Beruflich Dokumente

Kultur Dokumente

March 2010 Test

Hochgeladen von

daboraOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

March 2010 Test

Hochgeladen von

daboraCopyright:

Verfügbare Formate

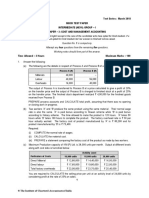

MBA Batch 3, Semester (1) Principles of Accounting Test March 2010

Time: 3 hours Section (A) (This question is compulsory)

Question One Choose the most appropriate answer Each MCQ carries two marks 1. A company receives rent from a large number of properties. The total received in the year ended 31 October 2009 was $481,200. The following were the amounts of rent in advance and in arrears at 31 October 2008 and 2009: 31 October 2008 31 October 2009 $ $ Rent received in advance 28,700 31,200 Rent in arrears (all subsequently received) 21,200 18,400 What amount of rental income should appear in the companys income statement for the year ended 31 October 2009? A. $486,500 B. $460,900 C. $501,500 D. $475,900 2. At 1 July 2008 the provision for doubtful debts of Queen was $18,000. During the year ended 30 June 2009 debts totaling $14,600 were written off. It was decided that the doubtful debt allowance should be $16,000 as at 30 June 2009. What amount should appear in Queens income statement for bad and doubtful debts for the year ended 30 June 2009? A. $12,600 B. $16,600 C. $48,600 D. $30,600. 3. A business compiling its financial statements for the year to 31 July each year pays rent quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was increased from $60,000 per year to $72,000 per year as from 1 October 2009. What figure should appear for rent expense in the business income statement for the year ended 31 July 2010? A. $69,000 B. $62,000 C. $70,000 D. $63,000 (1)

4. A companys trial balance totals were: Debit $387,642 Credit $379,511 A suspense account was opened for the difference. Which ONE of the following errors would have the effect of reducing the difference when corrected? A. The petty cash balance of $500 has been omitted from the trial balance B. $4,000 received for rent of part of the office has been correctly recorded in the cash book and debited to rent account C. No entry has been made in the records for a cash sale of $2,500 D. $3,000 paid for repairs to plant has been debited to the plant asset account. 5. The bookkeeper of a company made the following mistakes: Discount allowed $3,840 was credited to discounts received account. Discount received $2,960 was debited to discounts allowed account. Discounts were otherwise correctly recorded. Which of the following journal entries will correct the errors? Dr $ A. Discount allowed 7,680 Discount received Suspense account B. Discount allowed Discount received Suspense account C. Discount allowed Discount received D. Discount allowed Discount received Suspense account 880 880 1,760 6,800 6,800 3,840 2,960 880

Cr $ 5,920 1,760

6. A trial balance extracted from a sole traders records failed to agree, and a suspense account was opened for the difference. Which of the following errors would require an entry in the suspense account in correcting them? (1) Discount allowed was mistakenly debited to discount received account. (2) Cash received from the sale of a non-current asset was correctly entered in the cash book but was debited to the non-current asset account. (3) The balance on the rent account was omitted from the trial balance. (4) Goods taken from inventory by the proprietor had been recorded by crediting drawings account and debiting purchases account. A. All four items B. 2 and 3 only C. 2 and 4 only D. 1 and 3 only (2)

7. At 1 July 2008 a limited liability company had a provision for doubtful debts of $83,000. During the year ended 30 June 2009 debts totaling $146,000 were written off. At 30 June 2009 it was decided that a doubtful debt allowance of $218,000 was required. What figure should appear in the companys income statement for the year ended 30 June 2009 for bad and doubtful debts? A. $155,000 B. $364,000 C. $281,000 D. $11,000 8. Which of the following most closely describes the meaning of prudence, as the framework for the preparation and presentation of financial statements? A. The use of a degree of caution in making estimates required under conditions of uncertainty. B. Ensuring that accounting records and financial statements are free from material error. C. Understating assets and gains and overstating liabilities and losses. D. Ensuring that financial statements comply with all accounting standards and legal requirements. 9. The following information is available for a sole trader who keeps no accounting records: $ Net business assets at 1 July 2008 186,000 Net business assets at 30 June 2009 274,000 During the year ended 30 June 2009: Cash drawings by proprietor 68,000 Additional capital introduced by proprietor 50,000 Business cash used to buy a private car for the proprietors wife 20,000 Using this information, what is the traders profit for the year ended 30 June 2009? A. $126,000 B. $50,000 C. $86,000 D. $90,000 10. At 1 July 2008 a company had prepaid insurance of $8,200. On 1 January 2009 the company paid $38,000 for insurance for the year to 30 September 2009. What figures should appear for insurance in the companys financial statements for the year ended 30 June 2009? Income statement Balance sheet A $27,200 Prepayment $19,000 B $39,300 Prepayment $9,500 C $36,700 Prepayment $9,500 D $55,700 Prepayment $9,500 (20 marks)

(3)

Section (B) Answer two questions ONLY Question Two At the beginning of 1 January 2010, Amira Amir had $2,700 in the bank. During January 2010, Amira Amir had the following receipts and payments: a. Cash sale of $240. b. Payment from credit customer Tamir $1,200 less discount allowed $60. c. Cash received for sale of machine $600. d. Payment from credit customer Magid $2,160. e. Cheque received for cash to provide a short-term loan from Sky Bank $5,400. f. Second cash sale of $450. g. Payment of $4,500 to Aramco for new machinery. h. Payment to supplier Nahid $360. i. Payment from credit customer Peter $150 less discount allowed $30. j. Payment of telephone bill $1,200. k. Payment of electricity bill $840. l. $300 in cash withdrawn from bank for petty cash. m. Payment to supplier Malik $930.

Required: Prepare the Cash Book for 1 January 2010. (10 marks)

Question Three The following transactions were obtained from the records of Green Nile Company for the month of January 2010: Jan. 1 The Company started the business by investing $100,000 cash. Jan. 4 Bought furniture and fittings for $30,000 from Hilal Enterprises in cash. Jan. 6 Sold goods to Dalia for $6,800 in cash. Jan. 8 Purchased goods on credit for $3,400 from Hatim. Jan.11 Sold goods on credit to Hills Co. for $4,800. Jan, 12 Returns outwards amounted to $1,005. Jan. 13 Purchased a motor car from Giad Co. $12,800, but no payment was made. Jan. 16 Sold goods on credit for $3,640 to Rania Co. Jan. 18 Purchased goods on credit for $1,200 from Sudan Stores. Jan. 20 Sold goods on credit for $1,960 to Dina. Jan. 23 Purchased goods for cash from Sandy Co. for $3,120. Jan. 24 Received $600 as commission. Jan. 25 Paid $120 for electricity. Jan. 26 Returns inwards amounted to $2,100. Jan. 31 Paid wages $2,160. Required: Prepare the books of prime entry to record these transactions. (10 marks)

(4)

Question Four As at 30 March 2010, your business has the following balances on its ledger accounts: Accounts Bank loan Motor vehicles Sales Trade accounts payable Prepayments Purchases Capital Accruals Trade accounts receivable Bank loan interest Other expenses Cash at bank Balance ($) 24,000 4,040 29,200 22,400 3,760 24,800 26,000 3,240 24,000 2,800 22,040 23,400

During the year, the business made the following transactions which were not taken into account: a. Bought goods for $2,000, half for cash and half on credit. b. Made $2,080 sales, $1,600 of which was for credit. c. Paid wages to business assistants of $520 in cash. Required: Draw up a trial balance showing the balances as at the end of 31 March 2010. (10 marks)

Good Luck

(5)

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- فن الحرب - سون تزو - الترجمة العربية الكاملةDokument105 Seitenفن الحرب - سون تزو - الترجمة العربية الكاملةرءوف شبايك96% (83)

- CHKDokument12 SeitenCHKdaboraNoch keine Bewertungen

- فن الحرب - سون تزو - الترجمة العربية الكاملةDokument105 Seitenفن الحرب - سون تزو - الترجمة العربية الكاملةرءوف شبايك96% (83)

- Exam TQMDokument7 SeitenExam TQMdaboraNoch keine Bewertungen

- Batch 8 - Accounting Mid ExamDokument2 SeitenBatch 8 - Accounting Mid ExamdaboraNoch keine Bewertungen

- Batch 8 - Accounting Mid ExamDokument2 SeitenBatch 8 - Accounting Mid ExamdaboraNoch keine Bewertungen

- MBA assignment questions on management topicsDokument1 SeiteMBA assignment questions on management topicsguddupatnaNoch keine Bewertungen

- Communications Alliance LTD: Industry Code Telecommunications Consumer Protections Code C628:2007Dokument75 SeitenCommunications Alliance LTD: Industry Code Telecommunications Consumer Protections Code C628:2007daboraNoch keine Bewertungen

- Application Form (Chev/1)Dokument8 SeitenApplication Form (Chev/1)aver04Noch keine Bewertungen

- IP Private Branch ExchangeDokument4 SeitenIP Private Branch ExchangedaboraNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Answer: Disqualification, Directors, Trustees or Officers. - A Person ShallDokument5 SeitenAnswer: Disqualification, Directors, Trustees or Officers. - A Person ShallJC HilarioNoch keine Bewertungen

- A Study On Analysis of Financial Statements of Polyhydron Pvt. LTDDokument107 SeitenA Study On Analysis of Financial Statements of Polyhydron Pvt. LTDkunal hajareNoch keine Bewertungen

- PAL ActDokument8 SeitenPAL ActsudumalliNoch keine Bewertungen

- Contracts EssentialsDokument12 SeitenContracts EssentialsRizza Angela MangallenoNoch keine Bewertungen

- Paper 3 Cost and Management Accounting PDFDokument6 SeitenPaper 3 Cost and Management Accounting PDFMEGHANANoch keine Bewertungen

- Case AnalysisDokument3 SeitenCase AnalysisJoshua Adorco75% (12)

- 2015 UBS IB Challenge Corporate Finance OverviewDokument23 Seiten2015 UBS IB Challenge Corporate Finance Overviewkevin100% (1)

- Sample Questions and Solutions - Final ExamDokument4 SeitenSample Questions and Solutions - Final ExamNadjah JNoch keine Bewertungen

- AC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFDokument309 SeitenAC EXAM PDF 2019 - LIC Assistant Main Exam (Jan-Dec14th) by AffairsCloud PDFRajaram RNoch keine Bewertungen

- Affordable Housing PPT 1Dokument66 SeitenAffordable Housing PPT 1Sanjeev BumbNoch keine Bewertungen

- Crowdpower State of The Market 2020 2021 FinalDokument16 SeitenCrowdpower State of The Market 2020 2021 FinalNoel AgbeghaNoch keine Bewertungen

- Basant Maheshwari On How To Invest in HFCsDokument6 SeitenBasant Maheshwari On How To Invest in HFCsRajatNoch keine Bewertungen

- Digest - Consuelo v. Planters BankDokument3 SeitenDigest - Consuelo v. Planters BankA.T.ComiaNoch keine Bewertungen

- SEx 9Dokument24 SeitenSEx 9Amir Madani100% (1)

- Bedspace ContractDokument3 SeitenBedspace ContractDana100% (1)

- (2020 - 2021) Chapter 6 - Commercial BanksDokument32 Seiten(2020 - 2021) Chapter 6 - Commercial Banksmapdit choboonNoch keine Bewertungen

- 2) Instructions For Playing The GameDokument7 Seiten2) Instructions For Playing The GameAna MariaNoch keine Bewertungen

- 10000003728Dokument32 Seiten10000003728Chapter 11 DocketsNoch keine Bewertungen

- Withholding Rules 2018Dokument13 SeitenWithholding Rules 2018Gul Muhammad NoonariNoch keine Bewertungen

- Alpha Beta GammaDokument27 SeitenAlpha Beta GammaSarakhannnNoch keine Bewertungen

- Satyam Computer Services Case StudyDokument45 SeitenSatyam Computer Services Case StudyLokeshwar PawarNoch keine Bewertungen

- Wealth DynamicsDokument32 SeitenWealth Dynamicsmauve08Noch keine Bewertungen

- Goldman Sachs QuestionsDokument1 SeiteGoldman Sachs Questionspatrick-searle-3544Noch keine Bewertungen

- Annuity Due and Perpetuity Sample ProblemsDokument5 SeitenAnnuity Due and Perpetuity Sample ProblemsErvin Russel RoñaNoch keine Bewertungen

- Liquidity Preference TheoryDokument8 SeitenLiquidity Preference TheoryjacksonNoch keine Bewertungen

- Sadaya v. Sevilla case on accommodation partiesDokument16 SeitenSadaya v. Sevilla case on accommodation partiesAdrian HilarioNoch keine Bewertungen

- Types of EnterprisesDokument21 SeitenTypes of EnterprisesViviana IftimieNoch keine Bewertungen

- FM09-CH 27Dokument6 SeitenFM09-CH 27Kritika SwaminathanNoch keine Bewertungen

- Hsslive-Chapter 5 BRS 1 PDFDokument2 SeitenHsslive-Chapter 5 BRS 1 PDFRam IyerNoch keine Bewertungen

- Credit and CollectionDokument116 SeitenCredit and Collectionhadassah Villar100% (14)