Beruflich Dokumente

Kultur Dokumente

One World - One Accounting: Devon Erickson, Adam Esplin, Laureen A. Maines

Hochgeladen von

Adriana CalinOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

One World - One Accounting: Devon Erickson, Adam Esplin, Laureen A. Maines

Hochgeladen von

Adriana CalinCopyright:

Verfügbare Formate

Business Horizons (2009) 52, 531537

www.elsevier.com/locate/bushor

EXECUTIVE DIGEST

One world One accounting

Devon Erickson, Adam Esplin, Laureen A. Maines *

Kelley School of Business, Indiana University, 1309 East 10th Street, Bloomington, IN 47405-1701, U.S.A.

1. Tower of Babel accounting

The biblical story of the Tower of Babel explains the source of the many languages spoken throughout the world. According to the account, humankind shared one common language prior to the Tower of Babel, facilitating communication and cooperation. To stop the building of the tower, God splintered this single language into multiple languages such that workers could not communicate with each other. As intended, labor on the tower subsequently ceased. This confusion of language traditionally has described the state of international nancial reporting. Companies historically have been required to produce nancial statements based on countryspecic nancial reporting standards. As a result, individuals who invest in companies from different countries must contend with nancial statements based on different nancial languages. In fact, investors analyzing nancial statements from different countries face a worse situation than did workers at the Tower of Babel in that nancial statements often appear to be the same across countries when they really are not. Financial statements are all denominated in monetary terms and tend to have similar categories across countries. However, the rules used to arrive at the categories and numbers often differ by country. Thus, users of nancial statements may believe that the statements reect the same nancial language,

* Corresponding author. E-mail addresses: dkericks@indiana.edu (D. Erickson), aesplin@indiana.edu (A. Esplin), lmaines@indiana.edu (L.A. Maines).

but the words often have different meanings depending on the country from which the statements originate. The increased international movement of capital has spurred interest in a worldwide common nancial reporting system. It has become common for institutions and individuals to invest outside of their home country, as evidenced by the fact that approximately two-thirds of U.S. investors own securities of foreign companies (Scannell & Slater, 2008). Similarly, many rms now list on one or more foreign exchanges in addition to the stock exchange in their home country. In recognition of the international movement of capital, many countries are adopting or have adopted a version of the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting board headquartered in London, England and operates as a not-for-prot, private body. Currently, over 100 countries require or allow the use of IFRS (Securities and Exchange Commission, 2007). Recent actions by the Securities and Exchange Commission (SEC) indicate that U.S. nancial reporting is likely to move to IFRS in the near future. The SEC currently requires U.S. companies to report under Generally Accepted Accounting Principles (GAAP) as determined by the U.S.-based Financial Accounting Standards Board (FASB). Until recently, the SEC required foreign companies with securities traded on U.S. exchanges to present a reconciliation between income as reported on the companys domestic nancial statements and income as calculated under GAAP. The SEC rescinded this requirement in 2007 for companies using IFRS to prepare their

0007-6813/$ see front matter # 2009 Kelley School of Business, Indiana University. All rights reserved. doi:10.1016/j.bushor.2009.06.006

532 nancial statements (Securities and Exchange Commission, 2007). In November 2008, the SEC presented a roadmap for the transition of U.S. nancial reporting to IFRS. This roadmap indicates that the SEC will allow some U.S. companies to use IFRS for nancial reports as soon as 2010, and will require all U.S. companies to use IFRS by 2014 (Scannell & Slater, 2008). However, the new SEC chair, Mary Schapiro, has indicated that she does not feel bound by the existing roadmap, and has announced that the SEC plans to make a nal decision in 2011 about U.S. companies moving to IFRS (Millman, 2009). The actions taken by the SEC suggest that companies, auditors, and investors in the U.S. could soon face implications of the move from GAAP to IFRS. All three groups will incur costs associated with the transition, and presumably at least some of the groups will eventually benet from the move from GAAP to IFRS. In this article, we discuss the benets and costs of the move to IFRS for these groups. We rst focus on potential benets of moving to IFRS by illustrating the costs associated with having multiple nancial reporting regimes. We then discuss the differences between GAAP and IFRS and the implications of these differences for companies, auditors, and investors. Finally, we highlight several issues associated with the transition from GAAP to IFRS.

EXECUTIVE DIGEST pharmaceutical company located in England, with a product portfolio including drugs for asthma, diabetes, heart disease, and epilepsy. Smith & Nephew (S&N) also has its headquarters in England and produces medical devices for orthopedic reconstruction, orthopedic trauma, and clinical therapies. Although both companies reside in the same country and are governed by the same nancial reporting standards, we examine these companies because they provided reconciliations between nancial reporting under IFRS and GAAP up through 2006. Our hypothetical investor might choose to compare the performance of these two companies based on their return on equity (ROE), a measure of a companys ability to produce a return on funds contributed by investors. Stockholders often compare a companys return on equity against the returns of other potential investments to determine whether their investment in a company is performing satisfactorily (Pratt, 2006). Table 1 presents the net income, stockholders equity, and return on equity for 2006 for the two companies, as prepared under both GAAP and IFRS.

2.1. Example 1: Comparing companies on different standards

What happens if the investor compares the nancial results of these two companies based on different reporting standards? If GSKs nancial statements are prepared under GAAP and S&Ns nancial statements are prepared under IFRS, GSK will show a 2006 ROE of 12.9% as compared to a more attractive ROE of 34.3% for S&N. If the situation is reversed, however, and an investor compares IFRS-based nancial statements for GSK to GAAP-based nancial statements for S&N, GSKs ROE of 58.6% will appear much more attractive than the 31.8% ROE for S&N. This example suggests that one nancial reporting standard (in this case, GAAP) may be more conservative than the other (IFRS) in terms of the net income reported for the two companies. While simple, this example provides a real-world illustration of the potential problems investors face

2. Does the nancial reporting regime matter?

Will U.S. investors benet from having a common worldwide set of nancial reporting standards? One way to address this question is to look at an example of how investors may be hurt currently by the presence of multiple nancial reporting regimes. Consider the case of an investor who has identied two healthcare companies as potentially attractive investments based on information other than nancial statements: GlaxoSmithKline PLC and Smith & Nephew PLC. GlaxoSmithKline (GSK) is a

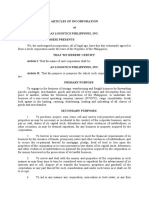

Table 1. GAAP vs. IFRS 2006 Net Income IFRS GlaxoSmithKline PLC * Smith & Nephew PLC^

* ^

Stockholders Equity GAAP 4,465 709 IFRS 9,386 2,174 GAAP 34,653 2,227

Return On Equity IFRS 58.6% 34.3% GAAP 12.9% 31.8%

5,498 745

Net Income and Stockholders Equity amounts for GlaxoSmithKline PLC in millions of Euros. Net Income and Stockholders Equity amounts for Smith & Nephew PLC in millions of U.S. dollars. Sources: GlaxoSmithKline PLC (2007), Smith & Nephew PLC (2007)

EXECUTIVE DIGEST when comparing a U.S. company reporting under GAAP to a foreign company reporting under IFRS. If investors fail to understand that the companies nancial statements are not based on common standards, they can be fooled into thinking that one company is performing better than another simply due to less-conservative nancial reporting standards. Although both companies report earnings, these numbers may reect different constructs. Just as a person ordering a biscuit in a restaurant in the U.S. would receive a product that is very different from a biscuit ordered in a restaurant in the UK, so could an investor viewing earnings for a U.S. company get something quite different from earnings for a UK company.

533 from GAAP. Although the FASB and the IASB have been collaborating on recent nancial reporting standards, differences still remain between GAAP and IFRS. Next, we describe some of the qualitative differences between GAAP and IFRS, the magnitude of these differences in terms of the impact on earnings (quantitative differences), and evidence examining whether one set of standards is superior to the other. (For an in-depth discussion regarding the latter two points, see American Accounting Association Financial Reporting Policy Committee, 2008).

3.1. Qualitative differences between GAAP and IFRS

One important difference between GAAP and IFRS relates to the level of detail and specicity in the standards. This difference manifests in a number of ways, including more standards, more implementation guidance, and more bright-line rules under GAAP than under IFRS. We discuss each of these differences in turn. GAAP contains more individual standards than does IFRS. The FASB and SEC tend to issue more special-industry standards and allow more exceptions for specic transactions than does the IASB. For example, regarding revenue recognition, GAAP contains extensive detailed guidance for specic types of transactions that may lead to differences in practice, while IFRS uses one underlying principle for revenue recognition and does not contain as many additional standards with detailed guidance (PricewaterhouseCoopers, 2007, p. 6). Overall, IFRS standards encompass about 2,500 pages, while new codication of GAAP standards will take up about 17,000 pages (Cohn, 2009). This difference suggests that managers and auditors will face less complexity in assessing which standard applies to a particular transaction under IFRS than under GAAP. However, managers and auditors will need to use more judgment to determine how to apply the general principles in IFRS to a particular transaction. IFRS also provides less guidance about how to implement standards with respect to specic transactions than does GAAP. The FASB provides several sources of implementation guidance, including FASB standards, FASB Interpretations, Staff Positions, and Emerging Issues Task Force Abstracts. The FASB website also welcomes technical inquiries about standards (http://www.fasb.org/inquiry/ index.shtml). While the IASB does provide interpretations of standards, it generally provides less detailed implementation guidance and is less open to inquiries about how to implement IFRS (http:// www.iasb.org/Home.htm). Again, this suggests that IFRS will require more judgment and allow

2.2. Example 2: Comparing companies on the same standards

The logical solution to the Tower of Babel accounting problem is to require that all companies use the same nancial reporting standards. But, will changing to one set of nancial reporting standards solve the problem? Looking at Table 1, if we compare nancial statements prepared using IFRS, GSK shows a 2006 return-on-equity of 58.6% while S&N reports a 2006 return-on-equity of 34.3%. Based on the simple ROE investment criterion, an investor would choose to invest in GSK over S&N. Alternatively, if we compare the performance of these two companies based on nancial statements prepared under GAAP, GSK reports an ROE of 12.9% while S&N reports an ROE of 31.8%. Under this scenario, S&N is the more attractive investment. From this example, it becomes clear that different sets of standards can lead to different decisions. Under IFRS, GSK appears to be the more attractive investment; under GAAP, though, S&N seems the more appealing of the two. Thus, nancial reporting standards are the lens through which investors evaluate a company, and the type of lens used can make a big difference in investors perception of reality. As the world moves to a single international set of standards, investors will no longer be fooled by the use of different lenses for U.S. versus foreign companies. Going forward, two things are clear: (1) the choice of lens still matters, and (2) it is important to understand how the view of the nancial landscape will change with the switch from a GAAP lens to an IFRS lens.

3. The gap between GAAP and IFRS

In order to navigate the transition to IFRS, it is important that investors understand how IFRS differs

534 more discretion on the part of managers and auditors in terms of applying standards to particular transactions. The last difference associated with the level of detail relates to bright-line rules. Some nancial reporting standards under GAAP contain bright-line rules with specic cutoff points to determine the appropriate accounting treatment. For example, under GAAP, leases are capitalized as an asset with a corresponding liability if the lease term exceeds 75% of the leased assets expected life (Financial Accounting Standards Board, 1976, para. 7). In contrast, the IFRS standard for lease accounting does not mention a specic cutoff point for lease capitalization; instead, it indicates factors which typically suggest that the lease should be capitalized. One of these factors is that the lease term is for the major part of the assets economic life; however, the standard does not precisely dene the term major part (International Accounting Standards Board, 2003, para. 10). As illustrated by the lease example, instead of providing detailed rules for determining an appropriate accounting treatment, IFRS generally outlines qualitative principles that managers should consider when choosing accounting treatments. Another difference between IFRS and GAAP is that IFRS has a greater emphasis on fair value accounting than does GAAP. Fair value accounting uses estimates of the current market value of an item, rather than the items original cost. Fair values are reliable measures of current value in the presence of an active market for the item. However, if the market is not active, the use of fair value accounting requires managers to make assumptions to arrive at a fair value estimate. If managers have incentives to bias nancial reports, the use of fair values can lead to biased values for assets and liabilities. Finally, the IASB disallows certain methods of accounting deemed acceptable under GAAP. For example, under GAAP, companies can choose among multiple methods for determining the cost of items associated with a particular sale. Most companies do not identify which specic unit of a product is sold in a particular sale, but rather use inventory cost ow assumptions such as rst-in, rst-out (FIFO), last-in, rst-out (LIFO), and weighted average cost. All three cost ow assumptions are acceptable under GAAP; however, IFRS prohibits use of the LIFO method.

EXECUTIVE DIGEST to important variations in the magnitude of numbers reported on nancial statements. Accounting research investigates this question by examining the differences in rms net income between GAAP and IFRS for foreign rms that trade on U.S. stock exchanges. Haverty (2006) uses a small sample of 11 Chinese companies that are listed on the New York Stock Exchange and which issued reconciliations between GAAP and IFRS nancial statements. He nds that 10 of the 11 companies in his sample reported IFRS earnings that differed from GAAP earnings by over 5% of their U.S. net income. The dollar magnitude of the differences ranged from $2.5 million to over $19.4 billion, based on exchange rates at the end of 2002. For a majority of these companies, net income under GAAP was higher than net income under IFRS. Henry, Lin, and Yang (2008) evaluate GAAP and IFRS differences using 83 European Union companies that are cross-listed in the United States. Net income under IFRS was 52% lower than GAAP earnings in 2005, on average, and 26% lower in 2006. As suggested by the pattern of these 2 years, the authors found that differences in income between IFRS and GAAP are diminishing over time, consistent with efforts by the IASB and FASB to converge the two sets of standards. Additional research shows that the capital markets value the informational differences between IFRS and GAAP contained in the reconciliations. Chen and Sami (2008) nd that an abnormally high number of trades occur when rms issue earnings reconciliations between IFRS and GAAP, indicating that investors nd the information relevant to their decisions to buy or sell stock. This nding suggests that each set of standards results in earnings that contain unique and relevant information for investors. In general, research nds that net income differs across the two sets of standards. The direction and magnitude of the differences in net income across nancial reporting regimes likely depends on the industry and business activities of specic companies. However, research nds that these differences are often signicant and that nancial statements prepared under each accounting regime contain unique and value-relevant information for investors.

3.3. Is GAAP better than IFRS, or just different?

Standard setters indicate that the quality of nancial reporting standards should be judged based primarily on two factors: (1) the relevance of the nancial information in the standard to investor and creditor

3.2. Quantitative differences between GAAP and IFRS

While GAAP and IFRS do have qualitative differences, it is unclear whether these differences lead

EXECUTIVE DIGEST decisions, and (2) the reliability of the nancial information as measured by the extent to which it faithfully represents rms economic position and performance (Financial Accounting Standards Board, 2008, pp. 17-26). Thus, addressing the question of whether GAAP or IFRS is of higher quality translates into whether one standard versus the other is superior in terms of relevance and reliability. Unfortunately, one of the primary challenges researchers face is measuring relevance and reliability. Researchers typically must infer relevance and reliability using proxies such as investor preferences (i.e., their willingness to invest in companies that use a particular set of standards for nancial reporting), market perceptions of information risk, and the association between earnings and stock returns. Bradshaw, Bushee, and Miller (2004) evaluate the relationship between a rms accounting choices and ownership of the rms stock by institutions such as insurance companies and pension plans. They nd that U.S. institutions are more likely to invest in rms with nancial statements that are prepared using accounting similar to GAAP. This result is consistent with investors exhibiting a home bias toward companies using U.S. accounting standards. The authors conjecture that institutional investors preference for GAAP-consistent accounting occurs because the accounting is more familiar, which reduces investors information processing costs. They also theorize that investors familiarity with GAAP may lead to perceptions that the information is of higher quality. It is important to note, however, that this study does not directly compare perceived accounting quality under GAAP and IFRS (American Accounting Association Financial Reporting Policy Committee, 2008). Leuz (2003) evaluates the quality of IFRS versus GAAP using a sample of German rms that are allowed to select U.S. GAAP, IFRS, or German GAAP for their nancial reports. He examines information asymmetry, or the extent to which certain investors face an informational advantage relative to other investors. Higher quality nancial reporting should reduce information asymmetry and, in turn, increase the liquidity of capital markets. Leuz nds little difference between U.S. GAAP and IFRS in terms of his information asymmetry measures, which include bid-ask spreads, share turnover, and the dispersion of nancial analysts earnings forecasts. His results suggest that market participants do not perceive differences in quality of nancial reports prepared under IFRS and GAAP, or at least do not care about any differences that do exist. Using a similar setting with German companies, Bartov, Goldberg, and Kim (2005) investigate if the stock market reacts differently to earnings

535 depending on whether the nancial statements are based on IFRS, U.S. GAAP, or German GAAP. The strength of the relation between earnings and stock returns indicates the extent to which investors perceive accounting earnings to reect the rms economic performance and future potential. The authors nd that the relation between earnings and market returns is weaker for rms whose nancial statements are prepared according to German GAAP than for rms whose statements are prepared according to U.S. GAAP or IFRS. However, the authors do not nd any differences in the association between earnings and returns for rms using U.S. GAAP versus rms using IFRS. Similar to the ndings in Leuz (2003), these results suggest that investors do not perceive differences in accounting quality between IFRS and GAAP. Overall, it seems that U.S. investors have some preference for companies using GAAP; this preference may simply be due to investors greater familiarity with GAAP. Moreover, research appears to suggest that large differences in quality between IFRS and GAAP do not exist, or at least that the capital markets do not care about the differences which do exist. Any perceived differences between GAAP and IFRS are likely to diminish prior to the transition to IFRS, due to the continuing convergence efforts of the FASB and the IASB. A related issue is that the quality of nancial reporting standards depends not only on the standards themselves, but also on the enforcement of the standards, which varies from country to country. Auditors enforce the standards prior to the release of nancial statements, and regulators such as the SEC enforce them after the release of the nancial statements. The level of enforcement affects how companies implement standards and the quality of their nancial reports. In other words, investors may perceive IFRS nancial statements issued from countries with extensive investor protection as being of higher quality than IFRS nancial statements issued from countries with limited investor protection. Thus, effects such as the previously-discussed home bias may still exist if investors view enforcement to be stronger in the U.S. than in other countries using IFRS (Beneish & Yohn, 2008). However, the adoption of a single set of accounting standards should diminish differences in perceived accounting quality resulting solely from the standards employed.

4. Transition issues

Although many market participants agree on the need for international accounting standards, numerous issues remain regarding the transition

536 from GAAP to IFRS. Standard setters must consider the often considerable implementation costs which are necessary to make the switch. Also, because IFRS relies to a greater extent on manager and auditor judgment, both groups must be able to justify the accounting positions they choose.

EXECUTIVE DIGEST numbers. Executive bonuses typically are based on nancial performance measures such as net income. For example, a bonus pool may be set at 10% of net income over $50,000,000. Boards of directors may need to reconsider both the bonus rate and baseline net income level, due to the change to IFRS.

4.1. Implementation costs

Users, managers, and auditors of nancial statements all likely face signicant implementation costs as the transition from GAAP to IFRS progresses. First, these parties must dedicate time and resources toward learning the new standards. Given the differences between the two sets of standards, this education will be no small task. Academics will bear part of the burden as they rewrite textbooks and revise courses to reect IFRS, but a large portion of learning for managers and auditors will have to occur on the job. Indeed, major international audit rms are already providing continuing education courses on IFRS for their employees and for members of the academic community. Investors also will need to educate themselves about IFRS if they want to avoid informational disadvantages and poor investment decisions, due to an inability to understand nancial statements. Companies switching to IFRS will typically face additional costs beyond education. For example, computer information systems currently are based on GAAP. As part of the conversion rms will need to implement new systems based on IFRS, and accountants will need to devote additional time to learn to use these new programs. Proponents of IFRS, however, argue that large multinational companies will eventually save money by reporting under the same set of standards for all countries in which the company operates. Additionally, audit and systems rms may benet from the transition as they take on additional engagements to help clients understand IFRS and implement updated nancial reporting systems. Finally, many contracts are currently based on GAAP standards and will need to be adjusted to incorporate IFRS differences. Debt agreements typically include covenants that contain nancial benchmarks a rm must meet to avoid negative consequences, such as increased interest rates or immediate repayment. For example, a debt covenant may require a rm to maintain a debt to asset ratio that is no greater than 40%. As companies change to IFRS, they will have to consider renegotiating the benchmarks in their covenants to reect the expected effects of the change to IFRS. Boards of directors also may have to renegotiate compensation contracts based on nancial statement

4.2. Increased reliance on auditor and manager judgment

Perhaps one of the greatest challenges managers and auditors face regarding transition to IFRS is an increased need for professional judgment. Under GAAP, managers and auditors received heavy implementation guidance from the FASB as to several accounting issues. IFRS, though, is based on general principles and provides less detailed guidance about how to apply these principles to a specic transaction. Thus, greater professional judgment is needed to determine an appropriate accounting treatment under IFRS. In the past, when the appropriate accounting treatment under IFRS was unclear, managers and auditors often looked to U.S. GAAP for direction. Ironically, the move to IFRS in the U.S. will reduce the ability of managers and auditors in all countries to rely on GAAP for guidance when the appropriate treatment under IFRS is unclear. Auditors and corporate managers have solicited much of the implementation guidance provided by the FASB; the U.S. legal environment has driven demand for such input. Managers and auditors are concerned that their professional accounting judgment will be second-guessed by attorneys and juries if future rm performance declines. Having implementation guidance provides a right answer that reduces the likelihood of this second-guessing. Implementation guidance also provides auditors with greater support for denying accounting treatments preferred by clients to achieve desired nancial results. Both managers and auditors will have a reduced ability to rely on specic rules and implementation guidance as justication to support their choice of accounting treatments. Other issues, beyond implementation costs and an increase in required professional judgment, are sure to surface as the progression toward IFRS continues. This dynamic environment provides opportunities for investors, companies, and audit rms to gain competitive advantages over their peersbut, the costs of achieving such advantages could be signicant.

5. The change is coming?

The next few years are sure to result in extensive changes to the accounting environment, both in the

EXECUTIVE DIGEST U.S. and across the globe. While the push toward international accounting standards has gained momentum, mixed opinions have been voiced about the transition from GAAP to IFRS. Proponents of this change highlight the potential to improve comparability of nancial statements for companies from different countries. This contingent believes use of IFRS will smooth cross-border investing, and will help U.S. companies and capital markets compete worldwide. Opponents of the shift to IFRS decry the implementation costs required to make the change; specically, they cite expenses related to educating market participants regarding differences in standards, and companies preparation of employees and computer systems for the transition. Critics also contend that the IASB has not yet found a stable and independent source of funding, and that the SEC will be tempted to write its own guidance and interpretation of international rules, defeating the purpose of a single set of standards (Scannell & Slater, 2008). While actions taken by the SEC suggest that the U.S. will soon adopt international standards, uncertainty about the conversion has recently arisen. This uncertainty has been roused by two factors: a new chair of the SEC and the current nancial crisis. Christopher Cox, former chair of the SEC, pushed the movement to IFRS; however, Mary Schapiro, who now holds the position, has indicated that she does not feel bound by the existing roadmap and believes another assessment should be made regarding the decision (Millman, 2009). For its part, the nancial crisis has placed numerous companies in precarious nancial positions, and the time may not be right to saddle them with another burden. The SEC has targeted 2011 as the year it will make a nal decision about the movement to IFRS; as such, U.S. investors, managers, and auditors will have to live with uncertainty for a while longer. Even so, it appears likely that IFRS eventually will be the basis for nancial reporting in the United States. Investors, managers, and auditors would be wise to start now in preparing for the change.

537

Bartov, E., Goldberg, S., & Kim, M. (2005). Comparative value relevance among German, U.S., and International Accounting Standards: A German stock market perspective. Journal of Accounting, Auditing, and Finance, 20(2), 95119. Beneish, M. D., & Yohn, T. L. (2008). Information friction and investor home bias: A perspective on the effect of global IFRS adoption on the extent of equity home bias. Journal of Accounting and Public Policy, 27(6), 433 443. Bradshaw, M. T., Bushee, B., & Miller, A. (2004). Accounting choice, home bias, and U.S. investment in non-U.S. rms. Journal of Accounting Research, 42(5), 795841. Chen, L. H., & Sami, H. (2008). Trading volume reaction to the earnings reconciliation from IAS to U.S. GAAP. Contemporary Accounting Research, 25(1), 1553. Cohn, M. (2009, May 4). Accountants uncertain about IFRS roadmap. WebCPA. Retrieved June 8, 2009, from http://www. webcpa.com/news/Accountants-Uncertain-IFRS-Roadmap50340-1.html Financial Accounting Standards Board. (1976). Statement of nancial accounting standards no. 13: Accounting for leases. Norwalk, CT: FASB. Financial Accounting Standards Board. (2008). Conceptual framework for nancial reporting: The objective of nancial reporting and qualitative characteristics and constraints of decision-useful nancial reporting information. Norwalk, CT: FASB. GlaxoSmithKline PLC. (2007, March 2). United States Securities and Exchange Commission, Form 20-F. Available at http:// www.gsk.com/investors/ Haverty, J. L. (2006). Are IFRS and U.S. GAAP converging? Some evidence from Peoples Republic of China companies listed on the New York Stock Exchange. Journal of International Accounting, Auditing, and Taxation, 15(1), 4871. Henry, E., Lin, S., & Yang, Y. (2008). The European-U.S. GAAP gap: IFRS to U.S. GAAP from 20-F reconciliations (Working Paper). Available at http://ssrn.com/abstract=982481 International Accounting Standards Board. (2003). International accounting standard 17: Leases. London: IASB. Leuz, C. (2003). IAS versus U.S. GAAP: Information asymmetrybased evidence from Germanys new market. Journal of Accounting Research, 41(3), 445472. Millman, G. (2009, January 26). Execs hail Mary Schapiro for folding IFRS roadmap. IFRS Reporter. Retrieved June 8, 2009, from http://www.ifrsreporter.com/index.php?option= com_content&view=article&id=52:-execs-hail-mary-schapiro -for-folding-ifrs-roadmap&catid=36:sec&Itemid=53 Pratt, J. (2006). Financial accounting in an economic context (6th ed.). Hoboken, NJ: John Wiley & Sons Inc. PricewaterhouseCoopers. (2007). Similarities and differences: A comparison of IFRS and U.S. GAAP. New York: PricewaterhouseCoopers. Scannell, K., & Slater, J. (2008, August 28). SEC moves to pull plug on U.S. accounting standards. The Wall Street Journal, p. A1. Securities and Exchange Commission. (2007, August 7). Concept release on allowing U.S. issuers to prepare nancial statements in accordance with International Financial Reporting Standards. Retrieved June 8, 2009, from http://www. sec.gov/rules/concept/2007/33-8831.pdf. Smith & Nephew PLC. (2007, March 28). United States Securities and Exchange Commission, Form 20-F. Available at http:// global.smith-nephew.com/master/investor_centre_2738.htm

References

American Accounting Association Financial Reporting Policy Committee. (2008). Response to the SEC release: Acceptance from foreign private issuers of nancial statements prepared in accordance with International Financial Reporting Standards without reconciliation to U.S. GAAP File No. S71307. Accounting Horizons, 22(2), 223240.

Das könnte Ihnen auch gefallen

- Christopher P. Mittleman's LetterDokument5 SeitenChristopher P. Mittleman's LetterDealBook100% (2)

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPVon EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Banking and InsuranceDokument20 SeitenBanking and Insurancebeena antuNoch keine Bewertungen

- 01 Basilan Estate V CIRDokument2 Seiten01 Basilan Estate V CIRBasil MaguigadNoch keine Bewertungen

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDokument4 SeitenDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Noch keine Bewertungen

- IFRS and US GAAP DifferencesDokument232 SeitenIFRS and US GAAP Differencesarvi78Noch keine Bewertungen

- Articles of IncorporationDokument4 SeitenArticles of IncorporationRuel FernandezNoch keine Bewertungen

- Doa TradeDokument17 SeitenDoa TradeEduardo WitonoNoch keine Bewertungen

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsVon EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsBewertung: 4 von 5 Sternen4/5 (11)

- Chapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Dokument38 SeitenChapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Sarah G100% (1)

- Master Thesis PP88092Dokument70 SeitenMaster Thesis PP88092Aeson Dela CruzNoch keine Bewertungen

- ACCT 1115 - Final Review SolutionsDokument13 SeitenACCT 1115 - Final Review SolutionsMarcelo BorgesNoch keine Bewertungen

- Professor Lori Perez: Jitendra Mathur Accounting 304 May 25, 2012Dokument7 SeitenProfessor Lori Perez: Jitendra Mathur Accounting 304 May 25, 2012Jitendra MathurNoch keine Bewertungen

- Financial Accounting (Assignment)Dokument7 SeitenFinancial Accounting (Assignment)Bella SeahNoch keine Bewertungen

- International Financial Reporting Standards (IFRS) TransitionDokument44 SeitenInternational Financial Reporting Standards (IFRS) TransitionAkram KhanNoch keine Bewertungen

- Lack of Comparability in Global FinanceDokument13 SeitenLack of Comparability in Global FinanceAnuj RungtaNoch keine Bewertungen

- GaapDokument10 SeitenGaapraj4473Noch keine Bewertungen

- The Role of Accounting in International BusinessDokument4 SeitenThe Role of Accounting in International BusinessAdzkiaNoch keine Bewertungen

- IFRS and US GAAP - Key DifferencesDokument17 SeitenIFRS and US GAAP - Key DifferenceswriterlakshmivNoch keine Bewertungen

- Does Pro Forma Reporting Bias Analyst Forecasts?: Patric Andersson & Niclas HellmanDokument23 SeitenDoes Pro Forma Reporting Bias Analyst Forecasts?: Patric Andersson & Niclas HellmanAji BramantyojatiNoch keine Bewertungen

- Assignment of M&aDokument7 SeitenAssignment of M&asantosh sainiNoch keine Bewertungen

- Research Paper - AccountingDokument12 SeitenResearch Paper - Accountingapi-341994537Noch keine Bewertungen

- 2010 AdeleHarrisonDokument14 Seiten2010 AdeleHarrisonAngga Putri AgustinaNoch keine Bewertungen

- The Economic Impact of IFRSDokument22 SeitenThe Economic Impact of IFRSSillyBee1205Noch keine Bewertungen

- The Volatility of The Comprehensive Income and Its Association With The Market RiskDokument22 SeitenThe Volatility of The Comprehensive Income and Its Association With The Market RiskKamran RaiysatNoch keine Bewertungen

- Some Issues About The Transition From U.S. Generally Accepted Accounting Principles (Gaap) To International Financial Reporting Standards (Ifrs)Dokument15 SeitenSome Issues About The Transition From U.S. Generally Accepted Accounting Principles (Gaap) To International Financial Reporting Standards (Ifrs)FIRAOL CHERUNoch keine Bewertungen

- Comparing IFRS To GAAP - Daniel Rauch - ACC290 - 2-9-15 v2Dokument4 SeitenComparing IFRS To GAAP - Daniel Rauch - ACC290 - 2-9-15 v2dorauchNoch keine Bewertungen

- US GAAP To IFRS Convergence AnalysisDokument52 SeitenUS GAAP To IFRS Convergence AnalysisDavid Iskander0% (1)

- H&M: The Challenges of Global Expansion and The Move To Adopt International Financial Reporting StandardsDokument6 SeitenH&M: The Challenges of Global Expansion and The Move To Adopt International Financial Reporting StandardsSami KhanNoch keine Bewertungen

- International Financial Reporting Standards: A Guide To Sources For International Accounting StandardsDokument25 SeitenInternational Financial Reporting Standards: A Guide To Sources For International Accounting StandardsbabylovelylovelyNoch keine Bewertungen

- 4 Continental and National Differences in The Financial Ratios of Investment Banking Companies An Application of The Altman Z Model.Dokument14 Seiten4 Continental and National Differences in The Financial Ratios of Investment Banking Companies An Application of The Altman Z Model.TathianaNoch keine Bewertungen

- Relevance of Financial Reporting For Firm Valuation in The Contemporary EraDokument16 SeitenRelevance of Financial Reporting For Firm Valuation in The Contemporary Erajothi subraNoch keine Bewertungen

- IFRS, Accounting Standards and Business: JanuaryDokument3 SeitenIFRS, Accounting Standards and Business: JanuaryZeris TheniseoNoch keine Bewertungen

- Chapter-1 Introducti ONDokument61 SeitenChapter-1 Introducti ONprashant mhatreNoch keine Bewertungen

- Review of International Accounting Information SystemsDokument6 SeitenReview of International Accounting Information SystemsMarwa RabieNoch keine Bewertungen

- Dimension of Financial and Management Finance EssayDokument11 SeitenDimension of Financial and Management Finance EssayHND Assignment HelpNoch keine Bewertungen

- Flexibility in Cash-Flow Classification Under IFRS: Determinants and ConsequencesDokument34 SeitenFlexibility in Cash-Flow Classification Under IFRS: Determinants and ConsequencesMariene Resende CunhaNoch keine Bewertungen

- Emerging Major Themes in The Financial Reporting World Relevance of Financial Reporting For Firm Valuation in The Contemporary EraDokument17 SeitenEmerging Major Themes in The Financial Reporting World Relevance of Financial Reporting For Firm Valuation in The Contemporary Erajothi subraNoch keine Bewertungen

- ACC501 Mod 1 Case Financial StatementsDokument12 SeitenACC501 Mod 1 Case Financial StatementsNoble S WolfeNoch keine Bewertungen

- Financial Accounting DiversityDokument16 SeitenFinancial Accounting DiversityDhea Nanda ChristaliaNoch keine Bewertungen

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzDokument16 SeitenSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzLoriSmithamdt100% (41)

- Competing Perspective Regarding Increased Regulations Regarding Financial Reporting.Dokument12 SeitenCompeting Perspective Regarding Increased Regulations Regarding Financial Reporting.Jasmeet DhillonNoch keine Bewertungen

- Book-Tax Income Differences and Major Determining FactorsDokument11 SeitenBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNoch keine Bewertungen

- Gaap Vs IfrsDokument7 SeitenGaap Vs IfrsAshutosh SharmaNoch keine Bewertungen

- Ifrs WhitepaperDokument14 SeitenIfrs Whitepapervcsekhar_caNoch keine Bewertungen

- The Differences of IFRS and U.S. GAAP and The Importance of Their Integration Liberty University ACCT 301-B02 Charles BuckleyDokument11 SeitenThe Differences of IFRS and U.S. GAAP and The Importance of Their Integration Liberty University ACCT 301-B02 Charles BuckleyMohamed BoutalebNoch keine Bewertungen

- Differences Between IFRS and US GAAPDokument7 SeitenDifferences Between IFRS and US GAAPAderonke AjibolaNoch keine Bewertungen

- Chapter 4Dokument27 SeitenChapter 4Annalyn MolinaNoch keine Bewertungen

- Ifrs Vs Us Gaap Basics March 2010Dokument56 SeitenIfrs Vs Us Gaap Basics March 2010rahulchutiaNoch keine Bewertungen

- Fraser Statements Ch01Dokument45 SeitenFraser Statements Ch01Pramod Bharadwaj0% (1)

- Chapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionDokument41 SeitenChapter 1 - Financial Reporting and Accounting Standards - Intermediate Accounting - IFRS Edition, 2nd EditionWihl Mathew ZalatarNoch keine Bewertungen

- Shannon McKenna - Accounting in 50 YearsDokument4 SeitenShannon McKenna - Accounting in 50 Yearssmckenna1224Noch keine Bewertungen

- Converting Financial Statements GAAP IFRS Jan2014 CPAJDokument10 SeitenConverting Financial Statements GAAP IFRS Jan2014 CPAJTranBinhNoch keine Bewertungen

- International Accounting - SwiftDokument7 SeitenInternational Accounting - Swiftzhayang1129Noch keine Bewertungen

- Regulatory Framework - Seminar SolutionsDokument3 SeitenRegulatory Framework - Seminar SolutionsbabylovelylovelyNoch keine Bewertungen

- Us Assurance International Financial Reporting STD 030108Dokument4 SeitenUs Assurance International Financial Reporting STD 030108Pallavi PalluNoch keine Bewertungen

- Financial Reporting EssentialsDokument20 SeitenFinancial Reporting EssentialsAnastasha Grey100% (1)

- Accepted RIBF 9 May 2020Dokument32 SeitenAccepted RIBF 9 May 2020Alexandru DavidNoch keine Bewertungen

- Research Paper On Accounting For Financial InstrumentsDokument6 SeitenResearch Paper On Accounting For Financial Instrumentsafeemfrve100% (1)

- IFRS Impact on Nigerian Bank PerformanceDokument73 SeitenIFRS Impact on Nigerian Bank PerformanceAjewole Eben TopeNoch keine Bewertungen

- CH 11solutionsDokument8 SeitenCH 11solutionsVincent Oluoch Odhiambo67% (3)

- Project 1 FinalDokument8 SeitenProject 1 Finalapi-315736190Noch keine Bewertungen

- IMChap 010Dokument28 SeitenIMChap 010Aaron Hamilton100% (1)

- Gaap Vs IfrsDokument6 SeitenGaap Vs IfrsCy WallNoch keine Bewertungen

- CN To Topic 1Dokument27 SeitenCN To Topic 1Faisel MohamedNoch keine Bewertungen

- Tax Policy and the Economy, Volume 34Von EverandTax Policy and the Economy, Volume 34Robert A. MoffittNoch keine Bewertungen

- 05 - CristescuDokument10 Seiten05 - CristescuAdriana CalinNoch keine Bewertungen

- Pages 4 5-15 Sandra MARTISIUTE, Gabriele VILUTYTE, Dainora GRUNDEY 16-22Dokument1 SeitePages 4 5-15 Sandra MARTISIUTE, Gabriele VILUTYTE, Dainora GRUNDEY 16-22Adriana CalinNoch keine Bewertungen

- 17 - Ciovica, CristescuDokument7 Seiten17 - Ciovica, CristescuAdriana CalinNoch keine Bewertungen

- Integrated Software Reliability AnalysisDokument13 SeitenIntegrated Software Reliability AnalysisAdriana CalinNoch keine Bewertungen

- Ef 4Dokument1 SeiteEf 4Adriana CalinNoch keine Bewertungen

- Adina LipaiDokument7 SeitenAdina LipaiAdriana CalinNoch keine Bewertungen

- Rosetta Stone Users GuideDokument71 SeitenRosetta Stone Users GuideElynel Dominguez MirandaNoch keine Bewertungen

- CC en-US Level 1 PDFDokument50 SeitenCC en-US Level 1 PDFCaio SchwenkeNoch keine Bewertungen

- Rosetta Stone Users GuideDokument71 SeitenRosetta Stone Users GuideElynel Dominguez MirandaNoch keine Bewertungen

- 05 - PetruselDokument13 Seiten05 - PetruselAdriana CalinNoch keine Bewertungen

- 01 - Mehmood, AzimDokument9 Seiten01 - Mehmood, AzimAdriana CalinNoch keine Bewertungen

- 13 - Ivan Articol Structuri enDokument15 Seiten13 - Ivan Articol Structuri enAdriana CalinNoch keine Bewertungen

- 02 - Chaudhari, Patnaik, PatilDokument10 Seiten02 - Chaudhari, Patnaik, PatilAdriana CalinNoch keine Bewertungen

- Raspunsuri Competa Cap 1, 2Dokument1 SeiteRaspunsuri Competa Cap 1, 2Adriana CalinNoch keine Bewertungen

- 01 - Mehmood, AzimDokument9 Seiten01 - Mehmood, AzimAdriana CalinNoch keine Bewertungen

- 02 - Chaudhari, Patnaik, PatilDokument10 Seiten02 - Chaudhari, Patnaik, PatilAdriana CalinNoch keine Bewertungen

- 106 - Cocianu, State, Constantin, Sararu2Dokument12 Seiten106 - Cocianu, State, Constantin, Sararu2Adriana CalinNoch keine Bewertungen

- Why Should SME Adopt IT Enabled CRM Strategy?Dokument4 SeitenWhy Should SME Adopt IT Enabled CRM Strategy?djumekenziNoch keine Bewertungen

- 10 - Ivan, Ciurea, Vintila, NoscaDokument18 Seiten10 - Ivan, Ciurea, Vintila, NoscaAdriana CalinNoch keine Bewertungen

- 10 - Ivan, VintilaDokument15 Seiten10 - Ivan, VintilaAdriana CalinNoch keine Bewertungen

- Designing Algorithms Using CAD Technologies: Keywords: Diagrams, Algorithms, Programming, Code GenerationDokument3 SeitenDesigning Algorithms Using CAD Technologies: Keywords: Diagrams, Algorithms, Programming, Code GenerationAdriana CalinNoch keine Bewertungen

- More General Credibility Models: F F P F FDokument6 SeitenMore General Credibility Models: F F P F FAdriana CalinNoch keine Bewertungen

- 03 - PribeanuDokument9 Seiten03 - PribeanuAdriana CalinNoch keine Bewertungen

- 05 - PopescuDokument11 Seiten05 - PopescuAdriana CalinNoch keine Bewertungen

- 04 - Ularu, Puican, Suciu, Vulpe, TodoranDokument13 Seiten04 - Ularu, Puican, Suciu, Vulpe, TodoranAdriana CalinNoch keine Bewertungen

- Art:10 2478%2Dokument14 SeitenArt:10 2478%2Adriana CalinNoch keine Bewertungen

- S - Jitaru, AlexandruDokument8 SeitenS - Jitaru, AlexandruAdriana CalinNoch keine Bewertungen

- 17 Andone, PavaloaiaDokument9 Seiten17 Andone, PavaloaiaAdriana CalinNoch keine Bewertungen

- Developing Performance SystemsDokument5 SeitenDeveloping Performance SystemsAdriana CalinNoch keine Bewertungen

- 11Dokument13 Seiten11Adriana CalinNoch keine Bewertungen

- Caltex v Security Bank: 280 CTDs worth P1.12MDokument52 SeitenCaltex v Security Bank: 280 CTDs worth P1.12MAir Dela CruzNoch keine Bewertungen

- JPM Fact Fiction and Momentum InvestingDokument19 SeitenJPM Fact Fiction and Momentum InvestingmatteotamborlaniNoch keine Bewertungen

- 2015 Accountancy Question PaperDokument4 Seiten2015 Accountancy Question PaperJoginder SinghNoch keine Bewertungen

- Closing Your Savings Account FormDokument1 SeiteClosing Your Savings Account FormtafseerahmedNoch keine Bewertungen

- Anand RathiDokument3 SeitenAnand RathiShilpa EdarNoch keine Bewertungen

- Investment Decision MakingDokument16 SeitenInvestment Decision MakingDhruvNoch keine Bewertungen

- Business Combi CH 6 de JesusDokument9 SeitenBusiness Combi CH 6 de JesusMerel Rose FloresNoch keine Bewertungen

- Republic of Austria Investor Information PDFDokument48 SeitenRepublic of Austria Investor Information PDFMi JpNoch keine Bewertungen

- PROFILE FINTECH MENARA JAMSOSTEK - ContohDokument18 SeitenPROFILE FINTECH MENARA JAMSOSTEK - ContohRioz GonzalezNoch keine Bewertungen

- 25dairy Cow ModuleDokument47 Seiten25dairy Cow ModulericoliwanagNoch keine Bewertungen

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDokument4 SeitenFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNoch keine Bewertungen

- Chapter - 9: General Financial Rules 2017Dokument40 SeitenChapter - 9: General Financial Rules 2017PatrickNoch keine Bewertungen

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDokument27 SeitenVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNoch keine Bewertungen

- Bank Reconciliation (Practice Quiz)Dokument4 SeitenBank Reconciliation (Practice Quiz)MoniqueNoch keine Bewertungen

- 1234449Dokument19 Seiten1234449Jade MarkNoch keine Bewertungen

- Renewal Premium Receipt - 00755988Dokument1 SeiteRenewal Premium Receipt - 00755988Tarun KushwahaNoch keine Bewertungen

- BIF Capital StructureDokument13 SeitenBIF Capital Structuresagar_funkNoch keine Bewertungen

- Dvorak Mar 23Dokument103 SeitenDvorak Mar 23glimmertwins100% (1)

- Statement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanDokument8 SeitenStatement of Account: PT 632 Desa Darul Naim Pasir Tumboh 16150 Kota Bharu, KelantanFadzianNoch keine Bewertungen

- Term Plan 65yeras PDFDokument5 SeitenTerm Plan 65yeras PDFRohit KhareNoch keine Bewertungen

- PPE HandoutsDokument6 SeitenPPE Handoutsashish.mathur1Noch keine Bewertungen

- Principles and Methods for Improving CollectionsDokument7 SeitenPrinciples and Methods for Improving Collectionsrosalyn mauricioNoch keine Bewertungen