Beruflich Dokumente

Kultur Dokumente

The Economic Impact of San Francisco's Nightlife Businesses

Hochgeladen von

NightlifeSFOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Economic Impact of San Francisco's Nightlife Businesses

Hochgeladen von

NightlifeSFCopyright:

Verfügbare Formate

Office of the Controller Office of Economic Analysis

City and County of San Francisco

The Economic Impact of San Franciscos Nightlife Businesses

Office of Economic Analysis March 5, 2012

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Introduction

In 2011, Supervisor Wiener requested the Office of Economic Analysis to conduct an economic impact study on entertainment and nightlife in San Francisco to determine:

The size of the Nightlife Industry. The number of jobs created by the Nightlife Industry. The amount of tourism the Nightlife Industry brings to San Francisco. The amount of tax the Nightlife Industry contributes to the City.

The Nightlife industries are a major source of employment, economic activity, and tax revenue for the city. In addition, by drawing new visitors and spending into San Francisco, the Nightlife Industries are an economic driver, which expand business and employment opportunities for other sectors of the economy.

2

Office of the Controller Office of Economic Analysis

City and County of San Francisco

San Franciscos Nightlife Industry

For the purposes of this study, San Francisco's Nightlife Industries include:

Restaurants Bars Venues/Nightclubs Art Galleries Live Theater and Other Performance.

These industries were included because they represent the economic activity of businesses that provide social activities and entertainment after normal business hours (after 8pm).

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Nightlife Industry Definitions

Bars are defined as establishments that have a bar license (ABC license 42 or 48) and do not charge admission. Bars may or may not have live performers. Restaurants are defined as establishments that have a restaurant license (ABC license 41, 47, and 49) and do not charge admission. Restaurants may or may not have live performers. Venues/Nightclubs are defined as establishments that have either a bar license or a restaurant license and charge for admission. Venue/Nightclubs may or may not have live performers. Venues can be distinguished from nightclubs as having live performers other than DJs, while nightclubs have DJs. Economically, these two groups are similar, so they were combined for the analysis in this report.

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Nightlife Industry Definitions

Live Theater or Other Performance are defined as establishments that provide live entertainment with an admissions charge. Live Theater or Other Performance venues do not have bar or restaurant licenses. Art Galleries are defined as establishments that conduct retail sales of art. Art galleries do not have a bar license or a restaurant license and do not charge admission. Art galleries may or may not have live performances.

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Outside Festivals and Events

Outdoor events and festivals were not included in our definition of Nightlife Industries, because they are not a distinct industry in the government economic statistics. Nevertheless, events and festivals generate a significant amount economic activity for the City. For example, based on web survey conducted by Folsom Street Events, attendance at the Folsom Street Fair is estimated at 350,000 - 400,000. 40% of attendees coming from outside of the Bay Area. In a recent study conducted by San Francisco State University and commissioned by Another Planet Entertainment, the Outside Lands Festival, an outdoor concert, was estimated to generate $60.6 million in San Francisco.

Office of the Controller Office of Economic Analysis

City and County of San Francisco

San Franciscos Nightlife Industries Include 3,200 Businesses That Employ 48,000 Workers

In 2010, there were over 3,200 businesses in these industries in the City. Over 2,600 of them are licensed by the Department of Alcoholic Beverage Control, while the remaining 600 are employers, and one or two person businesses, that do not serve alcohol. In 2010, these businesses employed nearly 48,000 people in San Francisco.

Source: Bureau of Labor Statistics; ABC

Office of the Controller Office of Economic Analysis

City and County of San Francisco

The Nightlife Industry hosts over 80 million customers a year

The City's Nightlife Industry businesses hosted approximately 80 million spending customers in 2010, as a conservative estimate. Restaurants account for 80% of spending customers, with more than 64 million.

Venue / Nightclub 4% Art Gallery/Retail 1% Bar 8% Live Theater 8%

Source: Bureau of Labor Statistics; U.S. Census Bureau; Controller's Office Nightlife Visitor Survey

Restaurant 79%

Office of the Controller Office of Economic Analysis

City and County of San Francisco

In 2010, Nightlife Establishments Generated $4.2 Billion in Spending

$3,210,000,000

As a group, the Nightlife Industries accounted for $4.2 billion in spending within the city in 2010. Restaurants was the largest segment making up 77% of spending with $3.2 billion.

$360,000,000

$150,000,000

Art Galleries

$240,000,000

$220,000,000

Bar

Live Theater and other Performance

Restaurant

Venue / Nightclub

Source: Bureau of Labor Statistics; U.S. Census Bureau

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Nightlife Establishments Support the Citys Economy by Purchasing from Local Businesses

Nightlife Industries also support local businesses in other industries. In 2010, the Nightlife Industries spent nearly $670M on local foods, $580M on local beverages, and $370M on performers, local business services, and other local suppliers.

$670,000,000 $580,000,000

$260,000,000

$110,000,000

Food Manufacturing and Wholesalers

Beverage Distributors

Musicans and Other Performers

Other Local Service Providers

Source: Bureau of Labor Statistics; U.S. Census Bureau; Controller's Office Nightlife Venue Survey

10

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Nightlife Establishments Contributed $55 Million in Tax Revenue

Nightlife businesses pay approximately $55 million per year in payroll and sales taxes to the City's general fund, in addition to other taxes and fees. Nearly 75% of the $55 million comes from sales taxes.

Payroll Tax Revenue

$50,000,000 $45,000,000 $40,000,000 $35,000,000

Sales Tax Revenue

$30,000,000 $25,000,000 $20,000,000 $15,000,000 $10,000,000 $5,000,000 $0 Art Galleries Bar Live Theater Restaurant Venue / Nightclub

Source: Bureau of Labor Statistics; ABC; U.S. Census Bureau; Controller's Office Nightlife Visitor Survey

11

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Nightlife Businesses are Concentrated in Core Visitor Areas within the City

Source: U.S. Census Bureau

12

Office of the Controller Office of Economic Analysis

City and County of San Francisco

80% of Nightlife Spending Happens in These Areas

Approximately 80% of the city's $4.2 billion Nightline Economy happens at establishments in core visitor areas. Union Square, North Beach, and Chinatown combine to generate 36% of Citywide sales from Nightlife establishments.

Other 20% Haight-Ashbury/Lower Haight/Hayes Valley 2% Union Square/North Beach/ Chinatown 36%

Mission/Portrero/ Castro 8%

Japantown/Fillmore 6% Embarcadero/ Fisherman's Wharf/Marina 14%

SOMA 14%

Source: Bureau of Labor Statistics; U.S. Census Bureau; Controller's Office Nightlife Visitor Survey; STARS database

13

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Out-of-Town Visitors Make Up More than Half of Nightlife Patrons in Core Visitor Areas

On an average night, 57% of patrons at Nightlife Industry businesses are visitors to San Francisco. 36% of all patrons come from other Bay Area counties, 11% come from elsewhere in California, and over 10% from other parts of the U.S. or other countries.

Somewhere else in the U.S. 7% Somewhere else in CA 11% Another country 3%

SF Resident 43%

Bay Area excluding SF 36%

Source: Controller's Office Nightlife Visitor Survey

14

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Bay Area Residents Visit More Frequently Than Patrons from Farther Away

Nearly all San Francisco residents, and nearly 80% of other Bay Area residents, go out at night in the City several times a month. 70% of international visitors were first-time patrons.

This is the first time

100%

Less than once a year

Several times a year

Several times a month

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

San Francisco

Bay Area excluding SF Somewhere else in CA Somewhere else in the U.S.

Another Country

Source: Controller's Office Nightlife Visitor Survey

15

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Main Destination for Evening: San Francisco Residents

Restaurants make up 37% of San Francisco residents main destination for the night, while the other Nightlife businesses make up 25% of the share. 38% of San Francisco patrons went out for other reasons, such as the movies, or a public event.

Bar 12%

Other 38%

Live theater 2% Venue/Nightclub 9%

Art Gallery 2%

Restaurant 37%

Source: Controller's Office Nightlife Visitor Survey

16

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Main Destination for Evening: Bay Area Residents

94% of Bay Area residents visited the City at night because of its Nightlife Businesses.

39% stated that their main reason for visiting the City was to go to a Restaurant. Venue/Nightclubs made up 31% of the share.

Other 6% Art Gallery 12% Bar 9% Live theater 3%

Restaurant 39%

Source: Controller's Office Nightlife Visitor Survey

Venue/Nightclub 31%

17

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Main Destination for Evening: Tourists from Outside of the Bay Area

31% of tourists stated that Venue or Nightclubs were the main reason for going out. Other Nightlife establishments make up 28% of the share. 41% of tourists stated other reasons for being out in the City, mainly the Golden Gate Bridge, Fishermans Wharf, and other tourist activities.

Art Gallery 6%

Source: Controller's Office Nightlife Visitor Survey

Bar 15% Other 41% Live theater 1%

Venue/Nightclub 31% Restaurant 6%

18

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Tourists Spend Nearly Three Times More at Night Than San Francisco Residents

San Francisco residents make up only one-third of spending on Nightlife in visitor areas.

On average, tourists spend $206 per evening, compared to $120 for Bay Area residents, and $70 for San Francisco residents.

San Francisco Residents Bay Area Residents (excluding SF) Out-of-Region Tourists

$206

$120 $105

$113

$70 $61

Source: Controller's Office Nightlife Visitor Survey

Total Spending

Spending on Nightlife Establishments

19

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Visitor Spending at San Franciscos Nightlife Businesses Generates Nearly 27,000 jobs

More than half of the Citywide $4.2 billion in nightlife industry spending comes from regional, state, national, and international visitors to San Francisco. This spending generates multiplier effects that ripple throughout the city's economy. In order to estimate the number of jobs generated by the Citys Nightlife, the OEA used its REMI model to simulate spending generated by out-of-town visitors. Spending in Nightlife establishments by non-San Francisco residents is estimated to have generated nearly 27,000 jobs. Of the 27,000 jobs, nearly 19,000 are at restaurants and bars, 2,500 are in performing arts, and nearly 1,200 from in retail trade. The remaining 4,300 jobs are spread across other industries.

20

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Conclusions

San Franciscos Nightlife Industry is a large part of the citys economy. 3,200 Nightlife establishments employed 48,000 workers, hosted 80 million spending customers, and generated $4.2 billion in 2010. These establishments also contributed $55 million in payroll taxes and sales taxes to the City. The Nightlife Industry supported the citys economy by purchasing $1.6 billion in services and supplies from local businesses, ranging from food and beverages to performers. 80% of San Francisco's Nightlife economy is concentrated in visitor areas in the Northeastern sector of the city. 57% of Nightlife patrons in these areas were visitors to San Francisco. Visitors who live in other Bay Area counties make up 40% of spending in these areas. The main reason cited by 94% of these visitors for coming to San Francisco was to patronize a Nightlife business. These Bay Area patrons spent an average of $120 per night; San Francisco residents spent an average of $70 per night, across all venues surveyed. Out-of-town visitors spend $2.2 billion at Nightlife businesses in San Francisco. This spending supports 27,000 jobs across every sector of the economy.

21

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Appendix: Methodology

Estimates in this study were calculated using the following sources of data:

Patron Survey: 331 Nightlife patrons were surveyed at 40 different establishments. Business Survey: 70 Nightlife business participated in the survey. Government Economic Statistics: Bureau of Labor Statistics Quarterly Census of Employment and Wages, the United States Economic Census, and the CA Department of Alcoholic Beverage Control license database The Sales Tax Analysis Reporting System (STARS) database developed by MuniServices, Inc.

The OEA's REMI model of the San Francisco economy was used to calculate the net jobs impact due to out-of-town visitors spending money on San Franciscos Nightlife Industry.

22

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Appendix: Profile of Surveyed Patrons

Age Under age 21 21 - 30 31 - 40 41 - 50 Over 50 Gender Female Male Race/Ethnicity African American/Black Asian/Pacific Islander Latino/Hispanic Mixed Other White/Caucasian Percent 3% 57% 24% 9% 7%

43% 57%

5% 19% 12% 7% 4% 53%

23

Office of the Controller Office of Economic Analysis

City and County of San Francisco

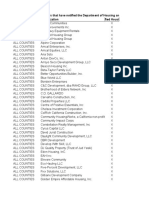

Appendix: Visitor Survey Locations

1015 Folsom Benihana Blondie's Bar & No Grill Boudin Butter Citrus Club City Tavern Club Deluxe Crepes-a-Go-Go Davies Symphony Hall DNA Lounge DNA Lounge Pizza E Tutto Qua Giordano Bros Glas Kat Gloss Gold Dust Lounge Gordon Biersch Hardrock Caf Hobsons Choice Hotel Utah Saloon In-N-Out Burger Jones Lime Macy's Marina Lounge Mezzanine Mighty SF Mission Dance Theater Mist Ultra Club Molotov's Orphan Andy's Rickshaw Stop SF Underground Slim's The Caf The Slanted Door Twin Peaks War Memorial Opera House / SF Ballet Yoshi's SF

24

Office of the Controller Office of Economic Analysis

City and County of San Francisco

Staff Contacts

Ted Egan, Chief Economist (415)554-5268 ted.egan@sfgov.org

Jay Liao, Economist (415)554-5159 jay.liao@sfgov.org

The authors acknowledge the assistance of Resource Development Associates, the businesses that allowed us to survey their patrons, and the people that participated in the business and patron surveys. All errors and omissions are the responsibility of the Office of Economic Analysis.

25

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Beyond "Urban Planning": An Overview of Challenges Unique To Planning Rural CaliforniaDokument45 SeitenBeyond "Urban Planning": An Overview of Challenges Unique To Planning Rural CaliforniaRuth MillerNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- PRR 18968 PDFDokument40 SeitenPRR 18968 PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Geology of The San Francisco Bay AreaDokument200 SeitenGeology of The San Francisco Bay AreaBaculitesNoch keine Bewertungen

- Scholarship ApplicationDokument28 SeitenScholarship ApplicationDrina Tobin100% (1)

- SV150 Doubletruck 042416Dokument1 SeiteSV150 Doubletruck 042416BayAreaNewsGroup100% (4)

- The Psychology of Silicon Valley PDFDokument314 SeitenThe Psychology of Silicon Valley PDFPioneer Easy Bus100% (1)

- SB50 Executive Summary by SportsimpactsDokument7 SeitenSB50 Executive Summary by SportsimpactsBayAreaNewsGroupNoch keine Bewertungen

- Neighborhood Restaurant Legislation Fact SheetDokument1 SeiteNeighborhood Restaurant Legislation Fact SheetNightlifeSFNoch keine Bewertungen

- The Other 9 To 5Dokument27 SeitenThe Other 9 To 5KQED NewsNoch keine Bewertungen

- SF Late Night Public Transit MapDokument2 SeitenSF Late Night Public Transit MapNightlifeSFNoch keine Bewertungen

- Limited Live Performance PublicationDokument2 SeitenLimited Live Performance PublicationNightlifeSFNoch keine Bewertungen

- Rodeo Creek Watershed Report Part 1Dokument50 SeitenRodeo Creek Watershed Report Part 1Muir Heritage Land TrustNoch keine Bewertungen

- Kalb As Records - Batch 2 - Final Final PDFDokument100 SeitenKalb As Records - Batch 2 - Final Final PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Detection Technologies, Inc.: General InformationDokument9 SeitenDetection Technologies, Inc.: General InformationAyeshaNoch keine Bewertungen

- Beach Chalet - Final - RCRDokument9 SeitenBeach Chalet - Final - RCRapi-608713574Noch keine Bewertungen

- Marguerite MapDokument1 SeiteMarguerite Mapapi-271993034Noch keine Bewertungen

- Ab 1486 Developer Interest ListDokument84 SeitenAb 1486 Developer Interest ListPrajwal DSNoch keine Bewertungen

- Case-Bart Case StudyDokument4 SeitenCase-Bart Case StudyJeanne Kamille Evangelista PiniliNoch keine Bewertungen

- 9.19.16 Mayor Lee & Sup. Cohen Hunters Point Shipyard LetterDokument2 Seiten9.19.16 Mayor Lee & Sup. Cohen Hunters Point Shipyard Lettercb0bNoch keine Bewertungen

- 09-21-12 EditionDokument32 Seiten09-21-12 EditionSan Mateo Daily JournalNoch keine Bewertungen

- Bay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011Dokument2 SeitenBay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011edbassonNoch keine Bewertungen

- 2009 Calsaga DirectoryDokument36 Seiten2009 Calsaga DirectoryErnie NNoch keine Bewertungen

- T5-6 Feas Study FinalDokument17 SeitenT5-6 Feas Study FinalRecordTrac - City of OaklandNoch keine Bewertungen

- Bay Area ResearchDokument2 SeitenBay Area ResearchDisha GehaniNoch keine Bewertungen

- I Left My Heart in San FranciscoDokument48 SeitenI Left My Heart in San Francisconmgrazioli0% (1)

- 02-05-18 EditionDokument28 Seiten02-05-18 EditionSan Mateo Daily JournalNoch keine Bewertungen

- Fall 2004 Greenbelt Action NewsletterDokument4 SeitenFall 2004 Greenbelt Action NewsletterGreenbelt AllianceNoch keine Bewertungen

- Diversity Index by City by ABAGDokument1 SeiteDiversity Index by City by ABAGMatthew PeraNoch keine Bewertungen

- AirBNB San FranciscoDokument534 SeitenAirBNB San FranciscoHero MeroneroNoch keine Bewertungen

- SB50 Economic Impact Fact SheetDokument2 SeitenSB50 Economic Impact Fact SheetBayAreaNewsGroupNoch keine Bewertungen

- Rediscovering The Bay Area's Chinese Heritage Three-Part Session of 2005 ConferenceDokument3 SeitenRediscovering The Bay Area's Chinese Heritage Three-Part Session of 2005 ConferenceAnna_NarutaNoch keine Bewertungen

- Lyrics - Little BoxesDokument1 SeiteLyrics - Little BoxesmelodylamourNoch keine Bewertungen

- CT Pocket Timetable 04-01-2019Dokument2 SeitenCT Pocket Timetable 04-01-2019robertclee1234Noch keine Bewertungen

- BPC-2020 Report PDFDokument56 SeitenBPC-2020 Report PDFIgnacio NorambuenaNoch keine Bewertungen