Beruflich Dokumente

Kultur Dokumente

075T BST130913-Yield Maturity

Hochgeladen von

patilvrCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

075T BST130913-Yield Maturity

Hochgeladen von

patilvrCopyright:

Verfügbare Formate

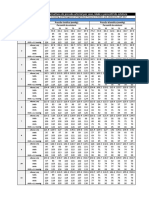

TABLE 75 : PRICES AND REDEMPTION YIELD ON CENTRAL GOVERNMENT

SECURITIES (SGL TRANSACTIONS)

Sr.No.

1

Annual Average Price (`)

Nomenclature of the

loan

2005-06

2006-07

2007-08

2008-09

2009-10

2005-06

2006-07

2007-08

2008-09

2009-10

10

11

12

95.10

100.25

100.93

115.10

116.71

97.32

101.65

103.34

107.93

118.27

118.28

121.60

120.09

103.90

111.91

118.64

121.81

124.51

124.14

101.15

99.94

102.30

113.05

116.87

121.54

101.63

111.37

116.04

131.28

96.06

98.50

99.10

109.69

110.90

99.25

100.45

102.97

112.98

113.14

115.66

113.97

100.88

107.31

114.43

116.26

116.59

117.14

99.18

96.90

99.45

108.01

110.54

115.01

98.07

105.90

110.40

123.72

96.93

98.53

98.45

105.69

105.88

96.69

99.99

99.65

108.53

108.96

110.86

109.51

100.68

105.22

109.40

112.18

114.11

111.94

95.73

96.45

98.34

106.26

108.09

111.42

97.80

102.71

107.80

120.58

98.51

98.21

99.17

101.43

90.33

98.14

99.72

100.56

101.85

106.42

107.21

106.28

105.39

98.36

102.06

100.94

108.52

110.19

112.72

110.03

96.73

101.34

99.73

108.11

106.86

111.67

98.82

105.32

109.43

118.64

100.78

101.30

102.00

103.21

105.49

104.46

106.17

103.00

101.87

102.58

106.55

108.64

110.67

112.84

109.26

101.48

103.10

108.13

109.03

111.41

102.30

104.93

108.32

118.88

6.87

6.54

6.73

6.71

6.59

6.57

6.89

6.69

6.95

6.85

6.85

6.86

6.85

7.10

6.86

6.96

6.98

7.03

6.89

6.51

6.86

6.95

6.96

7.06

7.02

6.98

7.06

7.11

7.17

6.88

7.51

7.50

7.52

7.25

7.77

7.42

7.98

7.39

7.43

7.45

7.50

7.86

7.52

7.33

7.43

7.97

7.59

6.93

7.58

7.55

7.60

7.88

7.81

7.58

7.86

7.85

7.93

7.63

7.66

8.09

7.95

7.65

7.63

7.35

7.69

7.70

7.70

7.55

7.78

7.93

7.78

7.94

7.82

7.95

7.85

7.87

7.80

7.83

7.87

8.08

8.10

7.66

8.25

8.11

7.99

7.29

6.62

7.75

7.31

7.40

7.48

7.61

6.60

7.52

7.65

6.32

6.90

7.29

7.28

7.11

7.11

6.86

6.37

6.92

7.09

7.75

6.32

7.35

7.10

8.36

6.62

7.21

7.61

6.92

7.90

3.97

6.06

4.16

4.93

4.45

4.41

4.28

4.02

5.08

6.49

5.41

5.44

5.30

5.41

5.00

6.28

6.08

6.42

6.52

6.54

6.48

7.45

6.94

6.80

97.88

102.04

117.54

121.53

130.76

102.03

118.45

121.87

125.02

129.20

129.35

92.54

98.12

112.86

115.76

124.42

98.03

112.96

118.10

119.63

122.94

121.73

94.30

97.62

109.09

113.89

120.64

97.11

110.94

113.07

115.40

119.29

118.83

100.45

98.90

104.08

107.22

114.73

119.59

98.22

110.26

113.57

116.47

122.15

116.38

96.64

99.22

100.46

101.73

103.07

109.34

113.18

119.28

96.99

101.65

114.69

112.76

119.30

119.99

7.05

7.04

7.22

7.28

7.17

7.06

7.24

7.22

7.22

7.19

7.27

8.05

7.74

7.71

7.83

7.84

7.70

7.76

7.59

7.65

7.92

7.91

7.89

7.86

8.09

7.85

7.94

7.95

8.01

8.06

8.02

8.06

8.12

6.63

7.40

6.27

7.96

7.86

7.85

7.66

7.69

7.49

8.37

6.96

7.46

6.77

6.75

7.21

6.76

6.60

7.53

7.46

7.23

7.10

6.99

7.53

7.06

7.75

7.37

7.14

A) Terminable under 5 years

1

5.48% 2009

2

6.65% 2009

3

7.00% 2009

4

11.50% 2009

5

11.99% 2009

6

5.87% 2010

7

7.50% 2010

8

7.55% 2010

9

8.75% 2010

10

11.30% 2010

11

11.50% 2010

12

12.25% 2010

13

12.29% 2010

14

6.57% 2011

15

8.00% 2011

16

9.39% 2011

17

10.95% 2011

18

11.50% 2011

19

12.00% 2011

20

12.32% 2011

21

6.72% 2007/2012

22

6.85% 2012

23

7.40% 2012

24

9.40% 2012

25

10.25% 2012

26

11.03% 2012

27

7.27% 2013

28

9.00% 2013

29

9.81% 2013

30

12.40% 2013

B) Between 5 and 10 years

31

6.07% 2014

32

6.72% 2014

33

7.32% 2014

34

7.37% 2014

35

7.56% 2014

36

10.00% 2014

37

10.50% 2014

38

11.83% 2014

39

6.49% 2015

40

7.38% 2015

41

9.85% 2015

42

10.47% 2015

43

10.79% 2015

44

11.43% 2015

45

11.50% 2015

Yield (Per cent per annum)

(Continued)

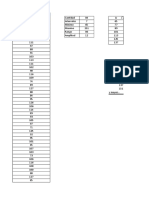

TABLE 75 : PRICES AND REDEMPTION YIELD ON CENTRAL GOVERNMENT

SECURITIES (SGL TRANSACTIONS) (Concld.)

Sr.No.

1

Annual Average Price (`)

Nomenclature of the

loan

2005-06

2006-07

2007-08

2008-09

2009-10

2005-06

2006-07

2007-08

2008-09

2009-10

10

11

12

88.28

125.60

136.99

101.92

101.78

106.43

87.09

92.11

125.25

140.47

85.95

98.96

118.72

129.49

97.43

97.59

102.01

82.62

87.86

117.99

135.08

83.87

98.14

117.63

123.21

96.91

97.50

101.08

83.52

87.60

115.81

-

90.26

98.26

124.38

120.49

97.76

98.20

99.18

101.31

76.38

91.23

102.99

123.42

130.94

92.77

98.16

102.09

118.22

125.87

101.13

101.19

104.68

103.45

88.93

93.97

105.82

120.61

131.52

7.17

7.26

7.26

7.25

7.25

7.22

7.29

7.23

7.34

7.61

7.66

7.79

7.95

8.21

7.81

7.82

7.80

7.95

7.91

8.05

7.91

8.18

7.91

7.89

8.41

7.88

7.87

7.93

7.99

8.03

8.19

-

7.13

7.33

6.44

8.04

7.00

7.57

7.84

7.29

7.54

7.15

7.60

7.00

7.74

7.26

7.41

7.02

7.43

7.43

7.19

7.26

7.06

7.20

7.11

6.93

7.24

7.41

7.81

86.08

89.59

122.85

91.56

128.20

137.79

125.66

85.24

109.27

88.19

89.60

-

81.91

84.94

117.23

87.25

121.94

131.69

99.04

119.45

82.61

102.31

83.00

84.07

-

82.02

84.91

113.84

86.09

118.53

128.52

99.24

117.47

91.12

102.26

82.37

83.77

-

85.23

88.58

119.73

80.22

118.17

130.05

99.88

117.45

86.70

102.82

101.47

84.33

88.87

80.22

88.80

92.09

96.35

115.08

92.34

122.26

122.00

101.25

118.43

81.13

103.38

101.68

103.79

105.75

87.84

89.15

-

7.27

7.27

7.38

7.33

7.46

7.36

7.46

7.51

7.41

7.38

7.36

-

8.12

7.91

7.83

7.95

8.00

7.73

8.07

8.07

8.02

8.02

8.01

8.01

-

8.07

8.11

8.22

8.12

8.48

8.00

8.11

8.11

6.87

7.99

8.18

8.08

-

7.66

7.06

6.90

7.19

7.54

7.91

7.52

7.81

7.48

7.84

7.90

7.44

6.85

-

7.38

6.95

7.44

7.92

7.52

7.55

8.39

7.53

7.89

8.32

7.57

7.98

7.64

7.46

7.57

7.56

-

128.11

85.04

86.00

104.57

99.39

98.24

-

122.72

100.52

79.20

80.17

98.08

92.76

91.52

100.19

-

117.81

101.71

77.76

78.91

96.98

90.87

90.55

100.64

-

121.67

97.95

101.37

78.36

80.41

96.65

98.22

100.01

93.08

92.44

102.10

93.13

95.41

118.39

102.35

99.60

102.01

82.86

84.38

99.93

101.90

101.22

100.59

94.57

93.61

100.59

87.86

7.49

7.38

7.42

7.57

7.54

7.55

-

7.86

8.19

8.02

8.02

8.07

8.19

8.14

8.13

-

8.26

8.06

8.28

8.31

8.38

8.27

8.28

-

8.00

8.32

8.34

7.82

7.58

8.19

8.27

8.26

7.64

7.53

8.05

7.39

7.72

8.21

8.01

8.30

8.07

7.68

7.63

7.93

8.25

8.20

8.27

7.97

7.95

7.91

7.69

B) Between 5 and 10 years

46

5.59% 2016

47

7.02% 2016

48

7.59% 2016

49

10.71% 2016

50

12.30% 2016

51

7.46% 2017

52

7.49% 2017

53

7.99% 2017

54

8.07% 2017

55

5.69% 2018

56

6.25% 2018

57

8.24% 2018

58

10.45% 2018

59

12.60% 2018

C) Between 10 and 15

years

60

5.64% 2019

61

6.05% 2019

62

6.90% 2019

63

10.03% 2019

64

6.35% 2020

65

10.70% 2020

66

11.60% 2020

67

7.94% 2021

68

10.25% 2021

69

5.87% 2022

70

8.08% 2022

71

8.13% 2022

72

8.20% 2022

73

8.35% 2022

74

6.17% 2023

75

6.30% 2023

76

6.35% 2023

D) Over 15 years

77

7.35% 2024

78

10.18% 2026

79

8.24% 2027

80

8.26% 2027

81

8.28% 2027

82

6.01% 2028

83

6.13% 2028

84

7.95% 2032

85

8.28% 2032

86

8.32% 2032

87

8.33% 2032

88

7.5% 2034

89

7.40% 2035

90

8.33% 2036

91

6.83% 2039

Yield (Per cent per annum)

Note : 1. Yields are based on redemption yield, which is computed from 2000-01 as the mean of the daily weighted average yield of the

transactions in each traded security. The weight is calculated as the share of the transaction in a given security in the aggregate

value of transactions in the said security.Prior to 2000-01, the redemption yield was not weighted and was computed as an

average of daily prices of each security.

2. 6.72 % 2007/ 2012 GOI securities was issued with call and put options exercisable on or after 5 years from the date of issue.

Das könnte Ihnen auch gefallen

- 101 Reasons Why I Lost My Homework Again: The Snotty SnailVon Everand101 Reasons Why I Lost My Homework Again: The Snotty SnailNoch keine Bewertungen

- Hindalco Industries: Date Daily Closing Security Yesterday Closing Security RJ R J (RJ-R J)Dokument5 SeitenHindalco Industries: Date Daily Closing Security Yesterday Closing Security RJ R J (RJ-R J)Kamal JoshiNoch keine Bewertungen

- Axial Deformation Proving Ring Reading Load (KN) Height (MM) Pore PressureDokument9 SeitenAxial Deformation Proving Ring Reading Load (KN) Height (MM) Pore PressureGayan Indunil JayasundaraNoch keine Bewertungen

- 為替相場 Foreign Exchange RateDokument1 Seite為替相場 Foreign Exchange Rateapi-223128362Noch keine Bewertungen

- T TestDokument6 SeitenT TestMarie Fe Y. LacsadoNoch keine Bewertungen

- Gujarat Industries Power CompanyDokument17 SeitenGujarat Industries Power CompanySunmeet HalkaiNoch keine Bewertungen

- CPK CalculationDokument7 SeitenCPK CalculationRph AinNoch keine Bewertungen

- Construction Input Price Indices For First Quarter 2021Dokument5 SeitenConstruction Input Price Indices For First Quarter 2021OngeriJNoch keine Bewertungen

- 115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii NeteDokument9 Seiten115.00 % Luna Precedentă 100: Indicele Preţurilor de Consum Indicele Câştigurilor Salariale Medii Netemircea_ghitescuNoch keine Bewertungen

- Resistance SupportsDokument496 SeitenResistance SupportsS K ENGINEERING AND TRADING CONoch keine Bewertungen

- Boots Trapping ExDokument2 SeitenBoots Trapping ExvivekNoch keine Bewertungen

- Here Is A Comparison Using Sun Life Scale - Canada Life and Others Are SimilarDokument1 SeiteHere Is A Comparison Using Sun Life Scale - Canada Life and Others Are Similarapi-233762832Noch keine Bewertungen

- Tug As Stat Fin ArimaDokument24 SeitenTug As Stat Fin ArimaResita Mia NovianaNoch keine Bewertungen

- Adani PowerDokument13 SeitenAdani PowerVishva JhaveriNoch keine Bewertungen

- Trend Analysis RevisedDokument3 SeitenTrend Analysis RevisedVandita KhudiaNoch keine Bewertungen

- Descargas Rios LambayequeDokument36 SeitenDescargas Rios LambayequeAngel AcuñaNoch keine Bewertungen

- Composite Index /1: Table With Row Headers in Column A and Column Headers in Row 4Dokument2 SeitenComposite Index /1: Table With Row Headers in Column A and Column Headers in Row 4MAHDIAH MUMTAZA HUSNA 056Noch keine Bewertungen

- Tabel Profil T-Beam - Gunung GarudaDokument2 SeitenTabel Profil T-Beam - Gunung GarudaIbato RutaNoch keine Bewertungen

- Soal RegresiDokument15 SeitenSoal RegresiRaden Rahmadi Kusumo PutraNoch keine Bewertungen

- Average Daily Block Hour Utilization of Total Operating FleetDokument4 SeitenAverage Daily Block Hour Utilization of Total Operating FleetzekiNoch keine Bewertungen

- Just Write Number in Box D1, You Will Get Degree in Box A1Dokument3 SeitenJust Write Number in Box D1, You Will Get Degree in Box A1Raghavendra KNoch keine Bewertungen

- AmortizationDokument1 SeiteAmortizationelizabeth_w_ctNoch keine Bewertungen

- ES 10 THW MidtermDokument9 SeitenES 10 THW MidtermAlvin AustriaNoch keine Bewertungen

- Pashta and Garambowad Bund ResultsDokument13 SeitenPashta and Garambowad Bund ResultsSALMAN SOHAIBNoch keine Bewertungen

- PID SistemDokument19 SeitenPID Sistemirawan pandu buditomoNoch keine Bewertungen

- Repaso CecDokument18 SeitenRepaso CecAlejandra CastañedaNoch keine Bewertungen

- Inflation and GDP DeflatorDokument1 SeiteInflation and GDP DeflatorSyed Abdul Wahab GilaniNoch keine Bewertungen

- Caudal Maximo GumbelDokument8 SeitenCaudal Maximo GumbelZander Meza ChoqueNoch keine Bewertungen

- Tabela-De-Pressão-Arterial Inf Adolesc 2017 PDFDokument4 SeitenTabela-De-Pressão-Arterial Inf Adolesc 2017 PDFTaináNoch keine Bewertungen

- Tabela de Sinais Viatais Pedi. Por GeneroDokument4 SeitenTabela de Sinais Viatais Pedi. Por GeneroMiuara Thalany Rodrigues NobreNoch keine Bewertungen

- Particulars 2014 2015 2016 2017 2018: Results For The YearDokument3 SeitenParticulars 2014 2015 2016 2017 2018: Results For The YearVandita KhudiaNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 14, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 14, 2013)Manila Standard TodayNoch keine Bewertungen

- Bank Vs LicDokument15 SeitenBank Vs LicPraveen AsokaranNoch keine Bewertungen

- First SessionDokument13 SeitenFirst SessionKanishka KaurNoch keine Bewertungen

- BSM Toolbox OriginalDokument651 SeitenBSM Toolbox Originalrdixit2Noch keine Bewertungen

- Trend Analysis of TCLDokument1 SeiteTrend Analysis of TCLRaviShankarSharmaNoch keine Bewertungen

- AirtelDokument3 SeitenAirtelAkhil JayathilakanNoch keine Bewertungen

- RF Index 2010 13Dokument2 SeitenRF Index 2010 13Amna MushtaqNoch keine Bewertungen

- Boiling Point of Water at Various PressuresDokument1 SeiteBoiling Point of Water at Various Pressuresyuda_meNoch keine Bewertungen

- Ayleen PorraControl 1Dokument7 SeitenAyleen PorraControl 1ayleenporraNoch keine Bewertungen

- Z, T, Chi, and F TablesDokument7 SeitenZ, T, Chi, and F TableshsurampudiNoch keine Bewertungen

- CDC Length Percentiles Calculator BP Calculator BoysDokument22 SeitenCDC Length Percentiles Calculator BP Calculator BoysSushant ShridharNoch keine Bewertungen

- Jadual Scri q1-q2 2023pDokument25 SeitenJadual Scri q1-q2 2023pEva TeohNoch keine Bewertungen

- g1 Fieldwork 5Dokument1 Seiteg1 Fieldwork 5julesNoch keine Bewertungen

- Loan 2Dokument3 SeitenLoan 2Melvyn Koa WingNoch keine Bewertungen

- Rata-Rata Harga Eceran Nasional Beberapa Jenis Barang (Rupiah), 2008-2013 (Diolah Dari Hasil Survei Harga Konsumen, BPS)Dokument2 SeitenRata-Rata Harga Eceran Nasional Beberapa Jenis Barang (Rupiah), 2008-2013 (Diolah Dari Hasil Survei Harga Konsumen, BPS)Dea JovitaNoch keine Bewertungen

- RBR1107Dokument7 SeitenRBR1107lfrancese100% (1)

- MurreyMathCalculator, Version 1.3 (Dec 1999)Dokument3 SeitenMurreyMathCalculator, Version 1.3 (Dec 1999)niol66Noch keine Bewertungen

- 2008 JEFFERSON COLORADO Precinct VoteDokument486 Seiten2008 JEFFERSON COLORADO Precinct VoteJohn MNoch keine Bewertungen

- Tablas Tension Arterial VaronesDokument3 SeitenTablas Tension Arterial VaronesSandra LilianaNoch keine Bewertungen

- Tablas Tension Arterial VaronesDokument3 SeitenTablas Tension Arterial VaronesSandra LilianaNoch keine Bewertungen

- Tabel Student T PDFDokument3 SeitenTabel Student T PDFStefany Luke100% (1)

- Compound Vs Simple Interest 8% Per Year For 40 YearsDokument6 SeitenCompound Vs Simple Interest 8% Per Year For 40 YearsVijai RajNoch keine Bewertungen

- Simple Vs Compound InterestDokument6 SeitenSimple Vs Compound Interestsatking24Noch keine Bewertungen

- Table 115: Direct and Indirect Tax Revenues of Central and State GovernmentsDokument2 SeitenTable 115: Direct and Indirect Tax Revenues of Central and State GovernmentsmaddyNoch keine Bewertungen

- Session 03 03 Currency Data FileDokument124 SeitenSession 03 03 Currency Data FileNandini NagabhushanNoch keine Bewertungen

- Profile LevelingDokument142 SeitenProfile LevelingAhsan AfzalNoch keine Bewertungen

- PPKom Q.2 2022 PDFDokument21 SeitenPPKom Q.2 2022 PDFwawanNoch keine Bewertungen

- Output GWRDokument6 SeitenOutput GWRerikaNoch keine Bewertungen

- Me Sail FinalDokument4 SeitenMe Sail FinalNikunj BeladiyaNoch keine Bewertungen

- Coordination in Supply ChainDokument8 SeitenCoordination in Supply ChainWaqqar ChaudhryNoch keine Bewertungen

- Maruti Suzuki ReportDokument45 SeitenMaruti Suzuki Reportsagar bhamareNoch keine Bewertungen

- Kumpulan Soal Listening Part 2 & 3Dokument13 SeitenKumpulan Soal Listening Part 2 & 3Martallena DwinandaNoch keine Bewertungen

- Indian Luggage IndustryDokument13 SeitenIndian Luggage IndustryAditya Khare0% (1)

- DI TableDokument44 SeitenDI TableSahil AroraNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument4 SeitenNew Microsoft Office Word DocumentRajni KumariNoch keine Bewertungen

- Bendigo Advertiser - August 21 2017Dokument32 SeitenBendigo Advertiser - August 21 2017Boki VaskeNoch keine Bewertungen

- Segmenting and TargetingDokument22 SeitenSegmenting and TargetingMalik MohamedNoch keine Bewertungen

- Manila Residential Property Market OverviewDokument3 SeitenManila Residential Property Market Overviewmackenzie02Noch keine Bewertungen

- Chemical Engineering Economics: Dr. Ir. Ahmad Rifandi, MSC., Cert IvDokument88 SeitenChemical Engineering Economics: Dr. Ir. Ahmad Rifandi, MSC., Cert Iviqbal m farizNoch keine Bewertungen

- PrtogualDokument689 SeitenPrtogualFilipa Monteiro da Silva100% (1)

- 5 Key Takeaways From Buffett's 2013 LetterDokument2 Seiten5 Key Takeaways From Buffett's 2013 Letterbhuiyan1Noch keine Bewertungen

- Simple InterestDokument3 SeitenSimple InterestlalaNoch keine Bewertungen

- Case Study in MarketingDokument4 SeitenCase Study in Marketingjay daveNoch keine Bewertungen

- A Self-Reliant and Independent Economic OrderDokument14 SeitenA Self-Reliant and Independent Economic OrderJen DeeNoch keine Bewertungen

- Indigo AirlinesDokument5 SeitenIndigo AirlinesAnonymous jGew8BNoch keine Bewertungen

- Regional Sales Director CPG in NYC Resume Arthur StantonDokument2 SeitenRegional Sales Director CPG in NYC Resume Arthur StantonArthurStantonNoch keine Bewertungen

- Chapter-5 - FI-BDokument20 SeitenChapter-5 - FI-BKhanh LinhNoch keine Bewertungen

- BEP ExercisesDokument11 SeitenBEP ExercisesBarack MikeNoch keine Bewertungen

- PV String Guide-3Dokument96 SeitenPV String Guide-3ankitNoch keine Bewertungen

- Business Combinations?: Multiple-Choice QuestionsDokument4 SeitenBusiness Combinations?: Multiple-Choice QuestionsEych Mendoza100% (1)

- Answer of The Case Study About Bata IndiaDokument2 SeitenAnswer of The Case Study About Bata IndiaImam Hasan Sazeeb33% (3)

- Reciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyDokument18 SeitenReciprocal Relation (RR) Based Payment Mechanism For Highway Ppps - Introductory Concepts Concepts by Devayan DeyAjay PannuNoch keine Bewertungen

- Solved Without Looking at The Text Derive A Nation S Offer CurveDokument1 SeiteSolved Without Looking at The Text Derive A Nation S Offer CurveM Bilal SaleemNoch keine Bewertungen

- Aqsat FAQs enDokument3 SeitenAqsat FAQs enRockroll AsimNoch keine Bewertungen

- H2 Lecture Notes - Scarcity, Choice and Opportunity Cost - 2012Dokument20 SeitenH2 Lecture Notes - Scarcity, Choice and Opportunity Cost - 2012lizzie3295100% (2)

- HUL Rural MarketingDokument22 SeitenHUL Rural Marketingtoto04858100% (1)

- Chapter 13 - The Costs of Production - Test BDokument2 SeitenChapter 13 - The Costs of Production - Test Bminh leNoch keine Bewertungen

- ST8 Pu 15 PDFDokument58 SeitenST8 Pu 15 PDFPolelarNoch keine Bewertungen

- 2019 Asia Insurance Market ReportDokument44 Seiten2019 Asia Insurance Market ReportFarraz RadityaNoch keine Bewertungen