument2 SeitenThe Great Depression Q&A: David WheelockABM2014100% (1)

- Strategic Urban Design and Cultural Diversity, by Nada Lazarevic Bajec, Marija MarunaDokument141 SeitenStrategic Urban Design and Cultural Diversity, by Nada Lazarevic Bajec, Marija MarunaArhitektonski fakultet100% (1)

- On Vallalar by Arul FileDokument14 SeitenOn Vallalar by Arul FileMithun Chozhan100% (1)

- OBE - Student Presentation 2021 - V1Dokument18 SeitenOBE - Student Presentation 2021 - V1Mubashir KhanNoch keine Bewertungen

- Curso Inglés Desde CERO - Nivel Básico - 21-25Dokument11 SeitenCurso Inglés Desde CERO - Nivel Básico - 21-25david morrisonNoch keine Bewertungen

- OSH Standards 2017Dokument422 SeitenOSH Standards 2017Kap LackNoch keine Bewertungen

- Frank Mwedzi Draft DissertationDokument57 SeitenFrank Mwedzi Draft DissertationFrank MwedziNoch keine Bewertungen

- The Poems of Henry Van DykeDokument493 SeitenThe Poems of Henry Van DykeChogan WingateNoch keine Bewertungen

- CN Lab 3Dokument7 SeitenCN Lab 3hira NawazNoch keine Bewertungen

- BLGS 2023 03 29 012 Advisory To All DILG and LGU FPs Re - FDP Portal V.3 LGU Users Cluster TrainingDokument3 SeitenBLGS 2023 03 29 012 Advisory To All DILG and LGU FPs Re - FDP Portal V.3 LGU Users Cluster TrainingMuhammad AbutazilNoch keine Bewertungen

- Just KidsDokument8 SeitenJust KidsSean MichaelNoch keine Bewertungen

- Cabuyao Zoning Ordinance No. 2019-562 S. 2019Dokument55 SeitenCabuyao Zoning Ordinance No. 2019-562 S. 2019melvin.francisco1078Noch keine Bewertungen

- Art Region 3Dokument49 SeitenArt Region 3JB LicongNoch keine Bewertungen

- Unit - I: Section - ADokument22 SeitenUnit - I: Section - AskirubaarunNoch keine Bewertungen

- Judicial Plans of CornwallisDokument23 SeitenJudicial Plans of CornwallisHarshitha EddalaNoch keine Bewertungen

- Close Reading Practice Sherman Alexies Superman and MeDokument4 SeitenClose Reading Practice Sherman Alexies Superman and Meapi-359644173Noch keine Bewertungen

- Balintuwad at Inay May MomoDokument21 SeitenBalintuwad at Inay May MomoJohn Lester Tan100% (1)

- IFF CAGNY 2018 PresentationDokument40 SeitenIFF CAGNY 2018 PresentationAla BasterNoch keine Bewertungen

- The Digital Future FinanceDokument17 SeitenThe Digital Future FinanceMid VillepinteNoch keine Bewertungen

- Chapter 12 Introduction To Cost Management SystemsDokument6 SeitenChapter 12 Introduction To Cost Management SystemsAnne Marieline BuenaventuraNoch keine Bewertungen

- C4ISR Architecture Framework PDFDokument231 SeitenC4ISR Architecture Framework PDFdiomsgNoch keine Bewertungen

- SSS Disability BenefitsDokument5 SeitenSSS Disability BenefitsJason TiongcoNoch keine Bewertungen

- CCES Guide 2018Dokument117 SeitenCCES Guide 2018Jonathan RobinsonNoch keine Bewertungen

- Solidcam Glodanje Vjezbe Ivo SladeDokument118 SeitenSolidcam Glodanje Vjezbe Ivo SladeGoran BertoNoch keine Bewertungen

- Omega Temp and Humidity Manual MQS4098Dokument2 SeitenOmega Temp and Humidity Manual MQS4098BSC-566731Noch keine Bewertungen

- Training and DevelopmentDokument46 SeitenTraining and DevelopmentRavi JoshiNoch keine Bewertungen

- BASE DE DATOS VTA para Plan de ResiduosDokument8 SeitenBASE DE DATOS VTA para Plan de ResiduosNEFTALI MENDEZ CANTILLONoch keine Bewertungen

- The Black Rite of HekateDokument6 SeitenThe Black Rite of HekateAugusto Macfergus100% (3)

- Grade 6 Lesson 4 Holy EucharistDokument25 SeitenGrade 6 Lesson 4 Holy EucharistJim TuscanoNoch keine Bewertungen

- Architect Delhi Urban Art CommissionDokument2 SeitenArchitect Delhi Urban Art CommissionshahimabduNoch keine Bewertungen

- Purpose and Process of WHO GuidelineDokument14 SeitenPurpose and Process of WHO GuidelineDisshiNoch keine Bewertungen