Beruflich Dokumente

Kultur Dokumente

Income Tax

Hochgeladen von

naeem_shamsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax

Hochgeladen von

naeem_shamsCopyright:

Verfügbare Formate

Schedule First Schedule

Part I II III IV

Second Schedule

I III III IV I II III I

Third Schedule

Fourth Schedule

Fifth Schedule

I II I II III

Sixth Schedule

Seventh Schedule Eighth Schedule

Rate of Taxes

Deals With Rates of Taxes Rates of Advance Tax Deduction of Tax at source Deduction or Collection of Advance Tax

Exemption from Total Income Reduction in Tax Rates Reduction in Tax liablity Exemption from Specific Provisions Depreciation Initial Allowance Pre commencment Exenditure Rules for the computation of the Profits and gains of insurance business

Rules for the computation of the profits and gains from the Exploration and production of mineral deposits Rules for the computation of the profits and gains from the Exploration and extraction of mineral deposits(other than petrole Recognized Provident Funds Approved Superannuation Funds Approved Gratuity Funds Rules for the computation of the profits and gains of a Banking Company and Tax payable thereon Rules for the computation of the Capital gains on listed Securities

mineral deposits neral deposits(other than petroleum)

Schedule First Schedule Second Schedule

Part

Third Schedule

Fourth Schedule

Fifth Schedule

Sixth Schedule

Seventh Schedule

Deals With Omitted Omitted

Was inserted By Finance Act 1996 Deals with Sales Tax on Grocery Items

Omitted

Supply ,R&M of Ship,aircraft or Spares Supply to duty free shops Supply of Raw material to EPZ,SPEZ(Gawader) Import or Supplies of food items, Holu Quran,Silver, Gold others

Omitted

FEDERAL EXCISE DUTY ACT 2005 Schedule First Schedule Part Table 1 Table 2

Second Schedule

Third Schedule

TABLE-I

TABLE-II

Deals With Excisable Goods Excisable Services

Goods on which duty is collectible under sales tax mode with entitlement for adjustment with sales tax and vice versa)

Conditional exemptions) [See Sub-section (1) of section 16] (Goods) Services

Schedule First Schedule -Table

Table /Part A B C D E I

Section

Second Schedule

1 2 3

II

1 2 3

Third Schedule

Form- A Form- B

Fourth Schedule

Fifth Schedule

Sixth Schedule

Seventh Schedule Eighth Schedule

Rate of Taxes Companies Banks Insurance

Deals With Regulation for Managemnt of a Company Limited By Shares Memorandum & Articles of Association of Company Limited By Shares Memorandum & Articles of Association of Company Limited By Guarantee and Not Having A Shares Capital Memorandum & Articles of Association of Company Limited By Guarantee and Having A Shares Capital Memorandum & Articles of Association of an Unlimited Company Having a Share Capital Matter to Be specified in Prospectus Reports to be Set out Provision Applying to Section 1 & 2 of this Part Form of Statemntin lieu of Prospectus to be Delivered to Registrar by a Company Which Does not Issue a Prospectus or Which Does not go to Allotment on A prospectus issued and Reports to be Set out therein Reports to be Set out Provision Applying to Section 1 & 2 of this Part Annual Returns of Company Having Share Capital Annual Returns of Company Not Having Share Capital Requirement as to Balance Sheet and Profit and Loss Account of Listed Companies

Requirement as to Balance Sheet and Profit and Loss Account of Non- Listed Companies

Table of Fees to be Paid to the Registrar and the Commission

Enactment repealed Ammendment of Ordinance XVII of 1969

34%

A Shares Capital

Das könnte Ihnen auch gefallen

- Secretarial Practices OutlineDokument5 SeitenSecretarial Practices Outlinenaeem_shamsNoch keine Bewertungen

- Project Cash Flow: ARE 413 Construction ManagementDokument25 SeitenProject Cash Flow: ARE 413 Construction Managementnaeem_shamsNoch keine Bewertungen

- PWC Finance 2013Dokument237 SeitenPWC Finance 2013abcabc2012100% (1)

- TRF-77 Green Electric LTDDokument34 SeitenTRF-77 Green Electric LTDnaeem_shamsNoch keine Bewertungen

- LC GuideDokument35 SeitenLC Guidenaeem_shamsNoch keine Bewertungen

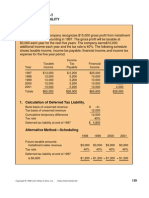

- Deferred Tax IllustrationDokument8 SeitenDeferred Tax IllustrationFaseeh IqbalNoch keine Bewertungen

- Consolidated Financial Statements 2013 (En)Dokument27 SeitenConsolidated Financial Statements 2013 (En)naeem_shamsNoch keine Bewertungen

- ItaxDokument3 SeitenItaxnaeem_shamsNoch keine Bewertungen

- BudgetDokument69 SeitenBudgetnaeem_shamsNoch keine Bewertungen

- Compendium of Withholding Tax PDFDokument44 SeitenCompendium of Withholding Tax PDFnaeem_shamsNoch keine Bewertungen

- Project Cash Flow: ARE 413 Construction ManagementDokument25 SeitenProject Cash Flow: ARE 413 Construction Managementnaeem_shamsNoch keine Bewertungen

- Dos and Donts of ConcreteDokument28 SeitenDos and Donts of ConcreteThanh Khiet UngNoch keine Bewertungen

- Consult - New-Registration - Form (For Local)Dokument16 SeitenConsult - New-Registration - Form (For Local)naeem_shamsNoch keine Bewertungen

- Economics MCQsDokument168 SeitenEconomics MCQsSanjeev Subedi83% (23)

- Comp Exam15 QP 05032k11Dokument2 SeitenComp Exam15 QP 05032k11naeem_shamsNoch keine Bewertungen

- InTech-Power Quality and Electrical Arc Furnaces PDFDokument25 SeitenInTech-Power Quality and Electrical Arc Furnaces PDFnaeem_shamsNoch keine Bewertungen

- Construction ContractsDokument10 SeitenConstruction Contractsnaeem_shamsNoch keine Bewertungen

- Comp Exam15 QP 05032k11Dokument2 SeitenComp Exam15 QP 05032k11naeem_shamsNoch keine Bewertungen

- 1 Piping CostingDokument33 Seiten1 Piping Costingamoldhole97% (34)

- Article Excel If Statements Look UpsDokument8 SeitenArticle Excel If Statements Look UpsMuneeb MansoorNoch keine Bewertungen

- CGS WithholdingDokument13 SeitenCGS WithholdingtouseefahmadNoch keine Bewertungen

- BFD Revision Kit (Question Bank With Solutions - Topicwise)Dokument106 SeitenBFD Revision Kit (Question Bank With Solutions - Topicwise)naeem_shamsNoch keine Bewertungen

- SEZDokument26 SeitenSEZnaeem_shamsNoch keine Bewertungen

- MoI Seeks To Grant Two New Units Pioneer Industry Status - Business Recorder PDFDokument3 SeitenMoI Seeks To Grant Two New Units Pioneer Industry Status - Business Recorder PDFnaeem_shamsNoch keine Bewertungen

- Special Economic Zones - An Overview PDFDokument7 SeitenSpecial Economic Zones - An Overview PDFnaeem_shamsNoch keine Bewertungen

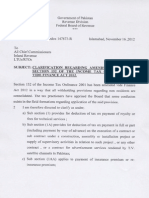

- Withholding Tax U/S 153Dokument10 SeitenWithholding Tax U/S 153kschishtiNoch keine Bewertungen

- Epzaord PDFDokument40 SeitenEpzaord PDFnaeem_shamsNoch keine Bewertungen

- Purchase Agreement ChinaDokument2 SeitenPurchase Agreement Chinanaeem_shamsNoch keine Bewertungen

- Sales Tax Act 1990 Updated Upto 2010Dokument84 SeitenSales Tax Act 1990 Updated Upto 2010Sohail AnjumNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Corporate InformationDokument6 SeitenCorporate InformationcmbbcorporNoch keine Bewertungen

- Midterm Examination With SolutionDokument2 SeitenMidterm Examination With SolutionSeulgi Bear100% (1)

- Income Tax Law & PracticeDokument29 SeitenIncome Tax Law & PracticeMohanNoch keine Bewertungen

- Absolutism Intro ComboDokument4 SeitenAbsolutism Intro Comboapi-262588001Noch keine Bewertungen

- Assignment One Name: Hussein Abdulkadir Ibrahim (Allauun)Dokument2 SeitenAssignment One Name: Hussein Abdulkadir Ibrahim (Allauun)Hussein Abdulkadir IbrahimNoch keine Bewertungen

- Soneri Bank A-Report 2013 FinalDokument144 SeitenSoneri Bank A-Report 2013 FinalMuqaddas IsrarNoch keine Bewertungen

- MicroEconomics ReviewerDokument8 SeitenMicroEconomics Reviewervon_montillaNoch keine Bewertungen

- Indian Insitute of Job-Oriented Training Tally Assignment: Company CreationDokument42 SeitenIndian Insitute of Job-Oriented Training Tally Assignment: Company CreationTapas GhoshNoch keine Bewertungen

- Lopez & Sons INC v. CTADokument7 SeitenLopez & Sons INC v. CTAfabsfabsNoch keine Bewertungen

- Chapter 6 Introduction To The Value Added TaxDokument27 SeitenChapter 6 Introduction To The Value Added TaxJoanna Louisa GabawanNoch keine Bewertungen

- FNB Pension Fund Irp5Dokument1 SeiteFNB Pension Fund Irp5Vovo SolutionsNoch keine Bewertungen

- Thesis Statement On National DebtDokument6 SeitenThesis Statement On National Debtkatiewilliamssyracuse100% (2)

- Tata Aia Life InsuranceDokument2 SeitenTata Aia Life InsurancekotijbNoch keine Bewertungen

- Income From SalariesDokument3 SeitenIncome From SalariesSiva SankariNoch keine Bewertungen

- The Offshore MoneyDokument339 SeitenThe Offshore MoneyjohnNoch keine Bewertungen

- Cfap 4 BFD Winter 2017Dokument4 SeitenCfap 4 BFD Winter 2017Tanveer RazaNoch keine Bewertungen

- State of The U.S. Economy: Why Have Eco-Nomic Growth and Job Creation Re - Mained Weak, and What Should Congress Do To Boost Them?Dokument68 SeitenState of The U.S. Economy: Why Have Eco-Nomic Growth and Job Creation Re - Mained Weak, and What Should Congress Do To Boost Them?Scribd Government DocsNoch keine Bewertungen

- Paper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1Dokument21 SeitenPaper 7-Direct Taxation: Answer To MTP - Intermediate - Syllabus 2016 - June 2020 & December 2020 - Set 1vikash guptaNoch keine Bewertungen

- Descriptive Guidelines On Flexi Pay ComponentsDokument5 SeitenDescriptive Guidelines On Flexi Pay Componentsshannbaby22Noch keine Bewertungen

- Risk Flags Action PointDokument5 SeitenRisk Flags Action PointAudit Circle IV BhavnagarNoch keine Bewertungen

- 2007 Summer Great Peninsula Conservancy NewsletterDokument8 Seiten2007 Summer Great Peninsula Conservancy NewsletterGreat Peninsula ConservancyNoch keine Bewertungen

- GSMI Legal Regulatory ReportDokument37 SeitenGSMI Legal Regulatory ReportSORY TOURENoch keine Bewertungen

- Session 3 World Bank, The East Asian Miracle, 1993, Pp. 1-26Dokument3 SeitenSession 3 World Bank, The East Asian Miracle, 1993, Pp. 1-26Muhd Hafiz PatolgaNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDokument43 SeitenInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareNoman KhalidNoch keine Bewertungen

- (DIGEST) Dominium Realty & Construction Corporation v. CIRDokument2 Seiten(DIGEST) Dominium Realty & Construction Corporation v. CIRYodh Jamin OngNoch keine Bewertungen

- Report InernDokument30 SeitenReport Inernshanmugam cNoch keine Bewertungen

- Sunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsDokument2 SeitenSunshine Window Washers SWW Provides Window Washing Services To Commercial ClientsAmit PandeyNoch keine Bewertungen

- SC746Dokument1 SeiteSC746Indîan NetizenNoch keine Bewertungen

- Income From Business or ProfessionDokument7 SeitenIncome From Business or ProfessionANNIE STEPHENNoch keine Bewertungen

- Class - XII CommerceDokument8 SeitenClass - XII CommercehardikNoch keine Bewertungen