Beruflich Dokumente

Kultur Dokumente

Complete Guide To Building An Acquistion Strategy and Valuation Methodologies

Hochgeladen von

STRATICXOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Complete Guide To Building An Acquistion Strategy and Valuation Methodologies

Hochgeladen von

STRATICXCopyright:

Verfügbare Formate

Complete Guide to Building an Acquisition Strategy and Valuation Methodologies

IDENTIFYING AN ACQUISTION TARGET

There are various aspects to consider when searching for an acquisition target

Key Aspects of Value to an Acquiror

Competitive Advantage Strong market position through large, stable user base or other competitive edge division or area Important Market Segment Operates key commercial platform with potential for strong cash growth Robust Financial Performance Healthy business with track record of strong cash flows and resilient earnings Access to New Geographies Target has established positions in new or high growth markets where the Acquiror is not present

This is only a partial view of the full presentation. For further details and download Market is of key strategic Strong top-line growth please goto: www.straticx.com/store.html Expertise in a particular importance in the value trajectory These new markets are

chain

Target's strengths can be leveraged throughout Acquiror's organization

Target's products or services can catalyze growth of Acquiror's existing businesses

Disciplined cost management

relatively difficult to expand into organically

Ideal Acquisition Target

IDENTIFYING AN ACQUISTION TARGET

Aligning Acquisition Strategy to Seller Process

Competitive Auction Formal process with organized disclosure on business sold via information memos and management presentations Auctions usually have a longer timetable Negotiated Transaction Less formal process with:

More flexibility in requesting specific or customized information

Greater access to Targets management team

Higher chance that Acquirors interest may be leaked to public

When drawn into a competitive auction, Acquiror can avoid a bidding war by positioning each bid strategically in two-tiered processes

In a limited negotiation, Acquiror can:

Push for exclusivity to remove concerns over

This is only a partial view of the full presentation. For further details and download interloper intervention Enjoy more room to structure transaction please goto: www.straticx.com/store.html

E.g. bid conservatively in first round to learn more about other bidders and preserve valuation flexibility Acquiror should also conduct an interloper analysis to Identify potential financial or strategic buyers creatively E.g. Acquiror can decide whether to acquire entire business or carve out specific assets Limited competition suggests a higher likelihood for Acquiror to capture pre-emptive value

Assess their ability to pay

Estimate rivals ability to achieve synergies with Target

Evaluate impact to market landscape if Target falls into competitors hands

Strategic positioning in a buyside approach can vary significantly depending on whether Seller is running a competitive auction or engaged in exclusive negotiations with Acquiror

DILIGENCING THE TARGET

Diligencing the Target entails reviewing the market, financials and the business

Key Areas Size and scope of markets Key economic drivers Market Overview

Details

Expected regulatory changes that could change competitive landscape

Key competitors Historical, current and anticipated

This is only a partial view of indicators the full presentation. For further details and download Key performance and expected trends Historical audited financials www.straticx.com/store.html please goto:

Financials Projected financials and near-term Variance between historical budgets and actual performance Capital structure and expected maturities Marketing and customer acquisition strategy vs. peers Customer mix Focus on high or low share customers Business Mix of customer demographics Outlook on required capex over next few years Could changes in technology etc derail those projections? Cost structure vs. peers

Strengths/weaknesses vs. peers

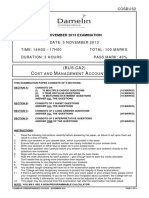

CONTENTS

1. Formulating an Acquisition Strategy

A. Identifying the Acquisition Target and Process B. Diligencing the Target

This is only a partial view of the full presentation. For further details and download goto: www.straticx.com/store.html C. please Evaluating Other Strategic Considerations

2. Overview of Valuation Methodologies

There are several critical aspects to a well thought-out acquisition strategy for enterprise assets

CONTENTS

1. Formulating an Acquisition Strategy

A. Identifying the Acquisition Target and Process B. Diligencing the Target

This is only a partial view of the full presentation. For further details and download goto: www.straticx.com/store.html C. please Evaluating Other Strategic Considerations

2. Overview of Valuation Methodologies

There are several critical aspects to a well thought-out acquisition strategy for enterprise assets

OVERVIEW OF VALUATION METHODOLOGIES

Valuation Methodologies and Key Issues

Methodology

Key Sensitivities Quality of comparables Market environment Consistent accounting treatment Forward-looking multiples Public data

Public Market Comparables

Trading multiples of comparable companies To determine the relative value of companies within the sector

This2 is only a partial view oftransactions the full presentation. For furthertransactions details and download Market of comparable Quality of comparable Takes into consideration acquisition premium Historical multiples please goto: www.straticx.com/store.html

Merger Market Comparables Discounted Cash Flow (DCF) Present value (PV) of projected unlevered free cash flows (FCFs) Discounted at weighted average cost of capital (WACC) Generally limited public data Market conditions at time of transaction Quality of financial forecasts (large number of assumptions) Discount rate Terminal value / perpetuity growth rate

4

Pro Forma Analysis

Impact of a transaction (growth, margins, credit rating, etc.)

Assess whether a transaction is accretive / dilutive to EPS Near-term vs. long-term impact

Affected by financing capital structure

Affected by accounting (purchase price allocation) Not indicator of fundamental value

OVERVIEW OF VALUATION METHODOLOGIES PUBLIC MARKET

1

Financial ratios should be compared across different sectors

Benchmarking of Market Multiples Example Output

2013E EV / Sales

This is only a partial view of the full presentation. For further details and download please goto: www.straticx.com/store.html

2013E EV / EBITDA

Sector 1

Sector 2

Sector 3

OVERVIEW OF VALUATION METHODOLOGIES PUBLIC MARKET

1

Overview of the Discounted Future Value Approach

Discounted Future Value Approach

Overview Consider the start-up when the business model approaches maturity, and achieves positive EBITDA and longer-target margin targets The start-up can be valued with a 1-year forward multiple on future financial metrics based on projected future forward multiples The resulting valuation is subsequently to today to find the present value of the start-up business

This is only a partial view of the full presentation. For further details and download Illustrative Calculation Methodology please goto: www.straticx.com/store.html

Forward 2017 Steady EBITDA

1 Year Forward Multiple

Future Value at 2016

Discount 4 Years

Present Value Today at 2013

OVERVIEW OF VALUATION METHODOLOGIES MERGER MARKET

Analysing precedent transactions will give a snapshot of multiples being paid

Selected Precedent Transactions Example Output

This is only a partial view of the full presentation. For further details and download please goto: www.straticx.com/store.html

Date

Acquirer

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

Target Transaction Value Period

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

_ _

OVERVIEW OF VALUATION METHODOLOGIES - DCF

3

There are three main components of a Discounted Cash Flow Analysis

Determination of Free Cash Flows

DCF Analysis

Calculation of Terminal Value

Value of business in projection period Projections (5 10 years)

Value of business / cashflows post projection period Exit multiple method

Sales growth This is only a partial view of the full presentation. For further details and download Perpetuity growth method Margins (steady state) please goto: www.straticx.com/store.html Capex Change in Working Capital

Calculation of Discount Rate

Incorporates time value of money WACC vs. Equity discounting Discount Rate

Acquiror, Target or Sector?

Risk Free Rate Beta

10

OVERVIEW OF VALUATION METHODOLOGIES - DCF

3B

Terminal value serves as proxy for present value of cash flow stream that is to be generated after the projection horizon

Terminal value serves as proxy for present value of cash flow stream that is to be generated after the projection horizon (usually 5 to 10 years) Ideally when business is in steady state Calculate PV of terminal value and add to PV of projected cash flows to arrive at a total value for the company The two principal terminal valuation approaches are: This is only a partial view of the full presentation. For further details and download Methodology Benchmarks please goto: www.straticx.com/store.html

FCF in Year after Final Year TV =

Industry growth rate

Perpetuity Method

TV =

WACC Growth Rate FCF5 x (1+g) WACC g

General economic growth rate Differentiate real growth vs. inflation Current trading multiples Mid-cycle trading multiples M&A multiples

Compare results to check assumptions

TV = EBITDA x Exit Multiple Exit Multiple Assumes sale/IPO of business at multiple of final years sales, EBITDA, EBIT or other metric

Alternatively, calculate terminal value through one method and back out the implied assumption for the other method (e.g. implied perpetuity growth of a certain exit multiple)

11

OVERVIEW OF VALUATION METHODOLOGIES PRO FORMA

Pro Forma Analysis is a method of calculating financial results in order to emphasize either current or projected figures

Key Inputs to Consider Mix of financing Considerations Impact of target to pro forma growth and margin profile

Stock vs. cash

Financing Cost (incremental debt to finance the acquisition) Interest expense on new debt issued

Potential multiple impact

Level of diversification vs. product concentration

Synergy Analysis

For Cross-selling opportunity This isInterest only income a partial view of the full presentation. further details and download lost on cash used Cost savings potential please goto: www.straticx.com/store.html Accounting Treatment Excess purchase price allocated to asset write-up Amount required to breakeven (if dilutive) vs. amount that is achievable

Depreciated / amortized over how long?

Transaction Costs

Balance sheet impact

Credit rating

Financing fees, advisor fees

Merger costs Taxes

Ability to de-lever

Pro forma ownership

12

OVERVIEW OF VALUATION METHODOLOGIES PRO FORMA

4

Company A Acquires Company B An Illustrative Example

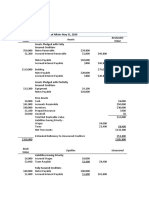

Illustrative EPS Accretion / (Dilution) Analysis

Deal Terms

Company B Share Price (US$) Premium Over Purchase Price Acquisiton Share Price (US$) Company B Shares Outstanding (mm) Implied Takeover Equity Value 10.00 20.0% 12.00 500 6,000

Sensitivity Analysis

2013E EPS Accretion

Acquisition Share Price

5.3% 10.00 8.9% 8.6% 8.2% 7.9% 7.5% 11.00 7.5% 7.1% 6.7% 6.4% 6.0% 12.00 6.2% 5.7% 5.3% 4.9% 4.5% 13.00 4.8% 4.3% 3.9% 3.4% 3.0% 14.00 3.5% 3.0% 2.5% 2.0% 1.5%

Pre-Tax Cost of Debt

3.0% 3.5% 4.0% 4.5% 5.0%

Financing Terms

Debt Financing (50%) Equity Financing (50%) 3,000 3,000

This is only a partial view of the full presentation. For further details and download Company A Share Price 20.00 please goto: www.straticx.com/store.html Company A Pre-Deal Shares Outstanding 1,000

Company A Post-Deal Shares Outstanding 1,150

2014E EPS Accretion

EPS Accretion / (Dilution)

(US$ mm) Company A Net Income Company B Net Income Post-Tax Interest Expense @ 4.0% Pre-Tax Pro Forma Net Income Company A Pro Forma EPS (US$) Company A Status Quo EPS (US$) EPS Accretion / (Dilution)

1

2013E 2,000 500 (78) 2,422 2.11 2.00 5.3%

2014E 2,200 550 (78) 2,672 2.32 2.20 5.6%

5.6% 10.00 9.1% 8.8% 8.5% 8.2% 7.8%

Acquisition Share Price

11.00 7.7% 7.4% 7.0% 6.7% 6.3% 12.00 6.4% 6.0% 5.6% 5.2% 4.8% 13.00 5.0% 4.6% 4.2% 3.8% 3.4% 14.00 3.7% 3.3% 2.9% 2.4% 2.0%

Pre-Tax Cost of Debt

3.0% 3.5% 4.0% 4.5% 5.0%

Assumes corporate tax rate of 35%

13

This is only a partial view of the full presentation. For further details and download please goto: www.straticx.com/store.html

14

Das könnte Ihnen auch gefallen

- Consulting Diagrams and Design Templates SampleDokument96 SeitenConsulting Diagrams and Design Templates SampleSTRATICX100% (1)

- Issue-Based Work Planning and Hypothesis Problem SolvingDokument13 SeitenIssue-Based Work Planning and Hypothesis Problem SolvingSTRATICXNoch keine Bewertungen

- Organizational Velocity - Improving Speed, Efficiency & Effectiveness of Business SampleDokument24 SeitenOrganizational Velocity - Improving Speed, Efficiency & Effectiveness of Business SampleSTRATICXNoch keine Bewertungen

- Complete Toolkit For Improving MeetingsDokument16 SeitenComplete Toolkit For Improving MeetingsSTRATICXNoch keine Bewertungen

- Complete Resource For Consulting Frameworks and Design TemplatesDokument180 SeitenComplete Resource For Consulting Frameworks and Design TemplatesSTRATICXNoch keine Bewertungen

- Complete Guide To Business Strategy DesignDokument26 SeitenComplete Guide To Business Strategy DesignSTRATICX100% (2)

- Building A Market Model and Market SizingDokument12 SeitenBuilding A Market Model and Market SizingSTRATICXNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- RSA CASES I To IIDokument215 SeitenRSA CASES I To IICrest PedrosaNoch keine Bewertungen

- Management Advisory ServicesDokument4 SeitenManagement Advisory ServicesYaj CruzadaNoch keine Bewertungen

- IDirect KalpataruPower Q2FY20Dokument10 SeitenIDirect KalpataruPower Q2FY20QuestAviatorNoch keine Bewertungen

- Warren Buffett and GEICO Case StudyDokument18 SeitenWarren Buffett and GEICO Case StudyReymond Jude PagcoNoch keine Bewertungen

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions Manual 1Dokument36 SeitenFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Solutions Manual 1ericsuttonybmqwiorsa100% (24)

- Investment and Portfolio Management: ACFN 3201Dokument16 SeitenInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNoch keine Bewertungen

- Manila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Dokument6 SeitenManila Electric Co Vs Province of Laguna - G.R. No. 131359. May 5, 1999Ebbe DyNoch keine Bewertungen

- Fis - Micro Finance NotesDokument5 SeitenFis - Micro Finance NotesDr. MURALI KRISHNA VELAVETINoch keine Bewertungen

- Module 7 CVP Analysis SolutionsDokument12 SeitenModule 7 CVP Analysis SolutionsChiran AdhikariNoch keine Bewertungen

- Residential Status: Project Report OnDokument6 SeitenResidential Status: Project Report OnTarun Inder KaurNoch keine Bewertungen

- Chapter - 8Dokument17 SeitenChapter - 8Maruf AhmedNoch keine Bewertungen

- Book Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596Dokument2 SeitenBook Value Assets Realizable Value: Nama: Firda Arfianti NIM: 2301949596FirdaNoch keine Bewertungen

- PolicyDokument5 SeitenPolicyRichard WijayaNoch keine Bewertungen

- 10 - G.R. No. 181845 - City of Manila V Coca-Cola PDFDokument7 Seiten10 - G.R. No. 181845 - City of Manila V Coca-Cola PDFRenz Francis LimNoch keine Bewertungen

- Chapter 5: Investment Companies: DefinitionDokument16 SeitenChapter 5: Investment Companies: Definitiontjarnob13100% (1)

- DA Case WriteupDokument2 SeitenDA Case WriteupHaseebAshfaqNoch keine Bewertungen

- Wacc and MMDokument2 SeitenWacc and MMThảo NguyễnNoch keine Bewertungen

- Turkish Tax SystemDokument3 SeitenTurkish Tax Systemapi-3835399Noch keine Bewertungen

- Control AccountsDokument1 SeiteControl AccountsFalak MuscatiNoch keine Bewertungen

- A Pair Trade With Some Sparkle - Long Signet Jewelers (SIG) /short Blue Nile (NILE)Dokument20 SeitenA Pair Trade With Some Sparkle - Long Signet Jewelers (SIG) /short Blue Nile (NILE)PAA researchNoch keine Bewertungen

- BCOM Syllabus MBB and Ram ThakurDokument4 SeitenBCOM Syllabus MBB and Ram ThakurAnimeshSahaNoch keine Bewertungen

- Multiple ChoiceDokument18 SeitenMultiple ChoiceJonnel Samaniego100% (1)

- (COSBUS2) (BUS-CA2) Cost and Management Accounting 2 (Nov2013) v5Dokument8 Seiten(COSBUS2) (BUS-CA2) Cost and Management Accounting 2 (Nov2013) v5FarrukhsgNoch keine Bewertungen

- CorpLiq Draft (Recovered)Dokument9 SeitenCorpLiq Draft (Recovered)Via Samantha de AustriaNoch keine Bewertungen

- Rumus Perhitungan KeekonomianDokument1 SeiteRumus Perhitungan KeekonomianihsansepalmaNoch keine Bewertungen

- Internship Report On The Bank of PunjabDokument91 SeitenInternship Report On The Bank of PunjabArslan73% (22)

- Ais Quiz 5Dokument5 SeitenAis Quiz 5Annieka PascualNoch keine Bewertungen

- IFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsDokument12 SeitenIFRS16 - Lease Standard SAP Solution Through Real Estate Management - SAP BlogsFranki Giassi MeurerNoch keine Bewertungen

- Rhombus Energy vs. CIRDokument7 SeitenRhombus Energy vs. CIREmNoch keine Bewertungen

- Sample by LawsDokument11 SeitenSample by Lawsgilberthufana446877Noch keine Bewertungen