Beruflich Dokumente

Kultur Dokumente

Forrester 2007 Japan's Offshore Evolution Baby Steps Toward China and India

Hochgeladen von

scarceboyzOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Forrester 2007 Japan's Offshore Evolution Baby Steps Toward China and India

Hochgeladen von

scarceboyzCopyright:

Verfügbare Formate

Q U I C K TA K E

February 1, 2007

Includes Business Technographics data

Japans Oshore Evolution: Baby Steps Toward China And India

Japanese IT Must Improve Processes And Adapt Culturally To Benet

by Jonathan Browne and John C. McCarthy with Sudin Apte and Francesca Bartolomey

EXECUT I V E S U M MA RY

Japanese companies are increasingly interested in oshore outsourcing, but they remain limited in their utilization, given their poorly developed IT processes. Theyre motivated to work with oshore partners not only by a desire to reduce cost but also to gain access to technology skills and process knowledge that are scarce domestically. China for reasons of cost, geographical proximity, and language capabilities is often touted as Japans ideal outsourcing partner, but Chinas oshore players lack the necessary skills and maturity. To fully leverage oshoring, Japanese rms need to improve their internal governance and project management capabilities. In order to mitigate their risk and acquire the process knowledge they require, they should hedge their China bets by working with more mature vendors in India. TARGET AUDIENCE Sourcing and vendor management professional JAPANS INTEREST IN OFFSHORING IS ON THE RISE Japanese companies face the two-headed beast of reducing costs and nding skilled IT personnel to meet the increased demand for the renewal of legacy applications and compliance with new regulations.1 The oshore imperative has become an increasingly compelling solution as Japan wakes up to the inadequacy of its current IT labor force. At the recent ASOCIO conference in Tokyo, a speaker from Japans Ministry of Economy, Trade and Industry (METI) said, There is a lack of skilled IT engineers, in terms of both quality and quantity.2 As Japanese rms increasingly consider oshoring, vendors are boosting their eorts to bring oshore capabilities to bear on the local market.

IT-intensive verticals like nancial services look oshore. Japanese companies show a high level Japanese systems vendors have increased their investments across Asia. To date, most of the

of interest in oshoring, with 16% of respondents currently using oshore IT providers for software services at a steady or increasing rate (see Figure 1).

activity has been in China, followed by India, and then by other Asian countries. For example, Hitachi currently has 2,000 IT engineers in China, 200 in India, and 100 in Vietnam.3 NEC has a similar distribution, with ve development centers in China. Fujitsu has a larger footprint in India, having obtained facilities there in February 2006 as part of the acquisition of US rm Rapidigm.

Headquarters Forrester Research, Inc., 400 Technology Square, Cambridge, MA 02139 USA Tel: +1 617/613-6000 Fax: +1 617/613-5000 www.forrester.com

Quick Take | Japans Oshore Evolution: Baby Steps Toward China And India

Figure 1 Oshore Activities

Which of the following statements best describes your companys approach to oshore IT services providers for software services?

Japan

65% 64% 67% 43%

Australia/New Zealand

North America*

Europe

15%

8% 9% 10%

16% 3%

12%

8%

14%

9% 11% 9%

Dont use and have no plans to

Dont use, but are considering using

Currently using at a steady rate

Currently using and expanding our use

Base: 808 software decision-makers at Japanese, Australian, New Zealand, North American, and European enterprises Source: Business Technographics August 2006 Asia Pacic Enterprise Technology Adoption And Governance Survey *Source: Business Technographics November 2005 North American And European Enterprise Software And Services Survey

41162 Source: Forrester Research, Inc.

Oshore vendors pay more attention to Japan. An estimated 60% of the export work from

Chinese software outsourcers like Neusoft and China National Software & Service (CS&S) is for Japanese clients. And recently, Indian vendors have augmented their capabilities in Japan: In October 2006, Tata Consultancy Services (TCS) announced the creation of an oshore development center (ODC) in Kolkata, housing 1,200 consultants focused on serving Japanese clients, and KPIT Cummins signed a deal with Renesas Technology to create a 500-person product development center in Bangalore. In addition, Vietnam has made a particular eort to win Japanese contracts. For example, FPT Software, Vietnams largest software outsourcer, opened a school in Vietnam in December to train university graduates in IT skills and Japanese.

JAPANS OFFSHORE EVOLUTION AT THE BYSTANDER AND EXPERIMENTER STAGE At rst glance, Japans oshoring activity appears similar to that of Europe. But a closer examination reveals that Japanese companies are at a relatively early stage in their oshore development and utilization:4

Bystanders comprise about 69% of the Japanese market. Fifty-eight percent of respondents

to Business Technographics August 2006 Asia Pacic Enterprise Technology Adoption And Governance Survey reported no oshore activity at this time, and 11% responded dont know. Surprisingly, only 43% of companies rule oshore out of their plans completely. This compares

2007, Forrester Research, Inc. Reproduction Prohibited

February 1, 2006

Quick Take | Japans Oshore Evolution: Baby Steps Toward China And India

with 64% of North American companies that do not use oshore and have no plans to. Sixteen percent of Japanese respondents claimed to be interested in oshore in the future. But when faced with a real decision, some of this enthusiasm will surely evaporate.

Experimenters comprise 14% to 28% of the market. Forresters data shows that 14% of

companies are increasing their oshore activities, but an equal number report cutting back. This points to a trial and error phase of oshore experimentation, with many instances of burnt ngers initiatives that fail to meet expectations as companies struggle to manage projects with oshore partners.

Committed companies have just begun to emerge. Most of the activity at this level centers on

the local IT services companies bolstering their oshore focus and commitment. In discussions with second-tier systems integrators in Japan, Forrester found that they are winnowing down their number of oshore partners from as many as 30 to three, while taking steps to improve governance. Top-tier companies such as NEC have also announced steps in this direction too, reducing partners in China from 120 rms down to 30.5 This winnowing down of suppliers will continue as rms deepen their focus on India and China.

Forrester rarely sees full exploiters. Very few companies have reached this level of utilization.

One notable company at this level is Shinsei Bank. Rescued from bankruptcy by foreign equity rms, the new leadership at the bank aggressively leveraged oshore providers to build modern IT systems, which now play a central role in the dierentiation of Shinseis products.

WHILE JAPAN AND CHINA ARE A MATCH ON PAPER, REAL CHALLENGES REMAIN China has long been touted as Japans logical oshore IT partner, given its natural advantages in language, proximity, and infrastructure. But during the past year, Japanese companies have gained a more realistic view of the benets and risks of using China as a sole oshore location. Theyve found that several issues on both the Chinese supplier side and the Japanese client side obstruct building a successful partnership. For example:

Poor project management skills hamper measurable success. Oshore vendors complain of

poorly dened projects, which result in unnecessary rework and cost overruns. In the case of China, this results from immature processes on the client side and with many of the small and midtier suppliers.

Political tensions between China and Japan make Japanese executives hesitate. A wave of

anti-Japanese demonstrations in several Chinese cities in April 2005 provided a rude reminder that Japanese companies should diversify their investments in more than one country. Although relations between the two countries appear to have been more cordial in recent months, the possibility of another manifestation of anti-Japanese sentiment remains embedded in the minds

2007, Forrester Research, Inc. Reproduction Prohibited

February 1, 2006

Quick Take | Japans Oshore Evolution: Baby Steps Toward China And India

of executives. Indian vendors comment that their Japanese clients are shying away from putting all their eggs into one basket.

Employee turnover disrupts operations. High attrition rates are a commonly cited problem

of Japanese employers in China. The situation is exacerbated by gaps between the expectations of employers and employees. Japanese companies exhibit typical experimenter behavior by treating their oshore centers as low-cost body shops rather than strategic partners. This deprives oshore employees of stimulating projects and the chance to develop new skills. In addition, career progression in Japanese companies often depends on length of employment rather than meritocratic principles, which provide quicker career advancement in US and European rms. M.B.A. students at Peking University recently told Forrester: Why would I want to study Japanese? It limits me to working with only Japanese companies, which have a glass ceiling for foreigners so you cant go far in your career.

R E C O M M E N D AT I O N S

JAPANS OFFSHORE SUCCESS REQUIRES A MULTI-TIERED STRATEGY

As Japanese companies move toward fully exploiting oshore capabilities to meet their cost reduction and skill requirements, they should:

Include India in their oshore mix. To hedge risks and pick up best practices from processoriented Indian companies, Japan should seek partners in India while using a low-cost center in China or Vietnam.

Invest resources to upgrade their internal software development processes. Japanese

rms need to adopt disciplined project scoping and project management processes to accelerate their oshore evolution and achieve improvements in the quality and exibility of their systems.

Provide clear career progression paths and stimulating work to combat high attrition

rates. To compete with European and American companies in attracting, and then holding onto, the top ight of Chinese graduates, IT divisions need to lead their companies in adjusting the business culture to show oshore employees they have a chance to develop valuable skills and advance their careers.

Focus their oshore eorts with a smaller pool of suppliers. Oshore partnerships will

bear fruit when the scale of oshore activity increases and the necessary skills are fully exploited. A simple body-shopping strategy yields much lower returns in quality or cost savings. To build trust and process cohesiveness, as well as implement consistent governance, Japanese companies should focus their eorts by using only two or three vendors.

February 1, 2006

2007, Forrester Research, Inc. Reproduction Prohibited

Quick Take | Japans Oshore Evolution: Baby Steps Toward China And India

W H AT I T M E A N S

THE MOVE OFFSHORE WILL IMPACT DOMESTIC AND FOREIGN IT SERVICES FIRMS IN JAPAN

Despite the inevitable need to seek skilled help from oshore vendors, Japanese companies will make slow and timid progress toward oshoring. Local companies long-standing preferences for custom applications and extensive customization of packaged applications will die hard. Furthermore, it will take time for vendors to build up a large number of suciently bilingual sta members to take on increasing volumes of work from Japan. However, Japans oshore evolution will be driven to a tipping point by developments such as the following:

Indian vendors will acquire Japans second-tier systems integration rms. To gain a

foothold in key industries, TCS, Infosys Technologies, or Wipro Technologies will follow the lead of Electronic Data Systems (EDS) which bought Japan Systems and buy out local companies. One potential pairing could be HCL and Exa a result of their existing partnership. The selection criteria will be whether or not the Japanese integrator has strong relationships in a specic industry. Japanese IT services rms with existing subsidiaries in China will also be acquisition targets as the Indian vendors build capabilities in China and Japan to optimize their global delivery models. The Indians need to avoid purchasing a vendor that is tied to a single keiretsu.

Indian vendors promote a study-in-India program with Japanese schools. They should

promote one-year India-based IT internships. Young Japanese students who take a year out from school to experience an Indian IT campus will ag themselves as having the right mindset to become facilitators for business between Japan and India. Simultaneously, such a program will boost Indias brand as a country with knowledge and skills that Japan needs.

Japans major domestic vendors lose control. The overwhelming market share currently

held by Japans IT giants will erode as Japanese user companies gradually wean themselves away from proprietary code and begin using packaged applications implemented by oshore rms with a depth of skills the giants cant match. Furthermore, Japans major vendors will nd it harder to compete with oshore players who bring process excellence to their clients.

Half measures will not save Japanese suppliers. Vendors who treat oshore partners as

body shops and take a scattershot approach will increase their own pain. They should focus their eorts on one to three oshore partners, make eorts to improve IT processes, and outsource higher-level work to their suppliers.

Companies with global ambition will adopt oshore aggressively to compete

internationally. Banks, auto manufacturers, and consumer electronics will increase their oshore reliance as the software value of their product rises. In particular, Japans banks are nally free of their bad debt problems and will seek new revenue through business

February 1, 2006

2007, Forrester Research, Inc. Reproduction Prohibited

Quick Take | Japans Oshore Evolution: Baby Steps Toward China And India

expansion in Asia. The exposure to international competition through experienced oshore practitioners such as Citibank will require Japans banks to become oshore experts. Similarly, Japans auto and consumer electronics companies will beat a path to Chinese and Indian developers who can provide the embedded software, an essential element of new product innovation in those industries.6

ENDNOTES

1

In August 2006, Forrester released its Business Technographics August 2006 Asia Pacic Enterprise Technology Adoption And Governance Survey, which received responses from 205 IT decision-makers in Japan. Fifty-ve percent of Japanese respondents said that reducing software costs in any way was a priority or critical priority for their organization. At the same time, the pressure to upgrade systems to comply with new regulations was evident from the high levels of interest in technologies for data protection, leak prevention, and so on. See the February 1, 2007, Data Overview Japan Technology Investments And Priorities. The speaker was Katsuhiko Kaji, director, Information Service Industry Division, Commerce & Information Policy Bureau, METI. Source: Speech, ASOCIO ICT Summit 2006; Tokyo, Japan; November 16, 2006. Source: Speech by Junzo Nakajima, vice president and executive ocer, Hitachi Ltd. ASOCIO ICT Summit 2006; Tokyo, Japan; November 16, 2006. In 2003, Forrester analyzed the progression of companies seeking to use oshore capabilities and outlined a four-stage migration through which companies progress over a period of 24 to 60 or more months (with less than 5% of the Fortune 1,000 having matured to the full exploiter stage at the time of Forresters original analysis). See the December 4, 2003, Brief Users Oshore Evolution And Its Governance Impact. NEC trimmed its expanse of partners in China down to 30 from 120 rms. In compensation, the company is oering software development tools that help automate program writing. In July, NEC mapped out a policy to dispatch workers as needed to help develop software personnel in China. See Nikkei Online, November 6, 2006, Software Jobs Shifting From Japan. http://www.nni.nikkei.co.jp/AC/TNW/Search/ Nni20061106AP9CHIN1.htm In industries such as automotive, telecom, and consumer electronics, the role of software and embedded intelligence as a way to add value continues to expand. For example, the percentage of a cars value that comes from software/electronics will increase from 10% to 25% over the next three years. See the August 3, 2006, Market Overview Oshore Product Development Has Arrived.

Forrester Research (Nasdaq: FORR) is an independent technology and market research company that provides pragmatic and forward-thinking advice about technologys impact on business and consumers. For 22 years, Forrester has been a thought leader and trusted advisor, helping global clients lead in their markets through its research, consulting, events, and peer-to-peer executive programs. For more information, visit www.forrester.com. 2007, Forrester Research, Inc. All rights reserved. Forrester, Forrester Wave, WholeView 2, Technographics, and Total Economic Impact are trademarks of Forrester Research, Inc. All other trademarks are the property of their respective companies. Forrester clients may make one attributed copy or slide of each gure contained herein. Additional reproduction is strictly prohibited. For additional reproduction rights and usage information, go to www.forrester.com. Information is based on best available resources. Opinions reect judgment at the time and are subject to change. To purchase reprints of this document, please email resourcecenter@forrester.com. 41162

Das könnte Ihnen auch gefallen

- Metallurgy: Pre-Medical: Chemistry AllenDokument15 SeitenMetallurgy: Pre-Medical: Chemistry AllenscarceboyzNoch keine Bewertungen

- Metals & Non MetalsDokument24 SeitenMetals & Non Metalsbharath vNoch keine Bewertungen

- Metals and Non-Metals Byjus NotesDokument9 SeitenMetals and Non-Metals Byjus NotesscarceboyzNoch keine Bewertungen

- CMMI PathDokument18 SeitenCMMI PathscarceboyzNoch keine Bewertungen

- UniversitiesDokument1 SeiteUniversitiesscarceboyzNoch keine Bewertungen

- Padhle OPN - Science 3 - Metals and Non-Metals PDFDokument2 SeitenPadhle OPN - Science 3 - Metals and Non-Metals PDFscarceboyzNoch keine Bewertungen

- Utkarsh Classes (Paper I)Dokument192 SeitenUtkarsh Classes (Paper I)scarceboyz0% (1)

- Transfer LetterDokument2 SeitenTransfer LetterscarceboyzNoch keine Bewertungen

- 6000033045Dokument1 Seite6000033045scarceboyzNoch keine Bewertungen

- PMP FormulasDokument2 SeitenPMP FormulasscarceboyzNoch keine Bewertungen

- GNoida SchoolsDokument3 SeitenGNoida SchoolsscarceboyzNoch keine Bewertungen

- CMMI® Training Deck PDFDokument35 SeitenCMMI® Training Deck PDFjawaddejawaddejawadd100% (1)

- Chess Teaching ManualDokument303 SeitenChess Teaching Manuallavallee2883Noch keine Bewertungen

- ADVERTISEMENT Captain - Application FormatDokument6 SeitenADVERTISEMENT Captain - Application FormatscarceboyzNoch keine Bewertungen

- Lalit ConvoDokument1 SeiteLalit ConvoscarceboyzNoch keine Bewertungen

- FCI - Saikripa Event - 26 - JanDokument1 SeiteFCI - Saikripa Event - 26 - JanscarceboyzNoch keine Bewertungen

- AIIMS PG ProspectusJuly2014Dokument50 SeitenAIIMS PG ProspectusJuly2014mohammedraziNoch keine Bewertungen

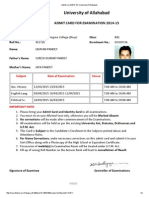

- Admit Card 2014-15, University of AllahabadDokument2 SeitenAdmit Card 2014-15, University of AllahabadscarceboyzNoch keine Bewertungen

- Leadership Lesssons From The Movie - The Last CastleDokument12 SeitenLeadership Lesssons From The Movie - The Last CastlescarceboyzNoch keine Bewertungen

- Maharana PratapDokument4 SeitenMaharana PratapscarceboyzNoch keine Bewertungen

- Dave Regis - Ten Steps To Learn Chess Tactics and Combinations - Short, Violent Games of Chess, Organised by Theme 2010Dokument80 SeitenDave Regis - Ten Steps To Learn Chess Tactics and Combinations - Short, Violent Games of Chess, Organised by Theme 2010Grigore Nicolae Petre100% (2)

- Handwriting self-evaluation rubricDokument2 SeitenHandwriting self-evaluation rubricscarceboyzNoch keine Bewertungen

- Ek Ruka Hua FaislaDokument4 SeitenEk Ruka Hua FaislascarceboyzNoch keine Bewertungen

- Umang Previous Activities - BriefDokument1 SeiteUmang Previous Activities - BriefscarceboyzNoch keine Bewertungen

- V Sem - Management Accounting - Unit IDokument8 SeitenV Sem - Management Accounting - Unit IscarceboyzNoch keine Bewertungen

- Saurabh Pandey Admit CardDokument2 SeitenSaurabh Pandey Admit CardscarceboyzNoch keine Bewertungen

- ExpressionsDokument9 SeitenExpressionsdukkasrinivasflexNoch keine Bewertungen

- En Kabu13su 1Dokument21 SeitenEn Kabu13su 1scarceboyzNoch keine Bewertungen

- Fujitsu India CSR Team Republic Day Event DetailsDokument1 SeiteFujitsu India CSR Team Republic Day Event DetailsscarceboyzNoch keine Bewertungen

- CBSE English Class 1Dokument3 SeitenCBSE English Class 1nbereraNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- English Jhs1Dokument5 SeitenEnglish Jhs1estherdarkwakoampahedkNoch keine Bewertungen

- Pictorial History of The Second World War - A Photographic Record of All Theaters of Action Chronologically Arranged Vol 3Dokument520 SeitenPictorial History of The Second World War - A Photographic Record of All Theaters of Action Chronologically Arranged Vol 3Lefteris Marinos100% (1)

- World in Flames Blitz RulesDokument40 SeitenWorld in Flames Blitz RulesjayjonbeachNoch keine Bewertungen

- ../../mind Map Msia Stud/japan - MMDokument46 Seiten../../mind Map Msia Stud/japan - MMhemanathanharikrishnNoch keine Bewertungen

- Oxford Insight History 9 Ch6 Australians at WarDokument90 SeitenOxford Insight History 9 Ch6 Australians at WarBilly BlattNoch keine Bewertungen

- Kobata Silver RoadDokument23 SeitenKobata Silver RoadRodrigo Luiz Medeiros SilvaNoch keine Bewertungen

- Annotated BibliographyDokument37 SeitenAnnotated Bibliographypikagirl5Noch keine Bewertungen

- Pacific Theatre WorksheetDokument3 SeitenPacific Theatre Worksheetapi-578666470Noch keine Bewertungen

- The Zulu Wars in AfricaDokument7 SeitenThe Zulu Wars in AfricaElizabeth AbekheNoch keine Bewertungen

- Economic History of JapanDokument10 SeitenEconomic History of JapanMariver LlorenteNoch keine Bewertungen

- Kamikaze Attacks of World War II A Complete History of Japanese Suicide STDokument385 SeitenKamikaze Attacks of World War II A Complete History of Japanese Suicide STani aniNoch keine Bewertungen

- WebDokument249 SeitenWebMaxi Fuentes CoderaNoch keine Bewertungen

- Cal Berkeley-Eusterman-Eusterman-Neg-Kentucky-Round3Dokument63 SeitenCal Berkeley-Eusterman-Eusterman-Neg-Kentucky-Round3IanNoch keine Bewertungen

- The Slef-Strengthening MovementDokument8 SeitenThe Slef-Strengthening MovementNazrul ImanNoch keine Bewertungen

- Japan History Fair BibliographyDokument15 SeitenJapan History Fair BibliographyJawad KhanNoch keine Bewertungen

- Educational Modernization of JapanDokument12 SeitenEducational Modernization of JapanRamita UdayashankarNoch keine Bewertungen

- Chapter 28 NotesDokument5 SeitenChapter 28 NotesMatthew SunajoNoch keine Bewertungen

- IGNOU History Blocks - 2013Dokument17 SeitenIGNOU History Blocks - 2013Rajkumar WaghmodeNoch keine Bewertungen

- Assignment 1Dokument1 SeiteAssignment 1Mihai StoicaNoch keine Bewertungen

- Total War Haruo Tohmatsu, H P Willmott A Gathering Darkness TheDokument196 SeitenTotal War Haruo Tohmatsu, H P Willmott A Gathering Darkness ThezackNoch keine Bewertungen

- Explore Japanese and Philippine ArchitectureDokument12 SeitenExplore Japanese and Philippine ArchitectureKim Casta100% (1)

- History of The SchoolDokument5 SeitenHistory of The SchoolGulod ElemNoch keine Bewertungen

- (Chinese Overseas - History, Literature, and Society) Marleen Dieleman, Juliette Koning, Peter Post-Chinese Indonesians and Regime Change-Brill Academic Pub (2010)Dokument249 Seiten(Chinese Overseas - History, Literature, and Society) Marleen Dieleman, Juliette Koning, Peter Post-Chinese Indonesians and Regime Change-Brill Academic Pub (2010)Musa DanielNoch keine Bewertungen

- Micro- and Macro-Economic Models of Direct Foreign Investment SynthesizedDokument21 SeitenMicro- and Macro-Economic Models of Direct Foreign Investment SynthesizedGabriel MerloNoch keine Bewertungen

- Final Letters of Kamikaze Pilots - Japan PoweredDokument11 SeitenFinal Letters of Kamikaze Pilots - Japan PoweredAnirban RoyNoch keine Bewertungen

- A Brief History of US-ROK Alliance and Anti Americanism in South KoreaDokument48 SeitenA Brief History of US-ROK Alliance and Anti Americanism in South KoreaBogan de Boganville100% (1)

- Full Text of Treaty of Shimonoseki in EnglishDokument5 SeitenFull Text of Treaty of Shimonoseki in Englishapi-200630969Noch keine Bewertungen

- Soviet Invasion of Manchuria In1945Dokument188 SeitenSoviet Invasion of Manchuria In1945Mgdth2Noch keine Bewertungen

- History 175 Second Half Keywords-JimDokument30 SeitenHistory 175 Second Half Keywords-JimJames FroschNoch keine Bewertungen

- Japan Japanese CuisineDokument35 SeitenJapan Japanese CuisineJulie Amor ZantuaNoch keine Bewertungen